Authored: January 11, 2026

The American small arms industry has historically been defined by a fragmented supply chain. For decades, the sector operated through a disconnected web of raw material suppliers, precision machine shops, independent brand holders, and wholesale distributors. This fragmentation created significant vulnerabilities, exposing manufacturers to supply chain volatility, fluctuating commodity costs, and political regulatory pressures. JJE Capital Holdings (JJE) has fundamentally disrupted this traditional model by constructing a vertically integrated industrial conglomerate that establishes “operational sovereignty”—the strategic capability to control the entire value chain of firearms production from the molecular level of raw manufacturing to the final point of retail sale.

Headquartered in Columbia, South Carolina, JJE Capital Holdings has evolved from the parent entity of a single burgeoning retailer—Palmetto State Armory (PSA)—into a diversified industrial powerhouse. The firm’s acquisition strategy is not merely financial; it is logistical and industrial. By acquiring critical manufacturing nodes such as Spartan Forge (aluminum forging) and DC Machine (precision barrel and receiver machining), JJE has insulated its consumer-facing brands from the upstream bottlenecks that frequently paralyze competitors. Furthermore, the strategic acquisition of heritage intellectual property—specifically the assets of the defunct Remington Outdoor Company, including Harrington & Richardson (H&R), DPMS, and Advanced Armament Company (AAC)—has allowed JJE to pivot from a budget-focused retailer to a custodian of American firearms history, serving segments ranging from entry-level hobbyists to high-end collectors and defense contractors.

This report provides an exhaustive, analyst-grade examination of the JJE Capital Holdings portfolio. It dissects the conglomerate’s corporate structure, operational synergies, and market positioning. The analysis categorizes the portfolio into four strategic pillars: Industrial Manufacturing Base, Firearms & Heritage Brands, Retail & Defense Services, and Lifestyle & Real Estate. For each entity, this report provides detailed operational profiles, location data, and strategic analysis of its role within the broader JJE ecosystem, demonstrating how a localized investment firm has reshaped the economics of the modern American arms industry.

1. Corporate Structure and Strategic Philosophy

1.1 The Genesis of JJE Capital Holdings

Location: 3850 Fernandina Road, Columbia, SC 29210

URL: jjech.com

Type: Private Equity & Industrial Holding Company

JJE Capital Holdings serves as the strategic nerve center for the conglomerate.1 Unlike traditional private equity firms that often prioritize short-term liquidity events or asset stripping, JJE operates with an industrialist philosophy centered on long-term value creation through manufacturing independence. The firm’s stated mission focuses on “reviving the American Dream” by repatriating manufacturing jobs and building a self-sustaining industrial ecosystem on American soil.2 This nationalist-industrialist ethos is not merely marketing; it is the central operational thesis that drives their acquisition strategy.

The leadership team comprises individuals with deep roots in operations, real estate, and construction, reflecting the physical nature of their investments. Jamin McCallum, the Owner and Chief Executive Officer, is the visionary behind the vertical integration strategy.3 His approach has been characterized by a refusal to accept industry standard lead times or supply constraints, preferring instead to buy or build the capacity required to meet demand. Julian Wilson (Real Estate Manager) and Edward LaRocque (Construction Manager) play pivotal roles in the rapid physical expansion of the conglomerate.3 As the group expands its retail footprint with massive “destination” brick-and-mortar stores and builds new manufacturing plants (such as the new AAC facility in Alabama or the ammo plant in South Carolina), the internal capability to manage real estate and construction becomes a strategic asset, allowing JJE to move faster than competitors who rely on external developers.

1.2 The Philosophy of Operational Sovereignty

The core differentiator of JJE Capital is its pursuit of “Operational Sovereignty.” In the firearms industry, “availability” is often a more significant driver of sales than “brand loyalty.” During the demand surges of 2012, 2016, and 2020, manufacturers who relied on third-party vendors for forgings (the raw aluminum shapes for receivers) or barrels found themselves unable to ship products.

