The global defense industry enters 2026 at a point of critical inflection. Following the supply chain disruptions of the early 2020s and the rapid re-armament initiatives triggered by conflicts in Eastern Europe and the Middle East, 2026 represents a year of “industrial maturity.” For the small arms industry analyst, this shift is profound. The frantic procurement of off-the-shelf solutions that characterized 2022-2025 is giving way to structured, long-term recapitalization programs. Nations are no longer just buying; they are seeking to localize production, integrate disparate systems, and prepare for high-intensity, peer-level conflict.

The 2026 trade show calendar reflects these strategic priorities. It is a schedule defined by density and regional competition. Major biennial heavyweights—Eurosatory in Paris, Farnborough in the UK, and Indo Defence in Jakarta—return to anchor the year. Simultaneously, the Middle East continues its ascent as a primary convening power for the defense sector, with Saudi Arabia’s World Defense Show and Qatar’s DIMDEX asserting their dominance early in the first quarter.

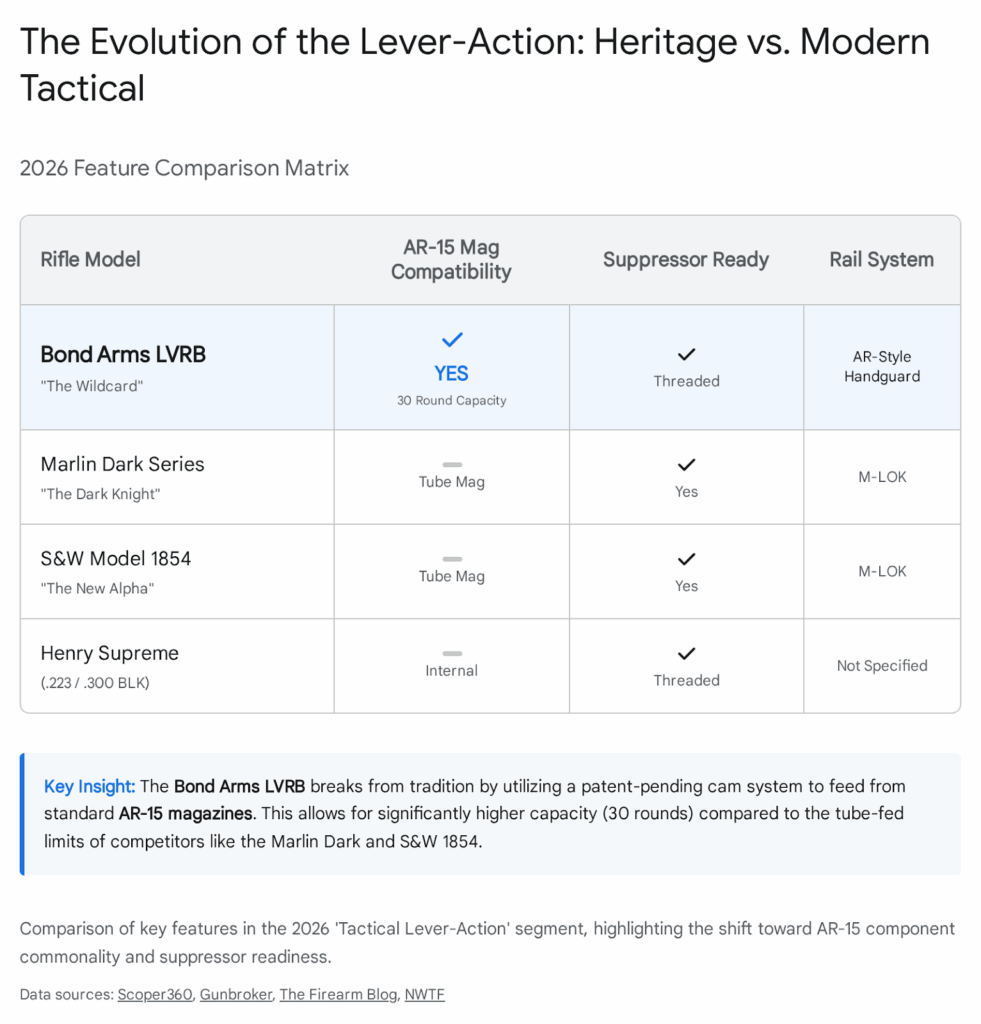

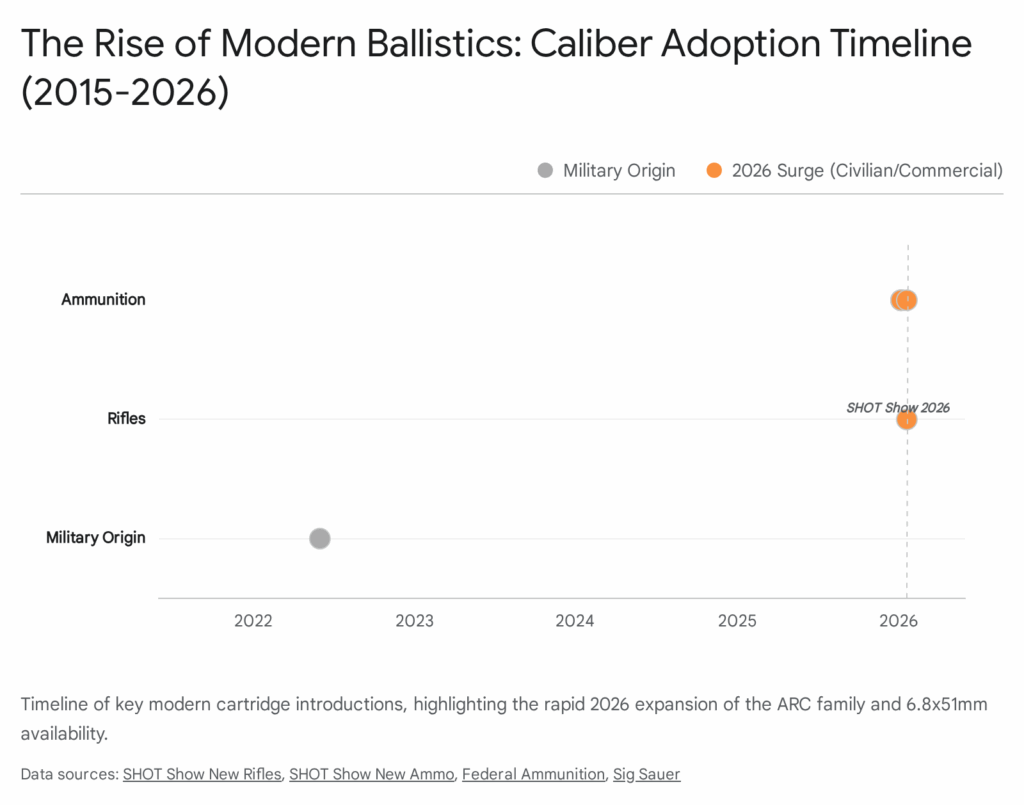

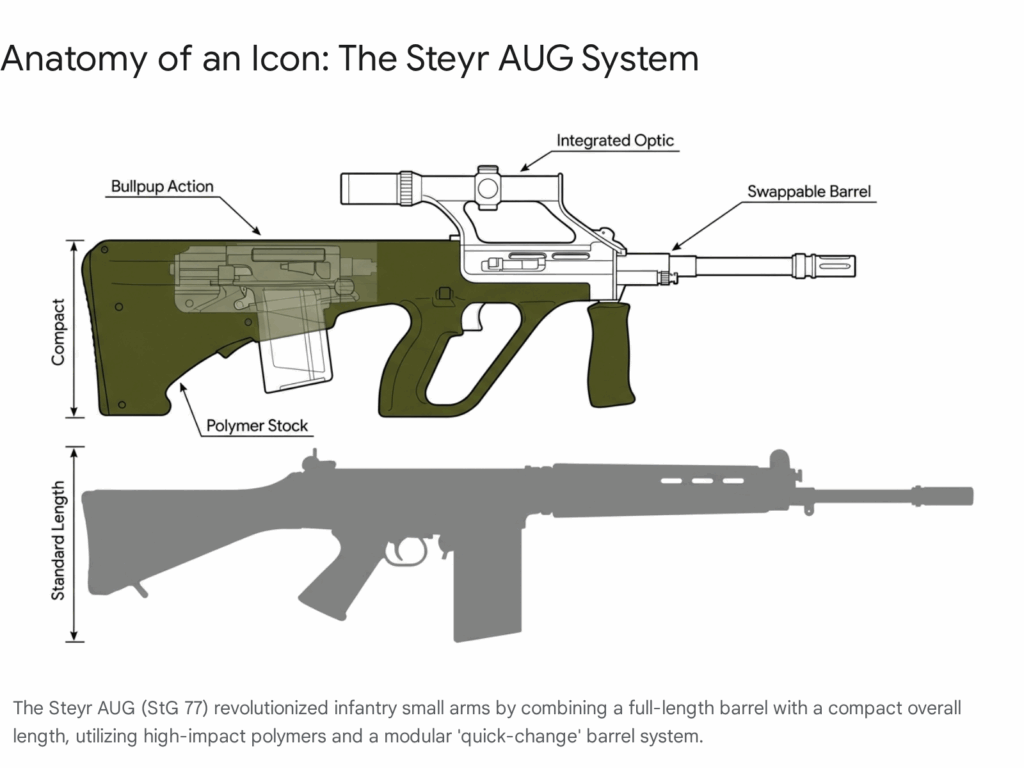

From a technological perspective, the exhibitions of 2026 will be the proving grounds for the “Next Generation” of infantry lethality. The transition to intermediate calibers (such as the 6.8mm family), the standardization of suppressors as general-issue equipment, and the fusion of optical sights with ballistics calculators will move from “special forces only” to “general infantry” status. Furthermore, the ubiquitous threat of unmanned aerial systems (UAS) has forced small arms manufacturers to pivot; nearly every major trade show in 2026 will feature kinetic and electronic Counter-UAS (C-UAS) solutions integrated directly into small arms platforms.

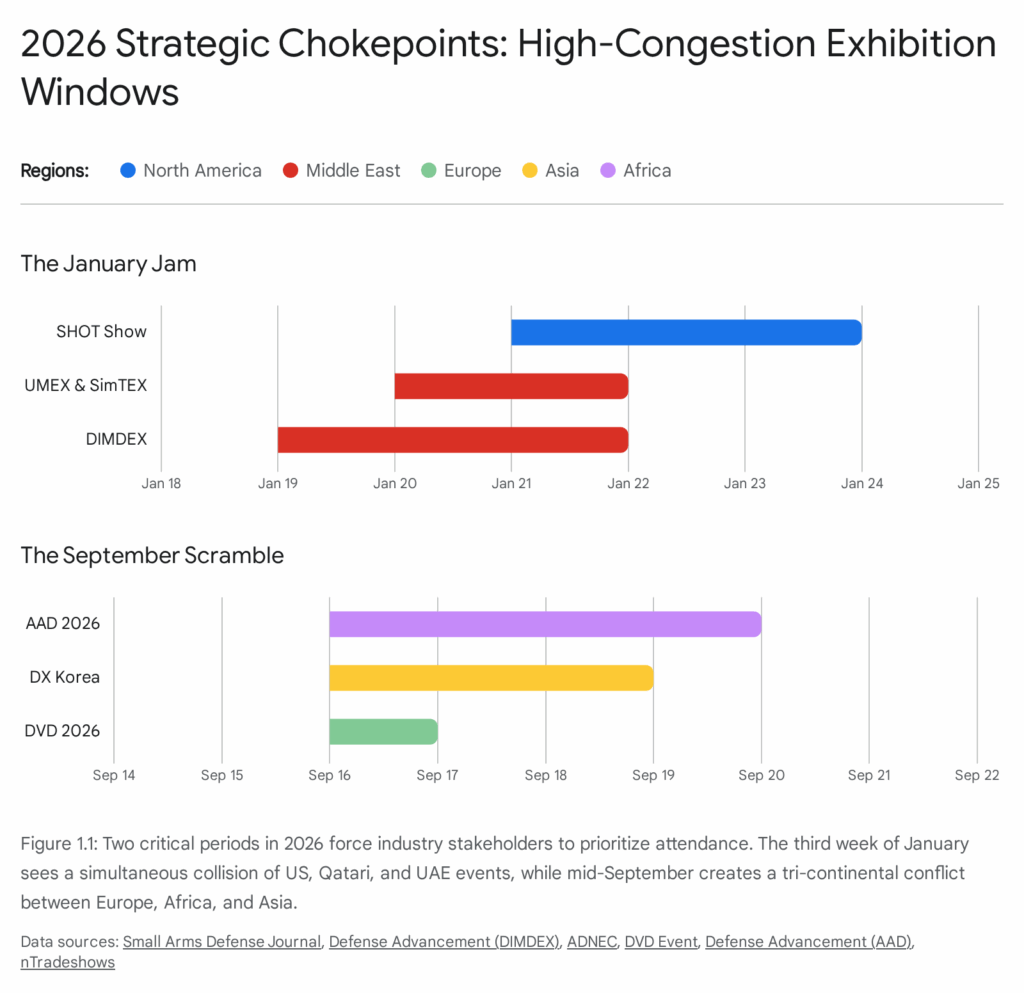

1.2 The Logistics of Congestion: Strategic Chokepoints

