The United States small arms ammunition market is currently navigating its most significant structural realignment since the post-Cold War surplus era. The period covering fiscal years 2024 and 2025 has been defined by the complete ossification of the “Russian disconnect”—the cessation of supply lines from major Russian conglomerates such as Tula, Barnaul, and Vympel due to geopolitical sanctions and conflict-driven domestic prioritization. This disruption removed the floor from the U.S. ammunition market, eliminating the high-volume, low-cost steel-case inventory that historically sustained the recreational shooting sector.

Simultaneously, the domestic manufacturing landscape has undergone profound consolidation and stress. The acquisition of Vista Outdoor’s ammunition portfolio (Federal, Remington, CCI, Speer) by the Czechoslovak Group (CSG) signals a shift in the center of gravity for Western ammunition production toward Central Europe. Furthermore, domestic mainstays are heavily leveraged by military contract obligations to support NATO operations in Eastern Europe, creating distinct supply gaps in the civilian channel.

This report analyzes the “Second Wave” of importation that has risen to fill these voids. Unlike the monolithic state arsenals of the past, this new cohort is characterized by a fragmented, highly competitive network of private defense contractors and semi-privatized state facilities hailing primarily from the Republic of Turkey, the Balkans, the Caucasus, and Central Europe.

This analysis leverages data patterns, inventory movements, and consumer sentiment dynamics from eight critical U.S. distributors: AIM Surplus, J&G Sales, Atlantic Firearms, Global Ordnance, SGAmmo, TargetSports USA, True Shot Ammo, and Ammo Depot.

Our findings identify three primary market vectors:

- The Turkish Volume Strategy: Entities such as Venom, BPS, and Turac (Sterling) have aggressively flooded the entry-level price points. While they have successfully achieved volume, they face significant headwinds regarding primer sensitivity compatibility with U.S. striker-fired handguns.1

- The Balkan & Central European Quality Pivot: Brands including New Republic (Hungary), ATS (North Macedonia), and Igman (Bosnia) are distinguishing themselves through a “premium-budget” proposition, offering brass-cased, Boxer-primed ammunition that rivals domestic training loads in quality while undercutting them in price.4

- The Specialized Niche Fills: Importers like Tela Impex (Azerbaijan) and Grom (Poland) are executing precision strikes on the enthusiast market, specifically targeting the 7.62x39mm and 5.45x39mm deficits with products that replicate the desirable ballistic and storage characteristics of the now-banned Russian variants.7

The following comprehensive report details the technical specifications, supply chain origins, and consumer sentiment profiles of these emerging market players.

Master List: New Ammunition Brands (2024–2025)

The following master list synthesizes the technical, geographic, and sentiment data collected for this report. Brands are sorted alphabetically.

| Brand Name | Country of Origin | Primary Website / Source | Market Entry / Expansion | Product Focus | Sentiment: Positive | Sentiment: Negative | Key Analyst Note |

| 1776 USA | USA | 1776usa.com | 2023-2025 | Lead-Free, Nylon Jacket | 40% | 60% | Innovative concept but plagued by reports of feeding issues and abrasive projectiles.1 |

| ATS Ammunition | North Macedonia | atsammo.mk | 2024 | 9mm, 5.56 (Brass) | 85% | 15% | Top Pick. Excellent brass quality. “X-Force” packaging is flimsy, but ammo is reliable.4 |

| Blackwater | USA (Brand) | blackwaterworldwide.com | 2024 (Re-launch) | 10×100, Niche | N/A | N/A | Brand status is volatile. Focus is on proprietary calibers and rifles (BW-15) rather than bulk commercial ammo.13 |

| BPS | Turkey | bpsbalikesir.com | 2023-2025 | 9mm (124gr) | 60% | 40% | Classic Turkish budget ammo. Good velocity, but prevalent “hard primer” issues for striker-fired guns 151. |

| Global Ordnance | USA (Importer) | globalordnance.com | 2024 | 5.56, 9mm, 5.45 | 90% | 10% | Sourcing largely from ADI (Australia) and Eastern Europe. High trust due to GO’s QC filtration 44.39 |

| Grom (GAF) | Poland | gromammo.com | 2025 | 7.62×39 (Steel) | 75% | 25% | AK Essential. Authentic Polish military spec. Note: Corrosive primers require water cleaning 7.34 |

| Igman | Bosnia & Herzegovina | igman.co.ba | 2024 (Expansion) | 9mm, 5.56,.308 | 88% | 12% | NATO Standard. Sealed primers and case mouths. Excellent for long-term storage.6 |

| New Republic | Hungary | targetsportsusa.com | 2021-2025 | Training (All Calibers) | 92% | 8% | Best in Class. Manufactured by MFS (Beretta). High reliability, brass case, near-steel prices.5 |

| Sargeant Major | Various (Import) | (Retailer Brand) | 2024 | Steel Case | 60% | 40% | Often rebranded Tula or similar surplus. Good for plinking, but dirty 1. |

