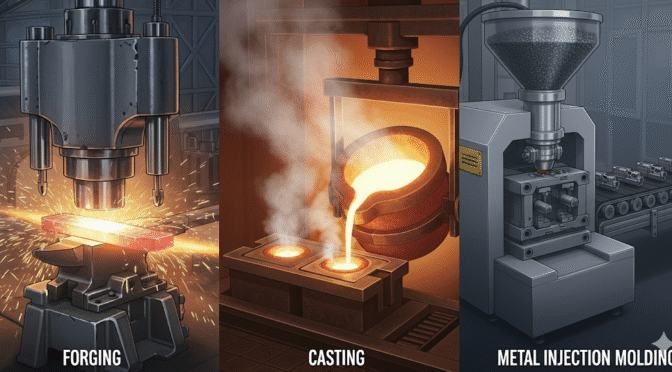

The selection of a manufacturing process for any firearm component is a critical engineering decision that dictates not only the part’s final geometry but, more importantly, its internal microstructure and subsequent mechanical performance. The three dominant methods for producing near-net-shape metal parts—forging, investment casting, and metal injection molding (MIM)—represent distinct pathways to a final product, each with a unique set of advantages and inherent limitations. A thorough understanding of these processes, from the flow of metal under a press to the fusion of powder in a furnace, is essential for designing reliable, safe, and cost-effective firearms. The fundamental difference between these methods lies in how they control the metal’s internal crystalline structure. Forging is a process of refining an existing solid structure, whereas casting and MIM involve creating a new solid structure from a liquid or particulate state. This distinction is the root cause of the hierarchy of mechanical properties observed in the final components.

1.1 Forging: The Gold Standard for Strength and Durability

Forging is a manufacturing process that shapes metal in its solid state through the application of localized compressive forces, delivered via hammering or pressing.1 This ancient technique, modernized with industrial power, remains the benchmark for components requiring maximum strength, impact toughness, and fatigue resistance.4 The process is typically categorized by the temperature at which it is performed: hot forging occurs above the metal’s recrystallization temperature, while cold forging is performed at or near room temperature.3

In firearms manufacturing, the most relevant technique is closed-die forging, also known as impression-die forging.3 In this process, a metal billet, heated to a plastic state, is placed in the lower half of a precision-machined steel die. A power hammer or press then drives the upper die onto the billet, forcing the metal to flow and fill the die cavities, taking on the shape of the final part.3 Excess metal is squeezed out between the die faces, forming “flash,” which is later trimmed off. This method is used to produce the rough forms of critical, high-stress components like pistol slides, revolver frames, and rifle receivers.5

The paramount engineering advantage of forging lies in its effect on the metal’s metallurgical structure. The process does not simply reshape the part; it fundamentally refines its internal grain structure. As the metal is compressed and forced to flow, the cast grain structure of the original billet is broken down and recrystallized into a much finer, more uniform grain structure.1 Critically, these grains are forced to align with the contours of the part, creating a continuous, directional grain flow.4 This is analogous to the grain in a piece of wood, which is strongest when stress is applied along its length. This controlled deformation eliminates the internal voids and porosity that can be found in cast metals, resulting in a component of superior metallurgical soundness, exceptional strength, and unparalleled resistance to fatigue and impact.1

A specialized application of this principle is the cold hammer forging (CHF) of barrels, a process utilized by manufacturers like Glock and SIG Sauer for high-performance firearms.10 In CHF, a barrel blank is impacted thousands of times by industrial hammers at room temperature, forming it around a hardened mandrel that has the inverse pattern of the rifling.12 This intense process simultaneously forms the external contour of the barrel and impresses the lands and grooves of the rifling into the bore. The constant pounding unifies the molecular structure of the steel, creating an exceptionally dense, hard, and smooth surface that is highly resistant to wear. The result is a barrel with superior longevity that does not require a “break-in” period to achieve optimal accuracy.12

1.2 Investment Casting: The Path to Geometric Complexity

Investment casting, colloquially known as the “lost wax” process, is a manufacturing method prized for its ability to produce parts with a high degree of geometric complexity and a superior surface finish.13 Though its principles are ancient, modern investment casting is a highly controlled, multi-step industrial process.15

The process begins with the creation of a precise wax pattern, an exact replica of the final part, which is produced by injecting wax into a reusable metal mold.13 Multiple wax patterns are then attached to a central wax runner system, forming a “tree” or cluster.13 This tree is then dipped repeatedly into a ceramic slurry and coated with sand, building up a layered ceramic shell—the “investment.” After the shell has dried and hardened, it is placed in a high-pressure steam autoclave, where the wax is rapidly melted and drained away, leaving a hollow, one-piece ceramic mold. This is the “lost wax” step.13 The empty ceramic mold is then fired in a high-temperature oven (approximately 1000 °C) to cure it and burn out any residual wax. Finally, molten metal is poured into the hot ceramic mold. Once the metal has solidified, the ceramic shell is broken away, and the individual parts are cut from the tree.13

The primary advantage of investment casting is its design freedom. Because the molten metal can flow into nearly any shape defined by the wax pattern, the process can create highly intricate components with undercuts, internal passages, and fine details that would be extremely difficult, expensive, or impossible to produce via forging or machining from solid stock.13 It is also compatible with a vast range of alloys, including stainless steels, aluminum, and nickel-based alloys, making it a versatile choice for many firearm components.13

However, the engineering vulnerability of casting lies in the physics of molten metal solidification. As the liquid metal is poured into the mold, turbulence can trap gases, and shrinkage during cooling can create voids, resulting in microscopic defects known as porosity.1 Furthermore, any impurities in the melt can become trapped in the final part as inclusions.19 While modern foundries employ stringent controls like vacuum casting to minimize these issues, the risk is inherent to the process. The resulting grain structure of a cast part is typically equiaxed and random, meaning the grains have no preferred orientation. This isotropic structure provides uniform mechanical properties in all directions, but it lacks the directionally optimized strength and fatigue resistance of a forging.8 Consequently, cast parts generally exhibit good compressive strength but are weaker in tension and more susceptible to failure under repeated bending or high-cycle fatigue loads.1

1.3 Metal Injection Molding (MIM): Precision and Volume for Intricate Components

Metal Injection Molding (MIM) is a relatively modern, highly advanced manufacturing process that synergizes the design complexity of plastic injection molding with the material properties of powder metallurgy.21 It is the process of choice for producing enormous quantities of small, geometrically complex, high-precision metal parts.22 The MIM process consists of four distinct stages 21:

- Feedstock Preparation: The process begins by combining extremely fine metal powders with a proprietary blend of polymer binders, such as wax and polypropylene, which act as a temporary medium to carry the metal powder.21 This mixture is heated and compounded to create a homogenous, sludge-like “feedstock” with rheological properties that allow it to be injected like a plastic.21

- Injection Molding: Using standard plastic injection molding machines, the feedstock is heated and injected under high pressure into a precision-machined, multi-cavity steel mold.21 Due to equipment limitations, the “shot” of material is typically 100 grams or less, which can be distributed across multiple cavities to produce several parts at once.21 The part cools and solidifies into a “green part,” which is an oversized replica of the final component; the mold is intentionally made larger to account for the significant shrinkage that will occur later in the process.21

