Reporting Period: January 18 – January 24, 2026

1. Executive Summary

The reporting period ending January 24, 2026, represents one of the most volatile and strategically consequential weeks for the European Union (EU) in the post-Cold War era. The Union faced a simultaneous, multi-vector stress test of its external security architecture, its internal economic cohesion, and its resilience against hybrid warfare. The convergence of these threats—originating from both allies and adversaries—has forced a rapid reassessment of the bloc’s strategic autonomy and crisis management mechanisms.

The dominant strategic development was the acute diplomatic rupture with the United States regarding the status of Greenland. President Donald Trump’s ultimatum—threatening punitive tariffs on eight European nations unless sovereignty transfer negotiations commenced—precipitated a crisis that momentarily threatened the foundational cohesion of the North Atlantic Treaty Organization (NATO). While a tentative “framework deal” announced at the World Economic Forum in Davos appears to have forestalled immediate economic sanctions, the episode has fundamentally altered the risk calculus in Brussels regarding the reliability of the US security umbrella. It has accelerated the EU’s drive toward “strategic autonomy,” shifting it from a rhetorical aspiration to an operational necessity.

On the eastern flank, the war in Ukraine has entered a critical phase of “energy attrition.” Russian forces have initiated a campaign targeting the electrical substations essential for the safety of Ukraine’s nuclear power plants, raising the specter of a radiological incident triggered by grid collapse. This kinetic escalation coincided with the first trilateral peace talks between the US, Russia, and Ukraine in Abu Dhabi. The talks concluded without a breakthrough, underscoring the entrenched positions of the belligerents despite the new US administration’s push for a negotiated settlement.

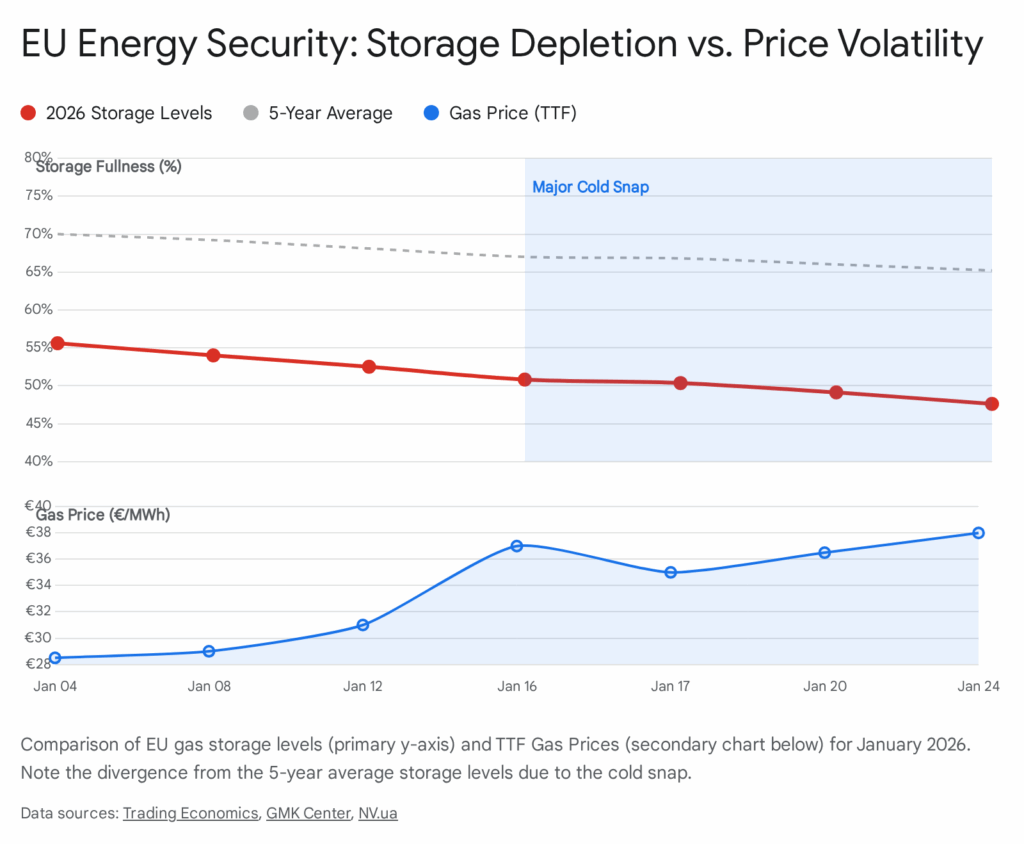

Internally, the EU is grappling with severe political dissonance over the EU-Mercosur trade agreement. The signing of the deal has triggered a wave of farmers’ protests across France, Germany, and Poland, reminiscent of the unrest in early 2024. The European Parliament’s move to refer the agreement to the European Court of Justice (ECJ) has created a constitutional standoff with the European Commission, which is now exploring mechanisms for provisional application to bypass legislative gridlock. This institutional friction is occurring against a backdrop of deteriorating energy security, with European gas storage depleting at rates significantly above the five-year average due to an intense January cold snap.

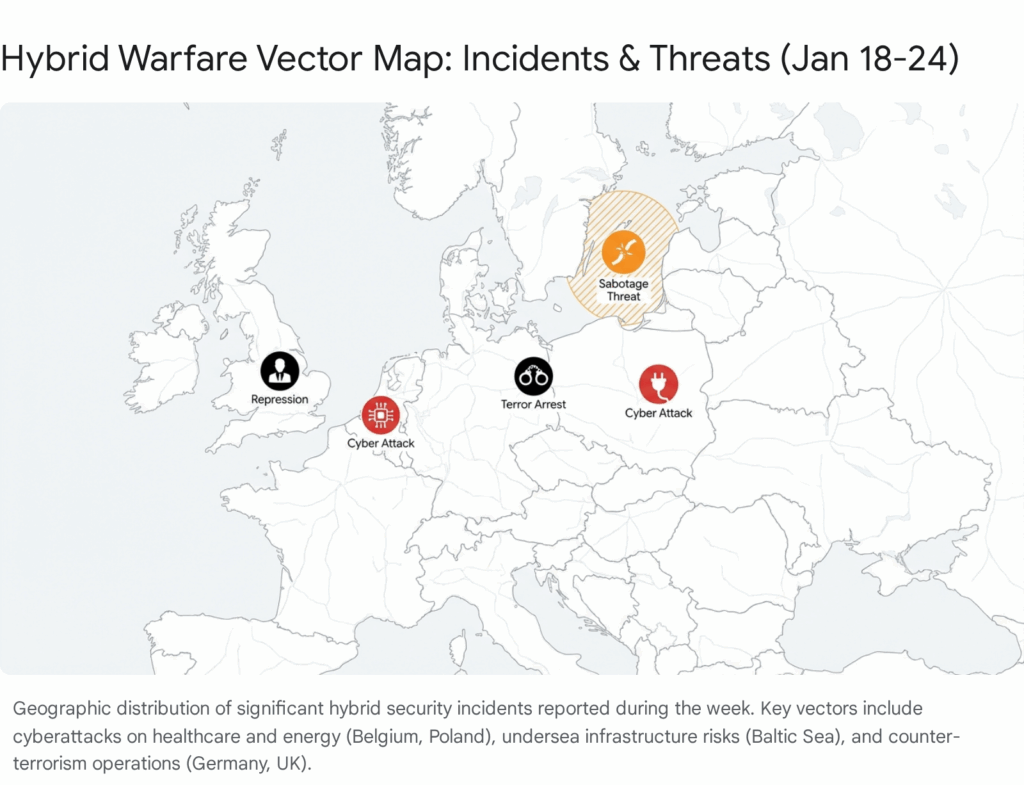

Hybrid threats have intensified, with a coordinated wave of cyberattacks targeting healthcare infrastructure in Belgium and the power grid in Poland. The attribution of these attacks to state-backed actors—implicitly or explicitly linked to Russia—has prompted the Commission to unveil a robust new Cybersecurity Act. Simultaneously, intelligence assessments from Finland and warnings regarding Baltic Sea undersea infrastructure indicate that “gray zone” warfare has become the primary vector for Russian pressure on the EU, bypassing direct military confrontation while degrading societal resilience.

