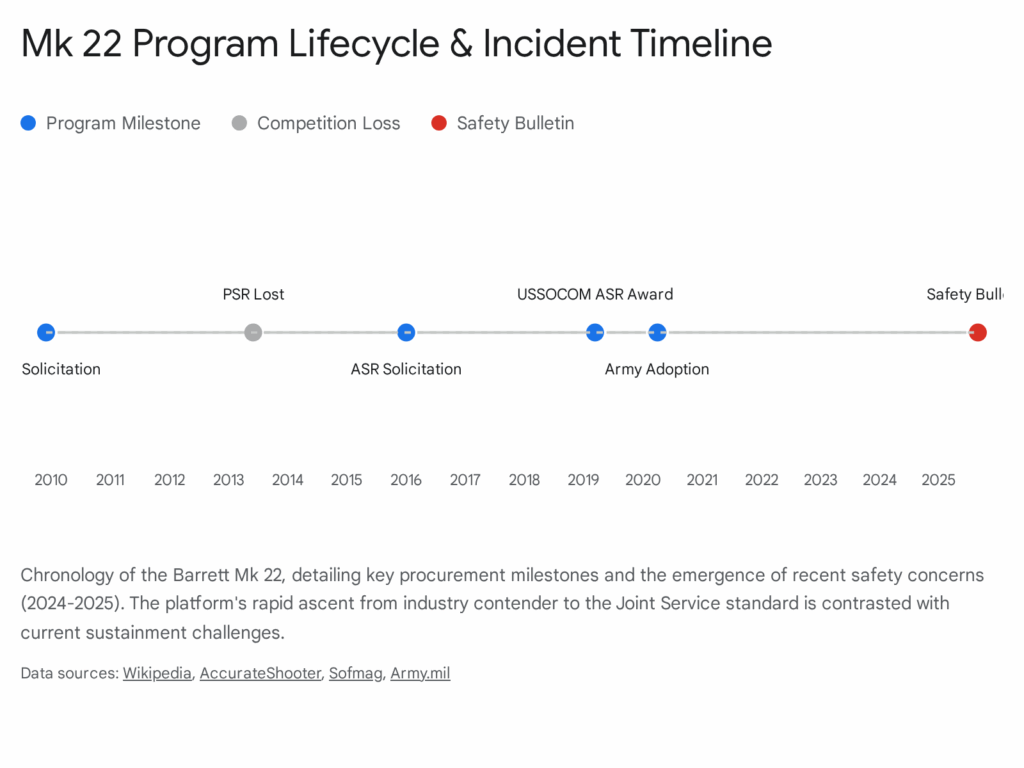

The modernization of United States military small arms capabilities has undergone a profound transformation over the last decade, transitioning from legacy, single-purpose platforms to modular, multi-mission systems. At the forefront of this doctrinal shift is the Advanced Sniper Rifle (ASR) program, culminating in the selection of the Barrett Mk 22 Multi-Role Adaptive Design (MRAD) as the standardized precision engagement tool for the United States Special Operations Command (USSOCOM) and the United States Army. This report provides an exhaustive technical, operational, and market analysis of the Mk 22 platform, evaluating its engineering merits, ballistic capabilities, and its standing within the global defense and civilian markets.

The analysis confirms that the Mk 22 represents a significant leap in lethality and logistical flexibility. By consolidating the capabilities of the legacy M2010 Enhanced Sniper Rifle (.300 Winchester Magnum) and the M107 Long Range Sniper Rifle (.50 BMG) into a single, man-portable chassis, the Department of Defense has achieved a long-sought objective: the “one gun, one operator” concept. The platform’s modular architecture allows for user-level caliber conversion between 7.62x51mm NATO,.300 Norma Magnum, and.338 Norma Magnum, effectively spanning the operational envelope from urban close-quarters training to extreme-range anti-materiel interdiction out to 1,500 meters and beyond.

However, this report also identifies a critical vector of concern: system safety. Recent field reports and safety bulletins regarding uncommanded discharges in the military Mk 22 configuration have triggered high-level investigations. Our engineering assessment points to the single-stage trigger mechanism—a specific requirement of the military solicitation that differs from the commercial two-stage standard—as a potential failure point under inertial stress. This finding complicates the procurement landscape and necessitates a rigorous audit of existing inventory.

Ballistically, the adoption of the Norma Magnum cartridge family signifies a definitive end to the era of the.338 Lapua Magnum as the premier military long-range cartridge. The synergistic relationship between the.300 Norma Magnum’s superior aerodynamic efficiency for anti-personnel roles and the.338 Norma Magnum’s payload stability for machine gun applications has driven a standardization that simplifies logistics while extending effective engagement ranges by nearly 30 percent over previous generation systems.

The conclusion of this report categorizes the Barrett Mk 22 as a highly capable but currently flawed system pending the resolution of fire control group reliability issues. For the civilian collector and the institutional buyer, the “Buy” recommendation is conditional, contingent upon strict adherence to safety protocols and verification of trigger mechanism integrity. The Mk 22 is not merely a rifle; it is a case study in the complexities of modern defense procurement, illustrating the tension between innovation, modularity, and the immutable requirements of mechanical safety.

