In the first decade of the 21st century, the global handgun market was a settled affair, an established oligarchy dominated by legacy titans from Austria, Germany, and the United States. Brands like Glock, Heckler & Koch, SIG Sauer, and Smith & Wesson had carved out their territories, defined the technological landscape, and set consumer expectations for price and performance. The polymer-framed, striker-fired pistol was the reigning monarch, and the cost of entry into this kingdom was steep, measured not just in dollars, but in decades of proven reliability and brand loyalty. Into this stratified world, a new challenger emerged, not from the traditional heartlands of firearms manufacturing, but from the industrial port city of Samsun on Turkey’s Black Sea coast. This challenger was Canik, and it did not come to politely ask for a seat at the table; it came to kick the legs out from under it.

Initially dismissed by many Western observers as just another “budget” brand offering clones of established designs, Canik’s market entry was, in reality, a far more calculated and disruptive strategic play. It was an assault predicated on a unique fusion of aerospace-grade manufacturing precision, an almost fanatical dedication to iterative product improvement, and an aggressive value proposition that forced the entire industry to re-evaluate what was possible at a given price point. Canik did not simply offer a cheaper gun; it offered a comprehensive performance package—replete with a world-class trigger, superior ergonomics, and a suite of accessories—for the price of a competitor’s base model. This report will argue that the rise of Canik is a masterclass in strategic imitation, rapid innovation, and vertical integration. It is the story of how its parent company, Samsun Yurt Savunma (SYS), leveraged a foundation in national defense and high-precision aerospace manufacturing to transform itself from a regional contractor into a global firearms and defense systems powerhouse. In doing so, Canik has not only captured significant market share but has fundamentally altered consumer and competitor expectations for out-of-the-box performance and value, securing its place as one of the most significant firearms manufacturers of the 21st century.

Forged in Samsun: The Genesis of a Defense Powerhouse

The story of Canik is inextricably linked to the story of its parent, Samsun Yurt Savunma (SYS). The company was not born in a garage workshop but was established in 1998 as a key component of a broader, state-sponsored industrial strategy known as the Eastern Black Sea Arms Project.1 This origin is fundamental to understanding the company’s trajectory. Rather than a speculative commercial venture, SYS was conceived as a pillar of Turkey’s national effort to build a self-sufficient and technologically advanced domestic defense industry. Its base of operations was strategically located in Samsun, a city with a rich industrial history on the Black Sea coast.3

This endeavor was guided by the long-term industrial vision of the Aral family. The journey began with Cahit Aral, a prominent industrialist who had served as Turkey’s Minister of Industry and Trade, and was propelled into the modern era under the leadership of his son, Zafer Aral.4 This continuity of leadership provided a stable, multi-generational perspective focused on sustainable growth and technological sovereignty, rather than short-term market pressures. The initial government-backed framework provided a crucial incubation period for SYS. This environment likely offered a combination of initial capital investment, guaranteed domestic contracts, and a de-risked runway to build out the sophisticated manufacturing infrastructure required for modern arms production. The immense capital cost of acquiring and mastering advanced CNC machining centers is a formidable barrier to entry in the firearms industry. By securing foundational contracts with the Turkish military and national law enforcement, SYS could amortize these costs and perfect its processes before venturing into the hyper-competitive global civilian market.5 This state-supported incubation period provided a profound and lasting financial advantage, allowing Canik to later compete on price not merely because of lower labor costs, but because its foundational capital expenditures were effectively underwritten by its role as a national defense asset.

Crucially, before a single pistol frame was molded, SYS had established its bona fides in an even more demanding field: aerospace manufacturing. The company became a high-precision parts supplier for global aerospace and defense giants, including Lockheed Martin, Boeing, and Airbus.8 This is not a trivial footnote in the company’s history; it is the cornerstone of its manufacturing philosophy and brand identity. Aerospace production demands a culture of absolute precision, adherence to the tightest possible tolerances, and rigorous quality control protocols, such as those mandated by ISO 9001 and NATO standards.6 This expertise, honed by meeting the exacting requirements of the world’s leading aviation firms, was directly transferred to its firearms division. It imbued the company with the institutional knowledge and technical capability to produce complex, reliable mechanical systems at scale, setting the stage for the quality and consistency that would later define the Canik brand.

The Proving Ground: Early Models and a Critical Alliance

Like many nascent firearms manufacturers, Canik’s initial forays into handgun production were characterized by a strategy of learning from the masters. Before developing a unique design language, the company first proved its manufacturing competence by producing firearms heavily influenced by, or directly cloned from, proven European designs. This phase was critical for mastering the intricacies of handgun manufacturing while building a reputation for reliability within its domestic market.

The Canik 55 Era – Learning from the Masters

The first significant handgun lines to emerge from the Samsun factory were under the “Canik 55” banner, a direct nod to the company’s aerospace heritage. This series included the “Dolphin” and “Shark” models, which were well-regarded clones of the legendary Czech CZ-75 pistol.11 The Shark-C, a compact variant, and the Stingray-C, another CZ-75 compact derivative, followed suit.12 These all-metal, hammer-fired pistols were praised for their solid construction, good machining, and the use of high-quality components like Mec-Gar magazines.11 While they performed reliably and offered excellent value, they were fundamentally derivative works. They demonstrated that Canik could build a good gun, but they did not yet define what a Canik gun was.

The Walther Influence and the Dawn of the TP9

The pivotal strategic shift came when Canik moved beyond the CZ-75 platform and began producing licensed derivatives of the German-engineered Walther P99.6 This was a momentous leap forward. It transitioned the company from the world of all-steel, hammer-fired designs into the modern era of polymer-framed, striker-fired pistols that dominated the global market. The P99’s advanced ergonomics, innovative DA/SA striker mechanism, and modular design provided a sophisticated and proven technological foundation upon which Canik could build. This licensed production was not merely imitation; it was an education in the state-of-the-art, allowing Canik’s engineers to deconstruct and master the design principles that would directly inform their most successful product line: the TP9.

