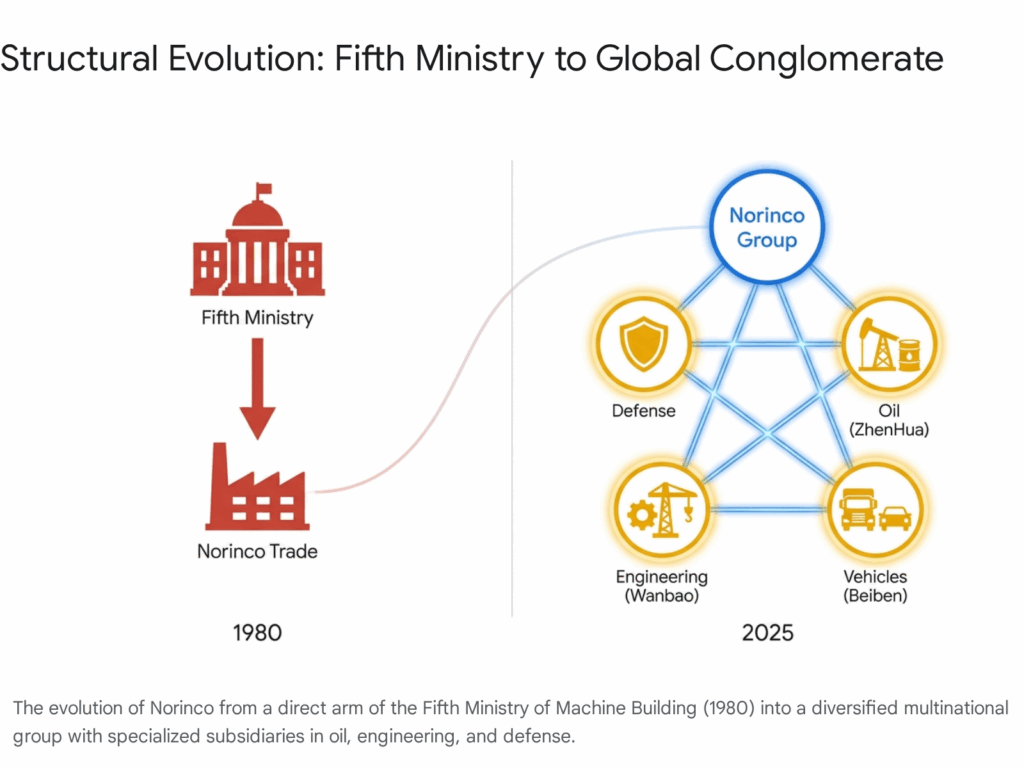

The trajectory of the China North Industries Corporation (Norinco) serves as the most potent industrial barometer for the broader rise of the People’s Republic of China (PRC). Established in 1980, ostensibly as a trading interface for the sprawling Fifth Ministry of Machine Building, Norinco has metastasized from a purveyor of reverse-engineered Soviet small arms into a globally integrated conglomerate with commanding stakes in defense manufacturing, petroleum extraction, strategic mineral supply chains, and civil infrastructure.

For the firearms industry analyst, Norinco presents a case study in adaptability and survival. In the 1980s and early 1990s, the corporation functioned as a prolific supplier to the American consumer market, flooding gun shows and retail shelves with affordable SKS carbines, AK-pattern rifles, and ammunition. This “Gold Rush” era was abruptly terminated by executive action in 1993 and 1994, forcing a strategic decoupling that redirected Norinco’s focus toward state-to-state sales in the developing world.

Today, Norinco is the vanguard of China’s “Military-Civil Fusion” strategy. It no longer merely sells weapons; it sells sovereignty packages. By bundling advanced land warfare platforms—such as the VT-4 main battle tank—with infrastructure projects delivered by its engineering subsidiaries and energy deals secured by its oil arm, Norinco offers a comprehensive partnership model that Western competitors struggle to replicate.

