Executive Summary

The modernization of small arms within the Russian Federation’s military branches represents a fundamental shift from Soviet-era mass-production standards to specialized, modular, and network-centric systems designed for the contemporary high-intensity battlefield. Under the umbrella of the Ratnik program, and transitioning into the fourth-generation Sotnik initiative slated for 2025, the Russian Ministry of Defense (MoD) has sought to integrate individual weaponry into a holistic “soldier as a system” framework.1 As of early 2026, this evolution is characterized by the widespread adoption of the Kalashnikov AK-12 series across the Ground Forces (SV), the development of shortened “K” variants for the Airborne Forces (VDV), and the integration of highly compact submachine guns like the PP-2000 into the survival kits of the Aerospace Forces (VKS).3

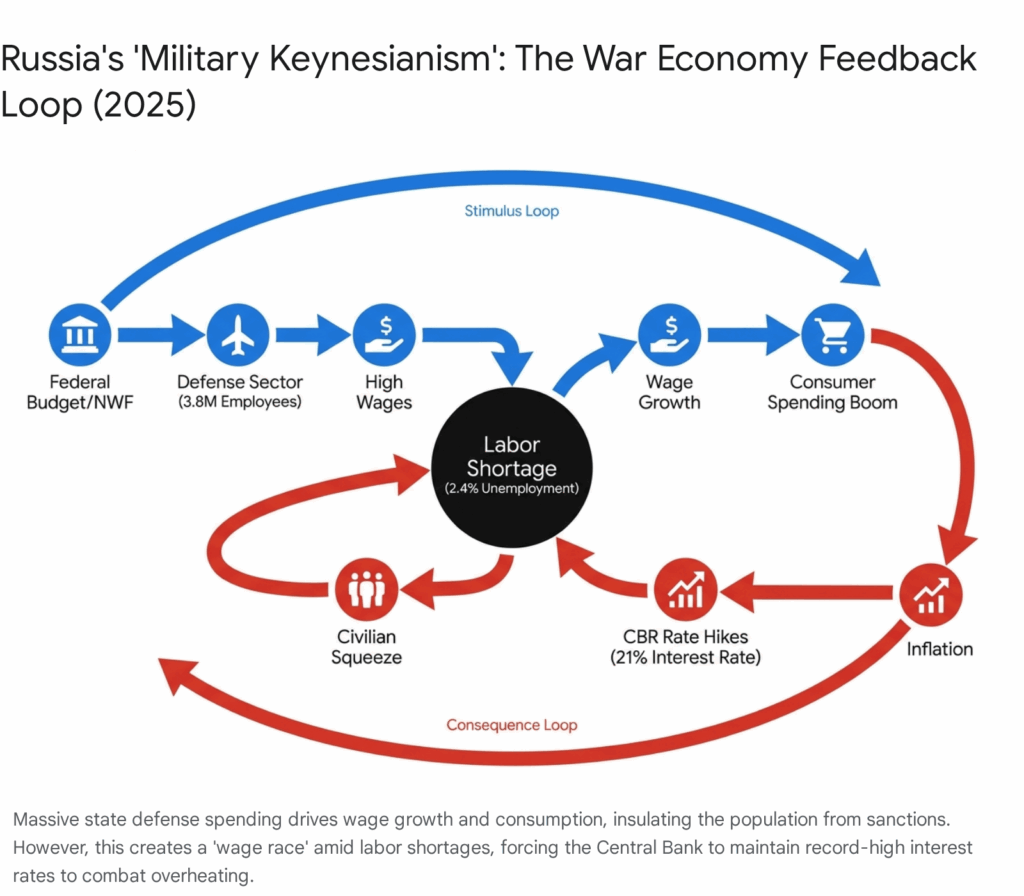

While the defense industrial base (DIB) has successfully transitioned to a “war economy” posture—with production of small arms and ammunition increasing manifold since 2022—it faces systemic challenges, including a 21% interest rate on independent production initiatives and a reliance on legacy Soviet designs to mitigate innovation stagnation caused by international sanctions.6 Furthermore, elite units such as the Special Operations Command (KSSO) continue to augment domestic inventories with Western-made high-precision systems to maintain tactical superiority and operational deniability.9 This report provides an exhaustive technical and strategic assessment of small arms across all Russian military branches, detailing the shifts in procurement, technical specifications, and the doctrinal implications of new infantry technologies.

