This report provides a detailed analysis of the Russian defense-industrial complex, the Оборонно-промышленный комплекс (ОПК) (Oboronno-promyshlennyy kompleks), or OPK. It contrasts this state-controlled industrial model with the competitive commercial marketplace of the United States, focusing on the central role of the State Corporation Rostec. The analysis delves into the history, structure, and specialization of three pivotal small arms enterprises under the Rostec umbrella: the Kalashnikov Concern, the primary manufacturer of assault rifles; the Central Research Institute of Precision Machine-Building (TsNIITochMash), a key research and development center; and the KBP Instrument Design Bureau, a developer of high-precision weapons.

The modern Russian OPK, consolidated under Rostec, is a direct state-engineered response to the catastrophic industrial collapse that followed the dissolution of the Soviet Union. It utilizes the structure of a modern holding company to achieve the objectives of a state-controlled command economy, prioritizing national security and strategic resilience over market-driven efficiency. This structure reveals a deliberate strategy of functional specialization, separating mass production (Kalashnikov) from advanced R&D (TsNIITochMash) and high-precision systems development (KBP). However, the recent absorption of the premier R&D institute, TsNIITochMash, by the mass-production giant Kalashnikov Concern represents a significant strategic shift, potentially subordinating long-term, revolutionary research to the incremental needs of existing product lines.

The report concludes by extracting four key lessons for the global small arms industry. First, the Russian model highlights the inherent tension between independent design bureaus and mass production plants, a dynamic that can foster innovation but also risks stifling it. Second, the creation of Rostec demonstrates strategic consolidation as a tool of state power to ensure industrial survival, a fundamentally different approach from market-driven consolidation in the West. Third, Russia’s enduring design philosophy—prioritizing reliability and simplicity—enables massive production surges but creates critical vulnerabilities in modernization, particularly given its dependence on foreign high-tech components. Finally, the Russian OPK’s current state presents a critical geopolitical trade-off: it can generate immense quantities of “good enough” military hardware for a war of attrition, but this comes at the cost of qualitative technological stagnation. This dynamic shows that while Russia may be winning the short-term production battle, it risks losing the long-term technology race, a reality with profound implications for the future global balance of military power.

Section 1: The Architecture of State Control: The OPK and Rostec State Corporation

To comprehend the contemporary Russian small arms industry, one must first understand that it does not operate within a competitive commercial marketplace akin to that of the United States. Instead, it is an integral component of a state-controlled system designed as a direct instrument of national power. This system, the Defense-Industrial Complex or OPK, is the product of a tumultuous history, shaped by the legacy of the Soviet command economy, the near-total collapse of the 1990s, and a deliberate, top-down reconsolidation in the 21st century under the state corporation Rostec.

1.1 The Soviet Legacy and Post-Soviet Evolution of the ОПК (OPK)

The foundational concept of the Russian defense industry is the Оборонно-промышленный комплекс (ОПК) (Oboronno-promyshlennyy kompleks), or Defense-Industrial Complex. The OPK is defined as the total aggregation of the nation’s scientific research institutes, testing organizations, and manufacturing enterprises that perform the development, production, storage, and deployment of military and special-purpose technology, ammunition, and materiel.1 Its origins lie in the centrally planned, administrative-command economy of the Soviet Union, a system that fundamentally prioritized military production and heavy industry over all other economic activity.2 Within this framework, vast state-owned enterprises, such as the historic arms factories in Tula and Izhevsk, and specialized design bureaus operated not as independent entities but as cogs in a machine directed by central planning agencies like Gosplan, the State Planning Committee.3

The dissolution of the Soviet Union in 1991 triggered a catastrophic collapse of this immense complex. The OPK was thrown into a “time of troubles,” hobbled by the abrupt cessation of state funding, the severing of deeply integrated supply chains, and rampant corruption.4 A significant portion of the Soviet OPK was located in newly independent states, most critically in Ukraine, which housed vital production centers for everything from tank engines to aircraft carriers.6 This industrial divorce dealt a strategic blow from which the Russian OPK has never fully recovered. Throughout the 1990s, the industry was on the brink of demise, with an estimated 6,000 companies, many of which were unprofitable, requiring continuous government subsidization simply to exist.5

During this period of profound crisis, the OPK found its “saving grace” in foreign exports.4 Key orders from nations like China, India, and Iran provided a lifeline of hard currency that staved off total collapse. This influx of export dollars gave the industry the “breathing space” it needed to survive the decade and claw back a degree of its competitive advantage.4 This experience forged a deep-seated reliance on the export market that continues to shape the strategic calculus of the Russian defense industry today.

