Executive Analysis

The global small arms industry is currently navigating a period of significant doctrinal and technological transition. For the past decade, the prevailing market vector has been defined by the “micro-compact revolution”—a relentless engineering drive to miniaturize the 9x19mm Parabellum platform into chassis dimensions previously reserved for smaller, less capable calibers. This trend, exemplified by the Sig Sauer P365 and Springfield Hellcat, appeared to signal the final obsolescence of sub-9mm cartridges for serious defensive use. However, a counter-current is emerging, driven by demographic shifts, “recoil fatigue,” and advancements in terminal ballistic technology.

At the epicenter of this discourse lies the century-old rivalry between two of John Moses Browning’s foundational designs: the .32 Automatic Colt Pistol (ACP) and the .380 ACP. For nearly fifty years, the .380 ACP has held the title of the “minimum acceptable floor” for personal defense in the United States market, largely relegating the .32 ACP to the status of a European historical footnote. Yet, the 2023-2025 release cycle has seen a surprising development: the re-introduction of the Beretta Cheetah platform, specifically the 80X model, in .32 ACP, accompanied by high-end customization from industry leaders like Langdon Tactical Technology (LTT).

This report serves as an exhaustive industry and engineering analysis of this potential realignment. It deconstructs the historical divergence of the two cartridges, analyzes their distinct internal and terminal ballistic profiles through the lens of modern physics, examines the mechanical operating principles that differentiate their “shootability,” and evaluates the commercial viability of a .32 ACP resurgence. The central thesis of this report posits that while the .380 ACP remains the logistical superior, the .32 ACP—when paired with modern fluid-transfer monolithics and refined blowback platforms—represents a functionally superior engineering solution for the specific envelope of the pocket pistol, offering a unique “shootability” advantage that the market is only now beginning to re-evaluate.

Section 1: Historical Genesis and Divergence (1899–2025)

To fully comprehend the current engineering trade-offs between the .32 and .380 ACP, one cannot view them merely as commodities on a shelf. They must be analyzed as specific engineering solutions to the constraints John Moses Browning faced at the turn of the 20th century. These cartridges were designed not in isolation, but as systemic components of the burgeoning auto-loading pistol ecosystem.

1.1 The Primacy of the .32 ACP (7.65mm Browning)

The .32 ACP, known in Europe as the 7.65x17mm Browning SR (Semi-Rimmed), was introduced in 1899 alongside the FN Model 1900.1 Its introduction marked a watershed moment in firearms history. Prior to the .32 ACP, self-loading pistols like the Borchardt C-93 and the Mauser C96 were unwieldy, complex mechanisms often requiring locked breeches or toggle locks to function. Browning’s objective was to create a cartridge that was powerful enough for military and police use but mild enough to operate safely in a simple straight blowback action.

In a straight blowback system, the barrel is fixed to the frame. The only force keeping the breech closed during firing is the inertia of the slide and the resistance of the recoil spring. This simplicity was revolutionary for mass production. The .32 ACP was the perfect thermodynamic match for this system. It generated enough pressure to cycle the slide reliably but not so much that the slide had to be prohibitively heavy or the spring impossible to compress by hand.