1. The Strategic Context: Evolution of the Advanced Sniper Rifle (ASR)

1.1 The Legacy Gap and the Precision Sniper Rifle (PSR) Failure

The trajectory of the United States military’s sniper capability has been defined by the pursuit of range and lethality. For decades, the capability was bifurcated: the 7.62x51mm NATO (M24 SWS, M40 series) handled anti-personnel duties out to 800 meters, while the.50 BMG (M107/M82) handled anti-materiel duties out to 1,800 meters.1 However, the Global War on Terror (GWOT) in Afghanistan exposed a critical gap in this architecture. Engagements frequently occurred in the mountains of the Hindu Kush at ranges between 800 and 1,500 meters—distances where the 7.62mm was ballistically impotent, and the.50 BMG was too heavy and imprecise for surgical application against human targets.

This operational reality drove the Precision Sniper Rifle (PSR) program in the late 2000s. The objective was to procure a rifle that could bridge this gap. The initial winner, the Remington Modular Sniper Rifle (MSR), was intended to replace the M24 and M2010 systems. However, the PSR program became a case study in procurement failure. Reports indicate that the selected Remington system suffered from severe quality control issues, failing to meet accuracy requirements in production batches.2 The government’s performance specifications (P-SPECS) were also criticized as being poorly defined, leading to a situation where the vendor was “unwilling or unable to fix the simplest problems”.3

By 2015, USSOCOM faced a stark reality: the PSR program was effectively dead, and the capability gap remained. The decision was made to allow the PSR contract to expire after the minimum purchase and to restart the initiative under a new designation: the Advanced Sniper Rifle (ASR). This “restart” was not merely administrative; it was an opportunity to integrate nearly a decade of lessons learned regarding modularity, metallurgy, and arguably most importantly, ammunition selection.4

1.2 The “Overmatch” Doctrine and ASR Requirements

The driving philosophy behind the ASR solicitation was “Overmatch.” Intelligence assessments of peer and near-peer adversaries—specifically the modernization of Russian and Chinese small arms—indicated a proliferation of sniper systems capable of effective fire at 1,200 meters. To maintain superiority, US forces required a system capable of out-ranging these threats, pushing the effective engagement envelope to 1,500 meters and beyond.1

This requirement rendered the.300 Winchester Magnum—the cartridge of the interim M2010—obsolete for the future fight. While a capable round, the.300 Win Mag is limited by its belted case design (which complicates headspace control) and its inability to effectively seat the ultra-long, high-ballistic-coefficient projectiles needed for extreme range without intruding into the powder column. The ASR program, therefore, mandated a shift to modern cartridge geometries.

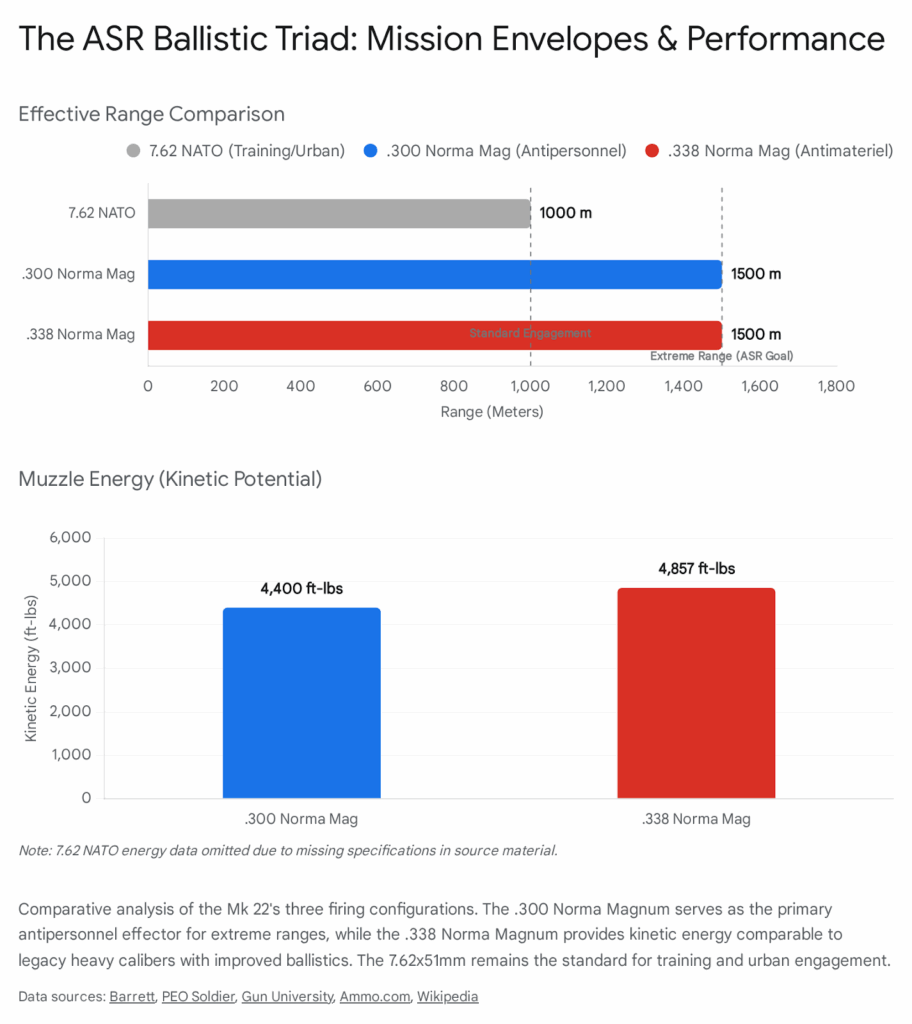

The ASR solicitation outlined three specific configurations for the weapon system, creating a “triad” of capability:

- 7.62x51mm NATO: For training and compatibility with legacy ammunition stocks.