A granular analysis of the 2026 schedule reveals severe logistical friction points that will challenge industry stakeholders. The most acute of these is the “January Jam,” a period in the third week of January where the industry is pulled between the commercial center of gravity in the United States and the G2G (Government-to-Government) hubs of the Persian Gulf. A similar convergence, the “September Scramble,” occurs in the third quarter, forcing a tri-continental choice between Europe, Africa, and the Asia-Pacific.

These convergences are not merely administrative nuisances; they represent strategic choices for small arms manufacturers. A company cannot effectively field its “A-Team” of executives and technical experts in Las Vegas, Doha, and Abu Dhabi simultaneously. Analysts must therefore track who goes where as a primary signal of corporate strategy. A firm prioritizing the World Defense Show over SHOT Show, for example, is signaling a pivot from commercial sales to state-level technology transfer agreements.

1.3 Regional Market Dynamics

North America: The Commercial & Modernization Hub

The United States remains the undisputed volume leader in the small arms market. The 2026 circuit here is anchored by the SHOT Show (Commercial/LE) and AUSA (Military). The overarching theme for North American shows in 2026 is “Modernization and Interoperability.” With the US Army’s Next Generation Squad Weapon (NGSW) program entering fielding phases, exhibitors at AUSA and Modern Day Marine will be showcasing the cascading effects of this shift: new ammunition manufacturing technologies, advanced optics capable of handling higher pressures and longer effective ranges, and lightweight polymer technologies to offset heavier ammunition loads.

Europe: The Fortress Continent

Europe’s defense posture has shifted permanently to one of territorial defense and high-intensity warfare resilience. Consequently, trade shows like Eurosatory (France), MSPO (Poland), and Enforce Tac (Germany) are experiencing a surge in relevance. The focus in Europe is twofold: capacity and lethality. Analysts should expect to see a heavy emphasis on ammunition production machinery, stockpiling solutions, and simple, robust infantry weapons that can be produced at scale. The “boutique” tactical solutions of the 2010s are taking a backseat to industrial-grade reliability and volume.

