This report provides a comprehensive analysis of the Polish firearms manufacturer Pioneer Arms Corp. (PAC) and its presence in the United States civilian market. The findings are based on a thorough review of corporate history, product specifications, market data, and extensive consumer sentiment analysis.

The current operational status of the company is bifurcated. As of September 2024, the U.S. import and distribution entity, Pioneer Arms USA, based in Florida, has ceased operations.1 Its website is non-functional, and social media posts from the company and former executives confirm its closure. In contrast, the manufacturing facility in Poland, Pioneer Arms Corp. of Radom, appears to remain in business, with its corporate website and contact information still active.2 This schism creates significant uncertainty regarding warranty support for existing U.S. customers and halts the flow of new products into the American market pending the establishment of a new importation agreement.

The overall brand sentiment for Pioneer Arms is deeply polarized and can be understood only by dividing its production history into two distinct eras. The first era is defined by the use of cast front trunnions in its AK-pattern firearms. This manufacturing choice, deviating from the military-standard forged component, led to a catastrophic loss of reputation due to numerous, well-documented instances of critical failures, earning the brand a reputation for being dangerously unreliable.4 The second era began with the company’s shift to producing rifles with forged trunnions, a direct response to market criticism. While sentiment towards these newer “forged” models is markedly improved, with many users reporting acceptable reliability, the brand has been unable to shed the stigma of its early failures.7

This reputational damage was compounded by a marketing strategy that leveraged the storied name of “Radom” and the history of the famed “Circle 11” Polish arms factory. This created a perception of deceptive marketing among knowledgeable enthusiasts, who correctly distinguish between Pioneer Arms and the true state-sponsored successor, Fabryka Broni “Łucznik” – Radom. This has resulted in a persistent credibility gap that transcends product quality.

Model-specific analysis reveals a stark contrast. The company’s niche historical reproductions, such as the semi-automatic PPS-43C pistol, enjoy a generally neutral-to-positive sentiment, valued as affordable and fun collector’s items.9 Conversely, its flagship AK products, the Sporter rifle and Hellpup pistol, remain the focus of intense scrutiny and controversy, even in their improved forged configurations.

In conclusion, Pioneer Arms represents a case study in the critical importance of initial product quality and brand integrity. The failure of its U.S. arm underscores the difficulty of recovering from a deeply negative reputation in a sophisticated consumer market. For the U.S. consumer, purchasing a Pioneer Arms product, particularly its AK-pattern firearms, now carries the additional risk of non-existent factory support, making it an inadvisable choice when compared to readily available, proven, and supported alternatives.

Section I: The Legacy of Radom – A Century of Polish Arms Manufacturing

To comprehend the controversy and market position of Pioneer Arms, one must first understand the profound historical significance of its home city: Radom. The name “Radom” in the firearms world is not merely a geographic identifier; it is a seal of quality and a symbol of Polish martial history, forged over a century of conflict and industrial achievement.

The Birth of a National Arsenal

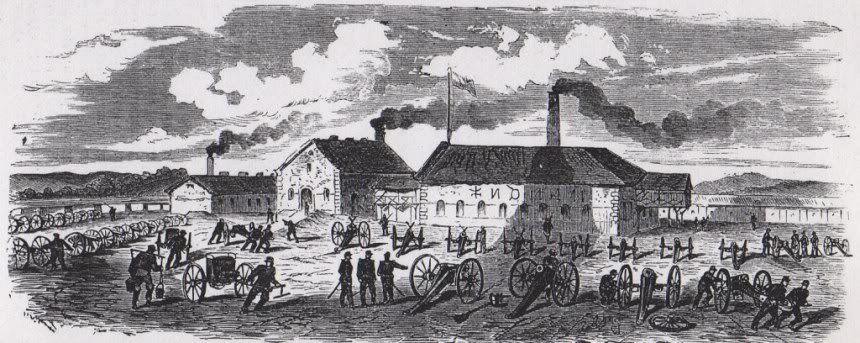

Following World War I, the reborn Second Polish Republic found itself in a precarious position, fighting for its borders and facing a massive Bolshevik invasion.11 Its nascent army was equipped with a chaotic mix of Austrian, Russian, German, and French arms, creating a logistical nightmare. The strategic imperative to unify small arms and establish a domestic arms industry was paramount. On April 29, 1922, the government made the decision to build its own arms industry, locating the new plants within a “safety triangle” in the country’s interior.11

Radom was a key choice for this initiative. Construction began in 1923, and by 1927, the Państwowa Fabryka Broni (State Arms Factory) was in full operation.11 Its initial machinery and technical documentation came from the former German rifle factory in Gdańsk, which had produced Mauser rifles. This inheritance determined that the Mauser wz. 98 would become a standard rifle for the Polish Army, and Radom would be its premier manufacturer.11 The factory quickly established a reputation for excellence, producing not only rifles but also the legendary Vis wz. 35 pistol, considered by many to be one of the finest handguns of its era. By 1939, the Radom factory was a pillar of the Central Industrial District and had produced over half a million weapons for the Polish military.11

WWII Occupation and Resistance

The strategic importance of the Radom factory was not lost on the German invaders in 1939. Hoping to capture it intact, they largely spared it from bombing.13 After the occupation, the plant was taken over by the Austrian conglomerate Steyr-Daimler-Puch and forced to produce weapons for the Wehrmacht, including a simplified version of the Vis pistol.13

Even under the brutal conditions of German administration, the factory became a center of Polish resistance. In a remarkable and dangerous act of defiance, workers belonging to the Home Army began clandestine production of duplicate Vis pistols, using identical serial numbers to conceal their activities.13 This operation was eventually discovered after a shootout led to the capture of two cloned pistols. The German response was swift and savage: in October 1942, 50 people, many of them factory workers, were publicly hanged.13 This tragic history imbued the Radom name with a legacy of patriotism and sacrifice, elevating it beyond a simple manufacturing site.

