Date Published: February 5, 2026

Event: World Defense Show (WDS) 2026

Location: Riyadh International Convention & Exhibition Center, Saudi Arabia

Report Focus: Small Arms, Light Weapons (SALW), Optics, and Soldier Systems

Executive Summary

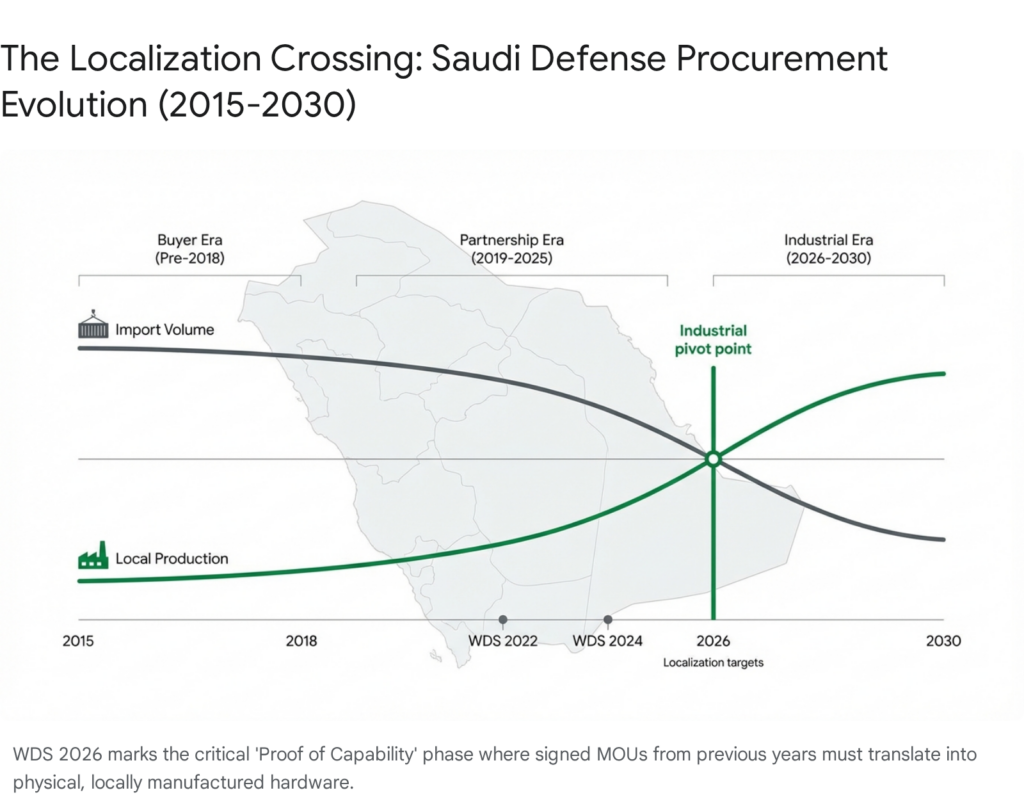

As the global defense community converges on Riyadh for the third edition of the World Defense Show (WDS), scheduled to open its doors on February 8, 2026, the atmosphere is charged with a distinct geopolitical and industrial electricity. Unlike the inaugural 2022 event, which functioned largely as a statement of intent, or the 2024 edition, which saw the initial stirrings of industrial localization, WDS 2026 stands as a mature, pivotal node in the global arms trade infrastructure. For the Small Arms and Light Weapons (SALW) sector, this year’s exhibition is not merely a display of hardware; it is a referendum on the success of Saudi Arabia’s Vision 2030 localization mandates and a battleground for Eastern and Western powers vying for dominance in the Gulf’s lucrative infantry modernization programs.1

This report, generated three days prior to the opening ceremony, synthesizes exhibitor data, open-source intelligence (OSINT), and social media sentiment to forecast the defining narratives of the show. Our analysis indicates that WDS 2026 will be characterized by three primary drivers: the aggressive operationalization of indigenous manufacturing by Saudi entities, the tactical resurgence of Russian and Chinese export variants designed specifically to displace Western hegemony, and the integration of algorithmic fire control systems into standard infantry squads. The show has expanded to cover over 800,000 square meters, hosting 925 exhibitors from more than 80 countries, reflecting a massive scale-up in participation and industrial interest.3