2. Strategic Focus: The Transatlantic Rift and Arctic Security

2.1 The “Greenland Crisis”: A Case Study in Coercive Diplomacy

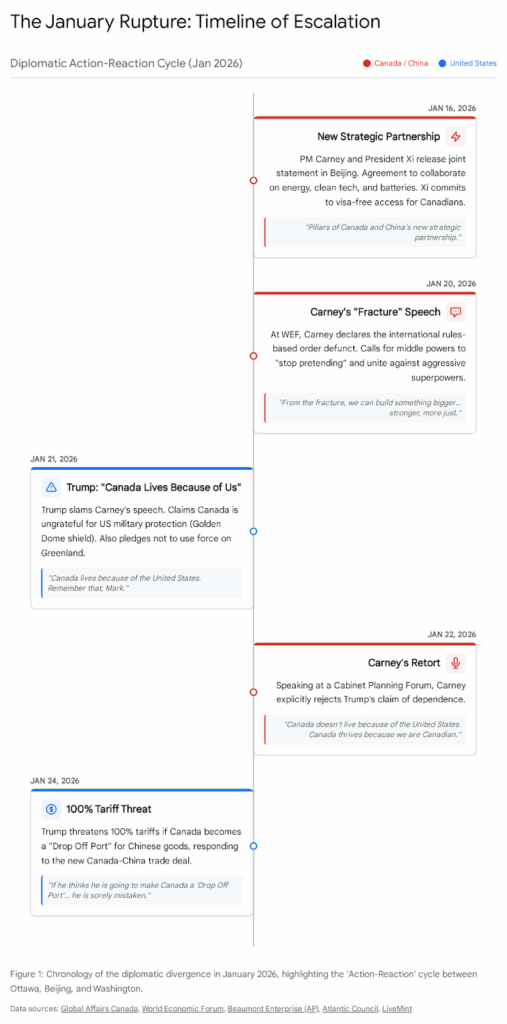

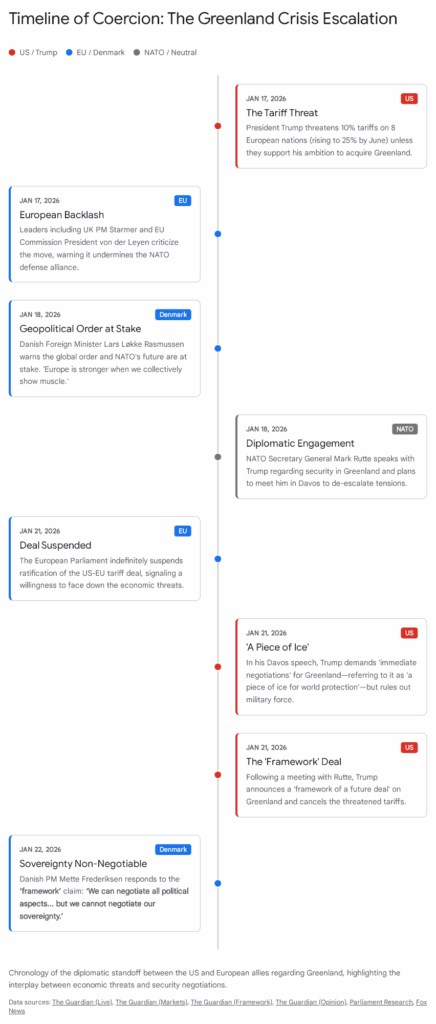

The reporting period was dominated by a geopolitical shockwave initiated by the United States regarding the status of Greenland. This event, now referred to in diplomatic circles as the “Greenland Crisis,” represents a paradigm shift in transatlantic relations, characterized by the weaponization of economic policy against NATO allies to achieve territorial security objectives.

2.1.1 The Escalation Mechanism

The crisis precipitated when President Donald Trump issued an explicit ultimatum: the United States would impose a 10% tariff on goods from eight European nations—Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland—unless they facilitated negotiations for the transfer of Greenland’s sovereignty to the United States.1 This tariff was threatened to escalate to 25% by June 1, 2026, creating a clear and imminent economic threat to the EU’s single market.