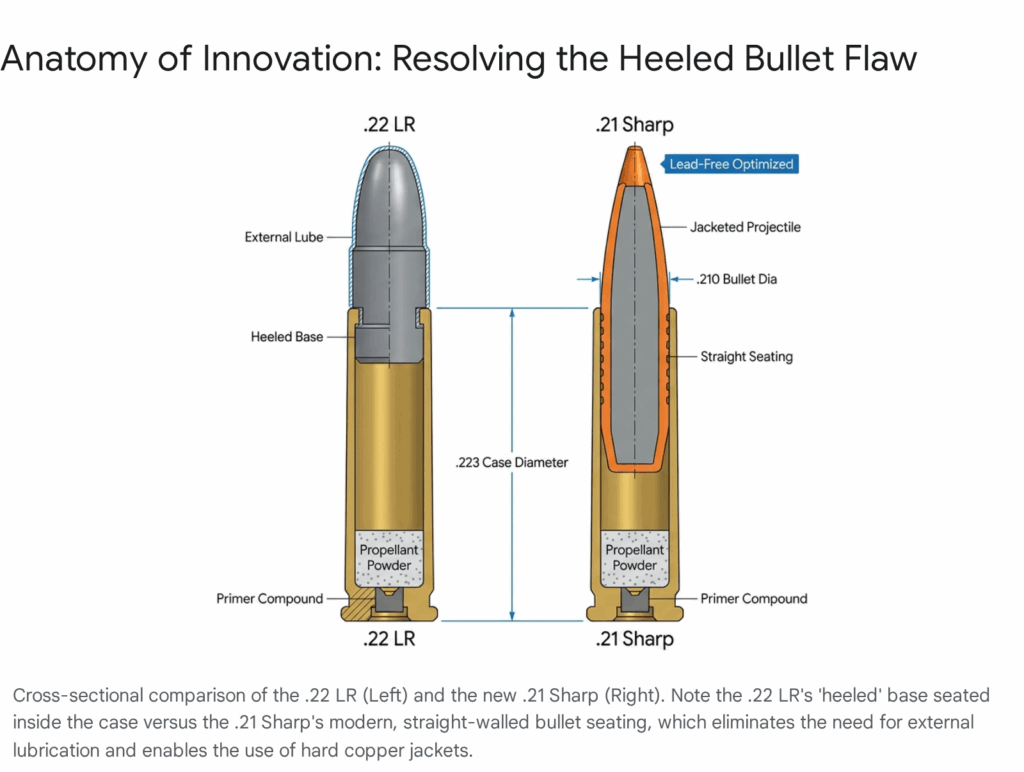

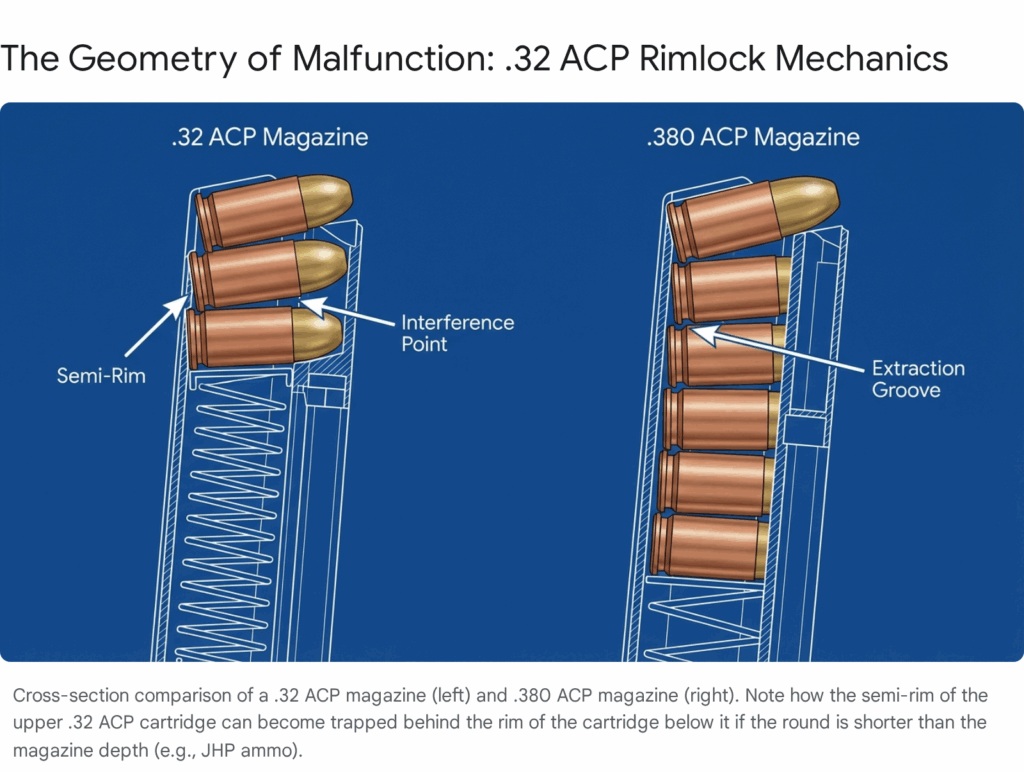

The Semi-Rimmed Design Choice: Crucially, the .32 ACP features a semi-rimmed case. In 1899, ammunition manufacturing technology was not as precise as it is today. The extractor grooves on rimless cases required tight tolerances to ensure reliable extraction. By retaining a slight rim (0 .358 inch diameter against a 0 .337 inch base), Browning provided a generous surface for the extractor to grab .3 Furthermore, the cartridge was designed to headspace on this rim, rather than on the case mouth. This design choice solved the immediate manufacturing challenges of the Victorian era but introduced a geometric flaw—”rimlock”—that plagues the cartridge in modern double-stack magazines to this day.

By 1910, the .32 ACP had become the de facto standard for European law enforcement and military officers. It offered a significant capacity advantage over the 5- or 6-shot revolvers of the time and was ballistically superior to the .32 S&W revolver cartridges.2 It was the caliber of the European establishment, carried by police in Germany, Belgium, Italy, and beyond for nearly three-quarters of a century.

1.2 The American Power Escalation: Enter .380 ACP

While Europe standardized on the 7.65mm, the American market was undergoing a different doctrinal evolution. Influenced by the U.S. Army’s negative experiences with the underpowered .38 Long Colt during the Philippine-American War, American shooters and agencies demanded larger bore diameters. They prioritized “stopping power”—often correlated simply with bullet width and weight—over the European prioritization of control and capacity.

Browning responded to this demand in 1908 with the .380 ACP (9x17mm, 9mm Kurz/Short) for the Colt Model 1908 Pocket Hammerless.1 The engineering challenge here was different: How to maximize bullet diameter and mass while still retaining the simple blowback operation of the Model 1903/1908 platform?

The .380 ACP represents the upper threshold of what is practical for a straight blowback handgun. It operates at higher pressures and generates significantly more recoil impulse than the .32 ACP. To manage this, the .380 requires a heavier slide and a stiffer recoil spring to prevent the action from opening too early.

The Rimless Innovation: Learning from the .32 ACP, Browning designed the .380 ACP as a truly rimless cartridge that headspaces on the case mouth.4 This was a forward-looking engineering decision. By removing the protruding rim, the .380 ACP feeds significantly more reliably from box magazines, as there is no rim to snag on the cartridge below it. This reliability advantage would become a decisive factor in its later dominance in the U.S. market.

1 .3 The Trans-Atlantic Schism

For much of the 20th century, a divergence in doctrine separated the two calibers, creating two distinct markets:

- The European Doctrine ( .32 ACP): This doctrine prioritized hit probability, ease of control, and magazine capacity. European agencies valued the ability to deliver multiple rounds rapidly and accurately. The .32 ACP’s low recoil facilitated this. Famous platforms like the Walther PP, the Mauser HSc, and the Beretta Model 70 and 81 series exemplified this philosophy. The .32 was seen as a “gentleman’s” or officer’s cartridge—refined and sufficient.1

- The American Doctrine ( .380 ACP): This doctrine prioritized maximizing the wound channel diameter within a compact package. The .380 became the standard for American “pocket pistols” and backup guns. The logic was simple: if you only have a small gun, you want the biggest bullet that fits in it. The .380 was viewed as the absolute minimum for self-defense, while the .32 was frequently dismissed as a “mouse gun” suitable only for deep concealment or as a deterrent .3

This historical context is vital because the current market resurgence of the .32 ACP is essentially a re-evaluation of the European Doctrine in the 21st century. It is an acknowledgement by modern shooters that in ultra-lightweight pistols, the “American Doctrine” of maximizing caliber may have reached a point of diminishing returns, where the recoil penalty outweighs the terminal ballistic advantage.

