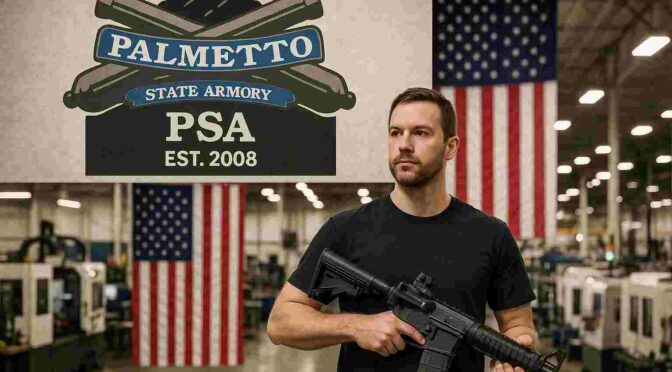

In the landscape of the American firearms industry, few companies have ascended with the velocity and disruptive impact of Palmetto State Armory (PSA). Since its inception in 2008, PSA has evolved from a humble e-commerce venture operating out of a garage into one of the largest and most influential firearms manufacturers and retailers in the United States.1sora The company’s trajectory represents more than a simple success story; it is a compelling case study in strategic agility, radical vertical integration, and aggressive market saturation that has fundamentally reshaped the consumer firearms market.

This report will argue that Palmetto State Armory’s success is the product of a unique synthesis of its founder’s dual-identity as a cost-conscious Certified Public Accountant (CPA) and a mission-driven combat veteran, a ruthlessly efficient vertically integrated business model, and a provocative, community-building marketing strategy that legacy brands have been unable or unwilling to replicate. This combination has allowed PSA to not only compete with but also systematically outmaneuver established industry giants, turning the AR-15 platform into an accessible commodity and applying the same disruptive playbook to other market segments, including AK-pattern rifles and polymer handguns.

Today, Palmetto State Armory stands as a titan of the industry. Its production volume has continued to climb, manufacturing 551,448 firearms in 2022 and increasing to 581,769 in 2023, which ranked it as the fifth-largest producer in the nation by volume that year. Its dominance is particularly stark in its home state of South Carolina, a significant hub for firearms manufacturing, where PSA accounted for an astounding 71.7% of all firearms produced that year.2 This industrial might is paired with a sprawling e-commerce platform, often dubbed the “Amazon of the gun world,” and a growing network of large-format retail stores across the Southeast.1

This analysis will trace the company’s chronological evolution, beginning with its ideological and operational origins. It will then dissect the core strategies that form the foundation of its business model, followed by an examination of its product development as a tool for market conquest. The report will also explore the company’s controversial but effective branding and the strategic acquisitions that have fueled its expansion. Finally, it will assess PSA’s market impact and future outlook, providing a comprehensive understanding of how this South Carolina powerhouse has permanently altered the American firearms industry.

The Genesis of an Empire (2008-2012)

The story of Palmetto State Armory is inextricably linked to the biography and ideology of its founder, Jamin McCallum. The company’s DNA—its mission, its business model, and its cultural posture—is a direct reflection of McCallum’s unique background as both a combat veteran and a financial professional. This fusion of mission-driven purpose and fiscal discipline created the perfect conditions for a new kind of firearms company to emerge at a pivotal moment in the market.

Founder’s Profile & The “Why”

Jamin McCallum is not a typical firearms industry executive. Before founding PSA, he served in the U.S. Army and the South Carolina National Guard, including two tours as a small arms expert in Iraq.3 This military service, particularly his time on deployment, instilled in him a deep appreciation for the M16/AR-15 platform and a powerful ideological conviction.5 As he later articulated, “I’ve seen what a society looks like when it falls apart. It’s really, really bad”.5 This experience forged the core mission of his future company: to ensure the widespread availability of firearms for law-abiding citizens.

Upon returning to civilian life, McCallum pursued a career as a Certified Public Accountant (CPA).3 However, he found it difficult to concentrate in the corporate accounting world after his experiences in Iraq.3 This confluence of military passion and financial expertise would become the defining characteristic of Palmetto State Armory. The veteran side provided the “why”—a mission to “maximize freedom, not our profits” by putting as many AR-15 and AK-47 rifles as possible into “common use in America today”.5 The CPA side provided the “how”—the financial acumen and understanding of cost control necessary to make that mission economically viable on a massive scale. While Jamin McCallum is the primary founder and CEO, some records also list his brother, Josiah McCallum, as a co-founder, suggesting a family-run enterprise from its earliest days.7

From Garage E-Commerce to Accidental Opportunity

Palmetto State Armory was officially formed in 2008, starting as a modest online-only business run from Jamin McCallum’s garage in South Carolina.1 The initial business model was simple: selling ammunition and magazines online.1 The timing of the company’s launch was exceptionally fortuitous. The election of President Barack Obama in 2008 triggered a massive surge in demand for firearms and ammunition, a phenomenon often referred to as “panic buying,” driven by fears of potential new gun control legislation.3 PSA was perfectly positioned to capitalize on this high-demand environment.

The company’s strategic direction, however, was solidified by a moment of serendipity. An ammunition dealer accidentally sent McCallum a shipment of AR-15 parts, specifically buffer tubes, instead of the magazines he had ordered.3 When he tried to return the parts, the seller told him to keep them. McCallum listed the components on his website, and they sold out almost instantly.3 This accidental transaction illuminated a vast, underserved market for affordable, individual AR-15 components. It was the catalyst that pivoted PSA’s focus from simply reselling finished goods to becoming a key supplier, and eventually a manufacturer, of the parts needed for individuals to build their own rifles.