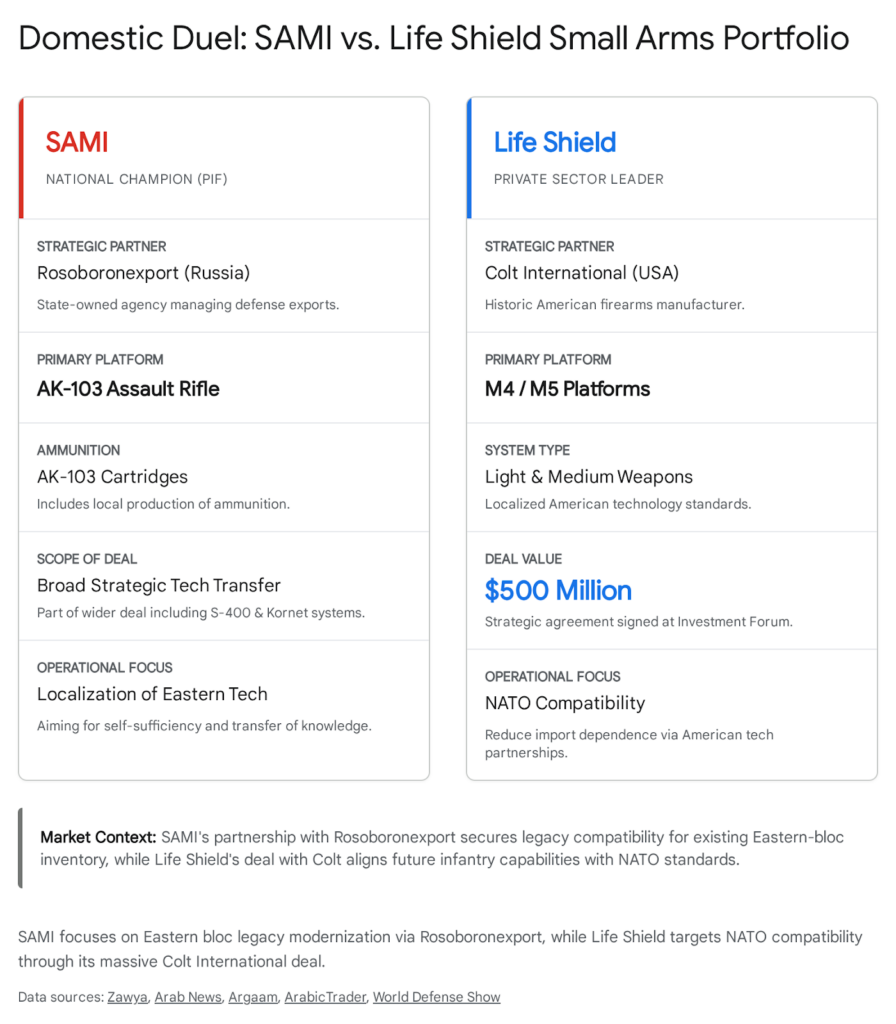

The “must-see” list for 2026 has shifted from pure platform procurement to industrial partnership. The headline battle is domestic: Saudi Arabian Military Industries (SAMI) versus Life Shield for Military Industries. With Life Shield’s recent $500 million agreement with Colt International to localize small arms production, and SAMI’s entrenched partnership with Kalashnikov and Thales, Riyadh has effectively created a competitive internal market.5 Attendees are clamoring to see the first physical evidence of “Made in Saudi” Colt M4s and AK-103s side-by-side.

Internationally, Rosoboronexport is deploying a “combat-proven” marketing strategy, debuting the modernized RPG-29M and NATO-caliber AK-19, explicitly targeting Gulf nations standardized on 5.56mm.7 Simultaneously, China’s Norinco is utilizing WDS 2026 to aggressively market the export variants of its Type 20 (QBZ-191) family, challenging the dominance of the AR-15 and AK platforms in the developing world.10

Technologically, the “dumb” iron sight era is definitively over. The proliferation of Smart Shooter’s SMASH technology and Thales’ XTRAIM sights indicates a market pivot toward “guaranteed hit” probabilities, driven by the urgent need for counter-UAS capabilities at the squad level.11 Social media analysis reveals a highly informed attendee base, less interested in booth glamour and more focused on hands-on capabilities, technology transfer (ToT) metrics, and the practical realities of integrating unmanned systems with infantry firepower.

This report provides an exhaustive preview of these dynamics, offering industry stakeholders a roadmap to the most critical exhibitions, announcements, and undercurrents expected at WDS 2026.

1.0 Strategic Context: The Riyadh Pivot

To understand the small arms landscape of WDS 2026, one must first appreciate the strategic theatre. The Riyadh International Convention and Exhibition Center has expanded to over 800,000 square meters, reflecting the Kingdom’s ambition not just to buy, but to become a global hub for defense integration.3 The event is poised to host over 130,000 visitors and 441 official delegations, signaling that Riyadh has firmly established itself as a premier node in the global defense calendar, rivaling events like IDEX in Abu Dhabi and Eurosatory in Paris.3

1.1 The Vision 2030 Imperative: From Buyer to Maker

The organizing principle of WDS 2026 is the General Authority for Military Industries (GAMI) mandate to localize 50% of defense spending by 2030.13 In 2026, we are past the midway point of this vision. The era of off-the-shelf purchases is largely over; the era of Joint Ventures (JVs) and domestic production lines has begun. The pressure on international OEMs (Original Equipment Manufacturers) is immense: establish a local footprint or risk losing access to the region’s largest defense budget.

For small arms manufacturers, the “price of admission” to the Saudi market is no longer just unit cost or performance—it is the willingness to transfer intellectual property (IP) and build factories in the Kingdom. This has bifurcated the exhibitor list into two camps:

- The Integrators: Companies like Colt, Thales, and EDGE Group (Caracal) that have signed deep localization deals and are present to showcase their local value addition.

- The Salesmen: Firms still attempting traditional Foreign Military Sales (FMS) models, who risk being marginalized in favor of those willing to play by GAMI’s new rules.

The implications of this shift are profound. Exhibitors at WDS 2026 are not just displaying weapons; they are displaying industrial capability. The booth designs themselves often reflect this, with dedicated sections for “Transfer of Technology” and “Local Content” metrics displayed as prominently as muzzle velocity or magazine capacity.

