| This is a time-sensitive special report and is based on information available as of January 5, 2026. Due to the situation being very dynamic the following report should be used to obtain a perspective but not viewed as an absolute. |

The geopolitical architecture of the Western Hemisphere underwent a seismic reconfiguration on January 3, 2026. The direct military intervention by United States forces in Caracas, resulting in the detention of Nicolás Maduro and the installation of a transitional administration under U.S. military oversight, marks the definitive end of the Bolivarian Revolution’s quarter-century dominance over the world’s largest proven oil reserves. This operation, termed “sovereign stabilization” by the White House, transcends a mere regime change; it represents the forced reintegration of 303 billion barrels of Venezuelan crude into the U.S. strategic energy sphere and the dismantling of the foremost Russian and Chinese geopolitical beachhead in the Americas.

This report provides an exhaustive analysis of the immediate and second-order consequences of this intervention. The disruption to global energy flows, sovereign debt structures, and regional security alliances is profound. The seizure of Petróleos de Venezuela, S.A. (PDVSA) and its subsequent placement under U.S. administrative control creates a distinct set of winners and losers, reshaping the fortunes of nations far beyond the Caribbean Basin.

Our analysis identifies the Republic of Cuba as the nation facing the most immediate and existential threat, confronting a total energy collapse that jeopardizes the continuity of the state itself. China and Russia face strategic defeats of the highest order, losing tens of billions in sunk costs and critical power projection capabilities. Conversely, the United States refining sector and India stand to gain significantly from the regularization of heavy crude flows, while Guyana sees its primary existential security threat neutralized.