Rapid Initial Expansion

Fueled by soaring demand and its new focus on AR-15 components, the business exploded. McCallum, who initially kept his day job as a CPA, saw his side business take over his home. Inventory expanded from the garage to the kitchen, the living room, and a backyard shed.3 The rapid growth quickly necessitated a move to a 30,000-square-foot warehouse in a Columbia industrial park.3

This move marked another critical evolution in the business model. As word spread, customers began showing up at the warehouse, hoping to buy products directly. Recognizing this demand, McCallum opened the first Palmetto State Armory brick-and-mortar retail store in Columbia in 2010.3 This established the hybrid e-commerce and physical retail model that continues to define PSA’s sales channels. The company’s retail footprint expanded quickly, with additional stores opening in Beaufort, Greenville, and Mt. Pleasant over the next few years.3

By 2011, PSA was not only a rapidly growing retailer and manufacturer but was also beginning to cultivate its distinct brand identity. The company released a limited-edition AR-15 lower receiver engraved with the phrase “You Lie”—the words famously shouted by South Carolina Congressman Joe Wilson at President Obama during a 2009 address.3 This move was an early and clear signal of the company’s willingness to engage in provocative, politically charged marketing to connect with its target demographic. It was a strategy that would become a hallmark of the PSA brand.

The Strategic Framework – Vertical Integration and Volume

The engine driving Palmetto State Armory’s disruptive growth is a strategic framework built on two pillars: a quasi-ideological doctrine of market saturation and a ruthlessly efficient, vertically integrated manufacturing model. This framework allows the company to operate with a speed, scale, and cost structure that legacy competitors have struggled to counter.

The “Freedom Over Profits” Doctrine as Market Strategy

At the heart of PSA’s corporate identity is its mission statement, a mantra repeated by founder Jamin McCallum and echoed throughout its marketing: “Our mission is to maximize freedom, not our profits. We want to sell as many AR-15 and AK-47 rifles as we can and put them into common use in America today”.12 This doctrine serves a threefold strategic purpose.

First, it is an ideological driver that provides a powerful, non-financial motivation for the company’s leadership and employees. It frames their work not as mere commerce but as a crusade to uphold Second Amendment rights. Second, it functions as a potent marketing tool. This message fosters a deep sense of alignment and loyalty within its customer base, transforming buyers into brand evangelists who feel they are participating in a shared mission.13

Third, and most critically from a strategic perspective, it is a doctrine of market saturation. By prioritizing volume over high margins, PSA aims to make firearms like the AR-15 so ubiquitous that they become “in common use,” thereby creating a practical and political bulwark against potential future regulations. McCallum has been explicit about this goal, stating his hope that in the future, people will recognize that PSA’s mass production made restrictive laws less effective because “there’s so much of it out there already”.12 This strategy creates a self-perpetuating cycle: the fear of regulation drives sales, and the resulting high volume of sales makes regulation more difficult to implement.

Building the Machine: JJE Capital and Vertical Integration

The operational execution of this doctrine is made possible by PSA’s corporate structure. Palmetto State Armory is a key subsidiary of JJE Capital Holdings, a private equity firm headquartered in Columbia, South Carolina, with Jamin McCallum serving as Owner and CEO.1 JJE Capital is the vehicle through which PSA has achieved a remarkable level of vertical integration. The firm’s portfolio includes a collection of specialized companies that form a self-contained manufacturing ecosystem.15

Key entities within the JJE Capital portfolio include:

- Spartan Forge: An aluminum forging facility in North Carolina, giving PSA control over the production of raw AR-15 lower and upper receiver forgings.15

- DC Machine: A state-of-the-art, high-volume CNC machining facility responsible for turning raw forgings and bar stock into finished components like receivers and barrels.15

- Ferrous Engineering and Tool: An integrated research and design center with prototyping and CNC capabilities, allowing for in-house product development and testing.15

This structure is the primary enabler of PSA’s low-cost model.19 By owning the means of production from raw material to finished product, PSA eliminates the markups and dependencies associated with external suppliers. While legacy manufacturers often rely on a complex network of third-party vendors for forgings, barrels, and small parts, PSA controls its own supply chain. This vertical integration provides more than just cost savings; it grants PSA unparalleled speed and control. New product ideas can be prototyped and iterated upon internally, and production can be scaled up or down rapidly in response to market demand without negotiating with external contractors.16

The “Good Enough” Quality Paradigm and Business Model

This manufacturing prowess is directed toward a specific market segment and business model. PSA consciously targets the budget-conscious buyer who prioritizes function and affordability over pristine cosmetic finishing or match-grade precision.4 The company’s products are frequently described as “good enough” for their intended purpose, catering to the vast majority of gun owners who may not put thousands of rounds through their firearms annually.4 This focus allows PSA to avoid the costs associated with the over-engineering and meticulous finishing of premium brands.

The business model relies on generating profit through massive sales volume on thin margins.13 PSA functions as both a manufacturer and a massive retailer, leveraging its website as the “Amazon of the gun world” to sell its own products alongside those of other brands, often taking a cut of transactions without holding inventory.4 The sheer scale of this operation created significant logistical challenges. The company’s initial reliance on disparate systems like SAP for accounting and Google Docs for inventory tracking became untenable with its rapid growth, leading to order backlogs and data discrepancies.22 To manage this complexity, PSA implemented NetSuite’s enterprise resource planning (ERP) software, creating a unified, cloud-based platform to provide real-time visibility into financials, inventory, and warehouse operations, enabling more accurate planning and decision-making.22

Product Line Development as a Market Conquest Tool

Palmetto State Armory’s product development strategy can be viewed as a series of calculated campaigns designed to enter, disrupt, and ultimately dominate specific segments of the firearms market. The company has repeatedly demonstrated a highly effective, repeatable playbook: identify a market-proven platform, clone it to minimize R&D risk, leverage vertical integration to produce it at a disruptive price point, and then iterate on the design based on direct community feedback to capture market share from established leaders.

