The fundamental geometry of infantry combat has remained relatively static for the better part of a century. A soldier identifies a threat, estimates the range, applies a super-elevation to the barrel to compensate for gravity, leads the target to account for movement, and holds into the wind to negate atmospheric drift. For decades, the United States Army relied on a doctrine of volume of fire and close-quarters dominance, facilitated by the 5.56x45mm NATO cartridge and passive optical aiming devices. The Global War on Terror (GWOT) reinforced this paradigm, as urban combat in Iraq and short-range ambushes in diverse environments often prioritized speed of acquisition over long-range precision. However, the strategic pivot toward Great Power Competition (GPC)—specifically the potential for conflict with near-peer adversaries like Russia and China—revealed a critical vulnerability in the American infantryman’s lethality.

Intelligence assessments indicated that modernized adversaries were fielding advanced ceramic body armor capable of defeating the 5.56mm M855A1 Enhanced Performance Round at standard engagement distances. Furthermore, potential theaters of operation in Eastern Europe or the Indo-Pacific presented engagement envelopes far exceeding the 300-meter effective point-target range of the M4 carbine. To restore overmatch, the Army initiated the Next Generation Squad Weapon (NGSW) program, selecting a high-velocity 6.8x51mm cartridge operating at chamber pressures exceeding 80,000 psi. Yet, the kinetic solution created a new problem: ballistics. While the high-velocity projectile flattened the trajectory, it did not eliminate the laws of physics. At the extended ranges of 600 to 1,200 meters envisioned by Army planners, the margin for error in aiming becomes vanishingly small. A range estimation error of just 50 meters, or a wind call off by a few miles per hour, results in a clean miss. The kinetic potential of the 6.8mm round was functionally useless without a sighting system capable of calculating the firing solution with mathematical precision under the extreme stress of combat.

This necessity birthed the Next Generation Squad Weapon-Fire Control (NGSW-FC) program. It represents not merely a procurement effort for a new scope, but a paradigmatic shift in small arms doctrine. The objective was to digitize the rifleman’s primary optic, transforming a passive glass tube into an integrated ballistic computer, environmental sensor suite, and network node. The resulting system, the XM157 Fire Control, aims to democratize the skill set of the sniper, utilizing advanced algorithms to increase the Probability of Hit (Ph) for the average infantryman. As we analyze the trajectory of this program, from the initial Prototype Project Opportunity Notice (PPON) to the selection of the commercially-rooted Vortex Optics over the defense-industrial titan L3Harris, and finally to the sobering operational realities revealed in recent testing, a complex picture emerges. It is a story of ambitious innovation, significant engineering hurdles, and the profound industrial implications of turning a rifle scope into a smart device.

2. The Acquisition Landscape: Defining the NGSW-FC Requirement

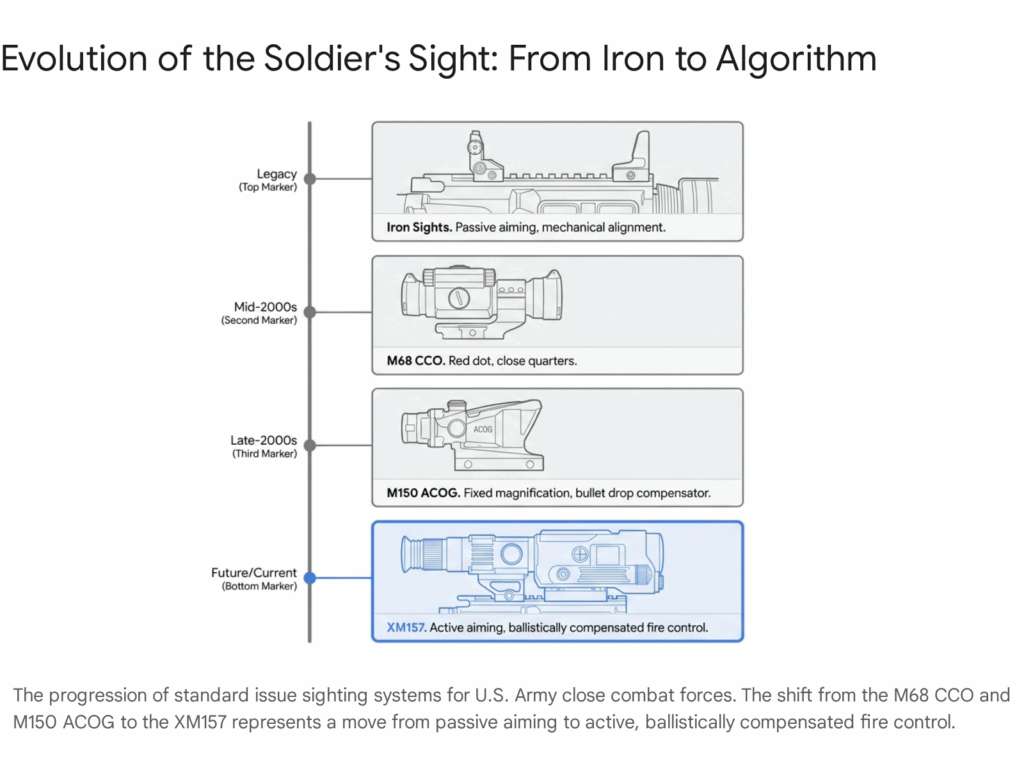

The genesis of the NGSW-FC lay in the realization that current optical solutions were reaching their theoretical limits. The standard issue optics for the Close Combat Force (CCF)—the M68 Close Combat Optic (Aimpoint CompM4) and the M150 Rifle Combat Optic (Trijicon ACOG)—operate on fixed principles. The M68 is a reflex sight offering infinite eye relief and rapid target acquisition but lacks magnification and ballistic reference points. The M150 is a 4x prism sight with a Bullet Drop Compensator (BDC) reticle. This BDC is etched with stadia lines corresponding to specific ranges, assuming a specific muzzle velocity and atmospheric density. If a soldier deploys to the high altitudes of Afghanistan, the thinner air reduces drag, causing the bullet to fly flatter and impact higher than the reticle indicates. Conversely, in dense sea-level air, the bullet drops faster. The fixed nature of the ACOG’s reticle means it cannot adapt to these environmental variables, nor can it account for windage without the soldier performing complex mental estimations known as “Kentucky Windage.”