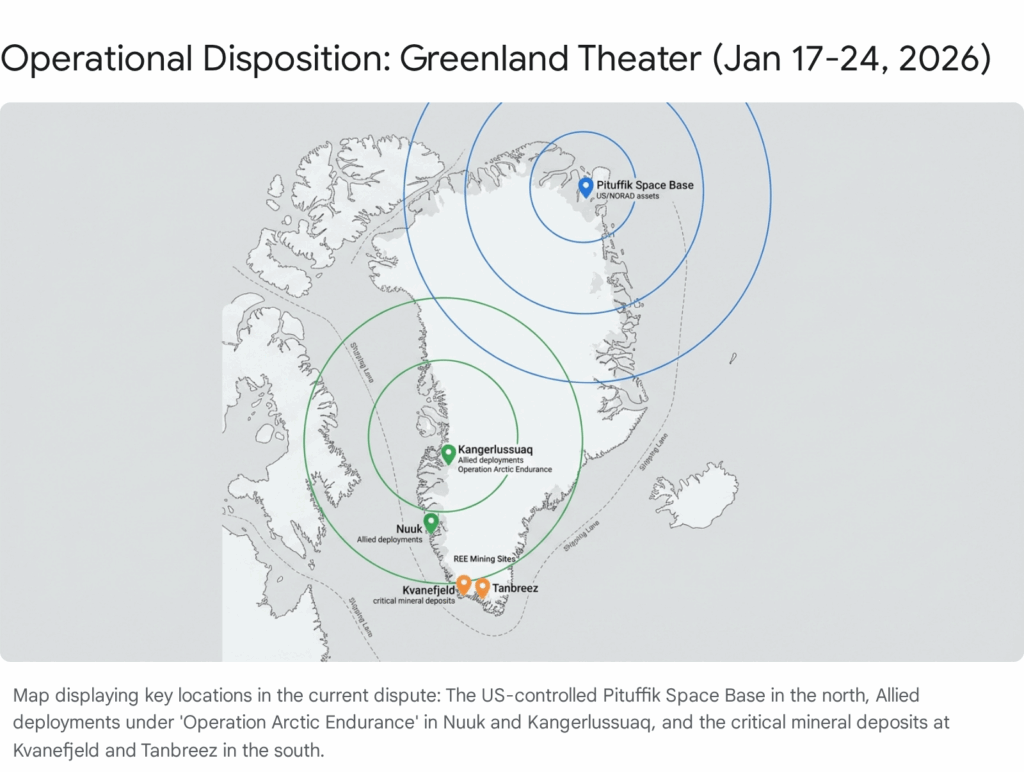

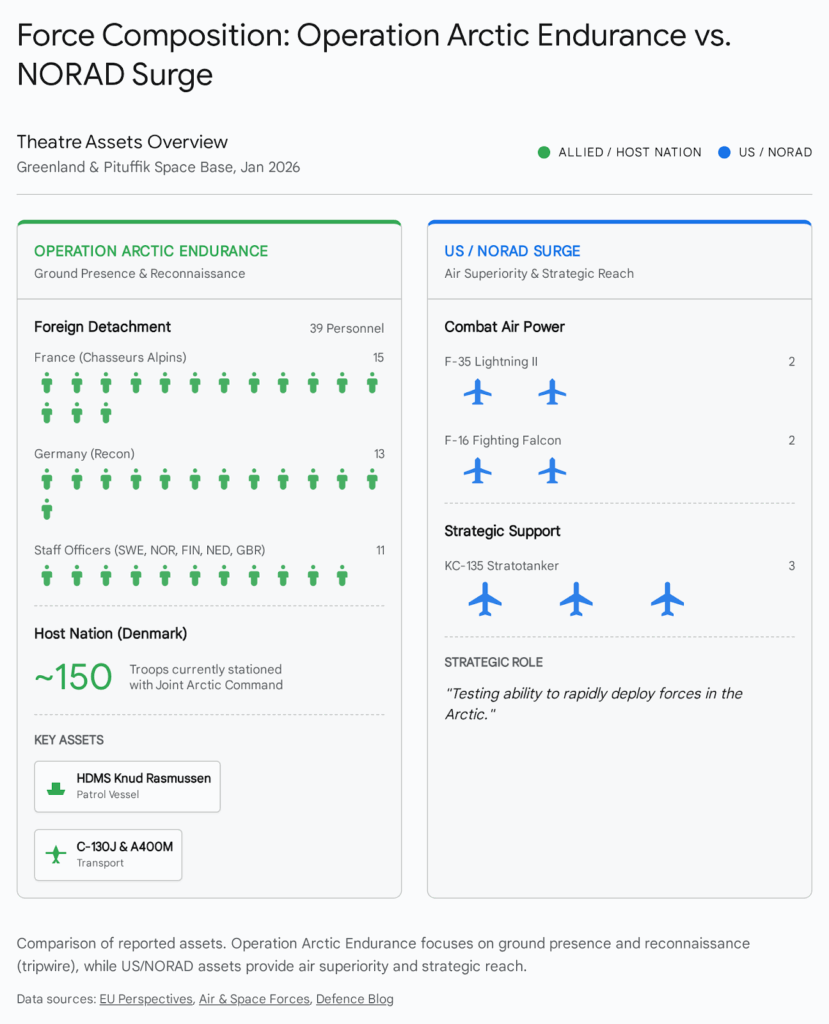

Operational Analysis of Targeted Nations: The inclusion of non-Danish allies in the tariff threat underscores a deliberate US strategy to fracture European unity. By penalizing the broader “North Sea” bloc, Washington sought to pressure Copenhagen through its neighbors and security partners. The pretext for this escalation was the participation of these nations in “Operation Arctic Endurance,” a joint military exercise in Greenland. The US administration reframed this routine exercise as a provocation and a challenge to the Monroe Doctrine application in the Arctic.2

2.1.2 The Davos Framework and De-escalation

The crisis reached its zenith mid-week and was subsequently diffused during the World Economic Forum in Davos. Following a high-stakes meeting with NATO Secretary General Mark Rutte, President Trump announced a “framework of a future deal” regarding Greenland.3

The “Davos Framework” Components:

While the full text remains classified, open-source intelligence and statements from principals indicate the framework rests on three pillars:

- Sovereignty Retention: Denmark and Greenland explicitly retain formal sovereignty. Danish Prime Minister Mette Frederiksen reiterated that “we cannot negotiate on our sovereignty,” a position supported by Greenlandic Premier Múte B. Egede.5

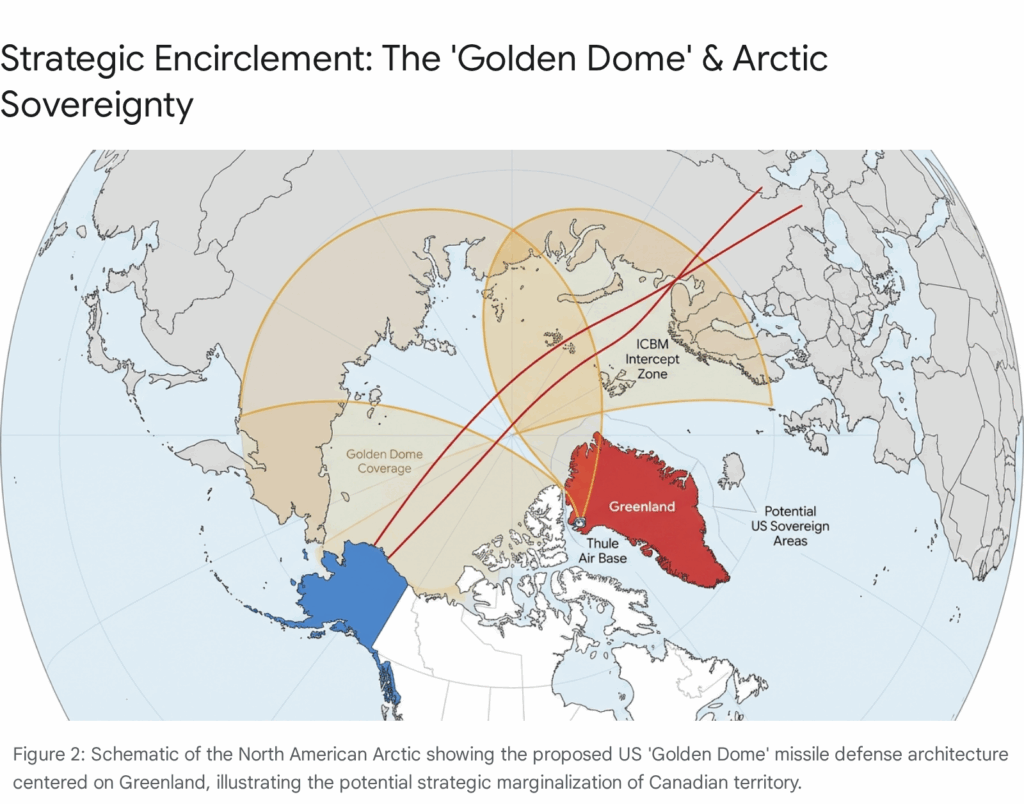

- Enhanced Security Access: The US likely secured expanded basing rights beyond Thule Air Base, potentially modeling the arrangement on the UK’s Sovereign Base Areas in Cyprus. President Trump referred to this as “total access” for “world protection”.3