The Middle East: Indigenization and Sovereignty

The Middle East trade show circuit is the busiest in the world for 2026. The defining trend here is “localization.” Governments in Saudi Arabia (World Defense Show), the UAE (UMEX), and Turkey (SAHA Expo) are demanding that defense contracts come with substantial domestic manufacturing components. For the small arms analyst, this means the booth to watch is not necessarily Heckler & Koch or FN Herstal, but rather the indigenous conglomerates like SAMI (Saudi Arabia) and EDGE (UAE), who are partnering with Western firms to produce localized variants of modern rifles.

Asia-Pacific: The Maritime-Land Nexus

In the Indo-Pacific, the threat model is archipelagic and naval. Shows like DSA (Malaysia), Indo Defence (Indonesia), and Land Forces (Australia) will highlight weapons optimized for marine environments. Corrosion resistance, over-the-beach capabilities, and integration with amphibious operations are key performance indicators. Furthermore, the region is seeing intense competition between South Korean, Turkish, and Western suppliers, with shows like DX Korea and KADEX serving as the home turf for Korea’s aggressive export push.

2. The First Quarter (Q1 2026): The Winter Campaign

The first quarter of 2026 is characterized by an immediate and intense burst of activity, primarily centered around the Persian Gulf and the United States. This period establishes the commercial and governmental baselines for the year.

2.1 The “January Jam”: A Logistics Analysis

The third week of January 2026 presents an unprecedented scheduling conflict. Three major events—DIMDEX (Qatar), UMEX (UAE), and SHOT Show (USA)—overlap, creating a tripartite split in industry attention.

Strategic Implications:

- Executive Split: CEO-level leadership will likely gravitate towards the Middle East (DIMDEX/UMEX) where G2G deals are signed, while VP of Sales/Marketing leadership will remain in Las Vegas (SHOT) to manage dealer networks and commercial orders.

- Product Launches: Commercial products will debut at SHOT; defense-specific variants and drone-integrated systems will debut at UMEX.

2.2 Event Profiles: January – March

DIMDEX 2026 (Doha International Maritime Defence Exhibition)

- Dates: January 19 – 22, 2026 1

- Location: Qatar National Convention Centre (QNCC), Doha, Qatar

- Region: Middle East

- Analyst Context: While primarily a maritime show, DIMDEX is critical for the “Naval Special Warfare” sector. As Qatar continues to expand its naval capabilities, the demand for boarding party equipment, vessel protection small arms, and maritime-grade optics is high. The show attracts high-level delegations from across the MENA region, making it a prime venue for G2G networking. The presence of the Middle East Naval Commanders Conference (MENC) on Jan 20 1 ensures a concentration of decision-makers.

UMEX & SimTEX 2026 (Unmanned Systems Exhibition)

- Dates: January 20 – 22, 2026 5

- Location: Abu Dhabi National Exhibition Centre (ADNEC), Abu Dhabi, UAE

- Region: Middle East

- Analyst Context: UMEX has evolved from a niche drone show into a central pillar of modern warfare technology. For the small arms analyst, this is the venue to observe the convergence of kinetic and unmanned systems. Expect to see “loitering munitions” that can be deployed by infantry squads, rifles equipped with anti-drone tracking optics, and the latest in electronic warfare (EW) jammers mounted on standard Picatinny rails. The “Coding Challenge” 5 and live demonstrations at Tilal Swaihan 8 provide proof-of-concept opportunities that static displays cannot match.

SHOT Show 2026 (Shooting, Hunting, Outdoor Trade Show)

- Dates: January 20 – 23, 2026 9 (Supplier Showcase: Jan 19-20)

- Location: Venetian Expo and Caesars Forum, Las Vegas, NV, USA

- Region: North America

- Analyst Context: SHOT Show remains the single largest event for the small arms industry by volume and attendance. While the main floor is dominated by commercial and hunting products, the law enforcement and military sections (often restricted access) are where the tactical innovations debut. The “Supplier Showcase” 10 is particularly valuable for analysts tracking supply chain health—availability of raw materials, precision machining capacity, and OEM component sourcing. Trends to watch in 2026 include the mainstreaming of thermal optics for police use and the expansion of suppressor-ready firearms across all price points.

Singapore Airshow 2026

- Dates: February 3 – 8, 2026 11

- Location: Changi Exhibition Centre, Singapore

- Region: Asia-Pacific

- Analyst Context: Although an aerospace event, the Singapore Airshow is the premier defense gathering for Southeast Asia in even-numbered years (alternating with LIMA). It serves as a key venue for base defense systems and helicopter-mounted weaponry (door guns, pod systems). It provides critical insight into the procurement priorities of ASEAN nations balancing relationships between the US and China.

World Defense Show (WDS) 2026

- Dates: February 8 – 12, 2026 12

- Location: Riyadh International Convention & Exhibition Center, Riyadh, Saudi Arabia

- Region: Middle East

- Analyst Context: WDS is the physical manifestation of Saudi Arabia’s “Vision 2030.” This show is massive, tri-service, and heavily focused on industrial localization. The General Authority for Military Industries (GAMI) uses this venue to sign joint venture agreements. Small arms analysts should focus on the SAMI pavilion to see which foreign rifles are being licensed for local production. The show’s “Future of Defense” theme 12 often highlights soldier system integration and desert-optimized infantry gear.

WEST 2026

- Dates: February 10 – 12, 2026 14

- Location: San Diego Convention Center, San Diego, CA, USA

- Region: North America

- Analyst Context: Co-hosted by AFCEA and the US Naval Institute, WEST is the premier naval conference on the US West Coast. Small arms relevance is specific to US Marine Corps and US Navy Expeditionary Combat Command (NECC) requirements. It is a key venue for understanding the “Force Design 2030” implications for Marine infantry weaponry, specifically in the context of littoral operations.

Enforce Tac 2026

- Dates: February 23 – 25, 2026 16

- Location: NürnbergMesse, Nuremberg, Germany

- Region: Europe

- Analyst Context: Over the last decade, Enforce Tac has graduated from a prelude to IWA into a standalone powerhouse for military and law enforcement special operations. It is a “quiet professional” show—highly restricted access, no civilians, and purely B2B/G2G. This is arguably the most important show in Europe for identifying the specific gear chosen by Tier-1 units (KSK, GIGN, SAS). The focus is on precision rifles, night vision, breaching tools, and ballistic protection. In 2026, expect a heavy focus on “grey zone” warfare tools and personal defense weapons (PDWs) for vehicle crews.

IWA OutdoorClassics 2026

- Dates: February 26 – March 1, 2026 20

- Location: NürnbergMesse, Nuremberg, Germany

- Region: Europe

- Analyst Context: Taking place immediately after Enforce Tac, IWA is the “SHOT Show of Europe.” While the focus is hunting and sport, the “dual-use” nature of the industry means many tactical innovations in optics, clothing, and accessories are displayed here. It is the primary venue for tracking the European civilian market and the health of the German/Italian manufacturing base.

Baltic Military Conference 2026

- Dates: March 19 – 20, 2026 24

- Location: Vilnius, Lithuania

- Region: Europe

- Analyst Context: A high-level strategic forum rather than a product expo. This conference is essential for understanding the doctrinal shifts on NATO’s eastern flank. The discussions here drive the procurement requirements that will appear in tenders for the next 3-5 years, particularly regarding territorial defense forces, reserves, and interoperability standards.

3. The Second Quarter (Q2 2026): Emerging Markets & Land Power

As spring arrives, the circuit shifts focus to the emerging markets of Asia and South America before culminating in the massive land warfare gathering in Paris.

3.1 Event Profiles: April – June

FIDAE 2026 (Feria Internacional del Aire y del Espacio)

- Dates: April 7 – 12, 2026 25

- Location: Arturo Merino Benítez Airport, Santiago, Chile

- Region: South America

- Analyst Context: FIDAE is the premier aerospace and defense exhibition in Latin America. It is the critical entry point for companies looking to sell into the Chilean, Brazilian, and Colombian markets. While aerospace-heavy, the land systems pavilions are significant. Security forces in the region are heavily focused on internal security and border control, driving demand for robust, cost-effective small arms and surveillance tech.

