O.F. Mossberg & Sons stands as a singular entity in the American firearms landscape: the oldest family-owned and operated firearms manufacturer in the United States. While competitors have undergone corporate consolidations, bankruptcies, and private equity acquisitions, Mossberg has maintained a direct lineage of ownership and operational philosophy from its founding in 1919 to the present day. This report provides an exhaustive analysis of the company’s trajectory, from its humble origins producing a four-barreled pocket pistol to its current status as the world’s dominant manufacturer of pump-action shotguns.

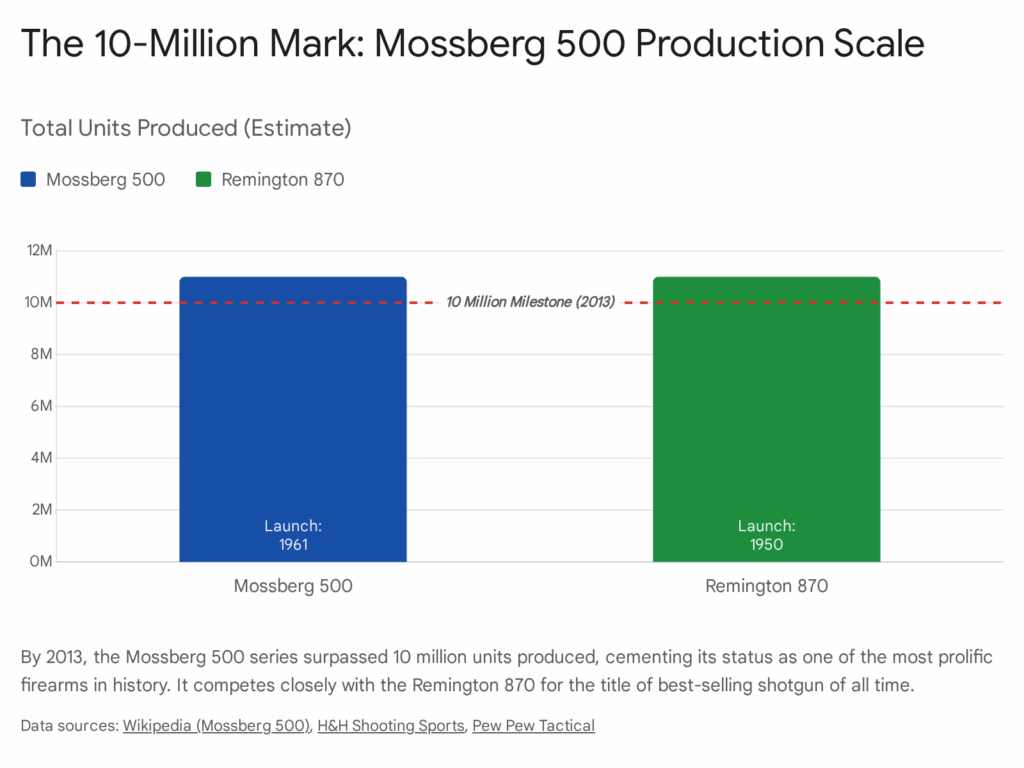

The company’s history is characterized by a specific industrial ethos: “More Gun for the Money.” This principle has driven Mossberg to democratize firearm ownership by utilizing innovative manufacturing techniques—such as investment casting and the use of aircraft-grade aluminum receivers—to lower costs without sacrificing functional reliability. This strategy allowed the Mossberg Model 500 to eventually overtake the Remington 870 in global production volume, becoming the most prolific shotgun platform in history with over 12 million units produced.

The analysis reveals that Mossberg’s longevity is attributed to three strategic pillars. First, the company successfully bifurcated its manufacturing early, establishing Maverick Arms in Texas to optimize labor and distribution costs while keeping headquarters in Connecticut. Second, Mossberg aggressively pursued military contracts, resulting in the Model 590A1 becoming the only pump-action shotgun to pass the U.S. Military’s Mil-Spec 3443E torture test. Third, the company has demonstrated remarkable agility in product development, evidenced by the creation of the “Shockwave” non-NFA firearm category and its recent successful re-entry into the handgun market after a century-long hiatus.

Looking forward, Mossberg faces a contracting post-pandemic market, with 2023 production figures showing a significant correction from historic highs. However, the company’s expansion into the “Professional Series” in 2025 and strategic partnerships with optics manufacturers suggest a pivot toward higher-margin, value-added products to offset volume declines. This report concludes that Mossberg’s vertically integrated manufacturing and debt-averse family management style position it uniquely to weather current industry headwinds.

1. Origins and the Founding Philosophy (1866–1930)

The genesis of O.F. Mossberg & Sons is inextricably linked to the broader industrial revolution of the American Northeast and the immigrant experience of the late 19th century. To understand the company’s engineering DNA, one must first examine the pre-founding career of its patriarch, Oscar Frederick Mossberg. His journey from a Swedish boiler factory to the helm of an American firearms dynasty illustrates the technical cross-pollination that defined the New England gun valley.

1.1 The Swedish Immigrant and the Northeastern Industrial Hubs

Oscar Frederick Mossberg emigrated from Sweden in 1886 at the age of 20, settling initially in Fitchburg, Massachusetts.1 This region was the Silicon Valley of its day, a hotbed of mechanical innovation and precision manufacturing. Mossberg possessed a robust mechanical aptitude, a trait common among the Scandinavian immigrants who populated the specialized machine shops of New England. His early career served as a masterclass in firearms design and mass production, distinct from the artisan gunsmithing of Europe. He did not start as an entrepreneur; he began as an innovator within established systems, absorbing the best practices of the era’s industrial giants.