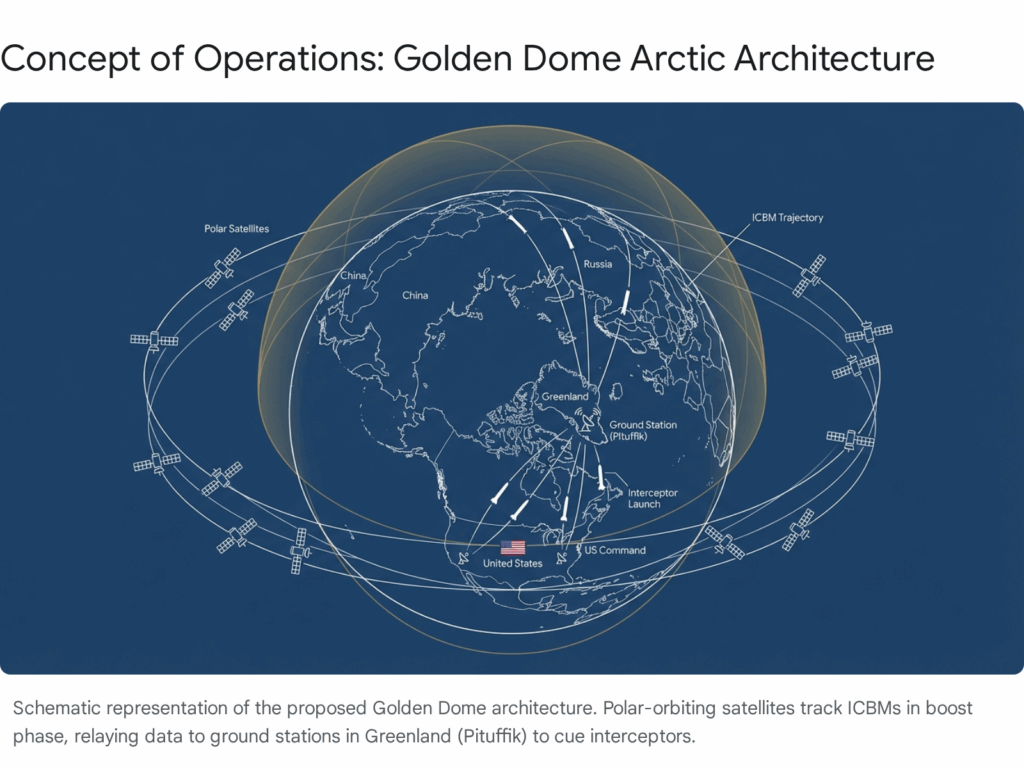

- Missile Defense Integration: References to a “Golden Dome” suggest the integration of Greenland into a modernized US ballistic missile defense shield, crucial for intercepting polar trajectories from Russia or China.4

Strategic Assessment: The “Davos Framework” appears to be a diplomatic construct designed to allow the US administration to claim a victory in securing the Arctic flank while preserving the nominal sovereignty of the Danish Kingdom. However, the use of tariff threats against allies to achieve this outcome has caused lasting damage. EU High Representative Kaja Kallas noted that transatlantic relations have “taken a big blow,” and the assumption of unconditional US security guarantees has been eroded.7

2.2 NATO Implications and the Arctic Theater

The Greenland dispute has catalyzed a shift in NATO’s operational focus toward the High North. The alliance is now compelled to balance the US demand for exclusive dominance in the Arctic against the sovereign rights of its Nordic members.

Secretary General’s Role: Mark Rutte’s pivotal role in mediating the dispute highlights NATO’s increasing function as a political stabilization mechanism between the US and Europe, rather than solely a defense alliance against external adversaries. Rutte successfully leveraged the narrative of “Arctic security” to bridge the gap between Trump’s transactional demands and European legalism.3

Adversarial Exploitation: Intelligence assessments suggest that the public rift within the alliance has been exploited by Russian and Chinese information operations. By portraying NATO as fractured and the US as predatory, these actors aim to weaken the resolve of European populations. The EU’s response—convening an emergency summit and invoking “full solidarity” with Denmark—was essential in mitigating this narrative, but the vulnerability remains.9

3. Operational Theater: Ukraine and Russia

3.1 Kinetic Operations: The Nuclear Grid Threat

The conflict in Ukraine has shifted dangerously toward a strategy of systemic infrastructure collapse. Reports from Ukraine’s Main Military Intelligence Directorate (GUR) and President Zelensky indicate that Russian forces are preparing, and have partially executed, strikes against the electrical substations that power Ukraine’s nuclear power plants (NPPs).10

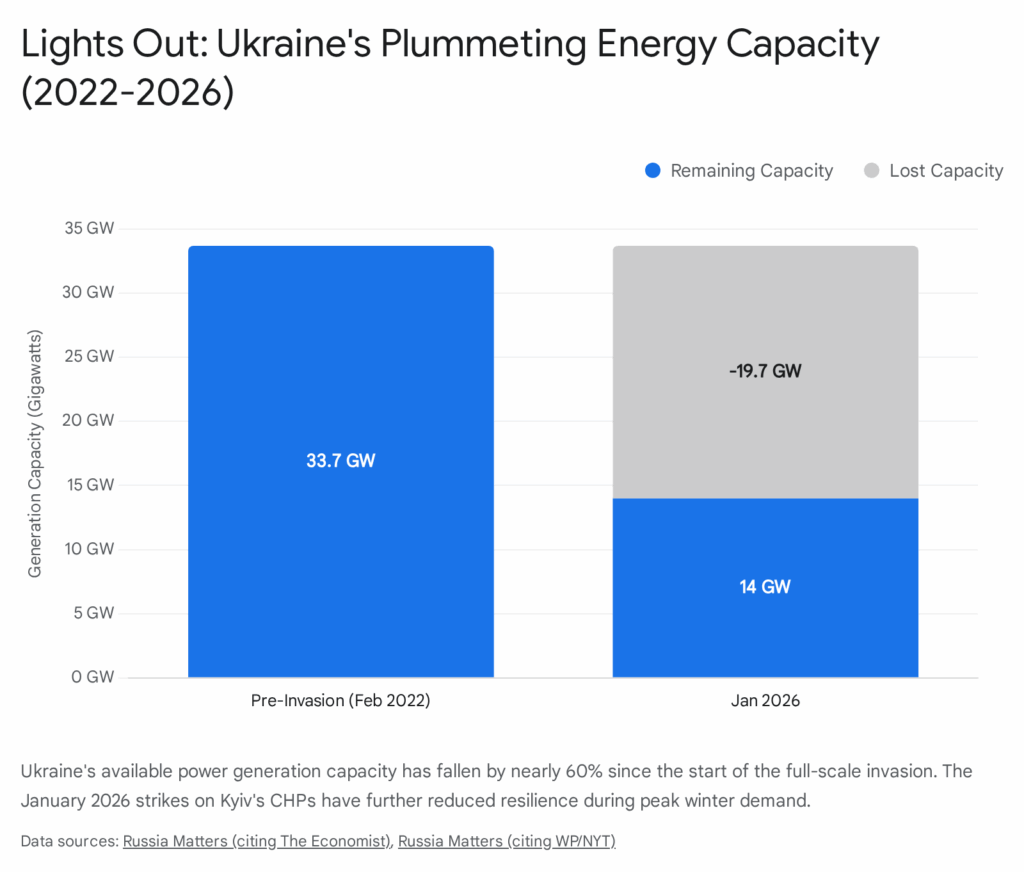

Targeting Analysis: This represents a specific evolution in targeting doctrine. Rather than striking the hardened reactor containment vessels, Russian forces are severing the off-site power supply required for cooling systems and operational safety. This “indirect radiological warfare” aims to force the shutdown of NPPs, which currently provide approximately 60% of Ukraine’s electricity.

- Capacity Crisis: Ukraine’s generation capacity has plummeted to 11 GW against a winter demand of 18 GW. The disconnection of NPPs would result in a catastrophic grid failure, rendering major cities uninhabitable during the deep freeze (-20°C).

- Oreshnik Missile Strike: The use of the Oreshnik intermediate-range ballistic missile (IRBM) against Lviv represents a significant escalation in signaling. By striking a target in the far west of Ukraine, close to the NATO border, Moscow is demonstrating a capability to bypass air defenses and strike logistics hubs used for Western aid. The Oreshnik’s multiple non-nuclear warheads and hypersonic terminal velocity make it nearly impossible to intercept with current defenses in Ukraine.11