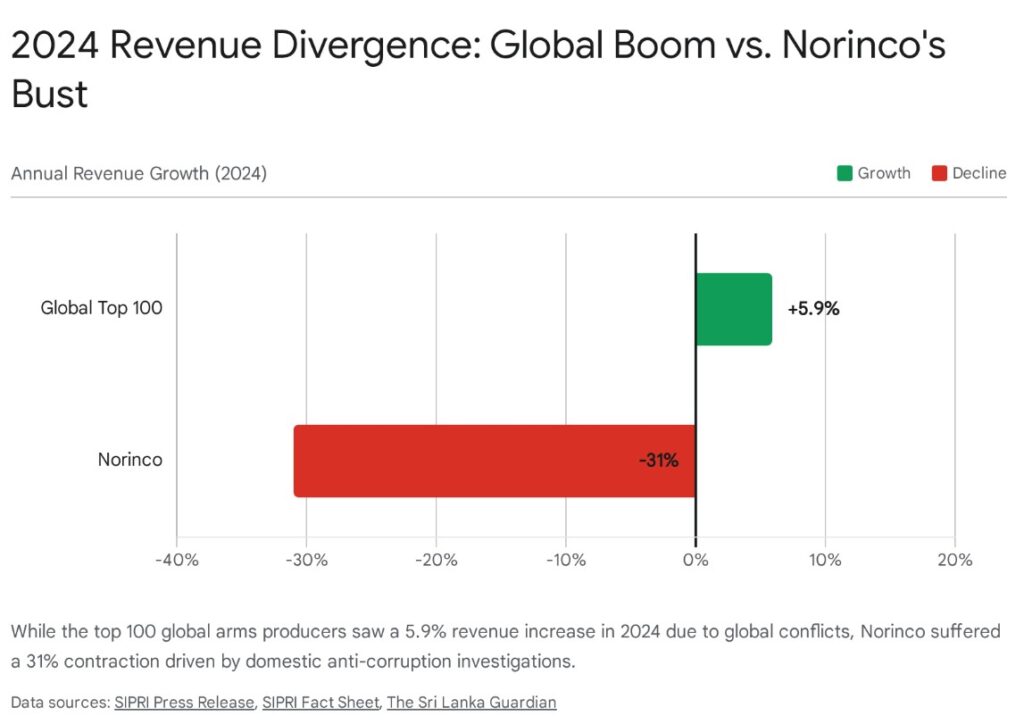

However, the corporation currently faces its most significant existential test since the 1990s. As it pivots toward “intelligentized warfare” with the integration of AI and autonomous systems like the P60 combat vehicle, it is simultaneously being hollowed out by a ferocious domestic anti-corruption purge. The removal of its chairman in 2024 and a resultant 31% collapse in arms revenue signal deep structural fissures within China’s defense industrial base. This report provides an exhaustive operational history, technical analysis, and future forecast for one of the world’s most opaque and powerful defense entities.

1. Genesis and Institutional DNA (1949–1989)

1.1 The Legacy of the Fifth Ministry

To understand the current operations of Norinco, one must first dissect its institutional parentage. Following the establishment of the PRC in 1949, China’s defense industry was organized along Soviet lines—rigid, centralized, and compartmentalized into numbered ministries. The Fifth Ministry of Machine Building was the designated custodian of conventional land armaments.1 This vast bureaucracy controlled hundreds of factories, research institutes, and proving grounds, yet it operated with zero commercial awareness. Production was dictated by quotas, not demand, resulting in massive inefficiencies and a lack of innovation.

By the late 1970s, as Deng Xiaoping initiated the era of “Reform and Opening Up,” the incompatibility of this Stalinist industrial model with China’s modernization goals became glaring. The state needed hard currency to purchase foreign technology, and the Fifth Ministry sat on a mountain of excess industrial capacity.

1.2 The Corporatization Experiment (1980)

In 1980, the State Council approved the creation of the China North Industries Corporation (Norinco).1 This was a radical departure from previous doctrine. Norinco was not just a manufacturer; it was a corporate entity empowered to engage in foreign trade, retain a portion of its foreign exchange earnings, and negotiate directly with international clients. It served as the commercial interface for the Fifth Ministry’s assets, tasked with transforming “steel into gold.”

The timing was fortuitous. The outbreak of the Iran-Iraq War (1980–1988) provided Norinco with a near-insatiable market for its wares. Operating with a pragmatic neutrality, Norinco supplied both Tehran and Baghdad with Type 69 tanks, towed artillery, and millions of rounds of small arms ammunition. This conflict was the crucible that forged Norinco’s logistics chains and provided the capital necessary to begin upgrading its manufacturing base from 1950s Soviet tooling to more modern standards.

2. The American Era: A Market Captured and Lost (1984–1994)

For the firearms industry analyst, the decade spanning the mid-1980s to the mid-1990s represents a unique epoch where Norinco was a household name in American gun culture. This period is critical for understanding the corporation’s manufacturing scalability and its subsequent reputational baggage.

2.1 The “SKS” Phenomenon

Entering the U.S. market in the mid-1980s, Norinco identified a massive gap in the entry-level segment. American manufacturers were focused on high-quality hunting rifles and expensive sporting arms. Norinco introduced the Type 56 Carbine, a Chinese variant of the Simonov SKS. Rugged, reliable, and featuring a chrome-lined bore (a feature absent in many domestic rifles), the Norinco SKS was imported in vast quantities.

By the early 1990s, these rifles were retailing for as little as $79 to $99.3 This aggressive pricing strategy allowed Norinco to dominate the surplus and entry-level markets. The SKS became the “everyman’s rifle,” ubiquitous in pickup trucks and gun safes across the Midwest and South. While collectors initially scoffed at the “cheap Chinese” finish, the underlying metallurgy was sound, derived from military specifications intended for the PLA.

2.2 The AK Market Dominance

Simultaneously, Norinco exported semi-automatic variants of the Type 56 Assault Rifle (AK-47 clone). Known commercially as the Type 56S, these rifles were distinct from their European counterparts due to their stamped receivers (on later models) and hooded front sights. In 1993 alone, largely driven by fear of impending legislation, nearly one million Chinese-made rifles entered the United States.3 This volume is staggering even by modern standards and underscores the sheer industrial capacity Norinco had mobilized for the civilian market.

2.3 The “MAK-90” and Regulatory Evasion

Following the 1989 import ban on “assault weapons” by the Bush administration (which targeted features like bayonet lugs and pistol grips), Norinco demonstrated remarkable agility. They rapidly retooled production lines to create the MAK-90 (Modified AK-1990). This rifle featured a thumbhole stock and removed the restricted military features, technically complying with the “sporting purpose” clause of the import regulations.4 The MAK-90 became the single most common AK-variant in America during the 1990s, a testament to Norinco’s ability to navigate complex regulatory environments to maintain market share.