The loss of the Ukrainian industrial base, in particular, cannot be overstated. Key strategic assets, including the Malyshev Plant in Kharkiv (a primary tank production center), the Antonov Design Bureau (creator of the world’s largest transport aircraft), and the Mykolaiv shipyards (which built the Soviet Union’s only aircraft carriers, including the Russian Navy’s current flagship, the Admiral Kuznetsov), were suddenly outside of Moscow’s control.6 This event created a permanent “phantom limb” for the Russian OPK. It was not merely a loss of physical capacity but a severing of decades-old research, development, and supply chain relationships. Russia’s subsequent and persistent struggles in sectors like large surface combatants and strategic airlifters can be traced directly to this foundational rupture. The consolidation efforts of the 2000s could patch over some of these deficiencies, but they could not recreate the integrated industrial ecosystem that was lost in 1991.

1.2 Государственная корпорация «Ростех» (Gosudarstvennaya korporatsiya “Rostekh”): The Lynchpin of the Modern OPK

By the mid-2000s, it was clear that market forces and ad-hoc state support were insufficient to reverse the OPK’s decay. In a decisive act of state intervention, the Russian government created a new entity to serve as the lynchpin of a revitalized, state-controlled defense industry. This entity is Rostec.

Established by Federal Law № 270-FZ on November 23, 2007, Rostec was created with the explicit mission to assist in the development, production, and export of high-tech industrial products for both military and civilian purposes.8 Its full official name is Государственная корпорация по содействию разработке, производству и экспорту высокотехнологичной промышленной продукции «Ростех» (Gosudarstvennaya korporatsiya po sodeystviyu razrabotke, proizvodstvu i eksportu vysokotekhnologichnoy promyshlennoy produktsii “Rostekh”), which translates to the State Corporation for the Promotion of the Development, Manufacture and Export of High Technology Products “Rostec”.10

The creation of Rostec was a state-led rescue operation. On July 10, 2008, a presidential decree transferred 443 struggling enterprises to Rostec’s control. The condition of these assets was dire: 30% were in pre-crisis or crisis condition, 28 were in bankruptcy proceedings, 17 had ceased operations entirely, and they faced a collective debt of 630 billion rubles.9 Rostec’s task was to consolidate these disparate and often failing assets, impose structural reforms, and restore them to a state of operational and financial viability.

Today, Rostec is a massive, 100% state-owned industrial conglomerate. It functions as a holding company for approximately 800 enterprises, which are organized into 15 smaller holding companies—eleven in the defense sector and four in civilian industries.11 These enterprises are spread across 60 constituent regions of the Russian Federation and employ roughly 4.5 million people, accounting for a staggering 20% of all manufacturing jobs in Russia.7

While Rostec has a stated mission to diversify the Russian economy and increase the share of civilian products in its portfolio, its core function remains the execution of the state’s military-industrial policy.11 It is the primary vehicle for fulfilling the государственный оборонный заказ (gosudarstvennyy oboronnyy zakaz), or State Defense Order (GOZ). Rostec’s holdings account for almost half of Russia’s total defense procurement, and the corporation traditionally reports a completion rate of nearly 100% for the GOZ.14 This structure is not that of a market participant but of a state ministry operating under the guise of a modern corporation. It is a hybrid model that uses the tools of capitalism—holding companies, branding, and global marketing—to achieve the objectives of a state-controlled command economy.

This central role has made Rostec and its subsidiaries primary targets for international sanctions, particularly since Russia’s annexation of Crimea in 2014 and the full-scale invasion of Ukraine in 2022.10 These sanctions have imposed asset freezes and severely limited access to Western technology, components, and financial markets. In response, the OPK has been forced to adapt through often inefficient import-substitution programs and a reliance on parallel imports of sanctioned goods through third countries.15 This has exposed critical dependencies, particularly on Western-made microelectronics, machine tools, and specialized materials, which has in turn degraded the technological sophistication of its output.16

Section 2: Pillars of Russian Small Arms: Key Enterprises Under the Rostec Umbrella

Within the vast structure of Rostec, the small arms sector is dominated by a handful of historically significant and highly specialized enterprises. These entities are not competitors in a traditional sense; rather, they form a state-managed ecosystem with distinct, complementary roles. The three most prominent pillars are the Kalashnikov Concern, the heart of mass production; TsNIITochMash, the industry’s specialized research and development brain; and the KBP Instrument Design Bureau, the master of high-precision weaponry. Their individual histories, locations, and, most importantly, their intricate relationships within the Rostec hierarchy reveal a deliberate strategy of functional specialization.