- Debinding: The “green part” is then subjected to a debinding process to remove the majority of the polymer binder. This is a critical step, and several methods can be employed, including solvent extraction, thermal furnaces, or catalytic processes; often, a combination of methods is used.21 The result is a fragile, porous “brown part,” which consists of metal particles held together by a small amount of remaining binder and is approximately 40% “air” by volume.21

- Sintering: Finally, the “brown part” is placed in a high-temperature, precisely controlled-atmosphere furnace for sintering. It is heated to a temperature just below the melting point of the metal alloy (e.g., 1,350-1,400 °C for stainless steel).21 At this temperature, capillary forces and solid-state diffusion cause the metal particles to fuse and bond together.21 This process, often a form of liquid phase sintering where partial melting occurs, causes the part to shrink significantly—typically by 15-20% in each dimension—to its final, precise dimensions.21 The final component is densified to typically 96-99% of its theoretical solid density, resulting in mechanical properties comparable to annealed parts made by traditional methods.21

MIM’s core strength is its ability to mass-produce small (usually under 100 grams), extremely complex parts to very tight dimensional tolerances (±0.3% is common) with an excellent surface finish, often completely eliminating the need for secondary machining.4 This makes it exceptionally cost-effective for high-volume components like triggers, hammers, sears, safeties, and magazine catches.26 The primary engineering weakness of MIM is the presence of residual porosity. Even with optimal sintering, the final part is not 100% dense. These microscopic, albeit uniformly distributed, voids can act as stress risers, providing initiation points for fatigue cracks under high-cycle or high-impact loading conditions.18 Like a casting, the resulting grain structure is fine and isotropic, lacking the aligned, fatigue-resistant grain flow of a forging.18 The term “near-net-shape” is often used to describe all three processes, but its practical meaning varies. A forged part requires machining of critical surfaces and flash removal.1 An investment cast part may need machining to correct for shrinkage or surface defects.16 MIM, for small, intricate components, is the truest to the “near-net-shape” promise, often being ready for assembly directly from the sintering furnace.21 This elimination of post-processing is a massive driver of its overall cost-effectiveness.

Section 2: Comparative Analysis of Material and Part Properties

A direct comparison of parts made by forging, casting, and MIM reveals a clear hierarchy of mechanical performance, directly attributable to the underlying microstructures created by each process. This analysis quantifies the engineering trade-offs between ultimate strength, fatigue life, geometric complexity, and production cost, providing a data-driven basis for component design and material selection. The central engineering dilemma is the inverse relationship between a process’s ability to create complex shapes and the ultimate strength of the resulting part. Forging maximizes strength by working solid metal, but this limits complexity. Casting and MIM achieve complexity with fluid-like materials but at the cost of potential microstructural flaws and a less optimal grain structure.

2.1 Structural Integrity: Grain Structure and Its Implications

The internal grain structure is the single most important determinant of a metal part’s strength and durability.

- Forging: The defining characteristic of a forged part is its continuous, directional grain structure that is deliberately aligned with the part’s geometry.1 This anisotropic structure is engineered to place the strongest orientation of the metal’s grains along the paths of highest stress. This refined, compressed grain flow dramatically increases resistance to fatigue and impact by inhibiting the initiation and propagation of micro-cracks.1 Properly executed, the forging process also compresses and closes any internal voids that may have existed in the initial billet, resulting in the highest possible material density and metallurgical soundness.1

- Casting & MIM: Both casting and MIM produce an isotropic, equiaxed grain structure, meaning the grains are randomly oriented and of roughly equal size in all directions.18 This results in uniform mechanical properties regardless of the direction of applied force. While this can be advantageous for components subjected to complex, multi-directional stress fields, it means the part lacks the peak directional strength that can be achieved with forging.20

- Inherent Defects: Each process has a characteristic potential for defects. Casting is the most susceptible to significant, randomly located defects like porosity (from trapped gas or shrinkage) and inclusions (non-metallic impurities).1 These defects can act as major stress concentrators and are a primary cause of unexpected part failure. MIM’s characteristic flaw is

residual porosity, microscopic voids left over from the sintering process where the metal particles did not fully fuse.20 While far smaller and more uniformly distributed than casting defects, these pores still reduce the cross-sectional area and can serve as initiation sites for fatigue cracks. Forging stands apart as the process that actively works to eliminate such defects, yielding the most structurally sound component.

2.2 Mechanical Properties: A Quantitative Comparison

The differences in microstructure translate directly into measurable differences in mechanical performance.

- Tensile & Yield Strength: For any given alloy, forging produces the highest tensile strength (the maximum stress a material can withstand before breaking) and yield strength (the stress at which it begins to deform permanently).1 Independent testing has shown that forged steel parts can exhibit

26% higher tensile strength and 34% higher yield strength than identical parts made from cast steel.9 MIM parts, when produced to high standards, can achieve mechanical properties approaching those of wrought (forged) metals, but are generally understood to reach approximately

90% of the strength of a comparable forged component.4 For a common firearm steel like AISI 4140, the baseline annealed tensile strength is 655 MPa (95,000 psi), a value that is significantly enhanced by the work hardening and grain refinement of the forging process and subsequent heat treatment.29 - Fatigue Resistance: Fatigue is failure under repeated or cyclic loading, even at stresses well below the material’s ultimate tensile strength. This is where forging demonstrates its most profound superiority. The aligned grain flow makes it difficult for fatigue cracks to cross grain boundaries, drastically slowing their propagation. As a result, forged parts have been shown to possess 37% higher fatigue strength, translating into a fatigue life that is a staggering six times longer than that of cast parts.9 The residual porosity inherent to MIM parts makes them inherently more susceptible to fatigue failure than forged parts. Each microscopic pore is a potential stress riser and a point where a fatigue crack can begin, giving forged components a definitive edge in applications involving millions of high-stress cycles, such as a pistol slide or rifle bolt.20

- Ductility & Toughness: Ductility, the ability to deform plastically before fracturing, is a critical measure of a material’s toughness and its failure mode. A ductile material provides warning before failure, while a brittle material fails suddenly and catastrophically. Forged parts exhibit vastly superior ductility. In destructive pull-to-failure tests, forged steel parts demonstrated a 58% reduction in cross-sectional area before breaking, compared to only a 6% reduction for cast parts.8 This data highlights a crucial safety consideration: under extreme overload, a forged part will bend, stretch, and deform significantly, likely rendering the firearm inoperable but contained. A less ductile cast or MIM part is more prone to a sudden, brittle fracture, which in a pressure-bearing component could lead to a catastrophic containment failure and potential injury to the shooter. This “graceful” versus “catastrophic” failure mode is a compelling reason for the mandatory use of forgings in the most critical components.

2.3 Design and Production Tolerances

While forging excels in mechanical properties, MIM and casting offer significant advantages in precision and the ability to create complex geometries.