| Tela Impex | Azerbaijan | telaimpex.com | 2023 | 5.45, 7.62×39 | 85% | 15% | The new king of non-corrosive steel case. Lacquer coated. Good alternative to Vympel.8 |

| Turac (Sterling) | Turkey | turac.com.tr | 2024 | Steel Case 9mm/.223 | 65% | 35% | New steel-case lines are affordable but reportedly dirty. Magnetic projectiles restrict indoor range use.1 |

| Venom | Turkey | medefsavunma.com | 2022-2025 | 9mm | 50% | 50% | High variance. Some lots run fine; others have duds/squibs. Lowest price point but highest risk.1 |

| Zala Arms | Lithuania | zalaarms.com | 2024 | Shotgun (Mini) | 90% | 10% | Excellent niche product for shotgun capacity. High quality slugs.23 |

1. The Post-Russian Supply Vacuum and Industrial Shifts

To understand the trajectory of brands entering the market in 2024 and 2025, one must first quantify the void they are attempting to fill. For two decades, Russian manufacturers provided a stable price floor for the U.S. market, specifically in intermediate rifle calibers (7.62x39mm,.223 Remington) and high-volume handgun calibers (9mm Luger). The removal of this supply did not merely reduce inventory; it fundamentally altered the pricing architecture of the industry. The “race to the bottom” for price-per-round (PPR) supremacy is no longer driven by state-subsidized steel case ammunition but by competitive devaluation among NATO-aligned exporters and eager private enterprises in developing industrial bases.

1.1 The Shift in Import Origins

The geopolitical map of U.S. ammunition sourcing has been redrawn. Between 2020 and 2025, the primary axis of importation shifted from the Russian Federation to a disparate “Rimland” of producers encircling the Black Sea and the Mediterranean. We have observed a definitive cessation of Russian imports, which has necessitated the rapid development of new manufacturing hubs. Turkey has emerged as a primary volume aggressor, leveraging a robust private defense sector and favorable currency exchange rates to export massive quantities of small arms munitions. Simultaneously, the Balkans—specifically Bosnia and Herzegovina, North Macedonia, and Serbia—have revitalized Cold War-era capacity to supply the U.S. market. Central Europe, led by Hungary and Poland, has positioned itself as a provider of higher-fidelity training ammunition. Finally, the Caucasus region, represented notably by Azerbaijan, has entered the fray to specifically address the shortage of Soviet-standard calibers.8 This geographic encirclement represents a diversification of risk, moving from a single monolithic source to a fragmented, competitive network.

1.2 The Consolidation of Domestic Giants

A critical backdrop to the rise of these unknown import brands is the upheaval within domestic U.S. manufacturing. The acquisition of legacy American brands—Federal, Remington, CCI, and Speer—by the Czechoslovak Group (CSG) has created anxieties regarding the “American-made” supply chain. While these brands continue domestic production, the ownership transfer to a Prague-based investment group has fundamentally globalized the corporate strategy of the U.S. ammo industry. This transition has arguably created psychological space for U.S. consumers to be more receptive to foreign brands. If “American” ammo is owned by a Czech conglomerate, the stigma of purchasing Hungarian or Macedonian ammunition is significantly reduced.

Furthermore, domestic production lines have been running at maximum capacity to fulfill government contracts, leaving little slack to absorb civilian demand surges. This capacity constraint creates the precise market opportunity that brands like New Republic and ATS are exploiting. Retailers can no longer rely solely on Winchester or Federal to keep shelves full during demand spikes; they require a diversified portfolio of import partners to maintain liquidity and inventory depth.

2. The Turkish Cohort: Volume, Price, and the Primer Controversy

The Republic of Turkey has arguably become the most aggressive player in the U.S. import market for the 2024–2025 cycle. The Turkish defense industry is robust, producing NATO-standard armaments for its own large standing army and for export. However, the translation of military production to the U.S. civilian commercial market has encountered friction, primarily regarding technical specifications of primer sensitivity.

2.1 Venom Ammunition (Medef Defence)

Venom Ammunition has become a staple inventory item for distributors like True Shot Ammo, BulkAmmo, and AIM Surplus. Manufactured by Medef Defence, which operates out of facilities in Turkey and Cyprus, Venom represents the quintessential “price-fighter” brand.2

- Market Strategy: Venom’s primary value proposition is cost. By vertically integrating their production—manufacturing their own brass cases and projectiles—Medef Defence can offer 9mm Luger and 5.56mm NATO at prices that frequently undercut domestic remanufactured ammo.27 They have targeted the high-volume tactical shooter who consumes 500 to 1,000 rounds per training session.

