Executive Summary

The 9th edition of the Doha International Maritime Defence Exhibition and Conference (DIMDEX 2026), convened from January 19 to 22 at the Qatar National Convention Centre (QNCC), represented a definitive inflection point in the Middle Eastern defense market, specifically within the sector of Small Arms and Light Weapons (SALW). While the exhibition’s nomenclature suggests a maritime focus, the 2026 iteration revealed a profound and deliberate restructuring of the land systems and infantry domains, driven by a singular, overarching strategic imperative: sovereign capability.

Historically, defense exhibitions in the Gulf Cooperation Council (GCC) region have functioned as marketplaces for import—venues where Western prime contractors displayed off-the-shelf hardware for direct procurement. DIMDEX 2026 effectively declared the end of this era. It has been replaced by a model of “mandatory localization,” where market access is strictly conditional on technology transfer, joint ventures (JVs), and domestic manufacturing infrastructure. This report, grounded in extensive analyst monitoring of the event, exhibitor disclosures, and regional industrial activity, concludes that the “Foreign Military Sale” (FMS) model for small arms is being systematically dismantled in favor of the “indigenous production license.”

Key Findings

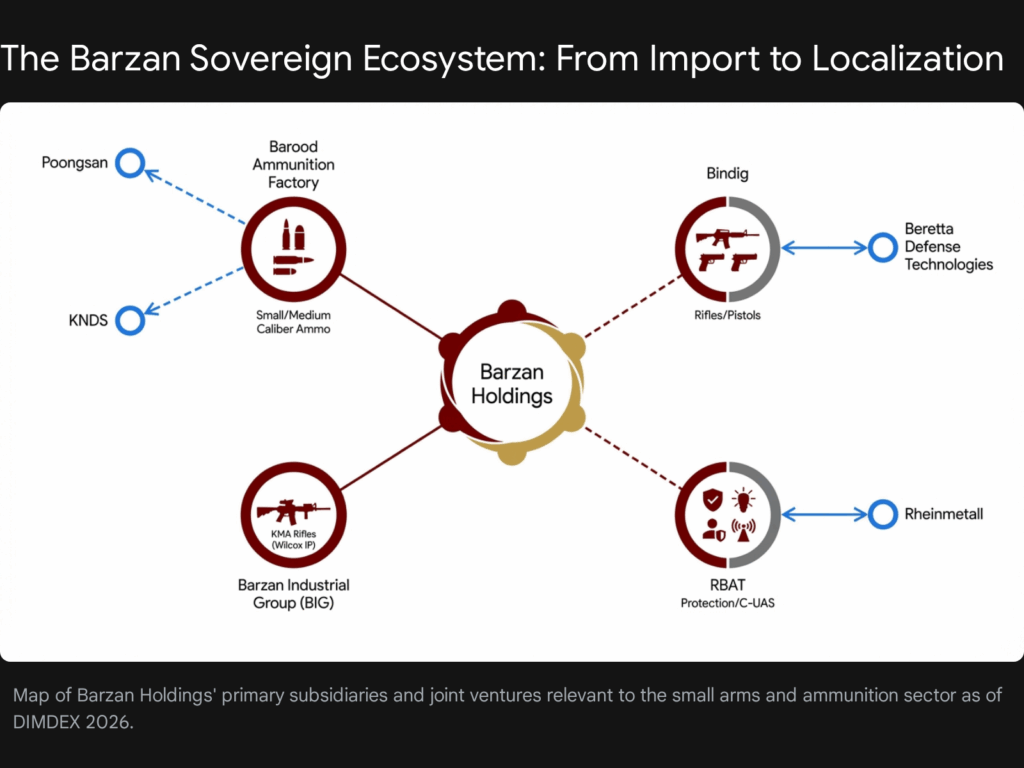

The exhibition’s centerpiece was not a foreign import, but the maturation of Barzan Holdings‘ subsidiaries. The Bindig joint venture, established with Italian firearms manufacturer Beretta, and the Barzan Industrial Group (BIG) demonstrated that Qatar has moved from simple assembly to genuine component manufacturing. The public debut of the KMA 556 and KMA 762 rifles, alongside domestically produced ammunition from Barood, signals Qatar’s intent to become self-sufficient in infantry equipping, insulating itself from the supply chain volatilities that have plagued the global market since the onset of high-intensity conflicts in Eastern Europe.1

Turkish industry has eclipsed traditional Western suppliers in the volume and depth of its engagement, effectively establishing a hegemony over the heavy support weapon categories. Sarsılmaz and CANiK (Samsun Yurt Savunma) dominated the floor, with the SAR 127 MT and M2 QCB machine guns securing their status as the standard heavy barrels for Qatari vehicle platforms. The integration of these weapons into remote controlled weapon stations (RCWS) from Aselsan and Unirobotics illustrates a cohesive “Turkish ecosystem” that Western competitors are struggling to match on price, transferability, and political reliability.4

A nascent but critical trend observed was the integration of small arms into the counter-UAS (C-UAS) kill chain. MKE (Turkey) and KNDS (France/Germany) both showcased ammunition technologies—specifically 40mm Case Telescoped Ammunition (CTA) airburst rounds and specialized 35mm particulate matter—designed to allow infantry fighting vehicles and remote stations to engage micro-drones effectively. This reflects a doctrinal shift where the small arm is no longer just an anti-personnel tool but a critical layer in the air defense umbrella.8