DSA 2026 (Defence Services Asia)

- Dates: April 20 – 23, 2026 27

- Location: MITEC, Kuala Lumpur, Malaysia

- Region: Asia-Pacific

- Analyst Context: DSA is one of the top defense shows in the world, not just Asia. It is a “Tri-Service” event but has a massive land and security component. For the small arms analyst, DSA is the window into the ASEAN market. The show is known for its “VVIP” program, bringing in delegations from across the developing world. Key themes in 2026 will include jungle warfare requirements, modernization of police forces, and the competition between Chinese, Turkish, and Western small arms suppliers for regional dominance.

Modern Day Marine 2026

- Dates: April 29 – May 1, 2026 25

- Location: Walter E. Washington Convention Center, Washington, DC, USA

- Region: North America

- Analyst Context: The definitive annual expo for the US Marine Corps. Located in DC, it attracts the acquisition community from Quantico and the Pentagon. This is where the rubber meets the road for Marine infantry modernization. Expect to see the latest evolutions in the Infantry Automatic Rifle (IAR) concepts, lightweight ammunition, and squad-level situational awareness tools.

SAHA EXPO 2026

- Dates: May 5 – 9, 2026 31

- Location: Istanbul Expo Center, Istanbul, Turkey

- Region: Europe/Middle East

- Analyst Context: Turkey has become a small arms superpower, exporting reliable and affordable NATO-standard weapons globally. SAHA EXPO is the showcase for this industrial base. It focuses on the high-tech supply chain—aerospace, avionics, but increasingly autonomous systems and advanced materials. It complements the larger IDEF (usually odd years) by focusing on the industrial ecosystem.

DAIMEX 2026 (Defence Aid & Military Exhibition)

- Dates: May 12 – 13, 2026 32

- Location: LITEXPO, Vilnius, Lithuania

- Region: Europe

- Analyst Context: A focused regional event for the Baltic states. Given the proximity to the Russian border, the procurement cycle here is fast and focused on “total defense.” Small arms interest is high for territorial defense units (National Guard), with a preference for simple, high-firepower systems like anti-tank guided missiles (ATGMs) and man-portable air-defense systems (MANPADS), alongside standard infantry rifles.

DefExpo India 2026

- Dates: May 20 – 22, 2026 34

- Location: KTPO Whitefield, Bengaluru, India

- Region: Asia-Pacific

- Analyst Context: DefExpo is India’s flagship biennial event. The market here is defined by the “Make in India” initiative. Foreign small arms manufacturers (like Sig Sauer, Kalashnikov, UAE’s Caracal) compete fiercely for massive Indian Army tenders, but success relies on establishing local joint ventures. The 2026 edition in Bengaluru (an aerospace/tech hub) suggests a strong focus on defense electronics and modernization.

CANSEC 2026

- Dates: May 27 – 28, 2026.3131

- Location: EY Centre, Ottawa, Canada

- Region: North America

- Analyst Context: Canada’s largest defense trade show. It is vital for companies doing business with the Canadian Armed Forces (CAF). The focus is often on cold-weather operations, Rangers support, and NATO commitments. Small arms contracts here are fewer but high-value and long-term.

ISDEF 2026

- Dates: June 1 – 3, 2026 36

- Location: Expo Tel Aviv, Israel

- Region: Middle East

- Analyst Context: ISDEF focuses heavily on Homeland Security (HLS), Cyber, and Special Forces. Israeli innovation in tactical accessories, optics, and “smart soldier” tech is world-leading. This show is often where the newest tactical concepts—later adopted by global police forces—are first seen. It is a smaller, more intimate show than Eurosatory but extremely high-density for innovation.

Hemus 2026

- Dates: June 3 – 6, 2026 31

- Location: International Fair Plovdiv, Bulgaria

- Region: Europe

- Analyst Context: A critical event for Eastern Europe. Bulgaria and its neighbors are in the process of replacing Soviet-era stockpiles with NATO-standard equipment. This is a prime market for “mid-tier” small arms manufacturers offering cost-effective modernization packages (e.g., AR-15 / AR-10 platforms, 5.56mm ammunition conversion).

Eurosatory 2026

- Dates: June 15 – 19, 2026 37

- Location: Paris Nord Villepinte, Paris, France

- Region: Europe

- Analyst Context: The “Super Bowl” of the land defense industry. Eurosatory is the largest and most comprehensive event of the year for land and air-land defense. Every major small arms manufacturer in the world will have a presence here. The 2026 edition is expected to be heavily influenced by the lessons of high-intensity conflict in Ukraine: the need for massive artillery and small arms ammunition capacity, the integration of drones at the squad level, and the protection of infantry against fragmentation. This is the venue for major European contract announcements.

4. The Third Quarter (Q3 2026): The September Scramble

The summer lull is followed by a chaotic September, where multiple major shows compete for attention.

4.1 The “September Scramble”: A Tri-Continental Conflict

The weeks of mid-September see major exhibitions in the UK (DVD), South Africa (AAD), South Korea (DX Korea), Poland (MSPO), and Australia (Land Forces). This scheduling cluster forces companies to decentralize their marketing efforts, relying on regional offices rather than HQ delegations.

4.2 Event Profiles: July – September

Farnborough International Airshow 2026

- Dates: July 20 – 24, 2026 41

- Location: Farnborough International Exhibition & Conference Centre, UK

- Region: Europe

- Analyst Context: While dominated by aerospace giants (Boeing, Airbus), Farnborough remains relevant for the defense analyst tracking “Force Protection.” The base defense sector—protecting airfields from ground attack—is a key niche here. Additionally, the integration of weaponry onto rotary-wing platforms (helicopters) is a major theme.

DALO Industry Days 2026

- Dates: August 19 – 21, 2026 43

- Location: Ballerup Super Arena, Ballerup, Denmark

- Region: Europe

- Analyst Context: Organized directly by the Danish Ministry of Defence Acquisition and Logistics Organisation (DALO). This is a unique, highly effective event. It is less of a “show” and more of a “meet the buyer” forum. It attracts procurement officers from across Scandinavia. For small arms vendors, this is an excellent venue to showcase cold-weather reliability and ergonomic designs favored by Nordic troops.

MSPO 2026 (International Defence Industry Exhibition)

- Dates: September 8 – 11, 2026 45

- Location: Targi Kielce, Kielce, Poland

- Region: Europe

- Analyst Context: MSPO has grown in importance alongside Poland’s defense spending. Poland is currently the “rampart” of NATO, spending heavily on modernization. This show is essential for any company wishing to enter the Central/Eastern European market. The focus is on heavy armor, but the “Tytan” future soldier program drives demand for modern small arms and optics.

Land Forces 2026

- Dates: September 9 – 11, 2026 31

- Location: Melbourne Convention & Exhibition Centre, Australia

- Region: Asia-Pacific

- Analyst Context: Australia’s premier land defense exposition. Occurring almost exactly at the same time as MSPO, it forces a split. The Australian Army is undergoing significant recapitalization (Land 400, Land 125). Small arms focus is on the EF88 replacement programs and advanced night fighting capabilities.

DVD 2026

- Dates: September 16 – 17, 2026 47

- Location: UTAC Millbrook, Bedfordshire, UK

- Region: Europe

- Analyst Context: A dynamic event held at a vehicle proving ground. Run by the UK’s Defence Equipment & Support (DE&S) agency. Unlike static hall shows, DVD allows for live vehicle demonstrations. For small arms, the focus is on vehicle-mounted weapons, remote weapon stations (RWS), and the equipment carried by mechanized infantry. It is the primary forum for the British Army’s land equipment stakeholders.

