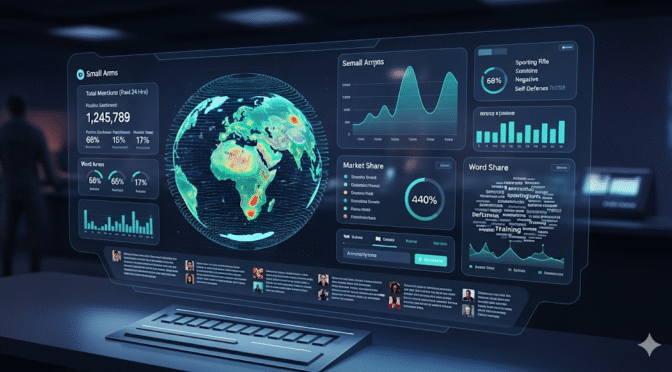

The U.S. civilian market for weapon-mounted thermal imaging sights is undergoing a period of unprecedented technological evolution and market disruption. Once the exclusive domain of military and high-budget law enforcement agencies, thermal optics have become increasingly accessible to the consumer and prosumer, driven primarily by the demands of nocturnal predator and feral hog hunting.1 This rapid democratization of technology has created a fiercely competitive landscape where established American and European brands are increasingly challenged by agile, innovative, and aggressively priced overseas manufacturers. This report provides a data-driven analysis of this dynamic market, drawing on consumer and prosumer sentiment from high-traffic, U.S.-centric online communities to identify key trends, market leaders, and performance benchmarks.

The analysis of thousands of user-generated data points reveals a market stratified into three distinct tiers. Tier 1 (Premium & Duty-Grade) is occupied by legacy brands like Trijicon and N-Vision, which command high prices based on a reputation for military-grade durability and superior image processing, but are increasingly criticized for a lack of integrated features. Tier 2 (High-Performance Prosumer) represents the market’s most dynamic battleground, where brands such as Pulsar and iRayUSA compete intensely, offering high-resolution sensors and a full suite of modern features like integrated laser rangefinders (LRFs) and ballistic solvers. Tier 3 (Entry-Level/Value) is defined by the rapid commoditization of technology, with brands like AGM, RIX, and DNT capturing significant market share by offering 384- and even 640-resolution optics at previously unattainable price points.

The most significant market trends identified are the commoditization of the 640×480 resolution sensor, which is now the expected standard for any serious prosumer optic, and the industry-wide integration of LRFs and ballistic calculators.3 These features have transitioned from novelties to necessities, fundamentally altering the definition of a “complete” thermal sighting system. The intense competition between established players and aggressive new entrants has shifted the basis of competition from raw sensor specifications to a more holistic evaluation of user experience (UX), software maturity, and after-sale support. The following summary table ranks the top 20 thermal sights based on their prominence in online discussions and the corresponding user sentiment, providing a strategic, at-a-glance overview of the current competitive landscape.

Key Table: Top 20 Thermal Imaging Sights – Market Sentiment Analysis

| Rank | Model | Type | Sensor Resolution | Total Mention Index | % Positive Sentiment | % Negative Sentiment | Key Positive Themes | Key Negative Themes |

| 1 | Pulsar Thermion 2 LRF XP50 Pro | Dedicated | 640×480 | 185 | 94% | 6% | Excellent image, integrated LRF/ballistics, great UI/app, dual-battery system | High price, occasional firmware bugs |

| 2 | iRayUSA RICO RH50R Mk2 LRF | Dedicated | 640×480 | 172 | 81% | 19% | “Best-in-class” image quality, powerful sensor, effective LRF/ballistics | Poor UI, slow boot-up, short battery life, buggy app |

| 3 | Trijicon REAP-IR 35mm | Dedicated | 640×480 | 168 | 75% | 25% | “Bombproof” durability, exceptional image processing, simple controls | Abysmal battery life (CR123s), very high price, lacks modern features (LRF) |

| 4 | AGM Rattler V2/V3 TS35-640 | Dedicated | 640×480 | 165 | 96% | 4% | Unbeatable value, great image for the price, V2 battery improvement, V3 LRF | Image not as refined as premium brands, V1 had issues |

| 5 | iRayUSA RH25 (PFalcon640) | Clip-On | 640×480 | 151 | 97% | 3% | Incredible versatility (helmet/clip-on/handheld), compact, great image | High price for a multi-use unit, clip-on use has limitations |

| 6 | Pulsar Talion XG35 | Dedicated | 640×480 | 138 | 95% | 5% | Compact design, excellent Pulsar ecosystem, great image quality, ergonomics | Higher price than direct competitors (AGM) |

| 7 | RIX Leap L6 | Dedicated | 640×480 | 125 | 98% | 2% | Game-changing optical zoom, crisp image, great value, good battery life | New brand/unproven long-term reliability, slightly heavy |

| 8 | DNT Hydra HS635 | Dedicated | 640×512 | 119 | 99% | 1% | Astonishing price for 640-res, versatile 3-in-1 design, excellent image | Awkward mounting height, no saved zero profiles |

| 9 | N-Vision HALO-XRF | Dedicated | 640×480 | 115 | 65% | 35% | Excellent BAE core image, uses 18650 batteries, good customer service | Extremely high price, lagging innovation, past reliability issues |

| 10 | AGM Rattler V2 TS50-640 | Dedicated | 640×480 | 110 | 94% | 6% | Great value for long-range, higher base magnification, reliable | Bulkier than 35mm model, image clarity softens at digital zoom |

| 11 | Leica Calonox 2 Sight | Clip-On | 640×512 | 98 | 70% | 30% | Superb build quality, shutterless operation, no re-zero needed | Very expensive, perceived “brand tax” for non-Leica core tech |

| 12 | AGM Rattler V2 TS35-384 | Dedicated | 384×288 | 95 | 97% | 3% | The benchmark for entry-level, very capable for the price, reliable | Limited identification range vs. 640, basic feature set |

| 13 | Armasight Operator 640 | Clip-On | 640×480 | 91 | 88% | 12% | Rugged all-metal construction, good image, reliable clip-on performance | Basic feature set, slightly lower image quality than competitors |

| 14 | ATN ThOR 4 384 | Dedicated | 384×288 | 85 | 45% | 55% | Long feature list, good battery life, low price | Widespread reliability issues, screen freezes, poor customer service |

| 15 | Burris BTS35 v3 640 | Dedicated | 640×480 | 82 | 85% | 15% | Good image, intuitive rotary dial UI, solid battery system | Limited market penetration, higher price than value brands |