The “Circle 11” Cold War Era

After the war, the factory was rebuilt and integrated into the new communist state’s defense infrastructure. It was renamed Zakłady Metalowe im. gen. “Waltera” (General Walter Metal Works) and assigned the factory code number 11.15 To distinguish its products from an earlier Factory #11, its mark was an oval around the number:

(11). This “Circle 11” marking became an iconic symbol for collectors, synonymous with high-quality, military-grade Warsaw Pact weaponry.15

Under this banner, the Radom factory produced a host of licensed Soviet-bloc arms, including the TT-33 pistol (as the pw wz. 1933), the PPSh-41 and PPS-43 submachine guns, and, most significantly, the AK-47 and its modernized successor, the AKM, from 1957 onwards.15 It also developed its own notable designs, such as the PM-63 RAK machine pistol and the wz. 88 Tantal rifle in 5.45x39mm.15 The Circle 11 factory was the benchmark for Polish Kalashnikov production, and its products are highly sought after on the surplus market for their quality and historical provenance.

Post-Communism and the Rise of New Entities

With the fall of communism, the state-owned enterprise struggled. In 1990, it reverted to the name Zakłady Metalowe “Łucznik” but was declared bankrupt on November 13, 2000.15 From the ashes of this industrial giant, two distinct entities emerged.

First, the true successor to the state arsenal, Fabryka Broni “Łucznik” – Radom Sp. z o.o., was formed on June 30, 2000, as a subsidiary of the state-owned Polish Armaments Group (Polska Grupa Zbrojeniowa).15 This is the company that continues to produce military firearms for the Polish Armed Forces, such as the Beryl and MSBS Grot rifles, and is the rightful heir to the Circle 11 legacy.15

Second, a new private enterprise, Pioneer Arms Corp. (PAC), was established in 2002.18 This company was a separate, commercial venture that would later acquire some of the old Circle 11 factory’s physical assets and technical data. The critical distinction between these two companies—the state-owned military arsenal and the private commercial manufacturer—is the foundational point of contention that defines Pioneer Arms’ market reputation.

Section II: The Pioneer Arms Venture – History, Structure, and Current Status

The story of Pioneer Arms is one of entrepreneurial ambition, strategic positioning, and ultimately, market turbulence. It is a narrative that begins not with Kalashnikovs, but with firearms designed for a niche American pastime, and evolves through a calculated association with the Radom legacy.

Founding and Initial Vision

The Pioneer Arms venture was a transatlantic effort from its inception. Pioneer Arms Corp. USA was established on January 2, 2001, followed by its Polish counterpart, Pioneer Arms Corp. Poland, on November 18, 2002.19 The founder, Michael Michalczuk, initially saw an opportunity in a market far removed from military-style rifles. The company’s first products were high-quality, Greener-style side-by-side shotguns with exposed hammers, specifically intended for the Cowboy Action Shooting community in the United States.17 This origin demonstrates that the company’s initial core competency was in traditional sporting arms, not in the mass production of high-stress, semi-automatic military rifles.

The Radom Connection

The company’s trajectory shifted dramatically in 2004 when it moved its Polish operations into facilities located on the grounds of the former Circle 11 factory in Radom.19 Pioneer Arms purchased two buildings at the old plant, totaling over 50,000 square feet, and hired many of the original employees from the Circle 11 era.19 This move was more than a real estate transaction; it was a strategic acquisition of legacy.

Crucially, PAC also acquired the complete sets of original technical specification documents for firearms previously produced by the Circle 11 factory. This technical data package included blueprints for the AK-47, AKM, Tantal, Beryl, PPS-43, and PM-63, along with the legal rights to produce these weapons.20 This acquisition formed the technical and legal foundation for their pivot towards the military surplus and civilian AK markets. Their first major success in this new area was converting new-old-stock PPS-43 submachine guns into semi-automatic PPS-43C pistols for the U.S. market, which proved to be a huge hit.21 Only after this, and with the purchase of advanced CNC machinery, did the company launch into the full, new-parts production of Kalashnikov clones.18

This history reveals a clear progression: from sporting shotguns to surplus conversions, and finally to new-manufacture AKs. This learning curve, particularly the jump to producing the high-stress components of an AK from scratch, is essential context for understanding the quality control issues that would later plague the brand.

The Bifurcated Corporate Structure

The Pioneer Arms enterprise operated as two distinct but symbiotic entities:

- Pioneer Arms Corp. (Radom, Poland): This is the manufacturing arm. All firearms and major components are produced at this facility in Radom.2 Based on its still-active website and contact details, this Polish entity appears to remain operational.2

- Pioneer Arms USA (Florida): This was the American import, distribution, and service arm. Based in Florida, this entity was responsible for importing the Polish-made components, performing the necessary assembly with U.S.-made parts to comply with Section 922r of the Gun Control Act, marketing, sales, and handling all warranty claims.1

This structure is common for foreign manufacturers selling in the U.S., but it also creates a critical point of failure. The health of the brand in its largest market is entirely dependent on the viability of the U.S. importer.

The Collapse of the U.S. Operation

In September 2024, the U.S. arm of the company collapsed. The closure was announced abruptly via social media. A post on the company’s Facebook page on September 18, 2024, stated plainly, “Pioneer is closed….. out of business”.1 A subsequent post warned customers to stop making purchases from the website, as they would not receive products and might not get refunds, stating, “there are no more pioneer employees”.1

The news was confirmed by Jay “CJ” Johnson, the former vice president of Pioneer Arms USA, who posted online that the owner had informed all employees they were fired and the company was closing its doors.1 Further evidence of the shutdown can be seen on the official U.S. website, pioneerarmsus.com, which now displays an “under construction” message and provides only a single email address for warranty issues, wa******@***********us.com.22

The failure of the U.S. operation is a distinct event from the status of the Polish manufacturing plant. However, its impact on the American market is total. Without an importer, no new Pioneer Arms products can legally enter the country. Furthermore, the dissolution of the entity responsible for warranty and customer service leaves existing owners in a precarious position, with little recourse for repairs or support. This collapse represents a significant market failure and creates a major disruption for the brand’s past, present, and future in the United States.