The Russian Defense Industrial Base and the Small Arms Paradigm

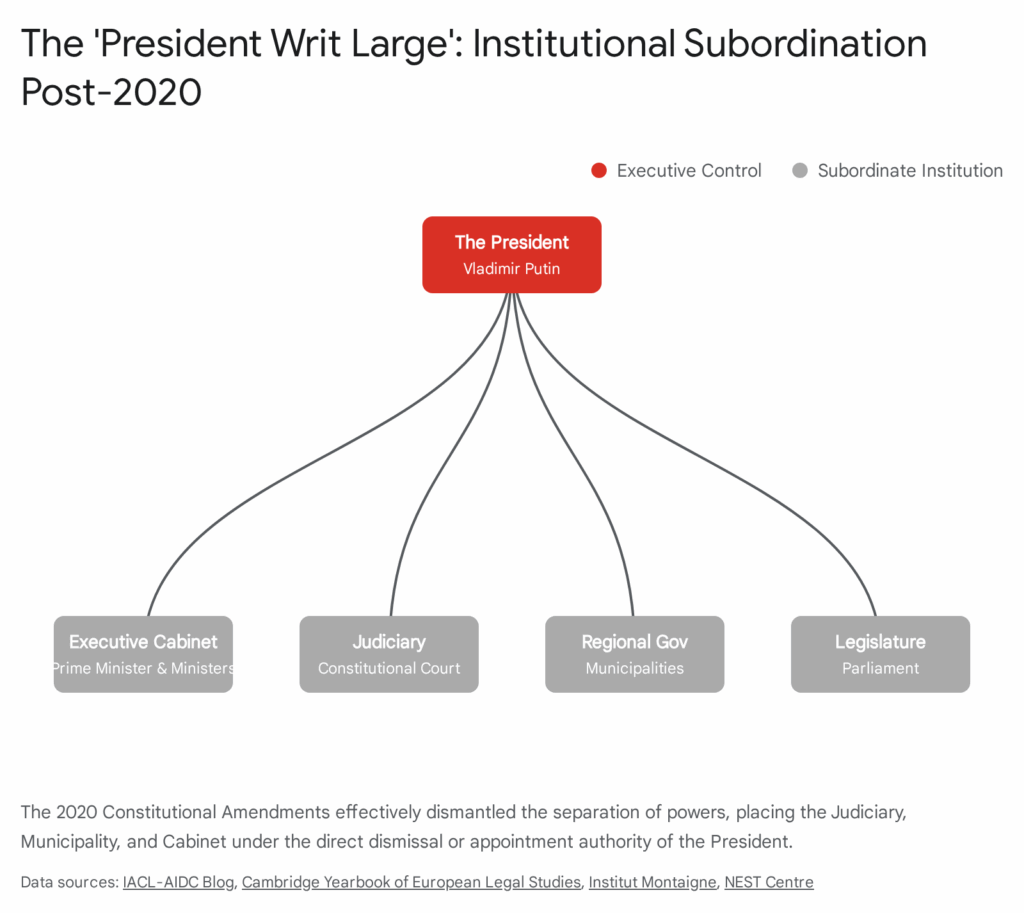

The current state of Russian small arms is inextricably linked to the performance and constraints of its military-industrial complex (OPK). Under the leadership of state conglomerate Rostec and its subsidiaries, such as Kalashnikov Concern and TsNIITochMash, the industry has prioritized the rapid scaling of proven platforms while attempting to manage a “degraded science” environment.2 Despite record spending, which is projected to exceed 6% of GDP in 2025, the industry struggles with bureaucratic bottlenecks and a lack of long-term contracts that often prevent manufacturers from scaling up production until orders are officially finalized.6

A critical second-order insight into this landscape is the “innovation stagnation” identified in recent strategic assessments. Rather than evolving toward fundamentally new kinetic mechanisms, the Russian DIB is focusing on the “Ratnik” and “Sotnik” modularity—applying modern ergonomics and electronic integration to the reliable foundations of the past.6 This has resulted in a proliferation of AK-pattern derivatives that, while technologically iterative, are optimized for the specific environmental and tactical requirements of each service branch.