Section 2: Engineering Architecture and Internal Ballistics

To analyze the suitability of these cartridges for modern defense, one must strip away the marketing narratives and examine the raw engineering specifications defined by the Sporting Arms and Ammunition Manufacturers’ Institute (SAAMI) and the Commission Internationale Permanente (CIP). The physical dimensions and pressure limits dictate the architecture of the firearms that shoot them and the reliability of those systems.

2.1 Dimensional Analysis and the Geometry of Feeding

The physical dimensions of the cartridges reveal the fundamental trade-offs in their design.

| Specification | .32 ACP (7.65mm Browning) | .380 ACP (9mm Kurz) | Engineering Implication |

| Bullet Diameter | 0 .3125″ (7.94 mm) | 0 .355″ (9.02 mm) | .380 has ~29% more frontal surface area, theoretically creating a wider wound channel.5 |

| Case Length | 0.680″ (17 .3 mm) | 0.680″ (17 .3 mm) | Identical case length allows for similar action stroke lengths in pistol designs.5 |

| Overall Length (OAL) | 0.984″ (25.0 mm) | 0.984″ (25.0 mm) | Identical max OAL means magazine depth and grip size can be nearly identical.5 |

| Rim Configuration | Semi-Rimmed | Rimless | The critical flaw of .32 ACP in box magazines .3 |

| Rim Diameter | 0 .358″ | 0 .374″ | The .32’s rim protrudes beyond the case body; the .380’s does not. |

| Base Diameter | 0 .337″ | 0 .374″ | .380 requires a wider breech face and magazine tube. |

The Rimlock Mechanism: An Engineering Achilles’ Heel

The semi-rimmed design of the .32 ACP is its primary mechanical liability in modern autoloaders. The rim diameter (0 .358″) is significantly wider than the base diameter (0 .337″) .3

In a magazine, cartridges are stacked on top of one another. For reliable feeding, the rim of the top cartridge must slide forward, pushing the round out of the magazine lips and into the chamber. In a semi-rimmed design, if the rim of the top cartridge slips behind the rim of the cartridge below it, the two rims interlock. When the slide attempts to push the top round forward, the rim catches on the round below, jamming the action. This is known as “rimlock”.6

The Role of OAL: Rimlock is most prevalent when using ammunition that is shorter than the standard length. Full Metal Jacket (FMJ) rounds are typically long (close to the 0.984″ max OAL), filling the magazine from front to back. This prevents the rounds from shifting longitudinally, keeping the rims in the correct “stepped” alignment. However, modern Hollow Point (JHP) ammunition often has a shorter OAL due to the flat nose profile. In a magazine designed for FMJ length, shorter JHP rounds can slide back and forth during recoil. If a round slides backward, its rim can slip behind the one below it.8

Mitigation Strategies:

- Mechanical Spacers: Manufacturers like KelTec historically offered “rimlock spacer kits”—a piece of wire or polymer inserted into the rear of the magazine to force shorter JHP rounds forward, preventing rearward movement.9

- Magazine Ribs: Modern magazine designs (like those in the Beretta 80X) may incorporate internal ribs to limit this movement, though the fundamental geometry remains a risk factor.

- Ammo Selection: The most reliable engineering solution is to use ammunition loaded to the max SAAMI OAL. This is why many “savvy” .32 ACP users prefer FMJ or specially designed defensive loads like the Lehigh Xtreme Cavitator, which maintains a longer profile.9