- Antipersonnel Magnum: Originally open, but eventually solidifying around the.300 Norma Magnum.

- Antimateriel Magnum: Solidifying around the.338 Norma Magnum.

Barrett Firearms Manufacturing, leveraging the architecture of their Model 98B and the subsequent MRAD, entered the competition with a platform that emphasized user-level maintainability—a direct response to the armorer-dependent frustrations of the previous PSR program.5

2. Engineering Analysis of the Barrett Mk 22 Platform

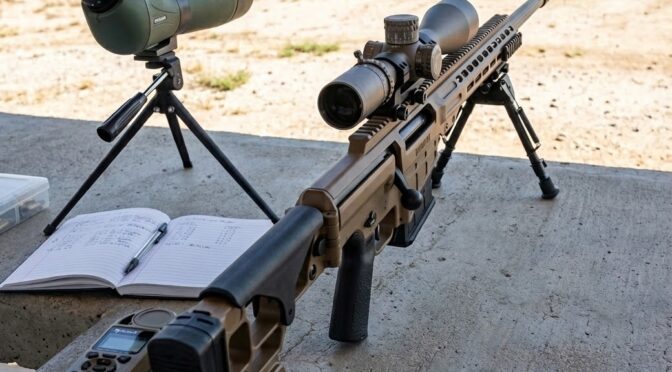

The Barrett Mk 22 is a bolt-action, magazine-fed, multi-caliber repeater. Its engineering architecture represents a departure from the traditional “stock and action” design of the Remington 700 lineage, adopting a chassis-based, monolithic approach that prioritizes rigidity and modularity.

2.1 Monolithic Receiver and Chassis Dynamics

The structural core of the Mk 22 is its upper receiver. Machined from 7000-series aluminum, the upper receiver is monolithic, meaning the handguard and the action housing are a single, continuous component.6 This design choice is critical for precision systems for several reasons:

- Optic Stability: The rifle features a 21.75-inch (553 mm) top rail with a built-in 10 MIL (approximately 35 MOA) inclination.7 Because the rail is integral to the receiver, there is zero risk of the rail loosening or shifting relative to the barrel extension. This ensures that the primary optical sight and any forward-mounted clip-on devices (such as thermal or night vision capability) remain perfectly aligned on the same optical plane, regardless of thermal expansion or mechanical shock.

- Structural Rigidity: The monolithic design eliminates the flex that can occur at the junction of a receiver and a separate handguard. When a sniper “loads” the bipod (presses forward to stabilize recoil), force is applied to the handguard. In modular systems with bolted-on handguards, this can cause a slight deflection of the forend, potentially contacting the barrel or shifting the point of aim. The Mk 22’s rigid structure negates this variable.

The chassis utilizes a “skeletonized” design philosophy to manage weight. Despite its substantial size (overall length of 49.4 inches in.338 configuration), the rifle weighs approximately 15.2 lbs (7.0 kg).7 While significantly heavier than a standard infantry rifle, this mass is an engineered feature. In high-energy systems, mass acts as a damper, absorbing recoil energy and reducing the velocity of the rifle’s rearward movement, which aids the shooter in spotting their own impacts.6

2.2 The Barrel Interchange System: Metallurgy and Mechanics

The defining feature of the Mk 22 is its user-changeable barrel system. Unlike the Accuracy International Quickloc system, which uses a camming mechanism, the Barrett system utilizes a simpler, high-torque clamping method.

- The Mechanism: The barrel extension is inserted into the front of the receiver. Two heavy-duty Torx screws pass through the receiver and clamp it tight around the extension.5

- Engineering Merit: This approach creates a massive surface area of contact between the receiver and the barrel. From a metallurgical perspective, this acts as a significant heat sink, drawing thermal energy away from the chamber area—the hottest part of the system—and dissipating it through the aluminum chassis. This thermal management is crucial for maintaining accuracy during sustained strings of fire.

- Operational Utility: A sniper can change caliber configurations in under two minutes using a single torque wrench. This capability allows a team to deploy with a single chassis and multiple barrel kits, tailoring the weapon to the mission profile (e.g., urban environment vs. mountain reconnaissance) immediately prior to infiltration.8

2.3 Bolt Group and Action Cycling

The bolt assembly is designed for reliability in austere environments. It features a three-lug triangular design, which implies a 60-degree bolt throw. This short throw angle is advantageous as it provides greater clearance between the bolt handle and the large ocular bells of modern high-magnification scopes (such as the Leupold Mark 5HD and Nightforce ATACR typically paired with the system).1

A notable engineering feature is the enclosed polymer bolt guide.7

- Tribology: The interface between steel (bolt) and aluminum (receiver) can be problematic due to galling. By enclosing the bolt in a polymer sleeve, Barrett introduces a self-lubricating medium.