| Manufacturer | Key Subsidiaries / Offices | Primary Small Arms Focus |

| Rostec | Kalashnikov Concern, TsNIITochMash, KBP Tula | Standard Assault Rifles, Sniper Systems, SMGs, Future Infantry Kits 1 |

| Tula Arms Plant (TOZ) | Tula Design Bureau | Specialized Underwater Arms, Legacy Survival Guns, Suppressed Weapons 12 |

| TsNIITochMash | Klimovsk Research Center | Ratnik/Sotnik R&D, Armor-Piercing Ammunition, Specialist Sidearms 1 |

| KBP Instrument Design | Tula | PP-2000 SMG, GSh-18 Pistol, ADS Amphibious Rifle 5 |

| Orsis (Promtekhnologiya) | Moscow | High-Precision Bolt Action Rifles, Licensed Glock Assembly 9 |

Russian Ground Forces (SV): The Evolution of Mass-Issue Weaponry

The Russian Ground Forces (SV) remain the primary beneficiary of the Ratnik program, which seeks to modernize nearly 90% of a soldier’s equipment.1 The standardization effort is centered on the AK-12 assault rifle, though the transition from the legacy AK-74M remains a multi-stage process hindered by the vast existing stockpiles of older rifles.3

The AK-12 Iterations and Combat Feedback

The 5.45x39mm AK-12 is the definitive standard-issue rifle of the modern Russian infantry. Since its initial fielding in 2018, the rifle has undergone three major design iterations to address deficiencies noted during large-scale combat operations.3 The early “Type 1” models were criticized for ergonomic flaws and a diopter sight that was difficult to use in low-light conditions. The subsequent “Type 2” (Army-2020) and “Type 3” (2023) upgrades have transformed the platform into a more resilient tool.3

A significant technical shift in the 2023 AK-12 (designated 6P70M) was the removal of the two-round burst mode. Military practitioners found the mode provided negligible increase in hit probability while complicating the trigger mechanism.3 Furthermore, the introduction of a non-removable muzzle device with a three-prong flash hider, designed to accept quick-detach suppressors, indicates a doctrinal move toward universal suppression in assault operations.3

Support Weapons: Machine Guns and Precision Fire

The SV has also modernized its squad-level support weapons. The PKP Pecheneg has largely replaced the PKM as the standard general-purpose machine gun. Its forced-air cooling system allows for sustained fire without the rapid barrel degradation typical of earlier designs.17 For light support, the RPK-74M is being supplemented by the RPK-16, which introduces a detachable barrel and high-capacity 95-round drum magazines, offering a level of versatility previously unavailable to the squad automatic rifleman.3

In the precision role, the SVDM represents the final iteration of the iconic Dragunov sniper rifle, featuring a heavier barrel and integrated Picatinny rails.9 However, the SV is preparing for the transition to the Chukavin SVCh, which moves toward an “upper/lower” receiver construction, improving modularity and allowing for the easier integration of modern thermal optics.9

Summary Table: Russian Ground Forces (SV) Small Arms Inventory

| Type | Model | Caliber | Technical Detail | Strategic Role |

| Assault Rifle | AK-12 (6P70M) | 5.45x39mm | Free-float handguard, 700 RPM, QD suppressor 3 | Primary Standard Issue for infantry and motorized units 11 |

| Assault Rifle | AK-74M | 5.45x39mm | Chrome-lined barrel, folding stock 17 | Legacy standard; still widely used by non-elite and reserve units 17 |

| Assault Rifle | AK-15 | 7.62x39mm | AK-12 ergonomics in 7.62mm caliber 11 | Issued for higher penetration requirements in urban or dense foliage 11 |

| Machine Gun | PKP Pecheneg | 7.62x54mmR | Fixed barrel, air-cooled jacket, 5.5 kg 17 | Standard General-Purpose Machine Gun (GPMG) 17 |

| Machine Gun | RPK-16 | 5.45x39mm | Detachable barrel, 95-rd drum option 3 | Modern Squad Automatic Weapon (SAW) / Light Support 19 |

| Sniper Rifle | SVDM / SVCh | 7.62x54mmR | Folding stock, Picatinny-integrated 9 | Standard Designated Marksman Rifle (DMR) 9 |

| Sidearm | MP-443 Grach | 9x19mm | 18-round capacity, double-action 9 | Primary service pistol for officers and support crews 19 |

| Sidearm | PLK (Lebedev) | 9x19mm | Striker-fired, modular aluminum frame 11 | Modern replacement for the Makarov and Grach 15 |

