The optics market for small arms has traditionally operated under a rigid dichotomy: consumers were forced to choose between the rugged, heavy, and mechanically complex sighting systems developed for military applications, or the lightweight, optically bright, but mechanically simpler designs favored by the hunting community. On January 14, 2026, Nightforce Optics fundamentally disrupted this paradigm with the introduction of the NX6™ series of riflescopes.1 This report provides an exhaustive technical and market analysis of the NX6 line, evaluating its optical architecture, mechanical engineering, and reception within the professional and consumer communities.

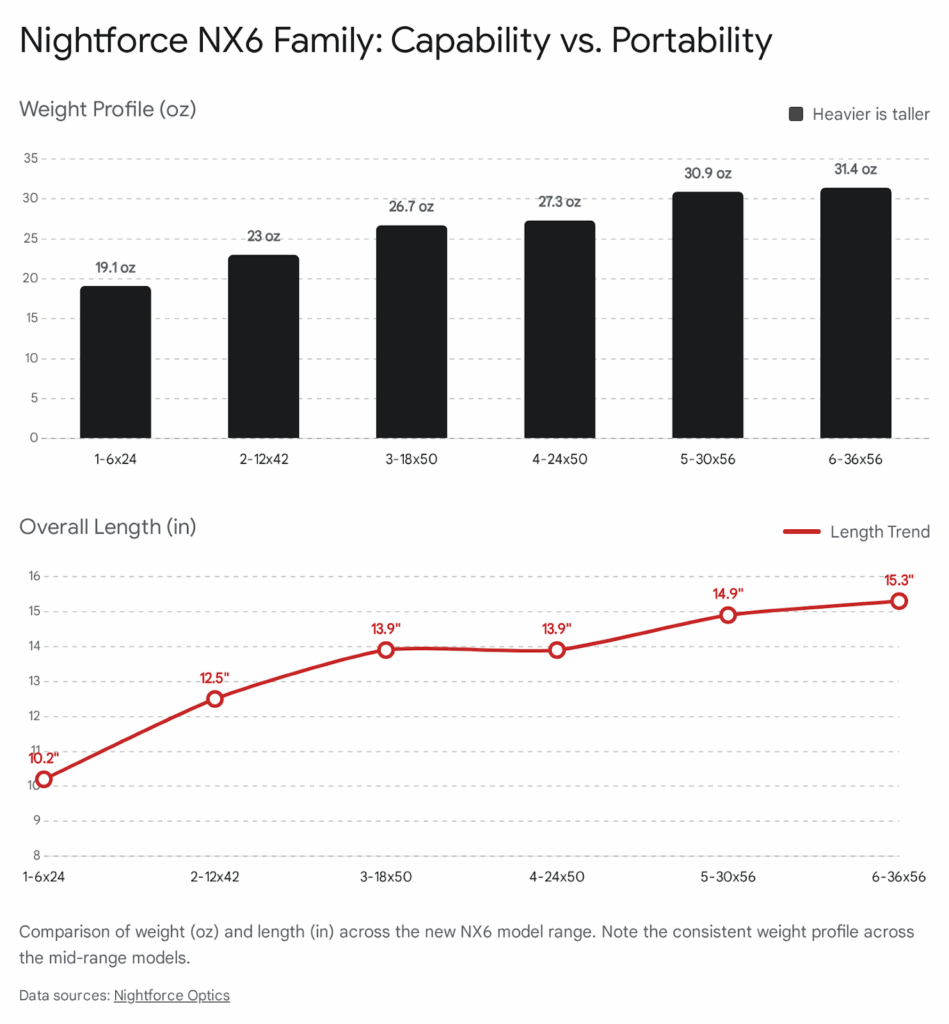

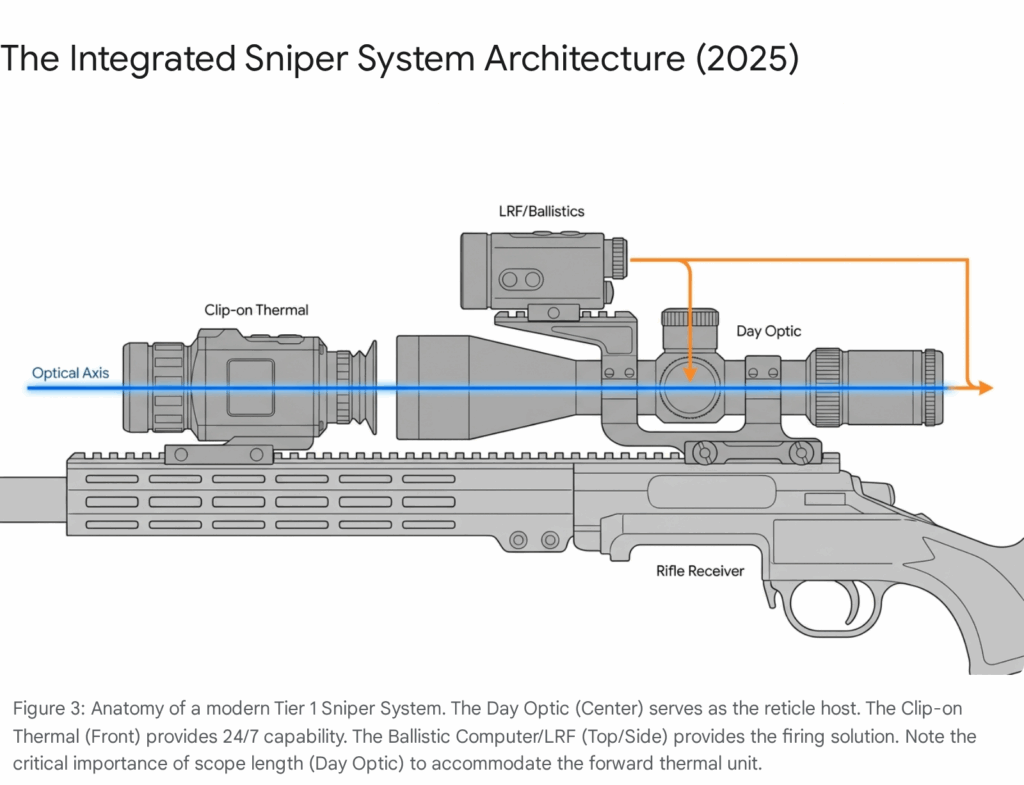

The NX6 series introduces a 6x zoom ratio optical system housed within a lightweight chassis, strategically positioned to bridge the gap between the compact durability of the legacy NXS™/NX8™ lines and the optical fidelity of the flagship ATACR™ series. Key innovations include the proprietary FieldSet™ turret system, which offers a tool-less, hybrid capped/exposed elevation adjustment mechanism, and the integration of Extra-Low Dispersion (ED) glass manufactured in Japan.1 The lineup spans six magnification ranges: 1-6x24mm, 2-12x42mm, 3-18x50mm, 4-24x50mm, 5-30x56mm, and 6-36x56mm, effectively targeting the Low Power Variable Optic (LPVO), Medium Power Variable Optic (MPVO), and High Power Variable Optic (HPVO) market segments simultaneously.1