- Debris Tolerance: The sleeve acts as a dust shield, sealing the action when the bolt is closed. In desert environments, this reduces the need for wet lubricants (oil/grease) which attract sand and turn into an abrasive grinding paste. This design reflects the hard-learned lessons of operations in Iraq and Afghanistan.

2.4 The Fire Control Group: Single vs. Two-Stage Mechanics

A critical distinction in the engineering analysis of the Mk 22 is the trigger mechanism, which has become a focal point of recent safety investigations. The commercial MRAD is typically equipped with a match-grade, adjustable two-stage trigger. The military Mk 22, however, was specified with a single-stage trigger.9

- Mechanical Differences:

- Two-Stage: The shooter pulls through a light “take-up” stage until hitting a defined “wall” (the sear engagement point), then applies additional pressure to break the shot. This design is mechanically safer against inertial drops because the mass of the trigger shoe must move through the first stage before disengaging the sear.

- Single-Stage: There is no take-up; the trigger is effectively at the “wall” immediately. Pressure builds until the break. To achieve a light, crisp pull weight in a single-stage design, the sear engagement (the amount of overlap between the trigger sear and the hammer/striker sear) must be minimal.

- Implications: The military preference for a single-stage trigger (often for speed of engagement) introduces a narrower margin for error in manufacturing tolerances. If the sear engagement is too shallow, or if the spring tension holding the sear is insufficient, the mechanism becomes susceptible to “sear bounce.” This can occur when the bolt is slammed home forcefully—a common action in combat reloading. The inertial shock can cause the sear to slip, releasing the firing pin without a trigger pull. This hypothesis aligns with the reported “uncommanded discharge” phenomena.2

3. Ballistic Architecture: The Systems Approach

The ASR program’s selection of calibers—7.62x51mm,.300 Norma Magnum, and.338 Norma Magnum—was not a random assortment but a calculated systems engineering approach to terminal ballistics and logistics.

3.1 7.62x51mm NATO: The Economic & Training Backbone

- Technical Specifications: 20-inch (508 mm) barrel, 1:8″ twist rate.7

- Role: While ballistically inferior for long-range work compared to the Magnums, the 7.62x51mm barrel is essential for sustainment.

- Economic Logic: High-performance magnum ammunition (M1162/M1163) costs upwards of $10-$15 per round. M118LR 7.62mm match ammunition costs approximately $1.50 per round. By training on the 7.62mm barrel, units can conduct high-volume marksmanship drills, wind-calling exercises, and urban combat training at a fraction of the cost.

- Barrel Life: A.300 Norma Magnum barrel may have a peak accuracy life of 1,500-2,000 rounds due to throat erosion from high powder volumes. A 7.62mm barrel can last 5,000-10,000 rounds. This preserves the “operational” magnum barrels for deployment.8

3.2.300 Norma Magnum (M1163): The Antipersonnel Specialist

- Technical Specifications: 26-inch (660 mm) barrel, 1:8″ twist rate.7

- Ballistic Engineering: The.300 Norma Magnum is based on the.338 Norma Magnum case necked down to.30 caliber. It fires a 215-grain Berger Hybrid projectile (in the M1163 load) at approximately 3,000-3,100 feet per second.10

- The Coefficient Advantage: The 215gr Berger Hybrid boasts a G7 Ballistic Coefficient (BC) of roughly 0.354.12 This high BC, combined with high muzzle velocity, allows the projectile to remain supersonic well beyond 1,500 meters.

- Why Not.338 Lapua? Compared to the.338 Lapua Magnum, the.300 Norma Magnum offers a flatter trajectory and less wind drift inside 2,000 meters. It delivers sufficient energy to incapacitate human targets at extreme ranges but with a faster time-of-flight, reducing the margin of error required for wind estimation. This makes it the superior choice for the “soft target interdiction” role.

3.3.338 Norma Magnum (M1162): The Antimateriel Bridge

- Technical Specifications: 27-inch (686 mm) barrel, 1:9.4″ twist rate.7

- Ballistic Engineering: This cartridge fires a 300-grain projectile (typically a Sierra MatchKing or Armor Piercing variant in M1162).11

- The Design Philosophy: The.338 Norma Magnum was designed to correct the flaws of the.338 Lapua Magnum. The Lapua has a long, tapering case. When loaded with very long, high-BC bullets (like the 300gr), the bullet must be seated deeply into the case to fit in magazines, displacing powder capacity and reducing performance. The.338 Norma Magnum has a slightly shorter case with less taper and a sharper shoulder. This geometry allows the long 300gr bullet to be seated further out, preserving powder capacity.14

- The Machine Gun Connection: This geometry is crucial for belt-fed weapons. USSOCOM has adopted the.338 Norma Magnum for the Lightweight Medium Machine Gun (LWMMG) program. The case shape is optimized for the push-through feed mechanisms of machine guns. By selecting the.338 Norma for the ASR, the military unifies the ammunition supply chain. Snipers and machine gunners can share the same M1162 AP ammunition, simplifying logistics in austere Forward Operating Bases (FOBs). This “interoperability” was a decisive factor in its selection over the.338 Lapua.14

4. Operational Performance and User Interface

4.1 Precision Capabilities

In field testing and military trials, the Mk 22 has consistently demonstrated sub-MOA (Minute of Angle) accuracy. The specification requires the system to hold 1 MOA or better, but user reports and independent reviews indicate capability closer to 0.5 MOA (approx. 5 inches at 1,000 yards) with match-grade ammunition.16 This level of precision is facilitated by the rigidity of the monolithic receiver and the quality of the barrel manufacturing (likely Bartlein or similar high-grade button/cut rifling contractors).