Russian Airborne Forces (VDV): Specialized Mobility and Firepower

The VDV (Vozdushno-desantnye voyska) has undergone a “mission retooling” since 2022, transitioning from light air-assault troops into heavy assault units specialized in trench-sweeping and high-intensity urban combat.4 This has necessitated a unique small arms profile that prioritizes compactness and suppressed fire.

The AK-12K and the Requirement for Compactness

The VDV has emerged as the primary user of the AK-12K, a shortened carbine variant of the 2023 AK-12 upgrades. With a barrel length of roughly 290mm (compared to the standard 415mm), the AK-12K is optimized for maneuverability within the tight confines of armored vehicles like the BMD-4 and the narrow dimensions of trench networks.3 A distinctive feature of the VDV’s procurement is that every AK-12K arrives from the factory with a specialized camouflage paint job and a 1.7-pound suppressor as standard kit.4

The reliance on suppressors is not merely a stealth measure but an occupational health and communication necessity in close-quarters battle. However, operational feedback has indicated that the back-pressure from the suppressors can cause significant gas blowback and fouling, leading to rapid overheating during intensive fire.4 Despite these drawbacks, the VDV views the AK-12K as a “big step forward” in equipping assault units.4

Specialized Airborne Support Weapons

The VDV is also the launch customer for the RPL-20, a 5.45mm belt-fed light machine gun.11 Unlike the magazine-fed RPK series, the RPL-20 provides the high-volume suppressive fire required for “heavy assault” tactics while maintaining a weight of only 5.5 kg, which is significantly lighter than the 7.62mm PKM.11 For clandestine operations, the VDV continues to rely on the AS Val and VSS Vintorez (9x39mm), which are valued for their near-silent operation and ability to defeat NATO body armor at ranges up to 400 meters.23

Summary Table: Russian Airborne Forces (VDV) Small Arms Inventory

| Category | Model | Caliber | Features / Improvements | Strategic Role |

| Assault Carbine | AK-12K | 5.45x39mm | 290mm barrel, factory camo, standard suppressor 4 | Primary weapon for trench-sweeping and assault groups 4 |

| Light Machine Gun | RPL-20 | 5.45x39mm | Belt-fed, 800m sighting range, lightweight 11 | Squad-level high-volume suppressive fire 11 |

| Suppressed Rifle | AS Val / ASM | 9x39mm | Integral suppressor, subsonic heavy bullet 19 | Specialized recon and clandestine assault 23 |

| Suppressed Sniper | VSS Vintorez | 9x39mm | Integrally suppressed, 10/20-rd magazines 23 | Silent precision engagement 23 |

| Sniper Rifle | SV-98M | 7.62x54mmR | Bolt-action, 1000m range, suppressor-ready 9 | Dedicated precision sniper rifle 9 |

| Submachine Gun | PPK-20 | 9x19mm | Compact AK-12 aesthetics, folding stock 11 | Personal Defense Weapon (PDW) for crews and officers 11 |

Special Operations Forces (KSSO and GRU Spetsnaz)

The Special Operations Command (KSSO) and GRU Spetsnaz occupy a unique position in the Russian hierarchy, operating with a high degree of procurement flexibility that allows for the integration of foreign weapon systems.9 This non-standardization is a deliberate strategy to achieve “deniability” and to provide operators with the highest performance metrics available globally.9

The Integration of Western Platforms

A defining characteristic of KSSO loadouts is the extensive use of Austrian Glock-17 and Glock-19 pistols.9 Russian analysts note that the Glock’s service life—exceeding 300,000 rounds—dramatically outperforms domestic counterparts like the Makarov, which is often rated for only 5,000 rounds.10 These weapons are frequently assembled locally by the Orsis factory to bypass import restrictions.9

Furthermore, for high-precision engagements, the KSSO utilizes Western rifles such as the Accuracy International L115 and the Steyr SSG 69.10 The use of the 7.62x51mm NATO and.338 Lapua Magnum cartridges provides a ballistic consistency that is highly sought after by tier-one operators.9