While losing volume share to Turkey, Western firms like Sig Sauer and Beretta (through JVs) retained dominance in the “tier-one” special operations niche. Sig Sauer’s introduction of the P211-GT4 and GT5 pistols during the show week underscored their focus on the elite operator market, emphasizing performance over mass-production logistics.10

1. Introduction: The Strategic Context of DIMDEX 2026

The global defense industry gathered in Doha against a backdrop of intensifying regional security complexification. The 2026 edition of DIMDEX was not merely a trade show; it was a geopolitical statement by the State of Qatar. Following the massive infrastructure investments of the 2022 World Cup era, Qatar has pivoted its national wealth toward the hardening of its security architecture. The Qatar National Convention Centre (QNCC) hosted what has become one of the premier maritime defense events in the world, yet the narrative on the ground was significantly broader than naval warfare. It encompassed a total systems approach to national defense, of which the individual soldier and their weapon are the foundational unit.

Historically, the Gulf states have been passive consumers of Western defense materiel. DIMDEX 2026 definitively shattered this paradigm. The show floor was characterized less by sales pitches for foreign equipment and more by signing ceremonies for technology transfer agreements. The theme, “A Global Hub for Defence Innovations,” was operationalized through the ubiquitous presence of Barzan Holdings, the commercial arm of the Qatari Ministry of Defence.1

For the small arms industry analyst, this shift is critical. The era of the “foreign military sale” (FMS) for basic infantry rifles is ending. It is being replaced by the “indigenous production license.” The focus of this report is to dissect this transition, analyzing not just the hardware on display—from the modular assault rifles to the anti-material sniper systems—but the industrial machinations that brought them there. We will explore how the “Made in Qatar” initiative is reshaping procurement, how Turkish industry has leveraged political alliances to dominate the heavy weapons market, and how traditional Western powers are maneuvering to maintain their foothold in the high-technology niche.

1.1 Methodology and Scope

This report synthesizes data collected from open-source intelligence (OSINT), exhibitor press releases, regional defense news outlets, and social media sentiment analysis surrounding the event dates of January 19-22, 2026. The analysis prioritizes hardware specifications, detailing the technical nuances of new platforms like the KMA 556 and SAR 127 MT; industrial partnerships, dissecting the legal and commercial structures of JVs like Bindig and Barood; and market dynamics, evaluating the competitive friction between Turkish, Emirati, and Western suppliers.1

The scope extends beyond the mere listing of exhibits. It seeks to place each weapon system within the broader context of Qatari and GCC military doctrine. Why is there a sudden surge in heavy machine gun procurement? How does the localization of ammunition production alter the strategic calculus of regional sustainability? These are the questions that drive the following analysis.

2. The Host’s Architecture: Barzan Holdings and the “Bindig” Strategy

The narrative of small arms at DIMDEX 2026 begins and ends with Barzan Holdings. Established to act as the gateway for all Qatari defense procurement, Barzan has successfully enforced a model where access to the Qatari Armed Forces (QAF) inventory requires industrial localization. This is not merely an offset program; it is a mandate for the creation of a sovereign industrial base capable of sustaining the nation’s defense needs independent of external supply chains.1

2.1 Project “Bindig”: The Italian Connection

One of the most significant mature fruits of this strategy displayed at DIMDEX 2026 was the output of Bindig, the joint venture between Barzan Holdings and the Italian firearms giant Beretta Defense Technologies. The name “Bindig” itself—the Qatari word for rifle—signals the intent: this is not a foreign subsidiary, but a national entity.2

“Bindig” represents a comprehensive localization of the Beretta ecosystem. Analysts at the show confirmed that the JV is no longer in the theoretical phase but is actively delivering hardware. The flagship offering remains a localized derivative of the Beretta ARX160/200 series. The presence of these rifles on the Barzan stand, branded with Qatari nomenclature, confirms the QAF’s commitment to this polymer-framed, modular platform as a standard service rifle, gradually supplementing and replacing legacy M16/M4 inventories.3

The strategic logic behind the ARX selection is multifaceted. Unlike the AR-15 platform, which requires frequent maintenance in dusty environments, the ARX series features a short-stroke gas piston system that is inherently more reliable in the fine sand conditions of the Gulf. Furthermore, the platform’s ambidextrous nature—allowing for ejection side swapping without tools—simplifies logistics and training for a conscript-heavy force.

In addition to the rifle, the JV encompasses the Beretta 92 series (specifically the M9A3/A4 variants) and the polymer-striker fired APX series. The “Bindig” booth highlighted the local assembly of these sidearms, positioning them as the standard issue for both military and internal security forces, such as the Lekhwiya. The localization of the APX, in particular, suggests a modernization of the police forces, moving away from older metal-framed pistols to lighter, high-capacity polymer alternatives.16

Analyst Insight: The choice of Beretta as a primary partner over US competitors for the “national rifle” project is deeply strategic. It allows Qatar to bypass potential ITAR (International Traffic in Arms Regulations) friction for basic infantry weapons and ensures a supply chain less susceptible to political oscillations in Washington. It is a hedging strategy, diversifying the sources of lethality.