1.2 The Geopolitical Assembly Area

Riyadh in February 2026 is a neutral ground where geopolitical rivals exhibit side-by-side. The floor plan reveals a physical manifestation of the multipolar world order. The US and UK primes (Lockheed Martin, BAE Systems) maintain massive pavilions, but they are flanked by aggressive, sprawling exhibits from Chinese state-owned enterprises (Norinco, ALIT) and a resilient Russian presence led by Rosoboronexport.15

For the small arms analyst, this proximity allows for direct, side-by-side comparison of competing doctrines:

- Western Doctrine: Precision, modularity, optics-heavy, expensive, high training requirement.

- Eastern Doctrine: Volume, ruggedness, increasingly modernized ergonomics, cost-effective, “good enough” lethality.

The presence of companies like 7Tao Engineering from the UK, which explicitly references the “US China Trade War” in its exhibitor description, underscores the tension present on the show floor.17 The global economic struggle is playing out in the aisles of the Riyadh International Convention & Exhibition Center, with small arms contracts serving as proxy indicators of broader diplomatic alignments.

2.0 The Host Nation’s Arsenal: Indigenous & Localized Giants

The most anticipated announcements at WDS 2026 are not coming from foreign entities, but from the Saudi national champions. The domestic industry has matured from re-badging imports to genuine assembly and component manufacturing. The narrative for 2026 is domestic competition: specifically, the emerging duopoly of SAMI and Life Shield.

2.1 SAMI (Saudi Arabian Military Industries): The National Champion

As the National Strategic Partner of WDS, SAMI occupies the central gravity of the show.5 Their small arms strategy is heavily scrutinized, as they are the primary vehicle for the Public Investment Fund (PIF) to deliver on the 50% localization target.

The Kalashnikov Question: AK-103 Localization

Following the Memorandum of Understanding (MoU) signed in 2017 during King Salman’s visit to Russia, and reaffirmed in subsequent years, industry observers are expecting to see the Saudi-manufactured AK-103. The initial agreement covered the production of the rifle and its ammunition.19 By 2026, the expectation is no longer just a prototype but a production-ready unit. Attendees are looking for the “Made in KSA” markings on the receiver.

The AK-103 program is pivotal because it represents the RSLF’s potential shift or augmentation of its small arms inventory, which has historically relied on the G3 (manufactured by MIC) and the M4. If SAMI displays a fully localized AK-103 with domestic polymer furniture and barrel manufacturing, it signals a major graduation in industrial capability. Conversely, if the display consists merely of imported Russian units with Saudi stickers, it will be viewed by analysts as a stall in the Vision 2030 roadmap.

SAMI-AEC (Advanced Electronics Company): The Digital Backbone

While primarily known for avionics and digital systems, SAMI-AEC is the backbone of the “Digital Soldier” initiative. They are expected to showcase integrated soldier systems—sights, comms, and situational awareness tools—that mount onto the localized small arms. The integration of Thales technology here is a key watch item, as Thales has a long-standing partnership with SAMI-AEC to localize defense electronics.21 SAMI-AEC’s recent “Best Graduation Project” awards and focus on national talent development suggest a strong push for indigenous R&D in soldier systems.23

2.2 Life Shield for Military Industries: The Aggressive Challenger

Life Shield for Military Industries (Life Shield) has emerged as the most dynamic competitor to SAMI in the small arms space. Owned and chaired by Hisham AlJuma’an, Life Shield has aggressively pursued partnerships to rapidly build capability.24 Their strategic agreement with Colt International, valued at up to $500 million, is the single most discussed topic in regional defense forums leading up to the show.6

The Saudi Colt: M4/M5 Localization

Life Shield is expected to debut a localized variant of the Colt M4 or potentially the newer M5 carbine series. This is a direct challenge to the AK-103 program. The Royal Saudi Land Forces (RSLF) and the Saudi National Guard have historically used both G3s and M4s; a locally made Colt gives the Saudi military a NATO-standard option that meets localization mandates without requiring a shift in manual of arms or caliber.26

The rivalry between SAMI (leaning Russian/Eastern for small arms legacy via the AK deal) and Life Shield (partnering with the quintessential American brand) mirrors the Kingdom’s broader hedging strategy. Life Shield’s ability to execute this deal positions it as a premier partner for Western firms looking to enter the Saudi market under the new GAMI regulations.

Aerial Integration and Diversification

Life Shield is not limited to terrestrial small arms. Their joint venture with UK-based ARC Aero Systems to form Life Shield Aerospace suggests a broader ambition.25 Analysts should watch for small arms integration on their VTOL drones—potentially lightweight machine guns or grenade launchers mounted on the Pegasus or P9 platforms for counter-insurgency roles. This cross-domain integration (airframes + small arms) is a trend to watch.