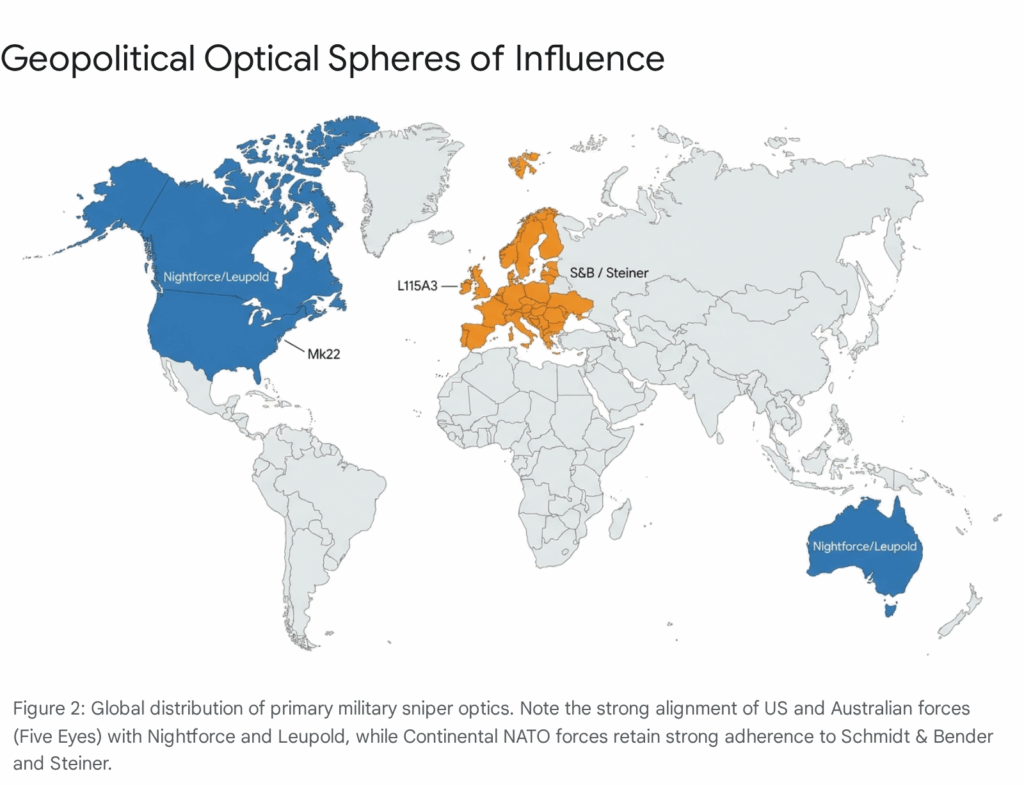

Our detailed sentiment analysis of social media platforms, including Reddit and SnipersHide, reveals a predominantly positive reception driven by the “crossover” capability of the 2-12x and 6-36x models.3 However, this optimism is tempered by scrutiny regarding specific reticle choices in the First Focal Plane (F1) models—specifically the cognitive load of the FC-MRx reticle—and initial confusion regarding third-party durability testing protocols.4 Pricing analysis places the NX6 directly in competition with the Leupold VX-6HD, Vortex Razor LHT, and Zeiss LRP S3, with street prices ranging from approximately $1,500 to $2,200.7 This report concludes that the NX6 series represents a strategic consolidation of Nightforce’s portfolio, offering performance characteristics that effectively challenge the dominance of European manufacturers in the premium hunting segment while retaining the mechanical ruggedization required for tactical applications.

1. Introduction and Market Context

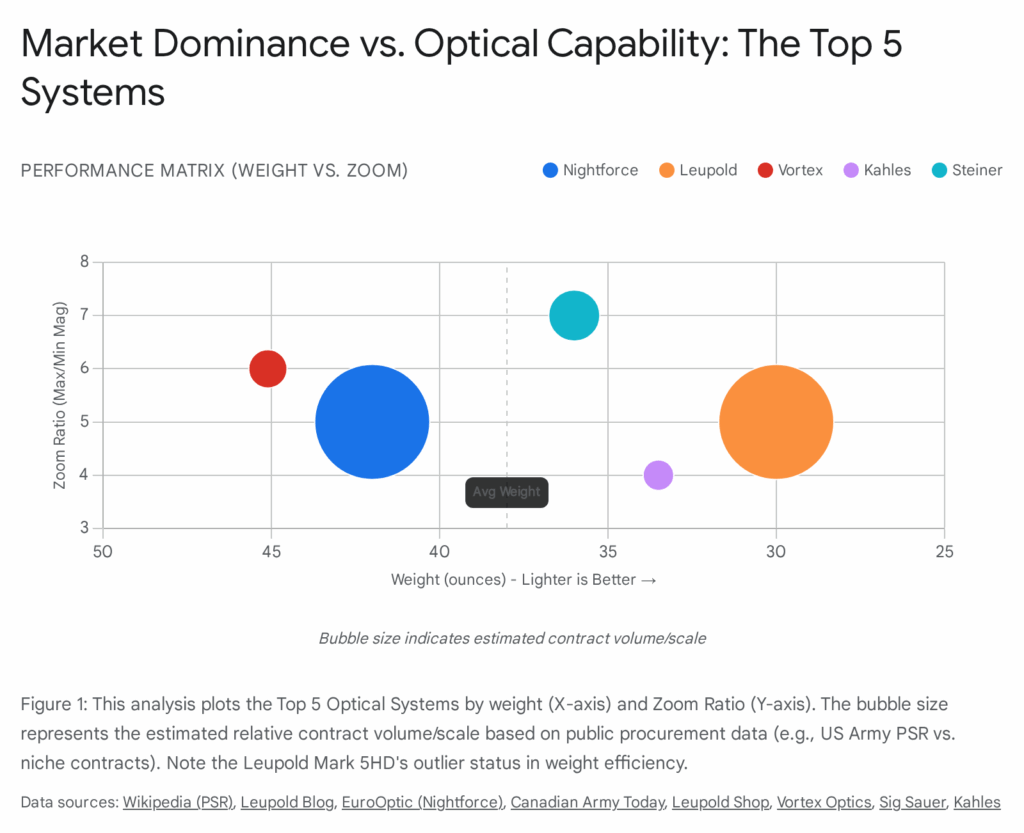

The contemporary small arms optics industry is currently defined by the convergence of two previously distinct design philosophies: the “Alpha” class precision optic and the lightweight hunting optic. Historically, end-users faced a binary choice. They could select a tactical scope, characterized by 34mm tubes, heavy distinct turrets, and intricate First Focal Plane (F1) reticles, which often weighed between 35 and 45 ounces. Alternatively, they could choose a hunting scope, typically featuring 1-inch or 30mm tubes, capped low-profile turrets, and simple Second Focal Plane (F2) reticles, weighing between 18 and 24 ounces but often lacking the mechanical repeatability required for long-range dialing.

The Nightforce NX6™ series enters a market that has increasingly demanded a “Hybrid” or “Crossover” solution. This demand is driven by the rise of hybrid shooting disciplines such as the National Rifle League (NRL) Hunter series, which compels competitors to carry their equipment over varying terrain and distances while engaging targets with precision tracking requirements previously reserved for benchrest shooting.9 The NX6 appears designed specifically to answer this requirement, potentially replacing or supplementing the older NXS and SHV lines while sitting just below the flagship ATACR line in terms of price and feature set.