3.2 Diplomatic Track: The Abu Dhabi Talks

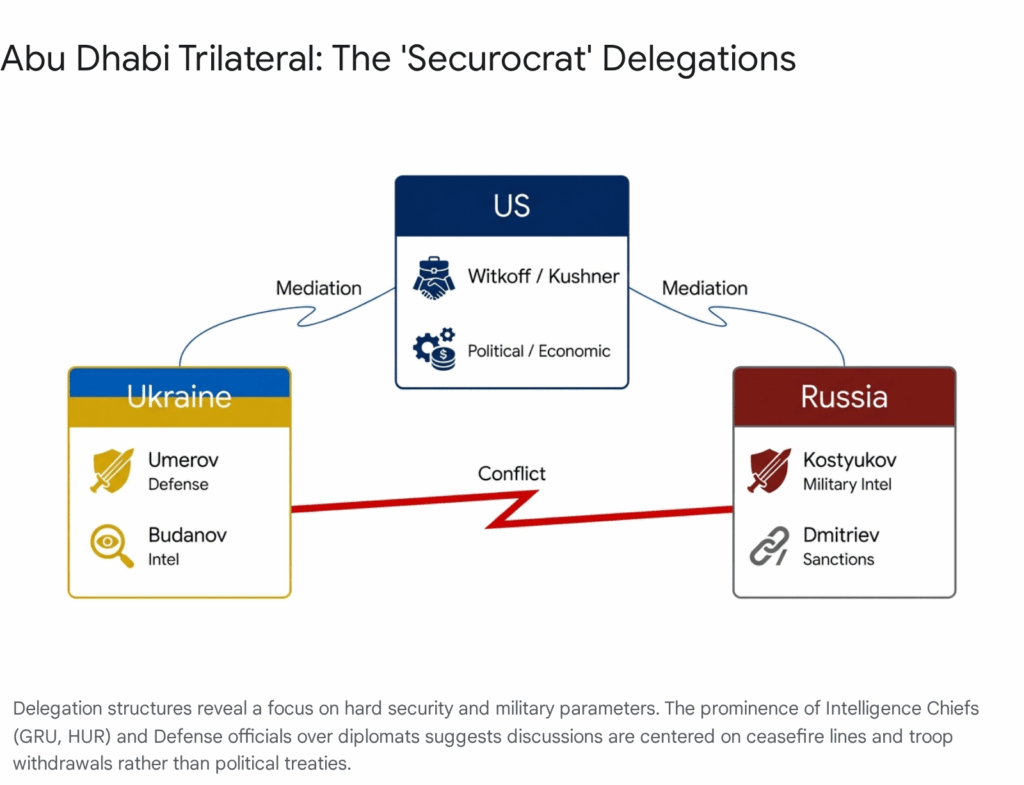

For the first time since the full-scale invasion began, high-level delegations from the US, Russia, and Ukraine met for trilateral talks in Abu Dhabi on January 23-24.14

Delegation Composition:

- United States: The delegation included Trump administration envoys Steve Witkoff and Jared Kushner, signaling a bypass of the traditional State Department apparatus.

- Ukraine: Led by Defense Council Secretary Rustem Umerov and GUR Chief Kyrylo Budanov.

- Russia: Led by GRU Head Admiral Igor Kostyukov and RDIF CEO Kirill Dmitriev.

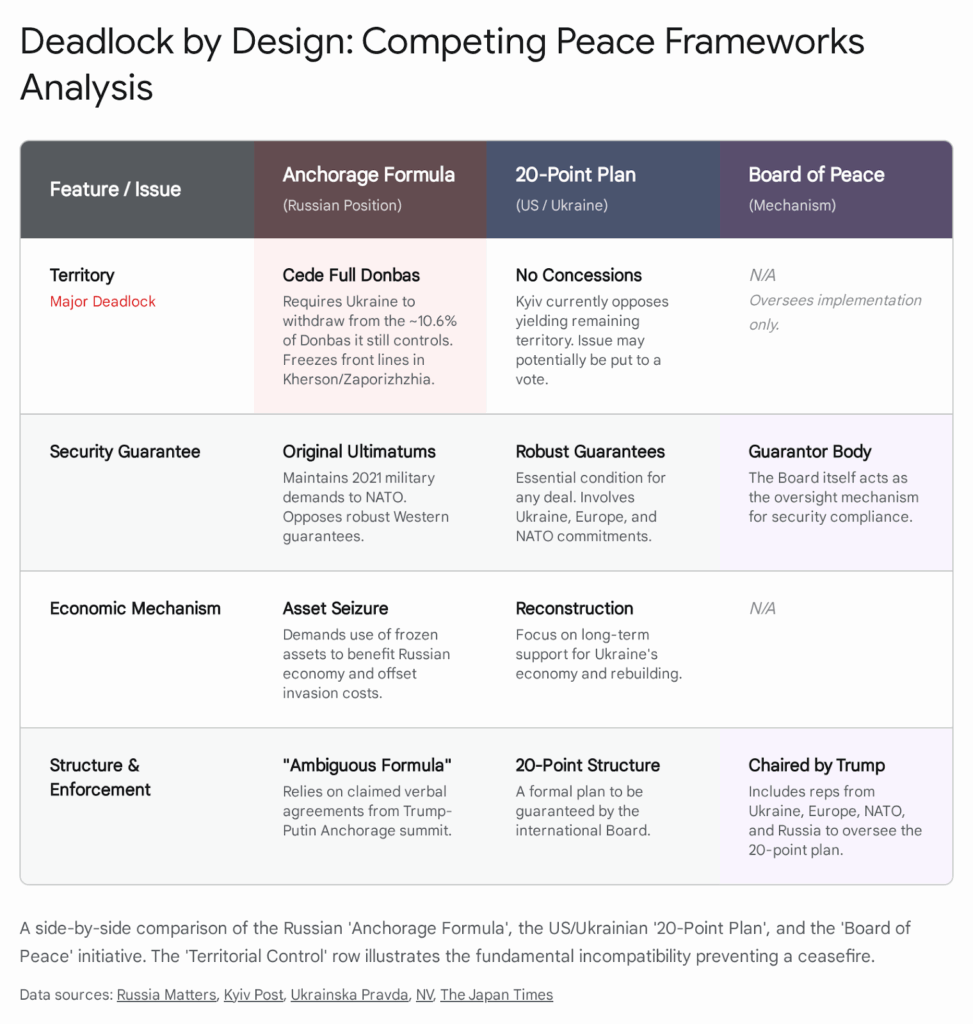

Outcome Analysis: The talks concluded without a joint statement or breakthrough. The primary stumbling block remains territorial control. While the US proposed “formalizing parameters” for a ceasefire, including potential demilitarized zones, the Russian position remains maximalist: demanding recognition of annexed territories.

- Assessment: The talks serve as a “reality check” for the Trump administration’s “deal-making” approach. The lack of quick progress confirms that the conflict’s drivers are structural and existential, not merely transactional. However, the existence of the channel provides a mechanism for crisis management, potentially useful for de-escalating specific risks like the nuclear grid threat.

3.3 Humanitarian Impact and EU Response

The combination of kinetic strikes and extreme weather has created a humanitarian emergency. The EU has mobilized its Civil Protection Mechanism to deploy 450 heavy-duty emergency generators worth €3.7 million.16 While tactically necessary, this assistance is strategic triage; it cannot compensate for the loss of gigawatt-scale generation capacity. The focus is shifting from “keeping the lights on” to preventing the freezing of district heating systems in urban centers.

4. The Hybrid Front: Cyber, Sabotage, and Terrorism

4.1 The Cyber Front: Healthcare and Grid Attacks

The reporting period witnessed a coordinated intensification of offensive cyber operations against EU critical infrastructure, characterized by high sophistication and strategic timing.

Belgium Hospital Attack (AZ Monica): On January 13, a major ransomware attack paralyzed the AZ Monica hospital group in Antwerp. The attack forced the cancellation of 70 surgeries and necessitated the emergency transfer of seven critical care patients to other facilities.17

- Impact Analysis: This incident aligns with a broader trend of targeting healthcare institutions, with global attacks up 30% in 2025. The attack not only disrupted immediate care but also leaked the personal data of 71,000 patients, creating a secondary layer of societal distress. The targeting of healthcare infrastructure is a hallmark of hybrid warfare, designed to erode public trust in the state’s ability to protect its most vulnerable citizens.