2.3 NCMS (National Company for Mechanical Systems)

NCMS operates in the high-tech niche of the Saudi defense ecosystem. They are not mass-producing assault rifles but are critical for the ecosystem around them. Known for their work on optical components and precision manufacturing, NCMS is the enabler for high-end targeting.28

Optics and Weaponization

NCMS has a history of manufacturing optical components. WDS 2026 is likely to feature domestic thermal and night-vision sights designed to pair with the SAMI AK-103 and Life Shield Colt. Furthermore, snippets indicate NCMS has developed an “Air Drop Bomb” (ADB) for commercial drones.30 At WDS 2026, expect to see this concept expanded to small-arms caliber weapon stations for UGVs (Unmanned Ground Vehicles) and heavy-lift drones, moving beyond gravity-dropped munitions to stabilized firing platforms.

3.0 The Russian Offensive: Innovation Under Pressure

Despite—or perhaps because of—sanctions and geopolitical isolation from the West, Russia’s Rosoboronexport is staging a massive intervention at WDS 2026. The Russian pavilion is leveraging “combat-proven” status from the Special Military Operation (SMO) to market weaponry as rugged, reliable, and effective against modern threats. The narrative is one of resilience and adaptation, pitching Russian hardware as the only option tested in high-intensity peer-to-peer conflict.7

3.1 The RPG-29M Debut: A Tank Hunter Reborn

One of the few explicitly confirmed premieres for WDS 2026 is the RPG-29M “Vampir”. This system’s presence is highly significant for the MENA region.

- The Hardware: The original RPG-29 is legendary in the Middle East for its ability to defeat modern armor (notably Merkava and Abrams tanks in past conflicts like the 2006 Lebanon War). However, its length and weight made it cumbersome for mobile infantry.

- The Upgrade: The “M” variant is a modernization that addresses its primary drawback: weight and bulk. Reports indicate the RPG-29M is up to 30% lighter than its predecessor.8 Crucially, it features a new 24/7 thermal imaging fire control system.8

- Market Relevance: This is a direct response to the proliferation of Active Protection Systems (APS) on Western armor. Russia is pitching the RPG-29M as a cost-effective infantry solution to defeat heavy armor, appealing to Gulf nations that need layered anti-tank capabilities beyond expensive guided missiles like the Javelin or TOW. The inclusion of a fire control system elevates it from a “dumb” rocket to a precision engagement tool, essential for the ranges expected in desert warfare.

3.2 The NATO-Caliber Kalashnikovs: AK-19 and AK-308

Russia is pragmatically acknowledging that many potential clients in the Gulf (Saudi Arabia, UAE, Qatar) have large stockpiles of 5.56x45mm NATO and 7.62x51mm NATO ammunition. They are not trying to force a caliber switch; they are offering a platform switch.

- The AK-19: This rifle is essentially the modern AK-12 platform chambered in 5.56mm NATO. It features the new ergonomic upgrades seen on the AK-12M: an adjustable telescoping stock, a rigid top receiver rail for optics (fixing the AK’s historical weakness with sighting systems), and a new muzzle device compatible with quick-detach suppressors.9

- The AK-308: Another export-focused heavy hitter, chambered in 7.62x51mm NATO. This positions it as a direct replacement candidate for the H&K G3, a rifle deeply entrenched in Saudi service.26 The AK-308 offers the punch of the G3 with the manual of arms of an AK, potentially appealing to units looking for a designated marksman rifle (DMR) or battle rifle update without leaving the 7.62 NATO ecosystem.

- The Pitch: “Russian reliability with Western logistics.” This weapon is targeted specifically at Saudi National Guard or special units that might appreciate the AK platform’s reliability in sand but are logistically tied to NATO calibers.

3.3 The Lebedev Pistol (PLK)

Replacing the Makarov is a long-overdue modernization for the Russian defense industry, and the PLK (Compact Lebedev Pistol) is the answer. Being pushed as a modern, striker-fired equivalent to the Glock 19 or Sig P320, the PLK features a low bore axis and slim profile. At WDS 2026, Russia is marketing this to police and internal security forces in the MENA region, emphasizing its suitability for concealed carry and rapid fire control.31

4.0 The Dragon in the Desert: Norinco’s Export Surge

China’s presence at WDS 2026 is massive, strategic, and aimed at filling every gap left by Western export controls or high prices. Norinco (China North Industries Corporation) is the spearhead, occupying one of the largest pavilions at the show.14 Their strategy is comprehensive, offering a full spectrum of small arms from pistols to heavy machine guns, all available for immediate export without the “political strings” attached to Western sales.

4.1 The “Type 20” Export Family (QBZ-191 Variants)

The People’s Liberation Army (PLA) adoption of the QBZ-191 (Type 20) marked a move away from the bullpup QBZ-95 back to a conventional layout. For WDS 2026, Norinco is aggressively marketing the export versions of this family, often designated under the NAR or CS/LR series codes in trade catalogs.10

- NAR-556 / NAR-751: These are the export variants chambered in NATO calibers (5.56mm and 7.62x51mm). They are designed to look and feel like a modern HK416 or SCAR, featuring full-length Picatinny rails, M-LOK handguards, and adjustable stocks.32 The aesthetics are intentionally “Western” to reduce the training transition for armies accustomed to AR-15 platforms.

- The Strategy: China is offering near-peer capability to Western rifles at a fraction of the cost. This is a compelling pitch for African and Middle Eastern clients who need to arm large numbers of troops or police forces but cannot afford the $2,000+ price tag of a German or American rifle. The NAR-556 allows them to maintain NATO caliber standardization while diversifying their supply chain away from Western manufacturers.