- Dimensional Accuracy: MIM is the undisputed leader for producing small, complex parts to extremely tight tolerances. A typical MIM tolerance is ±0.3% of the dimension, with tolerances as tight as ±0.01 mm being achievable for certain features.4 Investment casting follows, offering good precision with typical tolerances around

±0.005 inches per inch.14 Forging produces a near-net shape but has the loosest tolerances of the three, typically in the range of

±0.5 mm, necessitating subsequent machining operations for any critical mating surfaces or interfaces.4 - Surface Finish: The processes follow the same hierarchy for surface finish. MIM can produce an exceptionally smooth finish, around 1 µm Ra, which is often suitable for use without any polishing.21 Investment casting yields a good surface finish of about

3.2 µm Ra.24 Forged parts have a comparatively rough surface texture due to scale from heating and contact with the die, always requiring machining or other finishing for smooth operation or cosmetic appearance. - Geometric Complexity: MIM provides the greatest design freedom, enabling the creation of highly intricate features like thin walls, sharp corners, undercuts, cross-holes, and fine surface textures in a single step.4 Investment casting is also excellent for complex shapes that would be difficult to forge.13 Forging is the most restrictive process, generally limited to shapes without undercuts that can be readily extracted from a two-part die.1

The following table provides a summary of these comparative properties, offering an at-a-glance reference for preliminary process selection.

| Property | Forging | Investment Casting | Metal Injection Molding (MIM) |

| Tensile Strength | Highest (100%) 9 | Good (~70% of Forged) 8 | High (~90% of Forged) 4 |

| Fatigue Life | Highest (up to 6x Cast) 28 | Good 4 | High (Lower than Forged) 20 |

| Ductility / Toughness | Highest 8 | Low 8 | Good (Lower than Forged) |

| Microstructural Integrity | Highest (Refined Grain Flow) 1 | Good (Risk of Porosity) 1 | High (Risk of Micro-porosity) 20 |

| Geometric Complexity | Low 1 | High 13 | Highest (for small parts) 4 |

| Dimensional Tolerance | ±0.5 mm 4 | ±0.005″/inch 14 | ±0.01 mm to ±0.3% 4 |

| Surface Finish (Ra) | Rough (Requires Machining) | Good (~3.2 µm) 24 | Excellent (~1 µm) 24 |

| Tooling Cost | High 16 | Medium 16 | Highest 24 |

| Per-Unit Cost (High Vol.) | Low 16 | Medium 16 | Lowest (for small parts) 24 |

| Ideal Part Size | Grams to Tons 4 | Grams to Kilograms 13 | < 250 grams 4 |

Section 3: Application in Small Arms Design: A Component-by-Component Breakdown

The theoretical properties of each manufacturing process translate into a well-defined and logical distribution of their use across the components of a modern firearm. The selection of forging, casting, or MIM for a specific part is not arbitrary; it is a deliberate engineering decision based on a tiered system of component criticality. This hierarchy is determined by the consequence of a part’s failure, from a catastrophic breach of pressure containment to a minor functional inconvenience. The following matrix provides a practical overview of common manufacturing methods for key firearm components, which will be elaborated upon in the subsequent sections.

| Component | Primary Method | Secondary/Alternate Method(s) | Rationale / Key Engineering Considerations |

| Barrel | Forged (CHF) 12 | Machined from Bar Stock | Must contain 50k-65k+ psi; requires highest strength, fatigue life, and wear resistance. |

| Bolt / Bolt Lugs | Forged 5 | Machined from Bar Stock | Lugs under extreme shear/tensile stress; failure is catastrophic. Requires maximum strength and fatigue resistance. |

| Bolt Carrier (AR-15) | Forged 5 | Machined from Bar Stock | High-impact, high-cycle component. Forging provides durability. Machining offers precision and custom features. |

| Slide (Pistol) | Forged 5 | Investment Cast 14, Machined from Billet | Primary pressure-bearing structure in many designs. Forging is premium standard. Casting is a proven, cost-effective alternative. |

| Receiver (AR-15 Lower) | Forged 5 | Investment Cast 33, Machined from Billet 34 | Not a pressure-bearing part. Strength differences are less critical. Choice driven by cost, features, and aesthetics. |

| Frame (1911 / Revolver) | Forged 5 | Investment Cast 14 | Complex shape. Casting is ideal for geometry and cost. Forging is the premium, higher-strength option. |

| Hammer | MIM 26 | Investment Cast 17, Machined from Bar Stock | Complex geometry, primarily under compressive/impact stress. MIM provides precision and cost-effectiveness for mass production. |

| Trigger | MIM 26 | Investment Cast 17, Machined from Bar Stock | Complex geometry, low stress. MIM excels at providing consistent, precise engagement surfaces at low cost. |

| Sear / Disconnector | MIM 26 | Machined from Bar Stock | Very small, complex, high-precision parts. Primarily under compressive/frictional stress. Ideal MIM application. |

| Safety Lever | MIM 26 | Investment Cast 17 | Complex shape, low stress in normal use. MIM is cost-effective. Torsional stress can be a failure point. |

| Magazine Catch | MIM 26 | Investment Cast 14 | Intricate geometry, low stress. Perfect for high-volume, low-cost MIM production. |

| Gas Block (AR-15) | Forged 5 | Machined from Bar Stock, Cast 17 | Simple shape, moderate stress. Forging or machining are common. |

| Sights | MIM 26 | Investment Cast 17, Machined from Bar Stock | Complex shapes, low stress. MIM or casting are common for production sights. Machining for high-end adjustable sights. |

3.1 The Unforgivable Components: Where Forging is Mandatory

Certain components within a firearm are subjected to such extreme forces that their failure would be catastrophic, presenting a direct and immediate danger to the operator. These are the parts that form the pressure vessel, containing and directing the explosive energy of a detonating cartridge. For these Tier 1 critical components, the superior strength, ductility, and fatigue resistance of forging are not a luxury but an absolute engineering necessity.

- Barrels: The barrel must reliably contain chamber pressures that routinely exceed 50,000 to 65,000 psi for modern rifle cartridges. A barrel rupture is one of the most dangerous possible firearm failures. Forging, particularly cold hammer forging, provides the highest possible hoop strength and fatigue resistance to withstand tens of thousands of these pressure cycles without failure.5

- Bolts and Bolt Lugs: The bolt is the gatekeeper of the breech. Its locking lugs engage with the barrel extension or receiver and must withstand the full rearward thrust of the cartridge case upon firing. This places the lugs under immense tensile and shear stress. A failure of the locking lugs would allow the bolt to be violently propelled rearward into the receiver and potentially towards the shooter. Forging is the only process that can provide the requisite shear strength and fatigue life to prevent this. This is why Mil-Spec AR-15 bolts are required to be made from specific high-strength steels like Carpenter 158 or 9310, which are then forged and heat-treated.5

- High-Pressure Receivers and Slides: In many firearm designs, such as most semi-automatic pistols (e.g., 1911, Glock) and some rifles (e.g., M1 Garand), the slide or receiver directly contains the bolt and serves as the primary load-bearing structure. It must absorb the full impact of the recoiling bolt and barrel assembly on every shot. Forging ensures the highest strength-to-weight ratio and the necessary resistance to fatigue cracking after countless cycles of violent impact and stress.5 This is why premium firearm manufacturers explicitly market their slides and frames as being “CNC machined from forgings,” emphasizing that the part started as a superior forged blank before being precision machined to its final dimensions.7

3.2 The Case for Casting: Frames, Receivers, and Structural Parts

Where the absolute peak of mechanical properties is not a strict requirement, but geometric complexity and production cost are significant drivers, investment casting becomes a highly viable and proven engineering solution. These Tier 2 components are structurally critical, but they typically hold the pressure-bearing parts rather than directly containing the peak pressure themselves.