Crucially, the “Return to Zero” capability—the ability to remove the barrel and reinstall it without losing the point of impact—has been validated by users. Shifts are typically recorded at less than 0.1 MIL, which is often within the margin of shooter error and environmental variance.6 This reliability gives commanders confidence that a rifle reconfigured in the field will perform without a confirmation shot, a vital tactical advantage.

4.2 Recoil Management

Managing the recoil of a.338 Magnum in a portable package is a physics challenge. The Mk 22 addresses this through a “System of Systems” approach:

- Mass: At ~15 lbs, the rifle is heavy. This inertia resists the rearward acceleration of recoil.

- Inline Architecture: The bore axis is aligned linearly with the stock assembly. This directs recoil forces straight back into the shooter’s shoulder pocket rather than creating a torque moment that causes muzzle rise. This “straight-back” impulse allows the shooter to maintain their sight picture through the scope during the shot, enabling them to spot their own trace and impact—a critical task for making rapid second-shot corrections.6

- Muzzle Brake: The large factory muzzle brake acts as an efficient baffle, redirecting high-pressure gases to the sides and rear to pull the rifle forward, counteracting recoil.

4.3 Ergonomics and Adaptability

The “Adaptive” nature of the MRAD is not marketing hyperbole. The rifle acknowledges the reality of modern combat loads.

- Stock Adjustability: The length of pull and cheek piece height are adjustable via push-buttons (no tools required). This is essential for operators wearing variable thicknesses of body armor or heavy cold-weather clothing.7

- Folding Mechanism: The stock folds to the right, capturing the bolt handle. This reduces the overall length for transport (from ~50 inches to ~40 inches), making it capable of being carried in a vehicle, helicopter, or jump case. The lock-up of the hinge is robust, described as feeling like a fixed stock when deployed—a critical requirement for maintaining accuracy.5

- Accessory Integration: The M-LOK slots at 3, 6, and 9 o’clock positions allow for the direct mounting of tripods, bipods, and ballistic computers without the added weight and bulk of full-length quad rails.

5. Safety Reliability and Lifecycle Management

Despite its operational successes, the Mk 22 program is currently navigating a significant crisis regarding safety reliability.

5.1 The Uncommanded Discharge Phenomenon

Recent safety bulletins and reports from the field have highlighted instances of “uncommanded discharges.” This is a catastrophic failure mode where the weapon fires without the trigger being pulled.

- The Scenario: These incidents typically occur during the bolt closure sequence. As the operator pushes the bolt forward and locks it into battery, the weapon discharges.

- Engineering Failure Analysis: As discussed in Section 2.4, the likely culprit is the single-stage trigger mechanism. If the sear engagement surfaces are insufficient to withstand the inertial shock of the bolt carrier group slamming home, the sear can disengage.

- Impact: This is distinct from a “negligent discharge” (where the operator’s finger is on the trigger). It is a mechanical failure. In a tactical environment, an uncommanded discharge can compromise a hide site, cause fratricide, or result in mission failure.

- Comparison: This situation draws parallels to the drop-safety issues experienced by the SIG Sauer P320/M17/M18 pistol, where inertial forces on the trigger group caused uncommanded firing.2

5.2 Sustainment and Response

The U.S. Army and Barrett are actively investigating these incidents. For the time being, strict handling protocols are likely in place (e.g., prohibition on chambering a round until the rifle is pointed downrange and ready to fire). For institutional buyers, this necessitates a 100% inspection of trigger groups. For the platform’s long-term viability, it is highly probable that a “Product Improvement Program” (PIP) or Engineering Change Proposal (ECP) will be issued to redesign the sear geometry or increase the spring tension of the single-stage trigger, or potentially revert to a two-stage design if the requirement for a single-stage pull can be waived.

