The strategic competition between the United States and the People’s Republic of China is the defining geopolitical dynamic of the 21st century, and at its core lies a fundamental divergence in military philosophy, doctrine, and strategic posture. This report provides a comparative analysis of these competing military worldviews. The United States continues to operate under a philosophy of global power projection, enabled by a network of alliances and underpinned by a new doctrine of Joint All-Domain Operations (JADO) designed to achieve decision dominance through superior integration. In contrast, China’s military thought is rooted in a concept of “Active Defense,” a strategically defensive but operationally offensive posture designed to secure its regional periphery and deter outside intervention. This philosophy is operationalized through a doctrine of “Intelligentized Warfare” and “System Destruction,” which aims to paralyze a technologically superior adversary by attacking the network-centric systems that provide its strength.

These philosophies are not evolving in a vacuum; they are a direct response to one another, creating a dynamic of doctrinal competition. Where the U.S. seeks to build a resilient, integrated “kill web,” China seeks to develop the “assassin’s mace” capabilities to break it. Where the U.S. leverages a global network of allies, China pursues strategic self-reliance. This analysis reveals that while both powers converge on the belief that future warfare will be a contest of information and decision speed, their methods for achieving victory are starkly different, creating a complex and potentially volatile military balance.

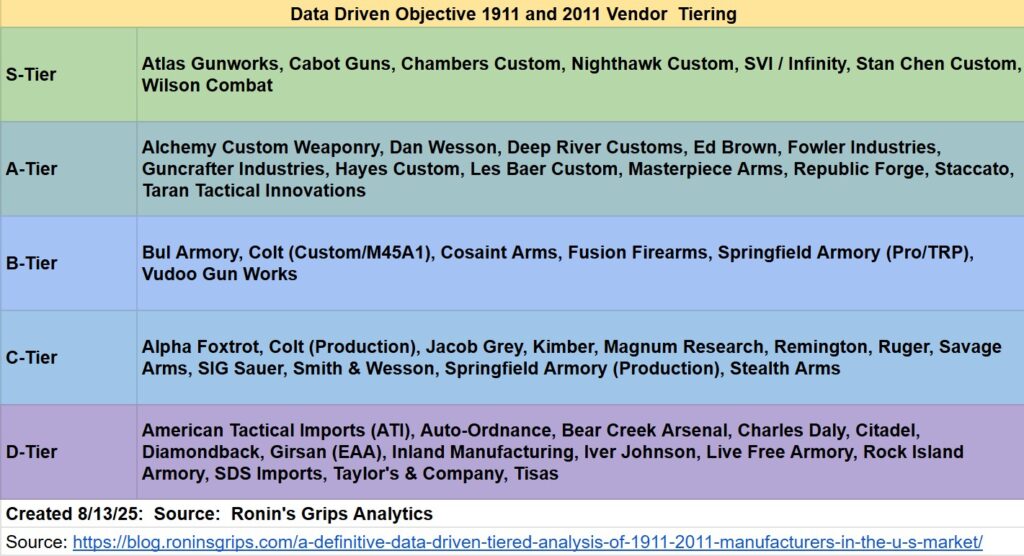

Table 1: Comparative Matrix of U.S. and Chinese Military Philosophies

| Capability/Mindset | United States | China | Areas of Similarity | Areas of Difference | Key Lessons |

| Overarching Philosophy | Global Power Projection: An expeditionary mindset focused on defending global interests far from home, maintaining access to the global commons, and supporting allies.1 | Active Defense: A strategically defensive posture focused on securing the national periphery, allowing for tactically and operationally offensive actions to deter or defeat intervention.3 | Both philosophies are designed to secure national interests and deter aggression, adapting to perceived threats. | Geographic Scope: Global and expeditionary vs. Regional and counter-interventionist. Strategic Posture: Proactive and forward-deployed vs. Reactive and bastion-focused. | U.S. power is inherently expeditionary, creating logistical vulnerabilities. China’s philosophy leverages geography as a strategic asset. |

| Core Doctrine | Joint All-Domain Operations (JADO): Integration of effects across all domains (air, land, sea, space, cyber, EMS) to overwhelm an adversary’s decision-making cycle.5 | Intelligentized Warfare / System Destruction: Use of AI-enabled systems to attack an adversary’s C4ISR network, causing systemic collapse rather than attriting forces.7 | Both doctrines prioritize information superiority and decision speed, viewing the network as the central battlefield. Both are moving toward AI-enabled C2. | Targeting Logic: U.S. targets adversary decision-making (paralysis). China targets the adversary’s system itself (collapse). Method: U.S. seeks integration (“kill web”). China seeks disintegration (“system destruction”). | The central conflict is a doctrinal race: the U.S. builds an integrated network while China builds the tools to break it. |

| Geographic Focus | Global: Postured to operate in multiple theaters simultaneously, with a significant focus on the Indo-Pacific and Europe.2 | Regional Periphery: Focused on the First and Second Island Chains, particularly scenarios involving Taiwan and the South China Sea.11 | Both view the Indo-Pacific as the primary theater of strategic competition. | U.S. faces the “tyranny of distance” and must project power across vast oceans. China enjoys the “tyranny of proximity,” a home-field advantage. | Geography remains a dominant factor. China’s A2/AD strategy is a direct exploitation of its geographic advantage. |

| Role of Alliances | Central Pillar: A global network of formal treaty allies is integral to strategy, providing basing, legitimacy, and combat power.13 | Strategic Self-Reliance: Advocates “partnerships, not alliances,” avoiding binding mutual defense commitments to maintain strategic autonomy.16 | Both engage in military diplomacy and joint exercises with other nations. | Nature of Commitment: U.S. has formal, binding defense treaties. China has pragmatic, non-binding partnerships. | Alliances are a key U.S. asymmetry, providing mass but adding complexity. China’s approach provides speed but risks isolation. |

| Technological Driver | Network-Centric “Kill Webs”: Focus on connecting any sensor to any shooter across all domains via JADC2 to create a resilient, integrated force.18 | Asymmetric “Assassin’s Mace”: Focus on developing niche, high-impact capabilities (e.g., ASBMs, hypersonics) to exploit specific U.S. vulnerabilities.20 | Both are heavily investing in AI, autonomy, cyber, and space capabilities as force multipliers. | U.S. seeks to enhance its existing system through networking. China seeks to bypass and defeat the U.S. system with asymmetric weapons. | Technology is not just about quality but about the strategic logic of its application. |