Section III: A Tale of Two Reputations – Brand Sentiment Analysis

The market sentiment surrounding Pioneer Arms is not a monolith; it is a fractured and deeply polarized narrative. It is impossible to analyze the brand without first understanding the single most critical factor that divides its history and reputation: a fundamental change in manufacturing metallurgy. The story of Pioneer Arms’ reputation is a tale of two trunnions, compounded by a marketing strategy that bred deep-seated distrust among the most dedicated segment of its target market.

The Original Sin: Cast Trunnions

From an engineering perspective, the front trunnion is the heart of a stamped-receiver AK-pattern rifle. It is the critical component that contains the barrel, houses the locking lugs for the rotating bolt, and absorbs the immense, repeated stress of firing. The original Soviet design, and the standard for every military-issue AKM produced since, specifies that this part must be made from a hammer-forged block of steel.6 Forging aligns the grain structure of the metal, creating a component with exceptional tensile and fatigue strength, capable of withstanding tens of thousands of violent firing cycles without deformation or failure.25

In its initial foray into AK manufacturing, Pioneer Arms deviated from this standard and used cast front trunnions. Casting involves pouring molten metal into a mold. While it is a cheaper and easier method for producing complex shapes, it results in a metal part with a random, non-directional grain structure. This can lead to internal voids, porosity, and inherent brittleness, making it fundamentally unsuited for a high-stress application like an AK trunnion.6

The market’s reaction to this was swift and brutal. As these cast-trunnion rifles entered the hands of American shooters, reports of catastrophic failures began to surface. The internet and firearms forums filled with accounts and images of cracked trunnions and dangerously excessive headspace. The brand became synonymous with terms like “pot metal,” “cheap,” “dangerous,” and “hand grenade”.4 This was not merely an issue of poor fit and finish; it was a fundamental safety concern. The use of cast trunnions became Pioneer’s “original sin,” cementing a reputation for producing unsafe, low-quality firearms that put the user at risk. This perception became the single greatest obstacle to the brand’s acceptance.

The Forged Redemption? A Shift in Production and Perception

Facing overwhelming and persistent criticism, Pioneer Arms eventually responded by changing its manufacturing process. The company began producing its AK-pattern firearms with forged front trunnions, explicitly advertising this feature in models like the “Forged Series,” “Sporter Elite,” and “Hellpup Pro”.7 This was a clear and direct admission of the market’s concerns and an attempt to rectify the core engineering flaw of their earlier products.

This shift has led to a noticeable, albeit incomplete, change in market sentiment. A growing number of reviews and user testimonials for these newer, forged-trunnion models report that the firearms are functional and reliable. Owners have documented running thousands of rounds through the rifles without the failures that plagued the cast versions, and tests have shown them to maintain proper headspace.7 However, this improving sentiment is heavily caveated. Deep skepticism remains within the enthusiast community, and even positive reviews often come with a warning about the company’s past. The brand’s history is so tarnished that many potential buyers remain unwilling to trust them, regardless of the new specifications. The narrative has shifted from “all Pioneer AKs are bad” to “make sure you get a new forged one,” but the reputational damage lingers.

The “Radom Conflation” and Credibility

Compounding the engineering-based criticism is a widespread perception of deceptive marketing. Pioneer Arms has consistently and heavily leveraged its location in Radom and its use of former Circle 11 facilities, employees, and technical data in its branding.20 This marketing creates a deliberate, if implicit, association with the storied legacy of the state-owned FB “Łucznik” Radom arsenal.

However, the knowledgeable AK enthusiast community—a core segment of their target market—is acutely aware that Pioneer Arms is a separate, private entity with no formal lineage to the original Circle 11.15 This has led to accusations of the company “using VERY deceptive language to trick people” and “pretending to be associated with FB Radom”.7 This perceived dishonesty has created a significant credibility problem. For many serious collectors and shooters, the issue is one of integrity; they distrust the company on principle, independent of the product’s mechanical quality. This failure in brand management has alienated the very “influencer” class of consumers whose validation is crucial for building a positive reputation in the firearms community.

Table: Overall Brand Sentiment Matrix

| Category | Positive Drivers / Sentiment | Negative Drivers / Sentiment |

| Manufacturing & Engineering | Introduction of forged trunnions on newer models, directly addressing the primary safety and quality concern.7 Use of nitrided barrels and improved triggers on some models.27 | Legacy of using dangerously inadequate cast trunnions, leading to catastrophic failures and an enduring reputation for being unsafe (“hand grenades”).4 Reports of inconsistent QC, such as poor rivet work and canted sights on early models. |

| Marketing & Branding | Successfully established a brand identity in the budget AK sector. Niche products like the PPS-43C are well-regarded in their category.10 | Perceived deceptive marketing by conflating the brand with the historical FB Radom “Circle 11” arsenal, leading to a loss of credibility with knowledgeable consumers.7 |

| Price & Value | Positioned as one of the most affordable entry points into the AK platform, offering a low cost of ownership for a “beater” or range gun.30 | The low price is seen by many as indicative of low quality. The risk of receiving a poor-quality rifle negates the value proposition for many buyers, who prefer to spend slightly more on a proven brand.4 |

| Customer Experience & Support | Some reports of the company honoring warranties and fixing issues on newer models prior to the U.S. closure.32 | The collapse of Pioneer Arms USA in September 2024 has effectively eliminated warranty and customer support for the U.S. market, creating a major risk for current and potential owners.1 |

Section IV: Product Line Analysis – A Model-by-Model Assessment for the U.S. Market

A granular analysis of Pioneer Arms’ product line reveals that market sentiment is not uniform across all models. The reception of their firearms varies dramatically based on the type of weapon, its historical context, and, most importantly, its underlying construction. The following is a model-by-model assessment of the products offered in the U.S. civilian market.

