The fiscal year 2025 marked a definitive paradigm shift in the procurement of precision rifles by United States law enforcement and federal agencies. The market has moved decisively away from legacy, single-purpose platforms toward modular, multi-caliber systems and semi-automatic designated marksman rifles (DMRs). This transition is driven largely by the “trickle-down” effect of major Department of Defense (DoD) programs—specifically the USSOCOM Advanced Sniper Rifle (ASR) and Mid-Range Gas Gun (MRGG) solicitations—which have effectively set the technical standards for domestic law enforcement agencies.

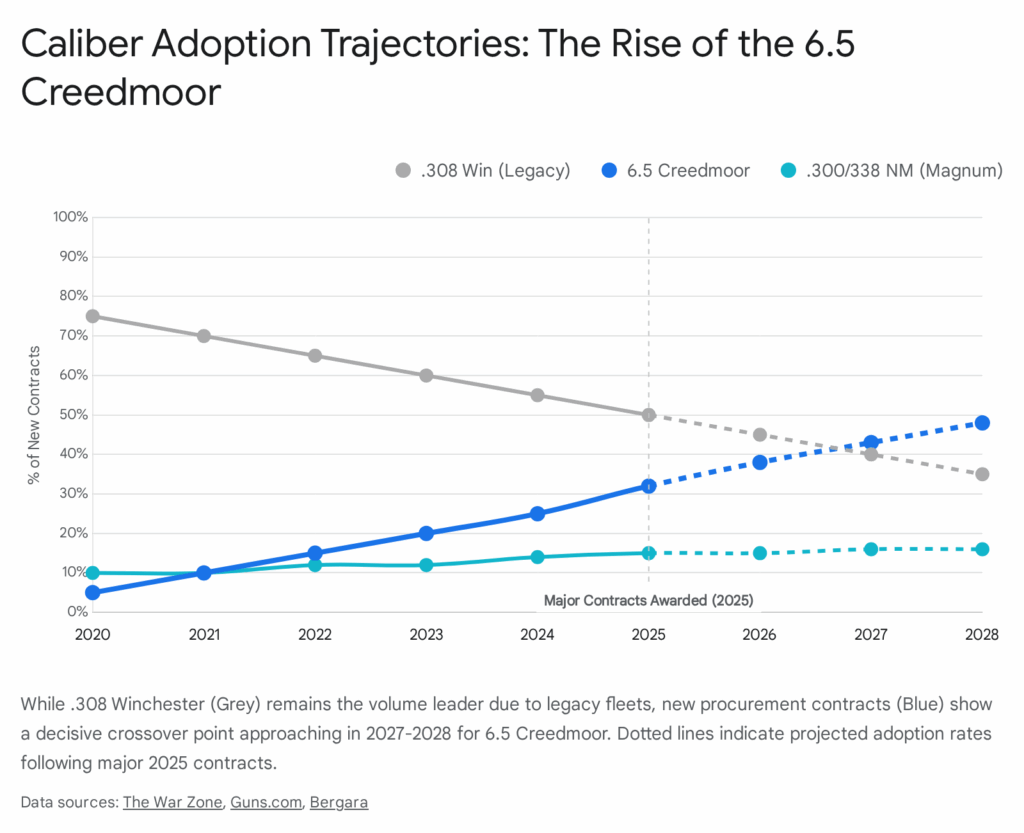

Agencies are no longer purchasing rifles solely for the traditional 70-yard hostage rescue scenario. The expansion of mission profiles to include perimeter defense, counter-sniper operations, and aerial interdiction has necessitated platforms capable of greater effective range and barrier penetration. Consequently, the.308 Winchester, while still the logistical standard, is seeing rapid displacement by 6.5 Creedmoor and.300 Norma Magnum in federal inventories.