2.1 The “Probability of Hit” (Ph) Metric and the PPON

To address these deficiencies, the US Army Contracting Command at Picatinny Arsenal issued the Prototype Project Opportunity Notice (PPON) for the NGSW-FC (Solicitation W15QKN-20-R-0448). The solicitation was driven by a single, overarching metric: Probability of Hit (Ph). In the lexicon of small arms systems engineering, Ph is the statistical likelihood that a round fired will impact the intended target. It is a function of three primary error budgets: weapon dispersion (mechanical accuracy), target acquisition error (finding the target), and aiming error (selecting the correct point of aim). The Army identified aiming error—specifically the soldier’s inability to accurately estimate range and wind—as the largest controllable variable.

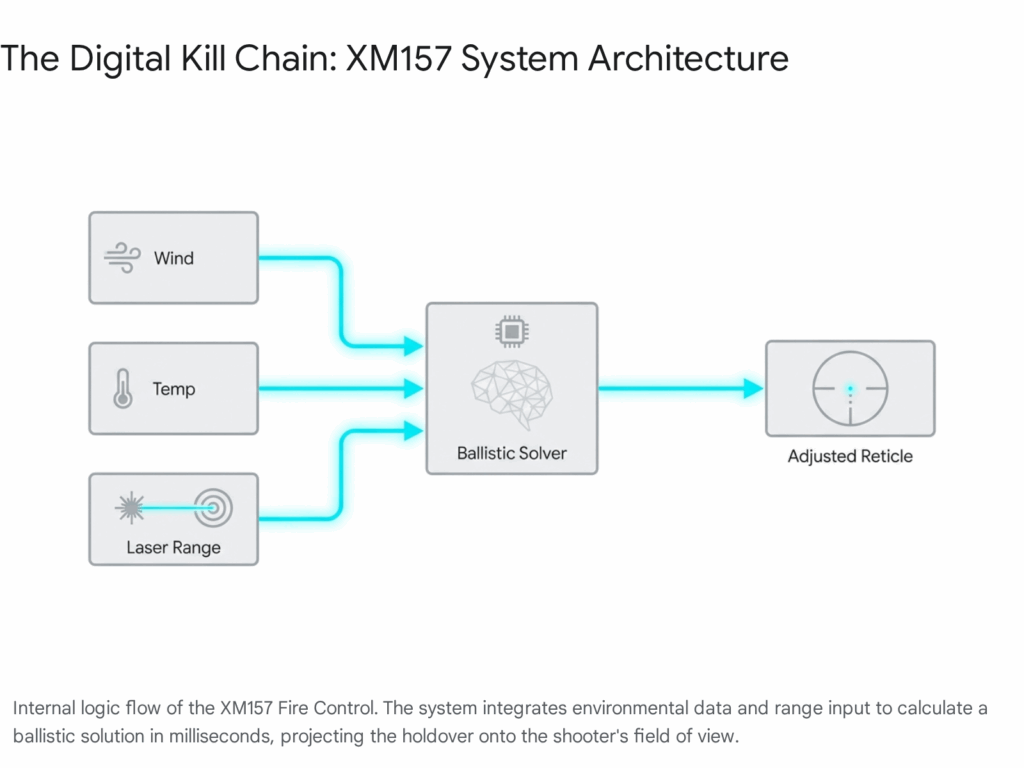

The PPON outlined a requirement for a “ruggedized fire control” that could calculate these variables for the soldier.1 The system needed to integrate a Laser Range Finder (LRF) to eliminate range estimation error, an atmospheric sensor suite to measure air density, and a ballistic calculator to compute the trajectory. Crucially, the system had to present a “disturbed reticle” or “digital overlay” that adjusted the point of aim in real-time.2 This meant that when a soldier lasered a target at 735 meters, the optic would either move the crosshair or project a new aiming dot at the precise location required to hit that target, removing the guesswork of holdovers.

2.2 Technical Thresholds and Objectives

The requirements set forth in the PPON were aggressive, pushing the boundaries of Size, Weight, and Power (SWaP) for weapon-mounted electronics. The Army demanded a Variable Magnification Optic (VMO) capable of transitioning from 1x for close quarters to high magnification (6x or 8x) for long-range identification.4 The integration of the Intra-Soldier Wireless (ISW) protocol was a mandatory objective, envisioning a future where the weapon sight communicated seamlessly with the Integrated Visual Augmentation System (IVAS) goggles, allowing soldiers to view the weapon’s sight picture through their heads-up display (HUD).5

The durability requirements were equally stringent. The system had to withstand the brutal recoil impulse of the high-pressure 6.8mm cartridge. Interestingly, the testing protocols evolved during the solicitation process. An amendment to the Prototype Test Outline reduced the weapon drop test requirement from 5 meters to 1.5 meters.7 This modification is significant; it suggests that the industry feedback indicated a 5-meter drop test for a precise optical instrument containing glass capability and sensitive electronics was technically unfeasible or would result in excessive weight armor to protect the unit. By adjusting this threshold, the Army acknowledged the engineering reality that “smart” scopes, by their nature, possess a fragility that solid chunks of aluminum do not.

3. Industry Response: The Clash of Philosophies

The competition to secure the NGSW-FC contract became a clash of two distinct industrial philosophies. On one side stood the traditional defense establishment, represented by L3Harris Technologies, a titan of military electronics. On the other stood the commercial sector disruptor, Vortex Optics, a company with massive market share in the civilian hunting and tactical world but a smaller footprint in major program-of-record acquisitions.