By 1892, Mossberg was machining bicycle parts and components for Iver Johnson Arms & Cycle Works.1 It was here that his latent talent for firearms design was recognized. He worked directly under the tutelage of engineers developing the “Hammer the Hammer” safety mechanism, a concept that likely influenced his lifelong obsession with safety and mechanical reliability.2 In 1893, Mossberg filed his first patent for a barrel strap catch, marking his transition from machinist to inventor. This period was crucial for understanding the Mossberg philosophy: Iver Johnson was known for producing affordable, safe, mass-market firearms, not luxury goods. Oscar absorbed this market positioning—safety and reliability did not need to be expensive.

His career trajectory then took him to the C.S. Shattuck Arms Co. in Hatfield, Massachusetts, where he served as production supervisor, and later to J. Stevens Arms & Tool Co..1 These experiences were critical. At Shattuck and Stevens, Mossberg learned the economics of high-volume, low-cost manufacturing—a lesson that would become the cornerstone of his own company. He observed that while bespoke, hand-fitted firearms garnered prestige, the true market opportunity lay in providing reliable tools to the working class. He managed the production of breech-loading rifles, gaining insight into the efficiencies of simplified actions and robust extractors.

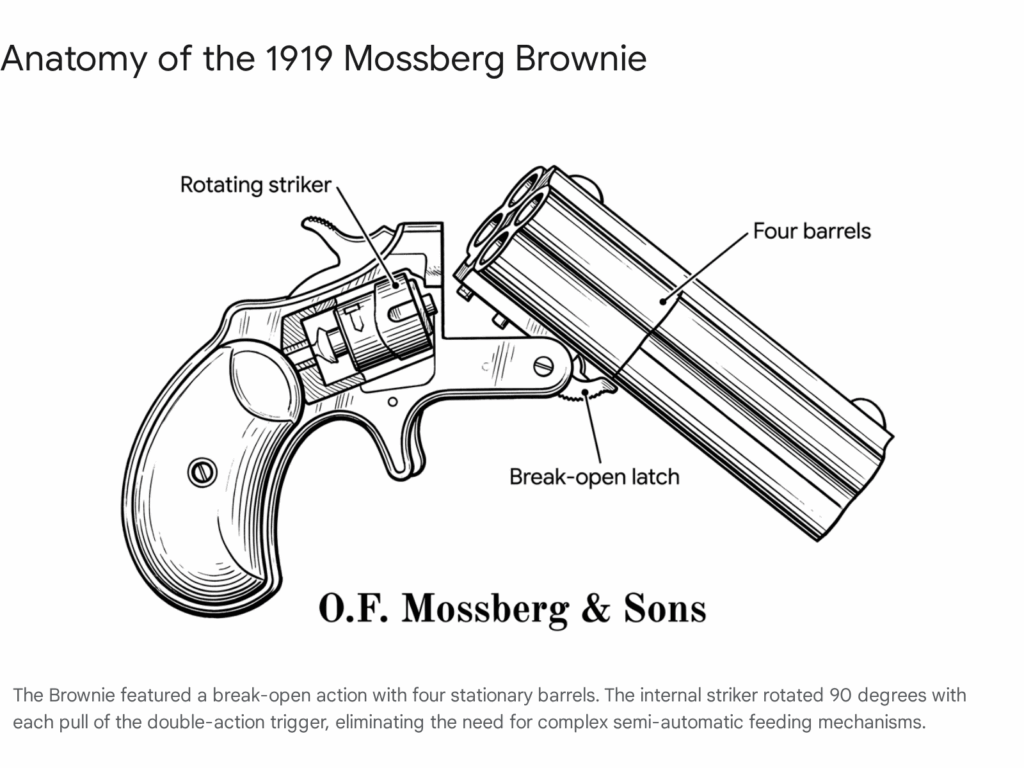

1.2 The Brownie: Innovation Born of Necessity

The catalyst for the formation of O.F. Mossberg & Sons was, paradoxically, unemployment. In 1919, following the end of World War I, Marlin-Rockwell (where Oscar and his sons were employed manufacturing machine guns) ceased military production and eventually shuttered operations.1 At 53 years old—an age when most men of his era were looking toward retirement—Oscar Mossberg, along with his sons Iver and Harold, founded the company in a rented loft on State Street in New Haven, Connecticut.4

Their debut product, the “Brownie,” was a masterstroke of market positioning. The Brownie was a four-barreled,.22 caliber pocket pistol.5 Technically, it was a “pepperbox” design, featuring a double-action trigger and a rotating firing pin that struck each of the four chambers in sequence.5 This design choice was deliberate; it avoided the complexity and potential unreliability of early semi-automatic feeding mechanisms while offering multi-shot capability.

The genius of the Brownie lay in its price and reliability. Retailing for approximately $5.00 (roughly $75 adjusted for inflation), it was marketed as “protection at a trifling sum” to trappers and hunters for dispatching trapped animals.2 Unlike complex semi-automatics of the time that were prone to jamming with cheap rimfire ammunition, the Brownie had no moving slide or feed ramp. It simply worked. Between 1920 and 1932, Mossberg produced over 30,000 to 37,000 units.1 This cash flow provided the capitalization necessary for the Mossbergs to expand into rifles. The commercial success of the Brownie validated the family’s hypothesis: the American consumer valued utility and value over ornamentation.

1.3 The Transition to Rifles and the Great Depression

Following the success of the Brownie, the company pivoted toward rifles, anticipating that the utility market (hunting and pest control) offered greater long-term stability than the pocket pistol market. In 1922, they introduced the Model K, a slide-action.22 rifle originally designed by Arthur Savage but refined by Mossberg.8 This collaboration with Arthur Savage, a titan of the industry, demonstrated that the fledgling Mossberg company was already punching above its weight class in terms of engineering capability.