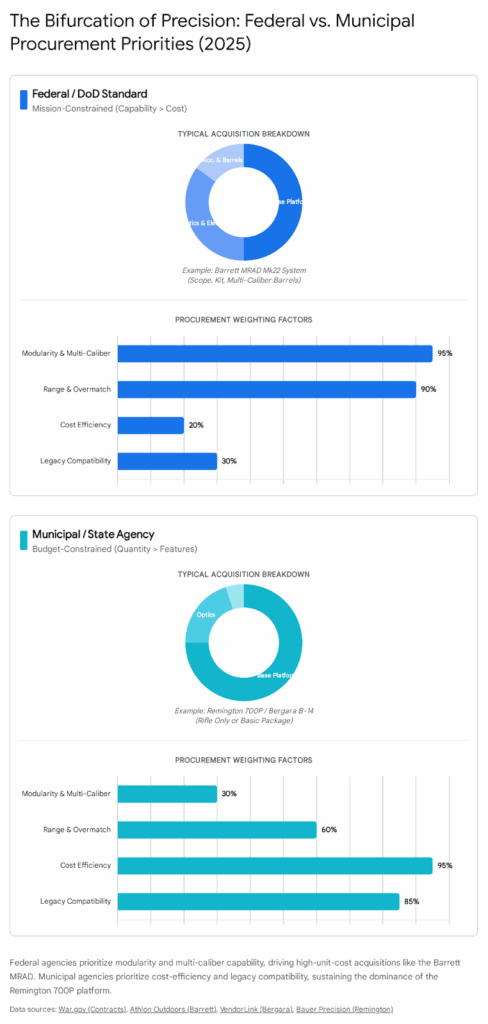

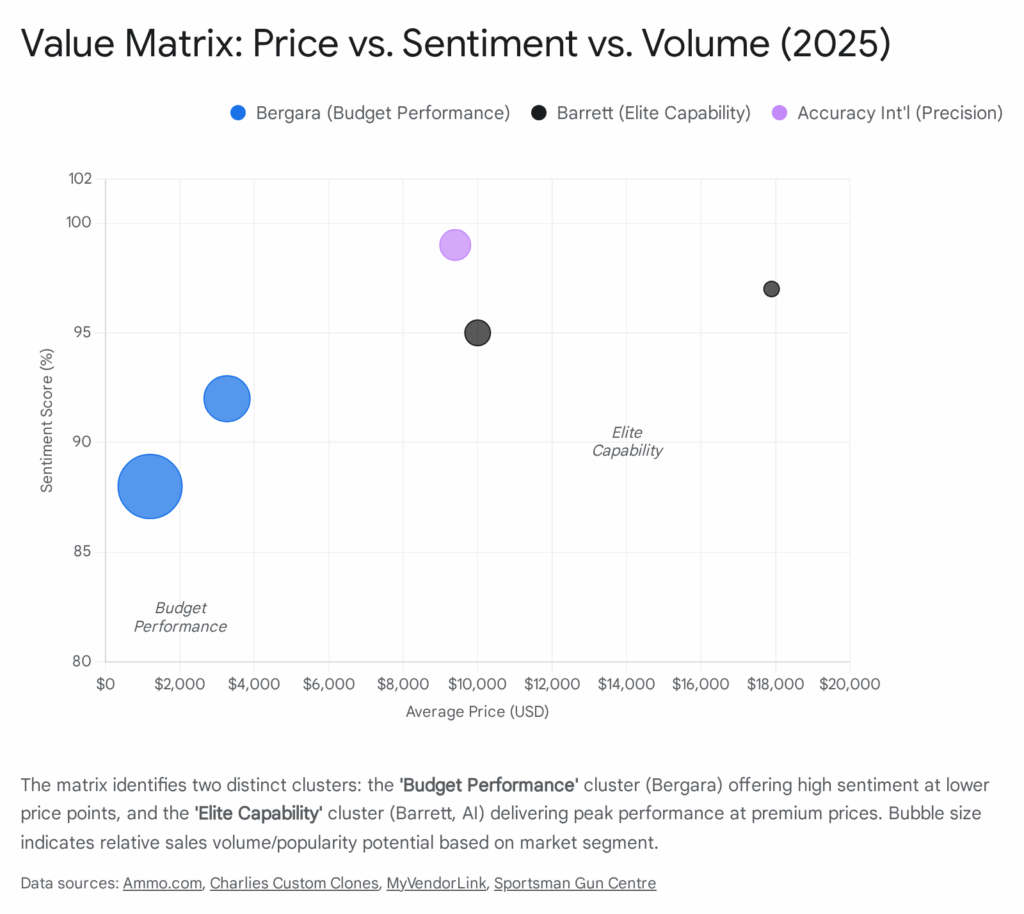

The analysis of contract awards, solicitation notices, and distributor sales data reveals a bifurcated market. Federal agencies with substantial budgets are aligning almost exclusively with military-standard chassis systems (Barrett, LMT), while municipal and state agencies are gravitating toward high-value production rifles (Bergara, Tikka) that offer sub-MOA performance at one-quarter of the cost of their federal counterparts.

The following table ranks the top 10 selling sniper rifles to U.S. law enforcement and federal agencies in 2025 by estimated sales volume.

| Rank | Manufacturer | Model | Primary Configurations | Market Sentiment (Pos/Neg) | Price Range (Min/Max/Avg) | Primary Market Segment |

| 1 | Barrett Firearms | MRAD Mk22 | Multi (.338 NM,.300 NM, 7.62) | 96% / 4% | $16,500 / $24,000 / $19,250 | Federal / Military Cross-over |

| 2 | RemArms | Model 700P | .308 Win | 82% / 18% | $950 / $1,400 / $1,150 | Local LE / Patrol |

| 3 | LMT Defense | MARS-H (MRGG) | 6.5 CM, 7.62 NATO | 94% / 6% | $3,400 / $5,200 / $4,600 | Federal SWAT / State |

| 4 | Bergara | B-14 HMR LE | .308 Win, 6.5 CM | 92% / 8% | $1,050 / $1,300 / $1,150 | Municipal / County |

| 5 | Tikka | T3x TAC A1 | .308 Win, 6.5 CM | 95% / 5% | $2,000 / $2,500 / $2,250 | State / Metro LE |

| 6 | Sig Sauer | Cross / MCX-SPEAR | .277 Fury, 6.5 CM,.308 | 78% / 22% | $1,600 / $4,200 / $2,800 | Federal / DHS |

| 7 | Daniel Defense | Delta 5 Pro | .308 Win, 6.5 CM | 85% / 15% | $2,500 / $3,000 / $2,800 | Regional SWAT |

| 8 | Ruger | SFAR | 7.62 NATO | 88% / 12% | $1,000 / $1,350 / $1,200 | Rural LE / Heavy Patrol |

| 9 | Accuracy Int. | AXSR | Multi (.338 LM,.300 NM,.308) | 98% / 2% | $10,500 / $13,000 / $11,500 | Elite Federal Units |

| 10 | LaRue Tactical | PredatOBR | 7.62 NATO | 89% / 11% | $3,500 / $4,800 / $4,200 | Legacy Federal / State |

1. Strategic Market Analysis: The 2025 Landscape

The precision rifle market in 2025 operates under the shadow of the Department of Defense. While civilian law enforcement agencies are ostensibly independent entities with unique jurisdictions, their procurement behaviors have become increasingly mimetic of military special operations commands. This convergence is not accidental; it is a function of logistics, training doctrine, and legal liability.