4.2 The CS/LS7 Submachine Gun

Also known as the QCQ-171 in PLA service, the CS/LS7 is a modern 9mm submachine gun that has garnered attention for its similarity to the MP5 and SIG MPX.34

- Features: It utilizes a telescoping stock, extensive rails, and is compatible with various optical sights. It is chambered in 9x19mm Parabellum, the global standard.

- Target Audience: VIP protection details, police SWAT teams, and Special Forces. China is marketing this as a cost-effective alternative to the MP5, capitalizing on the need for compact firepower in urban security environments, a growing concern in many regional capitals.

4.3 Sniper Solutions and QBU-191

Norinco is also showcasing the QBU-191 designated marksman rifle (export version) and heavy anti-materiel rifles like the NSG-50. The focus here is on integrated systems—selling the rifle, the scope, and the specialized ammunition as a complete package. The QBU-191, with its variable magnification optics and lighter weight compared to the older QBU-88, represents a significant leap in Chinese infantry precision.36

5.0 Western Primes: The High-End Specialists

While Russia and China fight for the mass infantry market, Western companies at WDS 2026 are dominating the high-end, special operations, and optics sectors. Their pitch is quality, precision, and the seamless integration of the “soldier as a system.”

5.1 Sig Sauer: The “Next Gen” Halo Effect

Sig Sauer arrives at WDS 2026 riding the massive momentum of its US Army Next Generation Squad Weapon (NGSW) wins. The company’s presence at the show is significant, with a dedicated booth rather than just distributor representation.37

- The XM7 / XM250 Influence: While the full mil-spec NGSW (spear) might be restricted for general export, Sig is showcasing the MCX Spear and its comprehensive ecosystem. The adoption of the MCX platform by US special operations forces creates a powerful “halo effect.”

- The Draw: Regional special forces, including the Saudi Royal Guard and UAE Presidential Guard, want what the US Army Rangers and Delta Force are using. Sig’s booth is expected to be a major hub for buzz, specifically around their hybrid ammunition technology (if exportable) and their advanced optics integration.

5.2 Beretta Defense Technologies (BDT)

Beretta Defense Technologies (BDT), comprising Beretta, Benelli, Sako, and Steiner, is presenting a “Total Solution” approach.39

- Sako TRG M10: A multi-caliber sniper system that is highly regarded in the region for its precision and adaptability.

- Beretta ARX 200: A battle rifle in 7.62mm that has seen interest as a modern alternative to the G3.

- Steiner Optics: The “intelligent” side of the gun. BDT is focusing on the sensor-to-shooter link, showcasing optics that integrate with laser rangefinders and ballistic calculators to increase first-round hit probability.40

5.3 Thales & Smart Shooter: The Algorithmic Aim

The most significant trend in Western small arms is not the gun, but the sight.

- Thales XTRAIM: This new weapon sight offers a fusion of thermal and reflex capabilities, allowing soldiers to decamouflage targets day or night without adding significant weight or bulk. It is compatible with all shoulder-fired assault rifles, making it a prime candidate for upgrade programs for existing fleets.41

- Smart Shooter (SMASH): The Israeli-designed (and increasingly global) fire control system is a game-changer for drone defense. The SMASH system uses image processing to lock onto a target and only allows the weapon to fire when a hit is guaranteed.12

- The “Must-See”: SMASH systems mounted on unmanned ground vehicles (UGVs) (like Ghost Robotics dogs) or networked into a counter-UAS perimeter. The ability of the SMASH scope to lock onto a moving drone and ensure a kinetic hit is a capability every Gulf nation is prioritizing due to the Houthi drone threat context. The Dutch military’s recent immediate purchase of SMASH AD systems underscores the operational urgency for this tech.43

5.4 FN Herstal and FNSS

FNSS (a joint venture between Nurol Holding and BAE Systems) and FN Herstal maintain a strong presence. FNSS is highlighting its armored platforms, but the integration of remote weapon stations (RWS) armed with FN machine guns is a key point of convergence.44 FN Herstal continues to market its SCAR family and its machine guns (Minimi/MAG), which remain the gold standard for sustained fire roles.

6.0 The Optics & C-UAS Revolution

The small arms sector is increasingly defined by what sits on the top rail. WDS 2026 confirms that the market is pivoting toward “intelligent” optics that do more than just magnify.

6.1 The Counter-UAS Imperative

Every small arms conversation at WDS 2026 eventually pivots to drones. The proliferation of cheap, weaponized commercial drones in regional conflicts (Yemen, Syria, Iraq) has made Counter-Unmanned Aerial Systems (C-UAS) a top priority for infantry squads.

- Kinetic Solutions: Exhibitors are showcasing high-capacity magazines, air-burst ammunition (like the 30mm shells from Rostec 45), and computerized sights (Smart Shooter) designed specifically to hit small, fast-moving aerial targets.

- NCMS Air Drop Bomb: The NCMS “Air Drop Bomb” represents the offensive side of this equation—weaponizing the drones themselves.30 This creates a dialectic at the show: companies selling the sword (weaponized drones) and the shield (C-UAS sights) often in the same hall.