DX Korea 2026

- Dates: September 16 – 19, 2026 49

- Location: KINTEX, Goyang, South Korea

- Region: Asia-Pacific

- Analyst Context: South Korea is rapidly becoming a top-tier global arms exporter. DX Korea showcases the “K-Defense” portfolio. The small arms sector is dominated by S&T Motiv (maker of the K2 rifle) and Hanwha. Analysts should watch this show for evidence of Korea’s push into new markets (Middle East, Poland) and the development of next-gen infantry weapons. Note: There is a competitor show, KADEX, in October.

Africa Aerospace and Defence (AAD) 2026

- Dates: September 16 – 20, 2026 52

- Location: Air Force Base Waterkloof, Tshwane, South Africa

- Region: Africa

- Analyst Context: The only major aerospace and defense exhibition on the African continent. It serves as the gateway to the African market. Key themes include border security, anti-poaching operations (which utilize military-grade small arms and optics), and peacekeeping equipment. South Africa’s own Denel Land Systems is a key exhibitor here.

ADEX 2026 (Azerbaijan International Defence Exhibition)

- Dates: September 30 – October 2, 2026 14

- Location: Baku Expo Center, Baku, Azerbaijan

- Region: Middle East/Eurasia

- Analyst Context: Located at a geopolitical crossroads. Azerbaijan is a significant consumer of Israeli and Turkish defense technology. This show is a key indicator of the “drone-ification” of the battlefield, reflecting the lessons of the Nagorno-Karabakh conflicts.

5. The Fourth Quarter (Q4 2026): Global Summits

The year concludes with high-profile events in the US and the Middle East, along with key regional shows.

5.1 Event Profiles: October – December

KADEX 2026 (Korea Army International Defense Exhibition)

- Dates: October 6 – 10, 2026 58

- Location: Gyeryongdae (Military HQ), South Korea

- Region: Asia-Pacific

- Analyst Context: A rival to DX Korea, KADEX is backed by the Association of the Republic of Korea Army (AROKA) and held at the military headquarters. This gives it a strong “user” focus. It is likely to feature more active duty military participation and operational feedback loops. The rivalry between DX Korea and KADEX splits the market, but KADEX’s official backing makes it essential for Army-specific programs.

AUSA 2026 Annual Meeting & Exposition

- Dates: October 12 – 14, 2026 61

- Location: Walter E. Washington Convention Center, Washington, DC, USA

- Region: North America

- Analyst Context: The largest land power exposition in North America. AUSA is where the US Army communicates its vision to the industry. For 2026, the focus will be on the “Army of 2030” and “Army of 2040” concepts. Small arms analysts must track the NGSW (Next Generation Squad Weapon) rollout updates, developments in the Precision Grenadier System (PGS), and the integration of AI into fire control systems.

Milipol Qatar 2026

- Dates: October 20 – 22, 2026 64

- Location: Doha Exhibition & Convention Center (DECC), Qatar

- Region: Middle East

- Analyst Context: A sister show to Milipol Paris, focusing on Homeland Security. It is vital for internal security forces (ISF) and police procurement. The region’s police forces are often equipped with military-grade hardware, blurring the lines between “police” and “soldier” equipment at this show.

Future Forces Forum 2026

- Dates: October 21 – 23, 2026 14

- Location: Prague, Czech Republic

- Region: Europe

- Analyst Context: A highly technical, “science-focused” event. It brings together NATO subject matter experts (SMEs) to discuss standards for future soldier systems—clothing, connectivity, and ballistics. It is less about sales and more about R&D and interoperability standards (STANAGs).

SOFEX 2026 (Special Operations Forces Exhibition)

- Dates: October 27 – 29, 2026 14

- Location: Aqaba, Jordan

- Region: Middle East

- Analyst Context: A biennial favorite for the special operations community. SOFEX is unique because it focuses exclusively on SOF requirements. It is a high-value, low-volume market. Small arms seen here are elite, highly customized, and expensive. It is a prime venue for seeing trends in suppressed weapons, subsonic ammunition, and specialized insertion gear.

Euronaval 2026

- Dates: November 3 – 6, 2026 14

- Location: Paris Nord Villepinte, France

- Region: Europe

- Analyst Context: The world’s leading naval defense exhibition. While focused on ships and submarines, the “Naval Special Warfare” component is significant. Equipment for combat swimmers, boarding teams (VBSS), and marine commandos is showcased here.

Bahrain International Airshow 2026

- Dates: November 18 – 20, 2026 14

- Location: Sakhir Air Base, Bahrain

- Region: Middle East

- Analyst Context: A boutique, VIP-heavy airshow. Strategically located near the US Navy’s 5th Fleet headquarters. While primarily aerospace, it serves as a networking hub for Gulf security officials.

Indo Defence 2026

- Dates: November 18 – 21, 2026 68

- Location: JIExpo Kemayoran / NICE PIK 2, Jakarta, Indonesia

- Region: Asia-Pacific

- Analyst Context: Indonesia is a massive, non-aligned market that buys from East and West. Indo Defence is huge, chaotic, and vital. It covers all three services. The “Transfer of Technology” (ToT) requirements for Indonesia are strict. This show is key for observing the competition between Russian (legacy), Western, and increasingly Korean/Turkish suppliers for the Indonesian Armed Forces (TNI) modernization.

NEDS 2026 (NIDV Exhibition Defence & Security)

- Dates: November 19, 2026 72

- Location: Rotterdam Ahoy, Netherlands

- Region: Europe

- Analyst Context: A one-day, highly efficient industry event for the Benelux region. It is excellent for supply chain networking and meeting Dutch naval and marine procurement officers.

Expodefensa 2026

- Dates: December 1 – 3, 2026 75

- Location: Corferias, Bogotá, Colombia

- Region: South America

- Analyst Context: The leading hub for Security and Defense in Latin America. It focuses on the specific needs of the region: counter-insurgency, counter-narcotics, and riverine operations. Small arms requirements here prioritize ruggedness, humidity resistance, and jungle operational capability.

Vietnam Defence 2026

- Dates: December 1 – 3, 2026 (Estimated/TBC) 77

- Location: Gia Lam Airport, Hanoi, Vietnam

- Region: Asia-Pacific

- Analyst Context: Vietnam is aggressively diversifying its supply chain away from historical reliance on Russia. This show is a magnet for Western and Asian companies looking to break into this substantial market. Note: Dates are based on the 2024 cycle and preliminary aggregator data; verification is needed closer to Q4 2026.