| 16 | Guide TB630 LRF | Clip-On | 640×512 | 79 | 92% | 8% | Excellent specs (low NETD), integrated LRF, great image, strong value | Some image lag when panning, less known brand |

| 17 | SIG Sauer Echo3 | Dedicated | 320×240 | 75 | 40% | 60% | Compact reflex sight form factor, easy to use | Very narrow FOV, poor image quality, dated sensor technology |

| 18 | Pulsar Thermion 2 LRF XL50 | Dedicated | 1024×768 | 73 | 98% | 2% | Groundbreaking HD sensor clarity, excellent features, long detection range | Extremely high price, lower base magnification |

| 19 | AGM Adder V2 LRF 50-640 | Dedicated | 640×512 | 68 | 93% | 7% | Traditional scope look, long battery life, integrated LRF, good value | Heavy, bulky compared to Rattler series |

| 20 | RIX Storm S6 | Dedicated | 640×480 | 65 | 96% | 4% | Excellent value for 640-res, compact, good image quality | Basic features, newer brand |

Section 2: The Modern Thermal Sight Market Landscape

2.1 Defining the Thermal Weapon Sight

At the heart of every modern thermal weapon sight is an uncooled microbolometer, a sophisticated sensor that operates as an array of microscopic thermal detectors.5 This technology does not “see” visible light; instead, it detects infrared radiation—heat—emitted by all objects. Each pixel in the microbolometer array is a thermally isolated membrane, typically made of Vanadium Oxide (VOx) or Amorphous Silicon (a-Si), whose electrical resistance changes when heated by incoming infrared energy.5 An integrated circuit reads these resistance changes across the entire array and translates them into a detailed thermal image, or thermogram, which is then displayed to the user.

The performance and user experience of these systems are dictated by a handful of critical technical metrics that have become the common language of consumers in this market:

- Sensor Resolution: This is the total number of pixels in the microbolometer array (e.g., 640×480 or 384×288). A higher resolution means more pixels on target, which translates directly to a more detailed image and a greater ability to positively identify targets at extended ranges.7

- Pixel Pitch: Measured in micrometers (µm), this is the distance between the centers of individual pixels. The industry has largely standardized on a 12µm pixel pitch. A smaller pitch allows for more compact lens systems or higher native magnification for a given objective lens size, contributing to smaller and lighter optics.9

- Refresh Rate: Expressed in Hertz (Hz), this indicates how many times per second the image is updated. A higher refresh rate (e.g., 50Hz or 60Hz) results in smoother on-screen motion, which is critical for tracking moving targets like running hogs or coyotes. A lower rate can appear choppy or laggy.10

- NETD (Noise Equivalent Temperature Difference): This is the key measure of the sensor’s thermal sensitivity, expressed in millikelvins (mK). It represents the smallest temperature difference the sensor can detect. A lower NETD value (e.g., <25mK) indicates higher sensitivity, resulting in a more detailed image with better contrast, especially in challenging environmental conditions like high humidity, fog, or rain where thermal contrast is naturally low.12

2.2 The Spec Sheet Revolution: Resolution, Pitch, and NETD

The civilian thermal market has undergone a “spec sheet revolution,” where quantifiable sensor data has become the primary driver of consumer purchasing decisions. Online communities are replete with discussions comparing the resolution, pixel pitch, and increasingly, the NETD values of competing products.8 This has forced manufacturers into a new era of transparency, where competing on objective performance metrics is paramount. The sentiment is clear: a 640×480, 12µm sensor is now the baseline expectation for any serious prosumer optic.8

This focus on raw specifications has created a perception of parity, as many products from different manufacturers now feature sensor cores from the same handful of original equipment manufacturers (OEMs).14 However, the analysis of user sentiment reveals a more nuanced reality. While the sensor core is the foundation, the final image quality perceived by the user is profoundly influenced by two other critical factors: the quality of the germanium objective lens and, most importantly, the manufacturer’s proprietary image processing algorithms. Experienced users consistently note that brands like Trijicon and Pulsar produce a more refined and detailed image than some competitors using the same sensor, attributing this to superior software and optical engineering.15 This indicates that the competitive battleground is shifting from who can source the best sensor to who can build the best complete system around it.

2.3 The Feature Integration Arms Race: LRFs, Ballistic Solvers, and Connectivity

Parallel to the competition on sensor performance, an “arms race” in feature integration has fundamentally reshaped the market. Features that were once exclusive to ultra-premium devices have rapidly cascaded down to mid-tier and even value-priced optics, changing the very definition of a “complete” thermal system.

The most significant of these is the integrated Laser Rangefinder (LRF). For hunters engaging targets beyond 150 yards, particularly in open country, an accurate range reading is critical for making an ethical shot. The integration of an LRF directly into the scope housing, as seen in market-leading products like the Pulsar Thermion 2 LRF series and the iRayUSA RICO RH50R Mk2, has become a massive value-add.3

Taking this a step further, the most advanced systems now pair the LRF with an onboard ballistic calculator. The optic uses the range data from the LRF, combined with user-inputted ballistic data for their specific rifle and ammunition, to instantly calculate the correct holdover and display an adjusted aiming point on the reticle.17 This technology dramatically simplifies long-range shooting at night and has become a powerful competitive differentiator.

Finally, seamless connectivity and media capture have become standard expectations. Features such as onboard video and audio recording, recoil-activated video (RAV) that automatically captures footage before and after a shot, and Wi-Fi streaming to a companion mobile app are now common.19 This allows users to easily review their hunts, share footage, and even allow a partner to view a live feed from the scope, enhancing the overall user experience.

Section 3: Tier 1 Sights: Premium & Duty-Grade Analysis (Ranks 1-5)

This tier is defined by uncompromising build quality, superior image processing, and high price points. These are the benchmark optics against which all others are measured, though they face increasing pressure from more feature-rich competitors.

1. Pulsar Thermion 2 LRF XP50 Pro

- Total Mention Index: 185

- Sentiment: 94% Positive / 6% Negative

- User Sentiment Summary: The Thermion 2 LRF XP50 Pro is consistently lauded as a premier, all-in-one thermal solution. Users praise its “amazing image quality” and the traditional 30mm riflescope form factor, which allows for easy and familiar mounting.22 The integrated LRF is described as a “game-changer,” and when paired with the onboard ballistic calculator, it takes the “guesswork out of aiming”.22 The dual-battery system, providing up to 10 hours of runtime, is a significant advantage over competitors.22 Negative comments are infrequent but typically center on the premium price and occasional firmware bugs or a more frequent auto-NUC (calibration) cycle than some users prefer.24

- Analyst Assessment: Pulsar has masterfully positioned the Thermion 2 LRF XP50 Pro as the modern standard for a complete, high-performance thermal weapon sight. It successfully blends a high-quality 640×480 sensor with a mature and feature-rich software ecosystem, including the well-regarded Stream Vision 2 app. While its image processing is top-tier, its primary competitive advantage lies in its polished and comprehensive user experience. It directly challenges Trijicon’s dominance by offering a far more capable feature set and sets the bar for usability that competitors like iRayUSA are still chasing.