Specialist Domestic Small Arms

In addition to foreign arms, the Spetsnaz utilize specialized domestic systems like the ShAK-12 (12.7x55mm). This bullpup rifle is designed for short-range, hard-hitting firepower capable of instantly neutralizing targets through heavy cover or advanced body armor.15 For extreme-range sniping, the Lobaev Sumrak (.408 CheyTac) is available, offering engagement ranges that far exceed standard military cartridges.15

Summary Table: Special Operations (KSSO / Spetsnaz) Inventory

| Type | Model | Caliber | Origin | Strategic Rationale |

| Assault Rifle | AK-105 / AK-12 | 5.45x39mm | Russia | Compact standard for high-intensity raids 9 |

| Assault Rifle | HK416 / MR556 | 5.56x45mm | Germany | High reliability, Western emulation 9 |

| Sniper Rifle | AI L115 | .338 Lapua | UK | Long-range precision and anti-personnel 19 |

| Sniper Rifle | Orsis T-5000 | .338 / 7.62mm | Russia | Modern domestic high-precision bolt-action 9 |

| Bullpup Rifle | ShAK-12 | 12.7x55mm | Russia | Suppressed, ultra-high stopping power for CQB 15 |

| SMG | HK MP5 / MP7 | 9mm / 4.6mm | Germany | Reliable close-quarters and PDW solutions 9 |

| Pistol | Glock-17 / 19 | 9x19mm | Austria | Exceptional durability and ergonomics 9 |

| Pistol | SR-1M Vektor | 9x21mm | Russia | Armor-piercing sidearm for special units 15 |

Russian Navy (VMF): Naval Infantry and Underwater Defense

The Russian Navy (VMF) inventory is split between the Naval Infantry, who increasingly mirror the equipment of the SV, and specialized naval spetsnaz (PDSS) who require weapons capable of functioning in aquatic environments.20

Supercavitation and Underwater Ballistics

The VMF utilizes specialized firearms like the APS underwater assault rifle and the SPP-1M pistol.12 These weapons do not fire standard bullets; instead, they utilize long, slender steel darts (flechettes).12 The physics of these rounds relies on supercavitation—creating a bubble of gas around the projectile to reduce hydrodynamic drag.13 The APS, while effective underwater (lethal up to 30m at 5m depth), is notoriously inaccurate on land as the smoothbore barrel cannot stabilize the darts in the air.27

A second-order insight into naval small arms modernization is the adoption of the ADS amphibious rifle. The ADS utilizes a unique 5.45x39mm PSP cartridge that allows the weapon to fire effectively both submerged and on land, using standard AK-74 magazines.14 This solves a critical logistical hurdle for amphibious reconnaissance units who previously had to carry two separate primary weapons.28

Summary Table: Russian Navy (VMF) Small Arms Inventory

| Category | Model | Caliber | Environment | Technical Insight |

| Underwater Rifle | APS | 5.66x120mm Dart | Submerged | Smoothbore, drag-stabilized flechettes 27 |

| Amphibious Rifle | ADS | 5.45x39mm | Dual-Medium | Fires standard and PSP underwater ammo 19 |

| Underwater Pistol | SPP-1M | 4.5x115mm Dart | Submerged | Four-barrel cluster, 17-round lethality 12 |

| Assault Rifle | AK-12 / AK-15 | 5.45 / 7.62mm | Land | Standard Naval Infantry assault rifles 20 |

| Submachine Gun | SR-2 Veresk | 9x21mm | Land / Ship | High-power PDW for boarding teams 26 |

| Shotgun | Saiga-12 | 12 Gauge | Close Quarters | Used for shipboard security and boarding 14 |

Russian Aerospace Forces (VKS): Survival and Pilot Self-Defense

The requirement for the VKS is characterized by the extreme spatial constraints of ejection seats and the necessity for survival weaponry in diverse geographic conditions.29

The Shift in Pilot Survival Kits (NAZ)

Since 2023, the VKS has actively sought to replace the AKS-74U in pilot survival kits with the more compact PP-2000 submachine gun.5 The PP-2000’s primary advantage is its size—555mm with the stock extended, fitting comfortably within the NAZ-7 survival containers stored under the ejection seat.5 Furthermore, the PP-2000 can utilize a spare 44-round magazine as a wire-stock, enhancing stability in high-stress survival scenarios.5