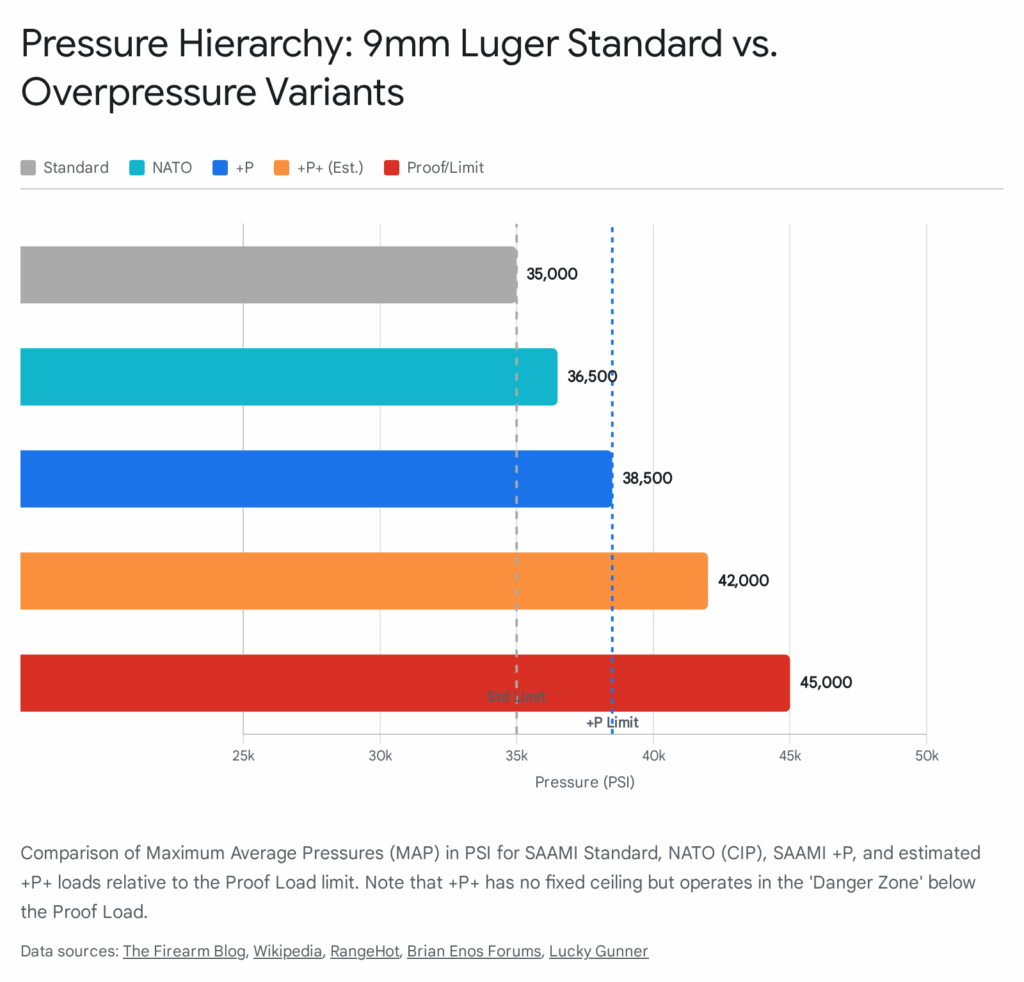

2.2 Pressure Standards and Structural Limits

The pressure specifications reveal the “power ceiling” of the cartridges and highlight a significant discrepancy between American and European standards.

- SAAMI MAP (Maximum Average Pressure):

- .32 ACP: 20,500 psi.5

- .380 ACP: 21,500 psi.5

- CIP Differential: Crucially, European CIP standards allow the .32 ACP (7.65 Browning) to be loaded up to ~23,000 psi (1,600 bar).10

This pressure differential explains a common observation: European ammunition (Fiocchi, Sellier & Bellot, Geco) often outperforms American ammunition (Federal, Winchester, Remington) on the chronograph. American manufacturers often “download” the .32 ACP to ensure safety in older, weaker top-break revolvers or early 1900s automatics that may be in poor condition. European manufacturers, serving a market where the caliber was a police standard for decades, assume the ammunition will be used in robust steel service pistols like the Beretta 81 or Walther PP.10

Implication for the Beretta 80X: As a modern pistol built on a robust aluminum alloy frame with a steel slide (and effectively a scaled-down version of the battle-proven Beretta 92), the 80X is structurally capable of handling the hotter CIP-spec ammunition. American shooters utilizing standard domestic target ammo in the 80X may find the recoil impulse surprisingly mild—perhaps even too mild to cycle the slide reliably if the gun is dirty—whereas European ammo will drive the gun with the authority for which it was designed.

Section 3: The Physics of Action: Blowback vs. Locked Breech

The “felt recoil” experience—a primary driver of the .32 ACP’s resurgence—is not just a function of bullet energy; it is dictated by the gun’s operating mechanism. This is where the .32 ACP gains its most significant advantage in the “shootability” equation.

3.1 Straight Blowback Dynamics

Most pistols in these calibers, including the classic Walther PPK, the Bersa Thunder, and the Beretta 84/80X series, utilize a Straight Blowback action.12

- Mechanism: In this system, the barrel is fixed to the frame and does not move. The only forces holding the breech closed are the mass of the slide and the potential energy stored in the compressed recoil spring. Upon firing, the expanding gases push the bullet forward and the case backward (Newton’s Third Law). The slide must have enough inertia to resist this rearward force until the bullet has left the barrel and pressures have dropped to safe levels.

- The .380 Problem: To safely contain the 21,500 psi of the .380 ACP, a blowback slide must be relatively heavy, and the recoil spring must be quite stiff. When fired, the slide overcomes this inertia and slams backward with significant velocity. This rapid acceleration and the subsequent impact of the slide against the frame stops result in a sharp, “snappy” recoil impulse.14 This is why a small .380 blowback pistol often has more felt recoil than a larger locked-breech 9mm. The recoil is direct and violent.

- The .32 Solution: The .32 ACP generates roughly 50% less free recoil energy than the .380 ACP.15 In a blowback system, this reduced energy input allows engineers to use a lighter recoil spring. This has two user-facing benefits:

- Ease of Manipulation: The slide is significantly easier to rack, a critical factor for shooters with reduced hand strength (arthritis, smaller stature).16

- Gentler Cycle: The slide velocity is lower, and the impact against the frame is less severe. The gun disturbs the sight picture less, allowing for faster, more accurate follow-up shots.

3.2 Locked Breech Systems

Modern micro-compacts (like the KelTec P32, Ruger LCP Max, Sig P365- .380) utilize Locked Breech (Short Recoil) actions.12

- Mechanism: In this system, the barrel and slide are locked together and travel rearward as a unit for a short distance. This movement delays the opening of the breech. The barrel then tilts or rotates to unlock from the slide, stopping its movement while the slide continues rearward.

- Impact: This mechanism spreads the recoil impulse over a longer duration. A locked-breech .380 (like the Sig P365-380 or Ruger Security-380) is incredibly soft-shooting because the mechanics absorb much of the energy. However, a locked-breech .32 ACP (like the KelTec P32) is almost recoil-neutral. It feels more akin to a.22 LR rimfire than a centerfire combat pistol.

