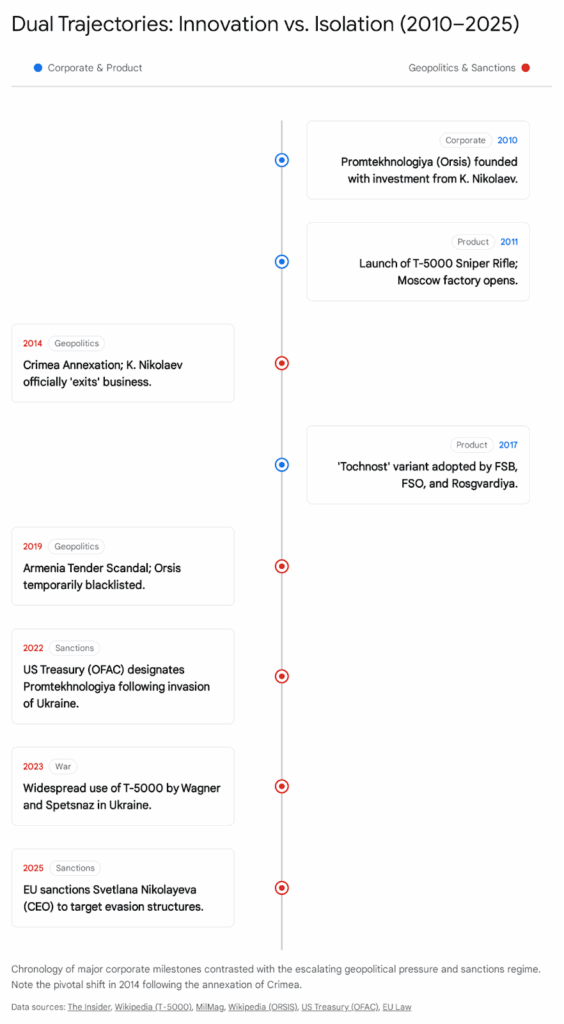

The trajectory of the Promtekhnologiya Group, trading globally under the brand Orsis, represents a singular anomaly within the contemporary Russian military-industrial complex. In a sector historically dominated by sprawling, state-owned conglomerates—such as Rostec and the Kalashnikov Group—Orsis emerged in the early 2010s as a privately capitalized, high-precision instrument manufacturer with the explicit strategic intent of surpassing Western engineering standards in small arms. This report provides an exhaustive, analyst-grade examination of the company’s corporate history, its unique technological methodology, and its increasingly critical role in the Russo-Ukrainian War.

Initially founded through a convergence of technical expertise and oligarchic capital, specifically that of transport tycoon Konstantin Nikolaev, Orsis sought to modernize Russian precision shooting capabilities which had stagnated in the post-Soviet era. The company’s flagship platform, the T-5000 sniper rifle, rapidly achieved iconic status, effectively bridging the gap between civilian sporting precision and military-grade ruggedness. By 2017, the rifle had secured official adoption by Russia’s premier state security services, including the Federal Security Service (FSB), the Federal Protective Service (FSO), and the National Guard (Rosgvardiya), fundamentally altering the tactical capabilities of Russian special operations forces.

However, the company’s corporate narrative is deeply and inextricably intertwined with the broader geopolitical isolation of the Russian Federation. Following the illegal annexation of Crimea in 2014 and the subsequent full-scale invasion of Ukraine in 2022, Orsis transitioned from a boutique exporter of sporting arms to a sanctioned entity integral to the Russian war effort. This analysis scrutinizes how the company has navigated the collapse of Western supply chains—critical for its initial high-grade steel and tooling needs—through aggressive import substitution and opaque procurement networks.

Furthermore, this report details the complex corporate governance maneuvers employed to evade international pressure, specifically examining the transfer of executive control to Svetlana Nikolayeva, wife of the original financier. This strategy was recently targeted by European Union and United States sanctions in 2025, aimed at piercing the corporate veil obscuring the ultimate beneficiaries of the firm’s wartime profits. The investigation highlights the friction between the company’s reliance on Western manufacturing technologies and its role in supplying forces hostile to Western interests.

The outlook for Orsis remains fraught with complexity. While the protracted conflict in Ukraine guarantees domestic demand and provides extensive field testing for its platforms, the firm faces existential challenges regarding advanced tooling acquisition and the loss of lucrative export markets, as exemplified by the diplomatic and commercial scandal in Armenia in 2019. This report concludes that while Orsis has successfully entrenched itself as the primary provider of precision bolt-action platforms for Russian special forces, its future technological evolution is severely constrained by the very geopolitical aggression its products now support.