- Frames and Lower Receivers: The frame of a pistol or the lower receiver of an AR-15 is a classic example. These parts have highly complex internal and external geometries to house the fire control group, magazine well, and grip. Investment casting is an excellent method for producing these intricate shapes to near-net dimensions, significantly reducing the amount of costly machining required.14 The famous durability of Ruger firearms is a direct testament to the potential of high-quality investment casting. Bill Ruger founded Pine Tree Castings specifically to produce investment cast frames and receivers for his firearms, creating parts renowned for their strength and toughness, proving that a well-engineered casting can be more than sufficient for the application.19

- The AR-15 Receiver Debate: The AR-15 lower receiver is a frequent subject of debate regarding forged versus cast versus billet manufacturing.19 From a purely structural standpoint, the AR-15 lower is not a high-stress part; the pressure is contained by the bolt, barrel extension, and upper receiver. Therefore, while a forged lower is measurably stronger than a cast lower of the same dimensions, the strength of the cast version is still far in excess of the loads it will ever experience in normal use.33 For many users and manufacturers, the debate becomes less about strength and more about other factors: forged receivers are valued for their adherence to the Mil-Spec standard and low cost, while billet receivers (machined from a solid block of aluminum) are prized for their sharp aesthetic, custom features (like integrated trigger guards), and tighter tolerances, albeit at a higher price.34

- Other Cast Parts: Many other firearm components with complex shapes but lower stress loads are also commonly produced via investment casting. These include trigger guards, sight bases, scope mounts, and gas blocks.14

A separate but related category is parts machined from billet or bar stock. This subtractive process starts with a solid block of pre-treated metal and carves away material to create the final part. It offers excellent material properties and the highest possible precision, but at the cost of significant material waste (up to 90%) and long, expensive machining cycles.30 It is therefore not a mass-production method but is reserved for low-volume custom firearms where tooling costs for forging or casting are prohibitive, or for high-end “premium” products where the sharp lines and perfect tolerances of a fully machined part are a key selling point.19

3.3 The Strategic Role of MIM: The Ecosystem of Small Parts

For the vast ecosystem of small, intricate, non-critical components within a firearm, Metal Injection Molding is the dominant and most logical manufacturing choice. For these Tier 3 parts, failure typically results in a malfunction rather than a safety hazard. Here, the unparalleled ability of MIM to produce massive quantities of highly precise, complex parts at a very low per-unit cost outweighs the slight reduction in ultimate strength compared to forging.

- Fire Control Group: The hammer, trigger, sear, and disconnector are the classic applications for MIM.26 These parts have complex engagement surfaces that must be held to tight tolerances to ensure a safe and consistent trigger pull. The stresses they endure are primarily compressive and frictional, not high-impact or tensile. MIM is perfectly suited to create these geometries with exceptional repeatability and an excellent surface finish that requires no secondary polishing, making it the ideal choice for mass production.10

- Other Common MIM Parts: The economic and precision advantages of MIM have led to its adoption for a wide range of other small parts. These include safety levers, magazine catches, slide stops, and ejectors.26 The complex shapes of these components make them expensive to machine, and the volumes required for modern firearm production make MIM the clear economic winner. While some of these parts, like the slide stop, do experience impact stress, modern MIM engineering has largely overcome the early issues, producing parts that are reliable for their intended service life.

Section 4: Economic Realities and Production Scaling

The choice between forging, casting, and MIM is as much an economic decision as it is an engineering one. Each process has a distinct cost structure, driven by tooling investment, material and labor efficiency, and production volume. Understanding these economic realities is crucial to comprehending why a manufacturer like Glock builds firearms differently from a custom shop like Standard Manufacturing. The “true cost” of a component is not its raw material price but the total cost to produce a finished, in-spec part ready for assembly.

4.1 The Cost of Entry: Tooling and Capital Investment

The upfront investment required to begin production varies dramatically between the three processes and is a primary determinant of their suitability for different production scales.

- Forging: This process demands the highest capital investment in heavy machinery. Large hydraulic presses or power hammers capable of exerting thousands of tons of force are required, representing a significant factory footprint and cost.31 The tooling itself—hardened steel dies precision-machined with the negative impression of the part—is also extremely expensive to design and create. However, these dies are very durable and can last for long production runs.16

- Investment Casting: The tooling for investment casting consists of the reusable metal molds used to create the wax patterns. These molds are complex but do not have to withstand the extreme forces of forging, making them significantly less expensive than forging dies.16 The associated equipment, such as wax injectors, slurry tanks, and autoclaves, represents a more moderate capital investment than a forging press, making casting more accessible for lower-volume or more complex parts.16

- Metal Injection Molding (MIM): MIM has the highest initial tooling cost for a given part. The steel molds must be machined to exceptionally high precision to account for material flow and predictable shrinkage, and a single multi-cavity mold can easily cost upwards of $30,000.24 Furthermore, a complete MIM production line, including specialized injection machines, debinding stations, and computer-controlled sintering furnaces, represents a multi-million-dollar capital investment.30 This makes MIM a technology reserved for very high-volume production where these costs can be justified.

4.2 The Volume Equation: Per-Unit Cost Analysis

The relationship between production volume and per-unit cost is the key to the economic model of these processes.

- Crossover Points: For very low quantities (prototypes or small custom runs), machining from billet is often the most economical choice as it requires no part-specific tooling. As production volume increases into the hundreds or low thousands, the lower tooling cost of investment casting makes it more cost-effective than forging or MIM.16 However, as production runs climb into the tens or hundreds of thousands, the high upfront tooling costs of forging and MIM become amortized over a vast number of parts. This, combined with their high-speed, automated nature, causes their per-unit cost to plummet, eventually becoming significantly cheaper than casting.25

- MIM’s Sweet Spot: MIM is fundamentally an “economy of scale” technology.24 Due to its extremely high tooling and capital costs, it is almost never cost-effective for low-volume production. The process is ideal for annual production volumes exceeding 10,000 pieces and becomes exceptionally efficient at runs of 200,000 or more.30 For the small, complex parts it is designed to make, MIM offers the lowest possible per-unit cost at mass-production volumes.

4.3 Material and Labor Efficiency

The efficiency of material and labor usage is a critical component of the finished part cost.

- Material Utilization: While forging and casting are considered “near-net-shape” processes, they both generate material waste. Forging produces flash that must be trimmed, and casting produces the gates, runners, and sprues of the “tree” that must be cut off and recycled.3 MIM is the most efficient process in terms of raw material, as the feedstock fills the mold cavity with virtually no waste.21 However, the most significant factor is often the waste from

post-processing. Cast parts frequently require the most machining to meet final tolerances, generating significant subtractive waste.16 Forged parts require less machining, while MIM parts often require none at all. This is why a manufacturer might choose MIM for a trigger even though the raw MIM feedstock can be ten times more expensive than conventional powdered metal or raw steel.30 The savings from eliminating all machining steps—including the time, labor, and capital cost of CNC machines—can far outweigh the higher initial material cost. - Labor Costs: Forging is a physically demanding, labor-intensive process that requires skilled operators for the presses and for handling hot metal.16 Investment casting can be highly automated, but the finishing and gate-removal processes can be manual. MIM is a largely automated process, from injection to sintering, which dramatically reduces the labor cost per part.30 This high level of automation is a major contributor to MIM’s low per-unit cost at high volumes.

This analysis reveals that the manufacturing process is a direct reflection of a company’s business model. A premium, low-volume manufacturer will choose methods like machining from forged billets to justify a high price point and market superior quality.7 A mass-market leader will leverage the economies of scale of MIM and polymer injection molding to produce millions of reliable, affordable firearms.10 The engineering choice is inseparable from the market strategy.