The Great Depression (1929–1939) destroyed many firearm manufacturers, yet Mossberg thrived. This period solidified the company’s identity. While competitors like Winchester and Remington focused on fit and finish, Mossberg focused on feature-density per dollar. They introduced innovations such as the “Targo” smoothbore.22s for aerial target shooting and bolt-action repeaters like the Model R and Model 42.8 The company’s survival strategy was simple: produce firearms that a cash-strapped American could afford but would never feel under-gunned with. They introduced features like molded finger grooves, ramp sights, and detachable magazines on budget rifles—features often reserved for premium models by competitors. This era established the “Mossberg Man” customer profile: a practical shooter who demanded performance but refused to pay for prestige.

2. The Mid-Century Pivot and War Efforts (1930s–1950s)

The trajectory of O.F. Mossberg & Sons shifted dramatically with the onset of global conflict. The company’s ability to rapidly retool from sporting arms to military production demonstrated a manufacturing flexibility that would later become a competitive advantage. The war years transformed Mossberg from a successful civilian manufacturer into a strategic defense asset.

2.1 The Arsenal of Democracy

During World War II, the U.S. government faced a critical shortage of small arms for training purposes. It was inefficient and expensive to train new recruits on full-power M1 Garands initially; the military needed millions of rounds of.22 Long Rifle trainers to teach marksmanship fundamentals cheaply and safely. The logic was simple: a recruit who could master trigger control and sight picture on a.22 could easily transition to a.30-06 service rifle.

Mossberg answered this call with the Model 42 and Model 44 rifles.10 These were not crude implements; they were precision training instruments used by the U.S. Army and Navy. The Model 44US, in particular, became legendary for its accuracy and robust build quality. It featured a heavy barrel, target sights, and a full-sized stock that mimicked the ergonomics of a service rifle. This contract work did two things for Mossberg:

- Capital Injection: It funded the modernization of their tooling and factory capabilities, introducing higher precision machinery than was typical for budget sporting arms.

- Reputation: It introduced a generation of GIs to the Mossberg brand, associating it with military-grade reliability.10 Veterans returning home remembered the name on the barrel of the rifle they learned to shoot with.

2.2 The Post-War Sporting Boom and Innovation

Returning servicemen created a massive demand for sporting firearms in the late 1940s and 1950s. The GI Bill and the booming post-war economy meant more Americans had leisure time for hunting and shooting sports. Mossberg returned to civilian production but retained the lessons learned from war production. They introduced the Model 200, a slide-action shotgun with a nylon slide and box magazine—a precursor to modern tactical aesthetics, though it was considered “strange-looking” at the time.10

In 1959, the company introduced the Model 400 “Palomino,” a lever-action shotgun that showcased Mossberg’s willingness to experiment with different actions.9 However, the company was still searching for a flagship product that could compete with the dominance of the Remington 870 Wingmaster, which had been introduced in 1950. The market was bifurcated: high-end machined steel guns (Winchester Model 12, Remington 870) and cheap single-shots. Mossberg saw a gap in the middle for a reliable, multi-shot pump gun that utilized modern materials to cut costs.

3. The Model 500 and the Pump-Action Revolution (1961–1980)

The year 1961 stands as the most significant milestone in the company’s history after its founding. It marked the introduction of the Mossberg Model 500, a firearm that would fundamentally alter the global shotgun market and define the company’s identity for the next six decades.

3.1 Engineering the Anti-870

In 1960, O.F. Mossberg & Sons moved to a new, larger facility in North Haven, Connecticut, specifically to prepare for the launch of the Model 500.10 The design brief was clear: create a pump-action shotgun that was more reliable, more ergonomic, and significantly cheaper to manufacture than the Remington 870 or the Ithaca 37.

The engineering team, led by Carl Benson, made several radical choices that defied the conventions of the time 11:

- Aluminum Alloy Receiver: Unlike the milled steel receiver of the Remington 870, the Model 500 used an aircraft-grade aluminum alloy receiver. This reduced weight and manufacturing cost (investment casting vs. machining steel) but was initially viewed with suspicion by traditionalists who equated weight with quality. To prove its durability, Mossberg used a steel barrel extension that locked directly into the bolt, meaning the receiver experienced little to no pressure upon firing.10 This “steel-on-steel” lockup ensured that the aluminum receiver served merely as a carrier for the moving parts, not a pressure-bearing component.

- Ambidextrous Tang Safety: The Model 500 placed the safety on the top rear of the receiver. This was ergonomically superior to the cross-bolt safety of the Remington 870, as it could be operated instantly by the thumb without breaking a firing grip, for both left and right-handed shooters.10 This feature became a signature selling point, particularly for southpaws who had been ignored by other manufacturers.

- Twin Action Bars: To prevent binding during the pump stroke, the Model 500 utilized dual action bars connecting the forend to the bolt. While common now, many budget shotguns of the era used a single bar, which caused twisting and jamming if the forend was torqued during cycling.13 This ensured smooth operation even under stress.

- Easy Field Stripping: The design prioritized ease of maintenance. The trigger group could be removed by punching out a single pin, and the elevator assembly was designed to be “self-cleaning” to a degree, shedding debris through the bottom of the action.

3.2 The Race to the Bottom (in Price) and Top (in Volume)

The Model 500 was designed for mass production. It utilized stamped parts and simplified assemblies. The “Mossberg Rattle”—the characteristic sound of a Model 500 when shaken—was often derided by critics as a sign of looseness. However, Mossberg engineers argued that these looser tolerances were a feature, not a bug. They allowed the shotgun to function reliably even when fouled with dirt, sand, or debris, whereas the tighter-fitting Remington 870 could seize up under similar conditions.14 This loose tolerance philosophy mirrored the reliability doctrine of military weapons like the AK-47.