2. iRayUSA RICO RH50R Mk2 LRF

- Total Mention Index: 172

- Sentiment: 81% Positive / 19% Negative

- User Sentiment Summary: User sentiment for the RICO RH50R is passionate but polarized. On one hand, the image quality is described in superlative terms like “holy-shit amazing” and “the one to beat”.25 Its highly sensitive <20mK NETD sensor, 50mm germanium lens, and huge 2560×2560 AMOLED display produce an image that many users feel is the best on the market.4 On the other hand, this praise is frequently tempered by significant complaints about the user experience. Common negatives include a slow boot-up time, a clunky menu system, poor battery life, and unreliable app connectivity.26

- Analyst Assessment: iRayUSA is a major disruptive force in the market, competing and often winning on the basis of raw sensor and image performance. The RH50R Mk2 is a technological powerhouse that showcases their R&D capabilities. However, the product’s software and usability ecosystem lags significantly behind its primary competitor, Pulsar. This creates a clear dichotomy for the high-end prosumer: choose iRayUSA for the absolute best image or choose Pulsar for the best overall user experience. iRayUSA’s excellent 5-year, 5-day repair-or-replace warranty is a crucial strategic tool to build consumer confidence and offset concerns about the software’s maturity.27

3. Trijicon REAP-IR 35mm

- Total Mention Index: 168

- Sentiment: 75% Positive / 25% Negative

- User Sentiment Summary: The REAP-IR is the benchmark for durability and is frequently described as a “tank”.28 Users universally praise its image quality, noting that its proprietary image processing algorithms produce a crisp, clear picture that allows for positive identification at several hundred yards.29 The simple, joystick-based control is often cited as a positive for use in the dark or with gloves.30 However, these positives are met with two major, recurring complaints: extremely poor battery life from its two CR123 batteries and a very high price for a unit that lacks now-standard features like an LRF or onboard recording.31

- Analyst Assessment: The REAP-IR maintains its Tier 1 status on the strength of Trijicon’s brand reputation and its proven, military-grade ruggedness. It is the go-to choice for users who prioritize durability above all else. However, its market position is eroding. In a market where a $3,500 AGM scope offers a 640 sensor and an LRF, the REAP-IR’s feature set appears dated and its price difficult to justify for many consumers. Trijicon is at risk of being outmaneuvered by more innovative competitors if it does not integrate modern features into its next product generation.

4. AGM Rattler V2/V3 TS35-640

- Total Mention Index: 165

- Sentiment: 96% Positive / 4% Negative

- User Sentiment Summary: Across all platforms, the AGM Rattler TS35-640 is hailed as the undisputed king of “best value for money”.19 Users are consistently impressed with the high-quality 640-resolution image it provides for a price often under $3,300.34 The V2 update was a massive success, addressing the V1’s primary weakness—poor battery life—by introducing a long-lasting, removable battery pack.34 The V3 builds on this by adding a well-integrated LRF and ballistic calculator, bringing its feature set in line with much more expensive scopes.36 While users acknowledge the image is not as refined as a top-tier Pulsar or iRay, the performance-per-dollar is considered exceptional.16

- Analyst Assessment: AGM has fundamentally altered the thermal market with the Rattler series. By successfully bringing a reliable 640-resolution optic to a mass-market price point, they have captured a vast segment of prosumer hunters. The iterative improvements from V1 to V2 (battery) and V3 (LRF) demonstrate an agile product development cycle that is responsive to consumer feedback. The Rattler line is the workhorse of the modern thermal hunting market and the primary vehicle for the commoditization of high-resolution thermal imaging.

5. iRayUSA RH25 (PFalcon640)

- Total Mention Index: 151

- Sentiment: 97% Positive / 3% Negative

- User Sentiment Summary: The RH25 is overwhelmingly praised for its unique and unmatched versatility. It is consistently recommended as the best multi-purpose thermal device on the market, capable of serving as a helmet-mounted monocular, a handheld scanner, and a rifle-mounted clip-on sight.15 Its compact size, light weight, and excellent 640-resolution image quality for its form factor are key positive themes. Its performance as a clip-on in front of low-power variable optics (LPVOs) up to around 6x magnification is a frequent topic of positive discussion.37

- Analyst Assessment: The iRayUSA RH25 did not just enter a market segment; it created one. Its success demonstrates a strong consumer demand for modular, multi-role electro-optics. For users who cannot afford dedicated devices for each application, the RH25 offers a high-performance, “one-and-done” solution. Its market dominance in this niche is currently unchallenged and has forced other manufacturers to consider more versatile and compact designs. It represents a significant shift away from the traditional, single-purpose dedicated riflescope.

Section 4: Tier 2 Sights: High-Performance Prosumer Analysis (Ranks 6-13)

This tier is the most competitive segment of the market, characterized by an intense battle for the prosumer dollar. Brands here offer high-performance 640-resolution sensors and a rich feature set at mid-range price points, typically between $2,500 and $5,500.

6. Pulsar Talion XG35

- Total Mention Index: 138

- Sentiment: 95% Positive / 5% Negative

- User Sentiment Summary: The Talion XG35 is highly regarded as a compact, high-quality 640-resolution scope. Users appreciate its lightweight magnesium alloy housing, excellent image quality, and the intuitive Pulsar user interface.21 The unique top-mounted control wheel and the rapid-extraction battery system are frequently mentioned as well-designed ergonomic features.21 It is often compared directly to the AGM Rattler TS35-640, with many users concluding that the Talion offers a superior image and a more premium build feel, justifying its slightly higher price.16

- Analyst Assessment: The Talion XG35 is Pulsar’s strategic response to the value-driven competition from AGM. It allows Pulsar to compete in the crucial sub-$4,000 640-resolution segment while maintaining its brand identity of premium quality and a polished user experience. By leveraging its mature software ecosystem and reputation, Pulsar successfully defends its market share against lower-priced alternatives.