The Century Arms Partnership – Unlocking the West

For all its manufacturing prowess, Canik’s global ambitions would have remained unrealized without a gateway to the West. That gateway opened in 2012 through a strategic partnership with Century International Arms, a major U.S. firearms importer.6 This alliance was the single most important commercial catalyst in the company’s history. It provided Canik with immediate and large-scale access to the United States, the largest and most influential civilian firearms market in the world. Century Arms’ extensive distribution network and marketing muscle put Canik pistols on the shelves of American gun stores and into the hands of American shooters, setting the stage for a market disruption of unprecedented scale.

The Game Changer: Anatomy of the TP9 Revolution

The introduction of the TP9 series, facilitated by the Century Arms partnership, marked Canik’s transformation from a competent manufacturer of clones into a global brand with a distinct identity. The series did not emerge fully formed but was the product of rapid, market-driven iteration, with each new model refining the platform and addressing consumer feedback with remarkable speed.

The Original TP9: A Quirky Debut

The first model to hit U.S. shores was simply the TP9. It was a close derivative of the Walther P99, featuring a polymer frame and a unique DA/SA striker-fired mechanism controlled by a slide-mounted decocking button.11 When the slide was cycled, the striker was fully cocked, and the trigger was in a short-travel single-action mode. Pressing the decocker would safely drop the striker to a double-action position, resulting in a long, heavy initial trigger pull. While reliable and praised for its ergonomics and low price, the decocker was a feature many American shooters, accustomed to the simple manual of arms of a Glock, found unfamiliar and superfluous.11

Iterative Refinement: The Path to the SF

Canik listened intently to the market’s response and began a rapid cycle of evolution.

- TP9SA: The next major iteration was the TP9SA (Single Action). This model featured a significantly improved trigger that was single-action-only, providing a crisp, consistent pull for every shot.7 The decocker was retained, but its function changed: it now served only to safely deactivate the striker for field stripping, eliminating the need to pull the trigger during disassembly—a feature praised for its safety.17 This model was a major step forward, offering a trigger experience that began to rival more expensive competitors.

- TP9SF: The definitive evolution, and the model that truly cemented Canik’s reputation, was the TP9SF (Special Forces). Responding directly to market demand for a simpler, more direct operating system, Canik removed the decocker button entirely.7 The result was a pure, uncomplicated striker-fired pistol that directly competed with the dominant platforms in the market. The TP9SF became the workhorse of the lineup, a robust and reliable firearm that famously passed a grueling 60,000-round torture test without failure, proving its durability beyond any doubt.18

- TP9DA: For users who still preferred the traditional double-action/single-action system, Canik offered the TP9DA. This model retained the DA/SA trigger but featured a more intuitive top-mounted decocker, allowing for a safe, heavy first trigger pull followed by lighter single-action shots.18

Branching Out: The Elite Series

With the full-size models firmly established, Canik turned its attention to the burgeoning concealed carry market. The TP9SF Elite was introduced as a compact version, analogous in size to a Glock 19, featuring a shorter barrel and grip for easier concealment while maintaining excellent capacity and performance.18 This was followed by the

TP9 Elite SC (Sub-Compact), a smaller, more concealable pistol designed to compete with the likes of the Glock 26 and SIG Sauer P365, complete with an optics-ready slide from the factory—a feature that was then a premium option on most competing subcompacts.16

The Engineering Core: A World-Class Trigger

Across all its variations, the single feature that came to define the TP9 series and drive its meteoric rise was its trigger. From an engineering perspective, the Canik trigger is a fully pre-cocked, single-action striker system.22 This design means that cycling the slide fully cocks the striker, so the trigger’s only job is to release it. This allows for a much lighter and crisper pull compared to partially-cocked systems like Glock’s “Safe Action.” Canik further refined this mechanical advantage by nickel-plating the internal fire control components, such as the trigger bar and sear, which significantly reduces friction and contributes to a smoother pull.20

The result is a factory trigger with an exceptionally short take-up, a clean, well-defined “wall,” a crisp break with minimal over-travel, and an incredibly short and tactile reset.21 For shooters, this translates directly into greater accuracy and the ability to fire rapid follow-up shots with ease. The consensus among reviewers and users alike was that the stock Canik TP9 trigger was not just “good for the money”; it was objectively superior to the factory triggers found on many pistols costing hundreds of dollars more.8 This single component became Canik’s calling card, the undeniable proof of their engineering prowess and the primary driver of their disruptive value proposition.

The Evolution of Excellence: From METE to Rival

Having conquered the value segment of the market with the TP9 series, Canik set its sights higher. The next phase of the company’s evolution was not about creating cheaper alternatives but about engineering superior platforms that could compete with, and in some cases surpass, the best offerings from any manufacturer, regardless of price. This ambition gave rise to two new flagship lines: the METE and the Rival.

METE: The Second Generation

Launched in 2021, the METE (pronounced Met-Ay, a Turkish word for a brave hero) series represents the official second generation of Canik’s pistol platform.26 It was a ground-up redesign based on years of consumer and engineering feedback from the TP9 line, incorporating a host of functional and ergonomic improvements.

- Ergonomic and Frame Upgrades: The METE frame is a significant evolution. It features an integrally flared magazine well molded directly into the grip, facilitating faster and more intuitive reloads without the need for aftermarket add-ons. The trigger guard was given a deeper double undercut, allowing for a higher, more secure grip on the firearm, which enhances recoil control. The grip texturing was also made more aggressive to provide a more positive purchase.26

- Enhanced Modularity: A key internal change was the introduction of an “easy in/easy out” push-pin disassembly system. This design allows the user to completely field-strip the firearm’s internal chassis from the polymer frame using only a simple punch tool (often included with the pistol), pointing toward a more modular architecture that simplifies deep cleaning and maintenance.26

- Superior Optics Integration: Perhaps the most critical upgrade was the redesigned optics-ready slide cut. The METE’s optics interface is milled deeper into the slide than the TP9’s. This seemingly small change has a massive functional benefit: it allows a micro red dot sight to sit low enough to co-witness with the pistol’s standard-height iron sights.26 This provides an immediate and reliable backup sighting system without the need for taller, aftermarket suppressor-height sights, a major advantage for both defensive and competitive shooters.