By the 1970s and 80s, the Model 500 and Remington 870 were engaged in a fierce battle for market share. Remington dominated the police and high-end sporting market with the Wingmaster, while Mossberg captured the working-class hunter and home defense market. The Model 500’s lower price point, combined with its 99% reliability rate, eventually allowed it to surpass 10 million units in production, making it the most produced shotgun platform in history.11

4. Military Adoption and Tactical Evolution (1980s–2000)

While the Model 500 was a commercial success, Mossberg sought the prestige and validation of a major U.S. military contract. The journey to military adoption would lead to the creation of the Model 590, the company’s most ruggedized platform, and fundamentally change the perception of the brand from “budget hunter” to “tactical professional.”

4.1 The Mil-Spec 3443E Challenge

In the 1970s, Mossberg submitted the Model 500 for military consideration. It initially failed the government’s Mil-Spec 3443E protocol. The military required a shotgun that could withstand brutal abuse, and the Model 500’s plastic trigger guard and plastic safety button were identified as points of failure during extreme durability testing. Furthermore, the magazine tube design of the 500 (closed at the end) made cleaning and maintenance in the field difficult, as the tube could not be easily removed or accessed for cleaning if filled with mud.14

Mossberg listened. Instead of abandoning the contract, they engineered a new shotgun based on the 500 architecture: the Model 590. Introduced in 1987-1988, the 590 was an evolution designed specifically to meet the military’s wishlist:

- Clean-out Magazine Tube: A screw-off cap allowed the user to remove the magazine spring and follower for cleaning without disassembling the receiver.14 This mirrored the design of the Remington 870 and allowed for magazine extensions to be added, increasing capacity.

- Heavy-Walled Barrel: To withstand the rigors of bayonet fighting and shipboard door breaching (specifically for the Navy), the barrel thickness was significantly increased.14 This added weight but ensured the barrel would not bend or burst under extreme stress.

- Metal Components: The plastic trigger guard and safety were replaced with aluminum versions in the 590A1 variant.14

- Bayonet Lug: A standard feature on the military models, allowing the mounting of the M9 bayonet.

The result was the Mossberg 590A1, the only pump-action shotgun to ever pass the Mil-Spec 3443E test, which included firing 3,000 rounds of full-power buckshot with zero malfunctions and surviving extreme drop tests.17 This adoption by the U.S. Army and Marine Corps was a marketing coup. It allowed Mossberg to stamp “U.S. Service Shotgun” on their marketing materials, branding the company as the premier choice for “duty” shotguns. In 2025, this relationship continued with an $11 million contract for M590A1 shotguns for the U.S. Army, proving the enduring relevance of the platform.18

4.2 The 835 Ulti-Mag: Defining the Super Magnum

Simultaneous with the military push, Mossberg revolutionized the hunting market. In 1988, they released the Model 835 Ulti-Mag. This was the first pump-action shotgun chambered for the 3.5-inch 12-gauge shell.19 The 3.5-inch shell offered payload capacities approaching that of a 10-gauge, making it devastatingly effective for turkey and waterfowl hunting.

The 835 utilized an “overbored” barrel (bored to 10-gauge dimensions inside a 12-gauge barrel) to improve pattern density and reduce recoil. This innovation forced competitors to play catch-up. Before the 835, hunters needing massive payloads had to carry heavy, expensive 10-gauge guns. Mossberg allowed them to use a standard 12-gauge platform with “magnum” capability. This solidified Mossberg’s reputation as an innovator in the hunting space, not just a budget manufacturer.

5. Strategic Manufacturing and Geographic Diversification

A critical, often overlooked aspect of O.F. Mossberg & Sons’ success is its corporate structure and manufacturing footprint. Unlike many New England gun makers who remained solely in the high-cost Northeast, Mossberg diversified geographically early on. This prescient move protected the company from the dual threats of rising labor costs and increasingly hostile state-level gun control legislation.

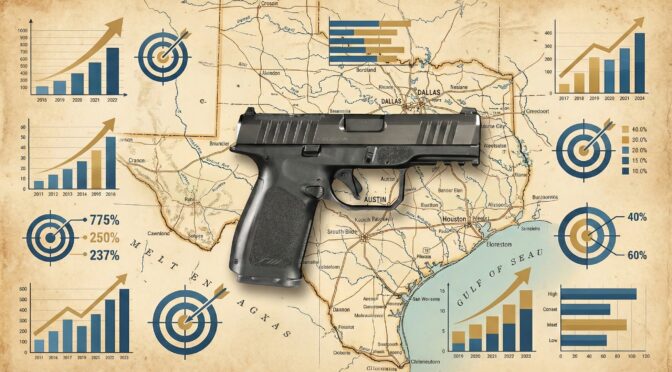

5.1 The Maverick Arms Subsidiary

In 1989, Mossberg opened Maverick Arms in Eagle Pass, Texas.20 Located on the U.S.-Mexico border, this facility was initially established to assemble the Maverick 88, a value-oriented version of the Model 500. The Maverick 88 utilized a cross-bolt safety (cheaper to make than the tang safety) and was assembled in Texas using some non-US sourced parts (often from Mexico) to keep costs rock-bottom.21

This strategy was brilliant. The Maverick 88 retailed for significantly less than the Model 500, capturing the entry-level market that Chinese imports were threatening to take over. By stripping away features like the tang safety and the drilled/tapped receiver, Mossberg created a “flanker brand” that protected the Model 500’s price point while capturing the sub-$250 market segment.