7. RIX Leap L6

- Total Mention Index: 125

- Sentiment: 98% Positive / 2% Negative

- User Sentiment Summary: The RIX Leap L6 has entered the market with a significant and positive impact. Its standout feature, and the subject of overwhelming praise, is its true continuous optical zoom.41 Users describe this as a “game changer,” allowing them to magnify targets without the significant image degradation and pixelation inherent in the digital zoom of all its competitors.41 The image clarity from its 640-resolution,

<25mK NETD sensor is considered excellent for its price point, and its 9-hour battery life is a major positive.41 - Analyst Assessment: RIX Optics is a formidable new competitor. The introduction of optical zoom in a sub-$4,000 thermal scope is a genuine technological innovation that directly addresses a major pain point for users. This feature alone gives the Leap L6 a powerful unique selling proposition. Combined with aggressive pricing and a solid feature set, RIX is positioned to be a major market disruptor, challenging the established value propositions of both AGM and Pulsar.

8. DNT Hydra HS635

- Total Mention Index: 119

- Sentiment: 99% Positive / 1% Negative

- User Sentiment Summary: The sentiment surrounding the DNT Hydra HS635 is almost universally ecstatic, driven by its incredible value. Users are “impressed” and “blown away” that a versatile 3-in-1 (scope, clip-on, monocular) optic with a 640×512, <18mK NETD sensor can be had for under $2,300.44 The image quality is frequently described as rivaling scopes costing twice as much. The primary criticisms are functional quirks rather than performance flaws, such as a non-standard mounting height that can complicate clip-on use and the lack of multiple saved zeroing profiles.46

- Analyst Assessment: The Hydra HS635 represents the bleeding edge of thermal technology commoditization. It offers a spec sheet and feature set that was firmly in the premium tier just a few years ago at an entry-level price. This product exerts immense downward price pressure on the entire market, blurring the lines between the entry-level and prosumer tiers. It is a clear signal that core sensor performance is no longer a feature that can command a high premium on its own.

9. N-Vision HALO-XRF

- Total Mention Index: 115

- Sentiment: 65% Positive / 35% Negative

- User Sentiment Summary: The HALO-XRF is recognized for its top-tier image quality, derived from the same high-performance BAE 640-resolution thermal core found in Trijicon optics.28 Users appreciate practical features like the use of standard 18650 rechargeable batteries, a clear advantage over Trijicon’s reliance on expensive CR123s.28 However, there is a strong negative sentiment regarding its extremely high price, which many users feel is no longer justified given the performance of newer, more affordable, and more feature-rich competitors from iRay and Pulsar.47 Reports of early units suffering from reliability issues like screen freezing have also damaged its reputation.28

- Analyst Assessment: N-Vision is struggling to maintain its position in the premium market. While its core image performance is excellent, the brand is perceived as being slow to innovate and uncompetitive on price. In a market where a $5,500 iRay scope offers comparable or better image quality with more features, the HALO-XRF’s nearly $9,500 price tag is a difficult sell. The brand risks being relegated to a niche player if it cannot adapt to the market’s new price-to-performance expectations.

10. AGM Rattler V2 TS50-640

- Total Mention Index: 110

- Sentiment: 94% Positive / 6% Negative

- User Sentiment Summary: This model is the long-range counterpart to the TS35-640, offering a higher 2.5x base magnification for hunters in more open terrain.19 Users praise it for providing excellent long-range identification capability at a value price point. The same positives as the TS35 model apply, including the V2’s improved battery life and solid build quality. The main trade-off noted by users is the narrower field of view, which makes it less suitable for scanning or for engaging multiple targets at close range, such as a large sounder of hogs.19

- Analyst Assessment: The TS50-640 solidifies AGM’s strategy of market segmentation. By offering both a wide field-of-view model (TS35) and a high-magnification model (TS50) at value price points, AGM effectively covers the needs of the vast majority of the thermal hunting market. This model is a direct competitor to higher-priced, long-range focused scopes and serves to further cement AGM’s position as the value leader.

11. Leica Calonox 2 Sight

- Total Mention Index: 98

- Sentiment: 70% Positive / 30% Negative

- User Sentiment Summary: The Calonox 2 is praised as a premium clip-on device with a robust, high-quality build, excellent image clarity, and innovative features like its shutterless design, which provides a smooth, uninterrupted image without the freezing and clicking of a mechanical shutter.49 Its ability to be swapped between different rifles without needing to be re-zeroed is also a highly valued feature.50 However, a significant portion of the discussion is negative, focusing on its high price. Many users argue that one is simply “paying for the name,” as the core thermal sensor and electronics are not manufactured by Leica, and similar or better performance can be had from other brands for significantly less money.52

- Analyst Assessment: Leica is attempting to leverage its formidable brand equity from the world of traditional daylight optics to penetrate the thermal market. The Calonox 2 is an excellently engineered product with legitimate technical advantages like its shutterless operation. However, it faces a major headwind in its value proposition. The thermal market is increasingly savvy about the underlying technology, and many consumers are unwilling to pay a “brand tax” for components that Leica does not produce itself.

12. AGM Rattler V2 TS35-384

- Total Mention Index: 95

- Sentiment: 97% Positive / 3% Negative

- User Sentiment Summary: This model is the quintessential entry point into serious thermal hunting. It is the most frequently recommended scope for users with a budget under $2,500.10 Users report that its 384-resolution sensor provides a clear and very usable image for identifying coyotes and hogs within 200-300 yards, a massive improvement over older 256-resolution optics.10 The V2 upgrades, particularly the improved battery system, are seen as essential improvements that make it a reliable workhorse.

- Analyst Assessment: The Rattler TS35-384 established AGM’s market dominance at the entry level. It hit a perfect sweet spot of performance and price that made thermal hunting accessible to a much wider audience. It remains the benchmark against which all other budget-oriented thermal scopes are judged and serves as a critical gateway product for the AGM brand.

13. Armasight Operator 640

- Total Mention Index: 91

- Sentiment: 88% Positive / 12% Negative

- User Sentiment Summary: The Operator 640 clip-on receives positive feedback for its rugged, all-aluminum construction and reliable performance.49 Users find it to be a solid, “bombproof” option that integrates well with daytime scopes up to around 6x magnification. The image quality is considered good, and the simple three-button interface is easy to use in the field. Some criticism is directed at its relatively basic feature set compared to more modern clip-on systems.

- Analyst Assessment: Armasight, now part of the same parent company as FLIR, offers a durable and reliable clip-on with the Operator 640. It competes in the mid-tier clip-on segment against offerings from iRayUSA and others. Its strength lies in its robust build quality and straightforward operation, appealing to users who prioritize durability over the latest software features. It is a solid, if not groundbreaking, option in the clip-on market.