JJE’s response was to internalize these dependencies. By owning the forge (Spartan Forge), the machine shop (DC Machine), the tool maker (Special Tool Solutions), and the ammunition plant (AAC Ammunition), JJE controls its own destiny. They are not subject to the allocation limits of a third-party vendor. This vertical integration allows JJE to:

- Maintain Production Velocity: When the market spikes, JJE factories prioritize JJE brands.

- Compress Margins: By eliminating the markup of intermediate vendors, JJE can sell finished rifles at retail prices that are often lower than the wholesale cost of competitors’ products.

- Innovate Rapidly: With R&D (Ferrous Engineering) co-located with manufacturing, the feedback loop from design to prototype to mass production is drastically shortened.

2. The Manufacturing Industrial Base

The foundation of JJE’s market power lies in its industrial capabilities. These entities typically do not face the consumer directly but provide the critical components that fuel the consumer-facing brands.

2.1 DC Machine: The Precision Engine

Location: 202 Thorpe Road, Summerville, SC 29483

URL: dcmachine.net

Role: High-Volume Precision Machining & Barrel Manufacturing

DC Machine is arguably the most critical operational asset in the JJE portfolio outside of Palmetto State Armory itself. Originally established as a high-precision contract manufacturer for the aerospace, medical, and automotive sectors, DC Machine was acquired to serve as the primary machining hub for JJE’s firearms production.2

Operational Capabilities:

The facility is a state-of-the-art CNC (Computer Numerical Control) operation, housing over 70 high-end machines.2 It is ISO 9001 (2008) certified and holds ITAR registration, qualifying it for defense-related manufacturing. The strategic significance of DC Machine cannot be overstated—it is one of the largest gun barrel manufacturers in the United States. In the firearms industry, the barrel is often the most difficult component to source in volume due to the specialized machinery (drilling, reaming, rifling) required. By bringing this capability in-house, JJE secured a consistent supply of barrels for its AR-15, AR-10, and AK-47 lines.

Strategic Integration:

DC Machine produces not just barrels, but also bolt carrier groups, gas blocks, and other critical steel components. The “vertical” connection here is direct: Spartan Forge provides the raw metal, and DC Machine turns it into a functional rifle component. This allows JJE to rapidly pivot production; if the market demand shifts from 16-inch carbines to 10.5-inch pistols, DC Machine can retool and redirect output far faster than a company relying on purchase orders to an external vendor.

2.2 Spartan Forge: The Raw Material Source

Location: Lincolnton, NC

URL: jjech.com/portfolio-companies/

Role: Aluminum Forging Facility

In the AR-15 supply chain, the “forging” is the bottleneck. There are only a handful of major forges in the United States that produce the raw 7075-T6 aluminum shapes that eventually become upper and lower receivers. During the 2013 and 2020 panics, these forges were booked years in advance, leaving smaller manufacturers without raw material.

Operational Capabilities:

Spartan Forge is a multi-press facility specializing in the high-pressure forging of aluminum products.2 Located in Lincolnton, NC, it sits strategically close to the South Carolina manufacturing hub. The facility produces the raw “paperweight” shapes of receivers, which are then shipped to DC Machine or PSA’s own machining centers for final cutting.

Strategic Integration:

Acquiring Spartan Forge was a defensive maneuver to secure the supply chain. It ensures that JJE brands—PSA, H&R, Lead Star, and DPMS—have prioritized access to receiver blanks. This acquisition effectively “firewalled” JJE from the raw material shortages that plague the industry.

2.3 Ferrous Engineering and Tool: The Innovation Lab

Location: West Columbia, SC

URL: jjech.com

Role: Research, Design, and Prototyping

While DC Machine handles mass production, Ferrous Engineering handles innovation. This entity operates as an integrated research and design center combined with a specialized CNC machine shop.2

Operational Capabilities:

Ferrous Engineering is tasked with taking concepts from ideation to first production. They handle the complex engineering challenges, such as reverse-engineering foreign weapons platforms (crucial for the PSA AK-V and Soviet Arms lines) or developing proprietary internal mechanisms (such as the bufferless system in the PSA JAKL).