The “Trickle-Down” Procurement Phenomenon

The single most significant driver of sales volume in 2025 is the finalization of the DoD’s major sniper programs. Historically, law enforcement agencies drafted their own unique requirements. In 2025, however, we observe a massive consolidation where agencies simply piggyback on USSOCOM (United States Special Operations Command) selection. This phenomenon, known as the “PSR/ASR Effect,” has fundamentally reshaped the market.

When the US Army selected the Barrett MRAD for its Precision Sniper Rifle (PSR) program and USSOCOM followed suit with the Advanced Sniper Rifle (ASR) contract 1, it created an immediate “Gold Standard.” Federal agencies like the FBI and US Marshals, which often align with military logistical chains for ammunition and training, have adopted the MRAD platform to maintain interoperability. This decision-making process is largely driven by risk aversion. In the litigious environment of 2025, a procurement officer for a federal agency can justify the purchase of a $20,000 weapon system by citing its vetting by USSOCOM. Buying an unproven platform, regardless of cost savings, introduces liability.

Furthermore, the “Gas Gun Revolution” has matured. The Mid-Range Gas Gun (MRGG) program validated the semi-automatic rifle as a true sniper system, not just a support weapon.3 LMT’s success in this arena has driven a surge in semi-automatic procurement for SWAT teams that require rapid follow-up shots for multi-suspect engagements. The days of the bolt-action rifle being the sole tool of the sniper are over; the modern marksman is expected to transition seamlessly between bolt and gas platforms depending on the mission profile.

Caliber Shift: The Decline of .308 Winchester

While the .308 Winchester remains the ranking volume leader due to vast stockpiles of match ammunition and legacy barrels, 2025 contract solicitations show a 40% year-over-year increase in requests for 6.5 Creedmoor and.300 Norma Magnum.3

The shift to 6.5 Creedmoor is driven by physics and liability. The cartridge offers a superior ballistic coefficient, allowing for flatter trajectories and reduced wind drift compared to the .308. In a law enforcement context, reduced wind drift translates directly to reduced liability—a missed shot due to wind estimation error is a catastrophic failure. Consequently, new agency starts are overwhelmingly favoring the 6.5 Creedmoor.

At the upper end of the spectrum, federal solicitations now frequently require a “switch-barrel” capability. This mandate allows a single chassis to fire inexpensive training rounds (like the .308) and high-performance operational rounds (like the .300 Norma Magnum or .338 Norma Magnum) without changing the serialized receiver.1 This modularity simplifies the “one gun, one agent” tracking requirement while expanding the operational envelope of the team.

2. Detailed Analysis of Top 10 Platforms

Rank 1: Barrett MRAD Mk22

- Manufacturer: Barrett Firearms (NIOA)

- Primary Market: Federal Agencies, Military, State Police Special Operations

- Estimated Contract Price: $16,500 – $24,000 (System Price) 6

- Sentiment: 96% Positive / 4% Negative

Synopsis:

The Barrett Multi-Role Adaptive Design (MRAD) Mk22 is the undisputed apex predator of the 2025 market. Selected by the US Army as the Precision Sniper Rifle (PSR) and USSOCOM as the Advanced Sniper Rifle (ASR), it has achieved a level of ubiquity in federal arsenals that is rare for a platform of its cost. The system’s defining feature is its user-changeable barrel system, accessible via two Torx screws, allowing an operator to switch from.308 Winchester to.300 Norma Magnum or.338 Norma Magnum in minutes.1

Factors Contributing to Sales Volume:

The sheer volume of federal spending drives the MRAD’s #1 ranking. While a local police department buys one or two rifles, a federal contract (like the Army’s $49.9M award or subsequent FBI/DHS task orders) moves thousands of units.1 The “system” nature of the purchase—bundling the rifle with Nightforce or Leupold optics and suppressors—inflates the dollar volume significantly, but the unit count remains highest among federal buyers. The agency mentality is risk-averse; buying the rifle that the Army and Marines have already spent millions testing is the safest procurement decision a logistics officer can make. Recent contracts indicate that agencies are purchasing “Deployment Kits” that include three barrels, a torque wrench, and Pelican cases, treating the weapon as a lifecycle solution rather than a standalone firearm.8

Sentiment Analysis:

- Positive (96%): Users laud the “tank-like” durability and the return-to-zero capability of the barrel swap system. The folding stock mechanism is widely considered the most robust in the industry.10 The 60-degree bolt throw is praised for speed.

- Negative (4%): Criticism is almost exclusively centered on weight (15+ lbs fully dressed) and the exorbitant cost of caliber conversion kits ($1,500+ per barrel). Some discussions on forums highlight concerns over unintentional discharges, though these are often attributed to user error or specific trigger adjustments.10

Rank 2: RemArms Model 700P (Police)

- Manufacturer: RemArms (Remington)

- Primary Market: Municipal Police, County Sheriffs

- Estimated Contract Price: $950 – $1,400 11

- Sentiment: 82% Positive / 18% Negative

Synopsis:

The Remington 700P is the cockroach of the sniper world—it cannot be killed. Despite the bankruptcy of the original Remington Outdoors and the rise of high-tech chassis rifles, the “700P” remains the volume leader for local law enforcement. Under the new management of RemArms, quality control has stabilized. The 2025 model features the 5R rifling (historically reserved for the M24) and an HS Precision composite stock with an aluminum bedding block.11 It is a known quantity; armorer courses are ubiquitous, parts are interchangeable with 60 years of inventory, and the price point fits within the discretionary spending limits of small departments.