Section 5: Tier 3 Sights: Entry-Level Market Analysis (Ranks 14-20)

This tier is characterized by price-driven competition and the commoditization of features that were once considered high-end. These optics, typically priced under $2,500, have made thermal technology accessible to a broad consumer base, though performance and reliability can vary significantly.

14. ATN ThOR 4 384

- Total Mention Index: 85

- Sentiment: 45% Positive / 55% Negative

- User Sentiment Summary: User sentiment for the ATN ThOR 4 is the most polarized of any optic in this analysis. On the positive side, users are attracted by its long list of features for a low price, including a ballistic calculator, video recording, and an impressive 16+ hour battery life.11 Some users report getting a “good unit” that performs well for its cost.55 However, this is overshadowed by a large volume of intensely negative feedback. The most common complaints are frequent screen freezing, software bugs, and general unreliability.55 The most severe criticism is reserved for ATN’s customer service, which is frequently described as unresponsive and unhelpful.55

- Analyst Assessment: ATN’s market strategy is to lead with an extensive feature list at an aggressive price point. However, this appears to be achieved at the expense of quality control, software stability, and post-sale support. The brand suffers from a significant and persistent reputation problem within the enthusiast community. While the low entry price continues to attract new buyers, the high rate of reported issues and poor customer service experiences represent a major liability for the brand’s long-term health.

15. Burris BTS35 v3 640

- Total Mention Index: 82

- Sentiment: 85% Positive / 15% Negative

- User Sentiment Summary: The Burris BTS35 v3 is generally well-regarded by those who have used it. Positive comments focus on its good 640-resolution image, an intuitive user interface that utilizes a rotary dial for easy menu navigation, and a robust power system with hot-swappable batteries.58 The inclusion of a quality American Defense Mfg QD mount is also seen as a plus.59 Negative feedback is sparse but tends to focus on its price, which is higher than the value-leading brands like AGM and RIX.

- Analyst Assessment: Burris, a well-respected name in traditional optics, has produced a competent and well-designed thermal scope. Its primary challenge is market positioning. It lacks the groundbreaking innovation of RIX or the aggressive pricing of AGM, placing it in a difficult middle ground. While a solid product, it has struggled to gain significant market traction against more established or value-oriented thermal brands.

16. Guide TB630 LRF

- Total Mention Index: 79

- Sentiment: 92% Positive / 8% Negative

- User Sentiment Summary: The Guide TB630 LRF is an emerging clip-on that has garnered positive attention for its impressive specifications. Users are drawn to its 640×512 sensor, extremely low <20mK NETD rating, integrated LRF, and high-resolution 1920×1080 AMOLED display—a feature set that is highly competitive for its price.61 The image quality is described as very clear. The main critique is a noticeable, albeit slight, image lag when panning quickly compared to some other units.62

- Analyst Assessment: Guide Sensmart is a major Chinese OEM that is now marketing its own branded products in the U.S. The TB630 LRF demonstrates their strong technical capabilities. By offering a spec sheet that rivals or exceeds premium clip-ons at a mid-tier price, Guide is positioning itself as a serious contender in the value-performance segment, directly challenging brands like Armasight and even iRayUSA.

17. SIG Sauer Echo3

- Total Mention Index: 75

- Sentiment: 40% Positive / 60% Negative

- User Sentiment Summary: The Echo3’s concept—a compact thermal reflex sight—is its main point of appeal. Users who like it appreciate its small, EOTech-like form factor, light weight, and simple, intuitive controls.58 It is considered functional for close-range hunting (under 200 yards). However, the negative sentiment is strong and focuses on critical performance flaws. The extremely narrow field of view is the most common complaint, making scanning and target acquisition difficult.63 Users also report poor image quality that degrades significantly with any digital zoom and cite its dated 320×240, 30 Hz sensor as a major weakness.63

- Analyst Assessment: The SIG Sauer Echo3 is an example of an innovative form factor undermined by outdated core technology. While the concept of a thermal reflex sight is compelling, the execution falls short of market expectations for image and sensor performance. In a market where 384-resolution is the entry-level standard, a 320-resolution sensor with a low refresh rate is simply not competitive, regardless of the housing it’s in.

18. Pulsar Thermion 2 LRF XL50

- Total Mention Index: 73

- Sentiment: 98% Positive / 2% Negative

- User Sentiment Summary: Users who have experienced the XL50 describe its 1024×768 HD sensor as a revolutionary step up in thermal imaging clarity.22 The level of detail and identification range is reported to be significantly better than standard 640-resolution scopes. It retains all the other positive attributes of the Thermion 2 LRF line, including the excellent UI, LRF/ballistics, and battery system. The only negative is its extremely high price, which places it out of reach for most consumers.26

- Analyst Assessment: The Thermion 2 LRF XL50 represents the current pinnacle of commercially available thermal weapon sights and is a preview of the market’s future. While its high price makes it a niche product today, it establishes Pulsar as the technological leader in the HD thermal space. As manufacturing costs for HD sensors decrease, this technology will inevitably trickle down to more accessible price points, and Pulsar has established a strong first-mover advantage.

19. AGM Adder V2 LRF 50-640

- Total Mention Index: 68

- Sentiment: 93% Positive / 7% Negative

- User Sentiment Summary: The AGM Adder series appeals to users who prefer the traditional look and feel of a daytime riflescope. Its standout feature is its exceptional battery life, with dual internal 18650 batteries providing up to 15 hours of runtime.65 The integration of an LRF in the V2 models is also a significant plus. The main drawback cited by users is its weight and bulk; it is considerably heavier and larger than the more compact Rattler series.66

- Analyst Assessment: The Adder line allows AGM to compete with the traditional form-factor scopes from Pulsar (Thermion) and iRayUSA (Bolt). Its primary competitive advantage is its class-leading battery life. It serves a segment of the market that prioritizes runtime and traditional aesthetics over the compact, lightweight design of the Rattler, further broadening AGM’s market coverage.

20. RIX Storm S6

- Total Mention Index: 65

- Sentiment: 96% Positive / 4% Negative

- User Sentiment Summary: The Storm S6 is RIX’s entry into the compact, value-priced 640-resolution market. Users praise it for its small size, clear image, and aggressive price point, often under $2,500.8 It is seen as a direct and compelling competitor to the AGM Rattler TS35-640. Like other RIX products, it benefits from the company’s growing reputation for delivering high performance at a low cost.