| Industrial Model | Distinct Defense Industrial Base: A largely separate ecosystem of specialized defense contractors, though with increasing ties to commercial tech.22 | Military-Civil Fusion (MCF): A national strategy to eliminate barriers between civilian and military R&D and industry, leveraging the entire national economy for military modernization.24 | Both recognize the need to leverage national technological and industrial power for military advantage. | Integration Level: U.S. model is one of partnership between distinct sectors. China’s model is one of state-directed fusion. | MCF presents a whole-of-nation challenge that blurs the lines between economic and military competition. |

| Theory of Victory | Paralysis through Overwhelm: Present the adversary with so many simultaneous, multi-domain dilemmas that their ability to command and control their forces is paralyzed.5 | Disintegration through Disruption: Degrade and destroy the adversary’s C4ISR systems, severing the links between sensors and shooters, causing their warfighting system to collapse.7 | Both aim to win decisively and quickly by targeting the adversary’s cognitive and command functions, not just their physical forces. | U.S. theory is based on the resilience of its own network. China’s theory is based on the fragility of the adversary’s network. | Victory is increasingly defined by disruption, not attrition. |

| Civil-Military Relations | Strict Civilian Control: The military is subordinate to elected civilian leadership (President, Congress) as mandated by the Constitution.27 | Party-Army Fusion: The People’s Liberation Army (PLA) is the armed wing of the Chinese Communist Party (CCP), not the state. Its ultimate loyalty is to the Party.3 | In both, the military is an instrument of national policy. | Source of Authority: U.S. military serves the Constitution and the nation. The PLA serves the CCP. | This fundamental difference shapes strategic objectives, risk tolerance, and the ultimate purpose for which military force is used. |

The 10 Key Lessons Learned

- The central battlefield of the 21st century is the network. Both the United States and China have concluded that victory in modern warfare hinges on achieving “decision dominance” by processing information and executing commands faster and more effectively than the adversary.

- U.S. military power is fundamentally expeditionary and alliance-dependent. Its ability to project force globally is its greatest strength, but the long logistical chains and complex political coordination required are also its most critical vulnerabilities.

- China’s military philosophy is fundamentally regional and counter-interventionist. It is designed to leverage geography and asymmetric technology to create a formidable bastion within the Indo-Pacific, making it prohibitively costly for the U.S. to intervene in matters China defines as its core interests.

- The U.S. and China are engaged in a direct doctrinal race. The U.S. is building integrated “kill webs” (JADO) to connect all its assets, while China is simultaneously developing “system destruction” capabilities specifically designed to find and break the links in those webs.

- The U.S. relies on a distinct, highly advanced defense industry, while China’s Military-Civil Fusion (MCF) strategy presents a whole-of-nation challenge. MCF blurs the lines between economic and military competition, turning the entire global technology ecosystem into a contested space.

- Alliances are a defining asymmetry. The U.S. fights as a coalition, gaining immense capability and legitimacy at the cost of operational complexity and slower decision-making. China fights alone, gaining speed and unity of command at the cost of strategic isolation.

- The character of conflict is shifting from attrition to disruption. Victory may be defined not by destroying the most enemy platforms, but by paralyzing an adversary’s ability to command them, causing a systemic collapse.

- Geography remains paramount. The United States faces the “tyranny of distance” in any potential Pacific conflict, while China enjoys the “tyranny of proximity”—a home-field advantage that its Anti-Access/Area Denial (A2/AD) strategy is built to exploit.

- The PLA’s modernization is a reactive process. Much of its doctrinal and technological development has been shaped by decades of meticulously studying U.S. military operations to identify and build capabilities to exploit perceived American weaknesses.

- Both powers believe emerging technologies like AI are revolutionary. However, China’s state-directed, fused civil-military approach aims to “leapfrog” U.S. capabilities, while the United States seeks to integrate these technologies to enhance its existing joint force structure and operational concepts.

Part I: The American Way of War: Global Expeditionary Power and All-Domain Integration

The military philosophy of the United States is intrinsically linked to its status as a global power with interests that span the globe. Its military is not postured primarily for homeland defense but as an expeditionary force designed to project power, deter aggression, and defend national interests far from its own shores. This philosophy has evolved from the Cold War’s containment strategy to a modern doctrine of integrated, all-domain operations designed to maintain a competitive edge in an era of renewed great power competition.

The Philosophy of Global Power Projection

The foundational strategic mindset of the U.S. military is that of a global power with global interests.2 Its economic prosperity depends on global trade, its security is tied to a network of international allies, and its influence is challenged by competitors in key regions worldwide. Consequently, its military is tasked with protecting the nation’s interests on a correspondingly global scale, including safeguarding the freedom to use the global commons—the sea, air, space, and cyberspace domains.2 This mandate necessitates a force capable of power projection, which the U.S. Department of Defense defines as the “ability of a nation to apply all or some of its elements of national power—political, economic, informational, or military—to rapidly and effectively deploy and sustain forces in and from multiple dispersed locations to respond to crises”.1

This philosophy is operationalized through a combination of strategic capabilities. At its heart is a reliance on expeditionary forces that can be deployed from bases within the United States and sustained over vast distances.29 This requires immense strategic mobility, including airlift and sealift capabilities, to move troops and equipment to distant theaters.1 To reduce deployment times, this expeditionary posture is augmented by a network of forward bases and prepositioned stocks of equipment at strategic locations around the world.1 This forward presence serves not only a logistical purpose but also a political one, demonstrating U.S. commitment and acting as a deterrent to potential aggressors.30

Crucially, this global posture is built upon a vast and deeply integrated network of alliances. Unlike the temporary arrangements that have characterized much of history, the U.S. network of formal treaty allies is treated as a permanent and indispensable operational platform.15 Allies share the burden of power projection, provide critical basing and overflight rights, and contribute their own military forces to coalition operations.1 This approach was historically shaped by a force-sizing construct intended to handle two “nearly simultaneous major regional conflicts,” a standard that, while no longer official doctrine, continues to inform the scale and ambition of the U.S. force structure.2 Russian military analysis acknowledges this unique characteristic, noting that “the U.S. military has a worldwide presence and can project combat power throughout the globe,” in stark contrast to Russia’s own regionally focused military.10

This reliance on global power projection, however, creates a profound strategic paradox. The very capability that underpins America’s superpower status—its global reach—is simultaneously the source of its greatest logistical vulnerability. The need to deploy and, critically, sustain forces across thousands of miles of ocean and air creates long and potentially exposed supply lines.1 An adversary focused on regional defense can concentrate its efforts on disrupting this logistical chain, preventing the U.S. from bringing its full military might to bear. This dynamic has not been lost on U.S. competitors and forms the central challenge that its modern military doctrine seeks to overcome.