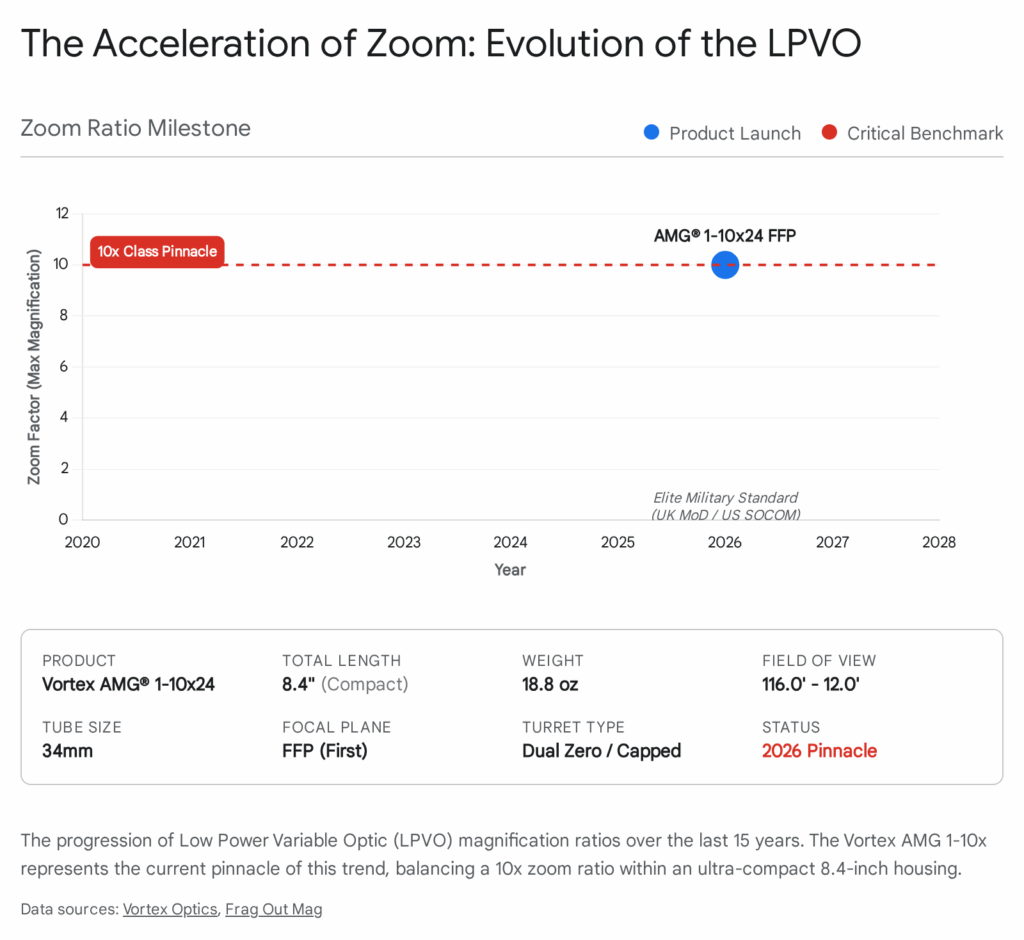

1.1 The Evolution of the Zoom Ratio

To understand the strategic significance of the NX6, one must analyze the progression of zoom ratios in the industry. The zoom ratio—the mathematical relationship between the lowest and highest magnification settings—dictates the versatility and optical complexity of a riflescope.

- 3x and 4x Ratios: For decades, the 3-9x (3x ratio) and 4-12x (3x ratio) were industry standards. These designs are optically simple, durable, and inexpensive to manufacture.

- 5x Ratios: Nightforce’s NXS series (e.g., 5.5-22x) utilized a 4x or 5x ratio, balancing magnification range with optical clarity and eyebox forgiveness.

- 8x and 10x Ratios: In recent years, the industry pushed toward 8x (e.g., Nightforce NX8 2.5-20x) and 10x ratios (e.g., March Optics). While offering immense versatility, high zoom ratios often introduce optical compromises. These include a tighter “eyebox” (exit pupil latitude), increased chromatic aberration, and a shallow depth of field, all of which can make the optic more difficult to use under stress or in low light.3

The NX6 represents a calculated retreat from the “maximized zoom” arms race. By settling on a 6x ratio, Nightforce engineers have likely prioritized optical stability and user experience over raw magnification range. A 6x system imposes fewer constraints on the optical design than an 8x system, theoretically allowing for a more forgiving optical prescription, wider fields of view, and better light transmission—factors critical for the hunting market where target acquisition speed is paramount.1

1.2 Strategic Positioning and Pricing

Nightforce has positioned the NX6 as a direct evolution of their capability, leveraging the 6x zoom ratio technology that has become the industry standard for high-end “crossover” optics. The release includes what industry observers have noted as an aggressive pricing strategy, offering premium-level performance at a price point that undercuts major European competitors.1 With a street price range of $1,500 to $2,200 7, the NX6 targets the mid-tier premium segment currently contested by Leupold’s VX-6HD and Vortex’s Razor LHT series. This positioning suggests Nightforce is looking to recapture market share in the hunting segment, where weight and optical ease-of-use have traditionally favored competitors, without abandoning the tactical durability that defines their brand identity.

2. Technical Architecture and Engineering Analysis

The engineering ethos of the NX6 series focuses on “Rugged, Reliable, and Repeatable” performance in a lightweight package.2 To achieve this, Nightforce has integrated several subsystems that warrant detailed technical examination.

2.1 Optical System: The 6x Erector Assembly

The core of the NX6 is its 6x zoom ratio erector system. The decision to utilize a 6x system rather than the 8x system found in the NX8 series is a defining characteristic of the line. High zoom ratios often induce optical aberrations such as chromatic aberration (color fringing) and restricted eyeboxes at maximum magnification. By limiting the ratio to 6x, Nightforce can optimize the optical prescription for a more consistent exit pupil and better light transmission across the entire magnification range.

Glass Composition and Manufacturing:

The NX6 utilizes Extra-Low Dispersion (ED) glass, manufactured in Japan.4 While Nightforce has not explicitly confirmed if the glass prescription is identical to the flagship ATACR line, industry speculation and performance observations suggest it is a step above the standard NXS glass, potentially sharing source elements with the NX8 or ATACR families.6 The use of ED glass is critical for reducing chromatic aberration, which manifests as purple or green fringing around high-contrast targets. This is particularly important for the higher magnification models, such as the 6-36x56mm, where color fidelity is essential for spotting bullet trace and impacts at extended ranges.

Eyebox and Field of View:

User reports indicate the NX6 has a more comfortable eye relief and “easy to use” eyebox compared to the NX8, particularly in field conditions where perfect head position is not guaranteed.1 The 6x optical system allows for a wider field of view at low magnification, which is crucial for target acquisition. For example, the 1-6x24mm model offers a field of view of 116.1 feet at 100 yards on 1x 11, providing excellent situational awareness for close-quarters engagements.

2.2 The FieldSet™ Turret System

A primary innovation of the NX6 is the FieldSet™ turret system.2 This mechanism addresses a common dilemma in crossover scopes: the choice between capped turrets (protected from bumps, preferred by hunters) and exposed turrets (fast dialing, preferred by tactical shooters).

- Mechanical Function: The FieldSet allows the user to configure the turret as either capped or exposed. It features a tool-less design, enabling shooters to reset the zero and zero-stop in the field without Allen keys or screwdrivers.12 This is a significant departure from previous Nightforce designs like the NXS, which required specific tools to loosen clutch screws.

- Zero Stop: The system utilizes a “pin-on-pin” zero stop design, known for its robustness. This prevents the turret from rotating past the zero point, ensuring a hard mechanical stop after dialing elevation.4 The distinct advantage here is reliability; under stress, a shooter can spin the turret down until it stops and know with absolute certainty they are back at their zero setting.

- BDC Integration: The exposed configuration supports custom Bullet Drop Compensating (BDC) dials, which Nightforce offers engraved to the user’s specific ballistic data.13 This appeals to long-range hunters who prefer dialing yardage directly rather than calculating MOA/MRAD adjustments. The interchangeability suggests a modular turret housing, a feature that simplifies logistics and inventory for the manufacturer while offering customization to the end-user.