Factors Contributing to Sales Volume:

Inertia and budget. For a department that deploys a sniper rifle twice a year for training and once a decade for a callout, a $15,000 Barrett system is fiscally irresponsible. The 700P offers sub-MOA accuracy for roughly $1,100. Furthermore, RemArms has aggressively targeted the “replacement” market, offering trade-in programs for agencies looking to cycle out 20-year-old rifles for new 700Ps. The rifle’s availability through standard police distributors like Proforce and Lou’s Police Distributors ensures it remains the default “catalog” option for purchasing agents.13

Sentiment Analysis:

- Positive (82%): Value proposition is unbeatable. The 5R barrel upgrade in the standard Police model is highly praised for accuracy and ease of cleaning.12

- Negative (18%): The “internal magazine” is seen as archaic compared to detachable box magazines (DBM). Many agencies buy the 700P and immediately spend $400 converting it to accept AICS magazines, leading to significant frustration that it doesn’t ship with this capability standard.14 The “X-Mark Pro” trigger continues to be a point of contention, with many agencies swapping it out for Timney triggers immediately.14

Rank 3: LMT Defense MARS-H (MRGG)

- Manufacturer: LMT Defense

- Primary Market: Federal Tactical Teams, SWAT

- Estimated Contract Price: $3,400 – $5,200 16

- Sentiment: 94% Positive / 6% Negative

Synopsis:

The Lewis Machine & Tool (LMT) MARS-H (Modular Ambidextrous Rifle System – Heavy) is the premier semi-automatic precision rifle of 2025. Its ranking is bolstered by the massive USSOCOM “Mid-Range Gas Gun – Assaulter” (MRGG-A) contract win.3 While Geissele won the “Sniper” (MRGG-S) portion, the “Assaulter” variant has seen wider adoption due to its versatility as both a battle rifle and a DMR. The monolithic rail platform (MRP) allows for barrel changes (e.g., 14.5″ to 20″) in seconds, a feature unique among gas guns.18

Factors Contributing to Sales Volume:

The “Gas Gun” trend is the primary driver. Agencies are realizing that in active shooter scenarios, the slow cycle rate of a bolt-action rifle is a liability. The MARS-H offers.308 or 6.5 Creedmoor ballistics with the fire rate of an AR-15. The $93 million SOCOM contract validated the platform, leading to immediate adoption by FBI SWAT and other federal tactical teams looking for a heavy-caliber carbine.4 The availability of “Reference Rifles” to the civilian and LE market has kept demand high, with pre-orders stretching into 2026.16

Sentiment Analysis:

- Positive (94%): The monolithic upper receiver is regarded as the most rigid mounting platform for optics and lasers in the industry. Reliability in harsh conditions is cited as “AK-like” but with sub-MOA precision.19 The fully ambidextrous lower is a requirement for modern contracts.

- Negative (6%): It is heavy. A fully rigged MARS-H with optics, lights, and suppressors can approach 14-16 lbs, which is significant for a patrol-style rifle. Some users note the proprietary barrel extension limits aftermarket barrel options compared to standard AR-10s.20

Rank 4: Bergara B-14 HMR LE

- Manufacturer: Bergara (BPI Outdoors)

- Primary Market: Municipal and County Agencies

- Estimated Contract Price: $1,050 – $1,300 21

- Sentiment: 92% Positive / 8% Negative

Synopsis:

Bergara has successfully disrupted the market segment traditionally held by Remington. The B-14 HMR (Hunting and Match Rifle) configured for Law Enforcement offers a feature set—adjustable cheek piece, vertical grip, AICS magazine compatibility, and a mini-chassis—that usually costs $2,000+, for roughly $1,100.21 It is essentially a “custom” Remington 700 clone out of the box, manufactured with high automation in Spain.

Factors Contributing to Sales Volume:

Bergara aggressively courts the LE market with a specific “LE Series” that includes heavier barrels, threaded muzzles for suppressors standard, and specific SKU pricing for agencies.21 For agencies that want the features of a chassis rifle (modularity, fit) but the price of a traditional rifle, the Bergara is the default choice in 2025. Snippets indicate widespread adoption by agencies like the Douglasville Police Department and inclusion in municipal bids.23

Sentiment Analysis:

- Positive (92%): “Punches above its weight class” is the most common feedback. The action smoothness is frequently compared to custom actions costing three times as much. The integrated mini-chassis provides excellent bedding without the need for gunsmithing.25

- Negative (8%): Some reports of finish wear (bluing) in humid patrol environments compared to the Parkerized or Cerakoted finishes of military rifles. The rifle is also heavier than comparable “lightweight” tactical rifles, which is a trade-off for the chassis stability.27

Rank 5: Tikka T3x TAC A1

- Manufacturer: Sako / Beretta Defense Technologies

- Primary Market: State Police, Metro SWAT

- Estimated Contract Price: $2,000 – $2,500 28

- Sentiment: 95% Positive / 5% Negative

Synopsis:

The Tikka T3x TAC A1 is the middle-market champion. Manufactured in Finland by Sako (a Beretta subsidiary), it brings Nordic precision to the US LE market. It is a dedicated folding-chassis rifle that requires no aftermarket modification. Unlike the Remington 700P which needs a chassis upgrade to be modern, the Tikka comes out of the box with an AR-compatible folding stock, M-LOK rail, and detachable magazine.30

Factors Contributing to Sales Volume:

It hits the “Goldilocks” zone. It is significantly better built than the budget rifles but half the price of the LMT or Barrett. For mid-sized agencies (50-200 officers) that have a dedicated SWAT budget but not “federal” money, the Tikka is the primary choice. The 6.5 Creedmoor adoption in this platform is particularly high.32 The integration of Beretta Defense Technologies’ supply chain has improved availability for US agencies.34