2.2 Barzan Industrial Group (BIG) and the KMA Series

While Bindig represents a partnership model, the Barzan Industrial Group (BIG) showcased a more direct approach to sovereignty: the ownership of intellectual property (IP). At DIMDEX 2026, BIG prominently displayed the KMA 556 and KMA 762 rifles.2

These platforms trace their lineage to design cooperation with US-based specialized manufacturers, notably Wilcox Industries, but the narrative at the show was strictly national. BIG representatives emphasized that 90% of the production now occurs within Qatari facilities. This claim of high indigenous content is significant; it implies that Qatar has mastered not just the assembly of parts, but the machining of receivers, the rifling of barrels, and the heat treatment of stress-bearing components—the “holy grail” of small arms manufacturing.2

Technical Profile of the KMA Series:

- KMA 556: A 5.56x45mm NATO gas-operated carbine. It features a monolithic upper receiver and a highly modular rail system, reflecting modern special operations requirements for accessory integration (lasers, illuminators, optics). The design philosophy mirrors the HK416, utilizing a piston system to enhance reliability over the direct impingement M4.

- KMA 762: The battle rifle variant (7.62x51mm). Displayed with short-stroke gas piston mechanics, this rifle is positioned for the Designated Marksman (DM) role, bridging the gap between the standard infantryman and the sniper. The adoption of a 7.62mm platform at the squad level reflects a global trend towards increasing the lethality and effective range of the infantry squad, a lesson learned from recent conflicts where engagement distances often exceed the effective range of 5.56mm projectiles.17

2.3 Barood Ammunition Factory: The Lifeblood of Sustainment

Weapons are useless without feed. The Barood Ammunition Factory, a 100% Barzan subsidiary, utilized DIMDEX 2026 to announce major expansions in its capability. The strategic importance of Barood cannot be overstated; in a high-intensity conflict, the consumption of small arms ammunition (SAA) is voracious, and reliance on external supply chains is a critical vulnerability.2

The exhibition saw the signing of key agreements that underscore Barood’s evolution from a “loading” facility to a full-spectrum manufacturer. A major Memorandum of Understanding (MoU) with South Korean giant Poongsan facilitates the transfer of technology for high-volume propellant and primer manufacturing. Primers are often the bottleneck in ammunition production; by domesticating this capability, Barood ensures Qatar’s autonomy.20

Furthermore, a strategic Letter of Intent (LoI) with KNDS France (formerly Nexter) was signed to localize medium and large-caliber ammunition. While this primarily impacts 30mm and 155mm stocks, it has direct implications for small arms, particularly in the production of high-grade 12.7mm (.50 BMG) ammunition. High-quality 12.7mm rounds, including armor-piercing incendiary (API) and sabot variants, are essential for the heavy machine guns that dominate the Qatari vehicle fleet.21

3. The Turkish Juggernaut: Dominating the Heavy Support Sector

If Qatar provided the venue and the strategy, Turkey provided the sheer volume of hardware. The Turkish defense industry’s presence at DIMDEX 2026 was overwhelming, occupying the largest international pavilion. In the small arms sector, Turkish firms have effectively cornered the market for heavy machine guns and vehicle-mounted secondary armaments. This dominance is not accidental; it is the result of a deliberate “G2G” (Government-to-Government) alignment between Ankara and Doha that has deepened significantly since 2017.

3.1 Sarsılmaz: From Infantry to Armor Integration

Sarsılmaz, a titan of the Turkish firearms industry with over 140 years of history, used DIMDEX 2026 to showcase its transition from a small arms manufacturer to a systems integrator. The company has moved beyond simply selling pistols and rifles to individual soldiers; they are now integrating their weapons into the heavy platforms that form the backbone of the Qatari military.5

The SAR 127 MT Heavy Machine Gun

The star of the Sarsılmaz booth was undoubtedly the SAR 127 MT. This 12.7x99mm (.50 caliber) machine gun represents Turkey’s answer to the ubiquitous Browning M2HB. Its presence in Doha is intrinsically linked to Qatar’s procurement of Turkish armor. As Qatar acquires Turkish BMC Amazon or Kirpi vehicles, the SAR 127 MT comes attached as the standard organic firepower, replacing legacy US-supplied M2s.5

The SAR 127 MT features a Quick-Change Barrel (QCB) system, allowing sustained fire support—a critical requirement for the hot, arid environment of the Gulf where barrel overheating is a rapid onset issue. It has a variable rate of fire, adjustable between 900 and 1,200 rounds per minute, offering a density of fire superior to the standard M2HB’s ~500 rpm. This high rate of fire is particularly relevant for anti-air and anti-drone applications, increasing the probability of a hit against fast-moving aerial targets.7

The SAR 56 and Special Forces Focus

Sarsılmaz also displayed the SAR 56, a 5.56mm piston-driven carbine designed specifically for Turkish Special Forces. Its presence at DIMDEX suggests marketing toward Qatar’s Joint Special Forces (QJSF). The rifle features a 5-position adjustable gas regulator, crucial for reliable operation with the suppressors that were also heavily featured in the display. The SAR 56 serves as a potential “off-the-shelf” alternative for Qatar should the indigenous KMA or Bindig projects face production delays.4