Polish Energy Grid Attack: Polish authorities thwarted a massive cyberattack aimed at destabilizing the national power grid in late December and early January. Prime Minister Donald Tusk attributed the attack to Russian intelligence services, noting the objective was to sever communications between renewable energy installations and distribution operators.19

- Strategic Intent: The timing of the attack—coinciding with a severe cold spell—suggests an intent to cause maximum societal disruption and potential loss of life. By targeting the renewable energy integration layer, the attackers likely sought to exploit the complexities of the modern grid, where intermittent sources require precise digital management.

EU Policy Response – The Cybersecurity Act: In direct response to these vulnerabilities, the European Commission proposed a comprehensive revision of the Cybersecurity Act on January 20.21

- Key Provisions: The new legislation mandates “cyber-secure by design” standards for products and enhances the powers of ENISA (EU Agency for Cybersecurity). Crucially, it creates a mechanism for the mandatory “de-risking” of ICT supply chains from high-risk third-country suppliers. This is a significant regulatory escalation, providing the legal framework to purge Chinese and Russian vendors from critical European networks.

4.2 Undersea Infrastructure Sabotage

Finnish military intelligence issued a stark warning on January 22 that Russia has the capability and intent to continue sabotage operations against Baltic Sea undersea infrastructure.23

- Operational Pattern: The “Shadow Fleet” of tankers and dual-use “research” vessels is increasingly being used to map and probe undersea vulnerabilities. The recent seizure of the vessel Fitburg by Finnish authorities, suspected of damaging cables, highlights the active nature of this threat.25

- Infrastructure Vulnerability: The Baltic Sea contains a dense network of data cables and power interconnectors (e.g., EstLink, Balticconnector). Disruption of these assets serves a dual purpose: economic damage and psychological pressure on Nordic and Baltic states.

4.3 Terrorism and Extremism

- United Kingdom: Counter-terrorism police are investigating “highly targeted” attacks on Pakistani dissidents, involving firearms and arson.26 This points to the growing threat of transnational repression—state actors using proxies to silence critics on European soil. This violates sovereignty and strains diplomatic relations with the source countries.

- Germany: The arrest of a suspect linked to a far-right terror plot involving the “Reichsbürger” movement in Saxony underscores the persistent internal threat from domestic extremism.27 This group’s ideology, which denies the legitimacy of the German state, poses a specific risk to government institutions and officials.

5. Economic Security and Trade Policy

5.1 The EU-Mercosur Fracture

The signing of the EU-Mercosur trade agreement has triggered a severe political crisis within the Union, revealing deep fissures between the Commission’s geopolitical trade agenda and the domestic political realities of key member states.

Institutional Standoff: The European Parliament voted to refer the agreement to the European Court of Justice (ECJ) to check its compatibility with EU treaties. The vote was razor-thin: 334 in favor, 324 against.28

- Tactical Analysis: This referral acts as a procedural brake, potentially delaying ratification by up to two years. In response, Commission President Ursula von der Leyen has indicated a willingness to bypass the standard ratification process by “provisionally applying” the trade pillar of the agreement once it is ratified by Mercosur states.29 This would effectively implement the deal without the immediate consent of all EU national parliaments, a move that risks a major democratic legitimacy crisis and exacerbating anti-EU sentiment.

Civil Unrest: Farmers in France, Germany, and Poland have launched coordinated protests. Tractors have blocked highways and city centers, including Paris and Strasbourg, arguing that the deal invites unfair competition from South American producers not subject to the same environmental and labor standards.30

- Political Fallout: The unrest is being capitalized on by populist parties. In France, figures like Marion Maréchal are aligning with the protests to attack the Commission, creating a volatile domestic environment for President Macron. The German government, however, supports the deal, viewing it as essential for industrial exports, creating a distinct Paris-Berlin policy divergence.32

5.2 Economic Outlook and Monetary Policy

Inflation Dynamics: Eurozone inflation has eased to 1.9% (revised down from 2.1%), technically hitting the ECB’s target. However, the composition of inflation remains problematic: services inflation is sticky at 3.4%, and food inflation has ticked up to 2.5%.33

- ECB Stance: ECB President Christine Lagarde, speaking at Davos, expressed confidence in the economic foundation but warned of the risks posed by geopolitical fragmentation. The market expectation is for the ECB to hold rates steady in the near term, balancing the inflation victory against the risk of an economic slowdown driven by high energy costs and trade uncertainty.35

Trade War Risks: While the immediate threat of US tariffs on the “Greenland 8” has receded, the structural threat of US protectionism remains. European industries are actively reassessing their supply chains and export dependencies. The “sell America” trade, where investors bet on US dominance at the expense of Europe, is being challenged by the resilience of European service sectors, but manufacturing remains under pressure.36

5.3 Energy Markets: The Winter Stress Test

Europe is facing a critical energy security test, driven by extreme weather and supply constraints.

Storage Depletion: Gas storage levels have fallen to approximately 50%, significantly below the 58-60% levels seen at this time in previous years. The depletion rate is accelerating due to the severe cold snap and the need to export electricity to Ukraine.37

- Price Volatility: Gas prices spiked to near €37/MWh before stabilizing. The market is currently tight, with little buffer against further supply shocks. The reliance on LNG imports (now 60% of supply) exposes the EU to global price competition, particularly from Asia.38

- Outlook: While a full-blown crisis is unlikely this winter barring a complete cessation of remaining flows or infrastructure sabotage, the buffer for next winter (2026-2027) is being eroded. The refilling season will be expensive and difficult, potentially dragging on European industrial competitiveness.

6. Diplomatic Relations: Beyond the Transatlantic

6.1 China: Strategic Encirclement and Engagement

EU-China relations remain characterized by a complex duality of economic engagement and security competition.

Taiwan Tensions: The European Parliament passed strong resolutions condemning Chinese aggression in the Taiwan Strait and challenging Beijing’s interpretation of UN Resolution 2758.39 This signals a hardening of political resolve to support the status quo in the Indo-Pacific, aligning closer with US strategic interests despite the trade friction.

Embassy Controversy: The UK government’s approval of a massive new Chinese embassy in London—the largest in Europe—has drawn criticism from security hawks who fear it will serve as an intelligence hub.41 This decision, seemingly contradictory to the “de-risking” agenda, reflects the UK’s post-Brexit desperation for trade investment, creating a potential weak link in the European counter-intelligence front.

Trade Disputes: The dispute over Chinese Electric Vehicles (EVs) continues, with the EU releasing guidance on “price undertakings” to replace punitive tariffs.42 This suggests a willingness to negotiate a managed trade solution rather than a full trade war, likely to placate German automakers who fear retaliation.

6.2 The Balkans: A Tinderbox

The Western Balkans remain a primary source of instability on the EU’s periphery.

- Kosovo-Serbia: Tensions persist in the north of Kosovo. The US has proposed new models for the Association of Serb-majority Municipalities, but the Kurti government in Pristina maintains a “strategic silence,” fearing any concession will be a prelude to partition.43

- Republika Srpska: Milorad Dodik continues to escalate secessionist rhetoric, threatening to fracture Bosnia and Herzegovina. The EU’s response remains fragmented, relying on US sanctions rather than a unified European coercive strategy.44

7. Defense and Industrial Base

7.1 Procurement and Modernization

The “SAFE” (Security Action for Europe) initiative has moved to the implementation phase, with the Commission approving funding plans for eight member states.45 This marks a milestone in the EU’s use of common funding for defense procurement, a taboo-breaking development driven by the Ukraine war.