Strategic Integration:

Separating R&D (Ferrous) from Production (DC Machine) is a mature industrial strategy. It prevents the disruption of high-volume lines for experimental runs. Ferrous Engineering allows JJE to iterate rapidly on new designs, testing prototypes and refining blueprints before handing the final “data package” to the mass production facilities.

2.4 Special Tool Solutions (STS): Complexity Management

Location: 11699 Camden Rd, Jacksonville, FL 32218

URL: jjech.com/portfolio-companies/

Role: Specialized Product Development & Tooling

Located in Jacksonville, Florida, STS provides high-end product development and design capabilities.2

Operational Capabilities:

STS focuses on “turning complex ideas into reality.” In manufacturing, “tooling” refers to the custom jigs, fixtures, and molds required to hold and shape parts during mass production. STS likely supports the broader group by designing and building these complex tools, ensuring that the production lines at DC Machine and PSA have the fixtures they need to operate efficiently. They handle “tough jobs that others do not have the capacity to do,” serving as a problem-solving node in the industrial network.

2.5 AAC Ammunition (America’s Ammo Company): The Consumable Engine

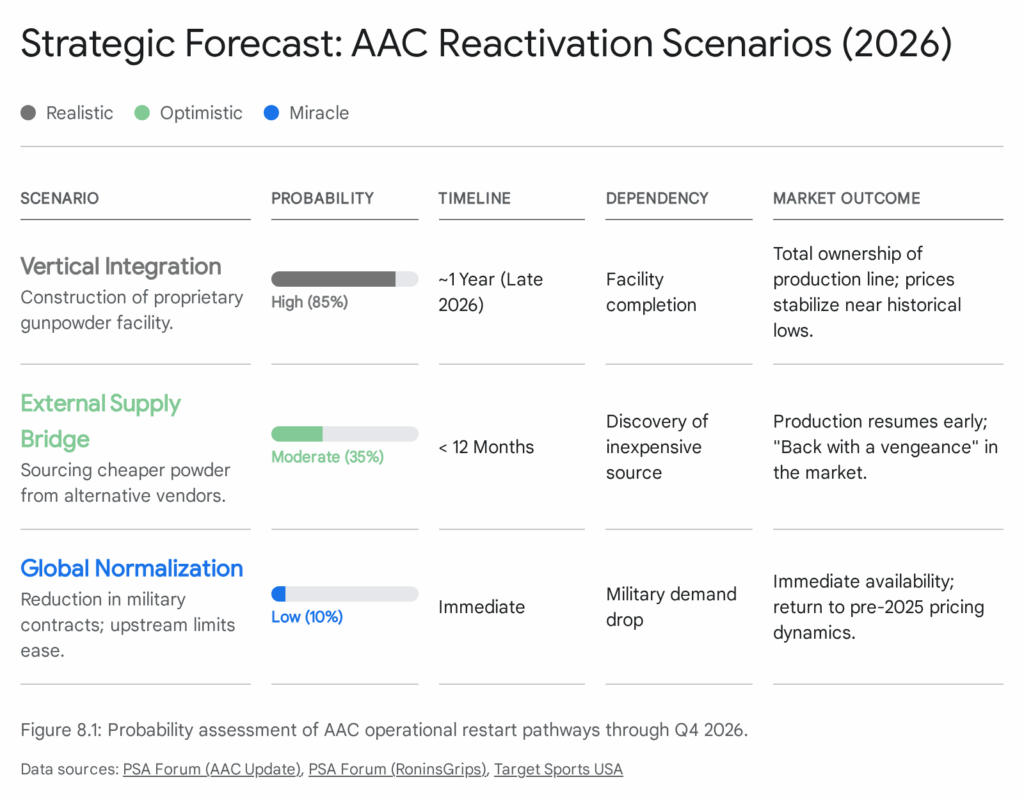

| January 11. 2026: Note, AAC is “paused” while JJE sorts out how to develop gunpowder manufacturing capabilities. Click here for an article about this. |

Location: Columbia, SC

URL: aacammo.com

Role: Ammunition Manufacturing (Projectiles & Cartridges)

Perhaps the most ambitious of JJE’s recent expansions is the launch of AAC Ammunition. Following the massive ammo shortage of 2020-2022, JJE recognized that selling firearms without ammunition was a vulnerability.