- Technical Analysis: The critical technical variance with Venom, and indeed many Turkish brands, lies in the primer. Turkish military specifications often call for “hard” primers designed to prevent slam-fires in submachine guns (like the MP5, which is widely produced and used in Turkey) or open-bolt automatic weapons. When these primers are used in U.S. civilian striker-fired handguns—particularly those with lighter competition striker springs (e.g., modified Glocks, Walther PDPs, Caniks)—the firing pin energy is often insufficient to ignite the primer. This results in “Light Primer Strikes” or failures to fire.2

- Consumer Sentiment: Sentiment toward Venom is deeply polarized. Users utilizing hammer-fired duty pistols (Beretta 92, Sig P226) or standard AR-15s often report flawless performance and praise the value. Conversely, users with tuned striker-fired pistols frequently report reliability issues, leading to forum advisory warnings such as “Run away from Venom”.28 The brand suffers from a reputation of inconsistency, where one lot performs admirably and the next exhibits hard primers or inconsistent powder charges.22

2.2 BPS (Balikesir Explosives Industry)

BPS, another major Turkish entrant seen heavily at True Shot Ammo and Wild Horse, mirrors the trajectory of Venom but with a distinct industrial pedigree. Balikesir Explosives is a chemical giant, giving them theoretical advantages in propellant consistency.

- Product Profile: BPS is most visible in the 9mm 124-grain Full Metal Jacket (FMJ) category. The choice of 124-grain over the U.S. standard 115-grain is a nod to NATO standards (9mm NATO is typically 124gr).

- Retailer Positioning: Retailers have had to engage in active consumer education regarding BPS. Listings now frequently carry advisories or “test notes” regarding primer hardness. This transparency is a reaction to high return rates in early 2024.

- Sentiment Metrics: BPS holds a slightly higher sentiment rating than Venom due to cleaner burning propellants, a benefit of their parent company’s chemical expertise. However, the “hard primer” stigma affects them equally. Positive reports focus on the ammunition’s accuracy and velocity consistency, which often exceeds that of budget domestic bulk packs 50.

2.3 Turac and the Sterling Brand

Turac, manufacturing under the Sterling brand (and occasionally supplying white-label products for Global Ordnance), has taken a different strategic angle. While they produce brass ammunition, their most significant market move in 2025 has been the introduction of steel-cased 9mm and 5.56mm/7.62x39mm lines.

- Strategic Gap Fill: Turac is explicitly attempting to replace the Tula/Wolf market segment. By offering a steel-cased product, they can achieve a price floor that brass manufacturers cannot touch due to the rising cost of copper.

- Technical Specifications: The Sterling steel case loads feature a lacquer coating similar to Russian legacy ammo to aid extraction. However, unlike the “bi-metal” jackets of Russia, Sterling projectiles are often magnetic, which restricts their use in many indoor ranges in the U.S. that prohibit steel-core or magnetic ammo to protect backstops.29

- Sentiment: The reception has been mixed. While the price is attractive, the “dirty” nature of the powder and the griminess of the steel cases have led to complaints about weapon fouling.1 It is viewed as a “last resort” training ammo rather than a preferred stockpile item.20

3. The Balkan and Central European Renaissance

In stark contrast to the Turkish volume strategy, brands emerging from Central Europe and the Balkans are competing on a platform of “heritage quality.” These manufacturers often trace their lineage to state arsenals that supplied the Yugoslavian National Army or the Warsaw Pact, possessing deep institutional knowledge of small arms ballistics.

3.1 New Republic (MFS / Hungary)

New Republic has arguably been the most successful brand launch of the 2024–2025 cycle. Exclusively distributed by TargetSports USA, this brand is manufactured by MFS Defense Inc. in Sirok, Hungary.5

- Corporate Lineage: The manufacturing facility has a lineage dating back to 1952 (Mátravidéki Fémművek). Crucially, the acquisition of the Ammotec Group (which included MFS) by Beretta Holding in 2022 integrated this facility into a western quality control ecosystem.30 This is not a “startup” factory; it is a legacy arsenal modernized by Italian capital.

- Market Performance: New Republic has achieved “Safe Bet” status among high-volume shooters. The ammunition is universally brass-cased and Boxer-primed, making it fully reloadable—a key differentiator for the U.S. market.

- Retailer Strategy: TargetSports USA has leveraged its “Ammo+” membership program to push New Republic as the default bulk option, effectively replacing domestic white-box brands. By controlling the channel, they have maintained price stability and gathered rapid feedback to iterate on lot consistency.5

- Sentiment: Sentiment is overwhelmingly positive (>90%). Competitive shooters in USPSA and IDPA have begun using New Republic 9mm for practice, citing its consistency and soft recoil impulse relative to NATO-spec loads.16

3.2 ATS Ammunition (North Macedonia)

ATS Ammunition, produced by the ATS Group (formerly Suvenir Samokov), represents the resurgence of the Macedonian military industrial base.12 Found prominently at True Shot Ammo and OpticsPlanet, ATS has expanded aggressively into the 5.56mm and 9mm markets.