Analyst Conclusion on Recoil: For pure blowback platforms—which includes the Beretta Cheetah series—the .32 ACP is the engineered optimum. The .380 ACP pushes the blowback mechanism to its limits, resulting in a gun that is often criticized for being unpleasant or “snappy” to shoot.14 The .32 version, operating well within the comfort zone of the blowback physics, is widely regarded as a mechanical joy to shoot—smooth, flat, and controllable.

Section 4: Terminal Ballistics and Lethality: The Penetration vs. Expansion Paradox

The debate over “stopping power” in small calibers is dominated by the FBI Protocol, which mandates 12 to 18 inches of penetration in 10% ordnance gelatin to ensure the projectile can reach vital organs regardless of the shot angle (e.g., passing through an arm before entering the chest).

4.1 The .380 ACP Performance Envelope

Modern .380 ACP ammunition has benefited significantly from bullet technology developed for 9mm service rounds. Premium loads like the Hornady Critical Defense or Federal Hydra-Shok Deep are designed to balance the limited energy of the cartridge. Typically, a good .380 defensive load can achieve 10-13 inches of penetration with expansion to roughly 0.50 inches.18

- The Compromise: To achieve expansion, the bullet must use resistance to deform, which sheds energy and reduces penetration depth. In the .380, there is barely enough energy to drive the expanded bullet deep enough. It exists on the “ragged edge” of reliability. If the bullet expands too aggressively (e.g., hitting a bone), it may under-penetrate (stopping at 7-8 inches). If it doesn’t expand (e.g., clogged by clothing), it behaves like an FMJ and may over-penetrate.15

4.2 The .32 ACP Deficiency and the Fluid Dynamics Revolution

Historically, .32 ACP hollow points (JHP) have been a dismal failure in ballistic testing. The cartridge simply lacks the velocity and mass to force reliable expansion while retaining enough momentum to drive penetration.

- Traditional JHP Failure: Tests consistently show that traditional .32 ACP JHPs (like the 60gr Silvertip or Gold Dot) often suffer from one of two failure modes:

- Under-penetration: They expand quickly but stop at 6-9 inches, failing to reach the FBI minimum.18

- Failure to Expand: They fail to open up, acting like a lightweight FMJ and penetrating deeply but leaving a narrow wound channel.

- Traditional FMJ: The 71gr FMJ penetrates deeply (16-20+ inches) but leaves a narrow 0 .31″ wound channel.20 This “ice pick” effect is reliable for reaching vitals but produces slow incapacitation through blood loss unless the central nervous system is directly struck.

Comparative Data Analysis:

The following table synthesizes gelatin test data from multiple independent sources to illustrate this disparity.

| Cartridge / Load Type | Avg. Penetration (Inches) | Expanded Diameter (Inches) | FBI Protocol Verdict | Notes |

| .380 ACP JHP (Premium) | 10.0″ – 13.0″ | 0.48″ – 0.52″ | Marginal Pass | Effective but recoil is high. |

| .32 ACP JHP (Traditional) | 6.5″ – 9.0″ | 0.40″ – 0.45″ | Fail | Severe under-penetration risk. |

| .32 ACP FMJ (71-73gr) | 16.0″ – 21.0″ | 0 .31″ (No exp.) | Pass (Over-penetration) | Reliable depth, minimal tissue damage. |

| .32 ACP Xtreme Cavitator | 14.0″ – 15.0″ | ~0.50″ (PWC equivalent) | Pass (Optimal) | Barrier blind, consistent depth. |

| 18 |

The Game Changer: Fluid Transfer Monolithics

The most significant development for the .32 ACP in the 21st century is the introduction of fluted, non-expanding bullets, most notably the Lehigh Defense Xtreme Cavitator (often loaded by Underwood Ammo).

- Mechanism: These bullets do not rely on mushrooming to create a wound channel. Instead, they feature a solid copper construction with a specific fluted nose geometry (resembling a Phillips head screwdriver). As the bullet moves through tissue at high velocity, the flutes constrain and accelerate the fluid (tissue) radially away from the bullet path. This creates a high-pressure hydraulic jet that tears a Permanent Wound Cavity (PWC) similar in volume to an expanded hollow point, but without the drag that slows down a JHP.21

- Data Validation: Independent tests confirm the Underwood .32 ACP Xtreme Defender/Cavitator penetrates 14-15 inches in gelatin—perfectly within the FBI sweet spot—while creating a wound channel volume superior to FMJ and more consistent than JHP.20

Analyst Insight: This ammunition technology fundamentally alters the viability of the .32 ACP. It solves the penetration/expansion trade-off that plagued the caliber for 100 years. For a defense analyst, a .32 ACP loaded with Xtreme Cavitators is no longer “underpowered” in terms of penetration depth; it is FBI-compliant, placing it on a functional par with the .380 ACP while retaining the recoil and capacity advantages.