1. Introduction: The Anomalous Rise of Private Defense in Russia

To understand the strategic significance of Orsis, one must first contextualize the environment of the Russian defense industry at the turn of the 2010s. The sector was, and largely remains, a state-centric monolith. The legacy of Soviet central planning meant that small arms development was concentrated in massive “Unitary Enterprises” like Izhmash (now Kalashnikov) and the KBP Instrument Design Bureau. These giants prioritized mass mobilization capabilities, reliability in extreme conditions, and ease of manufacture over high-precision tolerances.

1.1 The Precision Gap

By the late 2000s, specifically following the Russo-Georgian War of 2008, Russian military planners identified a critical capability gap. The standard-issue Dragunov SVD, while a robust designated marksman rifle, was incapable of matching the effective range and accuracy of Western bolt-action systems used by NATO forces.1 Russian elite units, particularly within the FSB Alpha Group and the FSO (Federal Protective Service), had begun procuring foreign systems—British Accuracy International AWMs, Finnish Sako TRGs, and Austrian Steyr SSGs—to fulfill their counter-terrorism and long-range interdiction requirements.1

This reliance on potential adversaries for critical weaponry was strategically untenable for the Kremlin. The Ministry of Defense, under the reformist agenda of Anatoly Serdyukov, sought to modernize the armed forces, but the state giants were slow to pivot from their mass-production ethos. This market failure created a unique opening for private capital to enter the strategic defense sector.

1.2 The Emergence of Promtekhnologiya

Promtekhnologiya LLC was established to fill this specific void. Unlike the privatization waves of the 1990s, which often involved the looting of state assets, Orsis was a “greenfield” project—built from scratch with private money.4 The company’s proposition was audacious: to build a factory in Moscow capable of producing barrels and actions that could rival the best custom shops in the United States and Europe, thereby recapturing the domestic special forces market and projecting Russian engineering prestige abroad.

The establishment of the Orsis facility in 2010-2011 was not merely a commercial venture; it was a statement of intent. It represented a departure from the “good enough” philosophy of the Kalashnikov era toward an aerospace-grade precision philosophy. This shift required not just new machinery, but a fundamentally different corporate culture—one driven by competitive shooting metrics rather than production quotas.

2. Genesis and Corporate Governance (2010–2015)

The corporate history of Orsis is defined by a coalition of technical brilliance and oligarchic financial backing. This partnership allowed the company to bypass the bureaucratic inertia that plagued state competitors.

2.1 The Founding Coalition

The technical vision was provided by Alexei Sorokin, a master of sport in shooting and a renowned firearms designer.5 Sorokin’s reputation within the shooting community was pivotal; he understood the nuances of ballistics, benchrest shooting, and the specific shortcomings of existing Russian hardware. His goal was to introduce “single-pass cut rifling” technology to Russia—a method renowned for producing superior barrel harmonics but historically considered too slow and expensive for Soviet mass production.6

The financial engine behind Sorokin was Konstantin Nikolaev, a billionaire entrepreneur with significant holdings in the transport sector (N-Trans, Globaltrans).5 Nikolaev, born in Ukraine and holding Maltese citizenship and Swiss residency, represented a new class of Russian investor—globally connected yet politically aligned with the Kremlin’s strategic imperatives. Investigative reports also identify Mikhail Abyzov, a former minister for “Open Government” and energy executive, as a co-investor in the early stages, highlighting the deep political patronage the project enjoyed.5

2.2 Political Patronage and High-Level Endorsements

The launch of Orsis was carefully choreographed to garnish high-level political support. In September 2011, the company showcased its rifles at the Sochi Investment Forum, where Prime Minister Vladimir Putin personally inspected the T-5000, engaging with investor Mikhail Abyzov.4 This signaled to the defense establishment that Orsis had the blessing of the highest echelons of power. Defense Minister Anatoly Serdyukov also visited the Moscow factory, a visit that presaged the eventual adoption of the rifles by state agencies.4

The fact that a private company was allowed to set up a weapons manufacturing plant in Moscow—a city with strict zoning and security regulations—further underscores the political capital of its backers. The facility was established at 14 Podyomnaya Street, leveraging an abandoned industrial site to create a modern, clean-room operational environment that contrasted sharply with the grime of older Soviet plants.8

2.3 The 2014 Pivot and Leadership Transition

The year 2014 marked a watershed moment for Orsis, coinciding with Russia’s annexation of Crimea and the onset of Western sanctions.