The AR-15 Beachhead: Commoditizing America’s Rifle

The foundation of PSA’s empire was built on the AR-15.3 Rather than trying to invent a new rifle, the company focused on making the existing, popular AR-15 platform accessible to a broader audience than ever before. It achieved this by commoditizing the rifle, breaking it down into its constituent parts, and selling them at unprecedentedly low prices. Daily deals featuring items like $150 complete upper receivers or $99 stripped lower receivers became legendary among gun enthusiasts.13

This strategy effectively transformed the AR-15 from a rifle one buys into a rifle one builds. It empowered a generation of consumers to assemble their own firearms, offering near-infinite customization. PSA strategically tiered its offerings to cater to every budget and need. A customer could buy a basic, entry-level kit with a phosphate-coated barrel or upgrade to a “Premium” line featuring a cold-hammer-forged (CHF) barrel made by renowned Belgian manufacturer FN Herstal—the same company that supplies barrels for the U.S. military’s machine guns.1 This tiered approach allowed customers to precisely balance cost and performance, a level of choice that many legacy brands did not offer.

The American Kalashnikov: Building Credibility with the PSAK-47

Having established dominance in the AR-15 market, PSA turned its attention to the AK-47. The company identified a clear market opportunity created by tightening import restrictions on Russian firearms and the dwindling supply of surplus parts kits from former ComBloc nations.23 This created a vacuum for a reliable, domestically produced AK-pattern rifle.

PSA’s initial forays into the AK market were met with criticism regarding quality control and the durability of key components, issues that had plagued other American AK manufacturers. However, true to its model, PSA listened to the market feedback and engaged in a public, iterative development process. This led to the creation of the “GF” (Goon Forged) series, which systematically addressed the weaknesses of earlier models and built significant credibility for the brand.

The key iterations demonstrate this strategic improvement:

- PSAK-47 GF3: This generation represented a major leap in quality. It introduced a hammer-forged bolt, carrier, and front trunnion—the critical, high-stress components of the AK action. This directly addressed the primary failure point of many previous US-made AKs, which often used inferior cast or billet parts.23

- PSAK-47 GF4: This model further enhanced the rifle by upgrading the barrel to a PSA-made cold-hammer-forged, chrome-lined (CHF CL) version, offering improved durability and barrel life over the GF3’s nitride-treated barrel.25

- PSAK-47 GF5: This is PSA’s premium AK offering, designed to compete with high-end imported rifles. The GF5 features a highly respected FN-made CHF CL barrel, often referred to as “machine gun steel,” and typically includes an upgraded ALG Defense trigger.25 With the GF5, PSA was no longer just making a budget AK; it was making a high-feature, American-made AK that could compete on quality while still undercutting competitors on price.

Cloning a Leader: The PSA Dagger and the Pistol Market

In January 2020, at the annual SHOT Show, PSA unveiled its most audacious move yet: the PS9 Dagger.28 The Dagger is an unabashed clone of the 3rd Generation Glock 19, one of the most popular and trusted handguns in the world.1 The strategy was transparent and brilliant: leverage Glock’s proven, reliable design and its massive aftermarket of compatible magazines, sights, and triggers, but offer the pistol at a fraction of the price. The target retail price was announced at or below $300, a figure that sent shockwaves through the industry.28

The launch was not without its challenges. The Dagger’s release was delayed, with the first pistols finally shipping to customers in May 2021.30 Early adopters reported some quality control and reliability issues, including feeding problems with full magazines and breakage of MIM (Metal Injection Molded) parts like the firing pin.29 However, PSA applied its iterative playbook. The company addressed the issues, and the Dagger line has since matured and expanded into a complete family of pistols. This now includes the original Dagger Compact (G19 size), a Dagger Full-Size (G17 size grip), and the highly anticipated

Micro Dagger, a clone of the popular Glock 43X for concealed carry, which began rolling out in 2023.29 The Dagger’s success proves that PSA’s “Clone, Iterate, Dominate” model is transferable beyond long guns.

Proprietary Platforms: The JAKL Initiative and a Move Toward Innovation

While cloning has been its primary tool, PSA has also invested in proprietary platform development. The most significant example is the PSA JAKL, first teased in 2020 and officially released in 2022.34 The JAKL represents a strategic graduation for the company, moving from imitation to innovation.

The JAKL is a hybrid design, built around a monolithic upper receiver and a long-stroke gas piston operating system.36 This system eliminates the need for an AR-15-style buffer tube, allowing for a true folding stock or brace, making it a compact platform. It consciously borrows elements from several successful designs:

- AR-15: It is compatible with any standard mil-spec AR-15 lower receiver, triggers, and magazines.34

- AK-47: It uses a robust and reliable long-stroke gas piston system.37

- SCAR/ACR: Its monolithic upper and folding stock capability evoke the aesthetics and functionality of more expensive modern military rifles.37

The JAKL is marketed as a highly modular platform, available in multiple calibers like 5.56x45mm and.300 AAC Blackout, and in various configurations from short-barreled pistols to full-length rifles.34 Critically, PSA also sells the JAKL as a complete upper receiver assembly, allowing any of the millions of existing AR-15 owners to convert their standard rifle into a piston-driven, folding-stock platform simply by swapping uppers.34 The continued development of concepts like the lighter JAKL 2.0 and the Olcan bullpup conversion lower demonstrates a clear commitment to evolving the JAKL into a major, long-term product family.39

Branding, Controversy, and Community

Palmetto State Armory’s marketing and branding strategy is as unconventional and disruptive as its business model. The company has eschewed the traditional, conservative marketing of legacy firearms manufacturers in favor of a provocative, politically charged, and deeply community-oriented approach. This strategy, while generating significant controversy, has been instrumental in building a fiercely loyal customer base and a powerful brand identity.

Meme Marketing and Political Provocation

From its early days, PSA demonstrated a willingness to embed political commentary and internet culture directly into its products. This has served to both energize its base and antagonize its critics, generating enormous amounts of publicity in the process.