5.2 The Texas Expansion

Over the decades, the Eagle Pass facility grew in importance. In 2013-2014, following the passage of restrictive gun control legislation in Connecticut (specifically SB 1160, passed after the Sandy Hook tragedy), Mossberg faced a hostile operating environment in its home state. The company chose to vote with its feet. Mossberg invested heavily in expanding the Texas plant, adding 116,000 square feet.4

While the corporate headquarters remained in North Haven, Connecticut, more than 90% of all manufacturing was shifted to Texas.4 This move was supported by the Texas Enterprise Fund and Governor Rick Perry, who actively courted firearms manufacturers. This pivot insulated the company from political hostility in the Northeast and leveraged Texas’s lower labor costs and favorable regulatory environment. Today, Eagle Pass is the beating heart of Mossberg’s production, churning out the vast majority of the shotguns found in American retail stores.

6. Modern Diversification (2010–2019)

As the 2010s approached, the firearms market became increasingly specialized. The days of a “do-it-all” wood-stocked shotgun were fading. Shooters wanted modularity, tactical features, and specialized platforms. Mossberg responded with a series of innovations that targeted specific niches.

6.1 The FLEX System

In 2012, Mossberg introduced the FLEX System. Utilizing a Tool-less Locking System (TLS), this innovation allowed users to swap stocks, forends, and recoil pads in seconds without tools.23 A single receiver could be transformed from a tactical home defense setup (pistol grip, short forend) to a turkey hunting rig (camo stock, hunting forend) in under a minute. This modularity appealed to the “one gun, many roles” philosophy of the budget-conscious consumer and generated over 16 patents for the company.

6.2 The Patriot Rifle (2015)

After years of experimenting with tactical rifles (like the MVP series which accepted AR magazines in a bolt action), Mossberg returned to its roots with the Patriot bolt-action rifle in 2015.25 The Patriot was designed to compete with the Ruger American and Savage Axis in the budget hunting rifle category. It featured a fluted bolt, adjustable LBA (Lightning Bolt Action) trigger, and classic styling. The rifle was a commercial success, proving that Mossberg could still compete in the traditional hunting rifle market.26 The Patriot served as a platform for diversification, spawning “Predator” and “Night Train” variants that catered to varmint hunters and long-range shooters.

6.3 The Shockwave Phenomenon (2017)

Perhaps the most disruptive product of the decade was the 590 Shockwave. Released in 2017, this 14-inch barreled firearm exploited a nuance in U.S. federal gun laws. Because it was manufactured from the factory with a pistol grip (specifically the Raptor bird’s head grip) and had an overall length over 26 inches, it was classified by the ATF as a “firearm,” not a “short-barreled shotgun” (SBS).13

This meant consumers could buy a compact, formidable defensive weapon without the $200 tax stamp and 9-month wait associated with NFA (National Firearms Act) items. The Shockwave was an instant viral success, spawning an entire category of “non-NFA” firearms and forcing Remington to release the Tac-14 in response.11 It demonstrated Mossberg’s ability to innovate not just in engineering, but in regulatory compliance strategy.

7. The Return to Handguns (2019–Present)

For 100 years, O.F. Mossberg & Sons was virtually synonymous with long guns. The company had not produced a handgun since the discontinuation of the Brownie in 1932. In 2019, to celebrate its centennial, Mossberg made a strategic pivot back to pistols, entering the most crowded and competitive segment of the market: concealed carry.

7.1 The MC1sc and MC2c

The MC1sc (Subcompact) was launched in January 2019. It was a polymer-framed, striker-fired 9mm pistol designed for the concealed carry market.27 While late to the party (competing against the established Glock 43 and SIG P365), the MC1sc offered unique features, such as a clear polymer magazine (for round counting) and a safe takedown system that did not require pulling the trigger.28 The trigger system was particularly praised for its crisp break compared to the mushy triggers of competitors.

In 2020, Mossberg followed up with the MC2c (Compact), a double-stack version holding 13 or 15 rounds.29 These pistols utilized high-strength steel magazines to maximize capacity while keeping the grip thin. The MC2c was positioned as a direct competitor to the Glock 48 and 19. While Mossberg has not displaced the market leaders, the successful launch proved the company could diversify its revenue stream beyond the seasonal fluctuations of the shotgun market.

8. Current Product Portfolio and Market Position (2020–2025)

Today, Mossberg operates as a diversified manufacturer with a dominant position in the shotgun market and a growing footprint in rifles and handguns. The company has moved beyond budget offerings to high-performance competition and tactical tools.

8.1 The 940 Pro Series

In 2020, Mossberg revamped its autoloader line with the 940 Pro. Developed in collaboration with world champion shooter Jerry Miculek, the 940 Pro addressed the shortcomings of the previous 930 model. It featured a redesigned gas system with boron-nitride coated components that could run up to 1,500 rounds between cleanings (compared to the frequent maintenance required by the 930).30 By 2024-2025, the line had expanded to include dedicated Tactical, Turkey, and Waterfowl models, establishing Mossberg as a serious contender in the semi-auto market previously dominated by Italian brands like Beretta and Benelli.

8.2 2025 Innovations: The Rotary Safety

At SHOT Show 2025, Mossberg unveiled the 590R. This model broke with 60 years of tradition by replacing the top tang safety with a Rotary Safety selector (similar to an AR-15) located on the side of the receiver.32 This change was driven by the increasing popularity of pistol-grip stocks on shotguns. While the tang safety is superior for traditional stocks, it is difficult to reach with a pistol grip. The 590R solves this, showing Mossberg’s willingness to adapt its core designs to modern ergonomic trends.