2.4 The Executive Order of 1993

The golden era ended abruptly on May 28, 1993. President Bill Clinton, while renewing China’s Most-Favored-Nation (MFN) trade status, issued an Executive Order (implemented via State Department determination) that specifically banned the importation of Chinese rifles and pistols and their ammunition.1

This action was ostensibly linked to human rights and proliferation concerns but also served as a concession to domestic gun control advocates who viewed the flood of cheap semi-automatic weapons as a public safety threat. The ban severed Norinco’s primary cash cow in the civilian sector. While shotguns (like the Norinco Hawk 982) remained importable for a time, the high-volume rifle trade was dead.

2.5 Operation Dragon Fire and the Total Embargo

The relationship hit its nadir in 1996 with Operation Dragon Fire. A federal sting operation targeted Norinco representatives who allegedly offered to sell fully automatic AK-47s and shoulder-fired missiles to undercover agents posing as gang suppliers.2 The fallout was immediate and severe. While Norinco Beijing claimed the individuals were rogue actors, the U.S. government imposed a comprehensive ban on all future imports from Norinco, extending to its subsidiaries. This event effectively ended Norinco’s direct commercial presence in the United States and cemented its status as a “bad actor” in Washington’s eyes.

3. The Pivot: Building a Geopolitical Conglomerate (1995–2015)

Expelled from the lucrative U.S. market, Norinco faced a strategic crisis. It could no longer rely on volume sales of small arms to Western civilians. The solution was a pivot toward a conglomerate model that integrated defense sales with energy extraction and infrastructure development—a strategy that would later become the blueprint for the Belt and Road Initiative.

3.1 The Energy-Defense Nexus: ZhenHua Oil

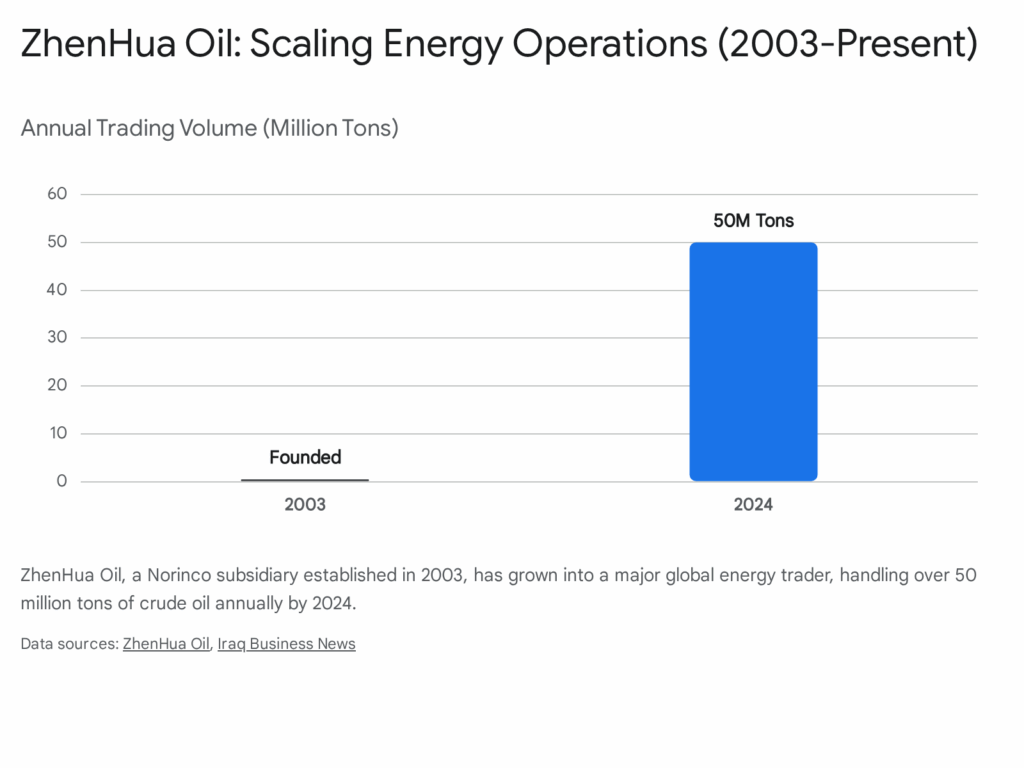

In 2003, Norinco founded China ZhenHua Oil Co., Ltd. as a wholly-owned subsidiary.8 This was a masterstroke of vertical integration. The rationale was simple: many of Norinco’s prospective arms clients (Iraq, Sudan, Angola, Venezuela) were cash-poor but resource-rich. By establishing its own oil company, Norinco could accept payment in crude or exploration rights, effectively bypassing the U.S. dollar-dominated financial system.

ZhenHua Oil grew rapidly. It secured rights to the East Baghdad Oil Field in Iraq, a project fraught with security risks that Western majors avoided.9 By 2024, ZhenHua Oil had evolved into a major global player, trading over 50 million tons of crude oil annually and operating exploration projects with recoverable reserves of 770 million tons.8 This subsidiary effectively transforms Norinco from a mere vendor into a strategic partner essential to the client nation’s economic survival.

3.2 Infrastructure as Diplomacy: Wanbao Engineering

Parallel to its energy expansion, Norinco elevated its construction subsidiary, China Wanbao Engineering Corporation. Originally tasked with building domestic factories, Wanbao began bidding on international civilian contracts.