6. Strategic Analysis & Recommendations

6.1 Recommendations for the Small Arms Analyst

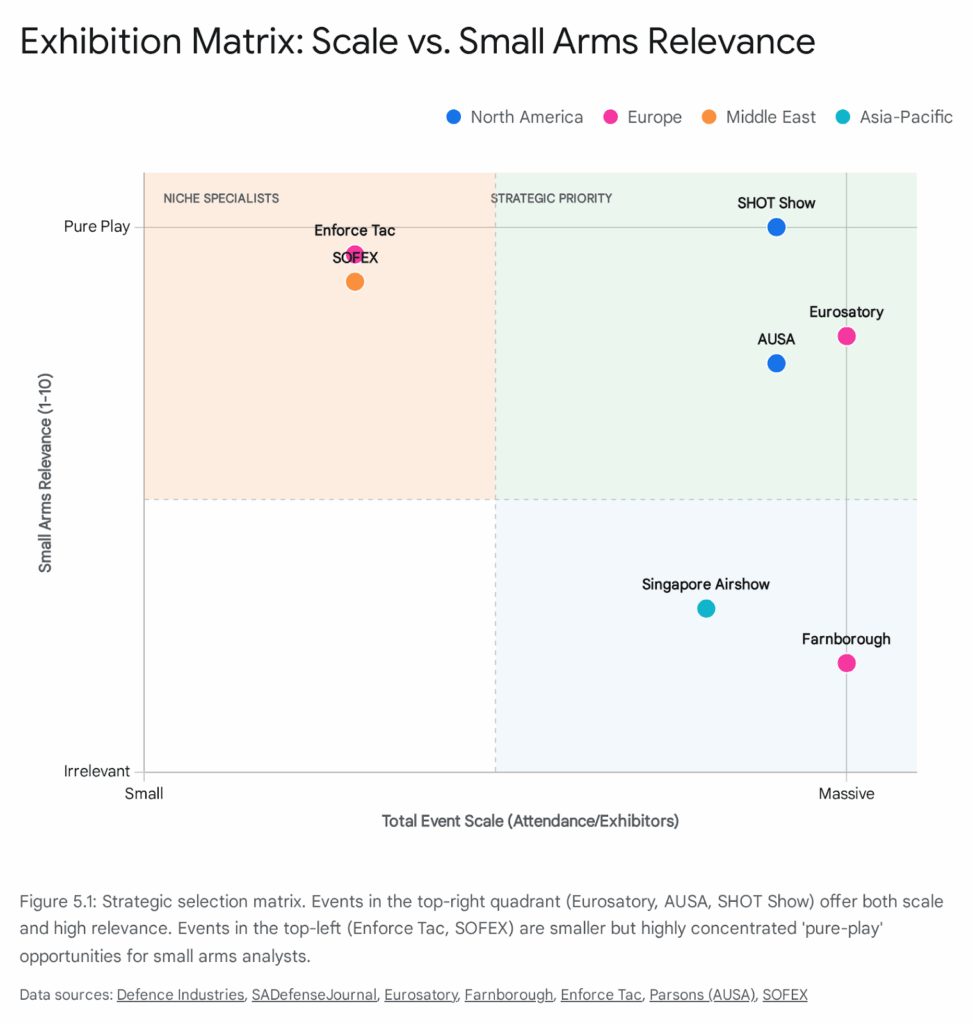

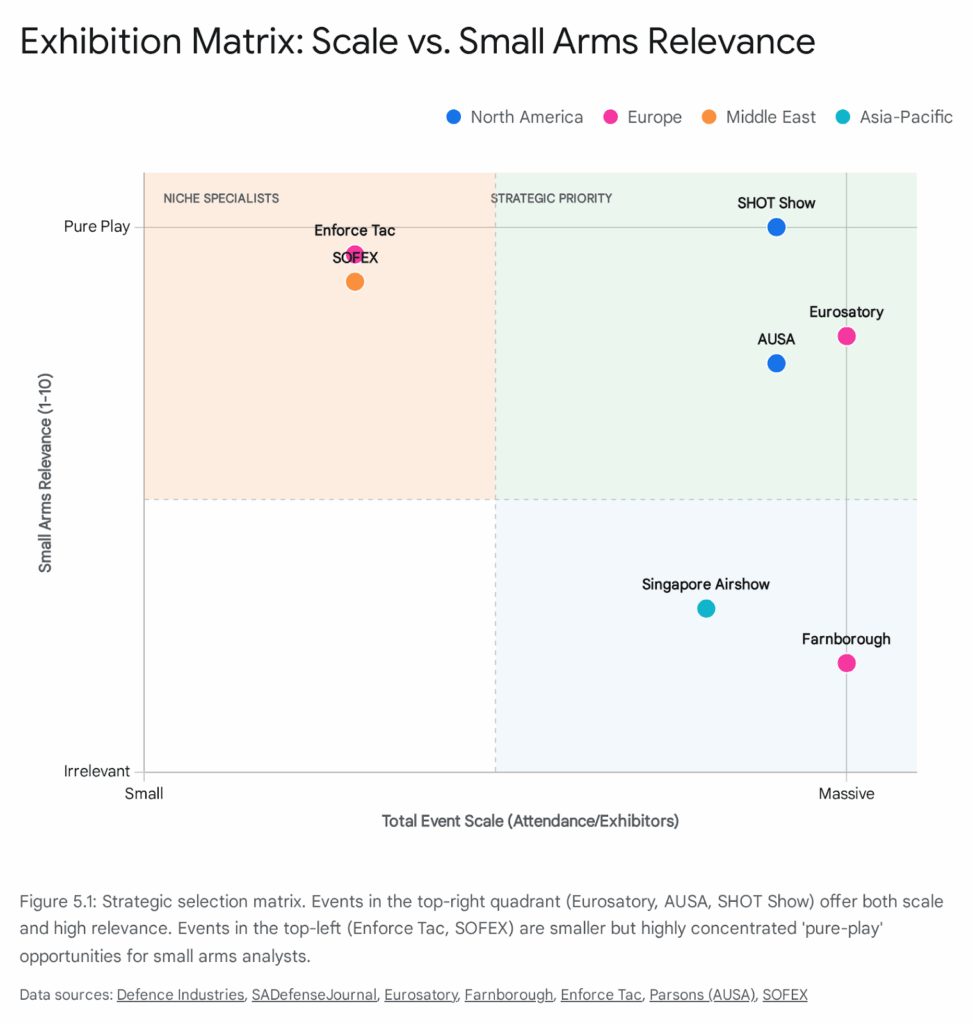

Not all shows generate equal value for the small arms specialist. The “Must-Attend” circuit for 2026 should be prioritized based on the type of intelligence required:

- For Commercial & Trend Intelligence: SHOT Show (Jan) is non-negotiable. It sets the product cadence for the year.

- For Tier-1 Military Tech: Enforce Tac (Feb) is the highest-density venue for elite special forces gear.

- For Emerging Market Contracts: DSA Malaysia (Apr) and Indo Defence (Nov) offer the best visibility into large-scale infantry modernization tenders in the non-Western world.

- For Global Land Warfare Context: Eurosatory (Jun) is the definitive event to see how small arms fit into the larger combined-arms puzzle.

6.2 Master Schedule Summary Table

The following table provides the comprehensive chronological index of all identified 2026 events.

| Start Date | End Date | Event Name | Location | Region | Primary Focus |

| Jan 19 | Jan 22 | DIMDEX | Doha, Qatar | Middle East | Naval / Maritime |

| Jan 20 | Jan 22 | UMEX & SimTEX | Abu Dhabi, UAE | Middle East | Unmanned Systems |

| Jan 20 | Jan 23 | SHOT Show | Las Vegas, USA | N. America | Small Arms / LE |

| Feb 03 | Feb 08 | Singapore Airshow | Singapore | Asia-Pacific | Aerospace / Defense |

| Feb 08 | Feb 12 | World Defense Show | Riyadh, Saudi Arabia | Middle East | Tri-Service |

| Feb 10 | Feb 12 | WEST 2026 | San Diego, USA | N. America | Naval / Marine Corps |

| Feb 23 | Feb 25 | Enforce Tac | Nuremberg, Germany | Europe | SOF / Law Enforcement |

| Feb 26 | Mar 01 | IWA OutdoorClassics | Nuremberg, Germany | Europe | Hunting / Sport |

| Mar 04 | Mar 05 | Space-Comm Expo | Farnborough, UK | Europe | Space / C4ISR |

| Mar 19 | Mar 20 | Baltic Military Conf. | Vilnius, Lithuania | Europe | Policy / Strategy |

| Apr 07 | Apr 12 | FIDAE | Santiago, Chile | S. America | Aerospace / Defense |

| Apr 20 | Apr 23 | DSA | Kuala Lumpur, Malaysia | Asia-Pacific | Tri-Service / ASEAN |

| Apr 29 | May 01 | Modern Day Marine | Washington DC, USA | N. America | USMC |

| May 05 | May 09 | SAHA EXPO | Istanbul, Turkey | Europe/ME | Industrial / Aerospace |