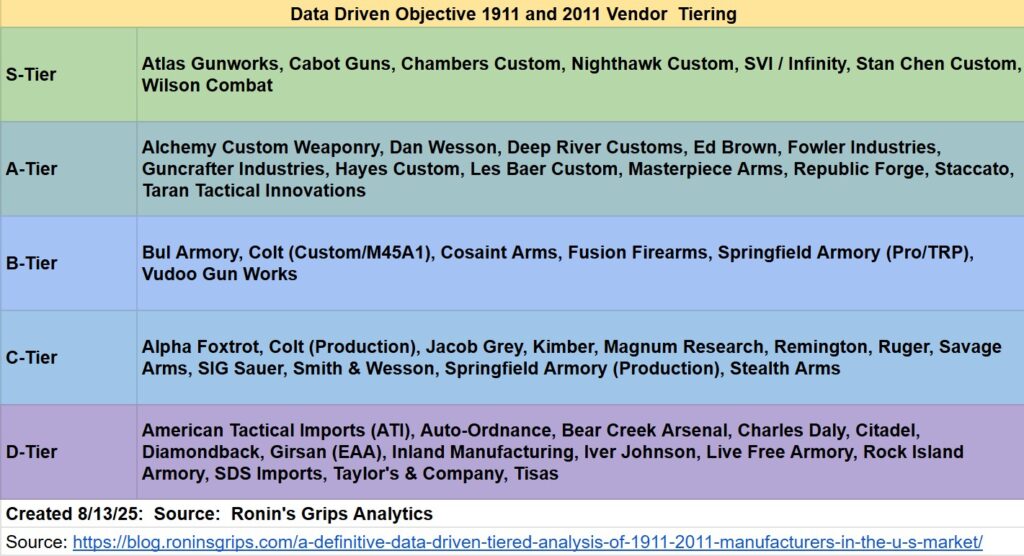

Table 1: Overview of Key Russian Small Arms Enterprises

| Enterprise Name (Cyrillic, Roman, English) | Founding Year | Primary Location | Core Specialization | Parent Holding (within Rostec) |

| Концерн Калашников (Kontsern Kalashnikov), Kalashnikov Concern | 1807 | Izhevsk, Udmurt Republic | Assault rifles, combat small arms, mass production | Rostec (Direct Control) |

| ЦНИИТочМаш (TsNIITochMash), Central Research Institute of Precision Machine-Building | 1944 | Podolsk (Klimovsk), Moscow Oblast | Ammunition, special-purpose weapons R&D, testing | Kalashnikov Concern |

| КБП им. академика А. Г. Шипунова (KBP im. akademika A. G. Shipunova), KBP Instrument Design Bureau | 1927 | Tula, Tula Oblast | High-precision weapons, pistols, ATGMs, air defense | High Precision Systems (Высокоточные комплексы) |

2.1 Концерн Калашников (Kontsern Kalashnikov): The Heart of Rifle Production

The Kalashnikov Concern is arguably the most recognized brand in the global firearms industry. Its official name is Акционерное общество «Концерн Калашников» (Aktsionernoye obshchestvo “Kontsern Kalashnikov”), or Joint Stock Company “Kalashnikov Concern”.18 Until a major rebranding effort in 2013, it was known as the Izhevsk Machine-Building Plant, or ИЖМАШ (IZhMASh).18

The enterprise’s history is deeply intertwined with that of the Russian state itself. It was founded on June 10, 1807, by a decree from Tsar Alexander I, who established a new state armory in the city of Izhevsk in the Udmurt Republic.18 The location was strategically chosen for its proximity to the region’s ironworks, ensuring a ready supply of raw materials for arms production.21 For over two centuries, this factory has served as the primary supplier of small arms to the Imperial Russian Army, the Soviet Red Army, and the modern Russian Armed Forces.20

The modern Concern was formed on August 13, 2013, through the state-directed merger of two historic Izhevsk-based firearms manufacturers: the Izhmash plant and the Izhevsk Mechanical Plant (ИЖМЕХ, IZHMEKH).19 This consolidation, orchestrated by Rostec, created a single, dominant entity in the Russian small arms landscape. Today, the Kalashnikov Concern is the undisputed flagship of the industry, accounting for approximately 95% of all small arms production in Russia.23 Its product line is extensive, including the iconic Kalashnikov series of assault rifles (from the original AK-47 to the modern AK-12), the Dragunov SVD sniper rifle, the RPK light machine gun, the Saiga family of civilian rifles and shotguns, and even more complex systems like the Vikhr-1 guided anti-tank missile.20