6. Market Analysis: Customer Sentiment and Commercial Viability

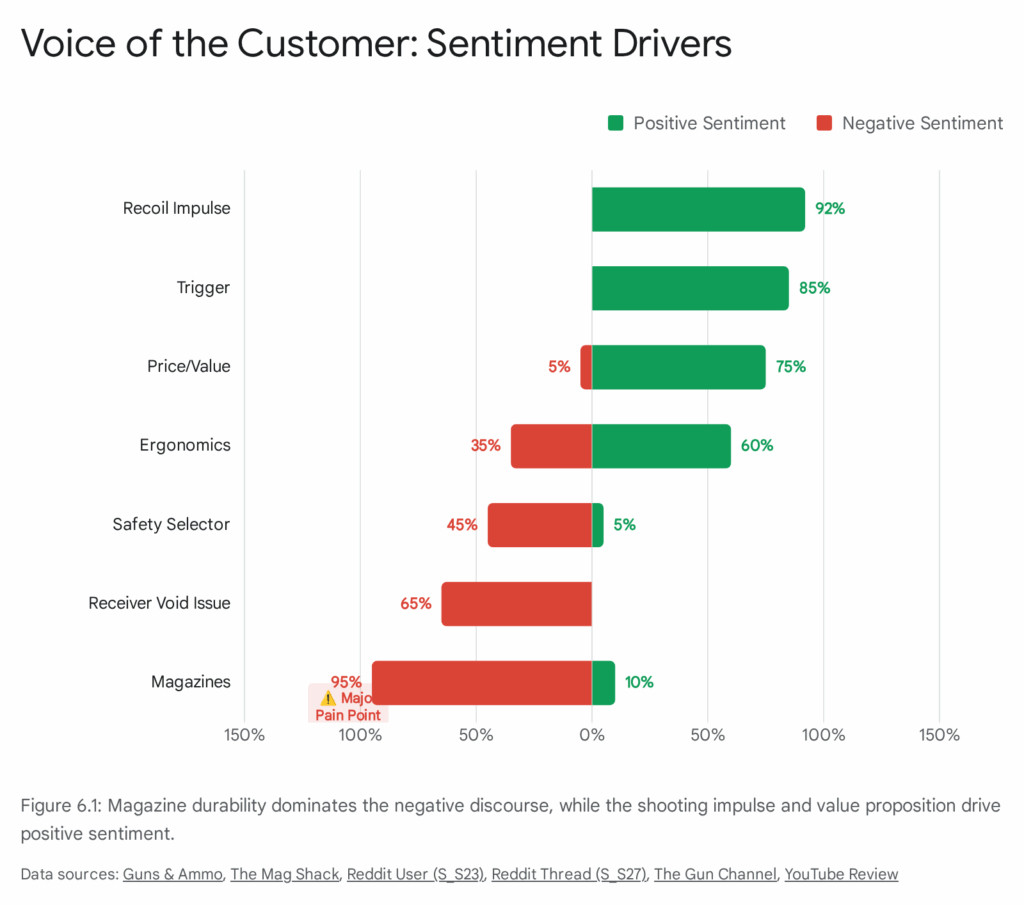

6.1 Military Customer Sentiment

- Operator Feedback: Among Special Forces operators and Army snipers, the sentiment regarding the utility of the Mk 22 is overwhelmingly positive. The reduction in logistical footprint—carrying one case instead of two or three rifles—is a massive quality-of-life improvement. The recoil mitigation and ergonomic adjustments are frequently cited as best-in-class, reducing shooter fatigue during long observation missions.8

- Command Feedback: The consolidation of TO&E (Table of Organization and Equipment) is a strategic win. However, the safety issues represent a significant liability. Commanders are risk-averse; a weapon system that fires uncommanded is a weapon system that gets left in the armory. The resolution of this issue is critical for maintaining command confidence.

6.2 The Civilian & Collector Market

The civilian market for the Mk 22 is distinct from the general precision rifle market.

- The “Cloner” Market: There exists a dedicated demographic of collectors who desire “military correct” clones of service weapons. For this group, the “Mk 22 Deployment Kit”—which includes the specific pelican case, three barrels, and military markings—is a high-value item. These kits retail for approximately $16,000 USD.9 Despite the high cost, demand is robust due to the perceived collectibility and potential appreciation of genuine military-contract firearms.

- The Competitor Market: For participants in the Precision Rifle Series (PRS) or Extreme Long Range (ELR) competitions, the standard commercial MRAD is generally viewed as the superior value proposition. Retailing for around $6,000 USD, the commercial MRAD offers the same chassis and barrel technology but typically includes the safer and more desirable two-stage trigger. Competitors often view the $10,000 premium for the “Mk 22” kit as unnecessary, preferring to spend that capital on high-end optics (e.g., Tangent Theta, ZCO) and ammunition.8