Section 5: Case Study: The Beretta 80X Cheetah and the “Lux-Carry” Market

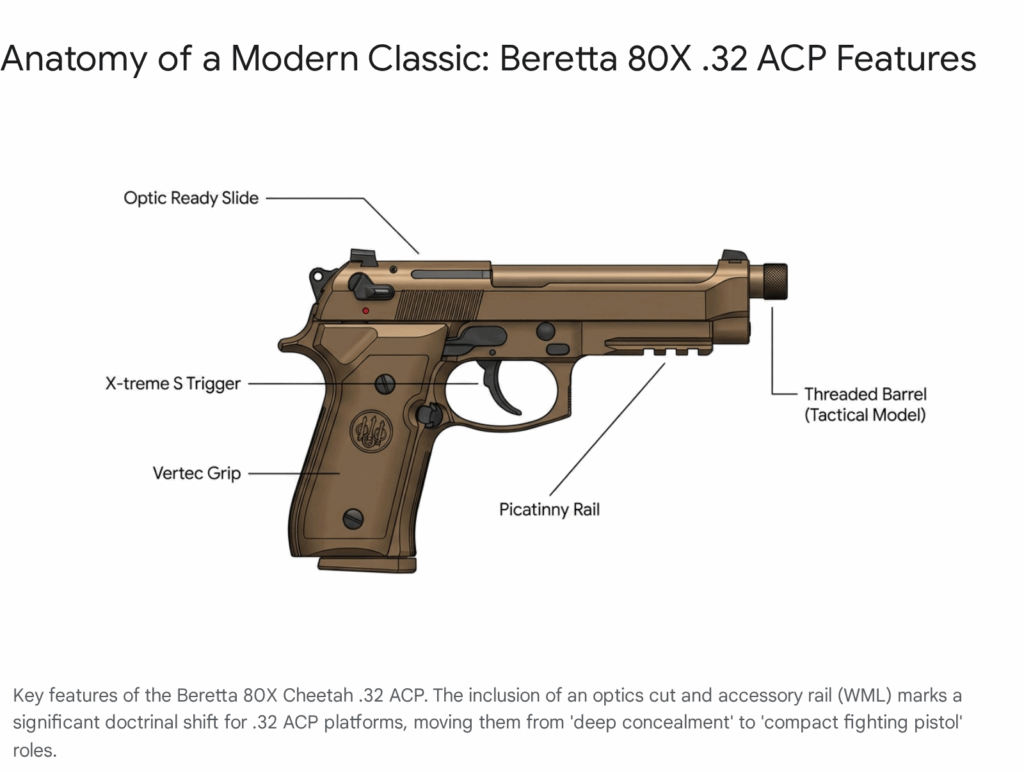

The re-introduction of the Beretta Cheetah platform, specifically the new 80X model in .32 ACP, serves as the primary catalyst for the current discussion on caliber resurgence. It represents a shift from “utility” firearms to “lifestyle” firearms.

5.1 The Platform Evolution: From 81 to 80X

The original Beretta 81 (introduced in 1976) was a staple of Italian law enforcement. The new 80X represents a comprehensive modernization of this chassis.24

- Modernization Suite: The 80X is not a simple re-release. It adds a standard Picatinny accessory rail (essential for modern weapon-mounted lights), an optics-ready slide (acknowledging the ubiquity of micro-red dots), a thinner Vertec-style grip for better ergonomics, and the “X-treme S” trigger system with adjustable overtravel.25

- Caliber Specifics: The 80X .32 ACP variants include a “Launch Edition” (Bronze) and a black tactical model. Notably, the tactical model features a threaded barrel, acknowledging the enthusiast desire to suppress the .32 ACP. Since standard 71gr .32 ACP loads are often subsonic or transonic, they suppress exceptionally well compared to the supersonic 9mm.27

5.2 The Magazine Capacity Puzzle

A critical engineering question arises regarding capacity. One would assume the smaller diameter .32 ACP would offer a higher capacity than the .380 ACP in the same frame size.

- Beretta 84 ( .380 ACP): 13 rounds double-stack.

- Beretta 81/80X ( .32 ACP): 12 or 13 rounds double-stack.26

The Anomaly: Theoretically, the smaller diameter .32 should allow for significantly higher capacity (perhaps 15-16 rounds). However, legacy Beretta 81 magazines held 12 rounds, and the 80X maintains similar limits.24 Engineering Cause: This goes back to the semi-rimmed case. Stacking semi-rimmed cartridges in a double-column magazine is geometrically inefficient. The rims interfere with each other, requiring a steeper follower angle or a wider magazine body to prevent binding (rimlock). This “wasted space” negates the size advantage of the cartridge.28 While modification (using .380 mags with .32 ammo) can sometimes yield 14+ rounds, reliability is often compromised, making it unsuitable for defensive carry.29

5 .3 LTT (Langdon Tactical) Involvement

The involvement of Langdon Tactical Technology (LTT) is a massive market signal. LTT is known for high-end customization of “serious” combat pistols (Beretta 92, HK P30). Their decision to offer a custom-tuned Beretta 80X in .32 ACP 30 moves the caliber from the “pocket mouse gun” category to the “connoisseur’s carry” category. LTT’s modifications—including trigger jobs, NP3 coatings for lubricity, and low-mount optics cuts—cater to a demographic that values mechanical excellence and low recoil over raw power. This endorsement validates the .32 ACP as a serious enthusiast choice, not just a historical novelty.

Section 6: Market Dynamics: Is the Resurgence Real?

Is the Beretta 80X the harbinger of a broad .32 ACP renaissance, or is it a “last hurrah” for a dying breed? To answer this, we must look at the drivers and barriers in the current market.

6.1 Drivers of the Resurgence

- Demographics (The “Aging Shooter”): The firearms market in the US is aging. As shooters age, grip strength diminishes, and sensitivity to recoil increases. A straight blowback .380 can be incredibly difficult to rack due to the heavy recoil spring required to contain the pressure. A .32 ACP, with 50% less recoil energy, allows for a lighter spring, making the slide significantly easier to manipulate .31

- The “Pocket Rocket” Fatigue: For the last 15 years, the market chased the smallest, lightest 9mm and .380 pistols (LCP, Hellcat, P365). While easy to carry, these guns are physically painful to practice with. Consumers are realizing that a gun they hate shooting is a gun they won’t train with. The .32 ACP offers a “training-friendly” recoil impulse that encourages practice.

- Ammo Tech: As analyzed in Section 4, the “Xtreme Cavitator” technology removes the primary objection (lack of lethality) to the caliber.