The adoption of the PLK (Lebedev Compact) pistol also marks a departure from the Makarov.16 The PLK is designed with modern ergonomics and a low bore axis, making it significantly easier to shoot accurately for pilots who may have suffered injuries during ejection.11 In 2025, Rostec launched mass production of a new survival waistcoat that incorporates these firearms into a ballistic-rated vest, ensuring the pilot retains the weapon even if the ejection seat kit is lost.31

Summary Table: Russian Aerospace Forces (VKS) Small Arms

| Component | Model | Caliber | Strategic Role | Technical Note |

| Primary PDW | PP-2000 | 9x19mm | Survival / Self-Defense | Fits inside NAZ-7 seat kits 5 |

| Standard Sidearm | PLK (Lebedev) | 9x19mm | General Aircrew Sidearm | Ergonomic striker-fired modern pistol 11 |

| Compact Carbine | AKS-74U | 5.45x39mm | Legacy PDW | Being phased out for more compact SMGs 32 |

| Specialized Sidearm | Stechkin APS | 9x18mm | Pilot combat sidearm | Selective-fire; favored for higher capacity 15 |

| Survival Gun | TP-82 | 12.5mm / 5.45mm | Legacy Wildlife Defense | Triple-barrel combination gun; out of service 29 |

Strategic Rocket Forces (RVSN) and Internal Security Units

The Strategic Rocket Forces (RVSN) utilize small arms primarily for the physical security of nuclear assets and the deterrence of specialized sabotage units.33 The security protocol is overseen by the 12th Main Directorate (GUMO), which employs a three-tier protection system.34

Anti-Sabotage Technology and Small Arms Integration

The RVSN has pioneered the use of the Typhoon-M anti-sabotage vehicle, which integrates a BTR-82 chassis with extensive sensor arrays and hand-launched ZALA drones.35 The primary small arms used by these security details are the AK-12 and the Kord heavy machine gun (12.7mm), the latter of which is increasingly utilized in a counter-UAV role.17 The Typhoon-PVO variant, modernized in 2025, specifically carries teams equipped with Verba MANPADS and Kord machine guns to protect mobile ICBM columns from aerial threats.37

Summary Table: Strategic Rocket Forces (RVSN) Security Inventory

| Category | Model | Caliber | Technical Detail | Strategic Role |

| Patrol Rifle | AK-12 | 5.45x39mm | 2023 Mod improvements | Standard asset protection rifle 18 |

| Heavy Machine Gun | Kord | 12.7x108mm | Muzzle brake, low recoil | Vehicle-mounted anti-sabotage/anti-drone 37 |

| General Purpose MG | PKP Pecheneg | 7.62x54mmR | Fixed air-cooled barrel | Perimeter and post defense 17 |

| Submachine Gun | PP-2000 | 9x19mm | Compact profile | Personal defense for vehicle and missile crews 5 |

| Sidearm | MP-443 Grach | 9x19mm | 18-rd steel magazine | Standard sidearm for security officers 19 |

The Future: Sotnik and Fourth-Generation Infantry Systems

Looking toward 2026, the Russian MoD is pivoting from the third-generation Ratnik to the “Sotnik” (Centurion) system.1 This program aims to introduce revolutionary capabilities that extend beyond traditional small arms.

Technological Goals of Sotnik (2025-2026)

- Exoskeletons: Passive and active titanium exoskeletons designed to increase the soldier’s endurance and allow for the carriage of up to 80 kg of equipment without restricting movement.39

- Advanced Protection: Claims have been made regarding ultra-high molecular weight polyethylene armor capable of stopping.50 caliber M2 Browning rounds, though many Western analysts view this as propaganda rather than a functional field reality.39

- Networked Lethality: Integration of micro-UAVs and robotic systems that project target data directly onto the soldier’s goggles.2

- Ammunition Development: Introduction of the 7N39 “Igolnik” and 7N40 cartridges, designed to provide the 5.45x39mm round with significantly increased density of fire and armor penetration.1