1. AKM Sporter / Classic Rifle (7.62×39mm & 5.56×45mm NATO)

- Technical Profile: The Sporter is Pioneer’s flagship product, a semi-automatic rifle based on the AKM pattern. It features a standard 1.0mm stamped receiver and a 16.3-inch barrel, which is nitrided in some versions for improved corrosion resistance.29 It has been offered in numerous configurations, including fixed polymer or laminate wood stocks, as well as an under-folding stock variant.30 Later, higher-tier models marketed as “Sporter Elite” or simply “Forged” were introduced, featuring the critical upgrade to a forged front trunnion, and often an improved, polished fire control group.27

- Sentiment Analysis: This model is the epicenter of the brand’s controversy and the clearest example of its bifurcated reputation.

- Negative: The early cast-trunnion Sporter rifles are universally condemned within the serious AK community. They are considered fundamentally unsafe due to the high risk of trunnion failure, which could lead to a catastrophic out-of-battery detonation.4 Beyond the trunnion, common complaints for this era of production included poorly pressed rivets, canted front sight blocks, and general rough fit and finish. These rifles are often cited as prime examples of what to avoid when purchasing an AK.

- Mixed/Improving: The introduction of forged-trunnion models marked a significant turning point. Owners and reviewers of these later Sporters report vastly different experiences. The rifles are generally found to be reliable, cycling various types of ammunition without issue.8 Accuracy is typically reported in the 2.5 to 3.5 MOA range with quality ammunition, which is perfectly acceptable and standard for a service-grade AKM.27 Long-term video reviews have shown the rifle can endure thousands of rounds, though sometimes with cosmetic wear or minor issues like a loose top cover.35 Despite these improvements, the shadow of the past looms large. Even positive reviews are often qualified with a warning about the brand’s history, and deep skepticism remains prevalent in online forums.4

- Analyst’s Note: The Sporter rifle is the ultimate “buyer beware” product in the Pioneer Arms catalog. Its value proposition is as a low-cost entry into the AK platform, but this comes with immense reputational baggage. Any potential buyer must verify they are purchasing a recent-production, forged-trunnion model. Without this verification, the rifle should be considered unsafe. Given the defunct status of the U.S. importer, purchasing even a forged model now carries the risk of zero factory support.

2. Hellpup / Hellpuppy Pistol (7.62×39mm)

- Technical Profile: The Hellpup is an AKM-pattern pistol, featuring a shorter 11.7-inch barrel and no stock, making it a more compact package.37 Because it is legally classified as a pistol, it can be imported from Poland without being subject to the same stringent 922r parts-count compliance as rifles, meaning more of the firearm is of Polish origin.37 The sentiment arc for the Hellpup directly mirrors that of the Sporter rifle. Early models were built with cast trunnions, while later versions, often branded “Forged” or “Hellpup Pro,” feature forged trunnions.39 The “Pro” models are a notable market adaptation, often including a rear 1913 Picatinny rail on the trunnion to facilitate the easy mounting of pistol braces.39

- Sentiment Analysis:

- Negative: The Hellpup was initially panned for the same reasons as the Sporter: the use of cast trunnions made it a risky and potentially dangerous firearm.26 It was often unfavorably compared to its direct competitors like the Romanian Draco and Serbian Zastava M92, being labeled an inferior clone. Some reviews have also noted poor ergonomic choices, such as sharp edges on the rear plate used for mounting buffer tube-style braces.43

- Mixed/Improving: As with the rifle, the shift to forged trunnions has improved the Hellpup’s reputation among those willing to try the newer models. It is frequently praised for having a surprisingly good trigger out of the box, often measuring a smooth 4.5 pounds, which is superior to many factory AK triggers.38 Users of the forged models report them to be fun, reliable, and powerful compact firearms, with some claiming thousands of rounds fired without malfunction.44 Nonetheless, the negative legacy persists, and many experienced AK buyers would still recommend established alternatives like the WBP Mini Jack or Zastava M92 over the Hellpup.42

- Analyst’s Note: The Hellpup competes in the very popular and crowded AK pistol segment. Its potential for success is entirely contingent on its ability to overcome the reputation of its predecessors. The introduction of the “Pro” model with an integrated Picatinny rail was a savvy move to appeal to modern shooters. However, the Pioneer Arms brand name remains a significant handicap in a market with trusted, high-quality alternatives.

3. PPS-43C Pistol (7.62×25mm Tokarev & 9×19mm)

- Technical Profile: This firearm is a semi-automatic, closed-bolt pistol conversion of the iconic Soviet PPS-43 submachine gun from World War II.21 It is constructed with a stamped steel receiver and features the original’s folding stock, which has been permanently welded in the closed position to comply with U.S. regulations defining a pistol.45 It was offered primarily in the original 7.62x25mm Tokarev chambering, with a less common 9x19mm variant also produced.45

- Sentiment Analysis: Largely Positive to Neutral. The PPS-43C is generally well-regarded within its niche.

- Praise: It is viewed by consumers as an affordable and enjoyable way to own a piece of military history.9 The historical aesthetic is a major selling point. The firearm’s substantial weight (over 8 pounds loaded) effectively mitigates recoil, making it a very pleasant and fun gun to shoot, or “plink” with.45

- Complaints: The criticisms directed at the PPS-43C are rarely about its fundamental quality or safety. Instead, they focus on the legally mandated modifications. The permanently welded stock is a significant frustration for enthusiasts who wish to register the firearm as a Short-Barreled Rifle (SBR) and restore its original functionality.45 Some users have also reported issues with the trigger failing to reset or experiencing light primer strikes, which may be inherent challenges in converting a simple, open-bolt submachine gun design to a more complex closed-bolt semi-automatic action.46

- Analyst’s Note: The PPS-43C is arguably Pioneer’s most successful product from a reputational standpoint. It succeeds because it occupies a specific niche with very little direct competition and is judged by a different set of standards. Consumers buy it as a historical novelty and a range toy, not as a primary defensive weapon. Its flaws are seen as quirks of its design and legal status, rather than markers of poor manufacturing.