Operational Capabilities:

AAC Ammunition is not merely an assembler of bought components; it is a primary manufacturer. The facility utilizes advanced research and design processes to manufacture its own projectiles.2 Recent industry reports indicate they have also moved into manufacturing their own shell casings and, critically, are working toward primer independence.4 Primers are the most volatile component in the ammo supply chain, involving dangerous chemical manufacturing.

Strategic Integration:

By manufacturing the “consumable” of the industry, JJE captures recurring revenue. A customer buys a rifle once, but buys ammunition for a lifetime. The vertical integration here allows JJE to bundle products (e.g., “buy a dagger pistol, get 500 rounds of AAC 9mm”), creating a value proposition that pure-play retailers cannot match.

3. The Retail & Distribution Juggernaut

While the industrial base provides the capacity, the retail arm provides the velocity. JJE’s primary revenue engine is its massive direct-to-consumer (DTC) distribution network.

3.1 Palmetto State Armory (PSA)

Location: Online HQ in West Columbia, SC; Multiple Retail Locations (SC, NC, GA).

URL: palmettostatearmory.com

Role: Primary Retailer, Ecommerce Platform, & Manufacturer

PSA is the face of the JJE conglomerate. It operates on a high-volume, low-margin philosophy famously summarized by their mission to “sell as many guns as possible to as many law-abiding Americans as possible.”

Operational Profile:

PSA is unique in that it is both a manufacturer and a distributor. It manufactures its own line of firearms (PA-15, PSAK-47, PSA Dagger) while simultaneously serving as one of the largest online retailers for third-party brands (Sig Sauer, Glock, Vortex Optics).

- The “PSA Ecosystem”: The company has successfully cloned the most popular platforms in the world. The PSA Dagger is a clone of the Glock 19 Gen 3 (following the patent expiration), offering compatibility with ubiquitous Glock parts at half the price. The PSAK-47 series (GF3, GF4, GF5) successfully challenged the dominance of imported AKs by offering an American-made alternative with a lifetime warranty.

- Ecommerce Dominance: The PSA website is a high-traffic hub that drives daily engagement through “Daily Deals,” conditioning customers to check the site frequently. This digital dominance allows JJE to launch new subsidiary brands (like AAC Ammo or Soviet Arms) with zero customer acquisition cost by simply featuring them on the PSA homepage.

- Physical Expansion: Unlike many digital-native retailers, PSA has invested heavily in physical retail. Their “superstores” in South Carolina (Columbia, Greenville, Myrtle Beach, Summerville) and expansion into North Carolina and Georgia serve as destination retail hubs, complete with indoor ranges and fishing departments.2

3.2 PSA Defense

Location: Multiple Training Centers (Columbia, Greenville, Myrtle Beach, etc.)

URL: psadefense.com

Role: Firearms Training & Education

PSA Defense represents the “software” side of the business. Owning the hardware is useless without the skill to use it. PSA Defense offers a curriculum ranging from South Carolina Concealed Weapons Permit (CWP) classes to advanced tactical carbine courses.2

Strategic Value:

This entity serves a dual purpose: risk mitigation and customer retention. By training their customers, they promote responsible ownership (mitigating political risk). Simultaneously, training creates a “sticky” relationship with the customer. A student who learns to shoot at a PSA range with a PSA instructor is statistically more likely to purchase their next firearm and ammunition from the PSA store located in the same building.

4. The Firearms & Heritage Brand Portfolio

In September 2020, the landscape of the American firearms industry shifted when Remington Outdoor Company declared bankruptcy. JJE Capital Holdings capitalized on this event to aggressively expand its portfolio, acquiring the intellectual property of several legendary brands. This move allowed JJE to diversify beyond the “budget” reputation of PSA and enter the heritage and collector markets.

4.1 Harrington & Richardson (H&R)

Location: West Columbia, SC (Manufacturing) / Sales via PSA

URL: hr1871.com

Role: Retro AR-15s & Historic Firearm Reproductions

H&R is a masterclass in brand revitalization. Historically, H&R was one of the few manufacturers (alongside Colt and GM) to produce M16A1 rifles for the US military during the Vietnam War.