Section 5: Industry Lessons Learned: The MIM Saga and the Primacy of Quality Control

The history of Metal Injection Molding in the firearms industry is a powerful case study in the challenges of adopting new manufacturing technologies. It demonstrates the collision of engineering capabilities, economic pressures, and persistent consumer perception. The lessons learned from the “MIM saga” are crucial for any engineer working in the field today, as they underscore the paramount importance of proper application, rigorous quality control, and managing user expectations.

5.1 The “MIMber” Effect: A History of Early Failures and Lasting Perceptions

MIM was introduced to the firearms industry in the 1980s and saw wider adoption in the 1990s as a cost-saving measure to produce complex parts.22 However, this early adoption was fraught with problems. Some manufacturers, in a rush to cut costs, sourced MIM parts from vendors who had not yet perfected the complex, multi-stage process. This resulted in a wave of well-publicized part failures, particularly in 1911-style pistols from brands like Kimber.18 Reports of broken slide stops, fractured thumb safeties, and failed sears became common in the shooting community.

These early failures created a powerful and enduring negative perception, coining the pejorative term “MIMber” for manufacturers who used the process extensively. This stigma has proven incredibly difficult to overcome, even decades after the initial quality control issues were resolved.18 To this day, “MIM is bad” remains a common refrain in online forums and among a segment of shooters, often based on anecdotal evidence or outdated information from the 1990s.18 This perception is so powerful that high-end and custom firearm makers continue to use “100% machined from bar stock” or “MIM-free” as a primary marketing tool to signify premium quality and justify a higher price point.7

5.2 Engineering for the Application: Understanding Stress and Failure Modes

A critical lesson from the history of MIM failures is the importance of applying the technology correctly. MIM is not a universal substitute for forging or machining; it has specific strengths and weaknesses that must be respected in the design process. Many early failures were the result of misapplication.

A classic example is the 1911 extractor. This is a long, thin component that must function as a leaf spring, flexing with every cycle of the slide while maintaining tension on the cartridge rim. This subjects the part to high-cycle bending and tensile stresses. MIM, with its isotropic grain structure and inherent micro-porosity, has lower fatigue resistance than a properly heat-treated spring steel part machined from bar stock. Consequently, MIM extractors were prone to breaking. Colt, after a brief period of using them, learned this lesson and reverted to using machined steel extractors, a practice that continues in quality 1911s today.39

The engineering analysis shows that MIM parts perform exceptionally well under compressive and frictional stress, making them ideal for sears and disconnectors.39 However, they are less suited for applications involving high impact, shear, or torsional stress. This is why MIM hammers (impact), slide stops (impact/shear), and thumb safeties (torsion) have historically been the most common points of failure.18 A modern, well-designed MIM hammer or slide stop from a reputable manufacturer is engineered to withstand these forces for a normal service life, but for extreme high-volume competition use, the higher failure probability still leads serious shooters to upgrade to machined tool steel parts.39

5.3 The Critical Role of Process Control: Not All MIM is Created Equal

Perhaps the most crucial lesson learned by the industry is that MIM is a process, not a material grade. The quality of the final part is not guaranteed by the name of the process but is entirely dependent on the rigor with which that process is executed.42 There is a vast quality spectrum, from cheap, poorly controlled MIM to the high-density, defect-free MIM used in the aerospace, medical, and automotive industries.18

The final properties of a MIM part are dictated by the quality of the initial metal powder, the proprietary binder formulation, the precision of the molding process, and, most critically, the exact time, temperature, and atmospheric controls of the debinding and sintering cycles.42 A small deviation in any of these steps can result in a part with excessive porosity, poor particle fusion, and drastically reduced strength.

Today, major manufacturers like Smith & Wesson, Ruger, SIG Sauer, and Glock have invested heavily in perfecting their MIM supply chains, either through trusted, high-quality vendors or by bringing the capability in-house.11 The result is that modern, high-quality MIM parts are exceptionally reliable for their intended applications. The failure rate for MIM parts from a reputable contemporary manufacturer is statistically very low; one source for Tisas firearms cites a warranty return rate of less than 2% for MIM part failures.45 For the vast majority of firearm owners, a well-made MIM part in a Tier 3 application will last the lifetime of the firearm and will likely outlast the barrel.18

This reality has led to a calculated business decision by manufacturers: the “lifetime warranty”.41 A manufacturer knows the statistical failure rate of their components. They have calculated that the cost of replacing the very small percentage of MIM parts that fail prematurely under warranty is infinitesimal compared to the immense cost savings of using MIM for millions of components instead of more expensive methods. The warranty effectively allows the manufacturer to reap the economic benefits of MIM while assuring the consumer that the small statistical risk of a part failure will be covered.

5.4 A Deeper Dive into MIM Variables: From Powder to Final Part

The final quality of a MIM component is not determined by a single factor but is the result of a chain of critical variables, starting with the raw material and extending through every stage of manufacturing and post-processing. Understanding these variables is key to appreciating the difference between a standard MIM part and a high-performance one.

Feedstock Selection and Formulation

The process begins with the selection of a metal alloy powder, and the choice is vast, including stainless steels (17-4 PH, 316L), low-alloy steels, tool steels (S7, M2), and even titanium or superalloys for extreme applications. The engineer’s selection is a methodical process based on a hierarchy of criteria:

- Mechanical Performance: The primary consideration is the load the part will endure. The engineer analyzes the application to determine the required tensile strength, impact strength, fatigue life, hardness, and wear resistance.46 A trigger sear, for example, requires high hardness, making a tool steel or a hardenable stainless steel a good candidate.46

- Operating Environment: The conditions the part will face are critical. If it will be exposed to moisture or chemicals, corrosion resistance becomes a key factor, pointing toward stainless steels like 316L or titanium.46

- Cost vs. Performance: There is always a balance between ideal properties and a target cost. Low-alloy steels offer excellent strength for their price, while titanium and superalloys provide ultimate performance at a premium.46 The engineer must select the most economical material that still meets all necessary safety and performance specifications.

Beyond the alloy, the characteristics of the powder itself are crucial. Finer powders (typically under 20 microns) with a narrow and consistent particle size distribution pack more tightly, leading to higher final part density and better mechanical properties.9 This powder is then mixed with a proprietary binder system to create the feedstock. The powder-to-binder ratio affects the feedstock’s viscosity, which is critical for ensuring the mold fills completely and uniformly. Some advanced MIM producers create custom, in-house feedstocks to achieve properties that exceed industry standards. For example, by tailoring the metal particle size and binder composition, it is possible to produce a 17-4 PH stainless steel part with up to 19% greater strength and 125% higher ductility than the industry standard.19

Process Control and Part Design

Strict adherence to “Design for Manufacturability” (DFM) principles is non-negotiable for producing high-quality MIM parts. This includes:

- Uniform Wall Thickness: Designing parts with consistent wall thickness is crucial to ensure uniform shrinkage and prevent defects like warping, sinks, or cracks during the high-temperature sintering phase.30

- Tooling Design: The design of the steel mold is a science in itself. The placement of the gate (where material is injected) must be in the thickest section of the part to promote balanced flow. Witness marks from parting lines and ejector pins must be placed on non-critical or hidden surfaces to avoid affecting function or aesthetics.30

- Process Parameter Control: During molding, variables like injection pressure, temperature, and cooling rates must be precisely controlled to ensure the mold cavity fills completely and uniformly.9 Likewise, the sintering phase requires exact control over the furnace type, atmospheric conditions (e.g., hydrogen, nitrogen), and the temperature-time profile to achieve proper densification and the desired final microstructure.9

Post-Sintering Enhancements

Even after a part is successfully sintered, its properties can be further enhanced through secondary operations to meet the most demanding requirements.