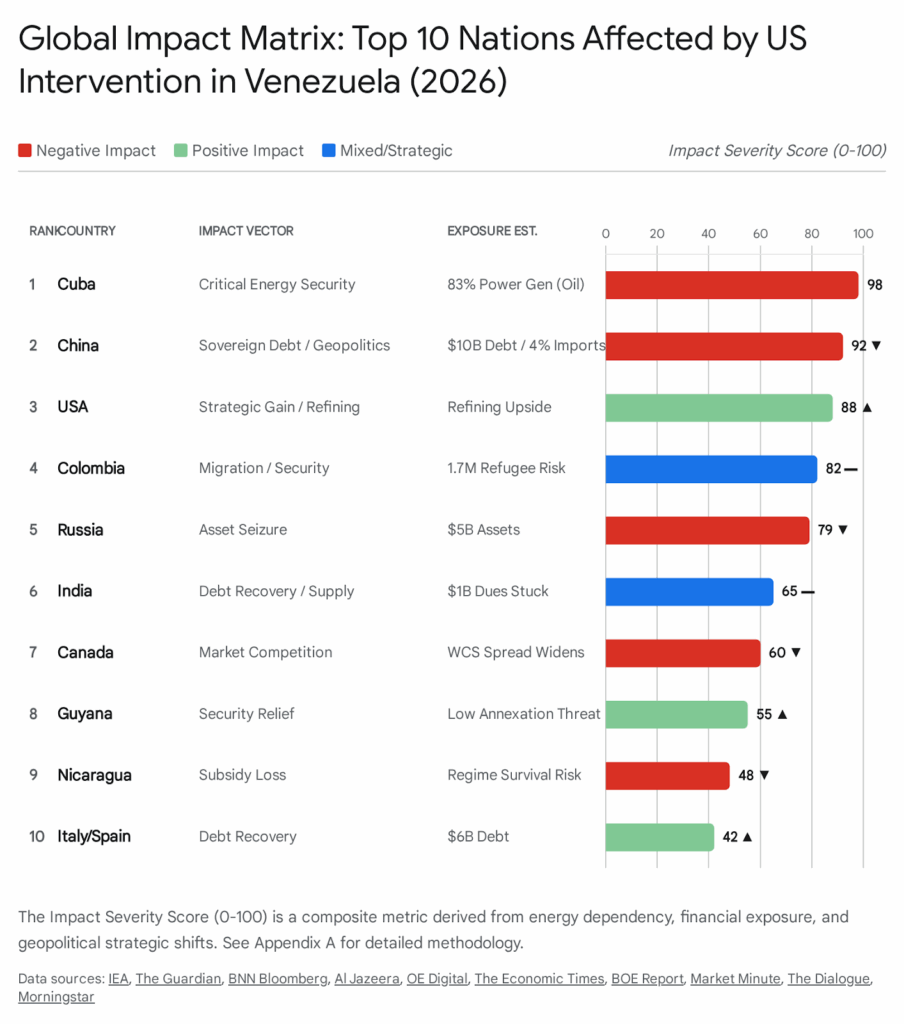

The following dashboard summarizes the “Impact Severity” across the top ten affected nations, calculated based on energy dependence, financial exposure, and geopolitical realignment risks.

1. The Strategic Context: The Return of the Monroe Doctrine

The intervention of January 2026 was not an isolated law enforcement action but the culmination of a decade-long struggle for control over the Western Hemisphere’s energy resources. The stated justification—countering “narco-terrorism”—provided the legal framework for an operation with profound geoeconomic objectives: the decoupling of Venezuela from the Sino-Russian axis and the revitalization of its oil sector under American stewardship.1

1.1 The Status of the Prize: PDVSA in 2026

At the moment of intervention, Venezuela’s oil production stood at approximately 1 million barrels per day (bpd), a shadow of its 1998 peak of 3.5 million bpd.1 The infrastructure, eroded by years of mismanagement, corruption, and sanctions, requires an estimated capital injection of billions to restore functionality.4 However, the “prize” remains unequaled: 303 billion barrels of extra-heavy crude in the Orinoco Belt, a resource base that exceeds that of Saudi Arabia.6

Control of this resource allows the United States to dictate the pace of its return to the global market. By controlling the spigot, Washington can manage global heavy crude prices, ensuring domestic refinery profitability while denying adversaries (China) their preferential access.7 This strategic recalibration drives the ranking of impacted nations detailed below.

2. Comprehensive Country Impact Analysis

Rank 1: Republic of Cuba

Classification: Existential Systemic Threat

Impact Score: 98/100

No nation faces a more catastrophic immediate future than Cuba. The U.S. intervention in Venezuela is functionally a blockade of Cuba’s energy lifeline, presenting a threat scenario exceeding the severity of the “Special Period” of the 1990s.