The NoDak Spud Integration:

To ensure the relaunch of H&R was authentic, JJE acquired NoDak Spud, a small but legendary manufacturer known for producing the most historically accurate “retro” AR-15 receivers in the world.6 They installed Mike Wetteland, the owner of NoDak Spud, as the CEO of the new H&R.

- Operational Focus: H&R now utilizes JJE’s manufacturing power (Spartan Forge/DC Machine) to mass-produce M16A1, XM177E2, and other historical variants with the correct grey anodizing and “Lion” roll marks.

- Market Position: This brand dominates the “Retromod” and “Cloner” market, allowing JJE to sell AR-15s at premium price points ($1,100–$1,500) that target collectors rather than utility buyers.

4.2 Advanced Armament Company (AAC)

Location: 5021 Bradford Dr. NW, Suite A, Huntsville, AL 35805

URL: advanced-armament.com

Role: Suppressor Manufacturing

Formerly Advanced Armament Corporation, the rebranded Advanced Armament Company was another jewel from the Remington bankruptcy.8 AAC was a pioneer in the modern suppressor market but had stagnated under Remington’s ownership.

Operational Revitalization:

Under JJE, AAC was moved to a new facility in Huntsville, Alabama—a major aerospace and defense hub.9 The brand was revitalized with a focus on its classic, battle-proven designs like the Ti-RANT (pistol), Ranger (rifle), and Element (rimfire) series.

- Market Position: The suppressor market is rapidly mainstreaming. Owning a Tier 1 suppressor brand allows JJE to capture the high-margin NFA (National Firearms Act) market and provides perfect cross-selling opportunities (e.g., PSA rifles are often sold with “suppressor-ready” muzzle devices compatible with AAC cans).

4.3 DPMS (Panther Arms)

Location: West Columbia, SC

URL: dpmsinc.com

Role: AR-15 / AR-10 Components & Rifles

DPMS was once a market leader in affordable AR-15s. Under JJE, it has been repositioned.

- Operational Focus: DPMS continues to support the AR platform but has a specific stronghold in the AR-10 (Large Frame) market. The “DPMS Gen 1” pattern is the industry standard for AR-10s (as opposed to the Armalite pattern).

- Strategic Role: DPMS serves as a “flank” brand. It allows JJE to sell products that might compete with PSA but capture a customer who prefers the “Panther Arms” heritage or specific configuration. It also provides a vehicle for wholesale distribution to other dealers, whereas PSA is largely exclusive to its own site.

4.4 Soviet Arms

Location: Columbia, SC (Integrated into PSA)

URL: palmettostatearmory.com/brands/soviet-arms.html

Role: Specialized AK Platform Sub-brand

Operational Context:

Following the ban on Russian ammunition and firearm imports, the supply of authentic Eastern Bloc weaponry to the US dried up. Soviet Arms is JJE’s strategic response to this geopolitical shift.

- Operational Focus: The brand focuses on “authentic Russian parts completed with American Made receivers”.2 It produces a line of AK-style rifles and accessories (flash hiders, optics mounts) that mimic the aesthetic of Soviet-era Zenitco and Izhmash products.

- Market Position: It caters to the “AK purist” who desires the specific look and feel of Russian hardware but can no longer buy imports. By manufacturing these parts in the US (likely at Ferrous/DC Machine), JJE fills the void left by sanctions.

4.5 Lead Star Arms

Location: West Columbia, SC

URL: leadstararms.com

Role: Competition & High-Performance Firearms

Operational Focus:

Lead Star Arms targets the competitive shooting circuit (3-Gun, USPSA). Their products are characterized by skeletonized receivers (to reduce weight), aggressive styling, and match-grade components.

- Market Position: This is the “Race Gun” brand. It contrasts sharply with the “Duty/Utility” focus of PSA and the “History” focus of H&R. It captures the high-disposable-income demographic of competitive shooters who require specialized gear.