Rival: The Assault on Competition

While the METE series refined the platform for duty and defensive use, the Rival series was an unapologetic, purpose-built assault on the world of competitive shooting. Canik’s strategy was to create a pistol that could dominate in disciplines like USPSA, IDPA, and IPSC right out of the box, offering a turnkey solution for a fraction of the cost of a custom-built race gun.30

- Performance-Driven Design: The polymer-framed SFx Rival is packed with competition-focused features. Its trigger is a masterpiece—a lightened, diamond-cut aluminum flat-faced trigger with a clean 90-degree break and an even shorter reset than the standard TP9/METE models.32 The frame is fully modular, and the slide features aggressive serrations and lightening cuts to reduce reciprocating mass and speed up cycle time.

- The Rival-S: The Steel Revolution: The pinnacle of this competitive drive is the SFx Rival-S.33 Here, Canik’s engineers made the deliberate choice to replace the polymer frame with one forged from solid steel. This dramatically increases the pistol’s weight from around 30 ounces to over 42 ounces.33 This added mass is not a drawback; it is the central design feature. In the physics of competitive shooting, weight is the enemy of recoil. The heavy steel frame acts as a stable platform, absorbing recoil energy and dramatically reducing muzzle flip, allowing the shooter to keep their sights on target for incredibly fast and accurate follow-up shots.

This intense focus on the competition market is a brilliant marketing strategy that creates a powerful “halo effect” for the entire brand. Competitive shooters are the most demanding users in the firearms world; their equipment choices are based purely on performance. When Team Canik shooters like Nils Jonasson win world championships with a factory SFx Rival-S, it serves as the ultimate validation of the platform’s accuracy, speed, and reliability under the most intense pressure.36 This success cascades down through the product line. A casual gun buyer, seeing a Canik win on the world stage, is no longer just buying a “good gun for the money.” They are buying a pistol with a championship pedigree. This elevates the perception of the entire brand, transforming it from a budget alternative into a proven winner that just happens to be an incredible value.

Table 1: The Canik Pistol Lineage: From Clone to Competitor

| Era/Series | Key Models | Primary Influence/Design | Key Features & Innovations | Target Market |

| Canik 55 (Early 2000s) | Dolphin, Shark, Stingray | CZ-75 | All-metal, hammer-fired DA/SA action; established manufacturing competence. | Domestic Military/LE |

| Early TP (c. 2012) | TP9 | Walther P99 | Polymer frame, DA/SA striker-fired action with slide-mounted decocker. | International Civilian |

| TP9 Evolution (2014-Present) | TP9SA, TP9SF, TP9DA, TP9SF Elite, TP9 Elite SC | Internal Iteration | SAO trigger (SA), removal of decocker (SF), introduction of compact/subcompact models (Elite/SC). | Civilian, Self-Defense, LE |

| METE Series (2021-Present) | METE SF, SFT, SFx, MC9 | User Feedback on TP9 | Deeper co-witness optics cut, flared magwell, improved frame ergonomics, modular push-pin design. | Duty, Self-Defense |

| Rival Series (2022-Present) | SFx Rival, SFx Rival-S | Competition Shooting | 90-degree break flat aluminum trigger, lightened slide, forged steel frame (Rival-S) for recoil mitigation. | Competition Shooters |

| Collaboration (2023-Present) | TTI Combat | Taran Tactical Innovations | Custom Taran Butler frame design, factory compensator, ported barrel, premium “halo” product features. | High-End Enthusiasts |

Apex Predator: The TTI Combat and the Power of Collaboration

At the apex of Canik’s product pyramid sits a firearm that represents a new level of ambition and a powerful statement of brand confidence: the TTI Combat. This pistol is the result of a strategic collaboration with Taran Butler of Taran Tactical Innovations (TTI), arguably one of the most influential figures in the modern firearms industry.37 Taran Butler is not only a world-champion shooter but also the founder of a company renowned for creating highly sought-after, performance-tuned firearms for competition, military special operations, and Hollywood films.

The partnership was more than a simple branding exercise; it was a deep engineering collaboration. The TTI Combat is built on a completely new polymer frame designed by Taran Butler himself, featuring a uniquely aggressive grip texture tailored to his specifications.38 The pistol incorporates a host of features that reflect TTI’s performance-first philosophy: a ported and fluted barrel to reduce weight and dissipate heat, the first-ever factory-installed Canik compensator to mitigate muzzle rise, a diamond-cut flat-faced 90-degree break trigger, and TTI-branded components like machined aluminum magazine base pads.37

With a price point approaching $1,000, the TTI Combat is not intended to be a high-volume seller like the TP9SF or METE SFT.38 Its strategic purpose is to serve as a “halo product.” By partnering with a name as respected as Taran Tactical, Canik instantly elevated its own brand prestige. The collaboration sent a clear message to the market: the underlying Canik platform is so robust and well-engineered that it is worthy of customization and enhancement by the very best in the industry. It placed the Canik name in the same conversation as high-end, custom-tuned firearms, effectively shattering any lingering perceptions of it being merely a “budget” brand. The TTI Combat serves as an aspirational flagship, demonstrating the ultimate performance potential of the Canik design and casting a glow of high-performance credibility over the entire product line.

Beyond the Pistol: A Vertically Integrated Defense Conglomerate

While the Canik brand’s meteoric rise in the civilian pistol market has captured global attention, the ambitions of its parent company, Samsun Yurt Savunma (SYS), extend far beyond handguns. Over the past decade, SYS has executed a deliberate and brilliant strategy to transform itself from a firearms manufacturer into a vertically integrated, comprehensive defense conglomerate capable of delivering complete weapon systems for land, air, and sea platforms.