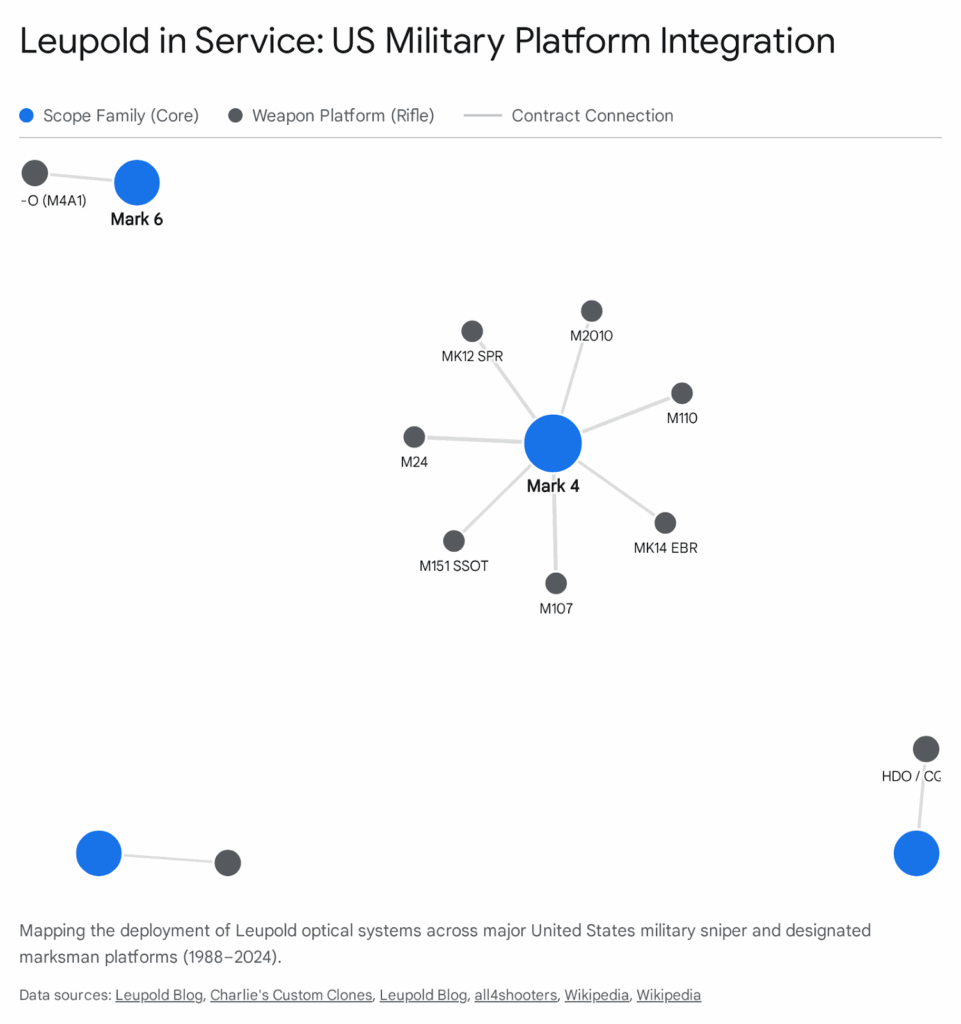

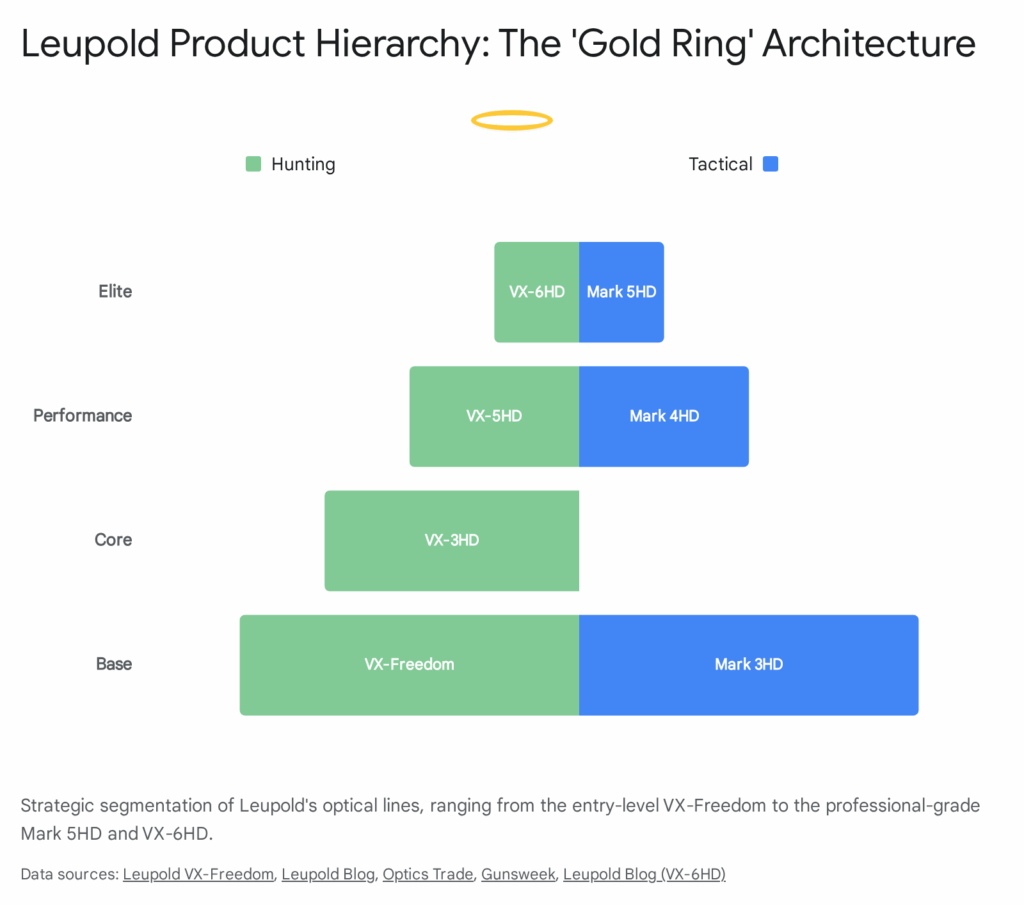

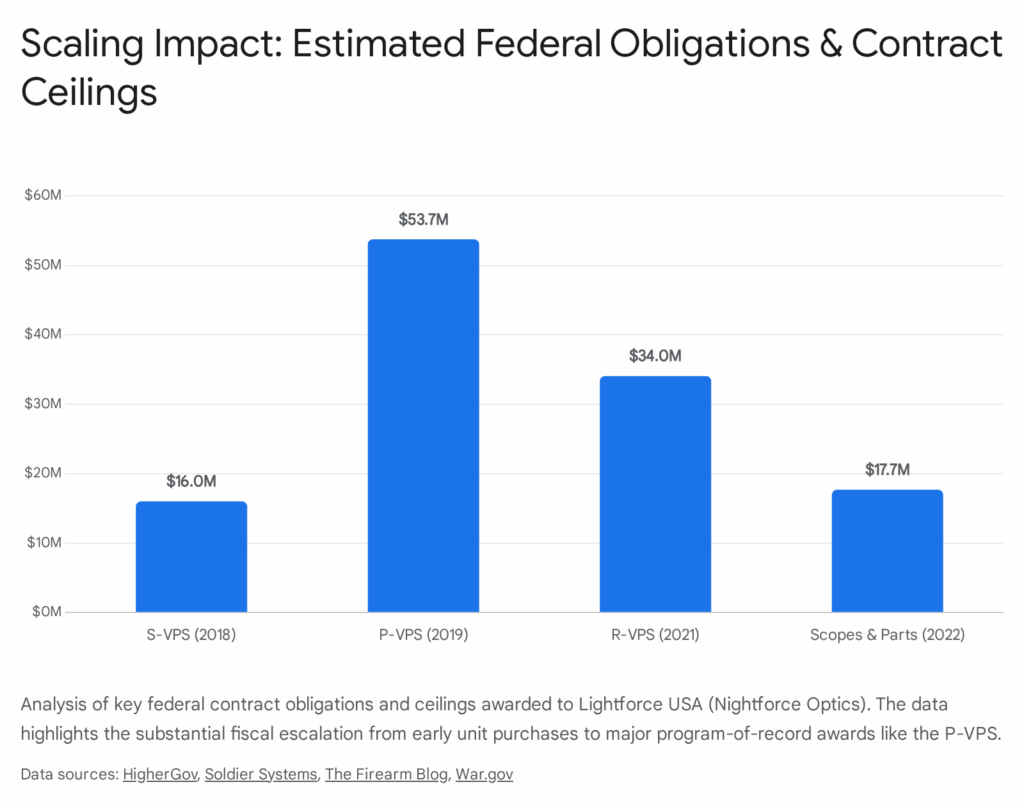

3.1 L3Harris Technologies and Leupold & Stevens

L3Harris approached the problem with the pedigree of a defense prime. Partnering with Leupold & Stevens, America’s oldest and most respected scope manufacturer, they formed a “dream team” of capability.8 L3Harris brought decades of experience in miniaturized thermal sensors, laser aiming devices (like the PEQ-15), and secure communications. Leupold provided the optical chassis and the domestic manufacturing capacity required by the Berry Amendment.

Their prototype solution leveraged this combined expertise, delivering 115 systems for evaluation.9 While specific details of their losing bid remain proprietary, industry analysis suggests their approach likely leaned heavily on existing military-grade sensor architectures integrated into a ruggedized housing. The partnership was a logical strategic move: L3Harris would handle the “brains” (the ballistic computer and sensors), while Leupold handled the “eyes” (the optical train). This approach promised a high degree of reliability and adherence to Mil-Spec standards, leveraging L3’s deep familiarity with Army acquisition processes.

3.2 Vortex Optics and Sheltered Wings Inc.

Vortex Optics, doing business as Sheltered Wings Inc., entered the fray with a solution that was radical in its commercial roots. Vortex is a dominant force in the civilian market, known for its agile supply chain and rapid product iteration cycles—traits often alien to the defense sector. Their proposal was centered around a technology they termed the “Active Reticle.”

Unlike traditional digital sights that use a camera and a screen (like a video camera), the Vortex solution maintained a “Direct View Optic” (DVO) architecture. This meant the soldier looked through physical glass lenses, preserving the clarity, resolution, and zero-latency characteristics of a traditional scope. The innovation was the integration of a transparent micro-display projected into the focal plane.1 This display could overlay data—ballistic holdovers, compass headings, and system status—directly onto the analog image. Crucially, if the battery failed, the digital overlay would disappear, but the etched glass reticle would remain, leaving the soldier with a fully functional, albeit “dumb,” 1-8x rifle scope. This fail-safe capability was a decisive factor in mitigating the Army’s fear of electronic reliance.