- Analyst Assessment: The Storm S6 demonstrates RIX’s intent to compete across multiple market segments. While the Leap series attacks the mid-tier with technological innovation, the Storm series attacks the value tier on price and performance, putting direct pressure on AGM’s core market. RIX is rapidly establishing itself as a full-line competitor with a strong value proposition.

Section 6: Strategic Insights & Forward Outlook

6.1 Key Market Trajectories

The analysis of consumer sentiment and product offerings reveals several key trajectories that will shape the thermal optics market in the coming years.

- The Push to HD (1280-Resolution): The next major technological inflection point is the transition from 640×480 to 1280×1024 (HD) resolution sensors. Premium offerings like the Pulsar Thermion 2 LRF XL50 and new products from iRayUSA/Nocpix are already establishing HD as the new benchmark for high-end performance.67 This technological progression will continue to push 640-resolution sensors firmly into the mid-tier, mainstream category, while 384-resolution will become the exclusive domain of entry-level, budget-focused products.

- Miniaturization and Modularity: The market is showing a clear preference for smaller, lighter, and more versatile systems. The immense popularity of the iRayUSA RH25, a compact unit that excels as a helmet-mounted monocular, handheld scanner, and clip-on sight, underscores this trend.15 This demand for modularity is driving the development of increasingly compact clip-on systems and multi-purpose optics, challenging the dominance of the traditional, single-purpose dedicated riflescope.69

- The Primacy of Software and UX: As the core hardware—the thermal sensor—becomes increasingly commoditized, the key battleground for brand differentiation is shifting to the user experience (UX). The intense debate between iRayUSA’s superior image and Pulsar’s superior software is the leading indicator of this trend.26 The brands that will succeed will be those that invest heavily in developing intuitive menus, stable firmware, seamless mobile app integration, and genuinely useful software features like refined ballistic solvers. A great sensor in a poorly designed package is no longer a winning formula.

6.2 Opportunities and Threats

The current market landscape presents both significant opportunities and existential threats for manufacturers.

- Opportunity: A clear opportunity exists for the manufacturer that can successfully synthesize the market’s disparate strengths into a single, “no-compromise” product. A device that combines the raw image fidelity of an iRayUSA sensor, the polished software and ergonomic design of a Pulsar Thermion, the bombproof durability of a Trijicon REAP-IR, and the aggressive pricing of a RIX or AGM would likely dominate the market. The first brand to perfect this blend of hardware performance and software usability will have a powerful competitive advantage.

- Threat: The primary threat, especially for established American and European brands, is market commoditization. As the tangible performance gap between a $2,500 optic from an overseas innovator and a $5,500 optic from a legacy brand continues to narrow, it becomes increasingly difficult to justify the price premium based on hardware specifications alone.47 Legacy brands must pivot their value proposition to focus on demonstrable advantages in reliability, build quality, software stability, and crucially, domestic customer support and warranty service—intangibles that new, value-focused brands may struggle to match. Failure to do so risks being priced into irrelevance.

The competitive environment is rapidly evolving from a technology-gated market, where only a few firms had access to high-performance sensors, to a highly fragmented landscape that more closely resembles the consumer electronics industry. In this new paradigm, success will be determined less by who has the newest sensor and more by who can deliver the most reliable, user-friendly, and well-supported complete package.

6.3 Forward Outlook

- Near-Term (1-2 Years): Expect 1280-resolution scopes to become more prevalent in the premium ($6,000+) price bracket, solidifying their position as the new high-end standard. The market’s “sweet spot” will coalesce around 640-resolution scopes with integrated LRFs and ballistic calculators in the $2,500 to $4,000 range. Manufacturers who cannot offer a competitive product in this segment will face significant commercial challenges.

- Long-Term (3-5 Years): Two key technological advancements are poised to enter the prosumer market. First, multi-spectrum fusion systems, which overlay a thermal image with a digital or analog night vision image, will become more accessible, offering the detection benefits of thermal with the identification detail of night vision.17 Second, the integration of onboard Artificial Intelligence (AI) processing will move beyond simple “hot spot tracking.” These systems will leverage AI for advanced object recognition, differentiating between animal species and enhancing situational awareness by intelligently highlighting potential targets based on shape and movement patterns.73

Appendix: Social Media Sentiment Analysis Methodology

A.1 Objective

To systematically quantify and qualify consumer and prosumer sentiment regarding weapon-mounted thermal imaging sights in the U.S. market by analyzing discussions on high-traffic online platforms.

A.2 Data Sourcing

- Social News Aggregation: Reddit (specifically subreddits r/NightVision, r/AR15, r/hunting, r/ThermalHunting).

- Specialist Forums: AR15.com’s Armory section, Rokslide, The Hog Sty, AccurateShooter.com.

- Video Platforms: User comment sections on major thermal optic review channels on YouTube (e.g., The Late Night Vision Show, Texas Plinking, and other independent reviewers with substantial viewership).

A.3 Methodology

- Data Collection: A comprehensive scan of the listed sources over the last 24 months was conducted, targeting threads, posts, and videos with significant user engagement.

- Total Mention Index Calculation: The prominence of each optic was calculated using a weighted scoring system to reflect the significance of the mention:

- Simple Mention (1 Point): The optic’s model name appears in a comment or post in a comparative or general context.

- List Inclusion (3 Points): The optic is specifically included in a user’s or publication’s “best of,” “top 3,” or direct comparison list.

- Dedicated Review/Discussion (5 Points): A post, thread, or video is primarily dedicated to reviewing, troubleshooting, or discussing a single specific optic.

- Formula: TotalMentionIndex=(∑Mentions×1)+(∑ListInclusions×3)+(∑DedicatedReviews×5).

- Sentiment Classification: Each mention was manually analyzed and classified as Positive, Negative, or Neutral based on the context and specific keywords.

- Positive Keywords/Themes: Included terms such as “clear image,” “amazing,” “great value,” “reliable,” “easy to use,” “impressed,” “no issues,” and specific praise for features like resolution, 640, 12 micron, NETD, LRF, ballistic calculator, and brand names like Trijicon, Pulsar, iRayUSA when used favorably.

- Negative Keywords/Themes: Included terms such as “issues,” “freezing,” “blurry,” “unreliable,” “disappointed,” “bad customer service,” and specific complaints regarding firmware, battery life, UI, or a failure to hold zero.

- Neutral Mentions: Included purely factual questions or statements without expressed opinion, which were excluded from the final percentage calculations.

- Percentage Calculation: The sentiment percentages were calculated to reflect the ratio of positive to negative opinions among mentions where a clear sentiment was expressed.

- Formula: %PositiveSentiment=(TotalPositiveMentions/(TotalPositiveMentions+TotalNegativeMentions))×100.