Conclusion

The Russian small arms ecosystem in 2025-2026 is a study in pragmatic adaptation. While the Ground Forces continue the massive, albeit slow, transition to the AK-12, specialized branches like the VDV and VMF have successfully optimized their inventories with niche weapons such as the AK-12K and the ADS amphibious rifle.4 The Aerospace Forces have made logical strides in pilot survival by adopting compact submachine guns, while the KSSO remains a sophisticated hybrid of Russian and Western technology.9

The primary risk to this modernization remains the economic and industrial friction identified in 2025: high interest rates, innovation stagnation, and a reliance on iterative rather than revolutionary breakthroughs.6 However, the Russian military has proven adept at refining existing platforms—such as the three generations of the AK-12—into weapons that are “good enough” to sustain its strategic objectives on the modern multi-domain battlefield.3 As the Sotnik program begins its phased introduction, the focus will likely remain on integrating these kinetic tools into an increasingly digital and roboticized infantry framework.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Ratnik (program) – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/Ratnik_(program)

- Ratnik: Russia’s Modern Warrior Program – Grey Dynamics, accessed January 31, 2026, https://greydynamics.com/ratnik-russias-modern-warrior-program/

- AK-12 – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/AK-12

- The VDV’s Newest Rifle for the Trenches – The “Type 3” AK-12K – Safar Publishing, accessed January 31, 2026, https://www.safar-publishing.com/post/the-vdv-s-newest-rifle-for-the-trenches-the-type-3-ak-12k

- PP-2000 – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/PP-2000

- Russia’s struggle to modernize its military industry – Chatham House, accessed January 31, 2026, https://www.chathamhouse.org/2025/07/russias-struggle-modernize-its-military-industry

- Russian Force Generation and Technological Adaptations Update May 30, 2025 | ISW, accessed January 31, 2026, https://understandingwar.org/research/russia-ukraine/russian-force-generation-and-technological-adaptations-update-may-30-2025/

- Arms industry of Russia – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/Arms_industry_of_Russia

- The KSSO: Russia’s Special Operations Command – Grey Dynamics, accessed January 31, 2026, https://greydynamics.com/the-ksso-russias-special-operations-command/

- 3 NATO weapons favored by Russian Special Forces – We Are The Mighty, accessed January 31, 2026, https://www.wearethemighty.com/articles/3-nato-weapons-favored-by-russian-special-forces/

- Defense products || Kalashnikov Group, accessed January 31, 2026, https://en.kalashnikovgroup.ru/catalog/boevoe-strelkovoe-oruzhie

- SPP-1 underwater pistol – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/SPP-1_underwater_pistol

- The Soviet SPP-1 underwater pistol – Guns.com, accessed January 31, 2026, https://www.guns.com/news/2013/07/05/spp-1-the-soviet-water-gun

- Precision at Distance: The Longest-Range Weapons in the Spetsnaz Arsenal – 24/7 Wall St., accessed January 31, 2026, https://247wallst.com/military/2025/09/25/precision-at-distance-the-longest-range-weapons-in-the-spetsnaz-arsenal/

- Weapons of the Russian Special Forces | Navy SEALs, accessed January 31, 2026, https://navyseals.com/5283/weapons-of-the-russian-special-forces/

- Russian Pilots Fielding PP-2000s & PLK Pistols – The Armourers …, accessed January 31, 2026, https://armourersbench.com/2023/10/08/russian-pilots-fielding-pp-2000s-plk-pistols/

- List of equipment of the Russian Ground Forces – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/List_of_equipment_of_the_Russian_Ground_Forces

- AK-12 – Kalashnikov Group, accessed January 31, 2026, https://en.kalashnikovgroup.ru/catalog/boevoe-strelkovoe-oruzhie/avtomaty/avtomat-kalashnikova-ak-12

- These Are the Small Arms Used by Russian Special Forces – 24/7 Wall St., accessed January 31, 2026, https://247wallst.com/special-report/2024/04/10/these-are-the-small-arms-used-by-russian-special-forces/

- Kalashnikov AK-12 and AK-15 assault rifles officially approved by Russian MoD, accessed January 31, 2026, https://en.kalashnikovgroup.ru/media/ak-12/ak-12-i-ak-15-prinyaty-na-vooruzhenie-minoborony-rossii