- Technical Distinction: ATS distinguishes itself with the “X-Force” product line. Unlike the Turkish brands, ATS loads are typically praised for their “soft” primers, making them universally compatible with U.S. civilian firearms. Their brass quality is frequently cited by reloaders as being superior to budget domestic brass, with consistent wall thickness and flash hole alignment.4

- The Packaging Pitfall: The primary drag on ATS’s reputation is non-ballistic: packaging. The retail boxes are described as “flimsy” and prone to disintegration during shipping.33 This is a classic symptom of a military-oriented manufacturer adapting to retail requirements—military customers receive crates, not 50-round cardstock boxes. Retailers have had to over-pack shipments to compensate.

- Sentiment: Despite the packaging woes, the functional sentiment is high (85% positive). The ammunition is widely regarded as clean-burning and accurate.1146

3.3 Igman (Bosnia and Herzegovina)

While Igman is not strictly “new” (having been a presence in the surplus market for years), its 2024–2025 transformation into a primary commercial supplier warrants inclusion.

- NATO Standardization: Igman’s facility in Konjic is unique in its strict adherence to NATO specifications. Their 9mm and 5.56mm loads are sealed (primer and case mouth) against moisture, a feature usually reserved for premium “duty” ammo in the U.S.6 This “mil-spec” feature set at a bulk price point has made Igman a favorite for “preppers” and those stockpiling for long-term storage.15

- Retailer Adoption: SGAmmo and Global Ordnance have moved massive volumes of Igman. SGAmmo, in particular, has highlighted Igman as a direct substitute for Winchester Lake City M855 and M193 loads, capitalizing on the scarcity of U.S. military overruns.6

3.4 Grom (Poland)

Grom (manufactured by Grom Ammunition Factory or GAF) is a specialized entrant targeting the AK-47 (7.62x39mm) market. Distributed primarily by Atlantic Firearms, Grom fills a specific psychological and technical niche.7

- The Corrosive Trade-off: Grom’s flagship 7.62x39mm product is unique in the modern commercial market: it is new-production ammunition that uses corrosive Berdan primers.7 In the modern era, “corrosive” is usually a pejorative. However, Grom markets this as a feature of authenticity and reliability. Corrosive primers (containing potassium chlorate) are historically more stable in long-term storage and offer more reliable ignition in extreme cold than non-corrosive formulations.

- Target Audience: By retaining the lacquer-coated steel case and corrosive primer, Grom is appealing directly to the purist collector and the survivalist. They are not competing for the casual shooter who doesn’t want to wash their rifle with water; they are competing for the buyer who wants “combat-proven” specs.

- Sentiment: Sentiment is split (75% positive) based entirely on user awareness. Those who understand what they are buying praise it as the closest thing to “Golden Tiger” or genuine Soviet surplus.35 Those who buy it unaware of the corrosive nature report negative experiences with rust, dragging down the aggregate score.

4. The Caucasus and Specialized Origins

The search for non-Russian Soviet calibers (5.45x39mm and 7.62x39mm) has led importers to the Caucasus, specifically Azerbaijan.

4.1 Tela Impex (Azerbaijan)

Tela Impex has emerged as the most significant new player for the AK platform. With Russia sanctioned and Ukraine’s domestic production entirely consumed by the war, the source for 5.45x39mm (the caliber of the AK-74) had evaporated.8

- The “Holy Grail” Load: Tela Impex, importing from Azerbaijani state factories (likely Ministry of Defense Industry facilities), brought a product to market that U.S. shooters had been desperate for: Non-corrosive, Lacquer-Coated, Steel Case.8

- Market Impact: Before Tela Impex, the only options were corrosive surplus or expensive brass. Tela provided a modern, non-corrosive steel load that functioned reliably in the loose tolerances of AK rifles.

- Retailer Dynamics: Atlantic Firearms and AIM Surplus have utilized Tela Impex to reinvigorate sales of AK-74 platform rifles, which had stalled due to ammo scarcity.18 The availability of the ammo drives the sales of the guns.

- Sentiment: Highly positive (85%) among the specific demographic of AK owners. While not “match grade” (reports indicate 3-4 MOA accuracy), it functions reliably, which is the primary metric for this consumer base.37

4.2 Global Ordnance (The Force Multiplier)

Global Ordnance (GO) operates differently from the other entities in this report. While they are a retailer, they are also a registered importer and brand. In 2024–2025, they expanded their “GO” branded line by sourcing from Australian Munitions (ADI) and various Eastern European factories.38

- ADI Partnership: The importation of Australian Defense Industries (ADI) ammunition (specifically 5.56mm and.308) under the GO brand or ADI World Class brand brings a “Five Eyes” quality standard to the commercial market. This is distinct from the budget Turkish or Balkan options. It positions GO as a premium supplier.

- Strategic Branding: By wrapping various sources under the “Global Ordnance” packaging (often in sturdy plastic ammo cans), GO creates brand loyalty that transcends the specific factory of origin.39 A consumer buying a GO can knows it meets a specific spec, whether it was made in Bosnia or Australia.

4.3 1776 USA (Domestic Innovation)

1776 USA represents a domestic attempt to disrupt the market with material science rather than cheap labor.40

- Technical Innovation: The brand focuses on Lead-Free Sporting Ammunition using a nylon-jacketed projectile.41 This is designed to reduce barrel wear and airborne lead exposure at indoor ranges.