4. PM-63C “RAK” Pistol (9×18mm Makarov)

- Technical Profile: The PM-63C is a semi-automatic, closed-bolt conversion of the unique Polish PM-63 “RAK,” a Cold War-era machine pistol often considered an early Personal Defense Weapon (PDW).47 Built using a mix of original Polish parts and a new semi-auto receiver, it shares the same legal constraints as the PPS-43C: the collapsing stock is welded closed, and the folding vertical foregrip is typically pinned or blocked to prevent its use, thereby maintaining its legal status as a pistol.32

- Sentiment Analysis: Mixed with Niche Appeal. The PM-63C is a much more polarizing firearm than its PPS-43C stablemate.

- Praise: The weapon is highly desirable to a specific subset of collectors fascinated by unique and obscure Cold War firearms.47 For these enthusiasts, it represents one of the only avenues to own a semi-automatic version of this iconic Polish design. When a good example is acquired, it is described as a unique and fun shooter.

- Complaints: This model appears to suffer from more significant and frequent quality control problems than the PPS-43C. There are multiple reports of receiving “lemon” firearms with out-of-the-box defects, most notably trigger groups that fail to function correctly and loose parts like the rear sight.49 Furthermore, converting one to an SBR is described as a major and difficult undertaking, requiring significant modification to the receiver beyond simply breaking a weld.32

- Analyst’s Note: The PM-63C is a high-risk, high-reward purchase suitable only for a dedicated and mechanically inclined collector. The inherent complexity of the original PM-63 design, combined with the challenges of a semi-auto conversion, seems to have pushed the limits of Pioneer’s manufacturing consistency. Receiving a defective unit, referred to as a “lemon” by one user, is a real possibility, and the closure of the U.S. service arm makes this a significant financial gamble with no clear path to resolution.49

Table: Pioneer Arms Model Comparison & Sentiment Scorecard

| Model | Model Type | Key Feature(s) | Primary Praise (Sentiment) | Primary Complaint (Sentiment) | Direct Competitor(s) | Analyst’s Sentiment Score |

| AKM Sporter | Semi-Auto Rifle | Forged trunnion (newer models), low price point. | Affordable entry-level AK, reliable if a forged model. | Legacy of unsafe cast trunnions, inconsistent QC, brand distrust. | Century WASR-10, PSAK-47, Century VSKA | Highly Negative (Cast) / Cautiously Neutral (Forged) |

| Hellpup Pistol | Semi-Auto Pistol | Compact size, forged trunnion & rear rail (Pro models). | Fun, compact, good trigger for the price (forged models). | Same unsafe legacy as Sporter, poor ergonomics on some brace mounts. | Zastava M92, WBP Mini Jack, Century Draco | Highly Negative (Cast) / Cautiously Neutral (Forged) |

| PPS-43C | Historical Pistol | Authentic look, affordable historical reproduction. | Fun to shoot, reliable for a novelty gun, low recoil. | Welded stock prevents easy SBR conversion, some trigger reset issues. | (Very few direct competitors) | Neutral to Positive |

| PM-63C RAK | Historical Pistol | Highly unique and collectible Cold War PDW design. | One of the only ways to own a semi-auto PM-63. | Significant QC issues, non-functional out of the box, difficult to SBR. | (No direct competitors) | Highly Mixed / Risky |

Section V: The American Kalashnikov Market – Competitive Landscape

Pioneer Arms did not operate in a vacuum. The U.S. civilian market for AK-pattern firearms is a crowded and fiercely competitive space, with established players at every price point. Understanding where Pioneer Arms fits—or fails to fit—within this landscape is crucial to analyzing its performance and reputation. Its products were positioned in the budget-to-entry-level segment, where they competed directly with both other imports and American-made alternatives.

- vs. Century Arms (WASR-10, VSKA): This is perhaps the most direct and relevant comparison. Century Arms imports the Romanian WASR-10 and manufactures the American VSKA. The WASR-10, produced in the Cugir military arsenal, has long been the benchmark for a budget-friendly, no-frills import. While notorious for cosmetic issues like rough finishes and occasionally canted sights, it is built with military-spec forged components and has a decades-long reputation as a durable “workhorse” that will function reliably under harsh conditions.51 In contrast, the US-made VSKA uses cast components and shares the same deeply negative reputation for catastrophic failures as the early cast-trunnion Pioneer rifles.54 A newer, forged-trunnion Pioneer Sporter is likely a superior firearm to a VSKA. However, against the WASR-10, Pioneer loses on the metric of proven, long-term durability and military provenance. The market generally considers a WASR-10 a safer bet and a better investment, even if it costs slightly more.

- vs. Palmetto State Armory (PSAK-47): Palmetto State Armory (PSA) is Pioneer’s chief rival in the American-made, budget-friendly AK category. Like Pioneer, PSA experienced significant early quality control issues as it learned to reverse-engineer and produce the AK platform.55 However, PSA has invested heavily in improving its products, culminating in its GF3, GF4, and GF5 generations, which all feature hammer-forged front trunnions and bolts.52 While still viewed with some skepticism by import purists, PSA has largely succeeded in building a reputation for producing reliable, affordable, American-made AKs. Crucially, PSA has a robust warranty and customer service department, giving it a massive competitive advantage over the now-defunct Pioneer Arms USA.57 A consumer choosing between a forged Pioneer and a PSAK-47 GF3 would almost certainly favor the PSA due to better company support and a more successfully rehabilitated brand image.

- vs. Zastava (ZPAP M70): The Serbian-made Zastava ZPAP M70 occupies the next tier up in the market and is widely considered the gold standard for a high-quality, mid-priced import AK. Zastava rifles are distinguished by their heavier-duty construction, featuring a thicker 1.5mm stamped receiver and a bulged front trunnion (similar to an RPK), which makes them exceptionally robust.52 They also come standard with chrome-lined, cold-hammer-forged barrels. While a ZPAP M70 is more expensive than a Pioneer Sporter, the difference in quality, durability, and reputation is substantial. Pioneer Arms does not seriously compete with Zastava on any metric other than initial purchase price. The informed buyer understands that the ZPAP M70 represents a significantly better value and a more reliable long-term investment.