Other 2025 releases included the 990 AfterShock, a semi-automatic version of the Shockwave, and the Professional Series, a line of upgraded 590A1s and 940s featuring Cerakote finishes and enhanced internal polishing.34

9. Financial and Operational Analysis

9.1 Production Volume and Market Share

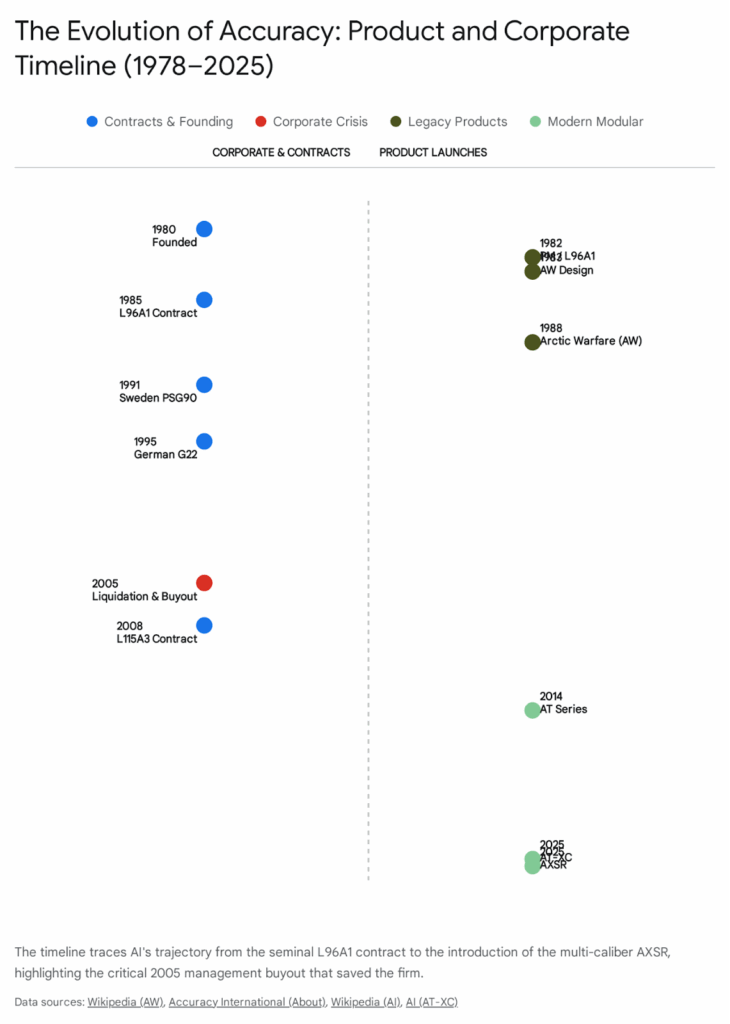

According to ATF Annual Firearms Manufacturing and Export Reports (AFMER), O.F. Mossberg (combined with Maverick Arms) consistently ranks among the top firearm manufacturers in the U.S.

- 2021 Peak: Mossberg produced approximately 675,000 shotguns, capitalizing on the pandemic-induced surge in demand.36 The Maverick 88 was a primary driver of this volume, as new gun owners sought affordable home defense options.

- 2022-2023 Correction: Production volumes have since normalized. In 2022, Mossberg produced over 1 million total firearms (ranking #1 in shotguns), but 2023 saw a sharp decline of roughly 72% in reported volume compared to the previous year.37 This drastic drop likely reflects an inventory correction after the massive over-production of 2021-2022. The market remains saturated, and manufacturers are scaling back to avoid devaluation. This cyclicality is typical of the firearms industry, often referred to as the “Trump Slump” or post-panic normalization.

9.2 The Strategic Advantage of Private Ownership

Unlike Remington (which faced bankruptcy due to debt load from private equity ownership) or Ruger and Smith & Wesson (public companies beholden to quarterly earnings calls), Mossberg remains 100% family-owned. Iver Mossberg serves as CEO, representing the fourth generation of leadership.1 This structure allows the company to:

- Avoid Debt: Mossberg has historically operated with low leverage, protecting it during market downturns.

- Long-Term Focus: They can invest in products like the 940 Pro or the Eagle Pass expansion without needing to show immediate quarterly ROI. They can weather a bad year (like 2023) without facing shareholder revolts.

9.3 Competitive Landscape

- Remington (RemArms): The bankruptcy of Remington Outdoor Company in 2020 allowed Mossberg to seize immense market share. While RemArms has restarted 870 production, Mossberg used that 2-3 year gap to cement the 590 and Maverick 88 as the default choices for retailers.39

- Turkish Imports: The biggest threat to the Maverick 88 line comes from cheap Turkish pump-actions. However, Mossberg’s established supply chain, U.S.-based warranty support, and brand heritage give it a significant edge over generic imports.

10. Future Outlook

The future for O.F. Mossberg & Sons appears to be one of premiumization and integration.

- Optic-Ready Standards: The industry is moving toward “optic-ready” firearms. Mossberg’s 2024/2025 lineup features “Holosun Combos” where shotguns ship with red dots installed.41 This signals a move to capture higher margins by selling complete systems rather than just bare firearms.

- Professional Series: By launching the “Professional Series” in 2025, Mossberg is attempting to move upmarket, challenging semi-custom brands like Beretta or Benelli in the tactical space. This moves the brand away from just being the “budget option.”

- Succession: With the passing of Karly Mossberg in 2023 42, the family succession plan remains a critical internal focus to ensure the “5th generation” leadership is prepared to maintain the private, family-held status of the firm.