- Heat Treatment: Just like their forged or machined counterparts, MIM parts can be heat-treated to significantly improve strength, hardness, and toughness. Martensitic stainless steels like 440C, for instance, are often heat-treated to achieve the high hardness required for wear-resistant components.

- Hot Isostatic Pressing (HIP): For the most critical applications, HIP is a transformative post-processing step. After sintering, the part is placed in a high-pressure vessel and subjected to high temperatures (up to 2,000°C) and extreme isostatic gas pressure (up to 45,000 psi). This process physically collapses any remaining internal microscopic voids, achieving up to 100% of the metal’s theoretical density. The elimination of this residual porosity dramatically improves dynamic properties like fatigue life and impact strength, which are highly sensitive to internal defects. The HIP process is used to ensure that certain firearm components meet the highest possible mechanical requirements.

In summary, the term “MIM” encompasses a wide spectrum of quality and performance. A part’s final integrity is a direct result of deliberate engineering choices made at every step, from the selection and formulation of the raw feedstock to the precision of the process controls and the application of advanced post-processing treatments.

Section 6: The Next Frontier: Additive Manufacturing in Firearms

While forging, casting, and MIM represent the established pillars of firearms manufacturing, a new technology is emerging that promises to revolutionize certain aspects of firearm design and production: industrial additive manufacturing, or 3D printing. This technology is not a direct replacement for traditional methods but rather a supplementary tool that offers unprecedented design freedom, enabling the creation of components that were previously impossible to make.

6.1 From Polymer Prints to Sintered Steel: The Evolution of Additive Manufacturing

It is crucial to differentiate between the hobbyist-level fused deposition modeling (FDM) polymer printing associated with the political debate around “ghost guns” like the Liberator pistol or FGC-9 carbine, and industrial-grade metal additive manufacturing.48 While polymer printing has enabled the creation of functional receivers and frames for homemade firearms, the technology relevant to industrial production is Direct Metal Laser Sintering (DMLS), a type of powder bed fusion.50

In the DMLS process, a high-power laser is precisely guided by a CAD file to melt and fuse microscopic layers of metal powder in a sealed chamber.50 The build platform lowers, a new layer of powder is spread, and the process repeats, building a fully dense metal part layer by layer. DMLS can be used with a wide range of high-performance alloys, including 17-4 stainless steel, titanium, and nickel-chromium superalloys like Inconel—materials common in aerospace and firearms.51

6.2 DMLS: Unprecedented Design Freedom and Its Engineering Implications

The paradigm shift offered by DMLS is the liberation of the engineer from the traditional constraints of “design for manufacturability.” A part does not need to be extractable from a die (like forging) or a mold (like casting), nor does it need to be accessible to a cutting tool (like machining). This allows for the creation of parts with staggering geometric complexity, such as:

- Internal Lattice Structures: Components can be designed with internal honeycomb or gyroid structures that drastically reduce weight while maintaining structural integrity in key areas.

- Optimized Internal Channels: Parts can have curved, optimized internal passages for gas or fluid flow that cannot be drilled or cast.

- Part Consolidation: Multiple individual components can be redesigned and printed as a single, monolithic part, eliminating joints, fasteners, and assembly steps, thereby increasing strength and reducing weight.53

The viability of DMLS for producing robust firearm components was proven in 2013 with the Solid Concepts 1911.51 This was the world’s first fully functional metal firearm created almost entirely with DMLS, including the slide, frame, and even the rifled barrel. The pistol successfully fired thousands of rounds, demonstrating that the mechanical properties of DMLS parts were sufficient to withstand the violent forces of the.45 ACP cartridge.51 While the cost was prohibitive for production (the DMLS machine alone cost over $500,000), it was a landmark proof of concept.51

6.3 Current Industry Adoption and Future Outlook

While DMLS is not yet being used to print entire firearms for commercial sale, it has established a significant beachhead in one specific, high-value area: firearm suppressors.55

The complex internal geometry of suppressor baffles is designed to disrupt and slow the flow of hot gas exiting the muzzle. DMLS allows for the creation of incredibly intricate baffle designs that are far more effective at reducing sound and muzzle flash than traditional designs made from machined components. Furthermore, materials like titanium and Inconel can be used to create suppressors that are simultaneously lighter and more durable than their conventional counterparts. Leading companies like SIG Sauer, Daniel Defense, HUXWRX, and CGS Group are now marketing and selling DMLS-produced suppressors, which are prized for their superior performance, albeit at a premium price.55

Looking forward, DMLS is unlikely to replace forging for barrels or MIM for small parts in the near future due to its high cost and relatively slow production speed.50 Its trajectory in the firearms industry will likely focus on three key areas:

- Rapid Prototyping: DMLS is an unparalleled tool for quickly creating and testing functional metal prototypes, dramatically shortening the R&D cycle for new designs.57

- High-Value, Complex Components: It will be used for parts where the performance gains from complex geometry justify the high cost. This could include skeletonized, lightweight bolt carriers; triggers with optimized internal mechanics; or custom parts for elite competition firearms.

- Mass Customization: In the long term, as costs decrease, DMLS holds the potential to shift the industry from mass production to mass customization. Because the process requires no hard tooling, the cost to produce one unique part is the same as producing one part in a large batch. This opens the door to a future where components like grips, frames, or stocks could be printed on demand, perfectly tailored to an individual user’s biometrics or preferences.58

Additive manufacturing should not be seen as a direct competitor to traditional methods across the board. Instead, it is a powerful new tool that competes on complexity, opening up a new design space for creating higher-performing components that were previously impossible to manufacture.

Section 7: Conclusion and Final Engineering Recommendations

The selection of a manufacturing process in small arms design is a complex equation of trade-offs between mechanical performance, geometric complexity, and production cost. There is no single “best” process; rather, there is an optimal process for each specific component based on its role within the firearm system. Forging remains the undisputed choice for ultimate strength and fatigue life, casting offers a cost-effective route to complex structural parts, and Metal Injection Molding provides unparalleled precision and economy for small, intricate components in high-volume production.

The analysis yields a clear hierarchy of material properties, with forged parts exhibiting the highest strength and durability due to their refined, directional grain flow. Cast and MIM parts, while possessing excellent properties for many applications, are fundamentally limited by their isotropic grain structures and the inherent risk of porosity, which reduces their ultimate strength and fatigue resistance compared to forgings. Emerging technologies like Direct Metal Laser Sintering are not yet replacing these established methods but are creating new possibilities by enabling the production of parts with a level of complexity previously unattainable.

Based on this comprehensive analysis, the following decision-making framework is recommended for the design engineer selecting a manufacturing process for a firearm component:

- Analyze the Component’s Criticality and Stress Loads: First, classify the component based on the consequence of its failure.

- Tier 1 (Catastrophic Failure): Is it a primary pressure-bearing component like a barrel, bolt, or locking lugs? These parts are subjected to extreme tensile, shear, and impact stresses. Failure is not an option. Forging is mandatory.