2.3 Chassis Architecture & Durability

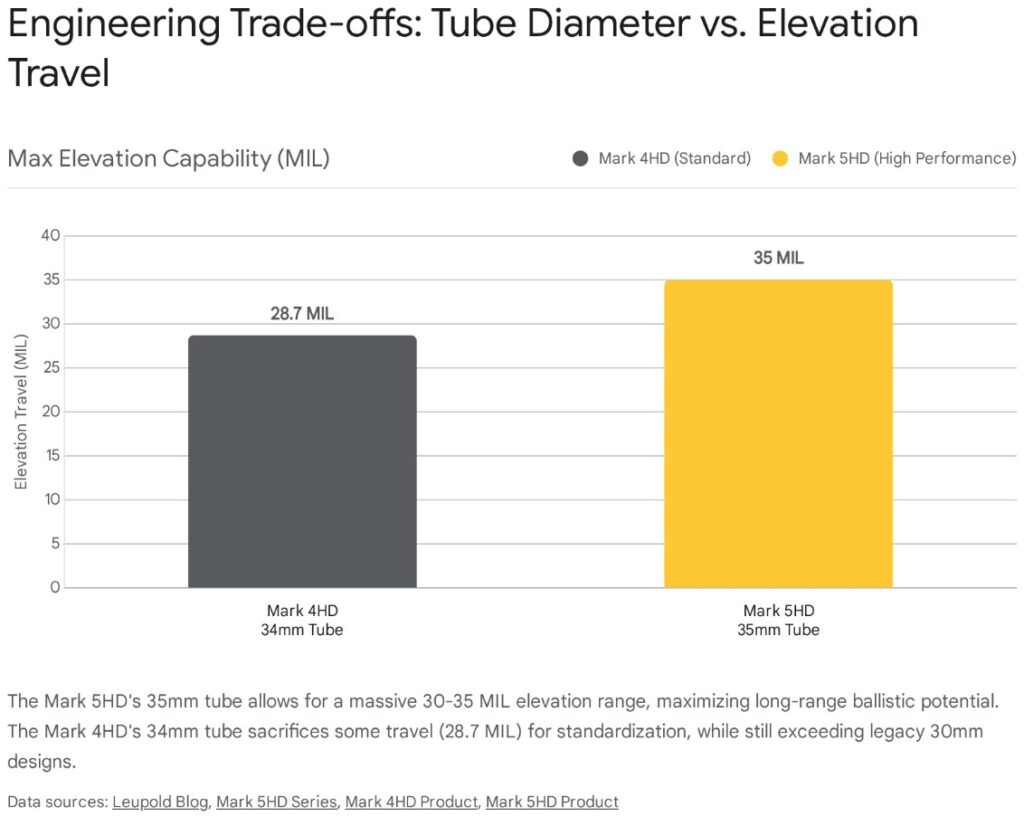

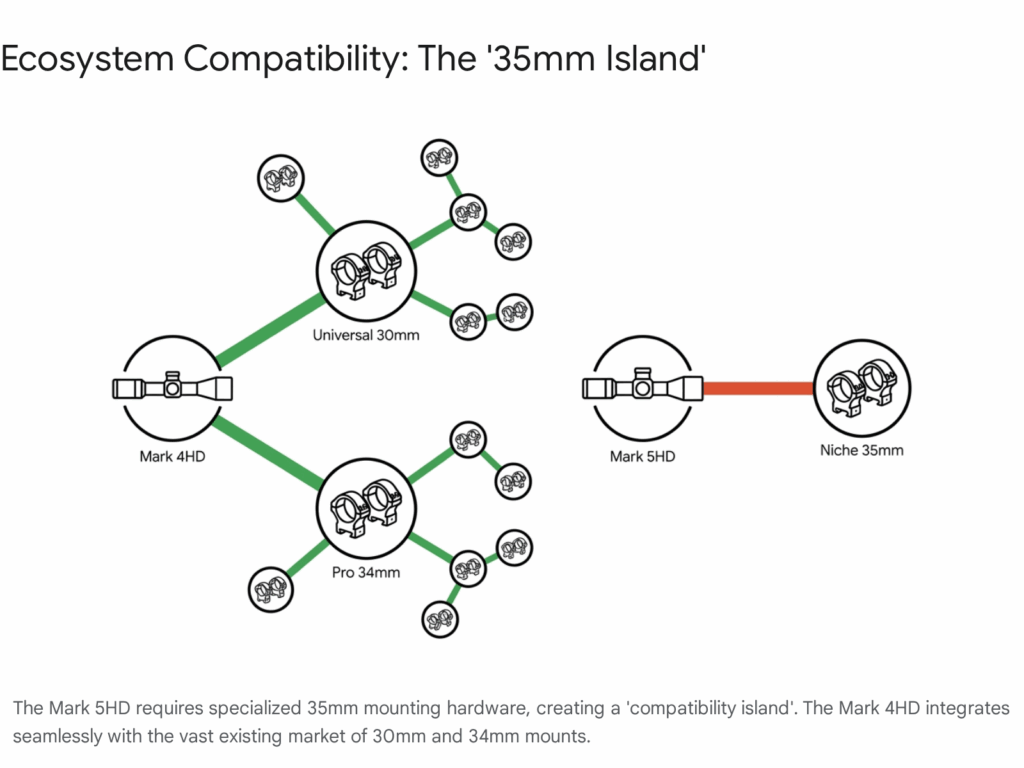

The NX6 line is split between two main tube diameters, dictating their intended use cases:

- 30mm Tube Models: 1-6×24, 2-12×42, 3-18×50, 4-24×50. These are optimized for weight savings. For instance, the 2-12×42 weighs only 23 ounces 1, making it highly competitive for mountain rifles where every ounce is scrutinized.

- 34mm Tube Models: 5-30×56, 6-36×56. The larger tube diameter provides increased internal adjustment range (elevation travel), which is critical for engaging targets at Extreme Long Range (ELR).3 The 6-36x model offers 33.4 MRAD (115 MOA) of elevation travel, a massive amount that rivals dedicated ELR scopes.

Weight Analysis and Material Science:

The “lightweight” claim holds true when compared to the ATACR line. The 3-18×50 weighs 26.7 oz 15, significantly lighter than the ATACR 4-16×42 (approx. 30 oz) or 4-20×50 (approx. 35 oz). This weight reduction is likely achieved through a combination of optimizing the housing wall thickness and using lighter weight aluminum alloys, though the exact metallurgy remains proprietary. Despite the weight reduction, Nightforce maintains that the NX6 meets their rigorous durability standards, including impact testing that simulates recoil impulses significantly higher than standard rifle calibers.

3. Detailed Model Analysis: Use Cases and Configurations

The NX6 series is not a monolithic release but rather a collection of targeted optical solutions. Each model addresses a specific segment of the shooting market.

3.1 The LPVO: NX6 1-6x24mm (F1/F2)

The 1-6x24mm model targets the Low Power Variable Optic (LPVO) market, which is heavily contested by tactical users and carbine competitors.

- Specifications: 30mm tube, ~19 oz weight, 10.2″ length.11

- Reticle Architecture: The inclusion of the FC-DMx reticle in the First Focal Plane (F1) version is a significant differentiator. Previously reserved for the NX8 1-8x and ATACR 1-8x, the FC-DMx provides a daylight-bright center dot and a functional grid for holds. By applying it to a 1-6x optical system, Nightforce offers a larger exit pupil (7.4mm at 1x) 16, potentially solving the “tight eyebox” complaints associated with 1-8x and 1-10x LPVOs.