A prime example of this synergy is the Kamoya Copper-Cobalt Project in the Democratic Republic of the Congo (DRC).11 Wanbao Engineering constructs the mining infrastructure, Norinco provides the heavy trucks (Beiben) and security equipment, and the mined cobalt feeds back into China’s strategic battery supply chain. This “minerals-for-security” model allows Norinco to extract value far exceeding the profit margins of simple arms sales. By 2016, the Kamoya project had reached an annual output of 55,000 tons of copper-cobalt concentrate, embedding Norinco deeply into the global tech supply chain.11

3.3 The Heavy Logistics Backbone: Beiben Truck

In 1988, Norinco signed a licensing agreement with Daimler-Benz to manufacture heavy-duty trucks in China, birthing Beiben Truck (North Benz).12 While the license eventually expired, Norinco retained the tooling and expertise. Beiben trucks, based on the legendary Mercedes NG80 chassis, became the standard logistical platform for the PLA and a key export item.

These trucks represent the perfect “dual-use” good. They are exported as civilian dump trucks and cargo haulers to construction firms (often Chinese-owned) in Africa and Central Asia. However, their rugged chassis is identical to the military variants used to mount rocket artillery or transport troops. This allows Norinco to maintain a “civilian” footprint in markets where overt military sales might be politically sensitive.

4. The Belt and Road Vanguard (2015–2023)

With the advent of the Belt and Road Initiative (BRI) under President Xi Jinping, Norinco’s role expanded from corporate opportunist to instrument of statecraft. The corporation rebranded itself as a “pioneer” of the BRI, leveraging its diversified portfolio to secure key nodes along the economic corridors.9

4.1 The Lahore Orange Line (Pakistan)

The Lahore Orange Line Metro Train stands as the crown jewel of Norinco’s civil engineering prowess. A flagship project of the China-Pakistan Economic Corridor (CPEC), this $1.62 billion mass transit system was constructed by a joint venture between Norinco International and China Railway Group.14

Why would a defense contractor build a subway? The project serves multiple strategic ends:

- Economic Stabilization: It stabilizes the economy of Pakistan, Norinco’s largest military client.

- Soft Power: It provides a highly visible public good to the citizens of Lahore, countering anti-Chinese sentiment.

- Operational Presence: The 8-year operation and maintenance contract gives Norinco a long-term, legitimate foothold in a key strategic city.14

4.2 Penetrating Europe: The Senj Wind Farm

In a move that surprised many observers, Norinco International acquired a 76% stake in the Senj Wind Power Project in Croatia in 2017.16 Investing over €160 million, Norinco built and now operates this 156MW facility, one of the largest in the region.

This project serves a vital branding function. It allows Norinco to present itself to European regulators not as a “merchant of death,” but as a provider of green energy solutions. It demonstrates compliance with stringent EU environmental and labor standards, creating a precedent for future investments in the bloc. The project entered full commercial operation in 2021, selling power into the Croatian grid—revenue that is diversified away from the volatile defense sector.16

5. Modern Arsenal: The Export Portfolio

Despite its diversification, Norinco remains the primary supplier of land armaments to the PLA and the developing world. Its modern product line has shed the “cheap clone” reputation of the 1980s, offering systems that compete directly with Russian and Western hardware on capability, if not yet on reliability.

5.1 The VT-4 Main Battle Tank

The VT-4 (MBT-3000) is the flagship of Norinco’s export catalog. It represents a generation leap over the T-54/55 derivatives that previously defined Chinese exports.

- Technical Specifications: The VT-4 features a 1,200 hp diesel engine, a 125mm smoothbore gun capable of firing gun-launched missiles, and a digitized fire control system with hunter-killer capabilities.18 It is protected by composite armor and FY-4 explosive reactive armor (ERA).

- Market Success – Thailand: In a major upset, the Royal Thai Army selected the VT-4 over the Ukrainian T-84 Oplot and various Western options. Thailand ordered 60 units, with deliveries completing in 2023.19 The deal was clinched by Norinco’s ability to deliver quickly—contrast to Ukraine’s production delays—and the inclusion of technology transfer packages.

- Strategic Deployment – Pakistan: Pakistan deployed the VT-4 (locally branded as “Haider”) to counter India’s T-90S tanks. This sale ensures a balance of power in South Asia favorable to Beijing.21

- Combat Debut – Nigeria: In April 2020, Nigeria received a batch of VT-4s specifically for the campaign against Boko Haram.22 This marked the first active combat deployment of the tank, serving as a critical marketing test for its durability in harsh African conditions.

However, the program has faced headwinds. Reports from Pakistan indicate reliability issues with the engine and transmission in extreme desert heat, leading to a reduction in the total procurement target from 468 to 258 units.23 This highlights a lingering weakness in Chinese heavy armor: the “heart disease” of engine reliability that still lags behind German and American powerpacks.

5.2 Precision Fires and Artillery

Norinco has achieved significant success with its PLZ-45 and PLZ-52 self-propelled howitzers. These 155mm systems utilize NATO-standard ammunition compatibility, allowing them to be sold to countries like Kuwait, Saudi Arabia, and Algeria that have mixed Western/Eastern inventories. The sale of these systems to wealthy Gulf states proves that Norinco can compete on quality, not just price, in the precision-fires domain.