The Doctrine of Joint All-Domain Operations (JADO)

In response to the reemergence of great power competition and the erosion of its traditional military advantages, the United States has developed a new operational concept: Joint All-Domain Operations (JADO). This doctrine represents a fundamental rethinking of how to orchestrate military power in a highly contested, technologically advanced battlespace where adversaries can challenge U.S. forces across every warfighting domain.5 JADO is the U.S. military’s answer to the proliferation of advanced technologies and the development of sophisticated Anti-Access/Area Denial (A2/AD) threats by competitors like China.5

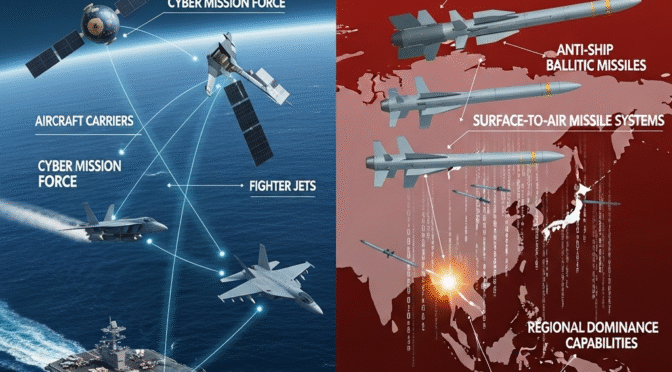

The core principle of JADO is the “convergence of effects,” which involves synchronizing kinetic (e.g., missiles) and non-kinetic (e.g., cyber attacks) capabilities across the domains of air, land, maritime, cyberspace, and space, as well as the electromagnetic spectrum.5 The goal is to present an adversary with multiple, simultaneous dilemmas at a tempo that complicates or negates their response, enabling U.S. forces to operate inside the adversary’s decision-making cycle.5 This approach is “objective-centric and domain-agnostic,” meaning it focuses on achieving a desired outcome using the most efficient and effective tools available, regardless of which military service owns the asset.6 For example, an air operation might be enabled by a preceding cyber operation that disables enemy air defense communications.6

Enabling this complex orchestration is the concept of Joint All-Domain Command and Control (JADC2). JADC2 is the technological and procedural backbone of JADO, designed to create a unified network that connects sensors from all military branches to all “shooters” or effectors.18 The goal is to turn the vast amounts of data collected from disparate sources into actionable intelligence, allowing commanders to “sense, make sense, and act” with a speed and coherence that outpaces the enemy.5 This is a direct application of Colonel John Boyd’s “OODA loop” (Observe, Orient, Decide, Act) theory to 21st-century warfare, where victory is achieved by manipulating the tempo of operations to generate confusion and paralysis in the adversary.5

Successfully implementing JADO requires a “paradigm shift” in military planning and execution. It demands that commanders consider all domains from the very beginning of the planning process, moving away from the traditional, stovepiped approach where each service plans its operations in its primary domain before attempting to deconflict and integrate them later.5 Furthermore, given the U.S. reliance on coalition warfare, JADO explicitly incorporates the challenge of operating in a combined environment with allies, whose capabilities and procedures must be integrated into the all-domain framework.31

The development of JADO is an implicit acknowledgment that the era of guaranteed U.S. domain dominance is over. Past doctrines, such as AirLand Battle, were predicated on the assumption that the U.S. could achieve air superiority, which would then create the conditions for freedom of maneuver on the ground.29 JADO, by contrast, starts from the premise that adversaries can now contest every domain simultaneously.5 Therefore, the new strategic objective is not necessarily to achieve total control of any single domain, but rather to achieve “decision dominance.” This is accomplished by using temporary or localized advantages in one domain to create decisive effects in another, ultimately paralyzing the adversary’s ability to command its forces. It marks a subtle but profound shift from a strategy of annihilation to a strategy of systemic paralysis.

The Engine of Dominance: The U.S. Defense-Industrial Ecosystem

The U.S. military’s technological superiority is sustained by a vast and sophisticated defense-industrial ecosystem. This ecosystem operates under the principle of strict civilian control, a cornerstone of American governance enshrined in the Constitution. The President acts as Commander-in-Chief, while Congress holds the power to declare war and, crucially, to raise, support, and fund the armed forces.22 This creates a clear, formal separation between the Department of Defense and the largely private-sector defense industry that equips it.23

The priorities of this industrial engine are guided by the National Defense Strategy, which explicitly identifies China as the “pacing challenge”.34 The Fiscal Year 2025 budget request reflects this focus, prioritizing investments in modernization to meet 21st-century threats.35 Key modernization priorities are directly aligned with the requirements of JADO and great power competition. These include developing and fielding long-range precision fires, advanced air and missile defense systems, cyber and electronic warfare capabilities, AI-driven command and control systems, and a new generation of unmanned and autonomous platforms.36

Concrete examples of this strategic pivot are evident across the services. The U.S. Army’s 2024 force structure transformation is a prime case, divesting legacy systems designed for counterinsurgency while creating new, high-tech formations such as Multi-Domain Task Forces (MDTFs) built to deliver long-range kinetic and non-kinetic effects.39 Similarly, the U.S. Air Force is investing heavily in its Next Generation Air Dominance (NGAD) family of systems, Collaborative Combat Aircraft (CCA), and the modernization of its nuclear triad with the B-21 Raider bomber and the Sentinel ICBM, all aimed at maintaining strategic superiority over a peer adversary.40

However, this powerful industrial ecosystem faces a significant challenge. The U.S. defense acquisition system has been optimized for decades to produce small numbers of exquisite, technologically complex, and extremely expensive platforms like aircraft carriers and stealth fighters. While these systems remain critical, the emerging character of modern warfare, as observed in conflicts like the war in Ukraine, increasingly demands mass, speed, and affordability—particularly in areas like attritable drones and loitering munitions. Directives to “accelerate delivery of war winning capabilities,” “eliminate wasteful spending,” and “reform the acquisition process” indicate a recognition that the current system is often too slow and inefficient to keep pace with the threat.37 This creates a fundamental tension: the established industrial base excels at large, multi-decade programs, but the future battlefield may be dominated by the rapid, iterative development of cheaper, more numerous, and potentially disposable systems. The U.S. is attempting to pivot, but its deeply entrenched industrial and bureaucratic structures present a formidable hurdle to this transformation.