Corporately, the Kalashnikov Concern is a direct subsidiary of the Rostec state corporation.19 Following the 2013 merger, Rostec initiated and funded a comprehensive rebranding campaign to create a more powerful and coherent global brand. This strategy consolidated the Concern’s diverse product lines under three distinct brands: “Kalashnikov” for combat weapons, “Baikal” for hunting firearms, and “Izhmash” for sporting rifles.25 This move was a clear example of Rostec employing modern marketing techniques to enhance the global competitiveness and brand value of a state-controlled strategic asset.

2.2 Центральный научно-исследовательский институт точного машиностроения (ЦНИИТочМаш): The Brains of the Operation

While Kalashnikov is the brawn of the Russian small arms industry, the Central Research Institute of Precision Machine-Building, or TsNIITochMash, is its specialized brain. Its full official name is Акционерное общество «Центральный научно-исследовательский институт точного машистроения» (Aktsionernoye obshchestvo “Tsentral’nyy nauchno-issledovatel’skiy institut tochnogo mashinostroyeniya”), or Joint Stock Company “Central Research Institute of Precision Machine-Building” (JSC “TsNIITochMash”).27

The institute was founded on May 17, 1944, during the height of the Great Patriotic War (World War II), to centralize and advance weapons research.28 It is located in the Klimovsk microdistrict of Podolsk, a city in the Moscow Oblast, placing it in close proximity to the nation’s political and military command centers.27

TsNIITochMash’s primary mission is to function as a central research, development, and testing facility for advanced and specialized military technology. It is not a mass-production factory but a scientific institute tasked with solving complex technical challenges for the Russian military and special services.30 The institute is particularly renowned for its work in specialized ammunition and the unique weapon systems designed to fire it. Its most famous creations are the 9x39mm family of subsonic, armor-piercing cartridges (the SP-5 and SP-6) and the legendary suppressed firearms developed for Spetsnaz (special forces) in the 1980s: the AS Val assault rifle and the VSS Vintorez sniper rifle.31 These weapons provided Soviet special forces with a unique capability for silent, lethal raids against protected targets. Beyond small arms, TsNIITochMash also plays a crucial role in developing control systems for precision-guided munitions, having contributed to the guidance equipment for the “Fagot,” “Konkurs,” and “Kornet” anti-tank guided missiles (ATGMs).30

The corporate relationship of TsNIITochMash is both crucial and complex. Like Kalashnikov, it is part of the Rostec state corporation.28 However, a significant organizational restructuring has placed TsNIITochMash structurally within the Kalashnikov Concern.27 This decision subordinates Russia’s premier R&D institute for special-purpose small arms and ammunition to the corporate control of its largest mass-production entity. This arrangement could theoretically streamline the transition of new technologies from the laboratory to the factory floor. However, it also creates a significant risk. The “brains” of the operation now report directly to the “factory floor.” This dynamic could potentially stifle the kind of blue-sky, revolutionary research that produced the AS Val in favor of more incremental, evolutionary projects that serve the immediate product development needs of the Kalashnikov rifle family—for instance, designing a new handguard or muzzle device for the next AK variant. This internal tension between the need for radical innovation and the demands of mass production is a critical dynamic to monitor within the Russian OPK.

2.3 Конструкторское бюро приборостроения (КБП): The Masters of Precision

The third pillar of the Russian small arms ecosystem is the KBP Instrument Design Bureau, located in the historic arms-making city of Tula. Its full name is АО «Конструкторское бюро приборостроения им. академика А. Г. Шипунова» (AO “Konstruktorskoye byuro priborostroyeniya im. akademika A. G. Shipunova”), or JSC “KBP Instrument Design Bureau named after Academician A. G. Shipunov”.32

KBP was founded on October 1, 1927, as a design organization within the legendary Tula Weapons Factory.32 The city of Tula is, along with Izhevsk, one of the foundational cradles of the Russian arms industry, with its state arsenal established by Peter the Great in 1712.34 This long heritage of design and manufacturing excellence continues to define KBP’s identity.