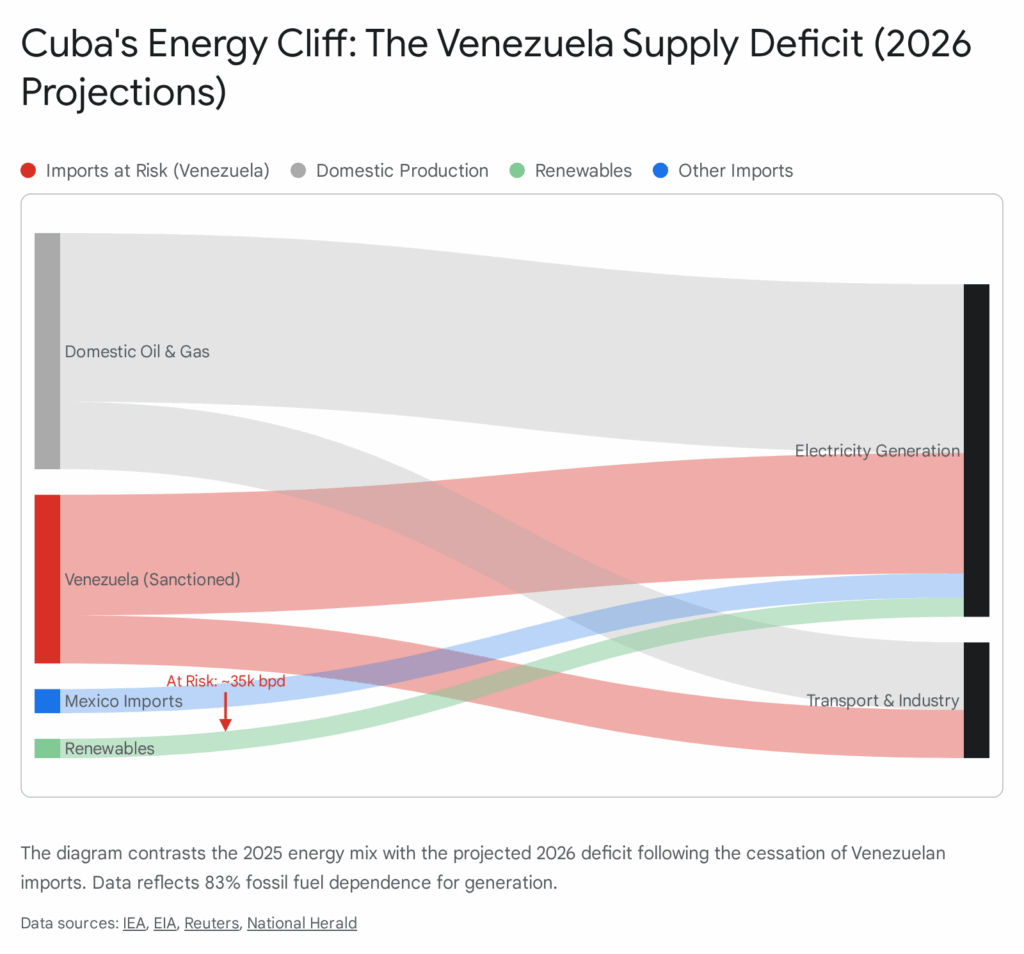

2.1 Energy Dependency and Grid Collapse

Cuba’s energy matrix is structurally flawed, relying on fossil fuels for 83% of its electricity generation as of late 2025.9 The island’s domestic production of heavy crude is insufficient and high in sulfur, requiring lighter Venezuelan grades for blending and direct burning in thermal plants like the Antonio Guiteras facility.

Prior to the intervention, Venezuela supplied approximately 35,000 to 55,000 bpd of crude and refined products to Havana.10 This flow was not merely a commercial transaction; it was a political subsidy, often paid for through the exchange of medical and intelligence services rather than hard currency. The U.S. naval blockade of Venezuelan ports initiated in December 2025, culminating in the January takeover, has severed this flow completely.12

The immediate consequence is a deficit in generation capacity that the Cuban grid cannot absorb. With the loss of Venezuelan fuel oil, daily blackouts are projected to expand from 6-8 hours to 12-18 hours.14 This level of energy poverty threatens the refrigeration of food, the operation of hospitals, and the pumping of municipal water supplies, creating the preconditions for total social collapse.

2.2 Intelligence and Security Decoupling

Beyond oil, the intervention severs the intelligence umbilical cord. Cuban operatives were deeply embedded in the Venezuelan military (FANB) and intelligence services (SEBIN), providing regime security in exchange for economic support.10 The U.S. stabilization force’s dismantling of these networks forces the repatriation of thousands of Cuban agents. This represents a dual blow: the loss of hard currency remittances from these workers and the humiliating exposure of Havana’s inability to protect its most critical ally. The psychological impact on the Cuban Communist Party’s hold on power cannot be overstated; the narrative of “socialist solidarity” has been shattered by American hard power.

Rank 2: People’s Republic of China

Classification: Strategic Financial & Geopolitical Loss

Impact Score: 92/100

For Beijing, the fall of the Maduro regime is a strategic disaster, representing the potential vaporization of a massive financial investment and the loss of its primary foothold in the Caribbean.

2.3 The $60 Billion Debt Trap

China is Venezuela’s largest sovereign creditor, having extended over $60 billion in loans since 2007, primarily through the China Development Bank’s “Joint Chinese-Venezuelan Fund”.16 These loans were structured as “oil-for-loan” deals, where repayment was made in physical barrels of crude.

The U.S. takeover fundamentally threatens this repayment mechanism. A U.S.-administered Venezuela is likely to declare these debts “odious” or subordinate them to new financing required for reconstruction. Estimates suggest that between $12 billion and $20 billion of this debt remains outstanding as of 2026.18 If the new administration in Caracas, under U.S. guidance, defaults on these obligations or prioritizes Western creditors (such as U.S. bondholders and oil majors), China faces a total write-down of these assets.19 The precedent of Iraq’s debt restructuring in 2003 suggests that “dictator debt” is often erased or deeply discounted by new regimes backed by Washington.