3.2 CANiK (Samsun Yurt Savunma): The Systems Approach

CANiK has moved beyond its reputation as a pistol manufacturer to become a powerhouse in the medium-caliber domain. Their showcase was defined by the M2 QCB and its integration into maritime platforms. The rivalry between Sarsılmaz and CANiK was palpable on the show floor, driving innovation and competitive pricing that benefits the Qatari buyer.25

Maritime Dominance and the Salvo USV

The most notable display was the TRAKON Lite Remote Controlled Weapon Station (RCWS) mounted on the Salvo Unmanned Surface Vehicle (USV). The Qatari Coast Guard and Navy have taken delivery of the first armed USVs, which are armed with CANiK’s M2 QCB 12.7mm guns. This signals a major shift: small arms are no longer just “soldier systems”; they are now critical sub-components of unmanned naval assets. The M2 QCB’s corrosion resistance and “maritimeization” were key selling points in Doha, addressing the severe salinity issues faced in Gulf waters.28

The following table compares the two primary competitors in the heavy machine gun sector showcased at DIMDEX 2026. This comparison highlights the technical nuances that procurement officers are evaluating.

| Feature / Spec | Sarsılmaz SAR 127 MT | CANiK M2 QCB |

| Caliber | 12.7x99mm NATO (.50 BMG) | 12.7x99mm NATO (.50 BMG) |

| Weight (Receiver) | ~38 kg | ~38 kg (Standard M2 Spec) |

| Operating Principle | Short Recoil, Open/Closed Bolt Hybrid | Short Recoil |

| Rate of Fire | 900 – 1,200 RPM (Adjustable) | 450 – 600 RPM (Standard), M2F variant is faster |

| Effective Range | 1,830 m | 1,830 m |

| Barrel Life | High durability stellite liner | Rated for 20,000+ rounds (Double standard life) |

| Key Differentiator | High ROF for Air Defense/Anti-Drone | Extreme durability / “Maritimeized” coating |

| Primary Integration | Land Vehicles (BMC Kirpi/Amazon), Altay Tank | Naval Platforms (Salvo USV), Fast Attack Craft |

3.3 MKE and the Anti-Drone Imperative

Makine ve Kimya Endüstrisi (MKE), the Turkish state-owned entity, focused on a specific niche: the TOLGA Short-Range Air Defence System. While TOLGA is a system, its lethality is derived from small-to-medium caliber ballistics. MKE highlighted a new line of “atomized” ammunition designed to detonate and create a particulate cloud, specifically engineered to shred the rotors of micro-UAVs. This reflects the growing need to counter asymmetric threats with cost-effective kinetic solutions rather than expensive missiles.30

MKE and Barzan signed a specific JV for the production of explosives and this air defense ammunition in Qatar, further reinforcing the localization theme. This agreement ensures that Qatar will have a domestic supply of the specialized warheads required to defend its critical infrastructure against drone swarms.30

4. The UAE’s EDGE Group: Aggressive Export Expansion

Making its debut at DIMDEX, the UAE’s EDGE Group occupied a massive stand, signaling that the Emirates are no longer content with just supplying their own forces. They are actively competing with European suppliers for Qatari contracts—a notable development given the complex diplomatic history between the two nations. The presence of EDGE is a sign of pragmatic détente; where politics may differ, the defense market provides a common ground for cooperation and competition.32

4.1 Caracal’s “Sultan” Class Portfolio

Caracal, the small arms entity of EDGE, displayed a portfolio designed to cover every infantry role, positioning itself as a one-stop-shop for small arms procurement.

- CAR 816 & 817: The staple assault rifles (5.56mm and 7.62mm respectively) were ubiquitous. The CAR 816 has already seen extensive export success (South Korea, India), and Caracal positioned it in Doha as a “battle-proven” alternative to the M4, citing its gas-piston reliability in desert conditions. The “Sultan” variant, named after a fallen Emirati hero, was showcased as the premium offering, featuring upgraded furniture and match-grade barrels.34

- CSA 338 Sniper System: The highlight for precision shooters was the CSA 338. This semi-automatic sniper system offers multi-caliber capability (.338 Lapua Magnum,.308 Win, 6.5 Creedmoor). Caracal representatives touted a patented system that ensures the rifle returns to “zero” immediately after a barrel change, a notorious difficulty in multi-caliber systems. This addresses a key logistical pain point for special forces who need to switch between training ammunition (.308) and operational long-range rounds (.338) without extensive re-zeroing.36

- CLMG 556: The display of the belt-fed 5.56mm Light Machine Gun (LMG) signifies Caracal’s entry into the squad support market, directly challenging the FN Minimi/M249. By offering a complete squad package (Rifle, DMR, LMG, Pistol), Caracal simplifies logistics for potential buyers, offering a single point of contact for training and spare parts.37

4.2 Lahab: Sovereign Ammo

Lahab, EDGE’s ammunition entity, showcased its full range of NATO-standard munitions. Their presence was a direct display of the UAE’s complete vertical integration—from brass casing manufacture to propellant mixing. For Qatari buyers, this presents a “regional” security of supply option, distinct from US or European supply chains which can be stretched by conflicts in Ukraine or elsewhere. The compatibility of Lahab ammunition with NATO standards ensures it can feed the diverse arsenal of the Qatari military.33

5. Western Innovation: Maintaining the Elite Niche

While the “mass” market at DIMDEX 2026 shifted toward Turkish and Local options, Western manufacturers retained a stronghold on the high-end, elite tier of weaponry. Brands like Sig Sauer and Beretta (via its Italian parent innovations) continue to define the bleeding edge of small arms technology.