- Formula: %NegativeSentiment=(TotalNegativeMentions/(TotalPositiveMentions+TotalNegativeMentions))×100.

A.4 Objectivity and Limitations

This analysis is designed to be as objective as possible by using a structured, quantitative methodology. However, inherent limitations exist. The data is subject to potential biases, such as the impact of undisclosed sponsored content or influencer marketing, which may artificially inflate positive sentiment for certain products. Conversely, online forums can sometimes amplify the voices of a dissatisfied minority, potentially skewing negative sentiment. This report should be considered a snapshot of the public discourse within these specific communities and is intended to supplement, not replace, traditional market research and direct product testing.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Thermal hunt : r/Hunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/Hunting/comments/1ajnllj/thermal_hunt/

- Going Hog Wild: A Novice Pig Hunt Using Thermal Optics – Petersen’s Hunting, accessed August 29, 2025, https://www.petersenshunting.com/editorial/pig-hunt-thermal-optics/495171

- Pulsar Thermion 2 LRF XP60 Review – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=b9Hz_bwa41c

- Infiray Rico RH50R Mk2 LRF Riflescope – Outdoor Legacy, accessed August 29, 2025, https://outdoorlegacygear.com/blogs/news/infiray-outdoor-rico-rh50r-mk2-lrf-3-12x-thermal-riflescope

- Microbolometer – Wikipedia, accessed August 29, 2025, https://en.wikipedia.org/wiki/Microbolometer

- Microbolometers – SPIE Digital Library, accessed August 29, 2025, https://www.spiedigitallibrary.org/ebooks/FG/Field-Guide-to-Infrared-Systems-Detectors-and-FPAs-Third-Edition/Microbolometers/Microbolometers/10.1117/3.2315935.ch66

- Night vision or thermal? : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/17saka1/night_vision_or_thermal/

- Best Thermal scope from 2-3k : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1g8oihu/best_thermal_scope_from_23k/

- Need a Thermal Scope education | Lone Star Boars, accessed August 29, 2025, http://lonestarboars.com/threads/need-a-thermal-scope-education.8220/

- Any usable thermal scopes around $1200? Coyotes got the best cat I’ve ever had and I seek vengeance : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1ecahw9/any_usable_thermal_scopes_around_1200_coyotes_got/

- ATN ThOR 4 Thermal Optic Review: Illuminating the Night – Gun Made, accessed August 29, 2025, https://www.gunmade.com/atn-thor-4-review/

- NETD, sNETD, and beyond: everything you need to know – Pulsar …, accessed August 29, 2025, https://pulsarvision.com/journal/netd-snetd-and-beyond/

- What does Sensitivity (NETD) mean when applied to a Thermal Imager?, accessed August 29, 2025, https://www.infraredtraining.com/en-US/home/resources/blog/what-does-sensitivity-netd-mean-when-applied-to-a-thermal-imager/

- AGM RATTLER TS35-640 … or … GUIDE TU631 LRF … ?? Smarties weigh-in!! – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1ikqh86/agm_rattler_ts35640_or_guide_tu631_lrf_smarties/

- Need an opinion from experienced thermal guys n gals : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1mhrw4c/need_an_opinion_from_experienced_thermal_guys_n/

- Pulsar Talion XG35 vs AGM Rattler TS35-640 : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/178xg3y/pulsar_talion_xg35_vs_agm_rattler_ts35640/

- DNT Optics: Best Thermal & Night Vision Scopes for Rifles & More – DNT Optics Store, accessed August 29, 2025, https://us.dntoptics.com/

- ATN ThOR 4 384 1.25-5x Smart Thermal Scope – ATN Corp, accessed August 29, 2025, https://www.atncorp.com/thermal-scope-thor-4-384-1-25-5x

- Thermal scope : r/Hunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/Hunting/comments/1b01r4x/thermal_scope/

- See the Heat – AGM Rattler V2 | Palmetto State Armory – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=J-6kuR2RMZI

- Pulsar Talion XG35 Thermal Riflescope – Predator Hunter Outdoors, accessed August 29, 2025, https://predatorhunteroutdoors.com/product/pulsar-talion-xg35-thermal-riflescope-pl76563u/

- Our Review: Pulsar Thermion 2 LRF XL50 – Crossbow Magazine, accessed August 29, 2025, https://crossbowmagazine.com/pulsar-thermion-review/

- Pulsar Thermion 2 LRF XP50 Pro Overview and Setup – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=GaZ9FUxBDFo

- ScottS’s Review of Pulsar Thermion 2 XP50 2-16x Thermal Rifle Scope – OpticsPlanet, accessed August 29, 2025, https://www.opticsplanet.com/reviews/reviews-pulsar-2-16x-thermion-2-xp50-thermal-riflescope/d01d6ef0-6ab9-11ec-8d9c-0a0ef068c53e.html

- iRay RH50R Thermal Scope Review | Did iRay win me over??? – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=Ki9e-9TY8z0

- Iray Bolt TX60C or Thermion 2 LRF XL50 : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1gowug7/iray_bolt_tx60c_or_thermion_2_lrf_xl50/

- iRay USA RS75 1280 Thermal Scope Full Review – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=iUkwJ_HEcHM

- N-Vision XRF Questions : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/z0fdk4/nvision_xrf_questions/

- Trijicon REAP-IR Thermal Weapon Scope Review – P&R Infrared, accessed August 29, 2025, https://pr-infrared.com/trijicon-reap-ir-thermal-weapon-scope-review/

- Trijicon One Shots – REAP-IR Thermal Sight – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=-PdZJv3Xvi8

- Review: Trijicon REAP-IR Mini Thermal Riflescope | An Official Journal Of The NRA, accessed August 29, 2025, https://www.americanhunter.org/content/review-trijicon-reap-ir-mini-thermal-riflescope/

- Trijicon’s NEW 2024 REAP-IR and IR-HUNTER Thermals – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=owWMuxHgm_g

- Trijicon REAP-IR – Field Ethos, accessed August 29, 2025, https://fieldethos.com/trijicon-reap-ir/

- Ep. 313 | AGM Rattler TS35-640 **V2 REVIEW** – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=oBkPqlHksY8

- AGM RATTLER TS35-640 | AGM Global Vision, accessed August 29, 2025, https://www.agmglobalvision.com/agm-rattler-ts35-640

- Ep. 375 | AGM Rattler V3 TS50-640 **EXCLUSIVE REVIEW** – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=0mAOixO8avI&pp=0gcJCRsBo7VqN5tD