2.4 Energy Security and the “Teapot” Refiners

In 2025, China imported approximately 85% of Venezuela’s crude exports, a trade flow that was vital for its independent “teapot” refineries in Shandong province.20 These refineries are specifically configured to process cheap, heavy Venezuelan crude, which allows them to operate profitably despite tight margins.

The U.S. intervention places the physical control of these barrels in American hands. President Trump’s assertion that the U.S. will “run” the country implies a redirection of these oil flows to the U.S. Gulf Coast to lower American domestic fuel prices.7 This forces Chinese refiners to source heavier grades from the Middle East or Canada at significantly higher market premiums, eroding their competitive edge and increasing China’s overall energy import bill.

2.5 Belt and Road Initiative (BRI) Reversal

Geopolitically, Venezuela was the crown jewel of the BRI in Latin America. Its loss signals a “rollback” of Chinese influence. The U.S. intervention demonstrates a revived capacity to enforce the Monroe Doctrine, potentially deterring other Latin American nations from deepening security or strategic ties with Beijing for fear of similar repercussions.22

Rank 3: United States

Classification: Strategic Beneficiary & Industrial Victor

Impact Score: 88/100

While the U.S. is the architect of this intervention, it is also deeply impacted as the primary beneficiary. The operation serves a dual purpose: national security (removing a hostile regime) and industrial strategy (securing feedstock for American refineries).

2.6 The Gulf Coast Refining Renaissance

The U.S. Gulf Coast (PADD 3) possesses the world’s most complex refining infrastructure, specifically engineered to process heavy, high-sulfur crude (API gravity < 22). Since the imposition of sanctions on Venezuela in 2019, these refineries have operated sub-optimally, relying on more expensive imports from Canada or unstable supplies from Mexico and Colombia.24

The return of Venezuelan “Merey 16” crude is the “perfect barrel” for this system. Access to this supply at stable, non-sanctioned volumes will significantly lower feedstock costs for U.S. refiners like Valero, Marathon Petroleum, and Phillips 66.7 Analysts project that this influx could widen the heavy-light differential, boosting refining margins and potentially suppressing U.S. retail gasoline prices, a key domestic political objective for the administration.8

2.7 Corporate Windfalls and the “Pay-to-Play” Model

U.S. oil majors are positioned to monopolize the reconstruction. Chevron, already operating under special licenses, is the de facto operator of the sector.7 Other majors like ConocoPhillips and ExxonMobil, which had assets expropriated by Hugo Chávez, now see a pathway to restitution.

However, the Trump administration has signaled a “pay-to-play” model: U.S. companies must front the capital to repair the “badly broken” infrastructure before they can recover past debts.26 This creates a high-stakes environment where U.S. corporate capital is the primary instrument of foreign policy. The integration of Venezuela’s reserves into the U.S. energy perimeter effectively creates a “Fortress Americas” energy independence, insulating the U.S. from Middle Eastern volatility.

Rank 4: Colombia

Classification: Humanitarian Shock & Economic Realignment

Impact Score: 82/100

Colombia, sharing a 2,200-kilometer border with Venezuela, faces a paradoxical impact: immediate humanitarian trauma followed by potential long-term economic bonanza.

2.8 The Migration Tsunami

The destabilization accompanying the regime change is expected to trigger a massive, albeit temporary, migration wave. Estimates suggest up to 1.7 million additional Venezuelans could flee to Colombia in the immediate aftermath of the intervention, fearing conflict or reprisals.27

This influx imposes a staggering fiscal cost. Based on previous models, the cost of hosting and integrating this population is estimated between $2.8 billion and $5.2 billion annually.28 This shock comes at a time when the Colombian economy is already strained, potentially forcing the Petro administration to divert funds from domestic social programs to crisis management.