5.1 Sig Sauer: The “Next Generation” Effect

Sig Sauer utilized the exhibition week to introduce the P211-GT4 and GT5. These are hammer-fired, competition-grade pistols that harken back to the legendary P210. Their launch at a defense show (alongside the US SHOT Show occurring concurrently) suggests a targeting of elite police units and special intervention teams (like Qatar’s Lekhwiya) who prioritize trigger feel and precision over the striker-fired simplicity of standard issue sidearms.10

The “prestige” of the US Army’s Next Generation Squad Weapon (NGSW) selection hung over the Sig Sauer booth. The company showcased the 6.8x51mm hybrid ammunition technology, positioning it as the future standard that Gulf allies will eventually need to adopt to maintain interoperability with US Central Command (CENTCOM) forces. While widespread adoption of the 6.8mm cartridge in the Gulf is likely years away, special forces units are undoubtedly evaluating the platform for its ability to defeat modern body armor at extended ranges.39

5.2 KNDS: The Lethality Upgrade

KNDS France (formerly Nexter) focused on the lethality of its platforms, specifically the VBCI MkII infantry fighting vehicle. The weapon system of note here is the 40mm Cased Telescoped Ammunition (CTA) gun.8

KNDS highlighted the A3B (Anti-Aerial Airburst) round. This programmable munition is capable of engaging drone swarms. By compressing the propellant around the projectile (telescoped), the ammunition is 30% smaller than conventional rounds, allowing vehicles to carry a larger combat load—a critical factor for sustained engagements against loitering munitions. This technology represents the “upper limit” of what might be considered a small/medium arm, bridging the gap into cannon territory, but it is operated by the infantry squad’s vehicle support element.9

6. The Russian Presence: The Ghost in the Room

Russia’s presence at DIMDEX 2026 was a study in ambiguity. Rosoboronexport, the state arms exporter, maintained a booth, but the messaging was low-profile compared to the bombastic Turkish and Emirati pavilions. While snippets indicated Rosoboronexport’s simultaneous focus on UMEX 2026 in Abu Dhabi with “single exhibits” of drones, their DIMDEX footprint focused on legacy small arms marketing—the AK-12, AK-15, AK-19, and the Chukavin sniper rifle.42

The AK-19, chambered in 5.56x45mm NATO, is Russia’s specific export pitch to countries like Qatar that are standardized on Western ammunition. However, with sanctions biting and supply chains constrained by the war in Ukraine, the feasibility of large-scale Russian small arms deliveries remains questionable. Russia’s presence serves more as a geopolitical placeholder, a reminder that they remain an alternative supplier should Western relations sour, rather than a primary source for immediate procurement.44

7. Optics and Fire Control: The Force Multipliers

The small arm is only as good as its sighting system. DIMDEX 2026 revealed a bifurcated market in optics, with Turkish and European firms vying for dominance.

7.1 Aselsan’s Electro-Optic Dominance

Turkish firm Aselsan was ubiquitous. Their optics were not just on Turkish guns; they were integrated into Qatari vehicle programs and naval stations. The ASELFLIR-500 system, while primarily an aerial gimbal, features technology that trickles down to the heavy weapon sights used on the SARP and SMASH remote weapon stations. These thermal/day sights provide the “hunter-killer” capability that turns a dumb machine gun into a precision engagement system, capable of spotting targets at night or through smoke.46

7.2 Steiner and the Beretta Ecosystem

Through the Beretta/Bindig partnership, Steiner Optics (a Beretta subsidiary) maintained a strong presence. The M7Xi military scopes were displayed on the Bindig/Beretta sniper rifles. These optics, known for their ruggedness and high light transmission, remain the preferred choice for the Western-trained snipers of the Qatari Emiri Land Forces. The integration of “smart” features, such as ballistic calculators and laser rangefinders directly into the optic housing, represents the next frontier for infantry precision.47

8. Deep Analysis: The Geopolitical Implications of Hardware Trends

The hardware displayed at DIMDEX 2026 tells a story deeper than ballistics. It reveals the shifting tectonic plates of Gulf alliances.

8.1 The “Qatar-Turkey-Pakistan” Axis

The interoperability between Qatari investment (Barzan), Turkish industry (Sarsılmaz/Aselsan/MKE), and Pakistani manpower/support (often integrated into Qatari training) is creating a distinct “Sunni Bloc” standard. The adoption of Turkish 12.7mm guns and Aselsan optics standardizes logistics across these allied nations, reducing dependence on NATO standards that come with political strings attached (e.g., human rights vetting from the US or Germany). This axis provides a level of strategic depth and resilience that buying purely Western equipment cannot matching.