4.6 The Strategic Reserves (Dormant Brands)

JJE also holds valuable IP that is currently less active or dormant, likely serving as strategic reserves for future expansion.

- Parker (Parker Brothers): A legendary American shotgun maker known for high-end side-by-sides. JJE acquired this brand in the Remington auction.10 It is currently dormant, but represents a potential future entry into the luxury sporting shotgun market to compete with brands like Browning or Beretta.

- Stormlake: Formerly a manufacturer of match-grade pistol barrels. Given DC Machine’s massive barrel capabilities, the brand Stormlake is currently dormant, but its technology and tapers have likely been absorbed into DC Machine’s production lines for PSA Dagger barrels.11

5. Lifestyle, Services, and Real Estate

JJE understands that the “Gun Culture” is a lifestyle that extends beyond the range. Their portfolio includes service and lifestyle brands designed to capture “share of wallet” from their core demographic even when they aren’t buying hardware.

5.1 Caliber Coffee

Location: 3850 Fernandina Road, Columbia, SC 29210

URL: calibercoffeecompany.com

Role: Coffee Roasting & Lifestyle Brand

Operational Focus:

Caliber Coffee is a vertically integrated coffee roaster that markets explicitly to the 2nd Amendment community. Products feature names like “.22 Light Roast” and “.300 Blackout Dark Roast.”

- Strategic Value: This serves as a low-cost “add-on” item for ecommerce orders (increasing average order value) and enhances the in-store experience at PSA retail locations. It reinforces the brand’s identity as a lifestyle choice, not just a retailer.

5.2 Right to Bear

Location: Columbia, SC (HQ) / National Coverage

URL: protectwithbear.com

Role: Self-Defense Liability Insurance

Operational Focus:

Right to Bear provides self-defense liability insurance, covering legal fees and civil liability for gun owners who are forced to use their weapons in self-defense.2

- Strategic Value: As firearm ownership expands, so does the fear of legal persecution. This service captures recurring monthly revenue (subscription model), a rarity in the durable goods firearms market. It complements the hardware sale perfectly: “You bought the gun for protection; now buy the insurance to protect your freedom.”

5.3 Palmetto Outdoors

Location: Columbia, SC

URL: jjech.com/portfolio-companies/

Role: Shooting Sports Facility

Operational Focus:

A full-service outdoor shooting facility offering skeet, trap, 5-stand, and rifle/pistol ranges.2

- Strategic Value: Ranges are the infrastructure of the industry. By owning the place where customers use the product, JJE ensures distinct localized demand for their ammunition and firearms, fostering a local community of active shooters.

5.4 Commercial Properties of South Carolina

Location: Columbia, SC

URL: jjech.com/portfolio-companies/

Role: Commercial Real Estate Management

Operational Focus:

This entity manages the extensive real estate portfolio of the group. Given the political polarization of the firearms industry, many gun companies face difficulties leasing prime commercial real estate from traditional landlords.

- Strategic Value: JJE’s strategy of owning their own dirt—for their factories, warehouses, and superstores—insulates them from “cancel culture” in the real estate market. This subsidiary manages these assets, ensuring the operational companies have stable, friendly leases.

5.5 Kronos Knives

Location: Sold via PSA

URL: kronosknives.com

Role: Edged Weapons & Tools

Operational Focus:

Kronos Knives features exclusive designs by master bladesmiths like Ken Onion and Justin Gingrich.2

- Strategic Value: Knives are a natural adjacent category for gun owners. By creating a house brand, JJE captures the margin that would otherwise go to third-party knife brands (like Kershaw or Benchmade) sold on their site.