6.2 Barriers to Mass Adoption

- Cost and Availability: While .32 ACP ammunition pricing is stabilizing (~$0 .34/round) 33, it remains a specialty item in brick-and-mortar stores. It lacks the ubiquity of 9mm or .380, which can be found at any rural gas station or hardware store.

- Platform Scarcity: Beyond the Beretta 80X and the boutique Seecamp, new options are scarce.

- KelTec P32: This remains the lightest production pistol in the world (6.6 oz) and is a cult favorite. However, production runs are sporadic, and availability is inconsistent .34

- The Polymer Gap: There is no “Glock 42 sized” .32 ACP. If a major manufacturer like Glock, Sig Sauer, or Smith & Wesson were to release a .32 version of their popular micro-compacts (e.g., a P365-32 with a 15-round magazine), the resurgence would be cemented. Without that, the .32 ACP remains a niche for enthusiasts and those specifically seeking the Beretta aesthetic.

Section 7: Strategic Conclusions and Future Outlook

The analysis indicates that the .32 ACP is functionally superior to the .380 ACP for the specific application of straight blowback pistols and ultra-lightweight pocket guns. The .380 ACP pushes the blowback mechanism to its violent limit, resulting in snappy recoil and stiff operation. The .32 ACP, by contrast, operates in harmony with the blowback design, offering a smooth, controllable, and precision-oriented shooting experience.

The Beretta 80X Cheetah does not signal a mass-market return to the .32 ACP replacing the 9mm as the dominant defensive caliber. Instead, it signals the emergence of a “Premium Low-Recoil” market segment. This segment caters to shooters who reject the “punishment” of micro-9mms and understand that modern fluid-transfer projectiles have narrowed the lethality gap.

Final Verdict:

- For Personal Defense: The .380 ACP remains the logistical winner due to ammo availability and platform variety. However, a .32 ACP loaded with Lehigh Xtreme Cavitators is a ballistically viable alternative that offers superior follow-up shot speed and comparable penetration.

- For the Beretta 80X: The .32 ACP is the correct caliber for this specific chassis. It transforms the gun from a “snappy” anachronism ( .380 version) into a highly refined, shootable, and effective defensive tool. The “resurgence” will likely be deep but narrow—limited to enthusiasts and those prioritizing recoil mitigation over raw caliber diameter.

Appendix A: Analytical Methodology

To ensure an exhaustive and unbiased analysis of the .32 ACP vs. .380 ACP question, this report utilized a multi-dimensional research framework that integrated historical data, engineering specifications, independent ballistic testing, and market sentiment analysis.

1. Historical & Geopolitical Analysis:

- Objective: To understand the doctrinal divergence between European and American usage.

- Sources: Historical patent records (John Browning), military adoption records (FN, Colt), and reputable firearms history publications.1

- Application: This data established the baseline for why the cartridges were designed as they were (rimmed vs. rimless, blowback vs. locked breech).

2. Engineering & Physics Review:

- Objective: To quantify the mechanical differences and performance ceilings.

- Data Points: SAAMI and CIP pressure specifications 5, dimensional drawings (case geometry) 3, and mechanical operating principles (Newtonian physics of blowback actions).12

- Application: Used to explain the “rimlock” phenomenon and the recoil impulse differences.

3. Terminal Ballistic Meta-Analysis:

- Objective: To determine the actual lethality and effectiveness of the rounds relative to established standards.

- Standard: The FBI Protocol (12-18 inches of penetration in 10% ordnance gelatin).

- Data Sources: Aggregation of independent gelatin tests from credible sources (Lucky Gunner Labs, independent ballistics testers).18

- Exclusion: Anecdotal “stopping power” stories were excluded in favor of repeatable, measurable gelatin data.

4. Market & Product Analysis:

- Objective: To assess the commercial viability of the resurgence.

- Focus: The Beretta 80X launch, LTT aftermarket support, and ammunition pricing trends.25

- Sentiment Analysis: Review of consumer feedback on recoil fatigue and the “micro-compact” trend.17

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- John Moses Browning: Historic Profile – Wideners Shooting, Hunting & Gun Blog, accessed January 24, 2026, https://www.wideners.com/blog/john-moses-browning/

- .32 ACP: The Round that Made the Auto Pistol – The Mag Life – GunMag Warehouse, accessed January 24, 2026, https://gunmagwarehouse.com/blog/32-acp-the-round-that-made-the-auto-pistol/

- The Forgotten .32 ACP: Still Kicking After 126 Years – Firearms News, accessed January 24, 2026, https://www.firearmsnews.com/editorial/forgotten-32-acp-still-kicking/529845

- The .380 ACP: History & Performance | An Official Journal Of The NRA – American Rifleman, accessed January 24, 2026, https://www.americanrifleman.org/content/the-380-acp-history-performance/

- 32 ACP vs. 380 ACP: Pistol Cartridge Comparison by Ammo.com, accessed January 24, 2026, https://ammo.com/comparison/32acp-vs-380

- How To Carry the .32 ACP – Inside Safariland, accessed January 24, 2026, https://inside.safariland.com/blog/how-to-carry-the-32-acp/

- What exactly is ‘rimlock’ and why does it mainly affect rimmed cartridges in box magazines?, accessed January 24, 2026, https://www.quora.com/What-exactly-is-rimlock-and-why-does-it-mainly-affect-rimmed-cartridges-in-box-magazines

- Preventing Rim Lock in Your 32 ACP Pocket Guns – GAT Daily, accessed January 24, 2026, https://gatdaily.com/articles/preventing-rim-lock-in-your-32-acp-pocket-guns/