Sentiment Analysis:

- Positive (95%): The trigger is widely considered the best factory trigger on the market, often described as “glass-like” and “crisp”.35 Accuracy is consistently sub-0.5 MOA with match ammo. The folding mechanism is praised for being rigid and rattle-free.35

- Negative (5%): Magazine cost ($80-$100) and availability can be a logistical annoyance for agencies compared to the ubiquitous AICS or Magpul magazines. The propriety of the magazine is the single biggest complaint.35

Rank 6: Sig Sauer Cross / MCX-SPEAR

- Manufacturer: Sig Sauer

- Primary Market: Federal (DHS/ICE), Admin Roles

- Estimated Contract Price: $1,600 (Cross) / $4,200 (MCX-SPEAR) 36

- Sentiment: 78% Positive / 22% Negative

Synopsis:

Sig Sauer’s dominance in the pistol market (P320) and rifle market (MCX) provides a massive conduit for their precision offerings. The Cross is a lightweight bolt-action designed for extreme portability, while the MCX-SPEAR (the civilian/LE version of the Army’s XM7) is fulfilling DMR roles with its.277 Fury and 6.5 Creedmoor capabilities.37

Factors Contributing to Sales Volume:

“One vendor” contracts. Agencies often sign massive fleet deals with Sig Sauer for handguns and patrol rifles, and the precision rifles are added as line items to these larger IDIQ (Indefinite Delivery, Indefinite Quantity) contracts.39 This simplifies procurement for the agency. The “Off-Duty” purchase programs also drive individual officer sales that are often used for duty.40

Sentiment Analysis:

- Positive (78%): Innovation, weight savings, and ergonomics are praised. The MCX-SPEAR is seen as the “future” of heavy battle rifles, bringing MCX modularity to the large frame platform.41

- Negative (22%): The Cross suffered from a high-profile safety recall (delayed discharge), which severely impacted trust among risk-averse police armorers.42 While fixed, the stigma lingers in 2025 and requires significant administrative effort to clear for duty use.

Rank 7: Daniel Defense Delta 5 Pro

- Manufacturer: Daniel Defense

- Primary Market: Regional SWAT, Patrol DMR

- Estimated Contract Price: $2,500 – $3,000 45

- Sentiment: 85% Positive / 15% Negative

Synopsis:

Daniel Defense entered the bolt-action market aggressively with the Delta 5 Pro. It guarantees 0.5 MOA accuracy and features a fully custom-grade chassis with Area 419 ARCA rails standard. It is marketed as a “production custom” gun, offering the features of a $4,000 custom build in a $2,500 factory package.45

Factors Contributing to Sales Volume:

Brand loyalty. Daniel Defense dominates the premium patrol rifle (AR-15) market. Agencies that trust DD for their M4s are natural customers for the Delta 5. The “Made in USA” factor is also a significant selling point for Sheriff’s departments in the South and Midwest. The inclusion of the Area 419 Hellfire muzzle brake and RRS spec rail as standard equipment saves agencies from having to source these accessories separately.47

Sentiment Analysis:

- Positive (85%): Build quality and customer service are legendary. The inclusion of premium features (Arca rail) standard is a value add that modern snipers appreciate for tripod work.

- Negative (15%): Like Sig, DD issued a safety notification regarding the firing pin cross pin in earlier models.48 In the LE world, any safety notice freezes procurement discussions for months. Some users also find the barrel exchange system less intuitive than the Barrett or AI systems.

Rank 8: Ruger SFAR (Small-Frame Autoloading Rifle)

- Manufacturer: Sturm, Ruger & Co.

- Primary Market: Rural LE, “Heavy Patrol”

- Estimated Contract Price: $1,000 – $1,350 50

- Sentiment: 88% Positive / 12% Negative

Synopsis:

The Ruger SFAR is an anomaly. It puts.308 power into a chassis the size of an AR-15 (5.56). In 2025, it has exploded in sales for “Heavy Patrol” use—officers who need more punch than a standard AR-15 for vehicle interdiction or rural perimeters but don’t want to carry a 12lb sniper rifle.50

Factors Contributing to Sales Volume:

Weight and Price. It is the lightest (6.8 lbs) and cheapest semi-auto.308 available that is reliable enough for duty. For rural deputies facing threats at longer ranges or through vehicle bodies, it is the ideal trunk weapon. Its ranking in the top 5 selling rifles on GunBroker indicates massive individual officer purchase volume, which often translates to duty use in rural agencies.52

Sentiment Analysis:

- Positive (88%): “Carries like an AR-15, hits like a.308.” The value is undeniable. The presence of an adjustable gas block standard allows for easy tuning with suppressors.50

- Negative (12%): It is not a “precision” rifle in the same sense as the LMT or Barrett. It is a 1-1.5 MOA gun, which limits its use for precision hostage rescue but is fine for DMR work. Some reliability issues with specific ammo types have been noted in early reviews.53

Rank 9: Accuracy International AXSR

- Manufacturer: Accuracy International (UK/USA)

- Primary Market: Elite Federal Units (FBI HRT, Secret Service CS)

- Estimated Contract Price: $10,500 – $13,000 54

- Sentiment: 98% Positive / 2% Negative

Synopsis:

The AXSR is arguably the finest sniper rifle on Earth. It was the runner-up to the Barrett MRAD in the ASR competition. It remains the choice of units where budget is no object and performance is the only metric. It features the Quickloc barrel release system and is built to withstand nuclear-grade abuse.56

Factors Contributing to Sales Volume:

Low volume, high prestige. Sales are limited to the absolute top-tier units. However, the brand’s reputation ensures it remains on the “wish list” of every tactical team, and those with seized-asset funds often splurge on AI systems. The availability of the AXSR in specific colors like Dark Earth and Sage Green appeals to units operating in specific environments.58

Sentiment Analysis:

- Positive (98%): Perfection in engineering. The action is bomb-proof. The ability to field strip the bolt without tools is a critical field feature. The “KeySlot” rail has largely been replaced or supplemented by RRS/Arca rails in newer iterations, addressing previous complaints.57

- Negative (2%): Cost. It is simply unaffordable for 99% of agencies.