The key differentiator for KBP is its unwavering focus on high-precision weapon systems.32 While Kalashnikov equips the common infantryman with a robust and simple rifle, KBP develops the complex, high-technology, high-value systems that provide Russian forces with their decisive combat edge. Its specialization spans multiple domains:

- Anti-Tank Guided Missiles (ATGMs): KBP is the designer of some of the world’s most effective ATGMs, including the 9M133 Kornet (NATO reporting name: AT-14 Spriggan) and the 9M113 Konkurs (AT-5 Spandrel).32

- Air Defense Systems: The bureau is responsible for developing highly mobile, integrated gun-missile air defense systems like the Pantsir-S1 (SA-22 Greyhound) and its predecessor, the Tunguska-M1 (SA-19 Grison).32

- Advanced Small Arms: In the small arms sphere, KBP focuses on innovative and specialized designs rather than mass-issue rifles. Its products include the GSh-18 pistol (known for its high-capacity magazine and powerful 9x19mm 7N31 armor-piercing round), the compact PP-2000 submachine gun, and specialized grenade launchers like the GM-94.32

KBP’s corporate structure underscores its specialized role. While it is part of the Rostec state corporation, it is pointedly not placed under the Kalashnikov Concern. Instead, KBP is a cornerstone enterprise within a different Rostec holding company: АО «НПО „Высокоточные комплексы“» (AO “NPO ‘Vysokotochnyye kompleksy'”), or JSC “High Precision Systems”.32 This places KBP in a separate corporate vertical dedicated exclusively to high-end guided weapons and complex systems. This organizational separation is a deliberate strategic choice, designed to insulate the development of costly, R&D-intensive precision weapons from the mass-production logic that governs the Kalashnikov Concern. It ensures that Russia’s high-precision capabilities are managed and developed within a dedicated ecosystem, preventing their dilution or subordination to the needs of conventional infantry arms.

Section 3: Analysis and Key Lessons for the Global Small Arms Industry

The state-controlled, centrally managed structure of the Russian OPK offers a stark contrast to the market-driven defense industrial base of the United States. Analyzing these differences, particularly through the lens of the key small arms enterprises, provides a series of crucial lessons for industry professionals, strategic analysts, and military planners worldwide. These lessons concern the fundamental trade-offs between state control and market competition, the relationship between innovation and production, and the long-term strategic consequences of a nation’s industrial philosophy.

3.1 The State-Controlled vs. Market-Driven Model: A Comparative Analysis

The Russian and American models for defense industrial production represent two fundamentally different philosophies.

The Russian Model can be characterized as a state-directed monopoly. It is dominated by massive, state-owned corporations like Rostec, within which individual enterprises hold de facto monopolies in their respective sectors. The Kalashnikov Concern’s 95% share of Russian small arms production is a prime example.25 The primary customer is the state, which dictates production targets through the State Defense Order (GOZ), and the industry’s objectives are determined by national security policy, not by consumer demand or market competition.14 The principal advantage of this model is the state’s ability to command a massive and rapid pivot to a war economy footing. Since the 2022 invasion of Ukraine, Rostec has reported exponential increases in the output of certain munitions and a near seven-fold increase in tank production.7 However, this model is historically plagued by deep-seated inefficiencies, a near-total lack of consumer choice, and a systemic vulnerability to corruption and technological stagnation due to the absence of competitive pressure.15

The U.S. Model, in contrast, is a regulated competitive market. The industrial landscape is fragmented, comprising numerous privately owned companies of varying sizes, from defense giants to small, specialized firms. These companies compete vigorously for both a large, dynamic civilian market and for government contracts.38 Government procurement is legally bound by a complex set of regulations, such as the Competition in Contracting Act (CICA), designed to promote “full and open competition” wherever possible.41 This system is intended to foster innovation, drive down costs, and improve quality through market pressure. However, the procurement process can be notoriously slow and bureaucratic, often taking 18 months or more for a new contractor to win their first contract.44 Furthermore, while highly innovative, a market-based system may not be able to scale up production for a major peer-level conflict as rapidly or as ruthlessly as a state-directed command system. A crucial feature of the U.S. ecosystem is the vast civilian market for personal defense and sporting firearms, which acts as a parallel engine of innovation and provides a financial foundation for many companies, insulating them from the cyclical nature of government procurement.45

3.2 Lesson 1: The Symbiosis and Conflict of Design Bureaus and Mass Production Plants

The historic Russian model, with its functional separation of R&D-focused design bureaus (like KBP and TsNIITochMash) from mass-production factories (like the Izhevsk plant), offers a valuable lesson. This structure allows for long-term, state-funded research to be insulated from the immediate pressures of quarterly profits and production line efficiency. This protection can foster the development of highly innovative, specialized, and even eccentric designs that might never survive a purely market-driven development process, such as the VSS Vintorez suppressed sniper rifle or the APS underwater assault rifle.31 The core lesson is that shielding pure R&D from the relentless demands of immediate production can be a powerful catalyst for breakthrough technologies.