- Sorokin’s Departure: Around 2014-2015, Alexei Sorokin departed the company. He eventually moved to head the TsKIB SOO (Central Design and Research Bureau of Sporting and Hunting Arms), a subsidiary of the state-owned KBP Instrument Design Bureau.5 This transfer of talent from the private to the state sector suggests a consolidation of expertise as the country moved to a war footing.

- Nikolaev’s “Exit”: Concurrently, Konstantin Nikolaev ostensibly exited the business, likely to insulate his Western assets and residency status from burgeoning sanctions regimes. However, as later sanctions designations would reveal, this exit was largely nominal. Control was effectively transferred within the family structure to his wife, Svetlana Nikolayeva.7 This “spousal shield” allowed the family to maintain control over the defense asset while Konstantin continued his international business activities—a structure that held until Western regulators caught up in 2025.

3. Industrial Philosophy and Manufacturing Base

Orsis’s manufacturing philosophy is the antithesis of the Soviet model. Instead of relying on vast forges and stamped metal, the company invested heavily in precision CNC (Computer Numerical Control) machining and advanced metallurgy.

3.1 The “Single-Pass Cut Rifling” Advantage

The crown jewel of the Orsis production line is its barrel manufacturing process. The company utilizes CNC single-pass cut rifling, a technology they market as “Technology for Champions”.6

- The Process: Unlike button rifling (where a hard button is pushed through the barrel to form grooves) or hammer forging (where the barrel is beaten around a mandrel), cut rifling involves a cutter removing microscopic amounts of metal in 60 to 80 passes per groove.2

- Time Intensity: This process is incredibly time-consuming, taking up to 2.5 hours to rifle a single barrel.2

- Performance Outcome: The result is a barrel with almost perfect internal geometry and minimal induced stress. This translates to superior thermal stability (the point of impact does not shift as the barrel heats up) and sub-MOA (Minute of Angle) accuracy, often cited as capable of 0.5 MOA or better with match-grade ammunition.6

- Uniqueness: Orsis claims that its machinery complex for this specific process is unique in Europe, highlighting the rarity of such high-end tooling outside of custom gunsmiths in the United States.13

3.2 Advanced CNC Infrastructure

The Moscow factory is equipped with over 40 machining centers.8 These machines are used to mill receivers, bolts, and trigger mechanisms from solid billets of steel.

- Tolerances: The reliance on CNC allows for tolerances measured in microns. For example, the bolt lugs are machined to ensure simultaneous contact with the receiver recesses, a critical factor for accuracy that mass-produced rifles often fail to achieve without hand-lapping.2

- Western Dependency: Crucially, much of this tooling was imported from Western Europe and the United States during the 2010-2013 window, before strict dual-use export controls were imposed. The maintenance of this fleet of foreign machines represents a significant, albeit opaque, operational challenge for the company in the current sanctions environment.

3.3 Material Science: The Steel Crisis and Import Substitution

In its early years, Orsis relied heavily on imported stainless steel, specifically varying grades of 416R stainless steel, the gold standard for match-grade barrels in the West due to its machinability and hardenability.14

- The Supply Shock: The imposition of sanctions following 2014 and 2022 severed access to American and European steel foundries.

- Domestic Pivot: Orsis was forced to pivot to domestic suppliers. The company now asserts that it uses “special stainless high-strength steel grades of Russian production” for its actions and barrels.13

- Metallurgical Risks: This transition is non-trivial. The consistency of the steel alloy is paramount for precision rifles. Any variance in the crystalline structure can lead to unpredictable harmonic vibrations or rapid throat erosion. While Orsis claims to have solved this with domestic “martensitic stainless steel” that is incredibly strong 13, independent verification of the long-term durability of these post-sanctions barrels compared to their pre-2014 counterparts remains a subject of debate among ballistic experts.

4. The Product Portfolio: Engineering Analysis

Orsis has developed a coherent product ecosystem that centers on the T-5000 but has expanded to include semi-automatic support weapons and civilian clones of Western designs.