Key Contracts:

- Germany: Placed significant new orders for Meteor beyond-visual-range air-to-air missiles, reinforcing its commitment to air superiority.47

- Poland: Continues its massive naval modernization, ordering new frigates and submarines to counter the Russian Baltic Fleet.49

- Space Defense: France has commissioned a “sovereign” Synthetic Aperture Radar (SAR) satellite from Loft Orbital. This move toward national assets, rather than purely EU-shared ones, reflects a desire for independent intelligence capabilities—a direct lesson from the reliance on US intelligence in the early stages of the Ukraine war.50

7.2 Exercises

NATO’s “Steadfast Dart 2026” exercise is underway, testing the deployment of the Allied Reaction Force (ARF) to the eastern flank. The scale and complexity of the exercise are designed to signal readiness to Russia, specifically demonstrating the ability to move forces rapidly across borders—a logistical challenge that remains a bottleneck for European defense.51

8. Conclusion and Outlook

The week ending January 24, 2026, served as a stress test for the European Union’s geopolitical resilience. The Union successfully navigated the immediate threat of a trade war with the US and managed the internal dissent over Mercosur without a collapse of the Commission’s agenda. However, these tactical successes mask deepening strategic vulnerabilities.

Strategic Outlook:

- Transatlantic: The “Greenland Framework” is a temporary fix. The EU must prepare for a US administration that views the alliance as transactional and is willing to use economic coercion against allies to achieve national security goals.

- Ukraine: The conflict is likely to worsen before it improves. The targeting of nuclear grid infrastructure suggests Russia is willing to court radiological disaster to force a capitulation. The EU must prepare for a potential refugee wave and energy emergency if the Ukrainian grid collapses.

- Internal: The Mercosur dispute will likely result in the deal being applied provisionally, but the political cost will be paid in the rising popularity of eurosceptic rural movements.

The EU is effectively operating in a “tri-crisis” environment: a security crisis in the East, a diplomatic crisis in the West, and an economic/political crisis internally. Its ability to maintain unity in the coming months will determine its survival as a coherent geopolitical actor.

End of Report

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- World stock markets brace for turbulence after Trump’s latest tariff shock, accessed January 24, 2026, https://www.theguardian.com/business/2026/jan/18/world-stock-markets-brace-for-turbulence-after-trumps-latest-tariff-shock

- President Trump and Greenland: Frequently asked questions – House of Commons Library, accessed January 24, 2026, https://commonslibrary.parliament.uk/research-briefings/cbp-10472/

- Trump walks back Greenland tariffs threat, citing vague ‘deal’ over territory – The Guardian, accessed January 24, 2026, https://www.theguardian.com/world/2026/jan/21/trump-framework-greenland-tariffs-threats

- Trump’s Greenland ‘framework’ deal: What we know about it, what we don’t, accessed January 24, 2026, https://www.aljazeera.com/news/2026/1/22/trumps-greenland-framework-deal-what-we-know-about-it-what-we-dont

- Sovereignty not negotiable, says Denmark as Trump claims Greenland negotiations allow US ‘total access’, accessed January 24, 2026, https://indianexpress.com/article/world/denmark-sovereignty-trump-greenland-negotiations-us-total-access-10489229/

- Denmark’s prime minister insists sovereignty is non-negotiable as Trump announces Greenland deal ‘framework’, accessed January 24, 2026, https://www.foxnews.com/world/denmarks-prime-minister-insists-sovereignty-non-negotiable-trump-announces-greenland-deal-framework

- Transatlantic relations dealt severe blow this week — Kallas, accessed January 24, 2026, https://en.apa.az/europe/transatlantic-relations-dealt-severe-blow-this-week-kallas-489742

- Foreign Affairs Council : Press remarks by High Representative Kaja Kallas upon arrival | EEAS, accessed January 24, 2026, https://www.eeas.europa.eu/eeas/foreign-affairs-council-press-remarks-high-representative-kaja-kallas-upon-arrival-5_en

- EU ambassadors hold emergency talks after Trump’s Greenland tariff threat – Polskie Radio, accessed January 24, 2026, https://www.polskieradio.pl/395/7785/Artykul/3635397,eu-ambassadors-hold-emergency-talks-after-trump%E2%80%99s-greenland-tariff-threat

- Russian Offensive Campaign Assessment, January 18, 2026 | ISW, accessed January 24, 2026, https://understandingwar.org/research/russia-ukraine/russian-offensive-campaign-assessment-january-18-2026/

- Russian Offensive Campaign Assessment, January 9, 2026 | ISW, accessed January 24, 2026, https://understandingwar.org/research/russia-ukraine/russian-offensive-campaign-assessment-january-9-2026/

- Oreshnik (missile) – Wikipedia, accessed January 24, 2026, https://en.wikipedia.org/wiki/Oreshnik_(missile)

- What We Know About Russia’s Oreshnik Missile Fired on Ukraine – The Moscow Times, accessed January 24, 2026, https://www.themoscowtimes.com/2026/01/09/what-we-know-about-russias-oreshnik-missile-fired-on-ukraine-a91636

- Russian Offensive Campaign Assessment, January 23, 2026 – Institute for the Study of War, accessed January 24, 2026, https://understandingwar.org/research/russia-ukraine/russian-offensive-campaign-assessment-january-23-2026/

- Russia-Ukraine war live: Talks end in Abu Dhabi without breakthrough – Al Jazeera, accessed January 24, 2026, https://www.aljazeera.com/news/liveblog/2026/1/24/live-kyiv-kharkiv-come-under-attack-amid-russia-ukraine-peace-talks

- EU steps in as Russian attacks leave Ukrainians without heat in -20°C winter, accessed January 24, 2026, https://euperspectives.eu/2026/01/eu-steps-in-as-russian-attacks-leave-ukrainians-without-heat-in-20c-winter/

- Belgium Hospital Cyber Attacks 2026 – Periculo, accessed January 24, 2026, https://www.periculo.co.uk/cyber-security-blog/belgium-hospital-cyber-attacks

- 2026 Belgian hospital cyberattack – Wikipedia, accessed January 24, 2026, https://en.wikipedia.org/wiki/2026_Belgian_hospital_cyberattack

- Poland Accuses Russia of Launching Major Cyberattack on Energy Grid, accessed January 24, 2026, https://www.themoscowtimes.com/2026/01/14/poland-accuses-russia-of-launching-major-cyberattack-on-energy-grid-a91682

- PM Confirms Poland Stopped Major Cyberattack Targeting its Energy Grid in December 2025, accessed January 24, 2026, https://www.asisonline.org/security-management-magazine/latest-news/today-in-security/2026/january/Poland-Stops-Cyberattack-On-Energy-Grid/

- Commission strengthens EU cybersecurity resilience and capabilities, accessed January 24, 2026, https://ec.europa.eu/commission/presscorner/detail/en/ip_26_105

- New measures to strengthen cybersecurity resilience and capabilities, accessed January 24, 2026, https://commission.europa.eu/news-and-media/news/new-measures-strengthen-cybersecurity-resilience-and-capabilities-2026-01-20_en

- Finnish intelligence warns of risk of new Russian sabotage in Baltic Sea, accessed January 24, 2026, https://www.pravda.com.ua/eng/news/2026/01/22/8017330/

- Russia Likely To Continue Damaging Critical Undersea Baltic Sea Infrastructure, Finland Says, accessed January 24, 2026, https://www.marineinsight.com/shipping-news/russia-likely-to-continue-damaging-critical-undersea-baltic-sea-infrastructure-finland-says/?utm_source=rss&utm_medium=rss&utm_campaign=russia-likely-to-continue-damaging-critical-undersea-baltic-sea-infrastructure-finland-says

- Baltic States on Alert After Undersea Cable Damage – SubTel Forum, accessed January 24, 2026, https://subtelforum.com/baltic-states-on-alert-after-undersea-cable-damage/