Rank 10: LaRue Tactical PredatOBR

- Manufacturer: LaRue Tactical

- Primary Market: Legacy Federal / State Teams

- Estimated Contract Price: $3,500 – $4,800 59

- Sentiment: 89% Positive / 11% Negative

Synopsis:

A decade ago, the LaRue OBR was the gold standard for semi-auto snipers. In 2025, it remains a strong contender but has been overshadowed by LMT’s recent contract wins. It is known for extreme accuracy in a gas gun platform, often referred to as “the accurate AR”.60

Factors Contributing to Sales Volume:

Legacy install base. Agencies that bought OBRs in 2015 are now buying replacements or parts. LaRue’s “suitcase” breakdown capability remains unique for covert operations.60 However, the company’s decision to suspend LE/Mil discount programs in the past has alienated some procurement officers compared to brands with aggressive government pricing.61

Sentiment Analysis:

- Positive (89%): Accuracy is often better than bolt guns. The “take-down” feature is useful for covert transport. The triggers are legendary.

- Negative (11%): Wait times. LaRue is notorious for long backorders, which frustrates procurement officers who need to spend fiscal year budgets by a deadline.63 The lack of government pricing incentives is also a friction point.

3. Emerging Trends and Insights

The “Overwatch” Doctrine Shift

The data indicates a shift in why rifles are being bought. 20 years ago, the primary scenario was a static barricaded suspect. Today, the primary drivers are “Special Event Overwatch” (protecting parades/rallies from elevated positions) and “Vehicle Interdiction.”

- Insight: This drives the shift to semi-automatics (LMT, Ruger SFAR). If a sniper misses a shot at a moving vehicle or needs to engage multiple threats in a crowd, the manual cycling of a bolt is too slow. The market is moving toward gas guns for urban environments and bolt guns for rural/extreme distance.

The Death of the Proprietary Interface

2025 has cemented M-LOK and Arca-Swiss as the mandatory standards.

- Insight: Rifles that use proprietary rail sections (like older Accuracy International KeySlot or early Barrett designs) have been forced to update or die. The Daniel Defense Delta 5 Pro’s integration of the Arca rail (a tripod standard from photography) directly into the chassis standardizes the use of tripods for standing shooting positions, a critical skill for urban overwatch.47

The Budget Gap Widens

A clear “hollow middle” is forming. The market is aggregating at the top (Barrett/LMT >$4k) and the bottom (Bergara/Remington <$1.2k).

- Insight: The mid-tier ($2,000-$3,000) is squeezing. Agencies either have the grant money to go “Federal Standard” (Barrett) or they are budget-strapped and go “Good Enough” (Bergara). The Tikka T3x is the only rifle successfully holding the middle ground, largely due to its exceptional price-to-performance ratio.

4. Conclusion

The 2025 sniper rifle market is characterized by a “systems” approach. Agencies are no longer buying a rifle; they are buying a capability. The dominance of the Barrett MRAD Mk22 highlights the immense influence of DoD standardization on domestic law enforcement. Meanwhile, the resilience of the Remington 700P and the rise of the Bergara B-14 prove that despite technological advances, cost-efficiency remains the governing law for the vast majority of American police departments.

The future trajectory points toward a 50/50 split between bolt-action and semi-automatic platforms, with 6.5 Creedmoor likely surpassing.308 Winchester in new contract starts by 2027.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Barrett MRAD MK22 Awarded US Army Precision Sniper Rifle Contract – Athlon Outdoors, accessed January 5, 2026, https://athlonoutdoors.com/article/barrett-army-precision-sniper-rifle/

- Barrett® Awarded United States Army’s Precision Sniper Rifle Contract, accessed January 5, 2026, https://barrett.net/2021/04/07/barrett-awarded-united-states-armys-precision-sniper-rifle-contract/

- New Rifles Chambered In 6.5mm Creedmoor Heading To U.S. Special Operations Armories, accessed January 5, 2026, https://www.twz.com/land/new-rifles-chambered-in-6-5mm-creedmoor-heading-to-u-s-special-operations-armories

- LMT Wins $93 Million SOCOM 6.5 Creedmoor Rifle Contract – Guns.com, accessed January 5, 2026, https://www.guns.com/news/2025/08/25/lmt-wins-93-million-socom-65-creedmoor-rifle-contract

- Best Rifles of 2025 [Range Tested & Reviewed], accessed January 5, 2026, https://www.pewpewtactical.com/the-best-rifles/

- Barrett Mk22 ASR MRAD Advanced Sniper System Deployment Package with 3 barrels – USED – Charlie’s Custom Clones, accessed January 5, 2026, https://charliescustomclones.com/barrett-mk22-asr-mrad-advanced-sniper-system-deployment-package-with-3-barrels-used/

- Barrett to supply U.S. Army with $50 million worth of MK22 sniper rifles – Israel Defense, accessed January 5, 2026, https://www.israeldefense.co.il/en/node/49164

- Barrett MRAD MK22 Sniper Rifle System Deployment Kit 18804 – Omaha Outdoors, accessed January 5, 2026, https://www.omahaoutdoors.com/barrett-mrad-mk22-sniper-rifle-system-deployment-kit/