- The VDV’s Newest Rifle for the Trenches – The “Type 3” AK-12K, accessed January 31, 2026, https://safar-publishing.com/post/the-vdv-s-newest-rifle-for-the-trenches-the-type-3-ak-12k

- How Russian weapons were improved in 2025 – ВПК.name, accessed January 31, 2026, https://vpk.name/en/1088737_how-russian-weapons-were-improved-in-2025.html

- AS Val and VSS Vintorez – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/AS_Val_and_VSS_Vintorez

- Captured russian VSSM Vintorez and AS Val. [2160×1116] : r/MilitaryPorn – Reddit, accessed January 31, 2026, https://www.reddit.com/r/MilitaryPorn/comments/168wbbx/captured_russian_vssm_vintorez_and_as_val_21601116/

- Russian Pilots Are Getting New Kalashnikov ‘Survival’ Submachine Guns – The National Interest, accessed January 31, 2026, https://nationalinterest.org/blog/buzz/russian-pilots-are-getting-new-kalashnikov-survival-submachine-guns-207310

- List of modern Russian small arms and light weapons – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/List_of_modern_Russian_small_arms_and_light_weapons

- Russian Underwater Guns – Small Arms Defense Journal, accessed January 31, 2026, https://sadefensejournal.com/russian-underwater-guns/

- Russian APS Underwater Assault Rifle – Forgotten Weapons, accessed January 31, 2026, https://www.forgottenweapons.com/rifles/aps-underwater-rifle/

- TP-82 – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/TP-82

- The TP-82 – Russian Space Gun – Athlon Outdoors, accessed January 31, 2026, https://athlonoutdoors.com/article/the-tp-82/

- A new NAZ waistcoat will help pilots survive in extreme conditions during ejection, accessed January 31, 2026, https://ruavia.su/a-new-naz-waistcoat-will-help-pilots-survive-in-extreme-conditions-during-ejection/

- PP-2000 Submachine Guns To Replace Kalashnikov Rifles In Russian Pilots’ Survival Kits, accessed January 31, 2026, https://defensemirror.com/news/25302/PP_2000_Submachine_Guns_To_Replace_Kalashnikov_Rifles_In_Russian_Pilots____Survival_Kits

- Strategic Rocket Forces – Wikipedia, accessed January 31, 2026, https://en.wikipedia.org/wiki/Strategic_Rocket_Forces

- RVSN – Strategic Missile Troops – Russian and Soviet Nuclear Forces – Nuke, accessed January 31, 2026, https://nuke.fas.org/guide/russia/agency/rvsn.htm

- Russia’s Strategic Rocket Forces get Typhoon-M “anti-sabotage vehicles”: do they know something we don’t? | In Moscow’s Shadows, accessed January 31, 2026, https://inmoscowsshadows.wordpress.com/2013/12/17/russias-strategic-rocket-forces-get-typhoon-m-anti-sabotage-vehicles-do-they-know-something-we-dont/

- Russian Strategic Rocket Forces receive 70 new combat anti-sabotage vehicles, accessed January 31, 2026, https://defence-blog.com/russian-strategic-rocket-forces-receive-70-new-combat-anti-sabotage-vehicles/

- Missiles, Machine Guns, and Panic: Russia Builds Typhoon-PVO to Guard What’s Left, accessed January 31, 2026, https://united24media.com/latest-news/missiles-machine-guns-and-panic-russia-builds-typhoon-pvo-to-guard-whats-left-10506

- Russia slated to field Sotnik soldier gear in 2025 – DIMDEX, accessed January 31, 2026, https://dimdex.com/News/russia-slated-to-field-sotnik-soldier-gear-in-2025/

- Russia is building a futuristic combat suit it claims can stop .50 caliber bullets – Task & Purpose, accessed January 31, 2026, https://taskandpurpose.com/news/russia-sotnik-combat-armor-development/

- Russia unveiled concept of new combat gear for “soldier of the future” – Defence Blog, accessed January 31, 2026, https://defence-blog.com/russia-unveiled-concept-of-new-combat-gear-for-soldier-of-the-future/

- No, Russia’s futuristic Sotnik armor isn’t real – Sandboxx, accessed January 31, 2026, https://www.sandboxx.us/news/no-russias-futuristic-sotnik-armor-isnt-real/