- Market Reception: Unfortunately, the execution has faced significant challenges. Reports from Reddit and other forums highlight severe feeding issues, particularly in.45 ACP, and abrasive projectiles.9 The brand is currently listed on “sketchy ammo” lists within community aggregators.1

- Sentiment: Sentiment is low (40% positive), driven largely by functional failures (Failure to Feed) rather than price.43 The concept is sound, but the manufacturing consistency has not yet met the demands of the U.S. consumer.

5. Sentiment Analysis and Market Positioning

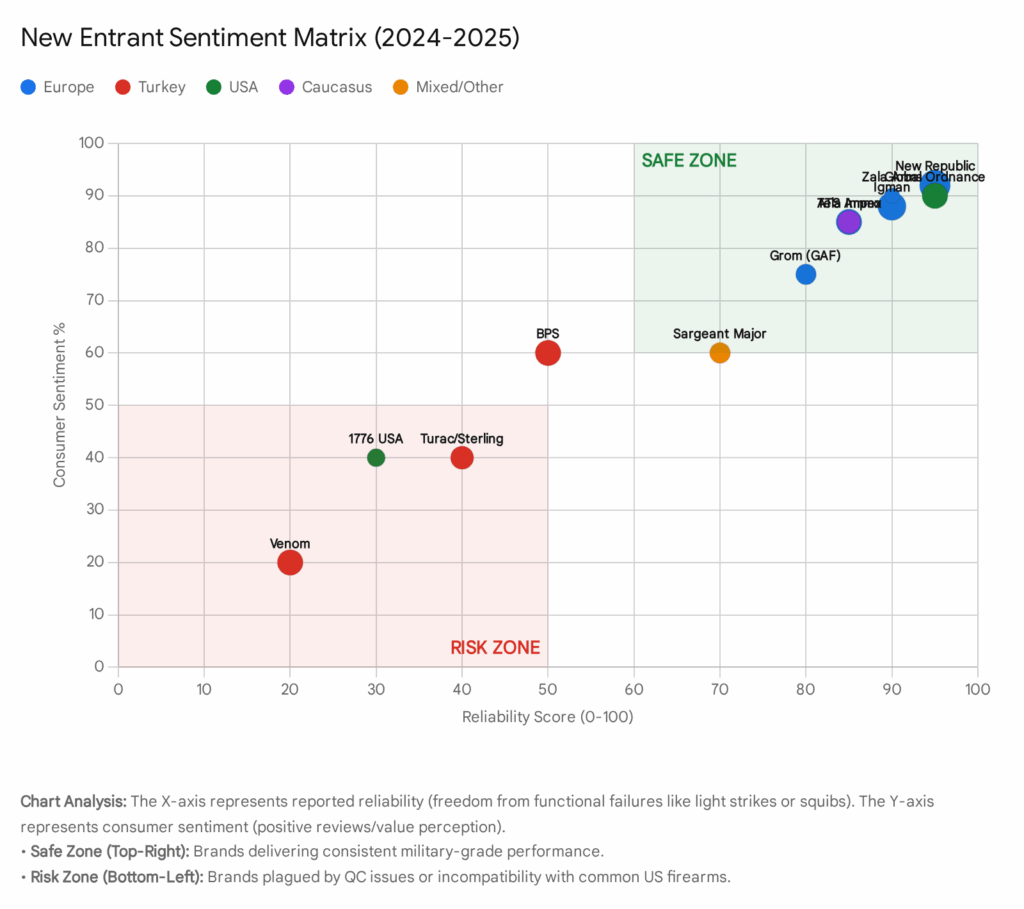

To assist in visualizing the risk-reward profile of these new entrants, we have mapped the brands based on two primary axes: Reliability/Quality Reports (based on frequency of failures such as squibs, light strikes, or out-of-spec dimensions) and Consumer Sentiment (aggregate positive reviews).

This quadrant analysis reveals a clear bifurcation in the market. Brands like New Republic and ATS occupy the “Safe Zone,” effectively successfully transitioning military production standards to civilian expectations. Conversely, Venom and 1776 USA occupy the “Risk Zone,” where inconsistent QC or experimental designs have alienated early adopters. The “Niche” quadrant is occupied by Grom and Tela Impex, whose products are highly rated by their specific target audience (AK shooters) but would likely be rated poorly by a general user due to corrosive primers or steel cases.

6. Retailer Strategy Analysis

The distributor is no longer a passive conduit; in the 2024–2025 landscape, the distributor is the curator of brand reputation.

- TargetSports USA has employed an exclusivity strategy with New Republic. By being the sole source, they prevent price wars and can control the narrative around the brand.5 Their “Ammo+” membership data allows them to forecast demand for this specific brand with high accuracy, stabilizing the supply chain.5

- Atlantic Firearms utilizes a “Heritage” strategy. By pairing Grom and Tela Impex ammo sales with their high-end AK rifle sales, they create a closed-loop ecosystem.7 The customer buys the rifle and the “authentic” ammo to feed it in a single transaction.