However, the recent absorption of TsNIITochMash by the Kalashnikov Concern demonstrates the fragility of this separation. This move creates a direct conflict of interest. The R&D agenda of the institute, historically tasked with developing niche capabilities for elite units, now risks being dictated by the commercial and production priorities of a mass-market entity. The pressure to develop incremental improvements for the AK platform—a new stock, a better rail system, a more effective muzzle brake—could easily overshadow and defund the high-risk, long-term research required to create the next generation of revolutionary weapon systems. For Western defense industries, this serves as a cautionary tale, highlighting the strategic importance of maintaining truly independent R&D organizations, whether government-run like DARPA or internal corporate “skunk works,” that are not solely beholden to the immediate needs of existing production lines.

3.3 Lesson 2: Strategic Consolidation as a Tool of State Power and Industrial Survival

The creation of Rostec was not a market event; it was a deliberate act of statecraft. It demonstrated the Russian government’s conviction that its defense industrial base is a core element of national sovereignty that cannot be left to the mercy of market forces.9 The consolidation of hundreds of failing enterprises under a single state-controlled umbrella was a tool to ensure the survival of critical skills, preserve production capabilities, and reassert state control over strategic assets. The lesson for global observers is that nations who view their OPK as an indispensable strategic asset will not hesitate to use state intervention, bailouts, and forced consolidation to protect it, even if doing so creates inefficient and uncompetitive monopolies.

This approach stands in stark contrast to the Western, particularly U.S., model, where the defense industry has consolidated primarily through market-based mergers and acquisitions. While this M&A activity is subject to government regulatory approval to prevent anti-competitive practices, the process is initiated and driven by the companies themselves, based on shareholder value and market logic.48 The critical implication is that the enterprises within the Russian OPK can be commanded by the state to operate at a financial loss indefinitely to achieve national security objectives. U.S. and European defense firms, by contrast, must remain profitable to answer to their shareholders and survive in the long run. This gives the Russian state a powerful, albeit economically inefficient, tool for sustaining industrial capacity during crises.

3.4 Lesson 3: The Durability of Design Philosophy and the Challenge of Modernization

Russian small arms design is dominated by a deeply ingrained philosophy that prioritizes extreme reliability in harsh conditions, simplicity of operation and maintenance, and ease of mass production. This “Kalashnikov philosophy” is not an accident but a direct product of the Soviet experience in World War II, a conflict that demanded millions of simple, durable weapons for a mass-mobilized conscript army.47 This design ethos allows the Russian OPK to achieve incredible production surges of “good enough” weapons, a significant advantage in a protracted war of attrition where sheer numbers can overwhelm technological superiority.

This very strength, however, has become a critical weakness in the face of modern technological warfare. The OPK has consistently struggled to indigenously develop and integrate advanced technologies such as high-quality microelectronics, advanced optics, and modern composite materials.15 For decades, it compensated for this by importing these critical components from the West and Asia. The imposition of stringent international sanctions has severed this “silicon lifeline,” exposing the deep vulnerability at the heart of Russia’s modernization efforts.17 This has led to a state of “innovation stagnation,” where Russian industry is forced to produce simplified, less capable versions of its weapon systems, or even fall back on reactivating Soviet-era legacy equipment. The lesson is that a nation’s dominant design philosophy must be holistically supported by its indigenous technological and industrial base. When a disconnect emerges—when a country designs weapons that require components it cannot produce—it creates a critical vulnerability that a determined adversary can exploit.

3.5 Lesson 4: The Geopolitical Trade-off: Quantitative Surge vs. Qualitative Stagnation

The ultimate lesson from analyzing the modern Russian OPK is the stark strategic trade-off it embodies. The state-controlled model provides the Kremlin with a formidable tool: the ability to rapidly and massively increase the quantity of military hardware by directing the entirety of its industrial base towards the war effort, unconstrained by market logic or profitability.7 Reports indicate that Russia is now out-producing the combined output of the U.S. and Europe in key areas like artillery shells by a factor of nearly three to one.7