11. Comprehensive Milestone Timeline

Below is a detailed chronological summary of the key milestones that have defined O.F. Mossberg & Sons over the last century.

| Year | Milestone | Description |

| 1919 | Founding | Oscar F. Mossberg and sons Iver and Harold found O.F. Mossberg & Sons in New Haven, CT. |

| 1920 | The Brownie | Launch of the Brownie, a 4-shot.22 pistol. The company’s first firearm. |

| 1922 | Model K | Introduction of the first rifle, the Model K.22 slide action. |

| 1938 | Model 42 | Launch of the Model 42 bolt-action.22, establishing Mossberg in the sporting rifle market. |

| 1942 | WWII Production | Production shifts to Model 42MB and 44US training rifles for the U.S. military. |

| 1960 | Move to North Haven | Company moves to a larger manufacturing facility in North Haven, CT. |

| 1961 | Model 500 | Introduction of the Model 500 pump-action shotgun. |

| 1987 | Model 590 | Introduction of the heavy-duty Model 590 for military and law enforcement use. |

| 1988 | Maverick 88 | Launch of the budget-friendly Maverick 88 line. |

| 1988 | Model 835 | Introduction of the Model 835 Ulti-Mag, the first 3.5″ chambered 12-gauge pump. |

| 1989 | Eagle Pass Expansion | Opening of the Maverick Arms facility in Eagle Pass, Texas. |

| 2002 | .17 HMR | Mossberg collaborates with Hornady to launch rifles for the new.17 HMR cartridge. |

| 2012 | FLEX System | Launch of the FLEX modular stock and forend system. |

| 2013 | 10 Millionth 500 | The 10 millionth Model 500 rolls off the assembly line. |

| 2013 | Texas Expansion | Major expansion of the Eagle Pass facility, shifting 90% of production to Texas. |

| 2015 | Patriot Rifle | Re-entry into the bolt-action hunting rifle market with the Patriot series. |

| 2017 | Shockwave | Release of the 590 Shockwave, pioneering the “Non-NFA Firearm” category. |

| 2019 | MC1sc | Mossberg returns to the handgun market after 100 years with the MC1sc subcompact. |

| 2020 | 940 Pro | Launch of the improved 940 Pro autoloader system with Jerry Miculek. |

| 2020 | MC2c | Release of the compact, double-stack MC2c 9mm pistol. |

| 2025 | 590R & 990 | Introduction of the Rotary Safety (590R) and semi-auto Shockwave (990 AfterShock). |

Appendix: Methodology

This report was compiled using a multi-source triangulation method to ensure accuracy and depth. The primary data sources include:

- Corporate Archives and Press Releases: Direct statements from O.F. Mossberg & Sons regarding product launches, facility expansions, and executive leadership changes were utilized to establish the official company narrative.

- Government Regulatory Data: Analysis of Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) Annual Firearms Manufacturing and Export Reports (AFMER) was conducted to verify production volumes and manufacturing locations. This data was prioritized over marketing claims.

- Industry Patents: Review of U.S. Patent filings by Oscar Mossberg and subsequent engineers was used to validate technical claims regarding mechanisms (e.g., the Brownie rotating pin, FLEX system).

- Third-Party Historical Analysis: Cross-referencing data with established firearms historians (e.g., National Mossberg Collectors Association) to verify dates and model designations.

- Market Reports: Utilization of NSSF and independent market research reports to contextualize sales trends and competitor movements.

The analysis prioritizes primary source data (ATF reports) over marketing claims when discussing market share and production volume. All financial inferences regarding the private company are based on public proxy data (production units) rather than private revenue sheets.

Works cited

- Mossberg: A Family-Owned Company That Lives On | An Official Journal Of The NRA, accessed January 16, 2026, https://www.americanrifleman.org/content/mossberg-a-family-owned-company-that-lives-on/

- A Look Back: Oscar F. Mossberg and O.F. Mossberg & Sons – uscca, accessed January 16, 2026, https://www.usconcealedcarry.com/blog/a-look-back-mossberg/

- Iver Johnson – Wikipedia, accessed January 16, 2026, https://en.wikipedia.org/wiki/Iver_Johnson

- O.F. Mossberg & Sons – Wikipedia, accessed January 16, 2026, https://en.wikipedia.org/wiki/O.F._Mossberg_%26_Sons

- Mossberg Brownie – Wikipedia, accessed January 16, 2026, https://en.wikipedia.org/wiki/Mossberg_Brownie

- The Brownie – Mossberg’s First Gun – GAT Daily, accessed January 16, 2026, https://gatdaily.com/articles/the-brownie-mossbergs-first-gun/

- Mossberg’s First Pistol – The 1919 Brownie | thefirearmblog.com, accessed January 16, 2026, https://www.thefirearmblog.com/blog/2019/01/07/mossbergs-first-pistol-the-1919-brownie/

- Chronology of Mossberg Firearms 1919-2019, accessed January 16, 2026, https://www.mossbergcollectors.org/100-years.pdf

- 100 Years of Mossberg, accessed January 16, 2026, https://www.mossberg.com/100-years-of-mossberg

- Mossberg 500 vs 590: What Sets Them Apart? | Field & Stream, accessed January 16, 2026, https://www.fieldandstream.com/outdoor-gear/guns/shotguns/mossberg-500-vs-590

- Mossberg 500 – Wikipedia, accessed January 16, 2026, https://en.wikipedia.org/wiki/Mossberg_500

- Remington 870 Vs. Mossberg 500: [Battle of the Pumps] – Pew Pew Tactical, accessed January 16, 2026, https://www.pewpewtactical.com/remington-870-vs-mossberg-500/

- Mossberg® Expands 590® Shockwave® 12-Gauge Offerings, accessed January 16, 2026, https://resources.mossberg.com/journal/mossberg-expands-590-shockwave-12-gauge-offerings