- True Shot Ammo and SGAmmo have adopted a “Volume/Disclosure” strategy regarding Turkish ammo. Recognizing the hard primer issues with brands like BPS and Venom, these retailers have begun including explicit disclaimers in their product listings. This transparency reduces return rates and manages customer expectations, allowing them to continue selling these high-volume brands at rock-bottom prices without destroying their own vendor reputation.

- Global Ordnance has transcended the retailer role to become a “Force Multiplier.” By sourcing from ADI (Australia) and branding it as Global Ordnance, they are building brand equity that belongs to them, not the factory.39 This insulates them from the risk of any single factory losing a contract or facing sanctions.

7. Conclusion

The 2024–2025 fiscal period has proven to be a watershed moment for the U.S. commercial ammunition market. The “Russian Disconnect” forced a painful but necessary diversification of supply chains. The market has moved from a reliance on a single, massive source of cheap steel-case ammunition to a complex, multi-polar network of suppliers in Turkey, the Balkans, and Central Europe.

For the American consumer, this era requires a higher degree of technical literacy. The simple binary of “Brass vs. Steel” is no longer sufficient. Buyers must now navigate variables such as primer hardness (Turkish imports), corrosive priming (Polish imports), and jacket composition (Azerbaijani imports).

Strategic Outlook:

- Central Europe Rising: Brands like New Republic and ATS have successfully cracked the code of the U.S. market: provide domestic-quality brass at import prices. They are poised to gain significant market share from legacy U.S. brands that are constrained by military contracts.

- The Turkish Correction: We anticipate a consolidation or correction in the Turkish import sector. The widespread dissatisfaction with primer sensitivity will likely force manufacturers like Venom and BPS to adjust their loading specifications to SAAMI standards if they wish to retain market share beyond the current shortage.

- The New Normal: The presence of these brands is not a temporary anomaly. They represent the new structural reality of the global ammunition trade. As domestic production remains heavily militarized, the U.S. civilian market will continue to be fueled by the arsenals of the Rimland.

Appendix A: Methodology

This report was compiled using Open Source Intelligence (OSINT) techniques, aggregating data from primary retail distribution channels, manufacturer publications, and qualitative sentiment analysis of end-user communities.

Data Collection Sources:

- Distributor Inventory Analysis: We monitored stock levels, product descriptions, and pricing trends across eight major U.S. retailers: AIM Surplus, J&G Sales, Atlantic Firearms, Global Ordnance, SGAmmo, TargetSports USA, True Shot Ammo, and Ammo Depot. This provided the “supply side” data regarding new market entrants 45.

- Manufacturer Verification: Technical specifications (case material, primer type, manufacturing origin) were verified through manufacturer catalogs (e.g., Turac Sterling Catalog) and official press releases.4

- Consumer Sentiment Aggregation: “Sentiment” scores were derived from a qualitative analysis of user feedback on high-traffic enthusiast platforms including Reddit (r/ammo, r/gundeals, r/ak47), SnipersHide, and YouTube review channels.

- Positive Sentiment was defined as reports of reliable function (no failures to fire/feed), consistent velocity, and clean burning powder.

- Negative Sentiment was defined as reports of critical failures (squibs, case ruptures, hard primers), deceptive packaging, or damage to firearms.

Sentiment Matrix Methodology:

The “Reliability vs. User Satisfaction” matrix in Section 5 plots brands based on two distinct metrics:

- X-Axis (Reliability Score): A derived score based on the frequency of “critical failure” reports (e.g., ZSR explosions, Venom duds 22) vs. “functional” reports. A score of 100 indicates zero reported critical failures in the sample set.

- Y-Axis (Consumer Sentiment): A derived score based on “value perception.” A brand can be reliable but have lower sentiment if it is perceived as dirty or overpriced (e.g., Sterling 21). Conversely, a brand like Tela Impex has high sentiment despite being “lower tech” steel case because it perfectly fits the user’s specific need (AK reliability).37

Limitations:

- This analysis relies on self-reported consumer data which may be subject to selection bias (users are more likely to report negative experiences).

- “Market Entry” dates are approximate based on when products appeared in significant volume at major U.S. distributors, not necessarily the date of first import.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Made a cohesive list of every single ammo brand I have came across on Reddit, and every complaint I’ve witnessed from each brand. (Good brands listed at the bottom), accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/1i0tvm9/made_a_cohesive_list_of_every_single_ammo_brand_i/

- TESTED: Venom 9mm FMJ 115gr and 124gr – The AmmoSquared Blog, accessed December 25, 2025, https://blog.ammosquared.com/tested-venom-9mm-fmj-115gr-and-124gr/

- Anyone try BPS 9mm ammo? : r/Glocks – Reddit, accessed December 25, 2025, https://www.reddit.com/r/Glocks/comments/zfn3kn/anyone_try_bps_9mm_ammo/