6. The Technological Frontier: Intelligentized Warfare (2024–Present)

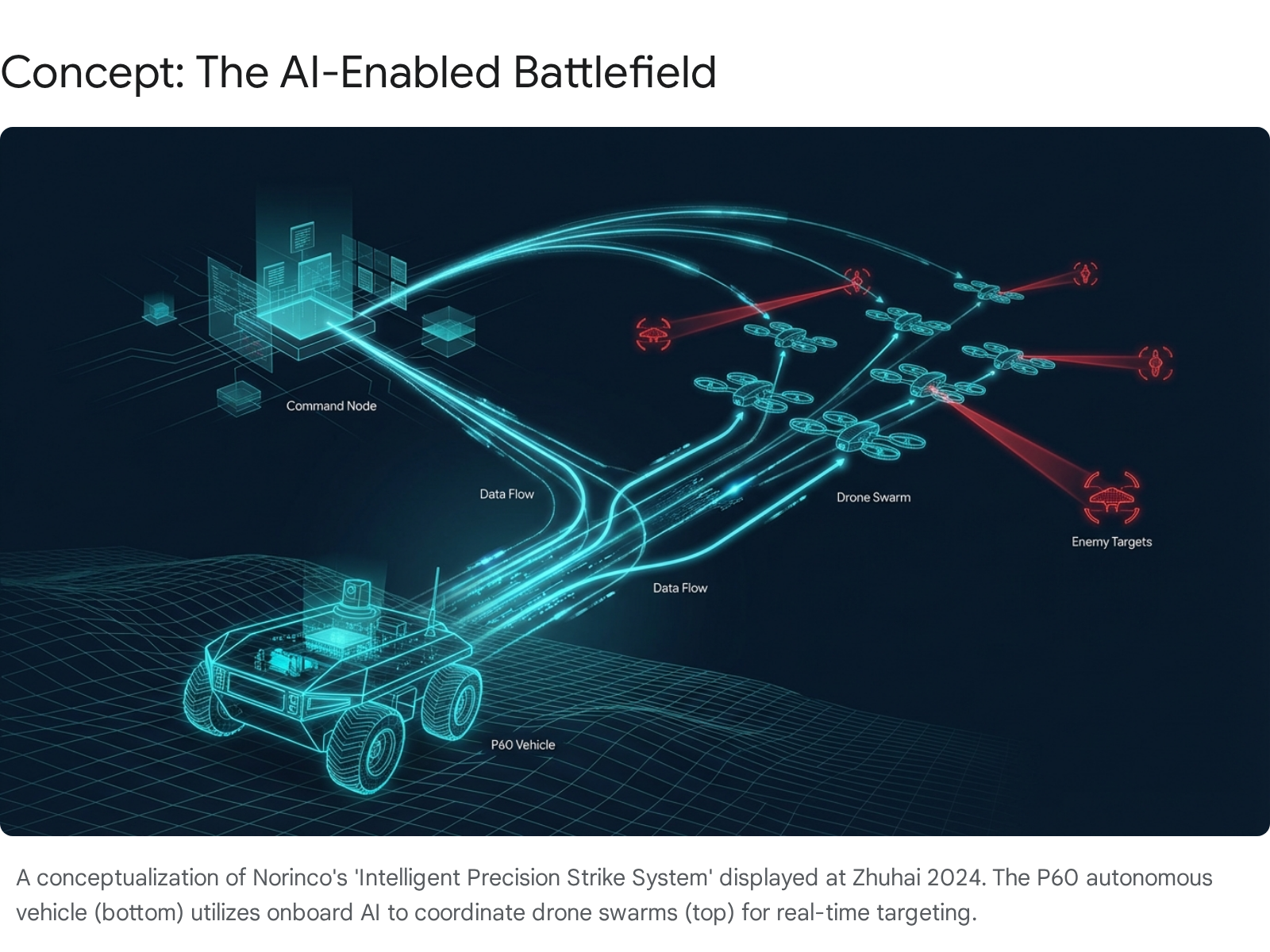

As of 2025, Norinco is undertaking its most ambitious transformation yet: the shift from mechanized warfare to “intelligentized” warfare. This involves the deep integration of Artificial Intelligence (AI) and autonomous behaviors into its weapons platforms.

6.1 The “Intelligent Precision Strike System”

At the Zhuhai Airshow in November 2024, Norinco unveiled a system-of-systems concept dubbed the “Intelligent Precision Strike System”.24 This is not a single weapon but a networked architecture. It envisions a battlefield where autonomous reconnaissance drones identify targets and automatically feed data to loitering munitions and rocket artillery batteries. The system utilizes edge computing to process targeting solutions locally, reducing the sensor-to-shooter loop to seconds.

6.2 The DeepSeek Integration and the P60

In early 2025, industry intelligence revealed a potentially paradigm-shifting development: the integration of the DeepSeek large language model (LLM) into Norinco’s military platforms. Specifically, the P60 autonomous combat support vehicle was highlighted as a testbed for this technology.26

The P60 is a robotic ground vehicle capable of navigating complex terrain at speeds up to 50 km/h. The integration of a “DeepSeek” derived AI suggests that these vehicles possess advanced cognitive capabilities—such as interpreting complex natural language commands from commanders, reasoning through tactical dilemmas, and autonomously recognizing disguised targets.26 While Western nations grapple with the ethics of Lethal Autonomous Weapons Systems (LAWS), Norinco’s aggressive push into this sector suggests a strategy to achieve “algorithmic superiority” by bypassing these ethical constraints. Procurement records reviewed by Reuters indicate that despite U.S. export controls on advanced chips (like the Nvidia H100), Norinco and its university partners are actively acquiring or finding workarounds to power these AI models.27

7. The Crisis Within: Corruption and Contraction (2023–2025)

Just as Norinco reaches for the technological cutting edge, its institutional foundations are crumbling. The corporation is currently ensnared in the widest-ranging anti-corruption purge to hit the Chinese military-industrial complex in decades.