- Field Ethos Retrograde: Evolution of Mossberg, accessed January 16, 2026, https://resources.mossberg.com/journal/field-ethos-retrograde-evolution-of-mossberg

- Mossberg 500 Surpasses 10 Millionth Production Landmark | Oklahoma City, accessed January 16, 2026, https://hhshootingsports.com/mossberg-500-surpasses-10-millionth-production-landmark/

- MOSSBERG® 500®: THE COMPLETE STORY OF AN AMERICAN ICON – WOOX, accessed January 16, 2026, https://wooxstore.com/blogs/woox-journal/mossberg-500-history

- Mossberg 500 Review – Why It’s a Great Shotgun – Guns.com, accessed January 16, 2026, https://www.guns.com/news/reviews/why-the-mossberg-500-is-a-great-shotgun

- Mossberg Has (At Least) 17 New Shotgun Models for 2024 – Guns.com, accessed January 16, 2026, https://www.guns.com/news/2024/01/10/mossberg-has-at-least-17-new-shotgun-models-for-2024

- MOSSBERG, O. F. & SONS, INC. MODEL 835 SERIES Models – Gun Values by Gun Digest, accessed January 16, 2026, https://gunvalues.gundigest.com/mossberg-o-f-sons-inc/model-835-series/

- Made in Texas: The story behind Mossberg & Sons, the oldest family-owned firearm manufacturer in the US – Click2Houston, accessed January 16, 2026, https://www.click2houston.com/features/2020/04/06/made-in-texas-the-story-behind-mossberg-sons-the-oldest-family-owned-firearm-manufacturer-in-the-us/

- Mossberg Maverick 88 – Wikipedia, accessed January 16, 2026, https://en.wikipedia.org/wiki/Mossberg_Maverick_88

- Mossberg Expands In Texas, accessed January 16, 2026, https://ttha.com/mossberg-expands-in-texas/

- Introducing the Mossberg Flex System – Petersen’s Hunting, accessed January 16, 2026, https://www.petersenshunting.com/editorial/introducing-the-mossberg-flex-system/273215

- Mossberg Expands the 500 FLEX System with New 20-Gauge Shotgun Offerings, accessed January 16, 2026, https://www.mossyoak.com/our-obsession/blogs/gear-spotlight/mossberg-expands-the-500-flex-system-with-new-20-gauge-shotgun

- Introducing the Mossberg Patriot Bolt Action Rifle – Petersen’s Hunting, accessed January 16, 2026, https://www.petersenshunting.com/editorial/introducing-mossberg-patriot-bolt-action-rifle/272626

- Review: Mossberg Patriot Rifle | An Official Journal Of The NRA – American Rifleman, accessed January 16, 2026, https://www.americanrifleman.org/content/review-mossberg-patriot-rifle/

- Mossberg® Expands Handgun Line with MC2c™ Compact 9mm Pistol, accessed January 16, 2026, https://resources.mossberg.com/journal/mossberg-expands-handgun-line-with-mc2c-compact-9mm-pistol

- New Mossberg MC2c – American Handgunner, accessed January 16, 2026, https://americanhandgunner.com/discover/new-mossberg-mc2c/

- Mossberg MC2c: Features Overview – YouTube, accessed January 16, 2026, https://www.youtube.com/watch?v=paDLluGucPw

- Mossberg® Introduces New 940™ Autoloading Competition Shotgun Platform, accessed January 16, 2026, https://resources.mossberg.com/journal/mossberg-introduces-new-940-autoloading-competition-shotgun-platform

- 940® Pro – Shotguns – Firearms O.F. Mossberg & Sons, accessed January 16, 2026, https://www.mossberg.com/firearms/shotguns/940-pro.html

- O.F. Mossberg & Sons | American Built. American Strong. O.F. Mossberg & Sons, accessed January 16, 2026, https://www.mossberg.com/

- [SHOT 2025] Mossberg Means Business With Updated Shotguns | thefirearmblog.com, accessed January 16, 2026, https://www.thefirearmblog.com/blog/shot-2025-mossberg-means-business-with-updated-shotguns-44818651

- The Mossberg 2025 SHOT Show Roundup – Guns and Ammo, accessed January 16, 2026, https://www.gunsandammo.com/editorial/new-shot-2025-reveals-mossberg/515290

- New Products – Collections O.F. Mossberg & Sons, accessed January 16, 2026, https://www.mossberg.com/collections/new-products.html

- Firearms Commerce in the United States: Annual Statistical Update 2024 – ATF, accessed January 16, 2026, https://www.atf.gov/resource-center/docs/report/2024firearmscommercereportpdf/download

- New Data Shows Drop in Gun Manufacturing Since Pandemic, accessed January 16, 2026, https://smokinggun.org/new-data-shows-drop-in-gun-manufacturing-since-pandemic/

- Since 1919…A Look at the Storied History of Mossberg, accessed January 16, 2026, https://resources.mossberg.com/journal/since-1919-a-look-at-the-storied-history-of-mossberg

- Best Selling Shotguns of 2023 (According to Gunbroker) – GAT Daily (Guns Ammo Tactical), accessed January 16, 2026, https://gatdaily.com/articles/best-selling-shotguns-of-2023-according-to-gunbroker/

- Top 30 Largest USA Firearm Manufacturers of 2022 – Orchid Advisors, accessed January 16, 2026, https://orchidadvisors.com/top-30-largest-firearm-manufacturers-of-2022/

- Media Resources O.F. Mossberg & Sons, accessed January 16, 2026, https://www.mossberg.com/corporate/press-releases

- Karly E. Mossberg, Class of 2005 – Hamden Hall Country Day School, accessed January 16, 2026, https://www.hamdenhall.org/news-detail?pk=1378829