Key examples of this strategy include:

- The “You Lie” Lower (2011): This AR-15 lower receiver, engraved with the words shouted by Rep. Joe Wilson at President Barack Obama, was a defining moment. It signaled that PSA was not a neutral corporate entity but an active participant in the political culture wars. The fact that Rep. Wilson’s son, Julian Wilson, is a co-owner of PSA’s parent company, JJE Capital, adds another layer to this politically-charged branding.3

- “Meme” Lowers: PSA created an entire product category for AR-15 lower receivers featuring engravings drawn from right-leaning internet culture and political discourse. Slogans like “Let’s Go Brandon,” “Build the Wall,” and imagery like the Gadsden flag transformed the firearm itself into a medium for political expression.12 This tactic trivializes the seriousness of weapon ownership for critics, but for supporters, it is a powerful statement of shared values.

- “Boogaloo” Association (2020): The company courted significant controversy in February 2020 by producing and selling a limited-edition AK-style pistol with a “Big Igloo Aloha” Hawaiian-print paint job. The Hawaiian shirt has been adopted as an unofficial uniform by adherents of the “boogaloo,” a loosely defined anti-government movement that anticipates or seeks to accelerate a second American civil war.11 PSA followed this with T-shirts featuring similar themes. This association drew intense scrutiny and criticism, positioning the company at the extreme edge of firearms marketing.

The Anti-Establishment Dichotomy

While PSA cultivates a hard-edged, anti-government, and grassroots image through its marketing, its parent company, JJE Capital, has demonstrated a pragmatic willingness to engage with the very political establishment its branding often rails against. This dichotomy reveals a sophisticated, multi-faceted approach to protecting its business interests.

In the final quarter of 2020, JJE Capital retained the services of Nelson Mullins Riley & Scarborough, a prominent Washington, D.C. lobbying firm.11 Filings show that the firm was paid $10,000 to lobby the U.S. Senate on behalf of PSA regarding the Bureau of Alcohol, Tobacco, Firearms and Explosives’ (ATF) classifications of firearm accessories.11 This move, coming shortly after the “boogaloo” marketing controversy, illustrates that while the company’s public face is one of defiance, its corporate strategy includes conventional, behind-the-scenes political engagement to influence policy and regulation.

Digital Grassroots and Community Building

A cornerstone of PSA’s branding is its direct and continuous engagement with its customer base. The company actively hosts and manages its own online forums, which serve as a vibrant hub for the PSA community.8 These forums are not merely a marketing channel; they are an integral part of the company’s operations.

This digital platform functions as:

- A Direct Customer Service Channel: Customers can post issues and often receive responses directly from PSA representatives or knowledgeable community members.

- A Real-Time Feedback Loop: PSA uses the forums to gauge customer sentiment on existing products and float ideas for new ones. The development of many of its products, including the iterative improvements to the AK and Dagger lines, has been heavily influenced by discussions on these forums.

- A Community Hub: The forums foster a sense of belonging and shared identity among PSA owners. This direct line to the consumer allows PSA to build a level of brand loyalty and gather market intelligence that is difficult for competitors who rely on traditional, multi-step distribution and retail channels to achieve. Company executives, including CEO Chad Wylie, are known to monitor these online discussions to keep a pulse on the customer base.16

This strategy effectively transforms customers into an extension of the R&D department and a volunteer marketing army. The controversy generated by their provocative products is not a liability but a feature; it solidifies the in-group identity and mobilizes the community to defend the brand against outside criticism, creating a powerful “brand moat” that insulates PSA from mainstream competitive pressures.

Expansion by Acquisition – The JJE Capital Engine

The rapid growth and diversification of Palmetto State Armory have been significantly accelerated by a shrewd acquisition strategy, executed through its parent company, JJE Capital Holdings. JJE Capital acts as the financial engine and holding company, pursuing strategic investments that expand the group’s capabilities, intellectual property, and market reach.1 Its stated mission to “revive the American Dream” through investment provides the philosophical framework for acquiring and revitalizing distressed or legacy American brands.14

The Remington Bankruptcy Opportunity (September 2020)

A pivotal moment in this expansion strategy came in September 2020 with the bankruptcy auction of the historic Remington Outdoor Company. JJE Capital emerged as a key player in the dissolution of the firearms conglomerate, strategically bidding on a bundle of valuable but neglected brands.43 For a reported purchase price between $2.15 million and $2.5 million, JJE Capital successfully acquired the intellectual property and brand names for five distinct entities:

DPMS Panther Arms, H&R 1871 (Harrington & Richardson), Stormlake Barrels, Advanced Armament Corporation (AAC), and Parker Shotguns.1

This was not a random shopping spree but a calculated acquisition of heritage, technology, and market position at a steep bankruptcy discount. Each brand offered a unique strategic value that could be integrated into the broader JJE/PSA ecosystem.

Table 1: JJE Capital’s 2020 Remington Bankruptcy Acquisitions

| Acquired Brand | Legacy/Market Position | Strategic Rationale for JJE/PSA | Post-Acquisition Status |

| DPMS Panther Arms | A pioneer in the consumer AR-10 market and a well-established, mid-tier AR-15 brand with significant name recognition.48 | Acquire an established brand to target a different segment of the AR market, leveraging existing brand loyalty without diluting the core PSA brand.49 | Relaunched with a full line of AR-15, AR-10, and AK (“Anvil”) rifles and parts, sold directly through PSA’s e-commerce platform.50 |

| H&R 1871 | A historic American firearms brand known for its single-shot rifles, shotguns, and revolvers; also a past manufacturer of M16 rifles for the military.46 | Revive a heritage brand to specifically target the growing and passionate niche market for “retro” military clone firearms (e.g., M16A1, XM177).53 | Relaunched with a focus on producing historically accurate M16 and CAR-15 style rifles and components, capturing a dedicated enthusiast market.53 |