This quantitative surge, however, is being purchased at the steep price of qualitative decline and future capability. By isolating itself from global technology supply chains and prioritizing sheer volume over sophistication, the OPK is falling further behind the technological frontier.16 The industry is producing more weapons, but these are often technologically simpler and less effective than their predecessors. It is reactivating 60-year-old T-62 and even 70-year-old T-55 tanks, not churning out advanced T-90M or next-generation T-14 Armata platforms. The key lesson for Western analysts and policymakers is that measuring the strength of a defense industrial base requires looking beyond raw production numbers. A holistic assessment must also weigh the technological sophistication of the output and the long-term capacity for innovation. The Russian OPK is a live-fire demonstration that it is possible for a nation to win the production battle in the short term while simultaneously losing the technology race in the long term. This is a dangerous and unstable dynamic with profound implications for the future of warfare and the global balance of military power.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Современное состояние оборонно-промышленного комплекса …, accessed August 20, 2025, https://cyberleninka.ru/article/n/sovremennoe-sostoyanie-oboronno-promyshlennogo-kompleksa-rossii

- Soviet Union Study_4 – Marines.mil, accessed August 20, 2025, https://www.marines.mil/Portals/1/Publications/Soviet%20Union%20Study_4.pdf

- Soviet-type economic planning – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Soviet-type_economic_planning

- Phoenix from the ashes? : Russia’s defence industrial complex and its arms exports, accessed August 20, 2025, https://openresearch-repository.anu.edu.au/items/3bdd00c0-8d25-40f1-81a1-421bebf1743d

- Military-Industrial Complex and Sanctions Impact – Riddle Russia, accessed August 20, 2025, https://ridl.io/military-industrial-complex-and-sanctions-impact/

- OPK Lost: Ukraine’s Defence Industrial Base In The 21st Century – Casimir Pulaski Foundation – Fundacja im. Kazimierza Pułaskiego, accessed August 20, 2025, https://pulaski.pl/en/pulaski-policy-paper-r-johnson-opk-lost-ukraines-defence-industrial-base-in-the-21st-century-2/

- Arms industry of Russia – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Arms_industry_of_Russia

- Rostec – RUDN University, accessed August 20, 2025, https://eng.rudn.ru/cooperation/employment-partnerships/partners/rostec/

- Rostec – About – History, accessed August 20, 2025, https://rostec.ru/en/about/history/

- State Corporation for the Promotion of the Development, Manufacture and Export of High Technology Products “Rostec” – NGO Report, accessed August 20, 2025, https://ngoreport.org/sanctions-database/state-corporation-for-the-promotion-of-the-development-manufacture-and-export-of-high-technology-products-rostec/

- Rostec – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Rostec

- ROSTEC STATE CORPORATION – RS Trade, accessed August 20, 2025, https://www.rstradehouse.com/pr_img/1002410047/20181108/74752642/Rostec_presentation.pdf

- Ростех | Лучшие традиции отечественной инженерной мысли и инновации в производстве. 2025 | ВКонтакте, accessed August 20, 2025, https://vk.com/rostec_ru

- Rostec – Key Industries – Weapons, accessed August 20, 2025, https://rostec.ru/en/directions/weapons/

- Russia’s struggle to modernize its military industry | The impact of sanctions and war, and how the OPK is adapting – Chatham House, accessed August 20, 2025, https://www.chathamhouse.org/2025/07/russias-struggle-modernize-its-military-industry/impact-sanctions-and-war-and-how-opk

- Assessing Russian plans for military regeneration | 07 Russia’s military-industrial complex and military innovation – Chatham House, accessed August 20, 2025, https://www.chathamhouse.org/2024/07/assessing-russian-plans-military-regeneration/07-russias-military-industrial-complex-and

- Russia’s struggle to modernize its military industry – Chatham House, accessed August 20, 2025, https://www.chathamhouse.org/2025/07/russias-struggle-modernize-its-military-industry

- Kalashnikov Concern – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Kalashnikov_Concern

- Media – Press releases – Kalashnikov Concern to undergo rebranding using its own funds, accessed August 20, 2025, https://rostec.ru/en/media/pressrelease/4513365/

- The Kalashnikov: 200 Years of Russian Guns (Not Just AK-47s) – The National Interest, accessed August 20, 2025, https://nationalinterest.org/blog/buzz/kalashnikov-200-years-russian-guns-not-just-ak-47s-164596

- Kalashnikov Concern: History Behind the AK Brand, accessed August 20, 2025, https://www.pewpewtactical.com/kalashnikov-history/

- Izhevsk Mechanical Plant – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Izhevsk_Mechanical_Plant

- Группа компаний «Калашников», accessed August 20, 2025, https://kalashnikovgroup.ru