4. The Selection: Vortex Optics and the Commercial Disruption

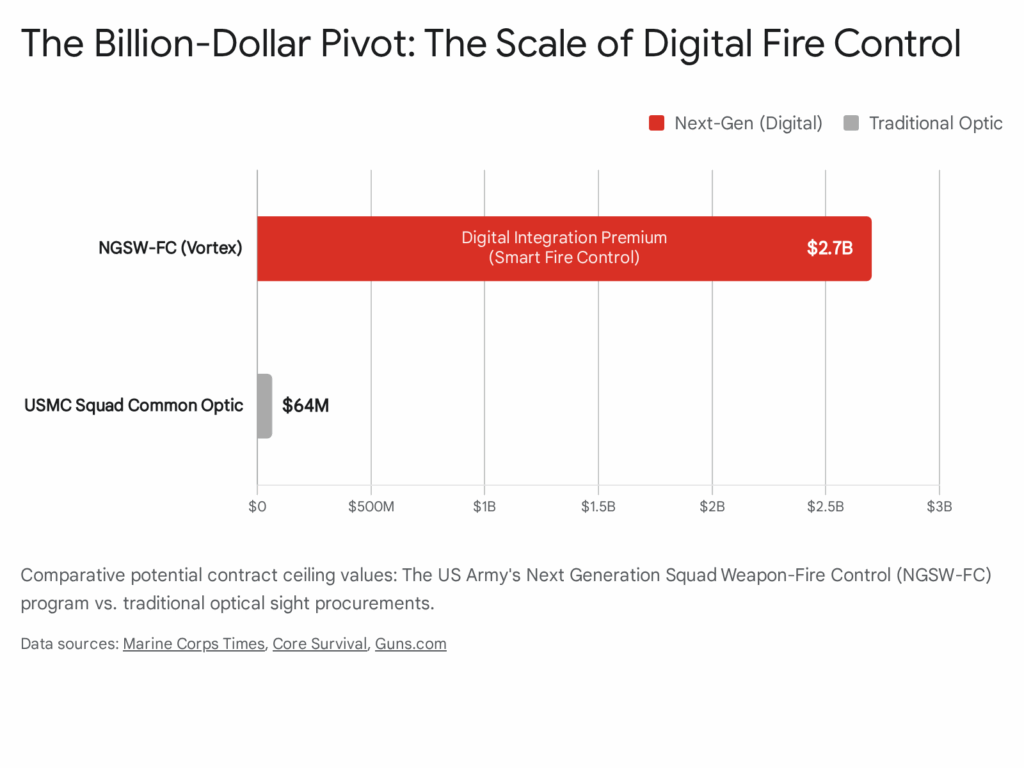

In January 2022, the Army announced the selection of Vortex Optics (Sheltered Wings Inc.) as the winner of the NGSW-FC competition, awarding a 10-year Indefinite Delivery/Indefinite Quantity (IDIQ) contract with a ceiling of $2.7 billion.1 The award covered the production and delivery of up to 250,000 XM157 systems, alongside accessories, spare parts, and engineering support.

4.1 The Economic and Strategic Rationale

The selection of Vortex over the L3Harris-Leupold team was a watershed moment in defense acquisition. It signaled a shift toward “Commercial Off-the-Shelf” (COTS) derived technologies and a willingness to embrace non-traditional defense contractors. The Army’s source selection board determined that the Vortex prototype offered the best overall balance of technical feasibility, manufacturing feasibility, and military utility.2

Financially, the contract’s $2.7 billion ceiling for 250,000 units implies a maximum programmatic unit cost of approximately $10,800.4 However, this figure is misleading as it includes the substantial costs of R&D, establishment of a new domestic manufacturing line, fielding support, and spares. The actual hardware cost is likely significantly lower, benefiting from Vortex’s commercial economies of scale. Vortex established a new manufacturing facility in Barneveld, Wisconsin, specifically to meet the domestic production requirements of the contract, creating a dedicated supply chain distinct from their overseas commercial operations.4

4.2 The “Active Reticle” Advantage

The decisive technical differentiator was likely the maturity and implementation of the Active Reticle technology. By sandwiching a digital display into the optical train of a First Focal Plane (FFP) Low Power Variable Optic (LPVO), Vortex solved the “battery anxiety” problem that plagues electronic sights.11 In a purely digital system (like a thermal scope), a dead battery renders the device a useless brick. In the XM157, a dead battery simply turns it into a standard LPVO, a piece of equipment soldiers are already comfortable using. This “graceful degradation” failure mode is a critical requirement for combat systems where logistics chains are uncertain and batteries are a finite resource.

5. Technical Architecture of the XM157

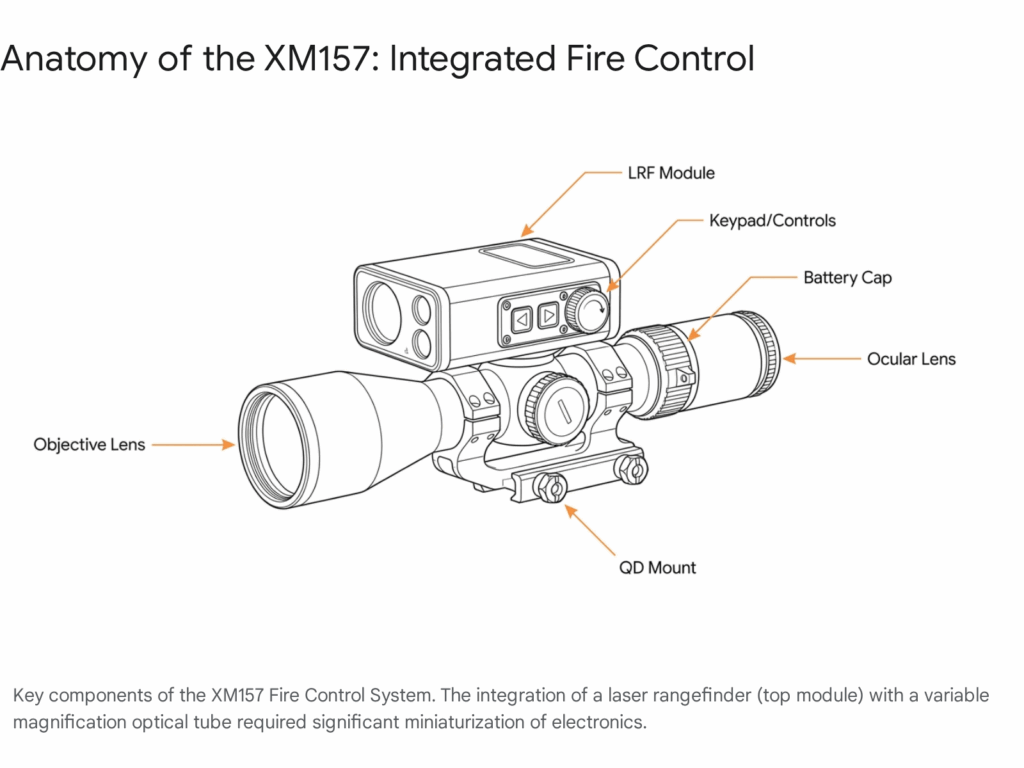

The XM157 is an engineering marvel that compresses the capability of a sniper team—spotter, rangefinder, and ballistic computer—into a single rail-mounted unit.