| Advanced Armament Corp. (AAC) | A pioneering and highly respected manufacturer of firearm suppressors (silencers) and the creator of the.300 AAC Blackout cartridge.55 | Gain immediate, credible entry into the highly regulated but lucrative NFA (National Firearms Act) market with an established, premium brand.46 | Relaunched with a renewed focus on customer service, a lifetime warranty on new products, and a full line of suppressors. Also launched a parallel AAC Ammunition brand.15 |

| Stormlake Barrels | A manufacturer of aftermarket pistol barrels.46 | Acquire additional barrel manufacturing capability and intellectual property to support existing and future handgun projects (like the Dagger).46 | Assets and IP likely integrated into JJE’s existing manufacturing operations (e.g., DC Machine) to bolster in-house barrel production. |

| Parker Shotguns | A legendary American brand known for producing high-end, collectible side-by-side shotguns.46 | Acquire a prestigious heritage brand name with potential for future high-end or commemorative product lines. | No significant public relaunch to date; likely holding the brand IP for future strategic use. |

Reviving Heritage and Integrating Capabilities

The post-acquisition strategy has been to operate these brands as distinct entities under the JJE Capital umbrella, each targeting a specific market segment while leveraging PSA’s immense manufacturing, logistics, and e-commerce power.

- DPMS/Panther Arms was resurrected to appeal to customers with an existing loyalty to the brand. The new DPMS offers a full suite of AR-platform rifles and even an AK variant, the “Anvil,” which appears to be based on the PSAK-47 GF3 platform.49 This allows JJE to capture a different customer demographic without altering the core PSA brand.

- H&R (Harrington & Richardson) was masterfully revived to cater to the “clone” building community. Instead of producing modern sporting rifles, the new H&R focuses exclusively on historically accurate reproductions of Vietnam-era and Cold War-era military firearms like the M16A1, M16A2, and various CAR-15 “Commando” models.53 This surgical approach has been met with enthusiasm from this niche but dedicated market segment.

- Advanced Armament Corporation (AAC) represented the most significant capability acquisition. It provided JJE with an immediate and credible foothold in the suppressor market. The brand was relaunched with a promise to service legacy products and offer a lifetime warranty on new suppressors, a clear move to rebuild trust after years of neglect under Remington.56 Simultaneously, JJE launched

AAC Ammunition, leveraging the respected brand name to market a wide range of ammunition calibers.15 This move further deepens the company’s vertical integration, allowing them to sell not only the firearm and the suppressor but also the ammunition to feed it.

Market Impact, Competitive Position, and Future Outlook

The cumulative effect of Palmetto State Armory’s strategies has been a seismic shift in the American consumer firearms market. By quantifying its production and comparing its business model to that of legacy manufacturers, the scale of its disruption becomes clear. However, this aggressive growth model is not without its challenges and risks, which will shape the company’s future trajectory.

PSA by the Numbers: Quantifying the Disruption

Analyzing the production and financial data of a privately held company like PSA is challenging, with public data being limited and sometimes contradictory. However, available figures paint a clear picture of explosive growth and significant market presence.

- Production Volume: According to ATF manufacturing data, PSA’s production of firearms (excluding miscellaneous parts like receivers) has shown explosive growth, rising from approximately 45,000 units in 2019 to nearly 380,000 in 2020, 551,448 in 2022, and 581,769 in 2023. (The company does not appear in the official 2021 manufacturing report).66 This performance in 2023 elevated PSA to the fifth-largest firearms manufacturer in the United States by total volume, placing it firmly in the same league as century-old, publicly-traded companies.

- State-Level Dominance: The company’s impact is most visible in its home state. In 2022, PSA’s West Columbia plant produced 71.7% of all firearms manufactured in South Carolina, a state that ranks fifth nationally in total firearm production.2 This concentration of production underscores PSA’s scale and efficiency.

- Revenue Estimates: Financial estimates for the private company vary widely. Growjo estimates annual revenue at $195.8 million, while LeadIQ places it as high as $750 million.60 While the exact figure is unknown, both estimates confirm that Palmetto State Armory is a major financial entity with hundreds of millions of dollars in annual sales.

Disruptor vs. Legacy: A New Business Model

Palmetto State Armory’s success can be understood as a classic case of market disruption. The company did not invent a new product but rather introduced a new business model that fundamentally changed the basis of competition. The following table contrasts PSA’s approach with that of a typical legacy manufacturer, such as Smith & Wesson or Sturm, Ruger & Co.

Table 2: Comparative Analysis of Business Models: PSA vs. Legacy Manufacturer

| Business Model Component | Palmetto State Armory | Typical Legacy Manufacturer (e.g., Ruger/S&W) |

| Manufacturing Strategy | Highly vertically integrated; owns forging, machining, and R&D facilities through parent company JJE Capital.15 | Primarily assembly-focused, with reliance on a network of external suppliers for key components like forgings, barrels, and small parts.62 |

| Primary Sales Channel | Hybrid model: Dominant direct-to-consumer (DTC) e-commerce platform supplemented by large-format retail stores.12 | Traditional two-step distribution: Sells to a limited number of large distributors, who then sell to thousands of independent firearm dealers (FFLs).63 |

| Pricing Strategy | Low-margin, high-volume, value-focused. Aims to make products as affordable as possible to “maximize freedom” and saturate the market.5 | Higher-margin, brand-prestige pricing. Prices must account for distributor and dealer markups. |

| Marketing Message | Ideological and provocative: “Maximize Freedom,” anti-establishment, culturally aligned with a specific political base through “meme” products.12 | Traditional and conservative: Focuses on heritage, reliability, American manufacturing, and endorsements from law enforcement or military contracts.64 |

| Product Development Cycle | Rapid, iterative, and public-facing. Uses direct customer feedback from online forums to quickly improve products and launch new variants.16 | Longer, more secretive internal R&D cycle. New products are typically developed over years and launched with major marketing campaigns. |

Challenges and Future Outlook

Despite its tremendous success, PSA faces significant challenges and risks that will define its future.