6. Comprehensive Holdings Matrix

The following matrix provides a consolidated view of the active entities within the JJE Capital Holdings portfolio, summarizing their location, digital presence, and operational status.

| Company Name | Primary Function | Location | Website | Status |

| Palmetto State Armory | Retail / Manufacturing | West Columbia, SC | palmettostatearmory.com | Active |

| DC Machine | Precision Machining | Summerville, SC | dcmachine.net | Active |

| Spartan Forge | Aluminum Forging | Lincolnton, NC | N/A | Active |

| Ferrous Engineering | R&D / Prototyping | West Columbia, SC | N/A | Active |

| AAC Ammunition | Ammo Manufacturing | Columbia, SC | aacammo.com | Active |

| Advanced Armament Co. | Suppressors | Huntsville, AL | advanced-armament.com | Active |

| H&R (Harrington & Richardson) | Retro Firearms | West Columbia, SC | hr1871.com | Active |

| DPMS | Firearms (AR-10/15) | West Columbia, SC | dpmsinc.com | Active |

| Lead Star Arms | Competition Firearms | West Columbia, SC | leadstararms.com | Active |

| Soviet Arms | AK Platform Brand | Columbia, SC | palmettostatearmory.com | Active |

| PSA Defense | Training & Education | Multiple Locations, SC | psadefense.com | Active |

| Special Tool Solutions | Tooling & Design | Jacksonville, FL | N/A | Active |

| Caliber Coffee | Coffee Roaster | Columbia, SC | calibercoffeecompany.com | Active |

| Right to Bear | Insurance | Columbia, SC | protectwithbear.com | Active |

| Kronos Knives | Knives / Tools | N/A | kronosknives.com | Active |

| Palmetto Outdoors | Shooting Range | Columbia, SC | N/A | Active |

| Parker | Shotguns (Heritage) | N/A | N/A | Dormant |

| Stormlake | Pistol Barrels | N/A | N/A | Dormant |

7. Conclusion: The New Industrial Model

JJE Capital Holdings represents a paradigm shift in the American firearms industry. While competitors have often pursued strategies of outsourcing and asset-light operations, JJE has doubled down on heavy industry and vertical integration. By effectively “insourcing” every aspect of the supply chain—from the forge to the retail counter—JJE has built a business model that is uniquely resilient to the volatility that characterizes the firearms market.

The conglomerate’s structure allows it to absorb shocks that would cripple smaller competitors. When ammunition is scarce, they make their own. When barrels are unavailable, they machine their own. When imports are banned, they reverse-engineer and manufacture domestic alternatives. This operational sovereignty, combined with a diversified portfolio of brands that appeals to every segment of the shooting public, positions JJE Capital Holdings not just as a participant in the industry, but as one of its most dominant and self-sufficient architects.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- JJE Capital Holdings – A Private Equity Firm Reviving the American Dream, accessed January 10, 2026, https://jjech.com/

- Portfolio Companies – JJE Capital Holdings, accessed January 10, 2026, https://jjech.com/portfolio-companies/

- About Us – JJE Capital Holdings, accessed January 10, 2026, https://jjech.com/about-us/

- America’s Ammo Company Factory Tour – How Ammo Gets Made – Lynx Defense, accessed January 10, 2026, https://lynxdefense.com/tour-americas-ammo-company-aac/

- About Palmetto State Armory, accessed January 10, 2026, https://palmettostatearmory.com/about-psa.html

- This classic firearms manufacturer is back with retro M16s – WeAreTheMighty.com, accessed January 10, 2026, https://www.wearethemighty.com/tactical/this-classic-firearms-manufacturer-is-back-with-retro-m16s/

- Palmetto State Armory Parent Company JJE to Acquire Nodak Spud – The Firearm Blog, accessed January 10, 2026, https://www.thefirearmblog.com/blog/2021/12/22/palmetto-state-armory-parent-company-jje-will-acquire-nodak-spud/

- Bankrupt Remington Sold Off: Here Are The Winners – Pew Pew Tactical, accessed January 10, 2026, https://www.pewpewtactical.com/bankrupt-remington-sold-off/

- Advanced Armament Corporation – Wikipedia, accessed January 10, 2026, https://en.wikipedia.org/wiki/Advanced_Armament_Corporation

- Remington Outdoor To Be Broken Up In Bankruptcy Sale | SGB Media Online, accessed January 10, 2026, https://sgbonline.com/remington-outdoor-to-be-broken-up-in-bankruptcy-sale/

- Remington: Who Owns the Brand & What Happened to its Intellectual Property?, accessed January 10, 2026, https://www.pewpewtactical.com/who-owns-remington-brand/