- Keltec P-32 Mag Spacers for HP ammo? : r/TheOneTrueCaliber – Reddit, accessed January 24, 2026, https://www.reddit.com/r/TheOneTrueCaliber/comments/1h0yfhn/keltec_p32_mag_spacers_for_hp_ammo/

- .32 ACP – Wikipedia, accessed January 24, 2026, https://en.wikipedia.org/wiki/ .32_ACP

- How to Carry a .32 ACP – GAT Daily (Guns Ammo Tactical), accessed January 24, 2026, https://gatdaily.com/articles/how-to-carry-a-32-acp/

- Blowback vs. Locked Breech Handguns: What’s the Difference? – The Mag Life, accessed January 24, 2026, https://gunmagwarehouse.com/blog/blowback-vs-locked-breech-handguns-whats-the-difference/

- Blowback Versus Recoil Operated Pistols – YouTube, accessed January 24, 2026, https://www.youtube.com/watch?v=qK6sNYz2aQg

- Blowback Versus Recoil Operated Pistols – Lucky Gunner Lounge, accessed January 24, 2026, https://www.luckygunner.com/lounge/blowback-versus-recoil/

- .32 ACP vs .380: Which Caliber for Self-Defense? | USCCA, accessed January 24, 2026, https://www.usconcealedcarry.com/blog/head-to-head-32-acp-vs-380-acp/

- “It’s a Blow- Back Auto” – American Handgunner, accessed January 24, 2026, https://americanhandgunner.com/our-experts/its-a-blow-back-auto/

- Beretta 80x Cheetah, 500 rounds in: cool but somewhat pointless : r/guns – Reddit, accessed January 24, 2026, https://www.reddit.com/r/guns/comments/145h06n/beretta_80x_cheetah_500_rounds_in_cool_but/

- Pocket Pistol Caliber Ballistic Gel Tests – LuckyGunner.com Labs, accessed January 24, 2026, https://www.luckygunner.com/labs/pocket-pistol-caliber-gel-test-results/

- Best 32 ACP Ammo for Your Pocket Pistol or Backup Gun, accessed January 24, 2026, https://ammo.com/best/best-32-acp-ammo

- .32 ACP Ammo Gel Test. : r/guns – Reddit, accessed January 24, 2026, https://www.reddit.com/r/guns/comments/s6d31o/32_acp_ammo_gel_test/

- Lehigh 32 ACP Xtreme Cavitator Ammunition & Bullets – ArmsVault, accessed January 24, 2026, https://armsvault.com/2016/05/lehigh-32-acp-xtreme-cavitator-ammunition-bullets/

- Xtreme Cavitator – Reloading Bullets – Lehigh Defense, accessed January 24, 2026, https://lehighdefense.com/reloading-bullets/xtreme-cavitator.html

- Underwood Xtreme Defender Gel Test : r/CCW – Reddit, accessed January 24, 2026, https://www.reddit.com/r/CCW/comments/1fbpy5x/underwood_xtreme_defender_gel_test/

- Beretta Cheetah – Wikipedia, accessed January 24, 2026, https://en.wikipedia.org/wiki/Beretta_Cheetah

- 80X Cheetah – Beretta, accessed January 24, 2026, https://www.beretta.com/en-us/product/80x-cheetah-FA0042

- New Beretta 80X Cheetah Launch Edition, accessed January 24, 2026, https://www.beretta.com/en/company/news/announcements/New-80X-Cheetah-launch-edition

- Beretta Introduces Two Models of 80X Cheetah in .32ACP Exclusively Tuned by Langdon Tactical Technology – The Outdoor Wire, accessed January 24, 2026, https://www.theoutdoorwire.com/releases/2026/01/beretta-introduces-two-models-of-80x-cheetah-in-32acp-exclusively-tuned-by-langdon-tactical

- When you know .32 ACP is underpowered, so you double stack it : r/guns – Reddit, accessed January 24, 2026, https://www.reddit.com/r/guns/comments/12em1i4/when_you_know_32_acp_is_underpowered_so_you/

- Beretta 84 mag in Beretta 81 – YouTube, accessed January 24, 2026, https://www.youtube.com/watch?v=ro2yqcJSbBg

- Beretta 80X .32 by LTT – Langdon Tactical, accessed January 24, 2026, https://langdontactical.com/beretta-80x-32-by-ltt/

- Review: Beretta 80x Cheetah | An Official Journal Of The NRA – Shooting Illustrated, accessed January 24, 2026, https://www.shootingillustrated.com/content/review-beretta-80x-cheetah/

- .32 ACP vs .380 ACP: Choosing the Right Self-Defense Round – Oreate AI Blog, accessed January 24, 2026, https://www.oreateai.com/blog/32-acp-vs-380-acp-choosing-the-right-selfdefense-round/2ae4f793d6a40d55683dc295f2bdf12a

- 32 ACP Ammo Price History Chart – Black Basin Outdoors, accessed January 24, 2026, https://blackbasin.com/ammo-prices/32-acp/

- The Kel-Tec P32 Gen 2: The Ultimate Pocket Pistol – The Mag Life – GunMag Warehouse, accessed January 24, 2026, https://gunmagwarehouse.com/blog/the-kel-tec-p32-gen-2-the-ultimate-pocket-pistol/

- Handgun Self-Defense Ammunition – Ballistic Testing Data – Lucky Gunner, accessed January 24, 2026, https://www.luckygunner.com/labs/self-defense-ammo-ballistic-tests/

- Direct Blowback vs. Locked Breech .380 – Recoil and Options : r/guns – Reddit, accessed January 24, 2026, https://www.reddit.com/r/guns/comments/1ic7xlf/direct_blowback_vs_locked_breech_380_recoil_and/