- Tactical Application: The 1-6x magnification range is often considered faster for close-quarters engagements due to the wider field of view and deeper depth of field compared to higher magnification LPVOs. The F2 version with the FC-6c reticle caters to 3-Gun competitors who prioritize speed and a static BDC over ranging capability.11

3.2 The MPVO: NX6 2-12x42mm (F1/F2)

The 2-12x42mm has been identified by early reviewers and industry analysts as the “Goldilocks” scope of the lineup.1 It fills the role of the Medium Power Variable Optic (MPVO), ideal for general-purpose hunting rifles or “Recce” style gas guns.

- Specifications: 30mm tube, 23 oz weight, 12.5″ length.1

- Reticle Innovation (FC-MRx): The F1 version features the FC-MRx, a new reticle derived from the FC-DMx. It features a segmented circle for fast acquisition at 2x and a grid for holds at 12x.1 This dual-nature reticle attempts to solve the problem of F1 reticles being too small to see at low magnification.

- Performance Analysis: With a weight of 23 ounces, the 2-12x is light enough for a mountain rifle but possesses the mechanical tracking reliability required for dialing shots at extended ranges. The 42mm objective keeps the mounting height low, improving the shooter’s cheek weld and overall rifle balance.

3.3 The Crossovers: 3-18x50mm & 4-24x50mm

The 3-18x50mm represents the quintessential “Western Hunter” specification. It provides sufficient magnification for long shots across canyons while maintaining a low enough bottom end (3x) for timber hunting.

- Specifications: 30mm tube, 26.7 oz (3-18x), 13.9″ length.15

- Reticle Options: Available with MOA-XT, Mil-XT, MOAR, and 4A-i reticles. The 3-18x allows for precise holding or dialing.

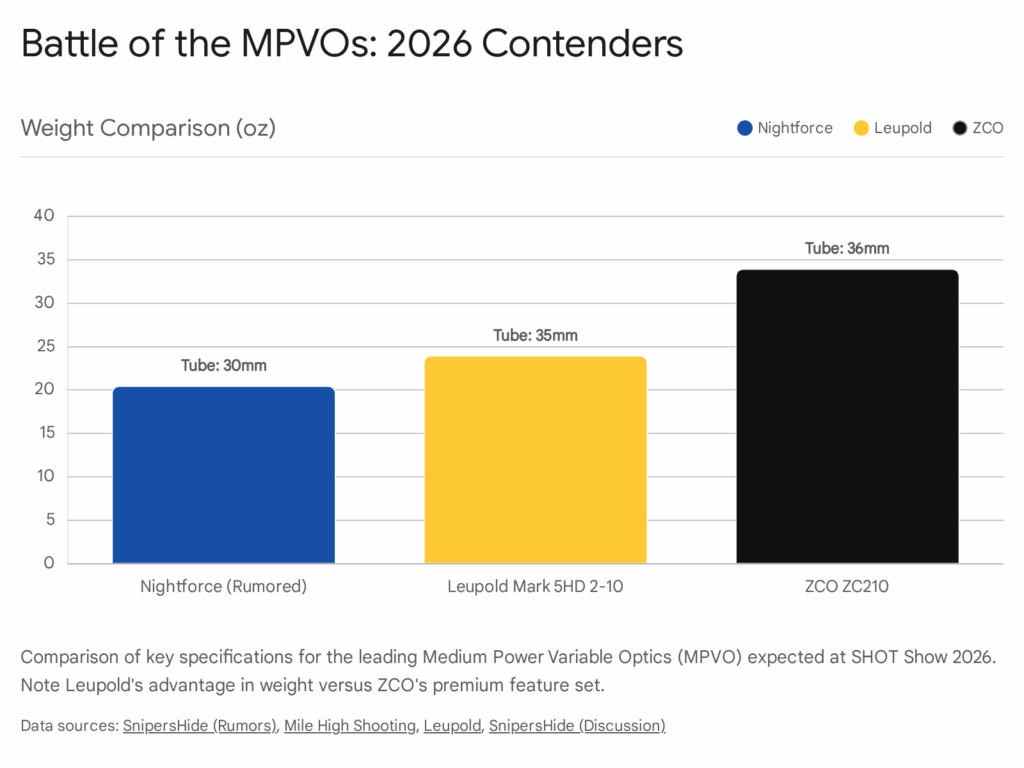

- Comparisons: The 26.7 oz weight is competitive with the Leupold VX-6HD 3-18x (21.6 oz) 18, though slightly heavier. This weight penalty is accepted by users who prioritize the robust internal mechanics and exposed turret capabilities of the Nightforce. The 4-24x50mm is an F2-only model 1, targeting predator hunters who prefer the reticle to stay constant in size for visibility against dark furs or complex backgrounds like brush.

3.4 The Long Range Specialists: 5-30x56mm & 6-36x56mm

The 5-30x56mm and 6-36x56mm models are a direct shot at the precision rifle market (PRS/NRL) and Extreme Long Range (ELR) hunting.

- Specifications: 34mm tube, ~31 oz weight.4

- Structural Advantage: The move to a 34mm tube is critical here. It allows for massive elevation travel—up to 33.4 MRAD (115 MOA) for the 6-36x model.14 This is sufficient to dial a.300 PRC or.338 Lapua Magnum out to distances exceeding 2,000 yards without needing to hold over the reticle.

- Market Disruption: The 6-36x56mm is particularly notable as it matches the magnification range of the premium ATACR 7-35x and the Zeiss LRP S3 6-36x, but at a significantly lower price point ($2,200 vs $3,600 for ATACR). This democratizes the 36x magnification class, making it accessible to a broader range of competitors and enthusiasts. The inclusion of the FVR-1 (Fine Varmint Reticle) in the F2 models highlights Nightforce’s commitment to the dedicated varmint hunting community, providing an ultra-fine crosshair for precision targeting of small game at distance.

4. Competitive Landscape Analysis

The NX6 series does not exist in a vacuum. It faces stiff competition from established players in the “Premium Crossover” category. To fully understand its market position, we must compare it against its primary rivals: the Leupold VX-6HD, the Vortex Razor LHT, and the Zeiss LRP S3.

4.1 Comparison of Key Competitors

The following table summarizes the competitive landscape by comparing flagship models in the “Long Range Crossover” segment.

| Metric | Nightforce NX6 6-36×56 | Zeiss LRP S3 6-36×56 | Leupold VX-6HD 3-18×44 | Vortex Razor LHT 4.5-22×50 |

| Max Magnification | 36x | 36x | 18x | 22x |

| Weight | 31.6 oz | 39.1 oz | 21.6 oz | 21.7 oz |

| Tube Diameter | 34mm | 34mm | 30mm | 30mm |

| Focal Plane | F1 / F2 | F1 | F2 (Mostly) | F1 / F2 |

| Elevation Travel | 33.4 MRAD (115 MOA) | 32 MRAD (110 MOA) | ~22 MRAD (75 MOA) | ~23 MRAD (80 MOA) |

| Street Price (Est.) | $2,200 | $2,500 | $1,900 | $1,500 |

| Origin | Japan (Glass/Assembly) | Japan (Glass/Assembly) | USA (Assembly) | Japan (Glass/Assembly) |

Analysis of the Efficiency Frontier:

The data reveals a distinct “efficiency frontier” in the relationship between weight, magnification, and price. The Zeiss LRP S3 offers similar magnification (36x) to the NX6 but incurs a significant weight penalty, coming in at 39.1 oz compared to the NX6’s 31.6 oz.19 This makes the NX6 a far more attractive option for a rifle that must be carried in the field. Conversely, the Leupold VX-6HD and Vortex Razor LHT are significantly lighter (~21 oz) but sacrifice maximum magnification and elevation travel. The Leupold tops out at 18x and the Vortex at 22x, limiting their utility for spotting bullet impacts at ELR distances. The NX6 6-36x, therefore, occupies a unique sweet spot: it offers “heavy tactical” capability (36x mag, 34mm tube, 33 MRAD travel) at a “crossover” weight (31 oz) and a competitive price point ($2,200).