7.1 The Purge of the Leadership

In 2024, Liu Shiquan, the chairman of Norinco, was unceremoniously stripped of his seat on the Chinese People’s Political Consultative Conference (CPPCC).29 In the opaque lexicon of Chinese politics, this is a clear precursor to criminal prosecution. His removal was not an isolated incident; it occurred alongside the decapitation of the PLA Rocket Force leadership and the removal of executives from CASC (aerospace) and CASIC (missiles).30

The allegations appear to center on the massive procurement contracts of the last decade. The rapid expansion of the PLA’s budget created opportunities for graft, bid-rigging, and the embezzlement of R&D funds. The “audit paralysis” resulting from these investigations has been severe. Decision-makers, fearful of attracting scrutiny, have frozen new contracts and delayed payments.

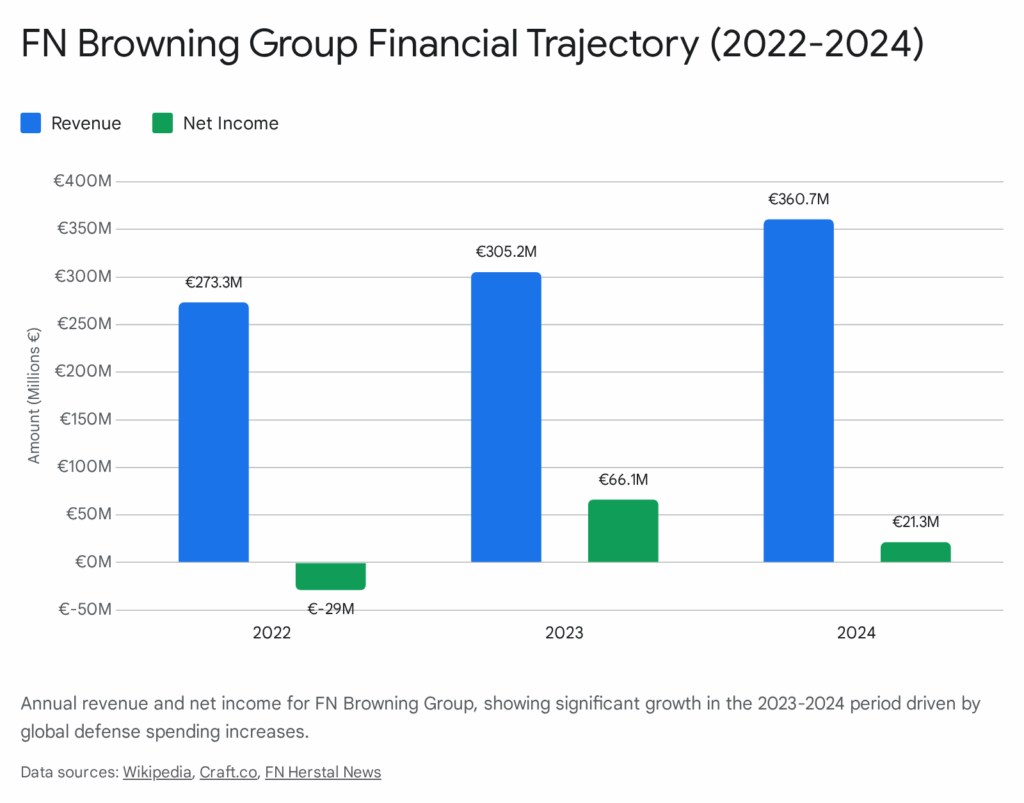

7.2 The 2024 Revenue Collapse

The financial impact of this political turmoil has been catastrophic. According to data released by the Stockholm International Peace Research Institute (SIPRI) in December 2025, Norinco’s arms revenue fell by 31% in 2024, dropping to approximately $14 billion.32

This contraction is even more stark when viewed against the global backdrop. In 2024, the top 100 global arms producers saw their revenues rise by nearly 6%, driven by the insatiable demands of the wars in Ukraine and Gaza.34 Norinco’s precipitous decline in a booming market indicates that the rot is internal. The corporation is effectively paralyzed, unable to finalize export deals or secure domestic orders while the political inquisition continues.

8. Future Outlook and Strategic Implications

Looking toward 2030, Norinco faces a dual reality. It possesses world-class technology and a diversified empire, yet it is hobbled by political distrust and leadership instability.

1. The “Supplier of Last Resort” Dividend:

As Western sanctions on Russia tighten, and as Russia’s own defense industry is consumed by the war in Ukraine, Norinco stands to gain. Countries that previously bought Russian gear (e.g., in Africa and Latin America) will increasingly turn to China. Norinco is positioned to capture this market share, provided it can resolve its internal production bottlenecks.

2. The AI Export Strategy:

Expect Norinco to aggressively market its AI capabilities. The P60 and similar systems will be marketed as cost-effective force multipliers for smaller militaries. Norinco will likely offer “Safe City” and “Smart Border” packages that integrate its surveillance tech with lethal autonomous response capabilities—a controversial but highly attractive proposition for authoritarian regimes.