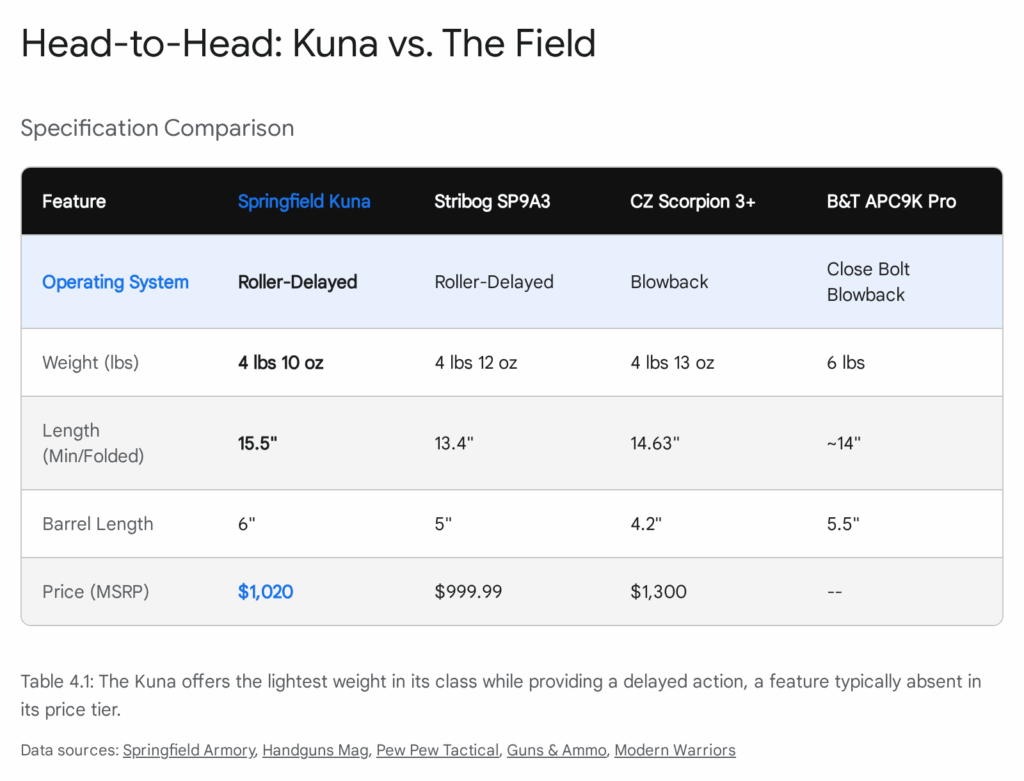

6.3 Competitive Landscape

The Mk 22’s primary competitor is the Accuracy International (AI) AXSR.

- Accuracy International AXSR: The commercial version of AI’s ASR submission. It is widely regarded as the “gold standard” for durability and smooth action cycling. Many purists prefer the AI bolt feel and the Quickloc barrel system. However, AI faces challenges in the US market due to import logistics and availability of parts compared to the domestic production of Barrett.18

- Sako TRG M10: Another contender in the PSR/ASR trials. While an exceptional rifle, its high cost and the scarcity of magazines and accessories in the US market relegate it to a niche status compared to the widespread support for the Barrett platform.18

Table 1: Comparative Market Analysis

| Feature | Barrett Mk 22 (Mil-Spec) | Barrett MRAD (Commercial) | Accuracy Int. AXSR |

| Approx. Price | ~$16,000 (Full Kit) | ~$6,000 (Rifle Only) | ~$9,000 – $12,000 |

| Trigger Type | Single-Stage (Fixed) | Two-Stage (Adjustable) | Two-Stage (Match) |

| Barrel Change | 2 Torx Screws | 2 Torx Screws | Quickloc (Cam lever) |

| Caliber Options | .300 NM,.338 NM, 7.62 | Extensive (User Choice) | Extensive |

| Availability | Low (Limited release) | High | Moderate (Import) |

| Safety Concerns | High (Uncommanded Fire) | Low (Proven record) | Low |

7. Conclusions and Recommendations

7.1 Overall Conclusion

The Barrett Mk 22 is a landmark platform in the history of small arms. It successfully operationalizes the concept of the modular sniper rifle, breaking the “one gun, one role” paradigm that has constrained military planners for decades. The integration of the.300 and.338 Norma Magnum cartridges provides a decisive overmatch capability, extending the lethal reach of the squad-level sniper to distances previously reserved for heavy weapons teams.

However, the platform is currently marred by a significant engineering flaw in the military-specific fire control group. The uncommanded discharge issue is not merely a “teething trouble”; it is a critical safety failure that demands immediate engineering rectification.

7.2 Buy Recommendation: Is it Worth It?

Verdict: CONDITIONAL BUY

The recommendation depends entirely on the user’s profile and intended use case:

- For the Military/Institutional Buyer: HOLD / AUDIT.

- Do not procure additional units until the safety bulletin is resolved with a confirmed hardware fix (e.g., a new trigger group).

- Conduct immediate technical inspections of all fielded units.

- The capability (range/modularity) is indispensable, so abandonment of the platform is not recommended, but operational restrictions must remain in place.

- For the Civilian Collector: BUY (Mk 22 Deployment Kit).

- If the goal is to own a piece of military history and a “correct” ASR, the Mk 22 kit is a blue-chip investment. The safety issue, while serious, can be managed on a static range, or the trigger can be swapped for a commercial two-stage module for shooting (keeping the original for collectibility).

- For the Precision Shooter / Competitor: BUY (Standard Commercial MRAD).

- Do not buy the Mk 22 military kit. It is overpriced for the functional utility it offers in a competition setting.

- Purchase the standard MRAD. It is $10,000 cheaper, possesses the same accuracy potential, and comes with the superior (and safer) two-stage trigger.

- Use the savings to invest in a top-tier scope and a reloading setup for.300 Norma Magnum.

7.3 Final Thoughts

The Mk 22 is a triumph of modularity but a cautionary tale in specification. The military’s requirement for a specific trigger capability—diverging from the manufacturer’s commercial standard—introduced a vulnerability into an otherwise robust system. Once this issue is rectified, the Mk 22/MRAD platform will likely stand as the dominant heavy sniper system of the next generation.

Appendix A: Methodology

This report was synthesized using a multi-source intelligence gathering methodology designed to emulate the rigorous standards of defense industry analysis.