2.9 Border Security and Trade

Conversely, the removal of the Maduro regime eliminates the safe haven historically enjoyed by Colombian armed groups, specifically the ELN and FARC dissidents, who operated with impunity from the Venezuelan state of Apure.29 The U.S.-led stabilization force will likely prioritize the neutralization of these “narco-terrorist” elements, directly improving Colombia’s internal security situation.

Economically, a stabilized Venezuela represents the reopening of Colombia’s natural export market. Historically, Venezuela was the second-largest buyer of Colombian goods. A U.S.-backed reconstruction effort would generate immense demand for Colombian cement, steel, food, and services, potentially driving a GDP boost that outweighs the short-term migration costs.30

Rank 5: Russian Federation

Classification: Strategic Asset Loss & Geopolitical Defeat

Impact Score: 79/100

For Moscow, the fall of Maduro is a geopolitical catastrophe comparable to the loss of Soviet influence in Eastern Europe in 1989. It represents the eviction of Russia from its only significant military and energy foothold in the Americas.

2.10 Rosneft’s Assets: A Total Write-Down

Russian state oil company Rosneft (and its vehicle Roszarubezhneft) holds an estimated $5 billion in assets within Venezuelan joint ventures, including Petromonagas and Boqueron.31 These investments were political bets, guaranteed by oil flows that are now under U.S. control.

Legal analysts predict that the new Venezuelan administration will nullify these contracts, citing corruption or “odious debt” principles. Unlike Western majors who can litigate in New York, Russian entities have no recourse in U.S. courts. The $30-$50 billion Russia has invested in loans, arms sales, and oil projects over two decades faces total erasure.33

2.11 Loss of Power Projection

Venezuela served as the primary host for Russian strategic bombers (Tu-160s) and naval vessels in the Western Hemisphere.35 The intervention explicitly aims to remove “extra-hemispheric” military influence.2 Moscow loses its ability to threaten the U.S. “near abroad,” significantly weakening its leverage in global negotiations regarding Ukraine or NATO expansion. The concept of a “multipolar world” with a Russian pole in Latin America has been physically dismantled.

Rank 6: India

Classification: Economic Beneficiary & Supply Diversification

Impact Score: 65/100

India ranks as a major beneficiary, uniquely positioned to recover lost capital and optimize its energy supply chain.

2.12 Unlocking the “Lost Billion”

ONGC Videsh Ltd (OVL), the overseas arm of India’s state-owned oil explorer, has approximately $1 billion in stuck dues (dividends and project costs) from the San Cristobal field, frozen since 2014.36 Under Maduro, these funds were inaccessible due to sanctions and state insolvency.

A U.S.-sanctioned restructuring offers the first viable pathway for OVL to recover these funds. The model likely involves “oil-for-debt” swaps, where OVL is permitted to lift cargoes of Venezuelan crude to offset the debt, similar to the licenses granted to Chevron.37 This recovery would be a significant balance sheet event for the Indian state firm.

2.13 Refining Economics

Indian refiners, particularly the private giants Reliance Industries (Jamnagar) and Nayara Energy (Vadinar), possess some of the world’s most complex coking units, designed to process extra-heavy crudes.38 These refineries were major buyers of Venezuelan oil before sanctions forced them to switch to more expensive Middle Eastern or Canadian grades.

The return of Venezuelan crude allows Indian refiners to diversify away from Middle Eastern suppliers, increasing their bargaining power and improving gross refining margins (GRMs). While state-owned refiners (IOC, BPCL) are less equipped for this grade, the private sector’s gain is a net positive for India’s energy security.38