5.1 Optical and Display Engineering

At its core, the XM157 is a 1-8x30mm LPVO. The 1x setting allows for both-eyes-open engagement in close quarters, functioning similarly to a red dot sight. The 8x setting provides the magnification necessary to identify and engage targets at the 6.8mm cartridge’s effective range of 800+ meters. The 30mm objective lens represents a balance between light transmission and physical profile; a larger objective would offer a brighter image but would increase the height over bore and snag hazards.

The internal display is generated via a beam-splitter prism integrated into the optical path. When the ballistic calculator computes a firing solution, it drives the micro-display to illuminate a specific pixel or group of pixels, creating a glowing red aim point that corresponds to the correct holdover for gravity and wind.2 This overlay is dynamic; as the soldier changes magnification, the digital reticle scales or adjusts to remain accurate, a feature inherent to First Focal Plane designs.

5.2 Sensor Fusion and Computation

The “brain” of the XM157 relies on a suite of sensors to feed the ballistic solver:

- Laser Range Finder (LRF): Housed in the “box” atop the main tube, the LRF uses a laser pulse (likely 1550nm for eye safety and performance) to measure the time-of-flight to the target.1 This data is the primary input for the ballistic calculation.

- Environmental Sensors: Onboard sensors continuously monitor ambient temperature and atmospheric pressure. These variables are critical for calculating air density, which determines the aerodynamic drag on the bullet. A shift in air pressure can alter point of impact by inches or feet at extended ranges.

- Inertial Sensors: Accelerometers and gyroscopes detect the weapon’s inclination (shooting up or down hill) and cant (tilting the rifle left or right). The ballistic solver applies the cosine rule to adjust for gravity’s vector and corrects for cant error, which induces horizontal dispersion at range.1

5.3 Connectivity: Intra-Soldier Wireless (ISW)

The XM157 is designed as a network node. It features the Intra-Soldier Wireless (ISW) protocol, a low-latency, secure wireless link that connects the weapon sight to other devices on the soldier.5 This capability is primarily designed for integration with the Integrated Visual Augmentation System (IVAS). In practice, this allows the video feed from the scope to be wirelessly transmitted to the soldier’s HUD. This creates a “Rapid Target Acquisition” capability, enabling soldiers to shoot from behind cover by exposing only the weapon and viewing the target through their goggles.6 This connectivity also allows for the future sharing of target data between squad members, where a squad leader could lase a target and populate the range data on the HUDs of their team.

6. Operational Realities: The DOT&E Assessment

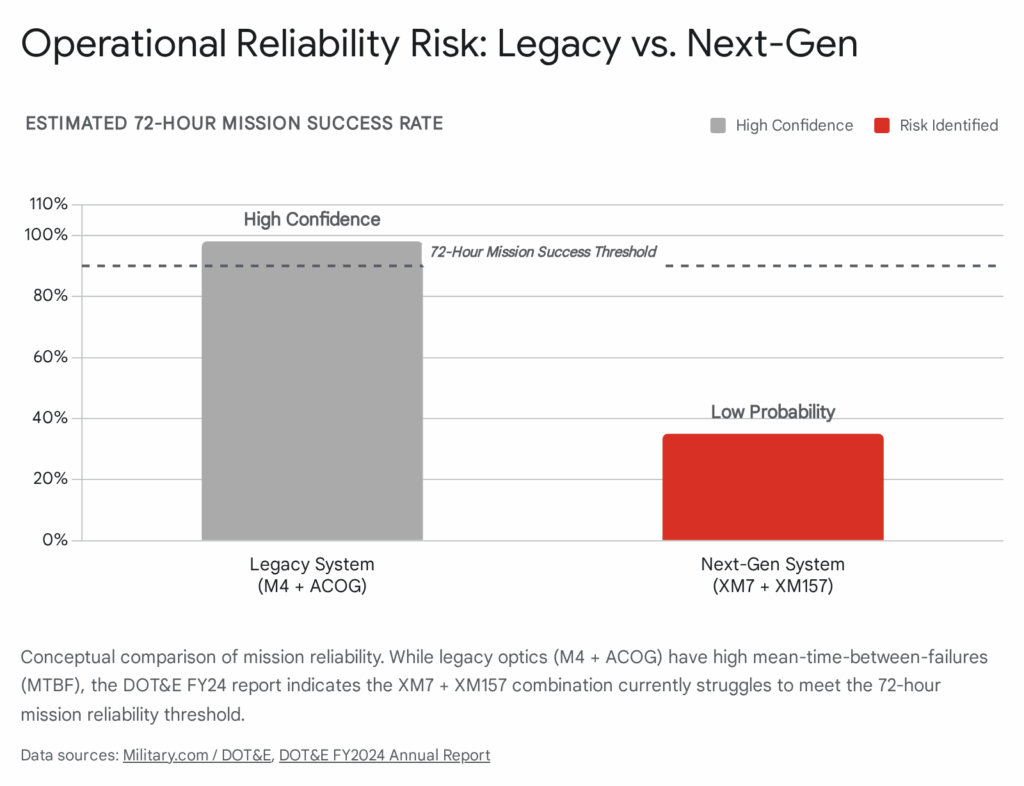

While the theoretical capabilities of the XM157 are transformative, the transition from engineering prototype to field-hardened equipment has revealed significant challenges. The Fiscal Year 2024 Annual Report from the Director, Operational Test and Evaluation (DOT&E) provides a critical assessment of the system’s current status.