Part II: The Chinese Way of War: Regional Bastion and System Confrontation

China’s military philosophy is a product of its unique history, political ideology, and strategic circumstances. It has evolved from a continental, revolutionary mindset into a sophisticated, technologically driven approach aimed at securing its regional interests and challenging the post-Cold War, U.S.-led order. Its core tenets are designed to counter a more powerful, expeditionary adversary by leveraging geography, asymmetric technology, and a whole-of-nation approach to military modernization.

The Philosophy of “Active Defense”

The cornerstone of the People’s Liberation Army’s (PLA) strategic thought is “Active Defense” (积极防御, jījí fángyù). This is not a modern invention but a long-standing concept with roots in the revolutionary warfare of the Chinese Communist Party (CCP), first articulated by Mao Zedong as early as 1935.43 The philosophy is a deliberate paradox: it maintains a strategically defensive posture, asserting that China will not be the aggressor, while simultaneously authorizing tactically and operationally offensive actions to defeat an attacking enemy.3 It is a strategy of counter-attack, designed to seize the initiative from an opponent who strikes first.

This philosophy has not been static. The PLA has issued nine major strategic guidelines since 1949, with three representing fundamental shifts in direction.43 The most significant of these occurred in 1993, a direct reaction to two world-changing events: the collapse of the Soviet Union, which removed the primary land threat to China’s north, and the stunning display of U.S. technological prowess in the First Gulf War.3 These events convinced PLA planners that their traditional strategy of “luring the enemy in deep” to swallow an invader in a protracted “People’s War” was obsolete. The new imperative was to win “local wars under high-technology conditions” by fighting a forward defense along China’s periphery, keeping any conflict far from its vital economic and political centers.3

Today, this philosophy is inextricably linked to President Xi Jinping’s overarching national goal of the “great rejuvenation of the Chinese nation”.3 Achieving this “Chinese Dream” requires a powerful military capable of protecting China’s sovereignty, securing its expanding overseas interests, and, crucially, preventing a repeat of the “century of humiliation” when foreign powers intervened in and dominated China.4 Active Defense, in its modern form, is therefore the military expression of this national ambition: a strategy to create a regional bastion so formidable that it deters intervention in what China considers its internal affairs, most notably Taiwan.17 It is a patient, long-term strategy that prioritizes political objectives, seeks to win without fighting where possible, but prepares to win quickly and decisively if conflict becomes unavoidable.

The Doctrine of “Intelligentized Warfare” and System Destruction

The modern operational expression of Active Defense is a doctrine centered on information, technology, and systemic disruption. The PLA’s modernization has progressed through distinct but overlapping phases: from mechanization (building a modern force of tanks, ships, and planes) to informatization (networking those platforms) and now to intelligentization (integrating artificial intelligence, big data, and autonomous systems into every aspect of warfare).8 This final phase, which China believes is the next revolution in military affairs, is intended to allow the PLA to “leapfrog” its competitors.9

The central warfighting concept within this framework is “system destruction warfare” (体系破击战, tǐxì pòjī zhàn). This doctrine, developed from years of studying the U.S. military’s network-centric approach, posits that a modern, technologically advanced military is a highly integrated “system of systems”.9 Its greatest strength—the network that connects sensors, command nodes, and shooters—is also its greatest vulnerability.7 Therefore, victory is achieved not by destroying enemy platforms in a battle of attrition, but by attacking the C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) architecture that enables the system to function. The objective is to sever the links, blind the sensors, and jam the communications, causing the adversary’s entire warfighting system to collapse into a collection of isolated, ineffective parts.7

To execute this doctrine, the PLA has invested heavily in asymmetric “assassin’s mace” (杀手锏, shāshǒujiǎn) capabilities—niche, high-impact weapons designed to exploit specific vulnerabilities of a superior foe.21 The most prominent examples are its families of anti-ship ballistic missiles (ASBMs), such as the DF-21D and DF-26, and its development of hypersonic weapons.11 These weapons are designed to hold high-value U.S. assets, particularly aircraft carriers and major forward bases like Guam, at risk from hundreds or even thousands of miles away.11 This doctrine of systemic fragility is a direct counter to the U.S. doctrine of network-centric integration. A PLA campaign would likely commence not with a direct assault on U.S. forces, but with a multi-domain barrage of cyber attacks, electronic warfare, anti-satellite weapons, and long-range missile strikes aimed at blinding, deafening, and decapitating the U.S. military before the main battle is joined.

The Engine of Modernization: Military-Civil Fusion (MCF)

Underpinning the PLA’s rapid technological advancement is a unique national strategy known as Military-Civil Fusion (MCF, 军民融合, jūnmín rónghé). Personally overseen by Xi Jinping, MCF is an aggressive, whole-of-government effort to build a “world-class military” by 2049.24 Its core objective is to systematically eliminate the barriers between China’s civilian research and commercial sectors and its military and defense industrial sectors. The goal is to ensure that any new innovation, whether developed in a state lab, a private company, or a university, simultaneously advances both economic and military development.24

MCF targets key dual-use technologies that are seen as driving the future of warfare: artificial intelligence, quantum computing, big data, semiconductors, 5G, and aerospace technology.24 The Chinese Communist Party implements this strategy through a wide range of licit and illicit means. These include direct state investment in private industries, global talent recruitment programs, directing academic and research collaboration toward military ends, and leveraging intelligence gathering, forced technology transfer, and outright theft to acquire foreign technology.24 The strategy explicitly exploits the open and transparent nature of the global research enterprise to bolster the PLA’s capabilities, often without the knowledge or consent of foreign partners.51

Military-Civil Fusion is far more than a simple defense procurement strategy; it represents a fundamental reconception of national power. It treats technological prowess, economic strength, and military might not as separate pillars of statecraft, but as a single, integrated objective. In the U.S. system, a clear, if sometimes blurry, line exists between a commercial tech firm and a defense contractor. MCF deliberately erases that line. A Chinese company developing AI for commercial logistics is, by national strategy, also developing it for military logistics. A university conducting fundamental research in quantum computing is contributing directly to national defense.51 This creates a strategic competition that transcends the military domain, turning the entire globalized economy and research ecosystem into a potential arena of conflict. For the United States and its allies, this means that competing with China militarily requires competing with its entire national technological and industrial base.

Part III: A Comparative Strategic Framework: Similarities, Differences, and Asymmetries

While the military philosophies of the United States and China are born of different histories and geopolitical realities, they exhibit striking points of convergence alongside their profound divergences. Both powers are grappling with the same technological revolution and have arrived at similar conclusions about the future character of war. Yet, their strategic responses to these shared realities are fundamentally asymmetric, reflecting their different positions in the international system, their geographic circumstances, and their political structures.