4.2 NX6 vs. Nightforce NX8 & ATACR: Internal Cannibalization?

- Vs. NX8: The NX6 is viewed by many analysts as a “correction” to the NX8. While the NX8 offers an 8x zoom (e.g., 2.5-20x), the 6x zoom of the NX6 likely offers better optical performance. For users who don’t strictly need the ultra-compact form factor of the NX8 2.5-20x, the NX6 3-18x or 4-24x offers a potentially better optical experience with less distortion and a more forgiving eyebox for similar money.3

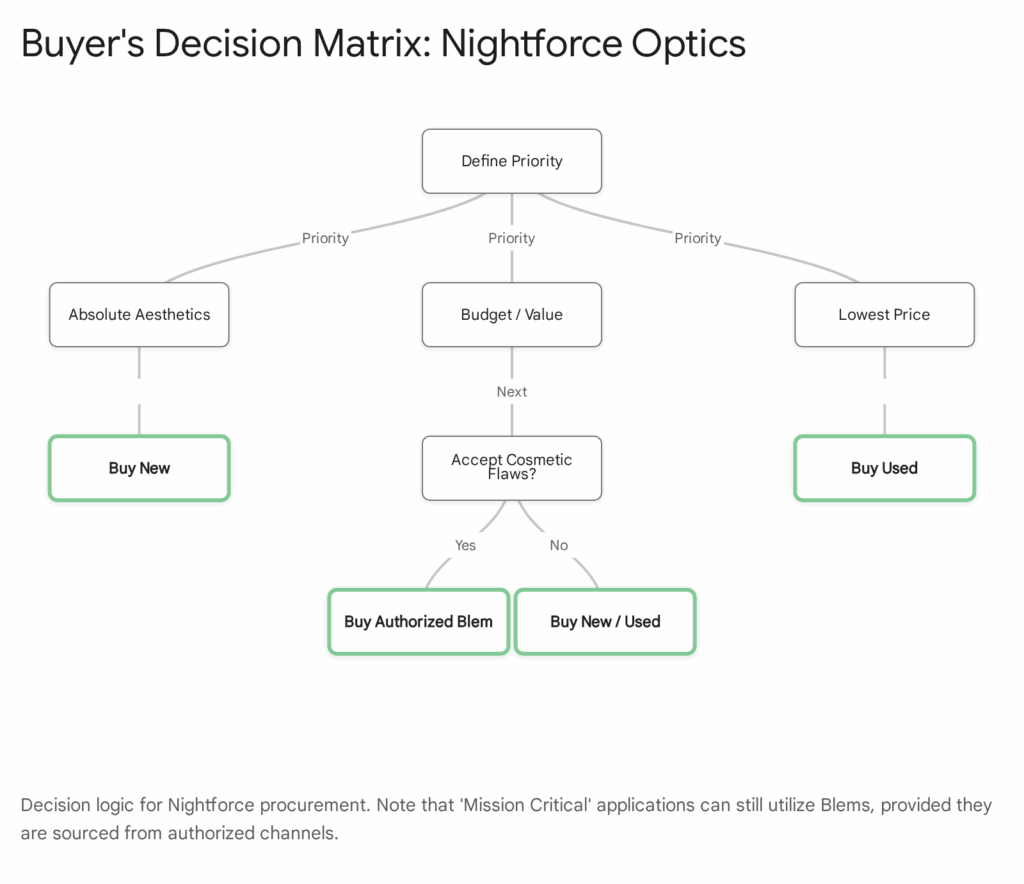

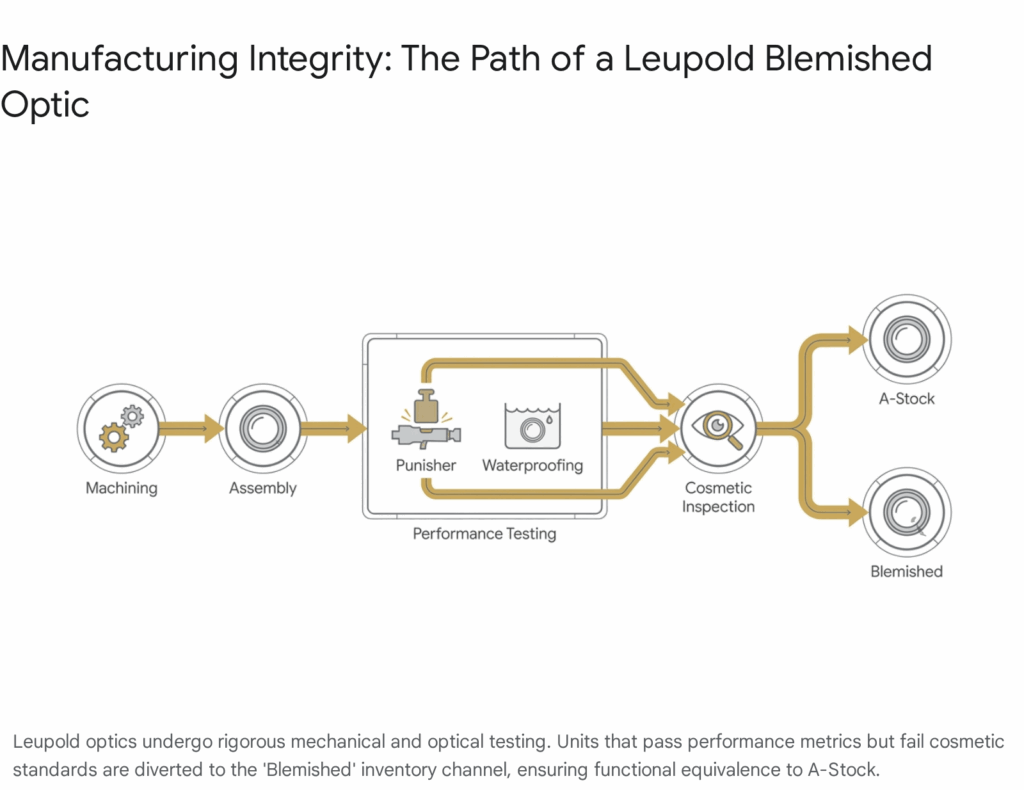

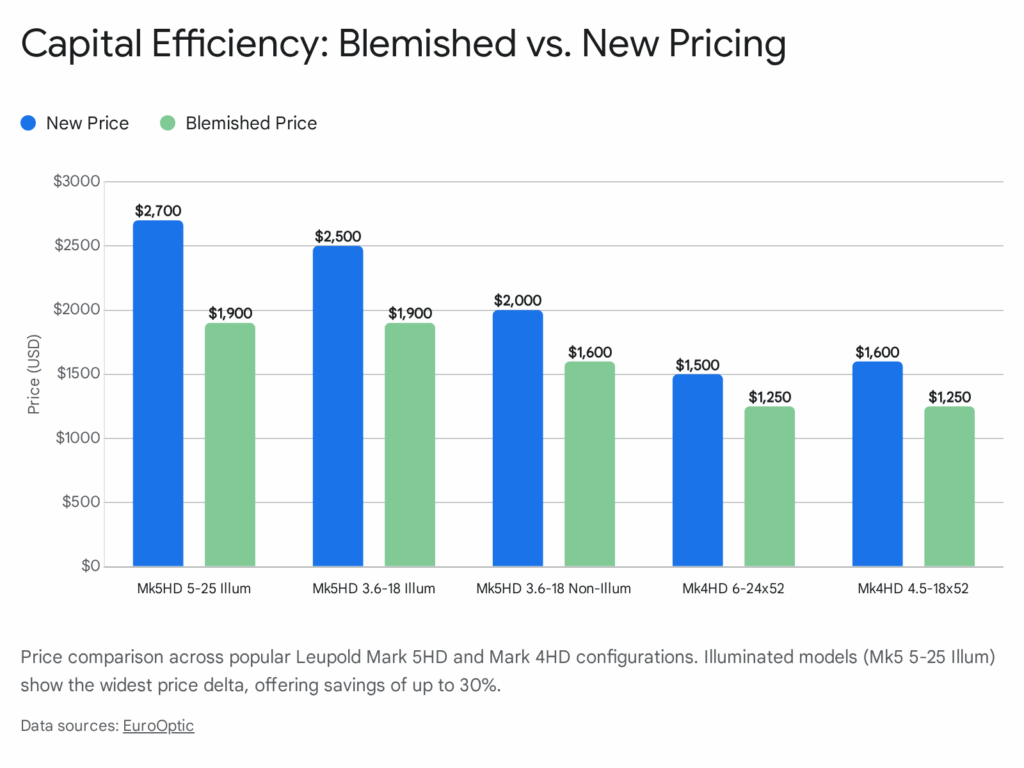

- Vs. ATACR: The ATACR remains the flagship with superior glass (ED prime), beefier internal erectors designed for heavy recoil (.50 BMG rating), and more robust turret clicks. However, for 95% of users (hunters and PRS competitors), the NX6 provides 90% of the capability at 60% of the cost. Nightforce risks some cannibalization of ATACR sales, particularly in the PRS Production Class where price caps exist.

4.3 NX6 vs. Vortex Razor LHT

- Price: Vortex holds the advantage here. The Razor LHT 4.5-22×50 can be found for approximately $1,500 21, significantly cheaper than the comparable NX6 ($1,800-$2,000).

- Durability Perception: Nightforce wins on reputation. The Razor LHT has had reported issues with zero retention in drop tests (the “Rokslide failure” mentioned in forums often refers to this or the Athlon, not Nightforce).4 Nightforce’s core brand identity is durability, and for users who have experienced optic failure in the field, the price premium for the NX6 is viewed as insurance.

5. Social Media and Sentiment Analysis

To aid prospective buyers, we conducted a rigorous sentiment analysis across key enthusiast hubs: Reddit (specifically r/longrange), SnipersHide, and Rokslide. These communities are composed of “power users” who often identify performance characteristics and flaws long before mainstream reviews.

5.1 General Reception: “Finally, a 2-12x F1”

The sentiment regarding the NX6 launch is overwhelmingly positive, centered largely on the 2-12x42mm F1 model. Users have clamored for a durable, mid-power First Focal Plane scope with a usable reticle for years. The “Goldilocks” factor is frequently cited—it is not too big, not too heavy, and offers enough magnification for 800-yard shots while being capable at 25 yards.1 The 6-36x is also highly anticipated as a high-value alternative to the ATACR 7-35x, with many users expressing intent to purchase it for PRS production class rifles.