6.2 Thermal Proliferation

Thermal imaging is moving from a specialized sniper tool to a general infantry capability. The Thales XTRAIM and the RPG-29M’s new thermal fire control system are evidence of this trend. The expectation is that future infantry engagements will occur in spectrums invisible to the naked eye. Companies like Steiner and Theon Sensors (partnering with NCMS) are pushing hard to supply these night vision and thermal devices to the Saudi military.40

7.0 Social Media Intelligence & Attendee Sentiment

An analysis of pre-show chatter on defense forums (e.g., SDArabia, Defense.pk), Reddit (r/WorldDefenseNews, r/TacticalGear), and industry analysis sites reveals distinct attendee priorities. The conversation has moved beyond “what looks cool” to “what actually works.”

7.1 The “Real vs. Vaporware” Skepticism

A dominant sentiment on forums like SDArabia and Reddit is skepticism regarding the pace and reality of localization announcements.47

- Buzz: “We’ve seen the MoUs for five years. Show us the factory.”

- Implication: Attendees are not impressed by paper signings anymore. They want to see videos of Saudi technicians operating CNC machines or assembling rifles. SAMI and Life Shield will be judged harshly if their booths are just models and mockups. The credibility of the “Made in Saudi” label is on the line.

7.2 The Chinese Quality Debate

There is a vibrant debate regarding the quality of the new Chinese Type 20 export rifles.

- Buzz: “Is the NAR-556 just a cheap HK416 knockoff, or is it duty-ready?” Threads on r/ForgottenWeapons and r/Firearms discuss the ergonomics and build quality of the QBZ-191 variants.48

- Implication: Norinco’s firing range demos (if available) or tactile handling stations will be critical. Attendees are looking to inspect fit and finish, rail stability, and polymer quality to see if Chinese manufacturing has truly caught up to Western standards.

7.3 The “Counter-Drone” Obsession

Analysis of search trends and forum questions shows a massive spike in interest regarding drone defense.

- Buzz: “Best shotgun for anti-drone?” “Smart sights for AKs?” “Can the new Russian armor stop top-attack drones?”

- Implication: Exhibitors who show a standard rifle without a counter-drone answer (electronic sight, air-burst ammo, high-capacity mag) are seen as behind the curve. The “cool factor” has been replaced by the “survival factor.”

The social media analysis indicates that the terms “Localization,” “Colt,” “Drone,” and “SAMI” are the most frequently discussed topics, reflecting the intense focus on domestic manufacturing and the urgent operational need for C-UAS capabilities.

8.0 Conclusion: The Integration Imperative

World Defense Show 2026 marks the end of the “shopping spree” era for the Gulf and the beginning of the “industrial partnership” era. For the small arms analyst, the key takeaways are:

- Sovereignty is King: The best rifle is no longer the one with the best MOA accuracy; it is the one that can be manufactured in Riyadh during a supply chain crisis. Life Shield and SAMI are the new gatekeepers of the Saudi market. Their ability to deliver on the Colt and Kalashnikov deals respectively will define the success of the show for the host nation.

- The East is Adapting: Russia and China are not retreating. They are adapting their calibers (5.56/7.62 NATO) and accessories (rails/optics) to slide into markets where Western political hesitation or cost creates an opening. The AK-19 and NAR-556 are tangible proof of this adaptability.

- The Scope is the Weapon: The rifle itself is becoming a delivery system for the optic. The real innovation is happening in fire control systems like Smart Shooter and Thales XTRAIM that can track drones and guarantee hits. The “dumb” gun is obsolete.

- The Informed Customer: The attendee at WDS 2026 is digitally savvy, skeptical of “vaporware,” and focused on practical metrics like Technology Transfer and Counter-UAS efficacy.

As the doors open on February 8, the eyes of the industry will not be on who has the biggest booth, but on who has the most credible factory blueprint and the most effective solution to the drone threat.

Appendix A: Methodology

Objective: To generate a predictive analysis of WDS 2026 small arms trends, announcements, and attendee sentiment.

Data Sources:

- Primary Research Material: A corpus of 338 snippets comprising exhibitor lists, press releases, official WDS 2026 announcements, and defense news articles dated up to February 5, 2026.

- OSINT (Open Source Intelligence): Analysis of exhibitor websites (SAMI, Life Shield, Rosoboronexport, Norinco) to identify product roadmaps and recent contract awards.

- Social Listening: Qualitative analysis of defense forums (SDArabia, Defense.pk) and social media platforms (Reddit, X/Twitter) to gauge attendee expectations and rumors.

Analytical Framework:

- Keyword Cluster Analysis: Snippets were indexed for keywords such as “small arms,” “assault rifle,” “localization,” “SAMI,” “Life Shield,” “export,” and “Colt.”

- Trend Extrapolation: Historical data from WDS 2022 and 2024 was compared with 2026 pre-show data to identify trajectory shifts (e.g., the move from “MoU signing” to “Production Line opening”).

- Gap Analysis: We identified discrepancies between official narratives (e.g., “100% readiness”) and forum chatter (e.g., “skepticism on timeline”) to provide a balanced “Analyst Insight.”

Visual Generation:

- Visuals were conceived based on the Principle of Intent-Driven Design, ensuring each graphic answers a specific user question (e.g., “Who are the domestic players?” or “How do the Russian and Chinese rifles compare?”). Data for visuals was strictly limited to the provided research snippets.