Heavy-Caliber Capabilities

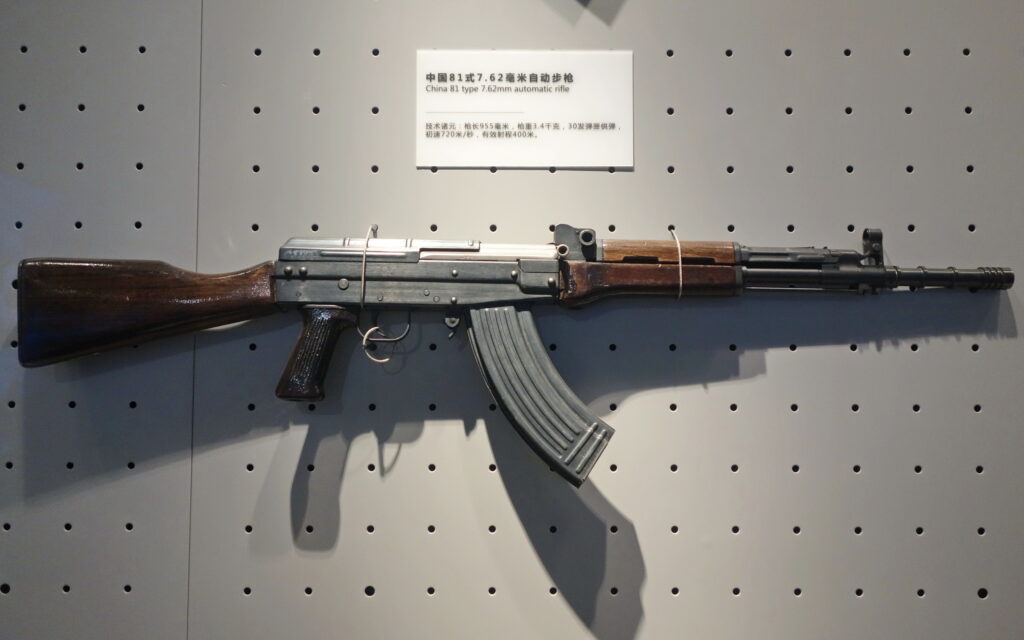

SYS’s first major step beyond pistols was to move directly into heavy-caliber weapons, developing the CANiK M2 QCB, a.50 BMG (12.7x99mm) heavy machine gun.39 Eschewing intermediate rifle calibers, the company focused on a high-value weapon system critical for vehicle-mounted and static defense roles. The M2 QCB is not merely a copy of an existing design; it is an improved platform that has undergone and passed some of the most grueling qualification tests in the world. It is the only firearm in its class to successfully complete both icing and fouling tests, and it has achieved a world-record barrel life of 20,000 rounds, double the typical expectation.39 The M2 QCB has been officially adopted by the Turkish Armed Forces and the Turkish National Police, with a landmark delivery of 750 units at once in late 2022, underscoring SYS’s significant production capacity.39

The AEI Systems Acquisition: A Strategic Masterstroke

The most transformative move in SYS’s recent history was the February 2023 acquisition of a majority stake in AEI Systems, a venerable UK-based defense company with over 60 years of experience in medium-caliber cannons.4 This acquisition was a strategic masterstroke. It instantly gave SYS access to a portfolio of proven, high-performance cannons, most notably the VENOM LR, a 30x113mm low-recoil revolver cannon.43 AEI Systems is one of only three companies in the world capable of producing 30x113mm cannons, a caliber with significant potential for use on a wide array of modern military platforms.44 The acquisition not only expanded SYS’s product line but also gave it a strategic manufacturing and business development hub within the United Kingdom, a key NATO ally.4

The Integration Ecosystem

SYS astutely recognized that modern defense procurement is not about selling individual weapons; it is about providing integrated solutions. A military force doesn’t just buy a cannon; it buys a complete remote weapon station (RWS) for its armored vehicle or patrol boat. Analysis of AEI Systems’ market position prior to the acquisition revealed that its excellent cannons were struggling to win contracts precisely because they were not offered as part of a pre-qualified, integrated system.45 In response, SYS had already built the missing pieces of the puzzle in-house.

- UNIDEF: Established in 2013, this subsidiary specializes in the physical integration of weapon systems onto various platforms.42

- UNIROBOTICS: Founded in 2020, this company provides the high-tech “brains” of the operation, developing the software, hardware, and mechatronic engineering for remote weapon stations like their TRAKON series.42

- MECANIK: This brand, initially focused on tactical gear, also produces electro-optics designed for integration with these weapon systems.43

This “system of systems” approach represents a fundamental shift up the defense industry value chain. SYS is no longer just a component supplier. It is now a prime contractor capable of bidding on multi-million-dollar defense programs with a complete, turnkey solution. When a nation issues a tender for arming its naval vessels, SYS can offer a fully integrated package: an AEI Systems VENOM LR cannon mounted on a UNIROBOTICS TRAKON naval RWS, controlled by UNIROBOTICS software and aimed with MECANIK optics, all integrated by UNIDEF. This holistic solution is vastly more attractive to military procurement agencies than purchasing individual components from disparate vendors and bearing the risk and expense of integration themselves. This strategic vertical integration is the key to SYS’s future growth and its emergence as a major player on the global defense stage.

Table 2: The SYS Group: An Integrated Defense Ecosystem

| Company/Brand | Role within SYS Group | Key Products/Capabilities | Strategic Value |

| CANiK | Small & Heavy Arms Division | TP9, METE, Rival Pistols; M2 QCB Heavy Machine Gun | Core brand recognition, high-volume manufacturing, entry point for global contracts. |

| AEI Systems | Medium-Caliber Cannon Division | VENOM LR 30x113mm Cannon, 20mm Cannons | Provides high-end firepower for vehicle, naval, and air platforms; UK/NATO footprint. |

| UNIROBOTICS | Mechatronics & Software Division | TRAKON Remote Weapon Stations (RWS), fire control systems, software. | The “brains” of the system; enables the sale of complete, automated weapon solutions. |

| UNIDEF | Systems Integration Division | Platform integration services for land, sea, and air vehicles. | The “hands” of the system; ensures all components work together seamlessly on the end-user’s platform. |

| MECANIK | Optics & Accessories Division | Red dot sights, tactical optics for RWS, tactical gear. | Provides critical sighting systems and enhances the value proposition of the complete package. |

The Global Verdict: A Reputation Forged in Fire

Over the course of a single decade, Canik has cultivated a global reputation that is both potent and multifaceted. The brand’s identity, forged in the crucible of a competitive market, now rests on several key pillars that resonate with a broad spectrum of shooters, from first-time buyers to seasoned competitors.