Points of Convergence – The Race for Decision Dominance

Despite their opposing strategic postures, both the U.S. and Chinese militaries have independently concluded that the decisive element in modern, high-tech warfare is the ability to make better decisions faster than the enemy. The future battlefield will not be won simply by the side with the superior platforms, but by the side with the superior information processing and command and control architecture. This shared belief has ignited a race for what can be termed “decision dominance.”

The U.S. concept of JADC2 is explicitly designed to “deliver information and decision advantage” to commanders, enabling them to operate inside an adversary’s OODA loop.5 Similarly, China’s doctrine of “Informatized Warfare” seeks to achieve “Information Dominance” by disrupting the enemy’s C2 systems, thereby paralyzing their ability to make coherent decisions.7 Russian military analysis, observing both powers, confirms this convergence, noting that a shared objective is “achieving dominance in decision-making in future wars”.9 To this end, both nations are pouring immense resources into the enabling technologies of this new era of warfare. The U.S. is pursuing “AI-driven command and control” at all echelons 37, while China’s entire concept of “intelligentization” is predicated on the mass integration of AI to accelerate sensing, analysis, and action.45

This convergence on decision-centric warfare creates a deeply unstable dynamic. When victory is perceived to depend on striking first and disabling the enemy’s cognitive functions, it creates a powerful “first-mover advantage.” In a crisis, the side that believes its AI-enabled C2 system can achieve a decisive advantage in the opening moments may be more tempted to launch a preemptive cyber, electronic, or kinetic strike against the adversary’s C2 network. This establishes a dangerous “use it or lose it” pressure on both sides’ most critical command systems, making any crisis over a flashpoint like Taiwan incredibly volatile and prone to rapid, hard-to-control escalation.

Points of Divergence – Expeditionary Offense vs. A2/AD Defense

The sharpest contrast between the two military postures lies in their geographic orientation and operational approach. The U.S. military is fundamentally an expeditionary force, structured for global power projection. Its ability to deploy and sustain forces thousands of miles from its homeland, centered on its fleet of 11 nuclear-powered aircraft carriers and a global network of bases, is the primary instrument of its foreign policy and military strategy.1

China’s military, in direct response, is structured as a regional bastion. Its A2/AD strategy is explicitly designed to counter U.S. power projection by raising the costs of intervention to an unacceptable level.20 This strategy creates a layered, integrated defense network of sensors, long-range anti-ship missiles, submarines, and air power that extends hundreds of miles from its coast, covering the First and Second Island Chains.11 This creates a significant “home game” advantage, where China’s land-based assets, particularly the PLA Rocket Force, can provide immense firepower to augment its naval and air forces.49 This has forced the U.S. to begin shifting its strategic focus from simple power projection to what some analysts call “power protection”—developing the capabilities and concepts needed for its forward forces to survive and operate effectively within a highly contested A2/AD environment.29

This creates a competition that is not symmetric—carrier versus carrier or fighter versus fighter—but is instead highly asymmetric. A U.S. carrier strike group operating in the Western Pacific would not merely face the Chinese Navy; it would be targeted by the full weight of China’s land-based missile forces, its space-based surveillance systems, and its cyber and electronic warfare units.48 China’s land-based “carrier-killer” anti-ship ballistic missiles, for example, possess a range that can exceed that of the aircraft deployed on a U.S. carrier. This forces U.S. naval forces to either operate from farther away, reducing their combat effectiveness and sortie rates, or to enter a “kill zone” and accept a level of risk not faced since World War II. China has successfully weaponized geography to offset the qualitative and quantitative superiority of U.S. expeditionary platforms.

The Alliance Factor – A Networked Coalition vs. Strategic Self-Reliance

A final, profound asymmetry lies in how each nation approaches partnerships. The U.S. military strategy is inseparable from its global network of formal treaty allies, including NATO in Europe and Japan, South Korea, the Philippines, and Australia in the Indo-Pacific.13 These alliances are not merely political arrangements; they are integral to U.S. military operations, providing essential basing, logistical support, intelligence sharing, and substantial additional combat power.14

China, by contrast, officially “advocates partnerships rather than alliances and does not join any military bloc”.17 Its relationships, even its close strategic partnership with Russia, are pragmatic and lack the binding mutual defense commitments of a formal alliance.16 Russian analysis suggests that while military cooperation with China is deep, it is highly unlikely to evolve into a formal alliance, primarily because Beijing is unwilling to cede any of its strategic autonomy or be drawn into conflicts not of its own choosing.58

This divergence presents a fundamental strategic trade-off for both sides. The U.S. approach generates potentially overwhelming combat mass and enhances the political legitimacy of its actions. However, operating as a coalition introduces immense friction. The need to coordinate the command and control, technological systems, and political objectives of multiple nations is an extraordinary challenge—one that the JADO concept explicitly seeks to address.31 This complexity inevitably slows down the decision-making cycle that JADO is trying to accelerate. China’s approach, conversely, preserves absolute unity of command and action. Decisions can be made and executed with a speed and coherence that a coalition would struggle to match. However, this self-reliance comes at the cost of potential strategic isolation. In a major conflict, China could find itself facing a coalition of powerful nations with no formal allies obligated to come to its aid. In essence, the United States trades speed for mass, while China trades mass for speed.

Part IV: Strategic Implications and Future Outlook

The collision of these competing military philosophies is reshaping the strategic landscape, particularly in the Indo-Pacific. The doctrinal and technological race between the United States and China is not an abstract exercise; it is actively playing out in the gray zone and defining the potential character of a future conflict. Understanding this dynamic is critical for assessing risk and navigating the turbulent decades ahead.

The Shifting Military Balance and Flashpoint Scenarios

The theoretical comparison of military doctrines becomes starkly practical when applied to the region’s most volatile flashpoints: Taiwan and the South China Sea. These are the arenas where the U.S. philosophy of power projection directly confronts China’s strategy of Active Defense and A2/AD.