5.2 The “Drop Test” Controversy and Clarification

A critical point of discussion—and confusion—on forums like SnipersHide and Rokslide involves “drop tests.” Rokslide is famous for its “Field Evaluation” where scopes are dropped onto rocks to test zero retention.

- The Confusion: Some users in discussion threads mistakenly conflated the NX6 with the Athlon Helos or Vortex Razor LHT, which have failed drop tests.4

- The Fact: As of January 2026, the Nightforce NX6 has not failed a public drop test. In fact, prototype testers were explicitly asked not to drop test the pre-production units to avoid misleading results from non-finalized hardware.4

- The Expectation: Given Nightforce’s rigorous internal testing standards (which include impact testing far exceeding standard drops), the community expectation is that the NX6 will pass these durability checks with ease.9 The sentiment is one of “trust but verify,” with the community eagerly awaiting the first independent destructive tests.

5.3 Reticle Critique: Complexity vs. Utility

The new reticles have generated mixed feedback, revealing a divide between tactical shooters and hunters.

- Positive: The FC-DMx in the 1-6x and the Mil-XT in the higher powers are universally praised. The Mil-XT is widely considered one of the best holding reticles on the market.

- Negative: The FC-MRx in the 2-12x has faced criticism for having a “Christmas tree” grid that extends to 20 mils. Users argue that on a 12x scope, they are unlikely to hold 20 mils of elevation (which equates to shooting extremely long distances where 12x is insufficient).2 They would have preferred a simpler drop grid to keep the view uncluttered for hunting scenarios. This feedback highlights the challenge of designing a “crossover” reticle that satisfies both disciplines.

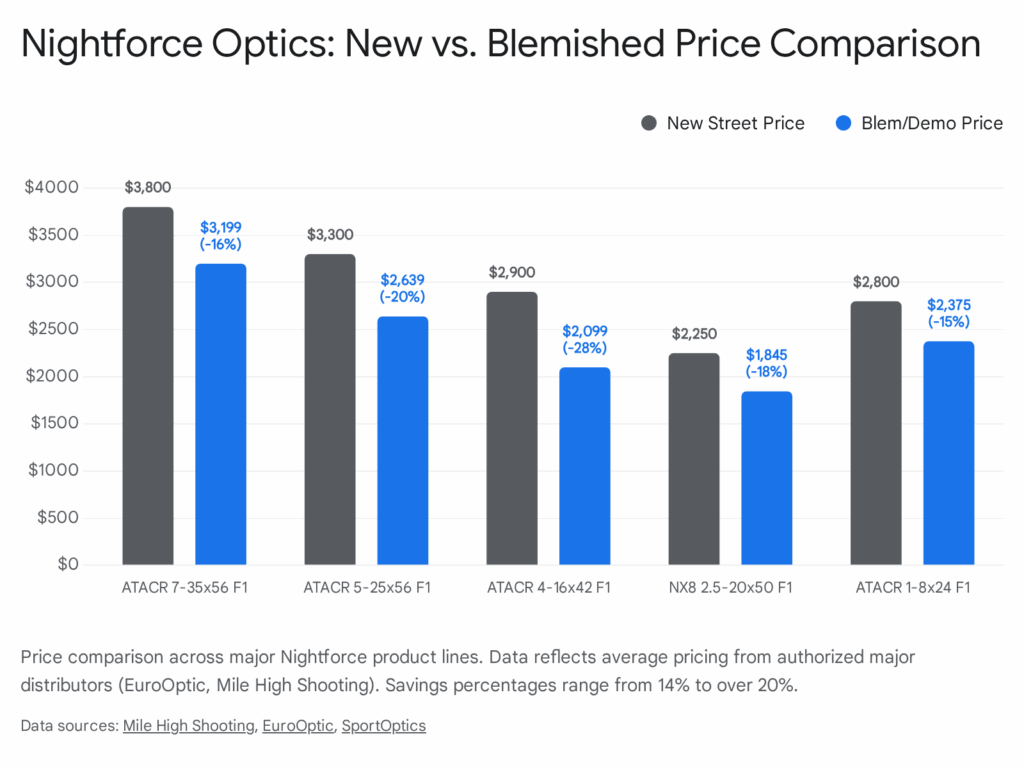

5.4 Pricing and Value Perception

Feedback on pricing is favorable. Users note that getting a Japanese-made, 34mm, 6-36x F1 scope for ~$2,200 is a strong value proposition.3 It undercuts the Zeiss LRP S3 slightly and the ATACR significantly. However, some legacy users argue that $2,200 is creeping close enough to “used ATACR” prices (often found for $2,500-$2,800 on the secondary market) that they might prefer the older, proven flagship.