- vs. WBP (Fox/Jack): Wytwórnia Broni Popiński (WBP) is another Polish manufacturer, based in Rogów, that exports premium-quality AK rifles to the U.S. market.60 WBP rifles like the Fox and Jack are celebrated for their superb fit and finish, use of new-production parts (including barrels from FB Radom), and adherence to high manufacturing standards.52 WBP represents the quality and reputation that Pioneer Arms attempted to evoke with its “Radom” marketing but failed to achieve in its execution. WBP rifles command a higher price but are considered top-tier imports, competing with brands like Arsenal, not Pioneer. The existence of WBP in the market serves to highlight the quality gap and further damages Pioneer’s claim to the legacy of Polish AK manufacturing.

This competitive analysis reveals that Pioneer Arms, even with its improved forged models, was trapped in a difficult market position. It was perceived as a low-cost alternative, likely better than the absolute worst US-made AKs (like the VSKA or products from the infamous I.O. Inc.) but demonstrably inferior in reputation, provenance, and proven reliability to standard-bearer imports like the WASR-10 and Zastava ZPAP M70.35 Its primary market niche was the budget-conscious buyer willing to accept a significant reputational risk in exchange for a lower price. The collapse of its U.S. support structure has made that risk untenable for most consumers.

Section VI: Analyst’s Conclusion and Forward Outlook

The trajectory of Pioneer Arms in the American firearms market serves as a potent case study in the interplay between manufacturing science, brand management, and consumer trust. The company’s story is not one of simple failure, but of a critical, late-stage pivot that was ultimately insufficient to overcome the damage of its initial missteps and the subsequent collapse of its U.S. operations.

Synthesized Findings

Pioneer Arms is a brand defined by a schism. Its product line and reputation are cleanly and irreconcilably divided into two eras: the pre-forged and the post-forged. The initial decision to use cast trunnions in their AK-pattern rifles was a catastrophic engineering and business error. It violated a fundamental principle of Kalashnikov design and resulted in a product that was not only of poor quality but was perceived by the market as actively dangerous. The reputation for “exploding guns” and “hand grenades” became an anchor from which the brand could never fully escape.

The subsequent transition to forged trunnions was the correct and necessary response. Evidence suggests these later models are serviceable, budget-level firearms that function as expected. However, this improvement was not enough. The brand’s recovery was fatally hampered by two additional factors. First, a marketing strategy that relied on the “Radom” and “Circle 11” legacy was seen as deceptive by the very community of dedicated enthusiasts whose approval is essential for building credibility. This created a foundational layer of distrust. Second, the abrupt closure of Pioneer Arms USA in September 2024 delivered a final, decisive blow, vaporizing all U.S.-based customer support and warranty service, and halting the supply chain.

Recommendation for the Prospective Buyer

Based on this comprehensive analysis, the following recommendations are offered:

- For Collectors of Historical Firearms:

- The Pioneer Arms PPS-43C is a Recommended purchase for its niche. It is an affordable, functional, and enjoyable reproduction of a significant WWII firearm. Its known quirks are manageable for a recreational shooter and collector.

- The Pioneer Arms PM-63C RAK is a High-Risk purchase, recommended only for the dedicated, mechanically-inclined collector who understands the potential for out-of-the-box quality control issues and is willing to accept the financial risk of a firearm with no warranty support.

- For Shooters Seeking an AK-Pattern Firearm (Sporter or Hellpup):

- Under no circumstances should any consumer purchase a Pioneer Arms AK-pattern firearm with a cast trunnion. These models should be considered unsafe.

- The newer forged-trunnion models can be functional firearms. However, given the complete lack of warranty support or customer service from the defunct Pioneer Arms USA, purchasing one at this time is Not Recommended. The risk of receiving a defective unit with no recourse for repair is unacceptably high. For a similar or slightly higher price, a buyer can acquire a Romanian WASR-10, a Serbian Zastava ZPAP M70, or an American-made Palmetto State Armory PSAK-47, all of which come from operational companies with established reputations and factory support. The marginal cost savings of a Pioneer AK are not sufficient to justify the significant risks involved.

Forward Outlook

The future of Pioneer Arms products in the United States is deeply uncertain. The Polish manufacturing facility, Pioneer Arms Corp. of Radom, may seek out a new U.S. importer to bring its products back to the American market. Should this occur, the brand would face a monumental challenge.

A successful relaunch would require more than simply finding a new distributor. It would necessitate a complete rebranding. The “Pioneer Arms” name is likely too tarnished to be salvaged in the AK community. A new importer would need to launch the products under a new brand name, aggressively market the exclusive use of forged components and other quality-control measures, and price the firearms competitively enough to entice buyers to overlook the brand’s troubled history. They would need to actively court influential reviewers and endure years of intense scrutiny to slowly build the trust that was so quickly squandered.