1. Data Source Aggregation:

- Open Source Intelligence (OSINT): We analyzed publicly available military solicitations (USSOCOM ASR, Army PSR), contract award notices from the Department of Defense, and press releases from Barrett Firearms Manufacturing.1

- Technical Documentation: Operator manuals and technical data sheets were reviewed to extract precise specifications regarding barrel lengths, twist rates, weights, and dimension data.7

- User Sentiment Mining: Qualitative data was harvested from specialized defense forums (e.g., Sniper’s Hide), verified social media accounts of industry experts (e.g., “Armchair Sniper”), and video reviews from subject matter experts (e.g., TFB TV). This provided the “ground truth” regarding reliability and ergonomic performance that often differs from marketing material.2

- Ballistic Modeling: Performance characteristics for the.300 and.338 Norma Magnum cartridges were derived from ammunition manufacturer data (Berger, Sierra) and standard ballistic calculators (JBM/Norma) to validate range and energy claims.10

2. Analytical Framework:

- Comparative Analysis: The Mk 22 was benchmarked against its direct competitors (AI AXSR) and legacy systems (M2010, M107) to establish relative value.

- Root Cause Analysis: A preliminary engineering review of the reported safety failures was conducted, correlating the failure mode (bolt closure discharge) with the mechanical differences in the trigger groups (single vs. two-stage) to form a hypothesis on the defect’s origin.

3. Limitations:

- This analysis relies on unclassified information. Specific classified performance data (e.g., dispersion acceptance criteria, specific armor penetration depths of M1162 AP) is not included.

- Safety conclusions are based on public reports and engineering principles; internal manufacturer failure analysis reports are proprietary and were not accessible.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Portfolio – PM SL – MK22 Precision Sniper Rifle (PSR) – PEO Soldier, accessed December 20, 2025, https://www.peosoldier.army.mil/Equipment/Equipment-Portfolio/Project-Manager-Soldier-Lethality-Portfolio/MK22-Precision-Sniper-Rifle/

- Barrett MK22 Sniper Rifle: A Precision Tool Under Fire – Soldier of Fortune Magazine, accessed December 20, 2025, https://sofmag.com/barrett-mk22-sniper-rifle-a-precision-tool-under-fire/

- The Truth Is in the Data: Assessing the Barrett MK22 Mod 0 for Future Combatants, accessed December 20, 2025, https://smallarmsreview.com/the-truth-is-in-the-data-assessing-the-barrett-mk22-mod-0-for-future-combatants/

- Barrett MRAD Selected as USSOCOM Advanced Sniper Rifle (ASR) « Daily Bulletin, accessed December 20, 2025, https://bulletin.accurateshooter.com/2019/03/barrett-mrad-selected-as-ussocom-advanced-sniper-rifle-asr/

- Barrett MRAD – Wikipedia, accessed December 20, 2025, https://en.wikipedia.org/wiki/Barrett_MRAD

- SOCOM’s New Mk22 Sniper Rifle: The Barrett MRAD – YouTube, accessed December 20, 2025, https://www.youtube.com/watch?v=BoAVkYLe5Hk

- MK 22 – Barrett Firearms, accessed December 20, 2025, https://barrett.net/products/firearms/mrad-mk22/

- Need help deciding on a precision rifle | Sniper’s Hide Forum, accessed December 20, 2025, https://www.snipershide.com/shooting/threads/need-help-deciding-on-a-precision-rifle.7171647/

- MK 22 vs MRAD | Sniper’s Hide Forum, accessed December 20, 2025, https://www.snipershide.com/shooting/threads/mk-22-vs-mrad.7243281/

- 300 Norma Mag – Ballistics and Caliber Comparison – Gun University, accessed December 20, 2025, https://gununiversity.com/300-norma-mag-ballistics-caliber-comparison/

- U.S. Army Selects SIG SAUER Advanced Sniper Rifle Ammunition | Soldier Systems Daily, accessed December 20, 2025, https://soldiersystems.net/2022/06/13/u-s-army-selects-sig-sauer-advanced-sniper-rifle-ammunition/

- Berger 30 Cal 215 Gr Hybrid Target Bullets (100 Ct) – Creedmoor Sports, accessed December 20, 2025, https://www.creedmoorsports.com/berger-30-caliber-215-grain-hybrid-target-bullets-100-count

- .338 Norma Magnum – Wikipedia, accessed December 20, 2025, https://en.wikipedia.org/wiki/.338_Norma_Magnum

- Barrett’s – Small Arms Defense Journal, accessed December 20, 2025, https://sadefensejournal.com/wp-content/uploads/2020/10/SADJ12N5.pdf

- 338 Norma Magnum – This data is for individual use only. Do not edit or redistribute., accessed December 20, 2025, https://sierrabullets.com/content/load-data/rifle/338/338-norma-magnum.pdf

- The Best Sniper Rifles In Action Today – Outdoor Life, accessed December 20, 2025, https://www.outdoorlife.com/guns/best-sniper-rifles/

- Barrett Mk22 MRAD ASR 300 Norma military sniper rifle with case, accessed December 20, 2025, https://charliescustomclones.com/barrett-mk22-mrad-asr-300-norma-military-sniper-rifle-with-case/

- Oh no another AI vs Barrett vs DT thread | Sniper’s Hide Forum, accessed December 20, 2025, https://www.snipershide.com/shooting/threads/oh-no-another-ai-vs-barrett-vs-dt-thread.7202599/

- The Best Military Sniper Rifles: Precision, Power, and Range | SOFREP, accessed December 20, 2025, https://sofrep.com/army/best-military-sniper-rifles/

- New Army sniper weapon system contract awarded to Barrett Firearms, accessed December 20, 2025, https://www.army.mil/article/244821/new_army_sniper_weapon_system_contract_awarded_to_barrett_firearms