Rank 7: Canada

Classification: Market Competitor & Pricing Risk

Impact Score: 60/100

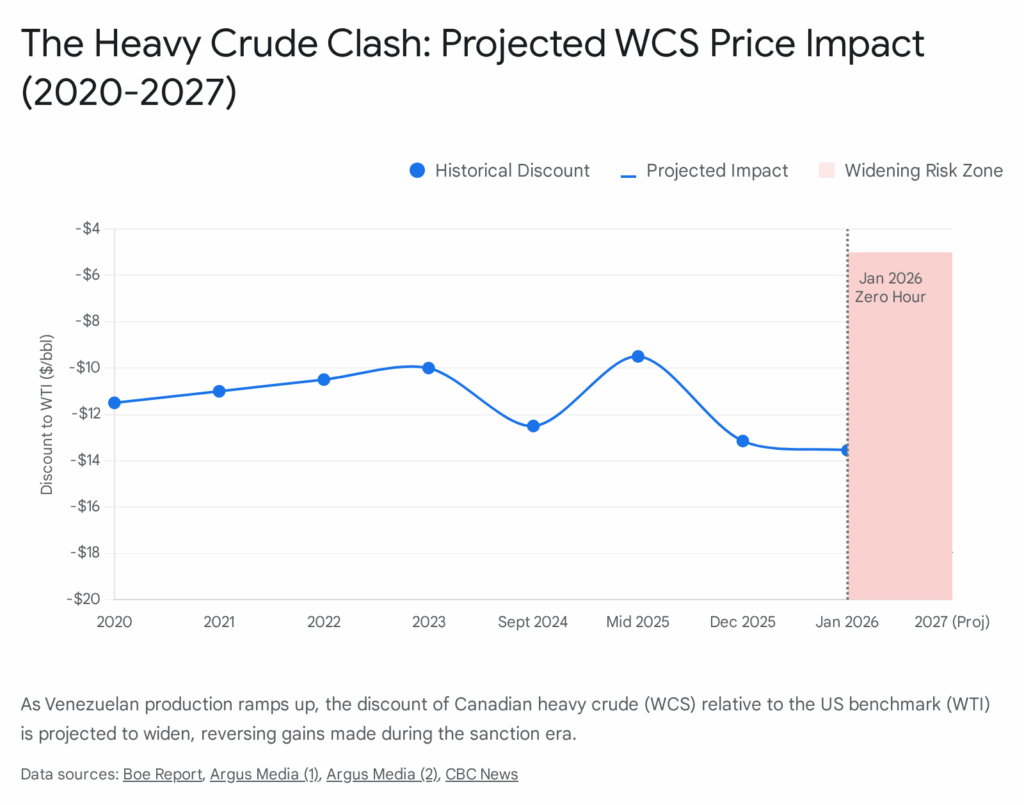

Canada faces a direct commercial threat. The relationship between Canadian oil and Venezuelan oil is a zero-sum game for market share in the U.S. Gulf Coast.

2.14 The Battle of the Heavy Barrels

Western Canada Select (WCS) and Venezuelan Merey 16 are direct competitors. Both are heavy, sour grades valued by Gulf Coast refiners. For years, Canadian producers have enjoyed a “sanctions premium”—the lack of Venezuelan barrels meant Gulf refiners had to buy Canadian crude, keeping WCS price differentials relatively narrow relative to WTI.40

The return of Venezuelan oil changes this calculus. Venezuelan oil has a logistical advantage: it can reach the Gulf Coast via tanker in days, whereas Canadian oil requires constrained pipeline transit or expensive rail. Analysts project that an influx of Venezuelan crude could widen the WCS-WTI differential by $2-$4 per barrel or more.42 This “widening of the discount” represents a direct revenue loss for Canadian oil sands producers like Cenovus and CNRL, potentially costing the Canadian industry billions annually.

2.15 Pipeline Pressures

This competitive threat accelerates the urgency for Canada to utilize the Trans Mountain pipeline expansion to export crude to Asia, reducing its dangerous over-reliance on the U.S. market. The Venezuelan revival is a wake-up call for Canadian energy diversification.1

Rank 8: Guyana

Classification: Security Beneficiary & Territorial Integrity

Impact Score: 55/100

For Guyana, the U.S. intervention is a Deus ex machina event that neutralizes its primary existential threat.

2.16 The End of the Essequibo Crisis

Prior to the intervention, the Maduro regime had escalated its claim over the Essequibo region—comprising two-thirds of Guyana’s territory—to the brink of war. Venezuela had held a referendum to annex the territory and mobilized troops to the border.44 This created a massive risk premium for investors in Guyana’s booming oil sector.