- Counter-terrorism police investigating ‘highly targeted’ attacks on Pakistani dissidents in UK, accessed January 24, 2026, https://www.theguardian.com/uk-news/2026/jan/23/counter-terrorism-police-investigating-highly-targeted-attacks-on-pakistani-dissidents-in-uk

- German police arrest suspect in far-right terror raid, accessed January 24, 2026, https://www.aa.com.tr/en/europe/german-police-arrest-suspect-in-far-right-terror-raid/3807990

- EU Parliament sends Mercosur deal for court review – Just Drinks, accessed January 24, 2026, https://www.just-drinks.com/news/eu-mercosur-court-review/

- EU Commission indicates it’s ready to implement Mercosur trade deal despite parliament vote to delay, accessed January 24, 2026, https://www.2news.com/news/national/eu-commission-indicates-its-ready-to-implement-mercosur-trade-deal-despite-parliament-vote-to-delay/article_40a0bcc9-0627-5ed1-8c56-f49e920b61ff.html

- French farmers stage protest in Paris to oppose EU-Mercosur trade deal, accessed January 24, 2026, https://www.theguardian.com/world/2026/jan/08/french-farmers-paris-protest-eu-mercosur-trade-deal

- EU farmers gear up for anti-Mercosur protests – Euractiv, accessed January 24, 2026, https://www.euractiv.com/news/eu-farmers-gear-up-for-anti-mercosur-protests/

- Mercosur halt sparks outrage in German business, accessed January 24, 2026, https://trans.info/en/mercosur-outrage-germany-450504

- Euro Area Inflation Rate – Trading Economics, accessed January 24, 2026, https://tradingeconomics.com/euro-area/inflation-cpi

- Eurostat revises eurozone inflation figure downwards: 1.9 per cent in December, accessed January 24, 2026, https://www.eunews.it/en/2026/01/19/eurostat-revises-eurozone-inflation-figure-downwards-1-9-per-cent-in-december/

- Economic Perspectives January 2026 – KBC, accessed January 24, 2026, https://www.kbc.com/en/economics/publications/economic-perspectives-january-2026.html?zone=topnav

- Debunking the “Sell America” Trade: Why Europe’s Move Could Fall Short, accessed January 24, 2026, https://www.jpmorgan.com/insights/markets-and-economy/top-market-takeaways/tmt-debunking-the-sell-america-trade-why-europes-move-could-fall-short

- Gas prices in Europe rose to €37/MWh in January – GMK Center, accessed January 24, 2026, https://gmk.center/en/news/gas-prices-in-europe-rose-to-e37-mwh-in-january/

- Europe’s Gas Storage Draining: Critical Supply Crisis, accessed January 24, 2026, https://discoveryalert.com.au/europe-gas-storage-crisis-2026-analysis/

- Foreign ministry thanks EU for adopting pro-Taiwan security policy | Taiwan News | Jan. 23, 2026 18:12, accessed January 24, 2026, https://www.taiwannews.com.tw/en/news/6288652

- Minister thanks European Parliament for its support – Taipei Times, accessed January 24, 2026, https://www.taipeitimes.com/News/front/archives/2026/01/24/2003851128

- UK approves China’s largest European embassy in London, accessed January 24, 2026, https://caliber.az/en/post/uk-approves-china-s-largest-european-embassy-in-london

- accessed January 24, 2026, https://www.csis.org/analysis/canada-and-european-union-two-new-wins-chinese-exports-west#:~:text=On%20January%2012%2C%202026%2C%20the,tariffs%20imposed%20after%20its%20anti%2D

- PartyBets Highlights US Proposals on Kosovo-Serbia Relations Amidst Political Silence – weareiowa.com, accessed January 24, 2026, https://www.weareiowa.com/article/news/local/plea-agreement-reached-in-des-moines-murder-trial/524-3069d9d4-6f9b-4039-b884-1d2146bd744f?y-news-27672908-2026-01-15-partybets-highlights-us-proposals-kosovo-serbia-relations-amidst-political-silence

- Dodik openly threatens: Republika Srpska towards separation from Bosnia – The Geopost, accessed January 24, 2026, https://thegeopost.com/en/news/dodik-openly-threatens-republika-srpska-towards-separation-from-bosnia/

- Commission approves first wave of defence funding for eight Member States under SAFE, accessed January 24, 2026, https://defence-industry-space.ec.europa.eu/commission-approves-first-wave-defence-funding-eight-member-states-under-safe-2026-01-15_en

- Commission approves first wave of defence funding for eight Member States under SAFE, accessed January 24, 2026, https://ec.europa.eu/commission/presscorner/detail/en/ip_26_111

- German Bundeswehr places order for more Meteor missiles – Air Force Technology, accessed January 24, 2026, https://www.airforce-technology.com/news/bundeswehr-meteor-missiles-order/

- MBDA receives new order for more METEOR from Germany, accessed January 24, 2026, https://www.mbda-systems.com/mbda-receives-new-order-more-meteor-germany

- Poland launches largest naval modernization since Cold War: FT, accessed January 24, 2026, https://www.polskieradio.pl/395/7784/Artykul/3638035,poland-launches-largest-naval-modernization-since-cold-war-ft

- France Commissions Loft Orbital to Develop First Sovereign SAR Satellite, accessed January 24, 2026, https://news.satnews.com/2026/01/21/france-commissions-loft-orbital-to-develop-first-sovereign-sar-satellite/

- NATO’s largest military exercise of 2026, Steadfast Dart, is underway | NATO News, accessed January 24, 2026, https://www.nato.int/en/news-and-events/articles/news/2026/01/15/natos-largest-military-exercise-of-2026-steadfast-dart-is-underway

- ‘Most visible’ NATO exercise in 2026, STEADFAST DART, begins – SHAPE, accessed January 24, 2026, https://shape.nato.int/news-releases/most-visible-nato-exercise-in-2026–steadfast-dart–begins

- January 18, 2026: Europe Between a Rock and a Hard Place – YouTube, accessed January 24, 2026, https://www.youtube.com/watch?v=RxHfim2Pfdc

- Trump’s tariff threat over Greenland risks ‘dangerous downward spiral’, warn Nato members – as it happened, accessed January 24, 2026, https://www.theguardian.com/world/live/2026/jan/18/greenland-eu-donald-trump-tariffs-keir-starmer-europe-live-latest-updates

- The Russia-Ukraine War Report Card, Jan. 21, 2026, accessed January 24, 2026, https://www.russiamatters.org/news/russia-ukraine-war-report-card/russia-ukraine-war-report-card-jan-21-2026

- Remarks by Commissioner Šefčovič at the EP plenary debate on the motion of censure of the Commission, accessed January 24, 2026, https://ec.europa.eu/commission/presscorner/detail/en/speech_26_154

- EU Agreements – Tuesday, 20 Jan 2026 – Parliamentary Questions (34th Dáil) – Oireachtas, accessed January 24, 2026, https://www.oireachtas.ie/en/debates/question/2026-01-20/206/

- EU Natural Gas – Price – Chart – Historical Data – News – Trading Economics, accessed January 24, 2026, https://tradingeconomics.com/commodity/eu-natural-gas

- Europe gas storage hits 5-year low, prices spike amid record cold, accessed January 24, 2026, https://english.nv.ua/nation/europe-s-gas-reserves-have-fallen-how-cold-january-of-2026-is-affecting-the-market-and-prices-50576800.html

- Spokesperson of the Chinese Mission to the EU Speaks on a Question Concerning China-Related Content in the European Parliament Reports, accessed January 24, 2026, https://eu.china-mission.gov.cn/eng/mh/202601/t20260123_11844487.htm

- Taiwan: Statement by the Spokesperson on the elections – EEAS – European Union, accessed January 24, 2026, https://www.eeas.europa.eu/eeas/taiwan-statement-spokesperson-elections-0_en