8.2 The Decline of European “Volume” Sales

European manufacturers like HK or FN Herstal, once the default for Gulf armies, are being pushed into a “boutique” role. They still supply the absolute elite units, but the “volume” contracts—equipping the regular infantry battalions, vehicle fleets, and conscript forces—are moving to JVs like Bindig or Turkish suppliers. This is driven by the European reluctance (or regulatory inability) to offer the depth of technology transfer that Qatar now demands. The “Bindig” model proves that Qatar is willing to pay a premium for the factory, not just the gun.

8.3 The “Post-American” Supply Chain?

While US firms like Sig Sauer are present, the core of the new procurement—basic rifles, ammo, and machine guns—is increasingly “ITAR-free.” Qatar is effectively “hedging” its inventory. By producing 5.56mm and 7.62mm ammo locally (Barood) and manufacturing rifles domestically (BIG/Bindig), Qatar is insulating itself from any potential future US arms embargoes, learning lessons from the 2017 blockade crisis. The strategic goal is not to replace the US, but to reduce dependency to a manageable level.

9. Future Outlook: The “Smart” Small Arm

Looking ahead to DIMDEX 2028, the trend lines visible in 2026 suggest the emergence of the “Smart Small Arm” in the Gulf.

- Fire Control for Everyone: With Aselsan and Steiner pushing the costs down, we expect to see ballistic computers (smart scopes) moving from sniper rifles to standard infantry machine guns and DMRs. This will democratize accuracy, allowing average soldiers to make hits at extended ranges previously reserved for specialists.

- Anti-Drone Standardization: By 2028, it is likely that every squad-level support weapon (LMG/HMG) will have a dedicated anti-drone sight and ammunition type. The MKE TOLGA and KNDS A3B concepts are the pioneers of this new standard, which will become mandatory for force protection.

- Full Sovereignty: By 2028, the “Bindig” and “Barood” facilities should be fully operational. The test will be whether they can maintain quality control at scale—a challenge that has plagued other indigenous manufacturing attempts in the region. If successful, Qatar could become a net exporter of small arms ammunition to its allies in the Horn of Africa and the wider Middle East.

10. Conclusion

DIMDEX 2026 will be remembered as the moment Qatar’s defense industry graduated. The exhibition floor demonstrated that Barzan Holdings has successfully executed its mandate: to convert petrodollars into industrial capability. For the global small arms analyst, the takeaways are clear: to sell to Qatar, you must build in Qatar. The Bindig and Barood models are the only path forward for major contracts. Turkey is the new heavy-weight, and competitors must now benchmark against Sarsılmaz and CANiK on price and integration. Finally, the drone is the target; small arms development is now inextricably linked to C-UAS. The “Global Hub” is no longer just a slogan; in the specific niche of small arms, Doha has built a functional, sovereign ecosystem that will influence regional procurement for the next decade.

11. Appendix: Methodology

This report was compiled using a Deep Research methodology that synthesized disparate open-source data points into a cohesive intelligence product.

Data Sources:

- Primary Exhibitor Materials: Press releases, brochures, and product specification sheets from Barzan Holdings, EDGE Group, Sarsılmaz, CANiK, and Rosoboronexport were analyzed to extract technical data and strategic messaging.

- Event Coverage: Real-time reporting from specialized defense news outlets (Naval News, EDR Magazine, Joint Forces News, DefenseHere) covering DIMDEX 2026, UMEX 2026, and SHOT Show 2026 provided situational awareness and verified exhibitor claims.

- Corporate Filings: Analysis of joint venture structures (Bindig, Barood) and financial disclosures regarding contract values offered insights into the commercial viability and scale of the announced projects.

Analytical Technique:

- Cross-Reference Verification: Claims of “indigenous production” were cross-referenced with global supply chain data (e.g., Wilcox Industries’ link to BIG rifles) to determine the true level of localization versus assembly.

- Trend Extrapolation: Individual product launches (like anti-drone ammo) were aggregated to identify broader market shifts (the C-UAS infantry layer) and predict future procurement requirements.

- Geopolitical Overlay: Hardware procurements were analyzed through the lens of regional diplomatic relations (Turkey-Qatar alliance, UAE-Qatar détente) to explain vendor selection biases and market access dynamics.

Limitations:

- Conflict of Interest in Reporting: Much of the available data comes from state-sponsored entities (Barzan, EDGE), which may naturally overstate the degree of domestic manufacturing capability for prestige purposes.

- Concurrent Events: The simultaneous timing of UMEX 2026 (Abu Dhabi) and SHOT Show (Las Vegas) created a dispersed news cycle. Some small arms announcements relevant to the Gulf may have been overshadowed by major US commercial releases or drone technology reveals in Abu Dhabi.