The Core Pillars: Trigger and Value

The overwhelming consensus from thousands of user reviews, forum discussions, and professional publications is that Canik’s rise is primarily attributable to two factors: its trigger and its value.8 The out-of-the-box trigger on nearly every Canik model is widely regarded as best-in-class for a factory striker-fired pistol, offering a crispness and reset that competitors often only achieve through expensive aftermarket upgrades.5 This superior performance is bundled into a package that represents an extraordinary price-to-performance ratio. Canik’s strategy of including multiple high-quality Mec-Gar magazines, a functional holster, optics mounting plates, and a comprehensive cleaning kit as standard fundamentally redefines the concept of value, significantly lowering the total cost of ownership for the end-user.5

Reliability: A Nuanced Picture

The question of reliability presents a more nuanced picture. The brand’s workhorse models, particularly the mature TP9SF line, have established a strong track record for durability and high-round-count reliability, with many users reporting thousands of rounds fired with zero malfunctions.48 These pistols have proven themselves to be robust and dependable platforms. However, the company’s rapid pace of innovation has not been without its challenges. The introduction of newer, more complex, and dimensionally compact models has been accompanied by some documented “teething issues.” The micro-compact METE MC9 and the initial releases of the steel-framed Rival-S, for example, saw a notable number of user reports citing failures to feed, eject, or return to battery, particularly during the break-in period.50 While these issues appear to be addressed in later production runs and are generally covered by Canik’s responsive warranty service, they highlight the inherent challenges of maintaining flawless quality control while pushing the boundaries of design and bringing new products to market at an aggressive pace.48

Ergonomics and Aesthetics

Canik pistols are almost universally praised for their ergonomics. The grip angle, interchangeable backstraps, and well-placed controls create a handgun that “melts into the hand” for many shooters, promoting a natural point of aim and effective recoil management.21 The brand’s aesthetic has also evolved significantly. Early TP9 models were sometimes described as having a “busy” or overly complex appearance.11 In contrast, the newer METE and Rival lines feature a more refined and aggressive styling, with clean lines, purposeful slide cuts, and a modern design language that communicates performance and quality.27

Trial by Fire: Validation on the World Stage

In the defense and firearms industry, market reputation is ultimately solidified not by user reviews, but by professional adoption and competitive victory. In this arena, Canik has amassed an impressive and undeniable record of success, providing objective validation of its products’ quality, reliability, and performance under the most demanding conditions.

Military & Law Enforcement Adoption

The most significant endorsement for any firearm is its selection for duty use by military and law enforcement agencies, where reliability is a matter of life and death. Canik has achieved this validation on a global scale.

- Turkey: At home, Canik is a cornerstone of national defense. It has become the sole provider of sidearms for the Turkish National Police and is a major supplier to the Turkish Armed Forces.7 Specific contracts include the delivery of the TP9SF Elite-S pistol to the Turkish Air Force and the adoption of their pistols and heavy machine guns by Turkish special forces units.39

- Global Contracts: Canik’s success extends far beyond its domestic market. The company’s firearms are in service with military and law enforcement agencies in at least 24 countries.57 Notable adoptions include contracts with the national police forces of Indonesia, the Philippines, Malaysia, and Bangladesh, demonstrating significant inroads into the crucial Southeast Asian market.57 These contracts are not merely sales figures; they are hard-won endorsements that testify to the platform’s ability to meet the rigorous standards of professional service.

Competitive Dominance

If military contracts are the proof of reliability, then victory in major shooting competitions is the proof of performance. Canik has strategically invested in building a world-class competitive shooting team, and the results have been a marketing windfall, cementing the brand’s reputation as a top-tier performer.

- Key Victories: Team Canik shooters, led by international champion Nils Jonasson, have consistently dominated the podium at major events. The team secured a landmark victory at the 2023 IDPA World Championship, with Jonasson taking first place in the Stock Service Pistol category using the SFx Rival-S.36 Other significant wins include the USPSA Carry Optic National Championship and numerous other national and international titles.59 These victories, achieved with factory-production firearms, serve as irrefutable evidence that Canik pistols can outperform the most expensive custom race guns in the world.

- Industry Awards: This competitive success has been mirrored by critical acclaim within the industry. Canik has won the prestigious “Handgun of the Year” award at the Industry Choice Awards multiple times, with honors going to the TP9 SFx (2017), TP9 Elite Combat (2019), TP9 Elite SC (2020), and the SFx Rival (2022).59 This consistent recognition from industry experts further validates the company’s commitment to innovation and quality.

Market Disruption: A Competitive Analysis

Canik’s success can be measured not only by its own growth but also by the profound impact it has had on the competitive landscape. By challenging the established hierarchy of price and performance, Canik has forced both consumers and competitors to re-evaluate their expectations.

- Canik vs. Glock: This is the quintessential matchup of the disruptor versus the incumbent. Canik’s primary advantages are a vastly superior factory trigger, more advanced ergonomics, and a complete, feature-rich package for a lower price.61 Glock’s formidable defense rests on its decades-long, unparalleled reputation for rock-solid reliability, its simple, rugged design, and the largest and most mature aftermarket for parts and accessories in the world.14 For many buyers, the choice comes down to whether they prioritize out-of-the-box performance and value (Canik) or a proven track record and ultimate customizability (Glock).