Taiwan remains the most dangerous potential flashpoint for a direct U.S.-China conflict.59 The PLA’s modernization is increasingly postured to provide Beijing with a credible military option to compel unification, with a key benchmark set for 2027.46 A Chinese campaign against Taiwan could manifest in several ways, from a “gray zone” quarantine led by its coast guard to disrupt shipping and assert administrative control, to a full-scale military blockade and invasion.61 Any such scenario would represent a direct clash of doctrines. A Chinese A2/AD bubble would be established to deter or defeat U.S. intervention, employing the principles of system destruction warfare against incoming U.S. naval and air forces. A U.S. response, guided by its obligations under the Taiwan Relations Act, would be a textbook application of JADO, attempting to penetrate this A2/AD zone and disrupt China’s invasion plans through integrated, multi-domain attacks.62

In the South China Sea, this doctrinal clash is already a daily reality. China’s assertion of sovereignty via its “nine-dash line,” coupled with its construction and militarization of artificial islands, is a direct challenge to the principle of freedom of navigation, a core U.S. interest.64 U.S. Freedom of Navigation Operations (FONOPS), where naval vessels sail through waters claimed by China, are a tangible application of the power projection philosophy, demonstrating that Washington does not accept Beijing’s claims and will operate its military wherever international law allows.65 China’s response—using its navy, coast guard, and maritime militia to shadow, harass, and attempt to expel U.S. ships—is a real-world application of its A2/AD and Active Defense mindset in the gray zone, short of open conflict.66 These interactions are a constant, high-stakes dialogue conducted with military hardware, where both sides test each other’s resolve, refine their operational procedures, and signal their strategic intent. The inherent risk is that a miscalculation by a single ship captain or pilot in this tense environment could rapidly escalate into the high-intensity conflict that both militaries are preparing to fight.

The Future Character of Conflict

The trajectory of this strategic competition points toward a future battlefield that is radically different from those of the past. It will be a battlespace saturated with ubiquitous sensors, from satellites in orbit to unmanned systems underwater, all connected through resilient networks and processing data at machine speed.69 The defining characteristic of future conflict will be a relentless “contest of data and deception.”

In response, the U.S. is driving its forces to become “leaner, more lethal,” and more adaptable. Its modernization efforts are focused on developing the tools for this new era: long-range autonomous weapons, AI-driven command and control, and resilient, networked communications.37 The goal is to create a force that can absorb an initial blow and still generate overwhelming, coordinated effects across all domains.

China, meanwhile, is pursuing its strategy of “intelligentization” with the explicit goal of leapfrogging U.S. capabilities. It believes that by mastering AI and autonomy within its state-directed, military-civil fused system, it can achieve an enduring advantage in decision speed and operational effectiveness, rendering traditional U.S. platform superiority irrelevant.9

This sets the stage for a future conflict defined by a “battle of the logics.” The United States is betting on the logic of network resilience. Its JADO concept is a wager that it can build a network of networks so robust, redundant, and intelligent that it can withstand systemic attacks and continue to function, ultimately overwhelming the enemy. China is betting on the logic of systemic fragility. Its doctrine of System Destruction is a wager that any complex network, no matter how resilient, contains critical nodes and unavoidable dependencies that can be identified and severed, triggering a cascading collapse that paralyzes the entire force. This is not just a technological race to build better hardware; it is a conceptual struggle over the fundamental nature of networked warfare. The winner of a future conflict may not be the side with the most advanced ship or plane, but the side whose underlying assumption about this new character of war proves more correct.

Conclusion – Ten Key Lessons for the Modern Strategist

The strategic competition between the United States and China is a multi-faceted and dynamic challenge that will define the international security environment for decades to come. A comparative analysis of their military philosophies reveals a complex interplay of converging technological paths and diverging strategic cultures. For the modern strategist, policymaker, and industry analyst, ten key lessons emerge from this analysis:

- The central battlefield of the 21st century is the network. Both powers have concluded that victory hinges on “decision dominance.” The U.S. JADC2 and China’s “Informatized Warfare” are parallel efforts to achieve information superiority, making the command, control, and communications architecture of each side the primary target and the primary weapon in any future conflict.

- U.S. military power is fundamentally expeditionary and alliance-dependent. The ability to project force across the globe is the defining feature of the U.S. military. However, this strength is predicated on secure logistical chains and the political cohesion of its alliances, both of which are now primary targets for adversary strategies.

- China’s military philosophy is fundamentally regional and counter-interventionist. The PLA is not currently configured for global power projection but is optimized for a single, overriding task: to dominate its immediate periphery and make it impossible for the U.S. to intervene effectively in a regional crisis, thereby leveraging geography as a decisive strategic asset.

- The U.S. and China are engaged in a direct doctrinal race. This is the central dynamic of the military competition. The U.S. concept of JADO aims to create a perfectly integrated “kill web.” China’s concept of “System Destruction” is designed to be the ultimate “web breaker.” This is a classic offense-defense spiral playing out in the information age.

- The U.S. relies on a distinct, highly advanced defense industry, while China’s Military-Civil Fusion (MCF) strategy presents a whole-of-nation challenge. MCF transforms the competition from a military-to-military affair into a nation-to-nation contest across the technological, industrial, and economic domains, posing a systemic challenge to the traditional Western model of defense procurement.

- Alliances are a defining asymmetry. The U.S. strategy is built on the overwhelming combat potential and political legitimacy of its coalition of allies. This provides strategic depth and mass but introduces operational friction. China’s preference for self-reliance ensures unity of command and speed of action but risks strategic isolation in a widespread conflict.

- The character of conflict is shifting from attrition to disruption. The theories of victory for both nations prioritize the paralysis and systemic collapse of the adversary’s military over the physical destruction of its forces. This suggests that future wars could be decided with shocking speed, with the decisive blows being struck in cyberspace and the electromagnetic spectrum.

- Geography remains paramount. Despite technological advances, the physical realities of the Indo-Pacific theater are critical. The U.S. must overcome the “tyranny of distance” to bring its power to bear. China, by contrast, is weaponizing the “tyranny of proximity” through its A2/AD strategy, turning its geographic position into a formidable defensive advantage.

- The PLA’s modernization is a reactive process. For three decades, the PLA has been a dedicated student of the American way of war. Its doctrines, technologies, and force structure have been systematically developed to counter specific, perceived U.S. strengths and exploit perceived weaknesses, making it a force tailored to fight the United States.