- Opaque Contract Details: While values were often announced (e.g., “billions”), specific unit counts for small arms deliveries are rarely disclosed, requiring estimation based on force structures.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Doha International Maritime Defence Exhibition and Conference (DIMDEX 2026) Announces Barzan Holdings as Strategic Partner and Gold Sponsor for the Ninth Edition of the Event, accessed January 26, 2026, https://dimdex.com/News/doha-international-maritime-defence-exhibition-and-conference-dimdex-2026-announces-barzan-holdings-as-strategic-partner-and-gold-sponsor-for-the-ninth-edition-of-the-event/

- Drones, Iran’s presence and Qatari branding: The notable sights from DIMDEX, accessed January 26, 2026, https://breakingdefense.com/2022/03/drones-irans-pressence-and-qatari-branding-the-notable-sights-from-dimdex/

- Beretta Agrees Qatar Rifle Production License | thefirearmblog.com, accessed January 26, 2026, https://www.thefirearmblog.com/blog/2018/03/22/beretta-agrees-qatar-rifle-production-license/

- Sarsılmaz showcases latest firearms (Video) – Defensehere, accessed January 26, 2026, https://defensehere.com/en/sarsilmaz-showcases-latest-firearms-video/

- ATAK-II Contract Signed for the New Heavy Class Attack Helicopter – Turkish Naval Forces Sail on Territorial Waters with Blue Homeland Drill – Defence Turkey Magazine, accessed January 26, 2026, https://www.defenceturkey.com/files/issues/DT_91_web.pdf

- CANİK Delivered 750 Anti-Aircraft to the TAF – TURDEF, accessed January 26, 2026, https://turdef.com/article/canik-delivered-750-anti-aircraft-to-the-taf

- SAR 127 MT – Sarsılmaz, accessed January 26, 2026, https://www.sarsilmaz.com/en/product/sar-127-mt

- KNDS France Showcases its Tailor Made Solutions for Qatari Forces at DIMDEX 2026, accessed January 26, 2026, https://www.defaiya.com/news/Defense%20News/Europe/2026/01/19/knds-france-showcases-its-tailor-made-solutions-for-qatari-forces-at-dimdex-2026

- More than 40 years of Franco-Qatari cooperation: KNDS Ammo’s expertise in support of the Qatari Armed Forces – ZAWYA, accessed January 26, 2026, https://www.zawya.com/en/press-release/companies-news/more-than-40-years-of-franco-qatari-cooperation-knds-ammos-expertise-in-support-of-the-qatari-armed-forces-ohyvagvz

- SIG SAUER Introduces P211-GT4 and GT5 | Joint Forces News, accessed January 26, 2026, https://www.joint-forces.com/defence-equipment-news/88494-sig-sauer-introduces-p211-gt4-and-gt5

- dimdex 2026, accessed January 26, 2026, https://dimdex.com/

- accessed January 26, 2026, https://www.defenseadvancement.com/events/dimdex/

- DIMDEX 2026 in Qatar Concludes | Joint Forces News, accessed January 26, 2026, https://www.joint-forces.com/world-news/expos-and-exhibitions/88621-dimdex-2026-in-qatar-concludes

- Barzan exec talks new business plan, unveils agreements and new platforms, accessed January 26, 2026, https://breakingdefense.com/2026/01/barzan-exec-talks-new-business-plan-unveils-agreements-and-new-platforms/

- Barzan Holdings Spreads its Wings, Facilitates Growth of Domestic Defence Industry, accessed January 26, 2026, https://gbp.com.sg/stories/barzan-holdings-spreads-its-wings-facilitates-growth-of-domestic-defence-industry/

- BDT UK Project GRAYBURN Strategy | Joint Forces News, accessed January 26, 2026, https://www.joint-forces.com/defence-equipment-news/85161-bdt-uk-project-grayburn-strategy

- BARZAN Industrial Group Unveils New KMA 762 Modular Rifle – Global Business Press, accessed January 26, 2026, https://gbp.com.sg/stories/barzan-industrial-group-unveils-new-kma-762-modular-rifle/

- Barood Factory QSTP-LLC Qatar – AmmoTerra, accessed January 26, 2026, https://ammoterra.com/company/barood-factory-qstp-llc

- Qatar Armed Forces ink contracts, MoUs with local, international defense companies, accessed January 26, 2026, https://www.zawya.com/en/world/middle-east/qatar-armed-forces-ink-contracts-mous-with-local-international-defense-companies-rk7cm4m6

- Barzan Holdings Signs MoUs with QAF, Poongsan – Global Business Press, accessed January 26, 2026, https://gbp.com.sg/stories/barzan-holdings-signs-mous-with-qaf-poongsan/

- KNDS France and BARZAN Holdings Sign Letter of Intent at DIMDEX to Localise Medium and Large-Calibre Ammunition | Defense Arabia, accessed January 26, 2026, https://english.defensearabia.com/knds-france-and-barzan-holdings-sign-letter-of-intent-at-dimdex-to-localise-medium-and-large-calibre-ammunition/

- SARSILMAZ: “Integrated Power” at SHOT Show 2026-C4Defence, accessed January 26, 2026, https://www.c4defence.com/en/sarsilmaz-shot-show-2026-integrated-power/

- President of Defense Industries Prof. Dr. İsmail Demir: “We Witnessed SARSILMAZ’s Achievements Firsthand” – Sarsılmaz, accessed January 26, 2026, https://www.sarsilmaz.com/en/new_detail/president-of-defense-industries-prof-dr-ismail-demir-we-witnessed-sarsilmaz-s-achievements-firsthand

- Sarsılmaz SAR 127MT-Altay: A METAL STORM for the Enemy! – YouTube, accessed January 26, 2026, https://www.youtube.com/watch?v=SEbHO0vyv8Q