6.1 Reliability Concerns and Critical Failures

The most alarming finding in the DOT&E report is the reliability of the system under simulated combat conditions. The report explicitly states that “The XM7 with mounted XM157 demonstrated a low probability of completing one 72-hour wartime mission without incurring a critical failure”.16 In the context of operational testing, a “critical failure” is defined as a malfunction that renders the system effectively unusable or unsafe, requiring maintenance actions beyond the operator’s capability to resolve in the field.

A 72-hour mission profile is a standard operational window for light infantry units, covering the duration of a typical patrol or raid cycle. The inability to reliably function for three days suggests deep-seated issues with the system’s robustness. While the unclassified report does not detail the specific failure modes, engineering analysis of similar systems points to several likely culprits. The recoil impulse of the 6.8x51mm cartridge is significantly higher than that of the 5.56mm M4. Repeated high-G shock loads can cause fatigue failures in printed circuit boards (PCBs), solder joints, and battery contacts. Furthermore, the power consumption of the LRF, onboard computer, and wireless radios may be draining batteries faster than anticipated, leading to power failures that render the “smart” features inert.18

6.2 Soldier Usability and Feedback

The DOT&E report also highlighted that “Soldiers assessed the usability of the XM157 as below average/failing”.16 This qualitative feedback points to a fundamental friction between technological capability and human cognition. The XM157 introduces a layer of complexity—menus, buttons, modes, and batteries—that does not exist with the simple red dots and ACOGs soldiers are accustomed to.

In the stress of a firefight, cognitive bandwidth is a precious resource. A system that requires a soldier to navigate a menu or troubleshoot a connection adds cognitive load. If the system is perceived as finicky or difficult to operate, soldiers will lose confidence in it, potentially reverting to using it as a “dumb” scope and ignoring the advanced features the Army paid billions to develop. Additionally, the physical burden cannot be overstated. The XM157 is larger and heavier than legacy optics. When combined with the heavier XM7 rifle and the heavier 6.8mm ammunition, the total load on the soldier increases significantly, affecting mobility and fatigue.19

7. Strategic Implications: The Algorithmic Infantry

The deployment of the XM157 signals the “iPhone moment” for small arms. Just as the smartphone consolidated the phone, camera, and GPS into one device, the XM157 consolidates the rifle sight, rangefinder, and ballistic computer. This has profound implications for the defense industry and the future of warfare.

7.1 Industrial Shift and “Module-X”

The Army’s willingness to bypass traditional primes for a commercial-focused company like Vortex suggests a desire to tap into the rapid innovation cycles of the civilian market. The commercial optics industry iterates product lines annually, whereas defense programs often span decades. By adopting an open architecture, the Army has also created a market for third-party integrations. The xTechSoldier Fire Control competition and the concept of “Module-X” envision a future where small businesses can develop specialized add-ons—such as advanced wind sensors or thermal clip-ons—that plug directly into the XM157’s ecosystem.21 This modularity prevents the system from becoming obsolete, allowing for software and hardware upgrades to be fielded incrementally.

7.2 The Democratization of Precision

Strategically, the XM157 aims to flatten the skill curve of marksmanship. Historically, hitting targets at 600+ meters was the domain of specialized designated marksmen and snipers who had undergone weeks of intensive training. The XM157 attempts to encode that expertise into silicon. If the system works as intended, any infantryman who can place a crosshair on a target and press a button can achieve a ballistic solution that previously required complex mental math. This restores the range overmatch that US forces enjoyed in previous conflicts, allowing them to engage adversaries well beyond the effective range of standard enemy weapons like the AK-74 or AK-12.

However, this reliance on algorithms brings new risks. “Smart” weapons are vulnerable to electronic warfare, cyber-attacks, and supply chain interdiction in ways that mechanical sights are not. The reliance on domestic battery production and complex semiconductor supply chains creates new points of failure in the national defense infrastructure. Furthermore, the proliferation of this technology is inevitable. Russia has already patented similar “electronic automated fire control” systems, explicitly designed to counter the XM157.23 We are entering an era of “Algorithmic Arms Racing,” where the software version on a rifle scope may be as decisive as the caliber of the bullet it fires.

8. Conclusion

The Next Generation Squad Weapon-Fire Control program is a bold, necessary, and risky modernization effort. It addresses the undeniable geometric reality that modern kinetic energy weapons have outpaced the human ability to aim them with the naked eye. The selection of the XM157 represents a triumph of commercial innovation and a recognition that the future of lethality lies in the fusion of silicon and glass.

Yet, the engineering challenges revealed by the DOT&E report—specifically the reliability failures and usability struggles—serve as a stark reminder that the battlefield is an unforgiving environment for delicate electronics. The Army’s challenge moving forward is not just to field the XM157, but to refine it into a system that is as robust as the soldiers who carry it. The vision of a networked, ballistically-enabled infantry force is within reach, but the gap between the prototype lab and the muddy trench remains the most difficult distance to bridge. The XM157 is not just a new scope; it is a test case for the digitization of the individual soldier, and the lessons learned from its deployment will shape the design of infantry systems for decades to come.