3. The Reconstruction of Trust:

The immediate priority for the new leadership will be survival. We can expect a period of extreme conservatism in Norinco’s operations—strict adherence to budgets, a slowdown in risky foreign acquisitions, and a focus on delivering core PLA contracts to prove loyalty to Beijing. The days of the “freewheeling” commercial expansion of the 2000s are over; the Norinco of the future will be more tightly leashed to the Party’s immediate strategic needs.

9. Appendix: Chronology of Major Milestones

| Year | Milestone Event | Category | Context & Impact |

| 1980 | Founding of Norinco | Corporate | Approved by State Council; evolved from Fifth Ministry of Machine Building to monetize defense capacity.1 |

| 1980s | Iran-Iraq War Sales | Export | Supplied tanks and artillery to both belligerents, generating initial foreign exchange reserves. |

| 1988 | Beiben Truck Established | Corporate | Licensing deal with Daimler-Benz to produce heavy trucks, creating a dual-use logistics backbone.12 |

| 1990 | US Import Surge | Trade | Peak imports of SKS and MAK-90 rifles to US civilian market; Norinco becomes a household brand.3 |

| 1993 | US Firearm Import Ban | Sanctions | President Clinton issues EO blocking import of Norinco rifles/pistols, citing proliferation concerns.1 |

| 1994 | Federal Assault Weapons Ban | US Law | Further restricts sale of military-style firearms, cementing the end of Norinco’s US civilian era.4 |

| 1996 | Operation Dragon Fire | Scandal | US sting operation implicates Norinco officials in smuggling fully automatic weapons; total embargo follows.7 |

| 2003 | Founding of ZhenHua Oil | Diversification | Creation of oil subsidiary to secure global energy assets in exchange for defense contracts.8 |

| 2003 | US Missile Sanctions | Sanctions | Sanctioned by Bush administration for alleged missile technology transfers to Iran.1 |

| 2010 | Wanbao Engineering Expansion | Corporate | Construction subsidiary expands into African mining and infrastructure, cementing the “conglomerate” model.37 |

| 2013 | BRI Launch | Strategy | Norinco officially positions itself as a key contractor for the Belt and Road Initiative.9 |

| 2016 | Thailand VT-4 Deal | Export | Major contract to supply advanced VT-4 Main Battle Tanks to Thailand, beating Ukraine and Western rivals.19 |

| 2020 | Lahore Orange Line Opens | Infrastructure | $1.6B metro project in Pakistan enters operation, managed by Norinco International.14 |

| 2020 | Nigeria Tank Delivery | Export | VT-4 tanks delivered and deployed in combat operations against Boko Haram.22 |

| 2021 | Senj Wind Farm Ops | Energy | 156MW wind project in Croatia begins commercial operation, marking entry into EU energy market.16 |

| 2021 | US Investment Ban | Sanctions | EO 14032 bans US investment in Norinco Group, citing links to the PLA.38 |

| 2024 | P60 / DeepSeek Integration | Technology | Unveiling of AI-powered autonomous combat vehicle using advanced LLM capabilities.26 |

| 2024 | Corruption Purge | Crisis | Chairman Liu Shiquan removed from CPPCC; Norinco arms revenue drops 31% amid investigations.29 |

| 2024 | Zhuhai Airshow Debut | Technology | “Intelligent Precision Strike System” unveiled, showcasing future networked warfare capabilities.24 |

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Chinese Construction Equipment Manufacturers: Norinco 2025 – CAMAL Group, accessed December 21, 2025, https://camaltd.com/norinco/

- China North Industries Corporation (NORINCO) – Iran Watch, accessed December 21, 2025, https://www.iranwatch.org/suppliers/china-north-industries-corporation-norinco

- Ammunition Was Seized Under ’94 Chinese Arms Embargo – SFGATE, accessed December 21, 2025, https://www.sfgate.com/news/article/Ammunition-Was-Seized-Under-94-Chinese-Arms-3035071.php

- Semiautomatic Assault Weapons Ban – EveryCRSReport.com, accessed December 21, 2025, https://www.everycrsreport.com/reports/RL32585.html

- Executive Order 12850 – National Archives, accessed December 21, 2025, https://www.archives.gov/files/federal-register/executive-orders/pdf/12850.pdf

- China-U.S. Relations: Chronology of Developments During the Clinton Administration – EveryCRSReport.com, accessed December 21, 2025, https://www.everycrsreport.com/reports/97-484.html

- Norinco: This Company Has Cloned (and Sold) American Gun Designs for Decades, accessed December 21, 2025, https://nationalinterest.org/blog/reboot/norinco-company-has-cloned-and-sold-american-gun-designs-decades-178484

- 振华石油控股有限公司 Corporate Profile, accessed December 21, 2025, https://www.zhenhuaoil.com/col/col9246/index.html

- About NORINCO, accessed December 21, 2025, http://en.norinco.cn/col/col6486/index.html

- International Oil Companies: Zhenhua Oil (EBS Petroleum) | Iraq Business News, accessed December 21, 2025, https://www.iraq-businessnews.com/list-of-international-oil-companies-in-iraq/international-oil-companies-zhenhua-oil/

- Kamoya copper cobalt ore, DRC – NORINCO, accessed December 21, 2025, http://en.norinco.cn/col/col6553/index.html

- BeiBen Truck – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/BeiBen_Truck