- CANiK, AEI Systems and UNIROBOTICS Take to the Field at SHOT Show, IAV and DIMDEX – C4Defence, accessed January 26, 2026, https://www.c4defence.com/en/sys-group-global-showcase-2026/

- CANiK to display its pistols and machine guns at defense exhibition in Saudi Arabia, accessed January 26, 2026, https://defensehere.com/en/canik-to-display-its-pistols-and-machine-guns-at-defense-exhibition-in-saudi-arabia/

- FNSS Brings ÇAKA 30/AT-O & ÇAKA AT-K Anti-Tank Guided Missile System RCT to the Show – Global Business Press, accessed January 26, 2026, https://gbp.com.sg/stories/fnss-brings-caka-30-at-o-caka-at-k-anti-tank-guided-missile-system-rct-to-the-show/

- Turkish Navy Commissions SALVO USV with TRAKON Lite RCWS – TURDEF, accessed January 26, 2026, https://turdef.com/article/turkish-navy-commissions-salvo-usv-with-trakon-lite-rcws

- SAHA EXPO 2022 International Defense and Aerospace Exhibition Begins in İstanbul, accessed January 26, 2026, https://www.defenceturkey.com/sahaexpo2.pdf

- MKE and Barzan Holding agree to establish joint venture at DIMDEX …, accessed January 26, 2026, https://defensehere.com/en/mke-and-barzan-holding-agree-to-establish-joint-venture-at-dimdex-2026/

- MKE Archives – EDR Magazine, accessed January 26, 2026, https://www.edrmagazine.eu/tag/mke

- Media – EDGE Group, accessed January 26, 2026, https://edgegroupuae.com/media

- EDGE Marks First Participation at DIMDEX With a Large-Scale Defence Capability Display, accessed January 26, 2026, https://edgegroupuae.com/news/edge-marks-first-participation-dimdex-large-scale-defence-capability-display

- Caracal International honours martyr – Nation Shield ::Military and Strategy Magazine, accessed January 26, 2026, https://www.nationshield.ae/index.php/home/details/reports/caracal-international-honours-martyr/en

- LIMA 2023 – Caracal UAE small arms manufacturer expands its footprint in Asia, accessed January 26, 2026, https://www.edrmagazine.eu/caracal-uae-small-arms-manufacturer-expands-its-footprint-in-asia

- IDEX 2025 – Caracal goes multi-calibre, and not only – EDR Magazine, accessed January 26, 2026, https://www.edrmagazine.eu/idex-2025-caracal-goes-multi-calibre-and-not-only

- Inside EDGE – Caracal, small arms from the UAE – EDR Magazine, accessed January 26, 2026, https://www.edrmagazine.eu/caracal-small-arms-from-the-uae

- EDGE Entity LAHAB Signs Agreement to Further Enhance Safety and Quality of UAE Ammunition – EDR Magazine, accessed January 26, 2026, https://www.edrmagazine.eu/%E2%96%BA-edge-entity-lahab-signs-agreement-to-further-enhance-safety-and-quality-of-uae-ammunition

- Security & Defence European – Euro-sd, accessed January 26, 2026, https://euro-sd.com/wp-content/uploads/2022/05/ESD_5_2022_web.pdf

- Security & Defence European – Euro-sd, accessed January 26, 2026, https://euro-sd.com/wp-content/uploads/2024/02/ESD_2_2024.pdf

- KNDS France Unveils Combat-Proven Systems for Qatari Forces, accessed January 26, 2026, https://defenceleaders.com/news/knds-france-showcases-vbci-mkii-for-qatar/

- Rosoboronexport to present Russian spacecraft for the first time at the 11th International Meeting of High-Ranking Officials Responsible for Security Matters | defence21, accessed January 26, 2026, https://www.defence21.com/en/rosoboronexport-present-russian-spacecraft-first-time-11th-international-meeting-high-ranking

- Special analytical export project of the United Industrial Publishing, accessed January 26, 2026, http://www.promweekly.ru/archive/ramg/2025/RAMG_05_2025.pdf

- Rosoboronexport Highlights New Russian Small Arms – Global Business Press, accessed January 26, 2026, https://gbp.com.sg/stories/idex-rosoboronexport-highlights-new-russian-small-arms/

- ROSOBORONEXPORT notes increase in the pace of development and production of Russian small arms – Defensehere, accessed January 26, 2026, https://defensehere.com/en/rosoboronexport-notes-increase-in-the-pace-of-development-and-production-of-russian-small-arms/

- ASELSAN Exports ASELFLIR 500 EO/IR System to 20+ Countries – TURDEF, accessed January 26, 2026, https://turdef.com/article/aselsan-exports-aselflir-500-eo-ir-system-to-20-countries

- Companies line up for the UK MIV programme – EDR Magazine, accessed January 26, 2026, https://www.edrmagazine.eu/companies-line-for-uk-miv

- New Steiner-Optik M-Series M7Xi and M7Xi IFS Scopes | Joint Forces News, accessed January 26, 2026, https://www.joint-forces.com/defence-equipment-news/34363-new-steiner-optik-m-series-m7xi-and-m7xi-ifs-scopes