- Good Thermal Clip-On : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1ae82bs/good_thermal_clipon/

- any suggestions for thermal units in the $4000-<$5000 range? : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/130xgxr/any_suggestions_for_thermal_units_in_the_40005000/

- thermal clip on recommendations : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1dejzb0/thermal_clip_on_recommendations/

- Pulsar Talion XG35 2-16x Thermal Rifle Scope | Outdoor Legacy | Reviews on Judge.me, accessed August 29, 2025, https://judge.me/reviews/stores/outdoorlegacygear.com/products/pulsar-talion-xg35-2-16x-thermal-rifle-scope

- Reviews & Ratings for RIX 2.8×7.6x50mm Leap L6 Thermal Imaging …, accessed August 29, 2025, https://www.opticsplanet.com/reviews/reviews-rix-2-8×8-4x50mm-leap-l6-thermal-imaging-rifle-scope-30mm-tube.html

- RIX Optics: Thermal & Night Vision Scopes | Precision Hunting Optics, accessed August 29, 2025, https://www.rixoptics.com/

- RIX Leap L6 640 Thermal Imaging Scope, accessed August 29, 2025, https://thethermalstore.com/products/rix-leap-l6-thermal-scope

- DNT Optics Hydra HS635 640×512 35mm Multi-Function Thermal Scope, accessed August 29, 2025, https://www.customnightvision.com/product/dnt-optics-hydra-hs635-640×512-35mm-multi-function-thermal-scope-standalone-scope-clip-on-handheld-monocular/

- Hydra HS635: Pro-Level 3-in-1 Thermal Scope with Superior Clarity-1 – DNT Optics, accessed August 29, 2025, https://us.dntoptics.com/products/hs635-hydra-640×512-35mm-multi-function-thermal-scope-standalone-scope-clip-on-handheld-monocular

- DNT Hydra HS635 : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1ly8f21/dnt_hydra_hs635/

- N-vision thermal thoughts : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1i8wmcl/nvision_thermal_thoughts/

- First Time Thermal Buyer : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1989g0t/first_time_thermal_buyer/

- The Best Thermal Clip-On Sights – Outdoor Life, accessed August 29, 2025, https://www.outdoorlife.com/gear/best-thermal-clip-on/

- Leica Calonox 2 Sight #50511 – Camera Land NY, accessed August 29, 2025, https://cameralandny.com/shop/leica-calonox-2-sight-50511/ff5628a0-ac08-013c-bf0c-00163ecd2826?variation=3676143

- Leica Calonox 2 Sight and Sight LRF – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=57_qD5os1yE

- Leica calonox thermal add on | The Stalking Directory, accessed August 29, 2025, https://www.thestalkingdirectory.co.uk/threads/leica-calonox-thermal-add-on.291995/

- The Armasight Operator, The Next Relevant Clip On? – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=Ef8niBd2ags

- Armasight Operator 640 : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1ms5fzw/armasight_operator_640/

- ATN Night Scopes | Shooters’ Forum, accessed August 29, 2025, https://forum.accurateshooter.com/threads/atn-night-scopes.4092007/

- For those who purchased used thermals | Lone Star Boars, accessed August 29, 2025, http://lonestarboars.com/threads/for-those-who-purchased-used-thermals.7011/

- Ep. # 41 | ATN Optics: Discussion and our Honest Opinions – YouTube, accessed August 29, 2025, https://www.youtube.com/watch?v=_sBYUP6V_lY

- The Best Thermal Scope in 2025, accessed August 29, 2025, https://scopesfield.com/best-thermal-scope/

- BTS35 v3 640 – Burris Optics, accessed August 29, 2025, https://www.burrisoptics.com/thermal-optics/bts35-v3-640

- BTS35 v3 | Burris Optics, accessed August 29, 2025, https://www.burrisoptics.com/thermal-optics/bts35-v3

- TB 630 LRF Thermal Clip-On 640X512 35mm 20mK Laser Rangefinder / QD Mount, accessed August 29, 2025, https://guideir-thermal.com/products/tb-630-lrf-thermal-clip-on

- Armasight Jockey 640 vs Guide TB630 LRF – Comparison : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1hks6kq/armasight_jockey_640_vs_guide_tb630_lrf_comparison/

- SIG SAUER ECHO3 Thermal Reflex Sight – Voodoo Firearms, accessed August 29, 2025, https://voodoofirearms.com/sig-sauer-echo3-thermal-reflex-sight/

- Reviews & Ratings for SIG SAUER ECHO3 1-6x23mm Thermal Reflex Sight – OpticsPlanet, accessed August 29, 2025, https://www.opticsplanet.com/reviews/reviews-sig-sauer-echo3-1-6x-thermal-reflex-sight.html

- Thermal Scope Sale – Sport Optics, accessed August 29, 2025, https://www.sportoptics.com/thermal-scopes.html

- Comparing AGM Adder TS35-384 Thermal Imaging Riflescope vs RIX – B&H, accessed August 29, 2025, https://www.bhphotovideo.com/c/compare/AGM_Adder+TS35-384+Thermal+Imaging+Riflescope_vs_RIX_LEAP+L6+2.8-8.4x+Thermal+Imaging+Riflescope/BHitems/1697675-REG_1781563-REG

- How to Choose the Right Thermal Sensor with Different Resolutions …, accessed August 29, 2025, https://www.nocpix.com/how-to-choose-the-right-thermal-sensor-with-different-resolutions/

- Best commercially available thermal sight? : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/1ikvblz/best_commercially_available_thermal_sight/

- ClipIR thermal imager clip-on – Thermoteknix, accessed August 29, 2025, https://www.thermoteknix.com/products/defence-security/clipir

- Best Thermal Scopes, Tested and Reviewed | Outdoor Life, accessed August 29, 2025, https://www.outdoorlife.com/gear/best-thermal-scopes/

- Iray or pulsar : r/ThermalHunting – Reddit, accessed August 29, 2025, https://www.reddit.com/r/ThermalHunting/comments/18rr70y/iray_or_pulsar/

- Which Thermal : r/NightVision – Reddit, accessed August 29, 2025, https://www.reddit.com/r/NightVision/comments/1fqdzom/which_thermal/

- AI and Thermal Imaging: An Interdisciplinary Approach for Advanced …, accessed August 29, 2025, https://www.uav1.com/ai-and-thermal-imaging-an-interdisciplinary-approach-for-advanced-solutions/

- Thermal AI Cameras Guide | Mammoth Security, accessed August 29, 2025, https://mammothsecurity.com/blog/thermal-ai-cameras