- Risks & Challenges:

- Long-Term Quality Control: The “good enough” quality paradigm is effective for capturing the budget market, but as the company scales and diversifies into more complex products, maintaining acceptable QC becomes a major challenge. Widespread issues could lead to brand erosion and warranty costs that undermine the low-margin model.4

- Regulatory and Political Pressure: PSA’s high-profile, provocative branding and its explicit mission to achieve “common use” of AR-15 and AK-47 platforms make it a prime target for gun control advocates and regulators. Its retail locations have also appeared on ATF lists for selling firearms traced to crimes, increasing scrutiny.12

- Market Saturation: The company’s entire model is predicated on high-volume sales. It is an open question whether this growth can be sustained indefinitely, or if the domestic market for affordable AR-15s will eventually become saturated.

- Opportunities & Growth Vectors:

- Continued Innovation: The successful launch of the JAKL platform shows a path forward beyond cloning. New concepts debuted at SHOT Show 2025, such as the modular 570 shotgun and the JAKL 2.0, indicate a continued investment in proprietary R&D.39

- NFA Market Dominance: The acquisition and relaunch of AAC provides a powerful vehicle for deeper penetration into the suppressor market. This could expand to other NFA items, leveraging PSA’s manufacturing scale to potentially lower the cost of entry for consumers.

- Ammunition Vertical: The expansion of the AAC ammunition line is a logical next step in vertical integration. Becoming a major ammunition manufacturer would make JJE Capital a self-sufficient ecosystem, from the forge to the finished cartridge.

- Further Acquisitions: JJE Capital remains an active private equity firm. It is likely to continue seeking opportunities to acquire other distressed or niche brands that can be bolted onto its powerful manufacturing and e-commerce infrastructure.

Comprehensive Milestone Timeline

The following timeline provides a chronological summary of Palmetto State Armory’s key milestones, charting its course from a garage startup to an industry powerhouse.

Table 3: Palmetto State Armory Key Milestones (2008-Present)

| Year/Date | Key Event / Product Launch / Acquisition | Strategic Significance |

| 2008 | Jamin McCallum, an Iraq War veteran and CPA, founds Palmetto State Armory. The company begins as an e-commerce website selling ammunition and magazines from his garage.1 | Establishes the company’s e-commerce foundation and capitalizes on the 2008 post-election demand surge. |

| ~2009 | A “mis-shipment” of AR-15 parts that sell out instantly reveals a massive market for individual components, pivoting the company’s focus from reselling to manufacturing.3 | The pivotal moment that defined PSA’s future as a leader in the AR-15 parts and build kit market. |

| 2010 | PSA opens its first brick-and-mortar retail store in Columbia, SC, after customers began showing up at its warehouse to buy products directly.3 | Establishes the hybrid online/retail business model that allows PSA to serve customers through multiple channels. |

| 2011 | The company launches the “You Lie” limited-edition AR-15 lower receiver, capitalizing on a political controversy.3 | A foundational event in PSA’s brand strategy, demonstrating its willingness to use provocative, politically charged marketing to connect with its base. |

| 2016 | PSA releases its first generation of American-made PSAK-47 rifles, entering the AK market.23 | A strategic move to fill the market gap for US-made AKs as import options dwindled. Early models faced quality critiques. |

| ~2019 | The PSAK-47 GF3 (Gen 3) is launched, featuring a hammer-forged bolt, carrier, and front trunnion.23 | Marks a significant improvement in the quality and durability of PSA’s AK line, building credibility and addressing market concerns. |

| Jan 2020 | At SHOT Show, PSA unveils the PS9 Dagger pistol (a Glock 19 clone) and teases the proprietary JAKL platform for the first time.28 | Signals a major expansion into the handgun market and a move toward proprietary platform innovation. |

| Feb 2020 | PSA sells the “Big Igloo Aloha” AK-style pistol, linking the brand to imagery associated with the anti-government “Boogaloo” movement.11 | Represents the peak of PSA’s controversial marketing, drawing significant media scrutiny and solidifying its anti-establishment image. |

| Sep 2020 | Parent company JJE Capital Holdings acquires five brands—DPMS, H&R, Stormlake, AAC, and Parker—from the Remington Outdoor Company bankruptcy auction.1 | A transformative acquisition that provides JJE/PSA with valuable brand IP, heritage, and immediate entry into new market segments like suppressors and retro rifles. |

| May 2021 | After delays, the first PSA Dagger pistols begin shipping to customers.30 | The official entry into the highly competitive polymer striker-fired pistol market, applying the “clone and undercut” strategy to a new category. |

| 2022 | The PSAK-47 GF5, featuring a premium FN-made cold-hammer-forged barrel, is launched.27 | Solidifies PSA’s position as a serious AK manufacturer, offering a premium, high-feature rifle to compete with top-tier imports. |

| 2022 | The PSA JAKL platform is officially released to the public after years of development.34 | Marks the successful launch of PSA’s first major proprietary firearm system, a significant step beyond cloning established designs. |

| 2023 | The PSA Micro Dagger line (a Glock 43X clone) is launched, expanding the Dagger family into the popular micro-compact concealed carry market.32 | Demonstrates the successful application of the Dagger playbook to a new handgun sub-segment, further challenging market leaders. |

| 2023 | The relaunched H&R brand gains significant traction with its line of “retro” AR-15s, successfully capturing the niche but passionate clone-builder market.53 | Validates the strategy of using acquired heritage brands to target specific enthusiast communities. |

| 2025 (Projected) | PSA debuts new concepts at SHOT Show, including the JAKL 2.0, a modular 570 shotgun, and a.50 BMG rifle, signaling continued investment in R&D and platform expansion.39 | Indicates a future focus on continued innovation and entry into new firearm categories beyond their core AR/AK/pistol offerings. |

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Palmetto State Armory – Wikipedia, accessed July 21, 2025, https://en.wikipedia.org/wiki/Palmetto_State_Armory