- Both powers believe emerging technologies like AI are revolutionary. The race to operationalize AI is central to the competition. China’s state-directed MCF model aims to use AI to “leapfrog” the U.S. technologically. The U.S. seeks to integrate AI to perfect its vision of a fully networked, all-domain force. The nation that most effectively harnesses this technology will likely hold a decisive military advantage for years to come.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Power projection – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Power_projection

- Introduction: An Assessment of U.S. Military Power | The Heritage Foundation, accessed August 21, 2025, https://www.heritage.org/military-strength/intro-assessment-us-military-power

- Xi Jinping’s PLA Reforms and Redefining “Active Defense”, accessed August 21, 2025, https://www.armyupress.army.mil/Journals/Military-Review/English-Edition-Archives/September-October-2023/Active-Defense/

- Xi Jinping’s PLA Reforms and Redefining “Active Defense” – Army University Press, accessed August 21, 2025, https://www.armyupress.army.mil/Portals/7/military-review/Archives/English/September-October-23/Active-Defense/Active-Defense-UA1.pdf

- USAF Role in Joint All-Domain Operations – Air Force Doctrine, accessed August 21, 2025, https://www.doctrine.af.mil/Portals/61/documents/Notes/Joint%20All-Domain%20Operations%20Doctrine–CSAF%20signed.pdf

- Joint All-Domain Operations (JADO): The Maneuver Concept for …, accessed August 21, 2025, https://othjournal.com/2024/11/22/joint-all-domain-operations-jado-the-maneuver-concept-for-future-conflict/

- Chinese information operations and information warfare – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Chinese_information_operations_and_information_warfare

- The Path to China’s Intelligentized Warfare: Converging on the Metaverse Battlefield – The Cyber Defense Review, accessed August 21, 2025, https://cyberdefensereview.army.mil/Portals/6/Documents/2024-Fall/Baughman_CDRV9N3-Fall-2024.pdf

- Russia and China Look at the Future of War | Institute for the Study …, accessed August 21, 2025, https://www.understandingwar.org/backgrounder/russia-and-china-look-future-war

- Introduction Be Aware That the Russian and U.S. Army Military Decision-Making Systems Differ Greatly Know That Russians Do Not T – Army University Press, accessed August 21, 2025, https://www.armyupress.army.mil/Portals/7/Hot%20Spots/Documents/Russia/Bartles-russian.pdf

- China’s Anti-Access/Area-Denial Strategy – TDHJ.org, accessed August 21, 2025, https://tdhj.org/blog/post/china-a2ad-strategy/

- China’s Modernizing Military | Council on Foreign Relations, accessed August 21, 2025, https://www.cfr.org/backgrounder/chinas-modernizing-military

- The National Military Strategy of the United States of America 2015 – Joint Chiefs of Staff, accessed August 21, 2025, https://www.jcs.mil/portals/36/documents/publications/2015_national_military_strategy.pdf

- Military Alliances, Partnerships Strengthened Through Defense Strategy Execution, accessed August 21, 2025, https://www.defense.gov/News/News-Stories/Article/Article/2300352/military-alliances-partnerships-strengthened-through-defense-strategy-execution/

- Grand strategy: Alliances – Defense Priorities, accessed August 21, 2025, https://www.defensepriorities.org/explainers/grand-strategy-alliances/

- The China-Russia relationship and threats to vital US interests – Brookings Institution, accessed August 21, 2025, https://www.brookings.edu/articles/the-china-russia-relationship-and-threats-to-vital-us-interests/

- Defense Policy, accessed August 21, 2025, http://eng.mod.gov.cn/xb/DefensePolicy/index.html

- Summary of the Joint All-Domain Command and Control Strategy – Department of Defense, accessed August 21, 2025, https://media.defense.gov/2022/Mar/17/2002958406/-1/-1/1/SUMMARY-OF-THE-JOINT-ALL-DOMAIN-COMMAND-AND-CONTROL-STRATEGY.pdf

- Joint All-Domain Command and Control – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Joint_All-Domain_Command_and_Control

- Anti-access/area denial – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Anti-access/area_denial

- A Low-Visibility Force Multiplier: Assessing China’s Cruise Missile Ambitions, accessed August 21, 2025, https://inss.ndu.edu/Media/News/Article/699509/a-low-visibility-force-multiplier-assessing-chinas-cruise-missile-ambitions/

- Relationship: The DoD and the Government – Challenge Coin Nation, accessed August 21, 2025, https://challengecoinnation.com/blogs/news/relationship-between-the-u-s-military-and-the-government

- United States Armed Forces – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/United_States_Armed_Forces

- Military-Civil Fusion – State Department, accessed August 21, 2025, https://www.state.gov/wp-content/uploads/2020/05/What-is-MCF-One-Pager.pdf

- Commercialized Militarization: China’s Military-Civil Fusion Strategy, accessed August 21, 2025, https://www.nbr.org/publication/commercialized-militarization-chinas-military-civil-fusion-strategy/

- China’s Strategy of ‘Informationised and Intelligent’ Warfare, accessed August 21, 2025, https://www.spsnavalforces.com/story/?id=802&h=Chinas-Strategy-of-Informationised-and-Intelligent-Warfare

- Military Power and Congress – Stennis Center for Public Service, accessed August 21, 2025, https://stennis.gov/new-brief-military-power-and-congress/

- Modernization of the People’s Liberation Army – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Modernization_of_the_People%27s_Liberation_Army

- From Power Projection to Power Protection – Department of Defense, accessed August 21, 2025, https://media.defense.gov/2019/Mar/21/2002104239/-1/-1/0/DP_0033_LOHSE_FROM_POWER_PROJECTION_TO_POWER_PROTECTION.PDF

- Forward Naval Presence: A Political, Not Military, Leadership Problem | Proceedings, accessed August 21, 2025, https://www.usni.org/magazines/proceedings/2022/january/forward-naval-presence-political-not-military-leadership-problem

- All-Domain Operations in a Combined Environment – Joint Air Power Competence Centre, accessed August 21, 2025, https://www.japcc.org/flyers/all-domain-operations-in-a-combined-environment/

- ‘NATO JADO’: A Comprehensive Approach to Joint All-Domain Operations in a Combined Environment, accessed August 21, 2025, https://www.japcc.org/wp-content/uploads/NATO-Joint-All-Domain-Operations.pdf

- Russian Military Doctrine – Geopolitical Futures, accessed August 21, 2025, https://geopoliticalfutures.com/russian-military-doctrine/

- FY2025 President’s Budget Highlights – Army Financial Management & Comptroller, accessed August 21, 2025, https://www.asafm.army.mil/Portals/72/Documents/BudgetMaterial/2025/pbr/Army%20FY%202025-Budget%20Highlights.pdf

- FY2025 Defense Budget – Department of Defense, accessed August 21, 2025, https://www.defense.gov/Spotlights/FY2025-Defense-Budget/

- An Army Modernization Update | AUSA, accessed August 21, 2025, https://www.ausa.org/publications/land-warfare-paper/an-army-modernization-update

- Army Transformation and Acquisition Reform – Department of Defense, accessed August 21, 2025, https://media.defense.gov/2025/May/01/2003702281/-1/-1/1/ARMY-TRANSFORMATION-AND-ACQUISITION-REFORM.PDF