Ultimately, the fall of Pioneer Arms USA is a cautionary tale. It demonstrates that in a mature and savvy consumer market like the American firearms community, initial quality is paramount, and reputation, once shattered, is incredibly difficult—and perhaps impossible—to fully rebuild.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Pioneer Arms Seems to Have Gone Belly Up :: Guns.com, accessed August 3, 2025, https://www.guns.com/news/2024/09/19/pioneer-arms-seems-to-have-gone-belly-up

- products – Pioneer Arms Corp, accessed August 3, 2025, https://www.pioneer-pac.com/products,pr1,2

- Contact – Pioneer Arms Corp, accessed August 3, 2025, https://www.pioneer-pac.com/contact,kw,4

- [Rifle] Forged/Wood 20 Inch 7.62×39 Sporter AK Rifle – $520 : r/gundeals – Reddit, accessed August 3, 2025, https://www.reddit.com/r/gundeals/comments/195yeo2/rifle_forgedwood_20_inch_762x39_sporter_ak_rifle/

- Pioneer arms, Good or Bad? : r/guns – Reddit, accessed August 3, 2025, https://www.reddit.com/r/guns/comments/mzekb5/pioneer_arms_good_or_bad/

- AKs with Cast Trunnions Drama, accessed August 3, 2025, https://www.akoperatorsunionlocal4774.com/2015/10/aks-with-cast-trunnions-drama/

- Pioneer Arms Forged Series AK first thoughts : r/liberalgunowners – Reddit, accessed August 3, 2025, https://www.reddit.com/r/liberalgunowners/comments/1d3fllr/pioneer_arms_forged_series_ak_first_thoughts/

- Pioneer Arms Forged AK performance. : r/liberalgunowners – Reddit, accessed August 3, 2025, https://www.reddit.com/r/liberalgunowners/comments/1dzwuv0/pioneer_arms_forged_ak_performance/

- PPS-43C Polish Pistol – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=k3JS1CQFKPc

- PPS43C 9mm Pistol. Old School COOL with a Facelift! – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=x7bpC7jWJYc

- FB Radom, accessed August 3, 2025, https://www.visitradom.pl/en/fb-radom-en/

- www.visitradom.pl, accessed August 3, 2025, https://www.visitradom.pl/en/fb-radom-en/#:~:text=Work%20on%20the%20construction%20of,over%20by%20the%20Polish%20authorities.

- the factory during the german occupation – Visit Radom, accessed August 3, 2025, https://www.visitradom.pl/en/fb-during-the-german-occupation/

- The Untold Story Of The Radom Pistol Under German Occupation – American Rifleman, accessed August 3, 2025, https://www.americanrifleman.org/content/the-untold-story-of-the-radom-pistol-under-german-occupation/

- FB “Łucznik” Radom – Wikipedia, accessed August 3, 2025, https://en.wikipedia.org/wiki/FB_%22%C5%81ucznik%22_Radom

- Fabryka Broni “Łucznik” – Radom Factory Tour – Forgotten Weapons, accessed August 3, 2025, https://www.forgottenweapons.com/fabryka-broni-lucznik-radom-factory-tour/

- Fortier 7-20-12.indd – Pioneer Arms Corp, accessed August 3, 2025, http://www.pioneer-pac.com/assets/spaw2/uploads/files/SGNFortierPoland.pdf

- Hellpup from Radom – MILMAG, accessed August 3, 2025, https://milmag.pl/en/hellpup-from-radom/

- www.talkinglead.com, accessed August 3, 2025, https://www.talkinglead.com/2024/01/15/talking-lead-520-ak-korner-s6-ep1-the-ak-from-radom-pioneer-arms-corp/#:~:text=Poland%20was%20established%20November%2018,plant%2C%20with%20over%2050%2C000%20sqft.

- Talking Lead 520 – AK KORNER S6 Ep1: The AK From Radom …, accessed August 3, 2025, https://www.talkinglead.com/2024/01/15/talking-lead-520-ak-korner-s6-ep1-the-ak-from-radom-pioneer-arms-corp/

- Pioneer Arms Corp: AK from Radom – Frag Out! Magazine, accessed August 3, 2025, https://fragoutmag.com/pioneer-arms-corp-ak-from-radom/

- Pioneer Arms US is under construction, accessed August 3, 2025, https://pioneerarmsus.com/

- Pioneer Arms Reviews – Read Customer Reviews of Pioneerarmsus.com, accessed August 3, 2025, https://pioneer-arms.tenereteam.com/

- Question for AK guys… | The Armory Life Forum, accessed August 3, 2025, https://www.thearmorylife.com/forum/threads/question-for-ak-guys.12801/

- Quality Control: Forged vs. Cast Steel Parts – The Mag Life – GunMag Warehouse, accessed August 3, 2025, https://gunmagwarehouse.com/blog/quality-control-forged-vs-cast-steel-parts/

- Is the hellpup by pioneer arms any good? : r/guns – Reddit, accessed August 3, 2025, https://www.reddit.com/r/guns/comments/a5o75x/is_the_hellpup_by_pioneer_arms_any_good/

- Pioneer Arms 5.56mm Sporter Elite Rifle: Full Review – Firearms News, accessed August 3, 2025, https://www.firearmsnews.com/editorial/pioneer-arms-5-56mm-sporter-elite-rifle-review/463806

- Pioneer Arms – MGE Wholesale, accessed August 3, 2025, https://www.mgewholesale.com/ecommerce/brand.cfm?brand=305

- Firearm Review: Pioneer Arms Classic AK in 7.62×39, accessed August 3, 2025, https://smallarmsreview.com/firearm-review-pioneer-arms-classic-ak-in-7-62×39/

- Pioneer Arms Affordable 5.56 NATO Under Folder AK Rifle Review – Firearms News, accessed August 3, 2025, https://www.firearmsnews.com/editorial/pioneer-arms-556-folder-ak-rifle/505108

- Pioneer Arms Polish AK-47 7.62×39 Sporter Review – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=KocY4ql1NcY

- [Pistol] Polish PM-63C RAK Pistol – $799 + shipping : r/gundeals – Reddit, accessed August 3, 2025, https://www.reddit.com/r/gundeals/comments/1aepw9l/pistol_polish_pm63c_rak_pistol_799_shipping/

- Pioneer Arms Sporter 7.62×39 Review – SSP Firearms, accessed August 3, 2025, https://www.sspfirearms.com/2023/05/11/pioneer-arms-sporter-7-62×39-review/

- Pioneer Arms AK47 Sporter – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=QRV6KGe56Vk

- Why PAC-USA Closed & How Fox’s Polish AK Sporter Failed The Smell Test After 4k (Radom News Update) – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=G58b7GHt1sk