4.1 The Flagship: Orsis T-5000

The T-5000 is the platform that put Orsis on the map. It is a manually operated bolt-action rifle designed from the ground up for the tactical environment.16

- Chassis System: The rifle is built on an aluminum alloy chassis (D16T alloy, roughly equivalent to American 2024 aluminum).12 This chassis is glass-bedded to ensure a stress-free fit for the action, a critical detail for accuracy. It features a folding stock with adjustable length of pull and cheek weld, essential for operators wearing body armor.17

- Action Design: The action features a two-lug bolt made from heat-treated stainless steel. The lugs are oversized to handle high-pressure cartridges.2

- Calibers and Capabilities:

- .308 Winchester (7.62x51mm): The standard variant for urban and medium-range engagements up to 800-1,000 meters.16

- .338 Lapua Magnum: The long-range variant, capable of engaging targets effectively at 1,500 meters and beyond.16 This caliber provides the kinetic energy to penetrate body armor at distances where standard 7.62mm rounds would fail.

- .375 CheyTac (Orsis-CT20): A later development for extreme long-range interdiction, claiming record hits beyond 2,000 meters.18

4.2 The “Tochnost” Project: Militarization

While the T-5000 was successful as a commercial product, its adoption by the Russian military required significant modification. This process was formalized under the “Tochnost” (Precision) R&D program.19

- Modifications: Over 200 changes were made to the base T-5000 design to meet state acceptance standards.19 These likely included ruggedization of the folding stock mechanism, changes to the trigger group to ensure safety in drop tests, and standardization of the optical rail interfaces.

- Adoption: The “Tochnost” complex was officially adopted by the FSB, FSO, and Rosgvardiya in 2017.16 This marked the transition of Orsis from a niche supplier to a primary contractor for the state’s most sensitive security organs.

4.3 The K-15 “Brother” (Brat)

Recognizing the tactical limitations of bolt-action rifles in dynamic firefights, Orsis developed the K-15, marketed as “Brother”.20

- Hybrid Design: The K-15 is a semi-automatic rifle chambered in.308 Winchester. It represents a fascinating hybrid of engineering schools: it utilizes a two-lug rotating bolt reminiscent of the AK platform (for reliability) but integrated into a split receiver architecture (upper and lower) similar to the American AR-10.21

- Role: While sold as a “hunting” rifle to navigate Russian civilian gun laws, its features—KeyMod handguards, quick-detach barrels, and high-capacity magazines—clearly identify it as a Designated Marksman Rifle (DMR) intended for military or paramilitary application.21

4.4 The F-17 Multicaliber System

The F-17 represents Orsis’s answer to the modularity trend popularized by the Barrett MRAD.

- Field Swappability: The key innovation is the ability to change calibers (.338 LM,.300 WM,.308 Win) in the field by unscrewing three hex bolts and swapping the barrel and bolt face.22 This modularity simplifies logistics, allowing a single chassis to serve multiple mission profiles—from anti-personnel to anti-materiel.

4.5 The AR-15J: Import Substitution in Action

In 2019, Orsis launched the AR-15J, a domestic clone of the ubiquitous American AR-15.14

- Strategic Intent: With sanctions cutting off the supply of genuine American AR-15s (which were popular among Russian civilian shooters and some specialized units), Orsis stepped in to fill the void. The company manufactures the barrels and receivers in-house, marketing them as “Russian ARs” with the superior accuracy of their cut-rifled barrels.14 This product exemplifies the broader Russian industrial strategy of import substitution—replicating Western designs using domestic supply chains.

5. Operational History and Doctrine

The true test of Orsis platforms has been their extensive deployment in Russia’s recent military conflicts. The shift from testing grounds to the battlefield has validated the company’s engineering but also implicated it deeply in the Kremlin’s aggressive foreign policy.

5.1 Syria and Iraq: The Proving Grounds

Before Ukraine, Orsis rifles were spotted in the Middle East. Snippets indicate their use by Iraqi Special Operations Forces (ISOF) and presence in the Syrian Civil War.2

- Context: In Iraq, the T-5000 was likely supplied as part of Russian military aid packages to Baghdad for the fight against ISIS. The presence of these rifles in the hands of Iraqi “Golden Division” troops provided Orsis with valuable combat data in desert conditions, testing the rifle’s resistance to fine sand and heat—environments vastly different from the Russian winter.