- U.S. Army 2025 Restructuring: Strategic Realignment and Industrial Impact, accessed August 21, 2025, https://defense-update.com/20250505_us-army-2025-restructuring.html

- The 2024 Army Force Structure Transformation Initiative | Congress …, accessed August 21, 2025, https://www.congress.gov/crs-product/R47985

- Air, Space Force Leaders Stress Modernization, Readiness – Department of Defense, accessed August 21, 2025, https://www.defense.gov/News/News-Stories/Article/Article/4193428/air-space-force-leaders-stress-modernization-readiness/

- DAF releases 2025 budget proposal > United States Space Force > Article Display, accessed August 21, 2025, https://www.spaceforce.mil/News/Article-Display/Article/3703322/daf-releases-2025-budget-proposal/

- Hegseth Tasks Army to Transform to Leaner, More Lethal Force – Department of Defense, accessed August 21, 2025, https://www.defense.gov/News/News-Stories/Article/Article/4172313/hegseth-tasks-army-to-transform-to-leaner-more-lethal-force/

- Active Defense: China’s Military Strategy since 1949, accessed August 21, 2025, https://digital-commons.usnwc.edu/cgi/viewcontent.cgi?article=8120&context=nwc-review

- The (evolving) art of war | MIT News | Massachusetts Institute of Technology, accessed August 21, 2025, https://news.mit.edu/2019/active-defense-chinese-military-0508

- PLA’s Perception about the Impact of AI on Military Affairs*, accessed August 21, 2025, https://www.nids.mod.go.jp/english/publication/security/pdf/2022/01/04.pdf

- A New Step in China’s Military Reform – National Defense University Press, accessed August 21, 2025, https://ndupress.ndu.edu/Media/News/News-Article-View/Article/4157257/a-new-step-in-chinas-military-reform/

- Military Artificial Intelligence, the People’s Liberation Army, and U.S.-China Strategic Competition | CNAS, accessed August 21, 2025, https://www.cnas.org/publications/congressional-testimony/military-artificial-intelligence-the-peoples-liberation-army-and-u-s-china-strategic-competition

- Fighting DMO, Pt. 8: China’s Anti-Ship Firepower and Mass Firing Schemes – CIMSEC, accessed August 21, 2025, https://cimsec.org/fighting-dmo-pt-8-chinas-anti-ship-firepower-and-mass-firing-schemes/

- China’s aircraft carriers in Pacific signals ability to ‘contest’ US power – Al Jazeera, accessed August 21, 2025, https://www.aljazeera.com/news/2025/8/15/china-navy-power-on-show-in-pacific-signals-ability-to-contest-us-access

- Military-civil fusion – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Military-civil_fusion

- The Chinese Communist Party’s Military-Civil Fusion Policy – state.gov, accessed August 21, 2025, https://2017-2021.state.gov/military-civil-fusion/

- U.S.-China Competition and Military AI – CNAS, accessed August 21, 2025, https://www.cnas.org/publications/reports/u-s-china-competition-and-military-ai

- US and China’s Aircraft Carriers Show Force in Contested Waters – Newsweek, accessed August 21, 2025, https://www.newsweek.com/us-china-news-aircraft-carriers-george-washington-shandong-2094003

- China Naval Modernization: Implications for U.S. Navy Capabilities—Background and Issues for Congress, accessed August 21, 2025, https://www.congress.gov/crs-product/RL33153

- Attaining All-domain Control: China’s Anti-Access/Area Denial (A2/AD) Capabilities in the South China Sea – Pacific Forum, accessed August 21, 2025, https://pacforum.org/publications/issues-insights-issues-and-insights-volume-25-wp-2-attaining-all-domain-control-chinas-anti-access-area-denial-a2-ad-capabilities-in-the-south-china-sea/

- Is China or Russia the bigger threat to the United States? There’s a clear answer., accessed August 21, 2025, https://www.atlanticcouncil.org/blogs/new-atlanticist/is-china-or-russia-the-bigger-threat-to-the-united-states-theres-a-clear-answer/

- China-Russia Military Relationship – Walter H. Shorenstein Asia-Pacific Research Center, accessed August 21, 2025, https://aparc.fsi.stanford.edu/research/china-russia-military-relationship

- Partnership Short of Alliance: Military Cooperation Between Russia and China – CEPA, accessed August 21, 2025, https://cepa.org/comprehensive-reports/partnership-short-of-alliance-military-cooperation-between-russia-and-china/

- The United States, China and Taiwan and the Role of Deterrence in Scenarios Short of War, accessed August 21, 2025, https://usa.embassy.gov.au/APCSS24

- The Risks of Rushing to Denial in the Taiwan Strait – CSIS, accessed August 21, 2025, https://www.csis.org/analysis/risks-rushing-denial-taiwan-strait

- How China Could Quarantine Taiwan: Mapping Out Two Possible Scenarios – CSIS, accessed August 21, 2025, https://www.csis.org/analysis/how-china-could-quarantine-taiwan-mapping-out-two-possible-scenarios

- Great Power Competition in Contested States: The Case of Taiwan – Project MUSE, accessed August 21, 2025, https://muse.jhu.edu/article/953086

- Why China-Taiwan Relations Are So Tense, accessed August 21, 2025, https://www.cfr.org/backgrounder/china-taiwan-relations-tension-us-policy-trump

- Territorial disputes in the South China Sea – Wikipedia, accessed August 21, 2025, https://en.wikipedia.org/wiki/Territorial_disputes_in_the_South_China_Sea

- Territorial Disputes in the South China Sea | Global Conflict Tracker, accessed August 21, 2025, https://www.cfr.org/global-conflict-tracker/conflict/territorial-disputes-south-china-sea

- A quiet path to peace in the South China Sea – Asia Times, accessed August 21, 2025, https://asiatimes.com/2025/08/a-quiet-path-to-peace-in-the-south-china-sea/

- Bejing Chases Off US Warship! China Challenges Trump In South China Sea? – YouTube, accessed August 21, 2025, https://www.youtube.com/watch?v=P8DH7sxZB_A

- Navigating Tensions in the South China Sea: A Multidimensional Analysis, accessed August 21, 2025, https://www.cjfp.org/navigating-tensions-in-the-south-china-sea-a-multidimensional-analysis/

- Next Army: Envisioning the U.S. Army at 250 and Beyond [CSIS] – Reddit, accessed August 21, 2025, https://www.reddit.com/r/army/comments/1lb5pw0/next_army_envisioning_the_us_army_at_250_and/