- This Company Makes Over 70% of Firearms in South Carolina – 24/7 Wall St., accessed July 21, 2025, https://247wallst.com/guns-and-hunting/2024/10/09/this-company-makes-over-70-of-firearms-in-south-carolina/

- Palmetto State Armory is arming South Carolina with its own take on …, accessed July 21, 2025, https://charlestoncitypaper.com/2015/02/11/palmetto-state-armory-is-arming-south-carolina-with-its-own-take-on-the-ar-15/

- Question about the company : r/PalmettoStateArms – Reddit, accessed July 21, 2025, https://www.reddit.com/r/PalmettoStateArms/comments/1fa7ju2/question_about_the_company/

- About Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/about-psa.html

- Relentless Pursuit – Episode 1 | The Founding of Palmetto State Armory – YouTube, accessed July 21, 2025, https://www.youtube.com/watch?v=dWtOUU-bXmE

- Palmetto State Armory – 2025 Company Profile, Team & Competitors – Tracxn, accessed July 21, 2025, https://tracxn.com/d/companies/palmetto-state-armory/__4VAZIXSUFh1j-SdRymCrVea0f2odR8brXog9hzK2CVY

- New Shot Show Releases – Page 3 – PSA Products – Palmetto State Armory | Forum, accessed July 21, 2025, https://palmettostatearmory.com/forum/t/new-shot-show-releases/12381?page=3

- Palmetto State Armory – The Story So Far… – AR Build Junkie, accessed July 21, 2025, https://www.arbuildjunkie.com/palmetto-state-armory-story-so-far/

- eCommerce Store Revamp for Palmetto State Armory – Wagento, accessed July 21, 2025, https://www.wagento.com/our-work/how-palmetto-state-armory-achieved-enterprise-success-with-wagento/

- Palmetto State Armory Marketed Boogaloo Then Lobbied Congress – The Trace, accessed July 21, 2025, https://www.thetrace.org/2021/03/palmetto-state-armory-boogaloo-south-carolina-nelson-mullins/

- Palmetto State Armory – The Smoking Gun | The Smoking Gun, accessed July 21, 2025, https://smokinggun.org/manufacturer/palmetto-state-armory/

- How does PSA make any money ? It’s a blem but still… : r/ar15 – Reddit, accessed July 21, 2025, https://www.reddit.com/r/ar15/comments/16edfry/how_does_psa_make_any_money_its_a_blem_but_still/

- About Us – JJE Capital Holdings, accessed July 21, 2025, https://jjech.com/about-us/

- Portfolio Companies – JJE Capital Holdings, accessed July 21, 2025, https://jjech.com/portfolio-companies/

- Palmetto State Armory Factory Tour & CEO Interview – Part 1 – YouTube, accessed July 21, 2025, https://www.youtube.com/watch?v=PrK7IXCMCP4

- Portfolio Companies – JJE Capital Holdings, accessed July 21, 2025, https://www.jjech.com/portfolio-companies/

- Palmetto State Armory Full Factory Tour! How the AK, AR, and Dagger are Made. – YouTube, accessed July 21, 2025, https://www.youtube.com/watch?v=HA6LuW27iZE

- [Review] Palmetto State Armory AK-47 (PSAK-47 GF3) with Video …, accessed July 21, 2025, https://www.pewpewtactical.com/palmetto-state-armory-ak-47-psak-47-review/

- [Review] Palmetto State Armory (PSA) AR-15 Review – Pew Pew …, accessed July 21, 2025, https://www.pewpewtactical.com/palmetto-state-armory-psa-ar-15-review/

- Palmetto State Armory AK-47 : r/guns – Reddit, accessed July 21, 2025, https://www.reddit.com/r/guns/comments/1ercb8x/palmetto_state_armory_ak47/

- Shootin’ it straight Palmetto State Armory streamlines with NetSuite – RSM US, accessed July 21, 2025, https://rsmus.com/insights/technology/netsuite/shootin-it-straight-palmetto-state-armory-streamlines-with-netsu.html

- PSA AK GF3 Review: Field Tested – Gun University, accessed July 21, 2025, https://gununiversity.com/psa-ak-gf3-review/

- PSAK-47 GF3 Rifles | Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/ak-47/psak-47-gf-series/psak-47.html

- PSAK47 GF5 or GF3? : r/guns – Reddit, accessed July 21, 2025, https://www.reddit.com/r/guns/comments/t0fax7/psak47_gf5_or_gf3/

- My new Palmetto AK-47 GF4. First ever AK, and I’m happy with this purchase. (Disclaimer – commie LARP is purely ironic) : r/guns – Reddit, accessed July 21, 2025, https://www.reddit.com/r/guns/comments/sjxbcx/my_new_palmetto_ak47_gf4_first_ever_ak_and_im/

- Palmetto State Armory PSAK-47 GF5 – Uncle Zo, accessed July 21, 2025, https://unclezo.com/2023/01/27/palmetto-state-armory-psak-47-gf5/

- Palmetto State Armory just unveiled its first-ever 9 mm pistol — here’s what it looks like, accessed July 21, 2025, https://www.militarytimes.com/off-duty/gearscout/irons/2020/01/29/palmetto-state-armory-just-unveiled-its-first-ever-9-mm-pistol-heres-what-it-looks-like/

- PSA Dagger Compact Review [3000 Round Test] – Pew Pew Tactical, accessed July 21, 2025, https://www.pewpewtactical.com/psa-dagger-review/

- When will the PSA Dagger Pistol be Available? – Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/forum/t/when-will-the-psa-dagger-pistol-be-available/907

- PSA Dagger review. 8 months, ~2000 rounds. : r/liberalgunowners – Reddit, accessed July 21, 2025, https://www.reddit.com/r/liberalgunowners/comments/1amudnu/psa_dagger_review_8_months_2000_rounds/