5.2 Ukraine (2014–Present): The Sniper War

The conflict in Ukraine has been the primary theater for the T-5000. Since the initial hostilities in Donbas in 2014, and escalating significantly after the 2022 invasion, the rifle has become a signature weapon for Russian high-value units.

- Users: The rifle is documented in the hands of the Spetsnaz (GRU special forces), FSB Alpha Group teams operating in the conflict zone, and the Wagner Group private military company.1

- Tactical Doctrine: Reports from the Ukrainian theater describe a “layered” sniper doctrine employed by Russian forces. In this structure, platoons of snipers operate in three ranks:

- First Rank: Proxy forces or conscripts acting as bait or spotters.

- Second Rank: Designated marksmen with SVDs or K-15s.

- Third Rank: Elite snipers equipped with T-5000s (.338 LM) acting as the “executioners”.1

- Overmatch Capability: The.338 Lapua Magnum T-5000 provides a significant range advantage over the standard 7.62x54R SVD used by many Ukrainian units. This “overmatch” allows Russian teams to engage Ukrainian positions from beyond the effective return-fire range of standard infantry weapons, forcing Ukrainian defenders to rely on heavy weapons (mortars, artillery) or FPV drones to dislodge them.24

5.3 The “Ratnik” Integration

The T-5000 was extensively tested as part of the “Ratnik” (Warrior) future infantry combat system trials.23 While Ratnik is a broad program covering everything from body armor to communications, the inclusion of the T-5000 signals a doctrinal shift. The Russian military is moving away from the Soviet doctrine of the sniper as merely a squad-level marksman (SVD equipped) toward a Western-style doctrine of specialized sniper teams equipped with precision bolt-action systems capable of extreme long-range elimination.

6. Geopolitical Friction and Export Strategy

While Orsis has found success domestically, its attempts to become a global exporter have been marred by diplomatic scandals and the stigma of Russian foreign policy.

6.1 The Armenia Tender Scandal (2019)

A defining moment in Orsis’s export history was the 2019 scandal in Armenia, which serves as a case study in how Russian private defense firms function as extensions of state power.

- The Incident: The Armenian Ministry of Defense opened a tender for military equipment worth several million dollars. Orsis was the favored bidder and appeared set to win. However, in an abrupt reversal, the tender was cancelled, and Orsis was disqualified on allegations of submitting false documentation.8

- The Blacklist: Armenia placed Orsis on a list of “unscrupulous suppliers,” effectively banning it from the market.27

- The State Response: The reaction from Moscow was immediate and disproportionate for a mere commercial dispute. The Russian Ministry of Industry and Trade sent a threatening letter to the Armenian Defense Minister, calling the rejection “unmotivated” and demanding a reversal.28

- Legal Warfare: A criminal case was subsequently launched in Armenia against high-ranking defense officials for “negligence”—a move widely interpreted as being instigated by Russian diplomatic pressure to punish Yerevan for rejecting the Russian firm.8

- Outcome: By late 2019, an Armenian court suspended the blacklist decision, allowing Orsis to re-enter the market.27 This episode demonstrated that Orsis enjoys the full diplomatic protection of the Kremlin, blurring the line between private enterprise and state instrument.

6.2 Middle East Outreach

With Western markets closed, Orsis has pivoted to the Middle East. The company has maintained a presence at major arms expos like IDEX in Abu Dhabi.

- Strategy: At IDEX 2025, Orsis and Rosoboronexport showcased their latest platforms, marketing them as “combat proven” in Ukraine.29 This marketing strategy aims to appeal to Gulf states and African nations that prioritize battlefield effectiveness over Western sanctions compliance. The narrative is simple: “These weapons are fighting NATO technology in Ukraine and winning.”

7. The Sanctions Regime and Corporate Evasion

As a key supplier to the Russian war machine, Orsis has been a primary target of Western economic warfare. The company’s survival depends on its ability to evade these restrictions.

7.1 The Sanctions Dragnet

Promtekhnologiya was designated by the U.S. Treasury (OFAC) in May 2022 pursuant to Executive Order 14024 for operating in the defense and related materiel sector.31 The European Union, Switzerland, and other allies followed suit.

- Targeting: The sanctions lists identify multiple corporate addresses in Moscow (14 Podyomnaya St. and 19 Smirnovskaya St.) and explicitly link the company to the “Moscow Industrial Bank,” which likely facilitates its domestic transactions and payroll.31

7.2 The “Spousal Shield” Maneuver

A critical insight derived from 2025 research data is the Western effort to target the company’s beneficial ownership, which had been obscured behind a “spousal shield.”