- Tier 2 (Major Functional Failure): Is it a major structural part like a slide or frame that contains the action? These parts see high-cycle fatigue and impact loads. Forging is the premium standard. High-quality investment casting is a proven and acceptable alternative.

- Tier 3 (Minor Functional Failure): Is it a small part within the fire control group or a user interface component like a safety or magazine catch? These parts are primarily under compressive or low-impact loads. MIM is the most logical and cost-effective choice for mass production. Investment casting or machining are alternatives.

- Define Performance and Geometric Requirements: Quantify the necessary strength, fatigue life, and precision. Is the geometry simple and robust, or is it small and highly intricate? Use the comparative data in this report to match the requirements to the process capabilities.

- Project Production Volume and Cost Targets: Is this a one-off prototype, a low-volume custom run, or a mass-market product with a target retail price? The economic analysis clearly shows that the optimal choice is heavily dependent on volume. MIM is only viable at high volumes, while machining from billet is only viable at very low volumes.

Ultimately, the most critical lesson for the firearms engineer is that the name of the process is secondary to the quality with which it is executed. A well-designed and meticulously controlled MIM part from a world-class vendor is vastly superior to a poorly executed forging with internal defects. The engineer’s responsibility extends beyond simply selecting a process on a drawing; it includes specifying the material, the heat treatment, the required testing, and the quality control standards that ensure the final component is safe, reliable, and fit for its purpose. The integrity of the final product and the safety of the end-user depend on this rigorous and informed approach to manufacturing.

Appendix: Methodology

This report was compiled to provide a comprehensive engineering analysis of the primary manufacturing methods used in the modern small arms industry. The methodology involved a multi-stage process of information gathering, synthesis, and structured analysis to ensure a thorough and balanced perspective suitable for an industry professional.

1. Information Gathering:

A wide-ranging survey of publicly available information was conducted to build a foundational understanding of each manufacturing process and its application in the firearms sector. The sources consulted can be categorized as follows:

- Industry and Technical Publications: Data from manufacturing and metallurgical sources, including the Forging Industry Association, were used to establish quantitative benchmarks for material properties like tensile strength and fatigue life.

- Manufacturer-Specific Information: Technical specifications, product descriptions, and educational materials from firearm manufacturers (e.g., SIG Sauer, Glock, Standard Manufacturing) and component forges (e.g., Cornell Forge) were reviewed to identify which processes are used for specific components and how these choices are marketed.

- Process Specialist Documentation: In-depth explanations of investment casting, MIM, and forging were sourced from companies specializing in these technologies (e.g., Aero Metals, JHMIM) to ensure accurate and detailed process descriptions.

- Firearms-Focused Media and Community Forums: Articles from specialized publications (e.g., GunMag Warehouse) and discussions among experienced shooters and gunsmiths on public forums were analyzed to gather insights into the historical context, real-world performance, user perceptions, and industry lessons learned, particularly regarding the adoption of MIM technology.

- Emerging Technology Reports: Information on additive manufacturing (DMLS) was gathered from industry analysis reports and news articles covering its adoption in the firearms and aerospace sectors, including the landmark Solid Concepts 1911 project.

2. Analysis and Synthesis:

The collected data was systematically organized, cross-referenced, and synthesized to build a coherent analytical framework. This involved:

- Establishing a Technical Baseline: The report begins by detailing the fundamental steps of each manufacturing process to provide the necessary context for subsequent analysis.

- Quantitative and Qualitative Comparison: Data points on mechanical properties, tolerances, and costs were collated into comparative tables to provide a clear, at-a-glance summary of the trade-offs between the methods.

- Application Mapping: The inherent properties of each process were mapped to specific firearm components, creating a logical hierarchy of applications based on stress loads and the consequence of failure.

- Thematic Analysis: Information regarding the history of MIM, user debates (e.g., forged vs. billet receivers), and economic factors was analyzed thematically to provide a nuanced understanding of the non-technical forces that influence manufacturing decisions.

3. Report Structuring and Composition:

The report was structured to follow a logical progression, moving from foundational principles to specific applications, economic considerations, historical lessons, and future trends. The content was written from the perspective of a small arms industry engineer, employing appropriate technical terminology while maintaining clarity and focus. The final document aims to serve as a practical and data-driven reference for engineers, designers, and decision-makers within the firearms industry.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- Forging vs. Casting, Machining, Powder Metal and Additive, accessed August 11, 2025, https://www.qcforge.com/forging-innovations-blog/forging-versus-casting-versus-machining-versus-powder-metal-versus-additive-which-is-best/

- www.reliance-foundry.com, accessed August 11, 2025, https://www.reliance-foundry.com/blog/forging#:~:text=Forging%20is%20a%20manufacturing%20process,of%20metals%20can%20be%20forged.

- Forging – Wikipedia, accessed August 11, 2025, https://en.wikipedia.org/wiki/Forging

- Metal Injection Molding vs Forging – ZCMIM, accessed August 11, 2025, https://www.zcmim.com/mim-vs-forging/

- Firearms and Defense – Cornell Forge Co., accessed August 11, 2025, https://www.cornellforge.com/markets/firearms-and-defense/

- Firearms – Trinity Forge, accessed August 11, 2025, https://trinityforge.com/industries/firearms/

- 1911 – Standard Manufacturing LLC., accessed August 11, 2025, https://stdgun.com/1911/

- Forged vs. Cast – What’s the Difference? – Milwaukee Forge, accessed August 11, 2025, https://www.milwaukeeforge.com/forged-vs-cast-whats-the-difference/

- www.cmco.com, accessed August 11, 2025, https://www.cmco.com/en-us/resources/blog/forging-vs-casting-which-is-better/#:~:text=Forged%20parts%20had%20a%2026,is%20going%20to%20last%20longer.

- www.designlife-cycle.com, accessed August 11, 2025, http://www.designlife-cycle.com/new-page-53#:~:text=These%20include%20hammer%20forging%20to,the%20testing%20of%20the%20gun.

- Advanced manufacturing – GLOCK Perfection, accessed August 11, 2025, https://eu.glock.com/en/explore-glock/advanced-manufacturing

- Cold Hammer Forged – SIG Sauer, accessed August 11, 2025, https://www.sigsauer.com/glossary/cold-hammer-forged/

- Investment Casting Process | Investment Casting Methods, accessed August 11, 2025, https://www.aerometals.com/metal-casting-101/casting-process

- Investment Casting Services | Firearm Parts & Components – Aero Metals, Inc., accessed August 11, 2025, https://www.aerometals.com/casting-industries/firearms

- How to Make a Gun – Springfield Armory National Historic Site (U.S. National Park Service), accessed August 11, 2025, https://www.nps.gov/spar/learn/historyculture/making-guns.htm

- Forging vs Casting: Which Manufacturing Method is More Cost-Effective? – RPPL, accessed August 11, 2025, https://rpplindustries.com/forging-vs-casting-which-manufacturing-method-is-more-cost-effective/

- Firearms Investment Casting & Component Casting Foundry, accessed August 11, 2025, https://kicastings.com/industries/firearms-casting/

- What’s so bad about cast and MIM parts? : r/1911 – Reddit, accessed August 11, 2025, https://www.reddit.com/r/1911/comments/1ap5z82/whats_so_bad_about_cast_and_mim_parts/

- Cast or Forged Receivers ? | Shooters’ Forum, accessed August 11, 2025, https://forum.accurateshooter.com/threads/cast-or-forged-receivers.3894010/