- Canik vs. Walther: This comparison is a fascinating battle between the inspiration and its most successful descendant. Both brands are lauded for their exceptional ergonomics and world-class triggers.63 The Walther PDP is often considered slightly more refined, with a more aggressive grip texture and what some argue is a superior optics mounting system, but these refinements come at a significant price premium.64 Canik, having built upon the foundational Walther design, competes by offering 95% of the performance for 70% of the cost, often winning the debate on overall value.64

- Canik vs. SIG Sauer: This is a contest of value versus modularity. Canik provides a more complete and higher-performing package straight from the factory for less money.25 SIG Sauer’s P320 platform, however, offers a level of modularity that Canik cannot match, thanks to its serialized Fire Control Unit (FCU). This allows the user to swap frames, slides, and calibers with ease, a powerful feature for those who value customization.67 SIG also benefits from the immense prestige of its M17/M18 service pistols winning the U.S. military’s Modular Handgun System contract.

- Canik vs. CZ: In the competition sphere, the Canik Rival-S goes head-to-head with the legendary CZ Shadow 2.52 The Rival-S offers a world-class striker-fired trigger in a heavy steel frame, providing a complete, match-ready package at an aggressive price.54 The CZ Shadow 2, however, is the undisputed benchmark for DA/SA steel-framed “race guns.” It boasts legendary ergonomics that feel custom-molded to the hand, a buttery-smooth DA/SA trigger, and a massive, competition-focused aftermarket that allows for infinite tuning.68 The choice often comes down to a shooter’s preference for a striker-fired versus a hammer-fired action and whether they want an out-of-the-box solution (Canik) or a platform for endless tinkering and optimization (CZ).

Table 3: Competitive Showdown: The Competition-Ready Pistol Market

| Feature | Canik SFx Rival-S | CZ Shadow 2 | Walther Q5 Match SF | SIG Sauer P320 XFIVE Legion |

| Action Type | Striker-Fired (SAO) | Hammer-Fired (DA/SA) | Striker-Fired (SAO) | Striker-Fired (SAO) |

| Frame Material | Forged Steel | Steel | Steel | Polymer (Tungsten-Infused) |

| Approx. Weight | ~42.7 oz | ~46.5 oz | ~41.6 oz | ~43.5 oz |

| Factory Trigger | Excellent, 90-degree break | Excellent, smooth DA/crisp SA | Very Good, crisp break | Very Good, lightened/skeletonized |

| Optics Ready | Yes, plates included | Yes (OR models) | Yes, plates included | Yes, direct mount |

| Approx. MSRP | ~$900 | ~$1,300 | ~$1,500 | ~$1,000 |

| Key Advantage | Unbeatable out-of-the-box value; complete competition package. | Legendary ergonomics; benchmark for DA/SA race guns; huge aftermarket. | Superb German engineering and refinement. | Unmatched modularity via FCU; heavy polymer frame. |

Conclusion: The Future Trajectory of a Turkish Titan

The story of Canik and its parent, Samsun Yurt Savunma, is a remarkable case study in modern industrial strategy and market disruption. In just over two decades, the company has traced an audacious trajectory from a state-backed aerospace parts manufacturer to a disruptive global firearms brand, and now, to an emerging, vertically integrated defense conglomerate. By leveraging a foundation of precision engineering, aggressively reinvesting in R&D, and astutely listening to the demands of the global market, Canik has successfully challenged the established order and carved out a significant and durable position in the industry.

However, the company’s path forward is not without significant challenges. First, it must continue to master the art of maintaining impeccable quality control at a massive scale. The “teething issues” reported with some of its newest and most ambitious models, while not catastrophic, represent a potential threat to the hard-won reputation for reliability that its workhorse TP9 series established. As the company continues to innovate at a blistering pace, ensuring that every new product is as dependable as its predecessors will be paramount. Second, Canik must navigate the delicate transition in brand perception from being a “great value” to being a “tier-one performer” that commands premium prices for its high-end offerings like the TTI Combat and Rival-S. This requires flawless execution and consistent competitive and professional validation. Finally, as a major Turkish defense company, SYS will have to navigate the complex and often volatile currents of geopolitics, which can impact its ability to secure defense contracts in a world of shifting alliances.

Despite these hurdles, Canik’s future opportunities are immense. The establishment of a new, state-of-the-art production facility in Florida is a strategic game-changer.70 It will not only streamline distribution in their largest market but will also make them eligible for lucrative U.S. military and law enforcement contracts, a market segment previously closed to them. Yet, the company’s greatest growth potential may no longer lie in pistols. The true future of SYS is in leveraging its complete, integrated defense ecosystem. By combining Canik’s firearms, AEI’s cannons, UNIROBOTICS’ remote weapon stations, and UNIDEF’s integration expertise, the SYS Group is poised to become a formidable competitor in the global market for advanced, turnkey weapon systems.

The Canik ascendancy is far from complete. The company’s unique blend of engineering excellence, strategic agility, and bold corporate vision has already permanently altered the landscape of the firearms industry. Its current trajectory suggests that its influence will only continue to grow, solidifying its status as a true Turkish titan on the world stage.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Canik Arms – Wikipedia, accessed August 30, 2025, https://en.wikipedia.org/wiki/Canik_Arms#:~:text=CANiK%20is%20a%20Turkish%20firearms,on%20the%20Black%20Sea%20coast.

- SAMSUN YURT SAVUNMA SANAYİ TİCARET AŞ – Vizyoner Genç, accessed August 30, 2025, https://vizyonergenc.com/firma/560-samsun-yurt-savunma-sanayi-ticaret-as#:~:text=Samsun%20Yurt%20Savunma%20Sanayi%20ve,Projenin%20Samsun%20aya%C4%9F%C4%B1%20olarak%20kurulmu%C5%9Ftur.