Citation Protocol:

- All factual claims are supported by snippet IDs (e.g.17) to ensure traceability and verification.

Limitations:

- This report is a pre-show analysis based on available data 72 hours prior to the event. Surprise announcements made on the show floor are by definition not included, though likely candidates have been predicted based on industrial logic.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- World Defense Show 2026 Exhibitors & Attendees Lists, accessed February 5, 2026, https://www.expocaptive.com/world-defense-show-exhibitors-list/

- Visit – World Defense Show, accessed February 5, 2026, https://www.worlddefenseshow.com/en/about-the-show/what-to-expect

- World Defense Show 2026 | 8-12 February | Saudi Arabia, accessed February 5, 2026, https://www.defenseadvancement.com/events/world-defense-show/

- World Defense Show | GAMI, accessed February 5, 2026, https://www.gami.gov.sa/en/world-defense-show

- SAMI strengthens its presence as the national strategic partner for the third consecutive edition at World Defense Show 2026, accessed February 5, 2026, https://www.zawya.com/en/press-release/companies-news/sami-strengthens-its-presence-as-the-national-strategic-partner-for-the-third-consecutive-edition-at-world-defense-show-2026-gtximpoc

- Saudi Life Shield and Colt International collaborate to localize weapons with a $500 million investment, accessed February 5, 2026, https://www.arabictrader.com/en/news/economy/182656/saudi-life-shield-and-colt-international-collaborate-to-localize-weapons-with-a-500-million-investment

- Russia to Unveil New Rocket Systems, Armored Vehicles & Drones at Riyadh Show, accessed February 5, 2026, https://defensemirror.com/news/41012/Russia_to_Unveil_New_Rocket_Systems__Armored_Vehicles___Drones_at_Riyadh_Show

- Russia Is About to Unveil Its New RPG-29 “Vampir” Grenade Launcher, accessed February 5, 2026, https://nationalinterest.org/blog/buzz/russia-about-to-unveil-new-rpg-29-vampir-grenade-launcher-ps-020526

- Rosoboronexport will hold world premieres of the latest Russian weapons at the World Defense Show 2026 – Vpk.name, accessed February 5, 2026, https://vpk.name/en/1099023_rosoboronexport-will-hold-world-premieres-of-the-latest-russian-weapons-at-the-world-defense-show-2026.html

- QBZ-191 – Wikipedia, accessed February 5, 2026, https://en.wikipedia.org/wiki/QBZ-191

- Thales Develops New Counter-Sniper System, accessed February 5, 2026, https://www.thalesdsi.com/2026/02/02/thales-develops-new-counter-sniper-system/

- Dutch Military orders Smart Shooter’s SMASH solution – EDR Magazine, accessed February 5, 2026, https://www.edrmagazine.eu/dutch-military-orders-smart-shooters-smash-solution

- Exhibit – World Defense Show, accessed February 5, 2026, https://www.worlddefenseshow.com/en/exhibit/why-exhibit

- Saudi Arabia inaugurates 1st World Defense Show with cutting-edge Chinese equipment, accessed February 5, 2026, https://english.news.cn/20220307/79dd67043b784653bc41c7e364b3050d/c.html

- World Defense Show, accessed February 5, 2026, https://www.worlddefenseshow.com/en

- ROSOBORONEXPORT to Hold World Premieres for Russia’s Latest Weapons at World Defence Show 2026 – Raksha Anirveda, accessed February 5, 2026, https://raksha-anirveda.com/rosoboronexport-to-hold-world-premieres-for-russias-latest-weapons-at-world-defence-show-2026/

- 2026 Exhibitors – World Defense Show, accessed February 5, 2026, https://www.worlddefenseshow.com/en/exhibitors

- WDS Continues Strategic Partnership with SAMI for 2026 as National Strategic Partner, accessed February 5, 2026, https://www.navalnews.com/naval-news/2025/01/wds-continues-strategic-partnership-with-sami-for-2026-as-national-strategic-partner/

- Kalashnikovs set to be made in Saudi Arabia | Arab News PK, accessed February 5, 2026, https://www.arabnews.pk/node/1172846/saudi-arabia

- Saudi Arabia signs agreement to manufacture Russian weapons – Argaam, accessed February 5, 2026, https://www.argaam.com/en/article/articledetail/id/508212

- Lockheed Martin to launch C2 software factory in Saudi Arabia – Breaking Defense, accessed February 5, 2026, https://breakingdefense.com/2026/02/lockheed-martin-to-launch-c2-software-factory-in-saudi-arabia/

- World Defense Show | Thales Group, accessed February 5, 2026, https://www.thalesgroup.com/en/news-centre/events/saudi-arabia/world-defense-show

- SAMI-AEC, King Saud University Mark 25-Year Partnership with Best Graduation Project Award | Al Defaiya, accessed February 5, 2026, https://www.defaiya.com/news/Regional%20News/KSA/2024/09/19/sami-aec-king-saud-university-mark-25-year-partnership-with-best-graduation-project-award

- Board of Directors – Life Shield, accessed February 5, 2026, https://lifeshield.com.sa/board-of-directors

- ARC’s Middle East deal will deliver economic boost to UK aviation – Business Air News, accessed February 5, 2026, https://www.businessairnews.com/mag_story.html?ident=31088