Table 1: Comparative Analysis of Standard Issue Army Optics

| Feature | M68 CCO (Aimpoint) | M150 RCO (ACOG) | XM157 NGSW-FC (Vortex) |

| Magnification | 1x (None) | 4x (Fixed) | 1-8x (Variable) |

| Aiming System | Red Dot (Reflex) | Etched BDC Reticle | Active Reticle (Digital Overlay) |

| Range Capability | 0 – 300m | 0 – 600m | 0 – 1000m+ |

| Ranging Method | Visual Estimation | Stadiametric Lines | Laser Range Finder (LRF) |

| Ballistic Comp. | None (Holdover) | Fixed (BDC) | Real-time Ballistic Solver |

| Power Source | AA Battery | Tritium / Fiber Optic | CR123A Batteries |

| Network | None | None | Intra-Soldier Wireless (ISW) |

| Est. Cost | ~$400 | ~$1,200 | ~$10,000+ (Programmatic) |

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Army awards $2.7B fire control systems contract for its Next Generation Squad Weapons, accessed December 22, 2025, https://breakingdefense.com/2022/01/army-awards-2-7b-fire-control-systems-contract-for-its-next-generation-squad-weapons/

- US Army Seeks Squad Fire Control System for Next Generation Small Arms | thefirearmblog.com, accessed December 22, 2025, https://www.thefirearmblog.com/blog/2019/01/28/us-army-seeks-squad-fire-control-for-next-generation-small-arms/

- Army receives Next Generation Squad Weapon optic from L3Harris – Task & Purpose, accessed December 22, 2025, https://taskandpurpose.com/news/army-next-generation-squad-weapon-fire-control-l3harris/

- Army Picks Vortex for Next Generation Weapon Optics – Guns.com, accessed December 22, 2025, https://www.guns.com/news/2022/01/10/army-picks-vortex-for-next-generation-weapon-optics

- Portfolio – PM SL – XM157 Next Generation Squad Weapons – Fire Control – PEO Soldier, accessed December 22, 2025, https://www.peosoldier.army.mil/Equipment/Equipment-Portfolio/Project-Manager-Soldier-Lethality-Portfolio/XM157-Next-Generation-Squad-Weapons-Fire-Control/

- DOT&E FY2021 Annual Report – Integrated Visual Augmentation System (IVAS), accessed December 22, 2025, https://www.dote.osd.mil/Portals/97/pub/reports/FY2021/army/2021ivas.pdf?ver=FZDivGDiByhjV9U-NnM9dQ%3D%3D

- Prototype Project Opportunity Notice (PPON) for Next Generation Squad Weapons (NGSW), accessed December 22, 2025, https://sam.gov/opp/e31a67310e833d2d5fcbcdc3aaa54897/view

- Leupold and L3 Team Awarded Contract to Deliver Prototypes to U.S. Army For Next-Gen Squad Weapon Fire Control Solution, accessed December 22, 2025, https://www.leupold.com/blog/post/leupold-l3-awarded-contract-deliver-prototypes-us-army-next-gen-squad-weapon-fire-control-solution

- Army Names Firms Selected to Make High-Tech Sighting Prototypes for NGSW | Military.com, accessed December 22, 2025, https://www.military.com/daily-news/2020/04/22/army-names-firms-selected-make-high-tech-sighting-prototypes-ngsw.html

- L3Harris: Optics prototype for NGSW – SPARTANAT.com, accessed December 22, 2025, https://spartanat.com/en/l3harris-optik-prototyp-fuer-ngsw

- Vortex Optics XM157 Overview: The Next Generation Squad Weapon-Fire Control (NGSW-FC) – GunsAmerica, accessed December 22, 2025, https://gunsamerica.com/digest/vortex-optics-xm157-overview-the-next-generation-squad-weapon-fire-control-nsgw-fc-2/

- Prototype Project Opportunity Notice (PPON) Next Generation Squad Weapons (NGSW) – AWS, accessed December 22, 2025, https://imlive.s3.amazonaws.com/Federal%20Government/ID238781524377771311451257352737390769977/NGSW_PPON_Amendment_1.pdf

- Ep. 220 | Army selects Vortex® for Next Generation Squad Weapon – Fire Control. What is it? – YouTube, accessed December 22, 2025, https://www.youtube.com/watch?v=y7NLMU1JZkY

- ISW Protocol Specification – AWS, accessed December 22, 2025, https://imlive.s3.amazonaws.com/Federal%20Government/ID432307301742870717393058329383741040/Attachment%2009%20ISW_SolNet_Protocol_FinalDraft.pdf

- RADAR, EO/IR, C-UAS, NIGHT VISION AND SURVEILLANCE UPDATE, accessed December 22, 2025, https://battle-updates.com/update/radar-eo-ir-c-uas-night-vision-and-surveillance-update-227/

- Soldiers Give the Army’s New Rifle Optic Low Ratings – Military.com, accessed December 22, 2025, https://www.military.com/daily-news/2025/02/04/armys-new-rifles-have-optic-problem.html

- DOT&E FY2024 Annual Report – Army – NGSW – Director Operational Test and Evaluation, accessed December 22, 2025, https://www.dote.osd.mil/Portals/97/pub/reports/FY2024/army/2024ngsw.pdf

- Vortex Gets $20 Million Contract for XM157 NGSW-FC Optic – Accurate Shooter Bulletin, accessed December 22, 2025, https://bulletin.accurateshooter.com/2022/02/vortex-gets-20-million-contract-for-xm157-ngsw-fc-optic/

- Army Captain shreds New experimental XM7 rifle, says its “unfit for modern service” – Reddit, accessed December 22, 2025, https://www.reddit.com/r/Firearms/comments/1kjijxs/army_captain_shreds_new_experimental_xm7_rifle/

- Army Captain Slams New XM7 Rifle As “Unfit,” Sig Sauer Says Otherwise (Updated), accessed December 22, 2025, https://www.twz.com/land/army-captain-slams-new-xm7-rifle-as-unfit-sig-sauer-says-otherwise

- The Army xTech Program – xTechSoldier Fire Control Announcement 1, accessed December 22, 2025, https://xtech.army.mil/wp-content/uploads/2025/02/xTechSoldier-Fire-Control-RFI_FINAL.pdf

- xTechSoldier Fire Control – xTechSearch – U.S. Army, accessed December 22, 2025, https://xtech.army.mil/competition/xtechsoldier-fire-control/

- Russian Smart Scope System – Their Answer To The XM157 | thefirearmblog.com, accessed December 22, 2025, https://www.thefirearmblog.com/blog/russian-smart-scope-system-their-answer-to-the-xm157-44819620