| May 12 | May 13 | DAIMEX | Vilnius, Lithuania | Europe | Regional Defense |

| May 20 | May 22 | DefExpo India | Bengaluru, India | Asia-Pacific | Land / Naval / Air |

| May 27 | May 28 | CANSEC | Ottawa, Canada | N. America | Canadian Defense |

| Jun 01 | Jun 03 | ISDEF | Tel Aviv, Israel | Middle East | HLS / Cyber / SOF |

| Jun 03 | Jun 06 | Hemus | Plovdiv, Bulgaria | Europe | Regional Land |

| Jun 15 | Jun 19 | Eurosatory | Paris, France | Europe | Land / Airland |

| Jul 20 | Jul 24 | Farnborough Airshow | Farnborough, UK | Europe | Aerospace |

| Aug 19 | Aug 21 | DALO Industry Days | Ballerup, Denmark | Europe | Nordic Procurement |

| Sep 08 | Sep 11 | MSPO | Kielce, Poland | Europe | Land / Regional |

| Sep 09 | Sep 11 | Land Forces | Melbourne, Australia | Asia-Pacific | Land Warfare |

| Sep 16 | Sep 17 | DVD 2026 | Millbrook, UK | Europe | Land Mobility |

| Sep 16 | Sep 19 | DX Korea | Goyang, South Korea | Asia-Pacific | Land / Systems |

| Sep 16 | Sep 20 | AAD | Tshwane, South Africa | Africa | African Defense |

| Sep 30 | Oct 02 | ADEX Azerbaijan | Baku, Azerbaijan | Eurasia | Regional Defense |

| Oct 06 | Oct 10 | KADEX | Gyeryongdae, Korea | Asia-Pacific | Army Focus |

| Oct 12 | Oct 14 | AUSA Annual | Washington DC, USA | N. America | US Army / Land |

| Oct 20 | Oct 22 | Milipol Qatar | Doha, Qatar | Middle East | HLS / Police |

| Oct 21 | Oct 23 | Future Forces Forum | Prague, Czech Rep. | Europe | Soldier Systems |

| Oct 27 | Oct 29 | SOFEX | Aqaba, Jordan | Middle East | Special Operations |

| Nov 03 | Nov 06 | Euronaval | Paris, France | Europe | Naval / NSW |

| Nov 18 | Nov 20 | Bahrain Int’l Airshow | Sakhir, Bahrain | Middle East | Aerospace / VIP |

| Nov 18 | Nov 21 | Indo Defence | Jakarta, Indonesia | Asia-Pacific | Tri-Service |

| Nov 19 | Nov 19 | NEDS | Rotterdam, Netherlands | Europe | Niche / Supply Chain |

| Dec 01 | Dec 03 | Expodefensa | Bogotá, Colombia | S. America | LatAm Security |

| Dec 01 | Dec 03 | Vietnam Defence | Hanoi, Vietnam | Asia-Pacific | Emerging Market |

6.3 Conclusion

The 2026 calendar is a testament to a revitalized and globally distributed defense industry. For the small arms professional, success in 2026 will not come from merely attending the usual events, but from strategically navigating the regional conflicts in the schedule. The pivot to the Middle East in Q1, the consolidation of Land Power in Europe in Q2, and the scramble for emerging markets in Q3 and Q4 offer a roadmap for those seeking to understand—and influence—the future of infantry warfare.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- MSPO 2026 – 34th International Defence Industry Exhibition, accessed January 26, 2026, https://www.unmannedsystemstechnology.com/events/mspo/

- BSDA 2026 – Black Sea Defense, Aerospace & Security, accessed January 26, 2026, https://www.defenseadvancement.com/events/bsda/

- World Defense Show, accessed January 26, 2026, https://www.worlddefenseshow.com/en

- World Defense Show, accessed January 26, 2026, https://www.baesystems.com/en-sa/event/world-defense-show

- DSA 2026 – Defence Services Asia – advantage austria, accessed January 26, 2026, https://www.advantageaustria.org/my/events/Defence_Services_Asia__DSA__2025.en.html

- Indo Defence Expo & Forum – The 11th Indonesia’s Official Tri-Service, accessed January 26, 2026, https://indodefence.com/

- Land Forces International Land Defence Exposition 2026 | Land Forces International Land Defence Exposition, accessed January 26, 2026, https://landforces.com.au/

- KADEX 2026 – Korea Army International Defense Exhibition, accessed January 26, 2026, https://kadexaroka.com/eng/

- DX KOREA 2026, accessed January 26, 2026, http://dxkorea.openhaja.com/en/index.asp

- Germany Events IWA – International Trade Administration, accessed January 26, 2026, https://www.trade.gov/germany-events-iwa

- Dates, opening times and Venue | Milipol Qatar, accessed January 26, 2026, https://www.milipolqatar.com/en/useful-information/date-access-map

- FIDAE 2026, accessed January 26, 2026, https://www.diamondaircraft.com/en/about-diamond/newsroom/events/detail/fidae2026/

- accessed January 26, 2026, https://www.triumfo.de/laad/#:~:text=LAAD%20Security%202026%20is%20a,assemble%20to%20make%20concrete%20decisions.

- 2026 Defence Event Calendar and Show News Portals | Shephard, accessed January 26, 2026, https://businessinfo.shephardmedia.com/show-news

- accessed January 26, 2026, https://www.exail.com/events/bdsa-2026#:~:text=Exail%20is%20exhibiting%20at%20BSDA%202026%2C%20from%2013%20to%2015,2026%2C%20in%20Bucarest%2C%20Romania.

- 20 – 22 May 2026, Leipzig, Germany: All for Internal Security, Law Enforcement and Homeland Defence, accessed January 26, 2026, https://www.gpec.de/en/gpec

- accessed January 26, 2026, https://www.theevent.co.uk/

- Asian Defense and Security Exhibition (ADAS) 2026 | September 2 …, accessed January 26, 2026, https://www.defenseadvancement.com/events/adas-asian-defense-and-security-exhibition/

- NSSF SHOT Show 2026, accessed January 26, 2026, https://shotshow.org/

- Defense & Security Events and Conferences – ASDEvents, accessed January 26, 2026, https://www.asdevents.com/defense-security

- List of Defense Exhibitions in 2026 – Global Defence Mart, accessed January 26, 2026, https://www.globaldefencemart.com/listing/scat/defence-exhibitions-and-seminars/year-2026

- IDEB | Events – Booking Expo, accessed January 26, 2026, https://www.booking-expo.com/events/ideb

- IDEB Defence &Security|Incheba | www.incheba.sk, accessed January 26, 2026, https://www.incheba.sk/en/fairs-and-exhibitions/ideb-defence-security-2/

- Hemus 2026, accessed January 26, 2026, https://www.hemusbg.org/en

- HEMUS 2026 | June 3–6, 2026 | Plovdiv, Bulgaria – Defense Advancement, accessed January 26, 2026, https://www.defenseadvancement.com/events/hemus/

- Eurosatory 2026: The Global Event for Defence and Security, accessed January 26, 2026, https://www.eurosatory.com/en/

- accessed January 26, 2026, https://www.eurosatory.com/en/official-delegations2026/#:~:text=Join%20us%20in%20Paris%20from%2015%20to%2019%20June%20for%20Eurosatory%202026

- Eurosatory – Wikipedia, accessed January 26, 2026, https://en.wikipedia.org/wiki/Eurosatory

- MSPO 2026 – Kallman Worldwide, Inc., accessed January 26, 2026, https://www.kallman.com/show/mspo-2026/

- DVD 2026 – Defence Online, accessed January 26, 2026, https://www.defenceonline.co.uk/event/dvd-2026/

- ADEX 2026 in Baku Expo (Sep) | Show info, accessed January 26, 2026, https://www.expostandservice.com/adex/

- 6th Azerbaijan International Defence Exhibition, accessed January 26, 2026, https://adex.az/

- NEDS 2026 – NIDV Exhibition Defence & Security | November 19, 2026 | Rotterdam Ahoy, Netherlands – Defense Advancement, accessed January 26, 2026, https://www.defenseadvancement.com/events/neds/

- NIDV Exhibition Defence & Security: Home – NEDS, accessed January 26, 2026, https://www.nidvexhibition.eu/

- accessed January 26, 2026, https://www.defenseadvancement.com/events/africa-aerospace-and-defence-expo-aad/#:~:text=Africa%20Aerospace%20and%20Defence%20(AAD,exhibition%20and%20public%20air%20show.