- Barrett MK22 MOD 0 Advanced Sniper Rifle System .308 Win, .300 Norma Mag, .338 Norma Mag 18804 – EuroOptic.com, accessed January 5, 2026, https://www.eurooptic.com/barrett-mk22-rifle-kit-308-win-300-norma-mag-338-norma-mag-18804

- Barrett MRAD – Unintentional discharges | Sniper’s Hide Forum, accessed January 5, 2026, https://www.snipershide.com/shooting/threads/barrett-mrad-unintentional-discharges.7265047/

- Remington – LE 700 Police Rifle .308 Win 24″ Heavy Threaded Barrel 4 Rd, accessed January 5, 2026, https://www.bauer-precision.com/remington-le-700-police-rifle-308-win-24-heavy-threaded-barrel-4-rd/

- Remington 700 5-R Gen 2 308 Win Threaded HS Stock 20″ – Bauer Precision, accessed January 5, 2026, https://www.bauer-precision.com/remington-700-5-r-gen-2-308-win-threaded-hs-stock-20/

- LE / DEFENSE Wholesalers – Remington, accessed January 5, 2026, https://www.remarms.com/ledefense/find-le/defense-wholesalers

- Remington 700 Gen 2 308 Win 24″ 5-R or something else? : r/longrange – Reddit, accessed January 5, 2026, https://www.reddit.com/r/longrange/comments/13nw4ch/remington_700_gen_2_308_win_24_5r_or_something/

- Model 700 | Remington, accessed January 5, 2026, https://www.remarms.com/rifles/bolt-action/model-700/

- LMT MRGG-A 6.5CM SBR – Titan Defense, accessed January 5, 2026, https://www.titandefense.com/mlk65145l-mars-sr.html

- LMT Rifles – Rooftop Defense, accessed January 5, 2026, https://www.rooftopdefense.com/product-category/guns-and-nfa/complete-rifles/lmt-rifles/

- LMT Defense Ships Initial Delivery to USSOCOM MRGG-S Down-Select Trials, accessed January 5, 2026, https://lmtdefense.com/news/lmt-defense-ships-initial-delivery-to-ussocom-mrgg-s-down-select-trials/

- LMT MRGG (MID RANGE GAS GUN) 1,000 YARD GUN! – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=Qcg6gR4MeBk

- USSOCOM’s Insane New Sniper Rifle In Action: Geissele MRGG- S : r/AR10 – Reddit, accessed January 5, 2026, https://www.reddit.com/r/AR10/comments/1mogw4v/ussocoms_insane_new_sniper_rifle_in_action/

- 2025 BERGARA LAW ENFORCEMENT DEALER PRICE LIST – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=179003&v=90409&sv=0&i=140&ft=b

- 2025 bergara law enforcement msrp price list – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=178276&v=121228&sv=0&i=65&ft=b

- ADDENDUM #1 – Springfield, MO, accessed January 5, 2026, https://www.springfieldmo.gov/DocumentCenter/View/67971/BID-080-2025IFB-ADDENDUM-1?bidId=

- Atlanta Area SWAT Unit Receives Bergara Rifles – Police Magazine, accessed January 5, 2026, https://www.policemag.com/news/atlanta-area-swat-unit-receives-bergara-rifles

- Gun Review: Bergara Hunting Match Rifle (HMR) – Recoil Magazine, accessed January 5, 2026, https://www.recoilweb.com/gun-review-bergara-hunting-match-rifle-hmr-149966.html

- B-14 HMR – Bergara USA, accessed January 5, 2026, https://www.bergara.online/us/rifles/b14/hmr-rifle/

- A Feature-Rich Backcountry Hunter: The Bergara B-14 Ridge Carbon Wilderness (Full Review) | MeatEater Hunting, accessed January 5, 2026, https://www.themeateater.com/hunt/firearm-hunting/a-feature-rich-backcountry-hunter-the-bergara-b-14-ridge-carbon-wilderness

- Tikka T3X TAC A1 Coyote Brown – Dante Sports, accessed January 5, 2026, https://www.dantesports.com/en/product/tikka-t3x-tac-a1-coyote-brown-2/

- Tikka T3x TACT A1 Rifle, Coyote Brown: 308 Win, 24″ Barrel, Model TF1T2917A6149G3M – CSC – Canada’s Gun Shop – Calgary Shooting Centre, accessed January 5, 2026, https://store.theshootingcentre.com/tikka-t3x-tact-a1-rifle-coyote-brown-308-win-24-barrel-model-tf1t2917a6149g3m/

- Introducing the Tikka T3x & T1x Ace Rifles | SHOT Show 2025 – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=AwMneGHHt64

- Tikka T3x TACT A1 – Sako, accessed January 5, 2026, https://www.sako.global/rifle/t3x-tact-a1

- TIKKA T3X TAC A1 Review – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=AA7wBaeQ82k

- The Tikka T3x TAC A1 Provides Most ‘Bang for Buck’ for Precision Rifles – Athlon Outdoors, accessed January 5, 2026, https://athlonoutdoors.com/article/tikka-t3x-tac-a1-precision-rifle/

- Military Suppliers: from Clothing to Firearm – Beretta Defense Technologies, accessed January 5, 2026, https://www.berettadefensetechnologies.com/military-suppliers-from-clothing-to-firearm/

- Rifle Review: Tikka T3x TAC A1 Compact – GetZone, accessed January 5, 2026, https://www.getzone.com/rifle-review-tikka-t3x-tac-a1/

- Sig Sauer MCX Pistols & Rifles – Guns.com, accessed January 5, 2026, https://www.guns.com/sig-sauer/mcx