- Micro Dagger update – Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/forum/t/micro-dagger-update/24484

- PSA Micro Dagger | In-Depth Review of the Sub-Compact Pistol – Lynx Defense, accessed July 21, 2025, https://lynxdefense.com/reviews/psa-micro-dagger/

- PSA Jakl Review | Is this 2024’s Truck Gun of the year? – Lynx Defense, accessed July 21, 2025, https://lynxdefense.com/reviews/psa-jakl/

- PSA JAKL AR/AK Pistol Review: Ultimate Truck Gun? – Pew Pew Tactical, accessed July 21, 2025, https://www.pewpewtactical.com/psa-jakl-review/

- PSA JAKL | Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/jakl.html

- Palmetto State Armory JAKL: Hottest Long Stroke Piston Action – Recoil Magazine, accessed July 21, 2025, https://www.recoilweb.com/palmetto-state-armory-jakl-review-183007.html

- Palmetto State Armory JAKL Review 2025 – Gun University, accessed July 21, 2025, https://gununiversity.com/palmetto-state-armory-jakl-review/

- PSA’s Revamped JAKL 2.0 Concept | SHOT Show 2025 – YouTube, accessed July 21, 2025, https://www.youtube.com/watch?v=rOGntY7LO-s

- PSA Rolls Deep for 2025: New Modular 570 Shotgun, Jakl 2.0, Vuk, Sabre .50 BMG Rifles, accessed July 21, 2025, https://www.guns.com/news/2025/01/31/psa-new-rifles-shotguns-2025

- Palmetto State Armory Is At It Again: New Concept Guns for 2025 | The Mag Shack, accessed July 21, 2025, https://themagshack.com/palmetto-state-armory-new-concept-guns-2025/

- Updated title: Message From CEO Jamin McCallum – Page 3 – General Discussion – Palmetto State Armory | Forum, accessed July 21, 2025, https://palmettostatearmory.com/forum/t/updated-title-message-from-ceo-jamin-mccallum/41358?page=3

- What’s Going On with the Remington Sale | RECOIL, accessed July 21, 2025, https://www.recoilweb.com/whats-going-on-with-the-remington-sale-162794.html

- Remington Assets to Be Split, Bidders Revealed – Shooting Industry Magazine, accessed July 21, 2025, https://shootingindustry.com/industry-news/remington-assets-to-be-split-bidders-revealed/

- A Long Term Review of the PSA PA-15 – American Firearms, accessed July 21, 2025, https://www.americanfirearms.org/psa-pa-15-review/

- Remington Arms Split Up and Sold [Details Here] : Gun University, accessed July 21, 2025, https://gununiversity.com/remington-arms-bankruptcy-sale/

- The Remington Sell-Off – RifleShooter, accessed July 21, 2025, https://www.rifleshootermag.com/editorial/the-remington-sell-off/384939

- Bushmaster, DPMS, Panther Arms Black Rifle Brands Revived – Guns.com, accessed July 21, 2025, https://www.guns.com/news/2021/08/05/bushmaster-dpms-panther-arms-black-rifle-brands-revived

- Psa gf3 is the new dpms anvil? – AK-47 / AK-74 – Palmetto State Armory | Forum, accessed July 21, 2025, https://palmettostatearmory.com/forum/t/psa-gf3-is-the-new-dpms-anvil/10770

- DPMS | Brands – Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/brands/dpms.html

- Firearms | DPMS | Brands – Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/brands/dpms/firearms.html

- DPMS Panther Arms, accessed July 21, 2025, https://dpmsinc.com/

- Firearms | H&R Arms Co. | Brands – Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/brands/h-r-arms-co/firearms.html

- Palmetto State Armory: Firearms, Ammo, Parts and Optics | Palmetto State Armory, accessed July 21, 2025, https://palmettostatearmory.com/

- Advanced Armament Corporation – Wikipedia, accessed July 21, 2025, https://en.wikipedia.org/wiki/Advanced_Armament_Corporation

- Advanced Armament Corporation (AAC) Silencers/Sound Suppressors is Back in Business with Brand Relaunch – Defense Review, accessed July 21, 2025, https://defensereview.com/advanced-armament-corporation-aac-silencers-sound-suppressors-is-back-in-business-with-brand-relaunch/

- The AAC Brand Suppressor Relaunch Promises a Customer Service Focus, accessed July 21, 2025, https://athlonoutdoors.com/article/aac-brand-suppressor-relaunch/

- AAC – AMERICA’S PIONEER AND LEADER IN SOUND …, accessed July 21, 2025, https://www.advanced-armament.com/

- Bankrupt Remington Sold Off: Here Are The Winners – Pew Pew Tactical, accessed July 21, 2025, https://www.pewpewtactical.com/bankrupt-remington-sold-off/

- Palmetto State Armory: Revenue, Competitors, Alternatives – Growjo, accessed July 21, 2025, https://growjo.com/company/Palmetto_State_Armory

- Palmetto State Armory Company Overview, Contact Details & Competitors | LeadIQ, accessed July 21, 2025, https://leadiq.com/c/palmetto-state-armory/5a1d97ef2300005300868abe

- Firearms Market Size, Competitors, Trends & Forecast to 2030, accessed July 21, 2025, https://www.researchandmarkets.com/report/firearm

- Firearms Market Size, Share & Forecast Analysis Report, 2034, accessed July 21, 2025, https://www.gminsights.com/industry-analysis/firearms-market

- Firearms Market Size, Share, Trends | CAGR of 6.3%, accessed July 21, 2025, https://market.us/report/firearms-market/

- Remington Outdoor To Be Broken Up In Bankruptcy Sale | SGB Media Online, accessed July 21, 2025, https://sgbonline.com/remington-outdoor-to-be-broken-up-in-bankruptcy-sale/

- ATF Releases Gun Production and Export Data for 2022, accessed July 21, 2025, https://smokinggun.org/atf-releases-gun-production-and-export-data-for-2022/