- The Mechanism: Konstantin Nikolaev, the billionaire founder, ostensibly “exited” the business in 2014. However, control was transferred to his wife, Svetlana Nikolayeva.

- Piercing the Veil: In 2025, the European Council explicitly sanctioned Svetlana Nikolayeva. The designation text states that her position as CEO was a mechanism to “conceal her husband’s controlling influence over the company”.10 This move acknowledges that the 2014 divestment was likely a sham designed to protect the Nikolaev family’s European assets (including residency in Switzerland and Maltese citizenship) while maintaining control of the strategic defense asset.7

7.3 Ownership and Control Structure

The ownership structure of Promtekhnologiya is a complex web designed to obscure beneficiaries and evade sanctions.

- Konstantin Nikolaev: The original financier and oligarch with deep ties to the transport sector (Globaltrans). His capital founded the company.

- Svetlana Nikolayeva: The wife and registered CEO/Owner post-2014. Her role was to hold the asset to avoid direct sanctions on her husband, allowing him to continue international business.

- Promtekhnologiya LLC: The operating entity manufacturing the rifles.

- AO Promyshlennye Tekhnologii: The joint-stock parent company, offering another layer of corporate anonymity.5

- End Users: The Russian Security Services (FSB, FSO, Spetsnaz) who provide the revenue stream.

- Sanctions Bodies: The EU, US, and Swiss authorities attempting to sever these links.

This structure allowed the family to profit from the Russian defense budget while enjoying the lifestyle afforded by European residency—until the loophole was closed in 2025.

7.4 Supply Chain Vulnerabilities

Despite claims of 100% localization, Orsis remains vulnerable.

- Tooling: The factory relies on Western CNC machines. Without official support from manufacturers (like Haas, Mazak, or DMG Mori), Orsis must rely on a grey market of smuggled spare parts and illicit software updates.

- Intermediaries: The U.S. Department of Justice has indicted numerous networks (such as the Artur Petrov network) that smuggle microelectronics and industrial machinery to Russian defense firms.34 While Orsis is not always named as the specific final recipient in every indictment, the continued operation of its high-tech plant implies it is a beneficiary of this broader evasion ecosystem.

8. Future Outlook (2025–2030)

As of late 2025, Orsis occupies a precarious but essential position in the Russian military-industrial landscape. Its immediate survival is guaranteed by the war, but its long-term technological viability is in question.

8.1 The “Tooling Cliff”

The most significant threat to Orsis is the degradation of its manufacturing base. Precision CNC machines are consumables; they require regular replacement of cutting heads, spindles, and control boards.

- Degradation: As the pre-2014 fleet of Western machines ages, maintaining sub-MOA tolerances will become increasingly difficult. Domestic Russian machine tool production is growing but lags behind the German and Japanese standards required for aerospace-grade machining. Orsis faces a “tooling cliff” where production quality may inevitably decline unless they can successfully source high-end Chinese alternatives or smuggle Western replacements at a premium.

8.2 The Drone Revolution

The tactical environment is shifting beneath the company’s feet. The proliferation of FPV (First Person View) drones in Ukraine challenges the traditional primacy of the sniper.

- Range vs. Cost: A T-5000 rifle costs thousands of dollars and requires a highly trained operator to hit a target at 1,500 meters. An FPV drone costs $500 and can kill a target at 5,000 meters with greater terminal effect.

- Adaptation: While snipers remain essential for reconnaissance and denial of area, Orsis may see its role diminish unless it can adapt. The company may need to pivot toward anti-drone kinetic solutions or integrate its platforms with electronic warfare suites to protect its operators.

8.3 Commercial Isolation

The loss of the Western civilian market is permanent. The brand “Orsis” is now toxic in Europe and North America. The company is effectively a captive supplier to the Russian Ministry of Defense and a handful of pariah states. This lack of commercial competition—which drove its early innovation—may lead to stagnation. Without the pressure to compete with Accuracy International or Barrett in the open market, the incentive for rapid innovation diminishes, risking a return to the complacency that plagued the Soviet industry it sought to replace.