- Africa Aerospace & Defence 2026 – Kallman Worldwide, Inc., accessed January 26, 2026, https://www.kallman.com/show/africa-aero-and-defence-2026/

- Milipol Network, accessed January 26, 2026, https://www.milipol.com/en/event/milipol-network

- accessed January 26, 2026, https://turdef.com/event/ideas-2026#:~:text=The%20IDEAS%2D2026%20team%20eagerly,24%20to%20November%2027%2C%202026.

- IDEAS 2026 – TURDEF, accessed January 26, 2026, https://turdef.com/event/ideas-2026

- Welcome to EDEX 2025, accessed January 26, 2026, https://www.egyptdefenceexpo.com/

- Global Defence Industry Events & Conferences | 2025-2026, accessed January 26, 2026, https://www.defence-industries.com/events

- About DSA 2026, accessed January 26, 2026, https://www.dsaexhibition.com/about-dsa-2026

- DefExpo India 2026 Exhibition Booth Design, Stand Builder – Suprano Displays, accessed January 26, 2026, https://supranodisplays.com/defexpo-india/

- DEF-TECH Bharat Bengaluru 2026 | May 2026, accessed January 26, 2026, https://www.deftechbharat.com/

- Land Forces Announces Perth as Host City for 2026, accessed January 26, 2026, https://landforces.com.au/news-media/latest-news/

- Indonesia’s Official Tri-service Defense, Aerospace, Maritime and Security Event – 2026/11 | Online Trade Fair Database (J-messe) – JETRO, accessed January 26, 2026, https://www.jetro.go.jp/en/database/j-messe/tradefair/detail/159029

- VIETNAM DEFENCE EXPO 2026 | globaltradeshows.vn, accessed January 26, 2026, https://www.globaltradeshows.com.vn/detail/vietnam-defence-expo-2026

- Home – VIETNAM EXPO, accessed January 26, 2026, https://vietnamexpo.com.vn/en/

- GICAN brings together the French Pavilion at the Vietnam International Defence Expo (Hanoi, Vietnam), accessed January 26, 2026, https://gican.asso.fr/en/french-pavilions/gican-brings-together-the-french-pavilion-at-the-vietnam-international-defence-expo-hanoi-vietnam/

- accessed January 26, 2026, https://www.tradeindia.com/tradeshows/143306/expodefense-bogota-2026.html#:~:text=Expodefense%20Bogota%202026%20will%20take,de%20Convenciones%2C%20Bogota%2C%20Colombia.

- Expodefense Bogota 2026 – Tradeindia, accessed January 26, 2026, https://www.tradeindia.com/tradeshows/143306/expodefense-bogota-2026.html

- accessed January 26, 2026, https://www.defenseadvancement.com/events/dimdex/

- DIMDEX 2026 | January 19–22, 2026 | Doha, Qatar – Ocean Science & Technology, accessed January 26, 2026, https://www.oceansciencetechnology.com/events/dimdex/

- DIMDEX 2026: Premier Maritime Defence Event Returns to Doha from 19 to 22 January 2026, accessed January 26, 2026, https://defenceturkey.com/en/content/dimdex-2026-premier-maritime-defence-event-returns-to-doha-from-19-to-22-january-2026-6286

- DIMDEX Maritime Defence 2026 Qatar – Exhibition, accessed January 26, 2026, https://www.exhibitionstand.contractors/en/news/81/DIMDEX-Maritime-Defence-2020-Qatar

- UMEX & SimTEX 2026 – “Unmanned Systems Exhibition” & “Simulation and Training Exhibition” | ADNEC Centre Abu Dhabi, accessed January 26, 2026, https://www.adnec.ae/en/eventlisting/umex-simtex-2026-unmanned-systems-exhibition-simulation-and-training-exhibition

- UMEX Abu Dhabi | UMEX & SimTEX UAE | 20-22 Jan 2026 – Unmanned Systems Technology, accessed January 26, 2026, https://www.unmannedsystemstechnology.com/events/umex/

- UMEX and SimTEX 2026 open in Abu Dhabi with strong global participation, accessed January 26, 2026, https://www.newsonair.gov.in/umex-and-simtex-2026-open-in-abu-dhabi-with-strong-global-participation/

- UMEX and SimTEX 2026 Day Two: Pioneering future of autonomy, defence, accessed January 26, 2026, https://www.wam.ae/en/article/byc8sye-umex-and-simtex-2026-day-two-pioneering-future

- 2026 SHOT Show – NSSF, accessed January 26, 2026, https://www.nssf.org/event/shot-show/

- accessed January 26, 2026, https://www.defenseadvancement.com/events/world-defense-show/

- Defence Conferences & Events 2025-2026 – Defense Advancement, accessed January 26, 2026, https://www.defenseadvancement.com/events/

- accessed January 26, 2026, https://www.mondaymerch.com/us/exhibitions/enforce-tac-2026#:~:text=Enforce%20Tac%202026%20on%20Feb,Guide%20%7C%20by%20%C2%A2Monday%20Merch

- Enforce Tac | Germany’s leading trade fair for security and defence, accessed January 26, 2026, https://www.enforcetac.com/en

- Enforce Tac 2026 – Dates and Hotel Options in Nuremberg – Fair Point GmbH, accessed January 26, 2026, https://www.fair-point.com/en/events/enforce-tac?id=5514

- Enforce Tac Nuremberg 2026 – Trade Fair Dates, accessed January 26, 2026, https://www.tradefairdates.com/Enforce-Tac-M9738/Nuremberg.html

- accessed January 26, 2026, https://www.trade.gov/germany-events-iwa#:~:text=IWA%20OutdoorClassics%202026-,February%2026%2DMarch%201%2C%202026%2C%20Nuremberg,2%2C%20in%20Nuremberg%2C%20Germany.

- Exhibition details – IWA OutdoorClassics, accessed January 26, 2026, https://www.iwa.info/en/all-about-the-exhibition/iwa/exhibition-details

- IWA OutdoorClassics | The world’s leading exhibition for the hunting and target sports industry, accessed January 26, 2026, https://www.iwa.info/en

- Baltic Military Conference, accessed January 26, 2026, https://bmc.lka.lt/

- Show Calendar – Small Arms Defense Journal, accessed January 26, 2026, https://sadefensejournal.com/trade-show-information/show-calendar/

- FIDAE 2026 – IDEF, accessed January 26, 2026, https://fidae-2026.idef.com.tr/

- DSA and NATSEC Asia, accessed January 26, 2026, https://www.dsaexhibition.com/

- DSA 2026 – Kallman Worldwide, Inc., accessed January 26, 2026, https://www.kallman.com/show/dsa-2026/

- THE CONFERENCE – DAIMEX Baltic, accessed January 26, 2026, https://daimex.lt/conference/

- DAIMEX Baltic – Defence & Aerospace Industry Meeting & Exposition, accessed January 26, 2026, https://daimex.lt/

- ISDEF | Events – Booking Expo, accessed January 26, 2026, https://www.booking-expo.com/events/isdef

- Dates, venue and opening hours – Eurosatory, accessed January 26, 2026, https://www.eurosatory.com/en/practical-infos/dates-venue-and-opening-hours/