- Ideanomics’ MEG Announces Strategic Agreement with Leading EV Heavy Truck and Bus Manufacturer, BeiBen Heavy Truck – PR Newswire, accessed December 21, 2025, https://www.prnewswire.com/news-releases/ideanomics-meg-announces-strategic-agreement-with-leading-ev-heavy-truck-and-bus-manufacturer-beiben-heavy-truck-301028158.html

- Orange Line (Lahore Metro) – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/Orange_Line_(Lahore_Metro)

- NORINCO To share, to care and to be together Orange Line Metro, A new Chapter in Lahore’s Urban Development:, accessed December 21, 2025, http://en.norinco.cn/art/2021/4/26/art_7412_274983.html

- Power plant profile: Senj Wind Power Project, Croatia – Power Technology, accessed December 21, 2025, https://www.power-technology.com/data-insights/power-plant-profile-senj-wind-power-project-croatia/

- Senj 156MW Wind Power Plant – Lisann Ltd, accessed December 21, 2025, https://lisannltd.com/senj-wind-power-plant/

- VT-4 – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/VT-4

- Thailand to buy more Chinese tanks, reportedly for $58M – Defense News, accessed December 21, 2025, https://www.defensenews.com/land/2017/04/04/thailand-to-buy-more-chinese-tanks-reportedly-for-58m/

- China’s NORINCO Completes Delivery of 60 VT-4 Main Battle Tanks To Thailand, accessed December 21, 2025, https://defencesecurityasia.com/en/chinas-norinco-completes-delivery-of-60-vt-4-main-battle-tanks-to-thailand/

- Pakistan’s Mass Production of VT4 Tanks Creates Chinese Tank Encirclement on India’s Eastern and Western Fronts – China-Arms, accessed December 21, 2025, https://www.china-arms.com/2024/03/pakistan-vt4-tanks-creates-chinese-tank-encirclement-on-india/

- China-made VT-4 MBT delivered to Nigeria – Ministry of National Defense, accessed December 21, 2025, http://eng.mod.gov.cn/xb/News_213114/TopStories/4863443.html

- From Nigerian Battlefields to Pakistani Trials, the Promised Capabilities of China’s VT-4 Tank Fall Short Amid Reliability Crises | Defence News India, accessed December 21, 2025, https://defence.in/threads/from-nigerian-battlefields-to-pakistani-trials-the-promised-capabilities-of-chinas-vt-4-tank-fall-short-amid-reliability-crises.13580/

- New products show China’s quest to automate battle – Defense One, accessed December 21, 2025, https://www.defenseone.com/threats/2025/03/new-products-show-chinas-quest-automate-battle/403387/

- Combat system ‘combining cluster loitering ammunition with multiple rocket launcher’ unveiled at Airshow China – Global Times, accessed December 21, 2025, https://www.globaltimes.cn/page/202411/1322985.shtml

- China Races Ahead With AI-Powered Military Technology – Evrim Ağacı, accessed December 21, 2025, https://evrimagaci.org/gpt/china-races-ahead-with-aipowered-military-technology-513910

- China’s autonomous military combat drone powered by DeepSeek highlights Nvidia reliance — investigation reveals People’s Liberation Army, supporting institutions continue to use restricted H100 chips | Tom’s Hardware, accessed December 21, 2025, https://www.tomshardware.com/tech-industry/artificial-intelligence/chinas-autonomous-military-combat-drone-powered-by-deepseek-highlights-nvidia-reliance-investigation-reveals-peoples-liberation-army-supporting-institutions-continue-to-use-restricted-h100-chips

- China’s next-generation weapons: AI, autonomy, and the race to outpace the U.S. | Ctech, accessed December 21, 2025, https://www.calcalistech.com/ctechnews/article/sktsoohcex

- Chinese defense firms saw mixed results, corruption fallout in 2023, accessed December 21, 2025, https://www.defensenews.com/top-100/2024/08/06/chinese-defense-firms-saw-mixed-results-corruption-fallout-in-2023/

- CHINA WATCH – TDI, accessed December 21, 2025, https://tdinternational.com/wp-content/uploads/2024/10/240103_PLA_personnel_final.pdf

- China’s military firms struggle as corruption purge bites, report says – bdnews24.com, accessed December 21, 2025, https://bdnews24.com/world/asia-pacific/bb034bf1088f

- The SIPRI Top 100 Arms-producing and Military Services Companies, 2024, accessed December 21, 2025, https://www.sipri.org/sites/default/files/2025-11/fs_2512_top_100_2024.pdf

- China’s Military Firms See Revenue Drop Amid Corruption Crackdown – Sri Lanka Guardian, accessed December 21, 2025, https://slguardian.org/chinas-military-firms-see-revenue-drop-amid-corruption-crackdown/

- SIPRI Top 100 arms producers see combined revenues surge as states rush to modernize and expand arsenals, accessed December 21, 2025, https://www.sipri.org/media/press-release/2025/sipri-top-100-arms-producers-see-combined-revenues-surge-states-rush-modernize-and-expand-arsenals

- Top 100 arms producers see combined revenues surge – APDR, accessed December 21, 2025, https://asiapacificdefencereporter.com/top-100-arms-producers-see-combined-revenues-surge/

- Change to nonproliferation listing | Office of Foreign Assets Control, accessed December 21, 2025, https://ofac.treasury.gov/recent-actions/20050527

- China North Industries Corporation – International Peace Information Service, accessed December 21, 2025, https://ipisresearch.be/wp-content/uploads/2017/04/201703_publicatie-Norinco.pdf

- Norinco – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/Norinco