9. Summary of Major Milestones

The following table summarizes the key events in the corporate and operational history of Promtekhnologiya.

| Year | Milestone Event | Context / Significance | Source |

| 2010 | Founding | Promtekhnologiya established with private funding from K. Nikolaev. | 5 |

| 2011 | Production Launch | Moscow factory opens; T-5000 rifle unveiled; Putin inspects prototypes. | 4 |

| 2012 | Trials | T-5000 enters state trials for the “Ratnik” future soldier program. | 25 |

| 2014 | Leadership Change | K. Nikolaev exits ownership (nominally); founder A. Sorokin leaves. | 5 |

| 2017 | State Adoption | Militarized “Tochnost” T-5000 adopted by FSB, FSO, and Rosgvardiya. | 16 |

| 2017 | New Models | Introduction of K-15 “Brother” semi-auto rifle. | 20 |

| 2019 | Armenia Scandal | Orsis disqualified from tender; blacklisted; diplomatic row ensues. | 8 |

| 2019 | Civilian Expansion | Release of AR-15J (Domestic AR-15 clone) for civilian market. | 14 |

| 2022 | US Sanctions | Designated by US Treasury (OFAC) post-Ukraine invasion. | 31 |

| 2023 | Combat Usage | Widespread documentation of T-5000 in use by Wagner/Spetsnaz in Ukraine. | 1 |

| 2024 | Trade Shows | Participation in Army 2024; marketing “combat proven” status. | 35 |

| 2025 | EU Sanctions | CEO Svetlana Nikolayeva sanctioned by EU to close evasion loopholes. | 10 |

| 2025 | Future Tech | Marketing push at IDEX 2025 (UAE) featuring upgraded platforms. | 29 |

10. Conclusion

Orsis represents a unique case study in the resilience and adaptability of the Russian defense industrial base. Born of Western technology and private oligarchic capital, it achieved a level of precision engineering that state factories struggled to match for decades. However, its success has become a double-edged sword.

The company is no longer the private, sporting-focused enterprise envisioned by Alexei Sorokin in 2011. It has been subsumed by the Russian state’s geopolitical ambitions, transformed into a critical node in the war against Ukraine. Its commercial future is now entirely dependent on the Kremlin’s protectionism and the continued conflict. While Orsis has successfully supplied Russian special forces with a world-class sniper system, its long-term viability is threatened by the very sanctions its products helped to provoke. The “tooling cliff” of aging Western machinery and the rise of drone warfare pose existential threats that the company must navigate in the coming half-decade. Whether Orsis can innovate its way out of isolation, or whether it will slowly degrade into a shadow of its former precision, remains the defining question of its next chapter.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Meet the Orsis T-5000: The Deadliest Russian Sniper Rifle You’ve Never Heard of, accessed December 21, 2025, https://nationalinterest.org/blog/buzz/meet-orsis-t-5000-deadliest-russian-sniper-rifle-youve-never-heard-135257/

- ORSIS T-5000: New Name in Precision Rifles – Small Arms Defense Journal, accessed December 21, 2025, https://sadefensejournal.com/orsis-t-5000-new-name-in-precision-rifles/

- A Visit to the ORSIS factory (Russia) – The Firearm Blog, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2014/04/18/visit-orsis-factory-russia/

- Lone Private Gun Maker Targets Locals – The Moscow Times, accessed December 21, 2025, https://www.themoscowtimes.com/2011/11/01/lone-private-gun-maker-targets-locals-a10555

- Justice served? Swiss Attorney General’s Office turns blind eye to machinery supplies for Russian military plant – The Insider, accessed December 21, 2025, https://theins.ru/en/politics/265275

- Orsis Varmint – AmmoTerra, accessed December 21, 2025, https://ammoterra.com/product/orsis-varmint

- Konstantin Nikolaev – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/Konstantin_Nikolaev

- ORSIS – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/ORSIS

- The ORSIS T-5000 Sniper Rifle – UN12Magazine, accessed December 21, 2025, https://un12magazine.com/orsis-high-precision-hunting-sport-and-tactical-rifles/

- L_202501478EN.000101.fmx.xml – EUR-Lex – European Union, accessed December 21, 2025, https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=OJ:L_202501478

- Behind The Scenes At The ORSIS Factory In Moscow – Athlon Outdoors, accessed December 21, 2025, https://athlonoutdoors.com/article/behind-scenes-orsis-factory-moscow/

- ORSIS T-5000 Rifle – Description, News and Rumors | thefirearmblog.com, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2017/04/21/orsis-t-5000-rifle-description-news-rumors/