- Canik Arms – Wikipedia, accessed August 30, 2025, https://en.wikipedia.org/wiki/Canik_Arms

- CANİK’i 25 Yılda 3 Kıtada Üretim Yapan Bir Şirkete Dönüştürdü – Milli Savunma Sanayi, accessed August 30, 2025, https://www.savunmasanayi.org/caniki-25-yilda-3-kitada-uretim-yapan-bir-sirkete-donusturdu/

- Pass The Turkey: Canik 9mm Handgun Line Review – Gun Digest, accessed August 30, 2025, https://gundigest.com/gun-reviews/handguns-reviews/pass-the-turkey-canik-9mm-handgun-line-review

- An In-Depth History of Canik Firearms – Coventry Tactical, accessed August 30, 2025, https://www.coventrytactical.com/post/an-in-depth-history-of-canik-firearms

- Canik Firearms History – 45 Blast, accessed August 30, 2025, https://45blast.com/pages/the-history-of-canik-firearms

- Is Canik Reliable? A Detailed Review on Canik Firearms – 45 Blast, accessed August 30, 2025, https://45blast.com/blogs/news/is-canik-reliable-a-detailed-review-on-canik-firearms

- Canik Firearms – Athlon Outdoors, accessed August 30, 2025, https://athlonoutdoors.com/article/canik-firearms/

- About Canik – Canik USA, accessed August 30, 2025, https://www.canikusa.com/about-canik

- The 9mm No-Name: Canik 55 TP9 Pistol Review – Handguns, accessed August 30, 2025, https://www.handgunsmag.com/editorial/the-9mm-no-name-canik-55-tp9-review/138120

- Hands On: Canik55 Stingray-C – Apex Gunsmithing, accessed August 30, 2025, https://apexgunsmithing.com/hands-on-canik55-stingray-c/

- My Canik 55 Shark C 9mm! : r/CCW – Reddit, accessed August 30, 2025, https://www.reddit.com/r/CCW/comments/27fn0b/my_canik_55_shark_c_9mm/

- Glock 17 vs. Canik TP9SA: Polymer Pistol Showdown – Handguns, accessed August 30, 2025, https://www.handgunsmag.com/editorial/polymer-pistol-showdown-glock-17-vs-canik-tp9sa/137873

- Century International Arms – Wikipedia, accessed August 30, 2025, https://en.wikipedia.org/wiki/Century_International_Arms

- Everything You Need To Know About The Canik TP9 Series, accessed August 30, 2025, https://aliengearholsters.com/blogs/news/canik-tp9

- Review: Canik TP9 SA – Affordable Quality in a 9mm Pistol – Eagle Gun Range, accessed August 30, 2025, https://www.eaglegunrangetx.com/shooting-review-the-canik-tp9-sa/

- Review of the Canik TP9 Series: A More-Than-Worthy Alternative to Glock, accessed August 30, 2025, https://themarksmanindoorrange.com/review-of-the-canik-tp9-series/

- TP9SF – Canik USA, accessed August 30, 2025, https://www.canikusa.com/tp9sf

- TP9DA – Canik USA, accessed August 30, 2025, https://www.canikusa.com/tp9da

- [Review] Canik TP9SF Elite | Dream Budget Pistol or Bust?, accessed August 30, 2025, https://lynxdefense.com/reviews/canik-tp9sf-elite/

- Canik firearms – SASS Wire Forum, accessed August 30, 2025, https://forums.sassnet.com/index.php?/topic/343908-canik-firearms/

- canik.pdf, accessed August 30, 2025, https://www.canikarms.com/pdf/canik.pdf

- Is a Canik really as good as the hype? : r/canik – Reddit, accessed August 30, 2025, https://www.reddit.com/r/canik/comments/17qa0nj/is_a_canik_really_as_good_as_the_hype/

- Canik VS Sig (handguns) : r/guns – Reddit, accessed August 30, 2025, https://www.reddit.com/r/guns/comments/1mhtnnh/canik_vs_sig_handguns/

- METE SFx – Canik USA, accessed August 30, 2025, https://www.canikusa.com/mete-sfx

- Review: Canik METE SF Pistol | An Official Journal Of The NRA – Shooting Illustrated, accessed August 30, 2025, https://www.shootingillustrated.com/content/review-canik-mete-sf-pistol/

- Mete Series – Canik Arms, accessed August 30, 2025, https://www.canikarms.com/en/series/mete-series

- Canik METE MC9 vs Canik TP9 Elite SC Tabletop Comparison – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=FnnPUmfp7s0

- Canik SFx Rival 9mm Luger Pistol – Academy Sports, accessed August 30, 2025, https://www.academy.com/p/canik-sfx-rival-9mm-luger-pistol-134507034

- Canik SFX Rival 9mm Luger 5in Rival Gray Pistol – 18+1 Rounds | Sportsman’s Warehouse, accessed August 30, 2025, https://www.sportsmans.com/shooting-gear-gun-supplies/handguns/canik-sfx-rival-9mm-luger-5in-greygold-pistol-181-rounds/p/1752661

- SFx RIVAL | Canik Arms, accessed August 30, 2025, https://www.canikarms.com/en/products_detail/sfx-rival

- SFx RIVAL-S | Canik Arms, accessed August 30, 2025, https://www.canikarms.com/en/products_detail/sfx-rival-s

- CANIK SFx Rival-S Steel-Framed Semi-Auto Pistol | Bass Pro Shops, accessed August 30, 2025, https://www.basspro.com/p/canik-sfx-rival-s-steel-framed-semi-auto-pistol

- canik-general-catalog-en.pdf – NET, accessed August 30, 2025, https://canikacademyne.blob.core.windows.net/content/catalog/f3e0d03d-60ec-4e1d-b939-4c004c35cd00/canik-general-catalog-en.pdf

- CANiK Team Dominates 2023 Championships, accessed August 30, 2025, https://news.canik.com/en/sayi-8/haberler/canik-team-dominates-2023-championships

- TTI COMBAT – Canik Arms, accessed August 30, 2025, https://www.canikarms.com/en/products_detail/tti-combat

- Canik TTI Combat Semi-Automatic Pistol – 9mm | Bass Pro Shops, accessed August 30, 2025, https://www.basspro.com/p/canik-tti-combat-semi-automatic-pistol-9mm

- CANiK Made History in Türkiye with Delivering 750 M2 QCB Heavy Machine Guns at Once, accessed August 30, 2025, https://news.canik.com/en/sayi-5/haberler/canik-made-history-in-turkiye-with-delivering-750-m2-qcb-heavy-machine-guns-at-once

- Barrel Technologies of SYS Make Its Firearm Peerless | Canik News, accessed August 30, 2025, https://news.canik.com/en/sayi-3/haberler/barrel-technologies-of-sys-make-its-firearm-peerless