- How MIM Work – Economical Metalworking Technology- ZCMIM, accessed August 11, 2025, https://www.zcmim.com/how-mim-work/

- Metal injection molding – Wikipedia, accessed August 11, 2025, https://en.wikipedia.org/wiki/Metal_injection_molding

- Gun Manufacturing: Secrets of MIM | NRA Family, accessed August 11, 2025, https://www.nrafamily.org/content/gun-manufacturing-secrets-of-mim/

- Metal Injection Molding Vs Die Casting: In-depth Comparison, accessed August 11, 2025, https://www.zetwerk.com/en-us/resources/knowledge-base/metal-injection-molding/metal-injection-molding-mim-vs-die-casting-key-differences/

- MIM or Investment Casting? – AmTech OEM, accessed August 11, 2025, https://www.amtechinternational.com/mim-or-investment-casting/

- Metal Injection Molding vs Forging: Analyzing the Pros and Cons, accessed August 11, 2025, https://www.sigmatechnik.com/injection-molding/metal-injection-molding-vs-forging-analyzing-the-pros-and-cons

- what are mim gun parts?- JHMIM, accessed August 11, 2025, https://jhmim.com/what-are-mim-gun-parts/

- Why are MIM parts to avoid ? : r/Firearms – Reddit, accessed August 11, 2025, https://www.reddit.com/r/Firearms/comments/1jdwdlg/why_are_mim_parts_to_avoid/

- Forging vs. Casting: Which is Better for Shackles? | Columbus …, accessed August 11, 2025, https://www.cmco.com/en-us/resources/blog/forging-vs-casting-which-is-better/

- AISI 4140 Alloy Steel (UNS G41400) – AZoM, accessed August 11, 2025, https://www.azom.com/article.aspx?ArticleID=6769

- Can MIM Replace Traditional Casting or Machining for Small Parts? -, accessed August 11, 2025, https://jhmim.com/can-mim-replace-traditional-casting-or-machining-for-small-parts/

- casting vs forging cost – MULAN Casting, accessed August 11, 2025, https://www.mulanmetal.com/casting-vs-forging-cost/

- The Full Guide to the AR-15 Bolt Carrier Group – Gun Builders Depot, accessed August 11, 2025, https://www.gunbuilders.com/blog/the-full-guide-to-the-ar15-bolt-carrier-group/

- Billet vs cast Lower Receivers | TacticalSkeleton.com, accessed August 11, 2025, https://tacticalskeleton.com/blog/3/billet-vs-cast-lower-receivers

- AR-15 Receiver: Forged vs. Billet – The Mag Life, accessed August 11, 2025, https://gunmagwarehouse.com/blog/ar-15-receiver-forged-vs-billet/

- The Anatomy of the MD Enhanced Bolt Carrier Group, accessed August 11, 2025, https://www.mitchelldefense.com/md-enhanced-bolt-carrier-group/

- WHAT IS THE BEST AR-15 RECEIVER? FORGED, CAST, AND BILLET ALUMINUM, accessed August 11, 2025, https://jacobgreyfirearms.com/blog/grey-books-1/what-is-the-best-ar-15-receiver-forged-cast-and-billet-aluminum-6

- Let’s sort this out. Lowers: Polymer vs. Cast vs. Forged vs. Milled : r/ar15 – Reddit, accessed August 11, 2025, https://www.reddit.com/r/ar15/comments/1ahl46/lets_sort_this_out_lowers_polymer_vs_cast_vs/

- Are forged receivers lighter weight than cast? Also, here’s my M1A! : r/M1Rifles – Reddit, accessed August 11, 2025, https://www.reddit.com/r/M1Rifles/comments/h9pfuy/are_forged_receivers_lighter_weight_than_cast/

- The MIM in 1911 – RangeHot, accessed August 11, 2025, https://rangehot.com/mim-1911-bugaboo/

- Metal Injection Molding Showdown | Advanced Powder Products, Inc, accessed August 11, 2025, https://advancedpowderproducts.com/blog/post/metal-injection-molding-showdown

- Why do people think MIM parts are no good? | The Armory Life Forum, accessed August 11, 2025, https://www.thearmorylife.com/forum/threads/why-do-people-think-mim-parts-are-no-good.16510/

- MiM parts better than I thought. : r/gunsmithing – Reddit, accessed August 11, 2025, https://www.reddit.com/r/gunsmithing/comments/k7hd9x/mim_parts_better_than_i_thought/

- LPKs, MIM=Casting : r/ar15 – Reddit, accessed August 11, 2025, https://www.reddit.com/r/ar15/comments/fxm31g/lpks_mimcasting/

- The Great MIM Debate – Bunker Arms, accessed August 11, 2025, https://www.bunkerarms.com/post/the-great-mim-debate

- MIM parts? : r/Tisas – Reddit, accessed August 11, 2025, https://www.reddit.com/r/Tisas/comments/16x6vmb/mim_parts/

- Metal Injection Molding (MIM) – Hiperbaric, accessed August 31, 2025, https://www.hiperbaric.com/en/hip-technology/hip-techniques/metal-injection-molding/

- The Escalating Threat of 3D-Printed ‘Ghost Guns’ – Governing Magazine, accessed August 11, 2025, https://www.governing.com/policy/the-escalating-threat-of-3d-printed-ghost-guns

- 3D-printed firearm – Wikipedia, accessed August 11, 2025, https://en.wikipedia.org/wiki/3D-printed_firearm

- 3D printing site bans guns designs, hobbyists undeterred – The Register, accessed August 11, 2025, https://www.theregister.com/2025/07/23/thingiverse_drops_3d_gun_designs/

- DMLS Metal Powder Bed Fusion Technology – NYU, accessed August 11, 2025, https://www.nyu.edu/life/information-technology/research-computing-services/additive-manufacturing-3d-digitization/laguardia-studio-3d-scanning-3d-printing/laguardia-studio-resources/3d-printing/dmls-metal-powder-bed-fusion-technology.html

- Solid Concepts 1911 DMLS – Wikipedia, accessed August 11, 2025, https://en.wikipedia.org/wiki/Solid_Concepts_1911_DMLS

- Solid Concepts 1911 DMLS – AmmoTerra, accessed August 11, 2025, https://ammoterra.com/product/solid-concepts-1911-dmls

- Metal 3D Printing in Aerospace – Forge Labs, accessed August 11, 2025, https://forgelabs.ca/metal-3d-printing-in-aerospace/

- The First Metal Gun from a 3D Printer – Engineering.com, accessed August 11, 2025, https://www.engineering.com/the-first-metal-gun-from-a-3d-printer/

- Metal Additive Manufacturing and Firearms—An Intersecting …, accessed August 11, 2025, https://additivemanufacturingresearch.com/wp-content/uploads/2017/09/20171114054910FAAM.pdf

- A Guide to Additive Manufacturing for Firearm Suppressors, accessed August 11, 2025, https://www.phillipscorp.com/usa/guide-to-additive-manufacturing-firearm-suppressors/

- 3D Printing Components for Firearms Manufacturing – ExOne, accessed August 11, 2025, https://www.exone.com/zh-CN/About/industries/firearms-3d-printing-applications

- hammy3dprints: On Demand 3D Printed Gun Accessories | SHOT Show 2025 – YouTube, accessed August 11, 2025, https://www.youtube.com/watch?v=CtQD8dpJByM