- ORSIS Russia – AmmoTerra, accessed December 21, 2025, https://ammoterra.com/company/orsis

- Russian ORSIS Starts Manufacturing AR-15 Rifles Called ORSIS-AR15J – The Firearm Blog, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2019/10/02/russian-orsis-ar15j/

- 416R Stainless Steel – Gun Barrel, accessed December 21, 2025, https://www.stainlessshapes.net/416r-stainless-steel-gun-barrel/

- ORSIS T-5000 – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/ORSIS_T-5000

- ORSIS T-5000 – Weaponsystems.net, accessed December 21, 2025, https://weaponsystems.net/system/700-AA05%20-%20T-5000

- Russian rifle breaks a world record for shooting range – Al Sharqiya, accessed December 21, 2025, https://www.alsharqiya.com/en/news/russian-rifle-breaks-a-world-record-for-shooting-range

- Tochnost sniper rifle – MILMAG, accessed December 21, 2025, https://milmag.pl/en/tochnost-sniper-rifle/

- ORSIS-K15 “Bro” Semi-Auto Rifle Released in Russia | thefirearmblog.com, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2018/02/13/orsis-k-15-semi-auto-rifle-released/

- New Russian Rifle: ORSIS K-151 | thefirearmblog.com, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2017/05/30/new-russian-rifle-orsis-k-151/

- ORSIS F17 Multi-Caliber Bolt Action Rifle [Arms & Hunting 2017] | thefirearmblog.com, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2017/10/17/orsis-f17-multi-caliber-bolt-action-rifle-arms-hunting-2017/

- These Russian Rifles Are So Deadly They Can Beat Body Armor, accessed December 21, 2025, https://www.bodyarmornews.com/youre-not-safe-these-russian-rifles-are-so-deadly-they-can-beat-body-armor/

- Why Ukraine Never Wants to See Russia’s T-5000 Sniper Rifle Again – The National Interest, accessed December 21, 2025, https://nationalinterest.org/blog/reboot/why-ukraine-never-wants-see-russias-t-5000-sniper-rifle-again-182982/

- ORSIS T-5000 – Gun Wiki | Fandom, accessed December 21, 2025, https://guns.fandom.com/wiki/ORSIS_T-5000

- Scandal erupts over Armenian defence ministry weapons tender – JAMnews, accessed December 21, 2025, https://jam-news.net/scandal-erupts-over-armenian-defence-ministry-weapons-tender/

- Armenia lifts ban on Russian arms manufacturer – Panorama.am, accessed December 21, 2025, https://www.panorama.am/en/news/2019/12/10/ORSIS/2208928

- Armenia, Russia argue over arms supplies – AzerNews, accessed December 21, 2025, https://www.azernews.az/region/157949.html

- At the IDEX-2025 exhibition, new weapons will be shown by more than 40 manufacturers from the Russian Federation – ВПК.name, accessed December 21, 2025, https://vpk.name/en/976377_at-the-idex-2025-exhibition-new-weapons-will-be-shown-by-more-than-40-manufacturers-from-the-russian-federation.html

- Rosoboronexport to exhibit a Record Number of new Russian Defense Products at IDEX, accessed December 21, 2025, https://www.arabiandefence.com/2025/02/13/rosoboronexport-to-exhibit-a-record-number-of-new-russian-defense-products-at-idex/

- BILLING CODE 4810-AL DEPARTMENT OF THE TREASURY Office of Foreign Assets Control Notice of OFAC Sanctions Actions AGENCY – Federal Register, accessed December 21, 2025, https://public-inspection.federalregister.gov/2022-10320.pdf

- Russia-related Designations and Designations Updates; Issuance of Russia-related General Licenses, Publication of Russia-related Frequently Asked Questions | Office of Foreign Assets Control, accessed December 21, 2025, https://ofac.treasury.gov/recent-actions/20220508

- U.S. Treasury Takes Sweeping Action Against Russia’s War Efforts, accessed December 21, 2025, https://home.treasury.gov/news/press-releases/jy0771

- Treasury Hardens Sanctions With 130 New Russian Evasion and Military-Industrial Targets, accessed December 21, 2025, https://home.treasury.gov/news/press-releases/jy1871

- ROSOBORONEXPORT Showcases Russian Arms at Army 2024 – Raksha Anirveda, accessed December 21, 2025, https://raksha-anirveda.com/rosoboronexport-showcases-russian-arms-at-army-2024/