- List of equipment of the Saudi Arabian Army – Wikipedia, accessed February 5, 2026, https://en.wikipedia.org/wiki/List_of_equipment_of_the_Saudi_Arabian_Army

- Middle East partnership delivers ‘huge economic boost’ to UK aviation | BlueSky News, accessed February 5, 2026, https://www.blueskynews.aero/issue-753/Middle-East-partnership-delivers-huge-economic-boost-to-UK-aviation.html

- Military and Defense Industries – Short Link – Gulf Research Center, accessed February 5, 2026, https://shortlink.grc.net/military-and-defense-industries/

- WDS 2024 Showcased Saudi Arabia’s Defence Sector Growth – Raksha Anirveda, accessed February 5, 2026, https://raksha-anirveda.com/wds-2024-showcased-saudi-arabias-defence-sector-growth/

- WDS 2024 – NCMS showcases its new lightweight Air Drop Bomb – EDR Magazine, accessed February 5, 2026, https://www.edrmagazine.eu/ncms-showcases-its-new-lightweight-air-drop-bomb

- Kalashnikov Group, accessed February 5, 2026, https://en.kalashnikovgroup.ru/

- BREAKING: New NORINCO NAR-556 and NAR-751 Modern Assault, Battle and Automatic Rifles | thefirearmblog.com, accessed February 5, 2026, https://www.thefirearmblog.com/blog/2016/11/01/breaking-new-norinco-nar-556-nar-751-modern-assault-battle-automatic-rifles/

- Norinco’s SCAR Copy in 7.62x39mm, and Picatinny Mounted Grenade Launcher, accessed February 5, 2026, https://www.thefirearmblog.com/blog/2018/01/02/norincos-scar-copy-7-62x39mm-picatinny-mounted-grenade-launcher/

- List of equipment of the People’s Liberation Army Ground Force – Wikipedia, accessed February 5, 2026, https://en.wikipedia.org/wiki/List_of_equipment_of_the_People%27s_Liberation_Army_Ground_Force

- IDEX 2023: The Modern Small Arms of China | thefirearmblog.com, accessed February 5, 2026, https://www.thefirearmblog.com/blog/2023/04/18/idex-2023-modern-small-arms-of-china/

- Norinco LG5 / QLU-11 – Military Wiki – Fandom, accessed February 5, 2026, https://military-history.fandom.com/wiki/Norinco_LG5_/_QLU-11

- SIG SAUER at IWA 2026: All you need to know, accessed February 5, 2026, https://www.iwa.info/en/knowledge/2025/article/sig-sauer-at-iwa-2026

- 2026 SHOT Show Planner – Exhibitors, accessed February 5, 2026, https://n2a.goexposoftware.com/events/ss26/goExpo/exhibitor/listExhibitorProfiles.php?category=SHOT+-++Firearms&list__sort=3&list__order=desc

- Beretta Defense Technologies (BDT) – 2026 SHOT Show Floor Plan, accessed February 5, 2026, https://n2a.goexposoftware.com/events/ss26/goExpo/floorPlan/viewFloorPlan.php?e=1&bi=1219

- Steiner’s T1Xi Selected as Top Performer in Texas DPS Optic Evaluation | Police Magazine, accessed February 5, 2026, https://www.policemag.com/news/steiners-t1xi-selected-as-top-performer-in-texas-dps-optic-evaluation

- Latest News | Al Defaiya, accessed February 5, 2026, https://www.defaiya.com/news/New?page=291

- Home – smart-shooter, accessed February 5, 2026, https://www.smart-shooter.com/

- After Successful Testing, Dutch Military Purchases Counter-Drone System – Finabel, accessed February 5, 2026, https://finabel.org/after-successful-testing-dutch-military-purchases-counter-drone-system/

- FNSS to showcase armoured platforms at World Defense Show 2026 in Riyadh, accessed February 5, 2026, https://defensehere.com/en/fnss-to-showcase-armoured-platforms-at-world-defense-show-2026-in-riyadh/

- Rostec to unveil remotely detonated 30mm shrapnel shell to counter drones at World Defense Show 2026, accessed February 5, 2026, https://defence-industry.eu/rostec-to-unveil-remotely-detonated-30mm-shrapnel-shell-to-counter-drones-at-world-defense-show-2026/

- PROSPECTUS, accessed February 5, 2026, https://s204.q4cdn.com/763095439/files/doc_downloads/IPO/THEON_INTERNATIONAL_Prospectus_dated_January_24-2024.pdf

- World Defense Show 2026 seeks to reshape how defense industry connects and collaborates : r/WorldDefenseNews – Reddit, accessed February 5, 2026, https://www.reddit.com/r/WorldDefenseNews/comments/1p1auuv/world_defense_show_2026_seeks_to_reshape_how/

- QBZ-191 Chinese New Service Rifle, possible importation to the U.S? : r/tacticalgear, accessed February 5, 2026, https://www.reddit.com/r/tacticalgear/comments/q3kczj/qbz191_chinese_new_service_rifle_possible/

- What weapon is this? : r/Firearms – Reddit, accessed February 5, 2026, https://www.reddit.com/r/Firearms/comments/1afos4d/what_weapon_is_this/