- Kalashnikov Group, accessed August 20, 2025, https://en.kalashnikovgroup.ru/

- Rostec – Media – Press releases – Kalashnikov Concern Presents a New Brand, accessed August 20, 2025, https://rostec.ru/en/media/pressrelease/4515144/

- Joint Stock Company Concern Kalashnikov – OpenSanctions, accessed August 20, 2025, https://www.opensanctions.org/entities/NK-nR5AXM9AVPq4pQaSPSaVam/

- Акционерное общество «Центральный научно …, accessed August 20, 2025, http://cniitm.ru

- АО “ЦНИИТОЧМАШ” | АО «ЦНИИточмаш» — Центральный научно-исследовательский институт точного машиностроения,.. 2025 | ВКонтакте, accessed August 20, 2025, https://vk.com/official_cniitm

- TsNIITochMash: 80 Years of Weaponmaking Art – Kalashnikov Group, accessed August 20, 2025, https://en.kalashnikovgroup.ru/news/tsniitochmash-80-years-of-weaponmaking-art

- TsNIITochMash – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/TsNIITochMash

- Russian Commandos Carry Suppressed Rifles That Can Shoot Through Body Armor | by War Is Boring – Medium, accessed August 20, 2025, https://medium.com/war-is-boring/russian-commandos-carry-suppressed-rifles-that-can-shoot-through-body-armor-15220633e421

- KBP Instrument Design Bureau – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/KBP_Instrument_Design_Bureau

- en.wikipedia.org, accessed August 20, 2025, https://en.wikipedia.org/wiki/KBP_Instrument_Design_Bureau#:~:text=5%20External%20links-,History,Central%20design%20bureau%20No%2014).

- Tula Arms Plant – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/Tula_Arms_Plant

- JOINT-STOCK COMPANY “DESIGN BUREAU OF INSTRUMENT MAKING NAMED AFTER ACADEMICIAN A. G. SHIPUNOV”, accessed August 20, 2025, https://war-sanctions.gur.gov.ua/en/rostec/1921

- High Precision Systems – Wikipedia, accessed August 20, 2025, https://en.wikipedia.org/wiki/High_Precision_Systems

- Russia and China’s Military Production Surge: Why the U.S. Military Is Alarmed, accessed August 20, 2025, https://www.aei.org/op-eds/russia-and-chinas-military-production-surge-why-the-u-s-military-is-alarmed/

- Small Arms Market Competitive Analysis: 2023-2028 – Stratview Research, accessed August 20, 2025, https://www.stratviewresearch.com/2962/small-arms-market.html

- Small Arms Market – Industry Research & Share | 2025 – 2030 – Mordor Intelligence, accessed August 20, 2025, https://www.mordorintelligence.com/industry-reports/small-arms-market

- North America Small Arms Market Size & Share Analysis – Industry Research Report, accessed August 20, 2025, https://www.mordorintelligence.com/industry-reports/north-america-small-arms-market

- Competition – ASD(A) – DPC – Contract Policy, accessed August 20, 2025, https://www.acq.osd.mil/asda/dpc/cp/policy/competition.html

- Part 6 – Competition Requirements | Acquisition.GOV, accessed August 20, 2025, https://www.acquisition.gov/far/part-6

- Guidelines For Creating and Maintaining a Competitive Environment for Supplies and Services in the Department of Defense Decembe, accessed August 20, 2025, https://www.acq.osd.mil/asda/dpc/cp/policy/docs/comp/BBP_2-0_Comp_Guidelines_Update_(3_Dec_2014).pdf

- Guide to working with DoD – DoD Office of Small Business Programs, accessed August 20, 2025, https://business.defense.gov/Work-with-us/Guide-to-working-with-DoD/

- North America Small Arms Market Size, Share, Trends & Forecast, accessed August 20, 2025, https://www.verifiedmarketresearch.com/product/north-america-small-arms-market/

- Small Arms Market Demand, Size, Share, Growth, industry, Outlook, accessed August 20, 2025, https://www.marketresearchfuture.com/reports/small-arms-market-7202

- In what areas was the Soviet Union more advanced than the West throughout the Cold War? – Reddit, accessed August 20, 2025, https://www.reddit.com/r/WarCollege/comments/ch2wm3/in_what_areas_was_the_soviet_union_more_advanced/

- Promoting Defense Industry Competition for National Security’s—Not Competition’s—Sake, accessed August 20, 2025, https://www.heritage.org/defense/report/promoting-defense-industry-competition-national-securitys-not-competitions-sake