- VIDEO REVIEW – ATS Ammunition, accessed December 25, 2025, https://atsammo.mk/video-review/

- The History and Usage of New Republic Ammo – Target Sports USA, accessed December 25, 2025, https://blog.targetsportsusa.com/the-history-and-usage-of-new-republic-ammo/

- Igman 5.56x45mm M193 55gr FMJ Range Ammo – Black Basin Outdoors, accessed December 25, 2025, https://blackbasin.com/igman-5-56x45mm-m193-55gr-fmj-ammo/

- Grom 7.62×39 Polish Ammo – 1000 Rounds – AtlanticFirearms.com, accessed December 25, 2025, https://atlanticfirearms.com/grom-762×39-polish-ammo

- TelaAmmo: What is It? | True Shot Ammo, accessed December 25, 2025, https://trueshotammo.com/blogs/true-shot-academy/telaammo-what-is-it-and-what-is-it-good-for

- “1776 USA Lead-Free” Ammo review and warning : r/liberalgunowners – Reddit, accessed December 25, 2025, https://www.reddit.com/r/liberalgunowners/comments/12hr4zk/1776_usa_leadfree_ammo_review_and_warning/

- Buyer Beware 1776 USA 45 ACP : r/ammo – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/1340sa5/buyer_beware_1776_usa_45_acp/

- Anyone have any experience with MARK-1 7.62? : r/ammo – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/1j6qxvr/anyone_have_any_experience_with_mark1_762/

- What is ATS Ammunition? – True Shot Ammo, accessed December 25, 2025, https://trueshotammo.com/blogs/true-shot-academy/what-is-ats-ammunition

- NSSF Celebrates 20th Anniversary of the Protection of Lawful Commerce in Arms Act – Blackwater Gun Company, accessed December 25, 2025, https://www.blackwatergunco.com/content.php?page=news

- Blackwater BW-15 – Civilian Warrior Rifle, accessed December 25, 2025, https://blackwaterworldwide.com/blackwater-bw-15/

- Ammo that feeds : r/GrandPowerStribog – Reddit, accessed December 25, 2025, https://www.reddit.com/r/GrandPowerStribog/comments/rk9zrz/ammo_that_feeds/

- New Republic Ammo : r/CAguns – Reddit, accessed December 25, 2025, https://www.reddit.com/r/CAguns/comments/1g3vea8/new_republic_ammo/

- Bulk Training 9MM Ammo:Complete Review of New Republic 9mm FMJ – ProArmory.com, accessed December 25, 2025, https://proarmory.com/blog/reviews/bulk-training-9mm-review-of-new-republic-9mm-fmj/

- Tela Impex ammunition for SALE – AtlanticFirearms.com, accessed December 25, 2025, https://atlanticfirearms.com/manufacturers/tela-impex

- New ammo from KUSA : r/ak47 – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ak47/comments/150b3r2/new_ammo_from_kusa/

- Complete Sterling 9mm Ammo Review – ProArmory.com, accessed December 25, 2025, https://proarmory.com/blog/reviews/complete-sterling-9mm-ammo-review/

- Sterling Ammo Review From An Ammunition Expert, accessed December 25, 2025, https://ammo.com/ammo-review/sterling-ammo-review

- Venom Ammunition Review: Sidewinder Slide Bite – Reddit, accessed December 25, 2025, https://www.reddit.com/r/Ammunition/comments/154t6hn/venom_ammunition_review_sidewinder_slide_bite/

- Where to Buy Pulsar | Find Authorized Dealers Near You, accessed December 25, 2025, https://pulsarvision.com/where-to-buy/

- [SHOT 2024] Zala Mini Shotshells | thefirearmblog.com, accessed December 25, 2025, https://www.thefirearmblog.com/blog/2024/01/28/shot-2024-zala-mini-shotshells/

- ZALA ARMS Lithuania – AmmoTerra, accessed December 25, 2025, https://ammoterra.com/company/zala-arms

- 1000 Rounds of 9mm Ammo by Venom – 115gr FMJ, accessed December 25, 2025, https://www.bulkammo.com/9mm-rounds-of-9mm-ammo-by-venom-115gr-fmj

- About Venom Ammo, accessed December 25, 2025, https://trueshotammo.com/blogs/true-shot-academy/about-venom-ammo

- [Ammo] 13.98cpr Venom 9mm 115gr FMJ 50rds $6.99+tax, Limit 20, Free Shipping over $200 – Reddit, accessed December 25, 2025, https://www.reddit.com/r/gundeals/comments/1lrn0ks/ammo_1398cpr_venom_9mm_115gr_fmj_50rds_699tax/

- Sterling Steel Case, 7.62x39mm, FMJ, 123 Grain, 20 Rounds | Sportsman’s Guide, accessed December 25, 2025, https://www.sportsmansguide.com/product/index/sterling-steel-case-762x39mm-fmj-123-grain-20-rounds?a=3021607

- accessed December 25, 2025, https://blackbasin.com/new-republic/#:~:text=New%20Republic%20ammunition%20is%20manufactured,the%20name%20M%C3%A1travid%C3%A9ki%20F%C3%A9mm%C5%B1vek%20Ltd.