6. Strategic Implications and Conclusion

The launch of the Nightforce NX6 series is a meticulously calculated strategic maneuver. It addresses the most significant gap in the current optics market: the space between the heavy tactical scope and the fragile hunting scope. By leveraging 6x optical technology, Japanese manufacturing, and the innovative FieldSet turret, Nightforce has created a product line that defines the “Crossover” category.

For the consumer, the NX6 offers a compelling answer to the “one rifle, do it all” question. The 2-12x42mm F1 stands out as a potential best-in-class optic for general purpose rifles, offering the durability of a tactical scope with the weight and form factor of a hunting scope. The 6-36x56mm redefines the price-to-performance ratio for precision rifle competition, making elite-level capability accessible to a wider audience.

While minor critiques regarding reticle design complexity exist, the overall package represents a significant leap forward in versatility and value. The NX6 is not merely a “cheaper ATACR”; it is a smarter, lighter, and more adaptable evolution of the Nightforce capability, positioning the company to dominate the premium mid-tier market for the next decade.

Appendix: Methodology

This report was compiled using a multi-source intelligence gathering approach, synthesizing official manufacturer data, technical reviews from industry experts, and user-generated content from specialized forums.

Data Sources:

- Official Documentation: Press releases, technical datasheets, and blog posts from Nightforce Optics were used to establish baseline specifications, feature sets, and official marketing claims.2

- Expert Reviews: Editorial content from Guns & Ammo and Petersen’s Hunting provided hands-on evaluation of pre-production units, verifying optical clarity and mechanical function in field conditions.1

- Community Intelligence: We analyzed discussion threads on SnipersHide, Rokslide, and Reddit (r/longrange). These platforms are frequented by high-level users who often identify flaws (such as parallax sensitivity or reticle usability) missed by mainstream media.

- Competitor Analysis: Specifications for competitor products (Leupold, Zeiss, Vortex) were sourced directly from their respective product pages to ensure accurate comparison of weight, price, and features.18

Analysis Constraints:

- Drop Test Data: As of January 2026, no third-party destructive testing (e.g., the “Rokslide Drop Test”) has been completed on production NX6 units. Analysis of durability is based on brand reputation and prototype handling reports.

- Optical Quantification: “Glass quality” is currently subjective without optical bench testing (Interferometry). We relied on consensus from users comparing it to known benchmarks (NX8, ATACR).

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- New Nightforce NX6 Riflescopes: Full Review – Guns and Ammo, accessed January 16, 2026, https://www.gunsandammo.com/editorial/nightforce-nx6-review/543928

- Nightforce Optics Announces the NX6™ Family of Riflescopes, accessed January 16, 2026, https://www.nightforceoptics.com/blog/nightforce-announces-the-nx6/

- Nightforce NX6 just dropped : r/longrange – Reddit, accessed January 16, 2026, https://www.reddit.com/r/longrange/comments/1qcqihm/nightforce_nx6_just_dropped/

- Nightforce NX6 scopes. | Rokslide Forum, accessed January 16, 2026, https://rokslide.com/forums/threads/nightforce-nx6-scopes.436324/

- Nightforce NX6 | Sniper’s Hide Forum, accessed January 16, 2026, https://www.snipershide.com/shooting/threads/nightforce-nx6-%F0%9F%8E%AF.7279730/

- NF NX6 | Page 2 | Sniper’s Hide Forum, accessed January 16, 2026, https://www.snipershide.com/shooting/threads/nf-nx6.7279717/page-2

- Nightforce NX6 Rifle Scopes – Sport Optics, accessed January 16, 2026, https://www.sportoptics.com/nightforce-nx6-rifle-scopes.html

- Nightforce NX6 Riflescopes | Compact Precision Optics – EuroOptic.com, accessed January 16, 2026, https://www.eurooptic.com/nightforce-nx6-riflescopes

- The New Nightforce NX6 Scope: Tested Tough – Petersen’s Hunting, accessed January 16, 2026, https://www.petersenshunting.com/editorial/nightforce-nx6-riflescope-great-review/543916

- Discussion NX6 vs 8? – RC Groups, accessed January 16, 2026, https://www.rcgroups.com/forums/showthread.php?3737235-NX6-vs-8

- NX6 1-6x24mm – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/riflescopes/products/nx6/nx6-1-6x24mm/

- Turrets – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/turrets/

- FieldSet™ – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/fieldset/

- Riflescopes | Ultimate Precision – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/riflescopes

- Nightforce: NX6 3-18×50, Fieldset, F1, DigIllum, MOA-XT – Mile High Shooting Accessories, accessed January 16, 2026, https://www.milehighshooting.com/nightforce-nx6-3-18×50-fieldset-f1-digillum-moa-xt/

- Nightforce – NX6 1-6×24, F1, FC-DMx – Mile High Shooting Accessories, accessed January 16, 2026, https://www.milehighshooting.com/nightforce-nx6-1-6×24-f1-fc-dmx/

- Nightforce NX6 – 2-12×24 – Mile High Shooting Accessories, accessed January 16, 2026, https://www.milehighshooting.com/brands/nightforce/nx6/nx6-2-12×42/

- Leupold VX-6HD 3-18x44MM Rifle Scope | Shop | Rocky Mountain Elk Foundation, accessed January 16, 2026, https://shop.rmef.org/product/leupold-vx-6hd-3-18x44mm-rifle-scope/

- NX6 6-36x56mm F1 – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/riflescopes/products/nx6/nx6-6-36x56mm-f1/

- Zeiss LRP S3 6-36×56 FFP – Sport Optics, accessed January 16, 2026, https://www.sportoptics.com/zeiss-lrp-s3-6-36-56-ffp-long-range-riflescope-522695-9916-090.html

- Vortex Razor HD LHT FFP 4.5-22×50 MOA Rifle Scope – GOHUNT Shop, accessed January 16, 2026, https://shop.gohunt.com/products/vortex-razor-hd-lht-ffp-4-5-22×50-moa-rifle-scope

- Q&A on NF NX6 scope reviews | Rokslide Forum, accessed January 16, 2026, https://rokslide.com/forums/threads/q-a-on-nf-nx6-scope-reviews.436364/

- Reticles – Nightforce Optics, accessed January 16, 2026, https://www.nightforceoptics.com/content/files/products/FC-MRx-FC-MRx-MOA-Reticle-Sheet.pdf

- Zeiss LRP S3 636-56 6-36×56 – ZF-MRi #522695-9916-090 – Camera Land NY, accessed January 16, 2026, https://cameralandny.com/shop/zeiss-lrp-s3-636-56-6-36×56-zf-mri-522695-9916-090/9b99bbc0-1220-013b-7ff4-00163ecd2826?variation=3260099

- Vortex Razor HD Gen II-E 1-6×24 Riflescope, accessed January 16, 2026, https://vortexoptics.com/razor-hd-gen-2-e-1-6×24-riflescope.html