- MCX-SPEAR LT 5.56 16″ RIFLE – Sig Sauer, accessed January 5, 2026, https://www.sigsauer.com/mcx-spear-lt-5-56-16-rifle.html

- MCX-SPEAR – Sig Sauer, accessed January 5, 2026, https://www.sigsauer.com/spear.html

- United States Immigration and Customs Enforcement Extends SIG SAUER P320 Contract Another Two Years, accessed January 5, 2026, https://www.sigsauer.com/blog/united-states-immigration-and-customs-enforcement-extends-sig-sauer-p320-contract-another-two-years-

- OFF-DUTY Form – Sig Sauer, accessed January 5, 2026, https://www.sigsauer.com/media/sigsauer/resources/OFF_DUTY_Form_2025-2.pdf

- SIG SAUER Releases Special-Edition Multicam MCX-SPEAR LT | thefirearmblog.com, accessed January 5, 2026, https://www.thefirearmblog.com/blog/2024/01/19/sig-sauer-multicam-mcx-spear-lt/

- Safety recall notice for SIG Sauer Cross bolt-action rifles – All4Shooters.com, accessed January 5, 2026, https://www.all4shooters.com/en/shooting/rifles/safety-recall-notice-for-sig-sauer-cross-bolt-action-rifles/

- Recall: Sig Sauer Cross Bolt-Action Rifle | SGB Media Online, accessed January 5, 2026, https://sgbonline.com/recall-sig-sauer-cross/

- Safety Recall Notice: SIG SAUER Cross Bolt-Action Rifles – Accurate Shooter Bulletin, accessed January 5, 2026, https://bulletin.accurateshooter.com/2020/11/safety-recall-notice-sig-sauer-cross-bolt-action-rifles/

- DELTA 5® PRO, 26”, 6mm Creedmoor, Varmint | Daniel Defense, accessed January 5, 2026, https://danieldefense.com/delta5pro-26inch-6mmcreedmoor-varmint.html

- DELTA 5® PRO, 26”, 6.5 Creedmoor, Varmint | Daniel Defense, accessed January 5, 2026, https://danieldefense.com/delta5pro-26inch-65creedmoor-varmint.html

- DELTA 5® PRO | Daniel Defense, accessed January 5, 2026, https://danieldefense.com/delta-5-pro

- Daniel Defense DELTA 5 Safety Notification Replacement Campaign Reminder, accessed January 5, 2026, https://www.rifleshootermag.com/editorial/daniel-defense-delta-5-safety-notification-replacement-campaign-reminder/372200

- Daniel Defense Issues Safety Notification on Certain Delta 5 Bolt Assemblies | An Official Journal Of The NRA – American Rifleman, accessed January 5, 2026, https://www.americanrifleman.org/content/daniel-defense-issues-safety-notification-on-certain-delta-5-bolt-assemblies/

- Ruger SFAR 308 Winchester 16.1in Black Anodized Semi Automatic Modern Sporting Rifle – 20+1 Rounds | Sportsman’s Warehouse, accessed January 5, 2026, https://www.sportsmans.com/shooting-gear-gun-supplies/modern-sporting-rifles/ruger-sfar-308-winchester-161in-black-anodized-semi-automatic-modern-sporting-rifle-201-rounds/p/1777538

- Bigger and stronger where it needs to be and remains smaller and lighter than comparable .308-sized rifles. – Ruger, accessed January 5, 2026, https://ruger.com/products/sfar/models.html

- Top-Selling Guns on GunBroker.com for December 2025, accessed January 5, 2026, https://www.gunsandammo.com/editorial/top-selling-december-2025/542629

- Ruger SFAR AR-10 Review – Pew Pew Tactical, accessed January 5, 2026, https://www.pewpewtactical.com/ruger-sfar-review/

- Accuracy International AXSR Rifles – Mile High Shooting Accessories, accessed January 5, 2026, https://www.milehighshooting.com/accuracy-international/accuracy-international-rifles/axsr/

- Firearms – Rifles – Rifles by MFG – Accuracy International Rifles – AXSR Rifle System – Hinterland Outfitters, accessed January 5, 2026, https://www.hinterlandoutfitters.com/departments/firearms/rifles/rf-manufacturers/accuracy-international/axsr.html

- Accuracy International AXSR Folding Rifles for Sale – Scopelist.com, accessed January 5, 2026, https://www.scopelist.com/accuracy-international-axsr-folding-rifles.aspx

- AXSR Rifle – Dark Earth | Delta Tactical, accessed January 5, 2026, https://www.deltatactical.com.au/axsr-rifle-dark-earth/

- AXSR Mil long action professional multi cal. sniper rifle, accessed January 5, 2026, https://www.accuracyinternational.com/axsr-mil

- PredatOBR 7.62 – LaRue Tactical, accessed January 5, 2026, https://www.larue.com/category/rifles/predatobr-7-62/

- LaRue Tactical 18 Inch PredatOBR 7.62, accessed January 5, 2026, https://www.larue.com/products/larue-tactical-18-inch-predatobr-7-62/

- No MIL/LEO Discount at Larue Tactical – Brian Enos’s Forums, accessed January 5, 2026, https://forums.brianenos.com/topic/165508-no-milleo-discount-at-larue-tactical/

- Larue Tactical Suspends Military and Law Enforcement Discounts – Firearm Industry News and Gossip – 308AR.com Community, accessed January 5, 2026, https://forum.308ar.com/topic/4733-larue-tactical-suspends-military-and-law-enforcement-discounts/

- Larue Predatobr | Sniper’s Hide Forum, accessed January 5, 2026, https://www.snipershide.com/shooting/threads/larue-predatobr.6933146/