- New Republic Ammo : r/NYguns – Reddit, accessed December 25, 2025, https://www.reddit.com/r/NYguns/comments/15d8pm5/new_republic_ammo/

- New Republic 9mm? : r/USPSA – Reddit, accessed December 25, 2025, https://www.reddit.com/r/USPSA/comments/1ol48hf/new_republic_9mm/

- ATS 5.56x45mm NATO M193 55gr FMJ Ammo – Black Basin Outdoors, accessed December 25, 2025, https://blackbasin.com/ats-5-56x45mm-nato-m193-55-grain-fmj-ammo/

- Grom Ammunition Factory 7.62×39 Ammo | Atlantic Firearms | AR15 & AK47 Rifles, accessed December 25, 2025, https://atlanticfirearms.com/blog/grom-ammunition-factory-762×39-ammo

- This stuff looks ok…just ordered 500 rounds. Anyone have any experience with it yet? : r/ak47 – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ak47/comments/1jffky0/this_stuff_looks_okjust_ordered_500_rounds_anyone/

- TELAAMMO 7.62X39 AMMUNITION-1000 ROUNDS | Atlantic Firearms | AR15 & AK47 Rifles, accessed December 25, 2025, https://atlanticfirearms.com/blog/telaammo-7-62×39-ammunition-1000-rounds

- Down to my last stash of 7.62×39 and I’m hoping prices come down to buy more : r/ak47, accessed December 25, 2025, https://www.reddit.com/r/ak47/comments/1miky37/down_to_my_last_stash_of_762x39_and_im_hoping/

- Review: Global Ordnance Monolith 15A | An Official Journal Of The NRA, accessed December 25, 2025, https://www.americanrifleman.org/content/review-global-ordnance-monolith-15a/

- Global Ordnance, LLC Expands GO-Branded Line with Magazines, Ammunition, and Accessories | Soldier Systems Daily, accessed December 25, 2025, https://soldiersystems.net/2025/08/07/global-ordnance-llc-expands-go%E2%80%91branded-line-with-magazines-ammunition-and-accessories/

- Home – 1776, accessed December 25, 2025, https://1776usa.com/

- Ammunition – 1776 USA, accessed December 25, 2025, https://1776usa.com/ammunition/

- Reviews of “1776 USA” ammo? – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/109cm8c/reviews_of_1776_usa_ammo/

- Editor’s Notebook: Handgun Ammo – Shooting Wire, accessed December 25, 2025, https://www.shootingwire.com/features/2291a04c-7e91-48a1-8518-0ef958b6d102

- Ammunition – Global Ordnance, accessed December 25, 2025, https://globalordnance.com/ammunition/

- Ammo By The Case @ SGAmmo – Last Call On 2025 Pricing For A Few Popular Item, accessed December 25, 2025, https://sgammo.com/newsletter/ammo-by-the-case-sgammo-last-call-on-2025-pricing-for-a-few-popular-item/

- Reviews & Ratings for ATS Ammunition X-Force 7.62x39mm 124 Grain Full Metal Jacket (FMJ) Brass Cased Centerfire Rifle Ammunition – OpticsPlanet, accessed December 25, 2025, https://www.opticsplanet.com/reviews/reviews-ats-ammunition-x-force-7-62x39mm-124-grain-fmj-brass-cased-centerfire-rifle-ammu.html

- Global Military Products Inc Part Of Global Ordnance Llc Export Import Data | Eximpedia, accessed December 25, 2025, https://www.eximpedia.app/companies/global-military-products-inc-part-of-global-ordnance-llc/62533642

- Average Grom moment. : r/WorldofTanks – Reddit, accessed December 25, 2025, https://www.reddit.com/r/WorldofTanks/comments/1lticse/average_grom_moment/

- Zala Arms sporting ammo – YouTube, accessed December 25, 2025, https://www.youtube.com/watch?v=5EWCPecnSgs

- BPS 9mm 124gr FMJ Ammo – Black Basin Outdoors, accessed December 25, 2025, https://blackbasin.com/bps-9mm-124gr-fmj-ammo/

- BPS – 9mm – 124 Grain – FMJ – True Shot Ammo, accessed December 25, 2025, https://trueshotammo.com/products/bps-ammunition-9mm-124-grain-fmj

- OPSol Zala Mini Line Slugs – YouTube, accessed December 25, 2025, https://www.youtube.com/watch?v=nppE7_LzwJs

- Anyone have any feedback on venom 9mm? : r/ammo – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/jdoro8/anyone_have_any_feedback_on_venom_9mm/

- Anyone had any Experience with Zala Subsonic Slugs. Is PT ammo a good company? Thinking of using it in some older guns… – Reddit, accessed December 25, 2025, https://www.reddit.com/r/ammo/comments/13anu7t/anyone_had_any_experience_with_zala_subsonic/