- Samsun Yurt Savunma 2025 Company Profile – PitchBook, accessed August 30, 2025, https://pitchbook.com/profiles/company/520540-75

- Samsun Yurt Savunma’s Latest Strategic Move: Acquisition Process …, accessed August 30, 2025, https://www.defenceturkey.com/en/content/samsun-yurt-savunma-s-latest-strategic-move-acquisition-process-of-aei-systems-completed-5412

- SYS Group to highlight integrated defense capabilities at DSEI 2025 …, accessed August 30, 2025, https://defensehere.com/en/sys-group-to-highlight-integrated-defense-capabilities-at-dsei-2025/

- CANIK ARMS | International Armoured Vehicles – Defence IQ, accessed August 30, 2025, https://www.defenceiq.com/events-internationalarmouredvehicles/sponsors/canik-arms

- SYS’ Latest Strategic Move: Acquisition Process of AEI Systems Complete | Canik News, accessed August 30, 2025, https://news.canik.com/en/sayi-5/haberler/sys-latest-strategic-move-acquisition-process-of-aei-systems-complete

- Review: Canik SFx Rival 9 mm | An NRA Shooting Sports Journal, accessed August 30, 2025, https://www.ssusa.org/content/review-canik-sfx-rival-9-mm/

- Review of the Turkish 9mm Luger Canik 55 TP-9 Handgun – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=lNfKFeAx06I

- Lifespan on Canik firearms : r/canik – Reddit, accessed August 30, 2025, https://www.reddit.com/r/canik/comments/yiqckm/lifespan_on_canik_firearms/

- Canik Long Term Reliability : r/canik – Reddit, accessed August 30, 2025, https://www.reddit.com/r/canik/comments/ipi320/canik_long_term_reliability/

- Handled my first Canik yesterday and loved it… But concerned about reliability. – Reddit, accessed August 30, 2025, https://www.reddit.com/r/canik/comments/15w9fpu/handled_my_first_canik_yesterday_and_loved_it_but/

- Canik MC9 vs. HK VP9SK : r/CAguns – Reddit, accessed August 30, 2025, https://www.reddit.com/r/CAguns/comments/1g6xia3/canik_mc9_vs_hk_vp9sk/

- CZ Shadow 2 vs Canik Rival S : r/CompetitionShooting – Reddit, accessed August 30, 2025, https://www.reddit.com/r/CompetitionShooting/comments/1k7r25z/cz_shadow_2_vs_canik_rival_s/

- Canik TP9SFX Review: Specifications, Performance, and Price …, accessed August 30, 2025, https://www.craftholsters.com/canik/guides/tp9sfx-review

- Canik SFx Rival-S Review: Best Budget Competition Gun? – Tactical Hyve, accessed August 30, 2025, https://tacticalhyve.com/canik-sfx-rival-s-review/

- In service of Turkish Air Force | News – Canik Arms, accessed August 30, 2025, https://www.canikarms.com/en/news/in-service-of-turkish-air-force

- A Review Of The Canik TP9SF 9mm Special Forces Pistol – Christian Gun Owner, accessed August 30, 2025, https://www.christiangunowner.com/canik-tp9sf-from-century-arms.html

- CANiK is the choice of police force in Indonesia – Defensehere, accessed August 30, 2025, https://defensehere.com/en/canik-is-the-choice-of-police-force-in-indonesia/

- Türkiye’s CANiK signs defense deals with Pakistan, Bangladesh, Azerbaijan at IDEF 2025, accessed August 30, 2025, https://www.turkiyetoday.com/nation/turkiyes-canik-signs-defense-deals-with-pakistan-bangladesh-and-azerbaijan-at-idef-20-3204658

- Another Success for CANiK SFx RIVAL in USA: Pistol of the Champion of Carry Optic National Tournament, accessed August 30, 2025, https://news.canik.com/en/sayi-5/haberler/another-success-for-canik-sfx-rival-in-usa-pistol-of-the-champion-of-carry-optic-national-tournament

- The History of Canik & Century Arms: Evolution of Legendary …, accessed August 30, 2025, https://45blast.com/blogs/news/the-history-of-canik-century-arms-evolution-of-legendary-firearms

- Canik vs Glock: Performance, Reliability, Which is Better? | Craft …, accessed August 30, 2025, https://www.craftholsters.com/glock/guides/glock-vs-canik

- Glock vs. Canik: Top Reasons to Choose Canik for Your Next Pistol – CYA Supply Co., accessed August 30, 2025, https://www.cyasupply.com/blogs/articles/glock-vs-canik-top-reasons-to-choose-canik-mc9-for-your-next-pistol

- Canik SFx Rival vs. Walther PDP : r/liberalgunowners – Reddit, accessed August 30, 2025, https://www.reddit.com/r/liberalgunowners/comments/1mbw06x/canik_sfx_rival_vs_walther_pdp/

- Walther PDP vs Canik Mete SFT – The shooter wins. – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=Itlth03MetI

- Walther PDP Pro SD vs Canik TP9 Elite Combat – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=4VfsZZ2RVIs&pp=ygUGI2NvcGRw

- Walther PDP F VS Canik TP9 Elite SC What Is A Better Value – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=BQGkY-Rlp1o

- Canik vs Sig: Which Handgun is Right for You? – 45 Blast, accessed August 30, 2025, https://45blast.com/blogs/news/canik-vs-sig-which-handgun-is-right-for-you

- Canik Rival-S VS CZ Shadow 2, Beretta 92X Performance, Stock 2, P320 Max, Walther Q5SF – YouTube, accessed August 30, 2025, https://www.youtube.com/watch?v=SDsvAAM68Ms

- Canik SFx Rival Review: Best Affordable Competition? – Pew Pew Tactical, accessed August 30, 2025, https://www.pewpewtactical.com/canik-sfx-rival-review/

- CANiK Counting Down to Mass Production in the U.S., accessed August 30, 2025, https://news.canik.com/en/sayi-11/haberler/canik-counting-down-to-mass-production-in-the-us