- Polish PAC Pioneer AKM Sporter 9 Months Later (Extended Range Review & Torture Test), accessed August 3, 2025, https://m.youtube.com/watch?v=rQu5B5PuHqk&pp=ygUHI3BhY2Zvcg%3D%3D

- Pioneer Arms Hellpup AK Pistol: Full Review – Guns and Ammo, accessed August 3, 2025, https://www.gunsandammo.com/editorial/hellpup-ak-pistol-full-review/518709

- Pioneer Arms Hellpup AK Pistol Updated: Full Review – Firearms News, accessed August 3, 2025, https://www.firearmsnews.com/editorial/pioneer-arms-hellpup-ak-pistol-review/463597

- Pioneer AK-47 Hellpup 11.7″ 7.62×39 Semi-Auto 30rd Pistol – AK0031-FTPROW, accessed August 3, 2025, https://palmettostatearmory.com/pioneer-ak-47-hellpup-11-7-7-62×39-semi-auto-30rd-pistol-ak0031-ftprow.html

- Pioneer Arms Handguns for Sale – Buds Gun Shop, accessed August 3, 2025, https://www.budsgunshop.com/search.php/type/handguns/manu/4118

- Custom (PAC) Pioneer Arms Corp. AK-47 Hellpup Pistol Variant – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=F1iHtpAEkBo

- Any thoughts on the Hellpup Pistol? Worth it to go more expensive for something like this? Any recommendations? : r/Firearms – Reddit, accessed August 3, 2025, https://www.reddit.com/r/Firearms/comments/xf3afs/any_thoughts_on_the_hellpup_pistol_worth_it_to_go/

- [Video+Review] PSA AK-104 vs. Pioneer Arms Hellpup: AK Carbine Battle, accessed August 3, 2025, https://www.pewpewtactical.com/psa-ak-104-pioneer-arms-hellpup-review/

- Pioneer Arms Hellpuppy AK Pistol – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=4IuEMt9Um94

- Gun Review: Pioneer Arms PPS-43C semi-automatic pistol in 7.62 Tokarev – Guns.com, accessed August 3, 2025, https://www.guns.com/news/review/gun-review-pps-43c-semi-automatic-pistol-in-7-62-tokarev-from-pioneer-arms

- [Video+Review] Pioneer Arms PPS43-C: Perfect Polish Pistol? – Pew Pew Tactical, accessed August 3, 2025, https://www.pewpewtactical.com/pioneer-arms-pps43-c-review/

- Pioneer Arms PM-63C Review – Firearms News, accessed August 3, 2025, https://www.firearmsnews.com/editorial/pioneer-arms-pm63c-review/384059

- PIONEER ARMS 9MM 6″ 25RD PM-63C RAK – Firearms Depot, accessed August 3, 2025, https://firearmsdepot.com/pioneer-arms-9mm-6-25rd-pm-63c-rak/

- Pioneer Arms PM-63C RAK : r/guns – Reddit, accessed August 3, 2025, https://www.reddit.com/r/guns/comments/1fqt0p1/pioneer_arms_pm63c_rak/

- Semiauto PM-63C “Rak” at the BUG Match (It’s Technically a Backup Gun…), accessed August 3, 2025, https://www.forgottenweapons.com/semiauto-pm-63c-rak-at-the-bug-match-its-technically-a-backup-gun/

- In your opinion, is the Zavasta M70 (AK) a good rifle? How would you rate its accuracy, reliability, and over all quality? Is it better than other AK’s in the same price range (PSAK, Century Arms, etc.)? – Quora, accessed August 3, 2025, https://www.quora.com/In-your-opinion-is-the-Zavasta-M70-AK-a-good-rifle-How-would-you-rate-its-accuracy-reliability-and-over-all-quality-Is-it-better-than-other-AK-s-in-the-same-price-range-PSAK-Century-Arms-etc

- Best AK-47 Rifles [Tested] – Pew Pew Tactical, accessed August 3, 2025, https://www.pewpewtactical.com/best-ak-47/

- Century WASR vs PSAK G3/4 : r/guns – Reddit, accessed August 3, 2025, https://www.reddit.com/r/guns/comments/p6a81i/century_wasr_vs_psak_g34/

- What’s a good make of AK-47 that you guys would recommend? : r/CAguns – Reddit, accessed August 3, 2025, https://www.reddit.com/r/CAguns/comments/owb4oi/whats_a_good_make_of_ak47_that_you_guys_would/

- Hello I was looking into getting an AK does anyone have recommendations for manufacturers or what type of model to get. I was think about a PSA AK but I am not sure if there quality. I have also heard good things about Zastava. : r/liberalgunowners – Reddit, accessed August 3, 2025, https://www.reddit.com/r/liberalgunowners/comments/s9iv1f/hello_i_was_looking_into_getting_an_ak_does/

- PSA AK47’s : r/PalmettoStateArms – Reddit, accessed August 3, 2025, https://www.reddit.com/r/PalmettoStateArms/comments/18k6lln/psa_ak47s/

- ZPAP M70 vs PSAK-47 GF5 – AK-47 / AK-74 – Palmetto State Armory | Forum, accessed August 3, 2025, https://palmettostatearmory.com/forum/t/zpap-m70-vs-psak-47-gf5/18096

- ZPAP M70 Underfolder AK Review: Zastava’s Serbian Red Classic Rocks – Guns.com, accessed August 3, 2025, https://www.guns.com/news/reviews/zastava-zpap-m70-underfold-ak-review

- 10 Best AK-47 Rifles & Pistols for Any Budget: Buyers Guide – Guns.com, accessed August 3, 2025, https://www.guns.com/news/best-available-ak-rifles-and-pistols-today

- WBP Fox: An AKM With Some Polish Flair – Gun Digest, accessed August 3, 2025, https://gundigest.com/gun-reviews/military-firearms-reviews/wbp-fox-an-akm-with-some-polish-flair

- Are Polish AK-47s Worth the Money? The WBP Jack Review – YouTube, accessed August 3, 2025, https://www.youtube.com/watch?v=ECneImQIXoQ