The U.S. takeover effectively dissolves this threat. The U.S. government, now the guarantor of security in Caracas, will not permit the annexation of territory belonging to a key Western ally and host to massive ExxonMobil operations.45 The threat of a Venezuelan military incursion drops to near zero, allowing Guyana to proceed with the development of the Stabroek block without the shadow of invasion. The “Law for the Defense of Guayana Esequiba” passed by Maduro becomes a dead letter.46

Rank 9: Islamic Republic of Iran

Classification: Strategic & Economic Loss

Impact Score: 52/100

Iran’s inclusion in the top impacted nations stems from the loss of a critical sanctions-busting partner and a strategic destination for its own hydrocarbon exports.

2.17 The Condensate Trade Collapse

Under Maduro, Venezuela and Iran developed a symbiotic energy relationship. Venezuela’s extra-heavy crude requires dilution with lighter hydrocarbons (condensate) to be transportable via pipeline. Iran supplied millions of barrels of this condensate, which it could not easily sell elsewhere due to its own sanctions.47 In return, Iran received Venezuelan crude or gold.

The U.S. takeover halts this trade immediately. Iran loses a vital market for its condensate and a source of hard assets. Furthermore, the “Axis of Resistance” loses its bridgehead in Latin America. The logistical network Iran built—including tanker fleets and refinery repair contracts—will be dismantled by U.S. authorities, further isolating Tehran economically.48

Rank 10: Nicaragua

Classification: Regime Stability Risk

Impact Score: 48/100

Nicaragua, under Daniel Ortega, remains one of the last ideological holdouts in the region, but its survival was heavily subsidized by Venezuelan largesse.

2.18 The End of ALBA Subsidies

Nicaragua was a primary beneficiary of the ALBA (Bolivarian Alliance for the Peoples of Our America) arrangement, receiving Venezuelan oil on preferential terms. These funds were often diverted to private accounts controlled by the Ortega family or used to fund social patronage networks.50

The fall of Maduro cuts off this flow of funds and fuel. Without Venezuelan subsidies, Nicaragua faces an acute balance-of-payments crisis. Furthermore, the U.S. administration, emboldened by its success in Venezuela, may turn its “maximum pressure” campaign toward Managua, using secondary sanctions to prevent any other supplier from filling the void.52 The economic fragility induced by this energy shock poses a direct threat to the stability of the Ortega regime.

3. Global Energy Market Reconfiguration

The intervention triggers a structural shift in global oil markets, specifically concerning the availability and pricing of heavy crude.

3.1 The “Heavy” Barrel Correction

The global oil market has suffered from a quality mismatch: the U.S. shale revolution produced a glut of light, sweet crude, while the world’s complex refineries are built for heavy, sour crude. The removal of Venezuelan (and Iranian) barrels created a scarcity of heavy oil, forcing refiners to pay premiums for Canadian or Middle Eastern grades.8

- Short-Term (0-12 Months): Volatility will rule. Production in Venezuela may initially dip due to the chaos of transition. The market will remain tight.

- Medium-Term (12-36 Months): As U.S. capital repairs the upgraders in the Orinoco Belt, a flood of heavy crude will hit the market. This will depress heavy oil prices relative to light oil (widening the differential). This is bearish for heavy oil producers (Canada, Mexico, Iraq) but bullish for complex refiners (U.S. Gulf Coast, India).24

3.2 The OPEC+ Fracture

Venezuela is a founding member of OPEC. A U.S.-administered Venezuela creates a geopolitical anomaly: a “Trojan Horse” within the cartel. It is highly unlikely that a U.S.-led administration in Caracas will adhere to OPEC+ production quotas if those quotas conflict with the U.S. goal of lowering gasoline prices or maximizing reconstruction revenue.53 This could undermine OPEC’s ability to manage global supply, potentially leading to a market share war if Saudi Arabia attempts to discipline the new Venezuelan output.

4. The Sovereign Debt Quagmire

The restructuring of Venezuela’s external debt—estimated between $150 billion and $170 billion—will be the most complex sovereign bankruptcy in history, eclipsing the Argentine defaults.19

4.1 The Hierarchy of Claims

The U.S. strategy appears to favor a “Iraq-style” restructuring, where oil revenues are shielded from creditors to fund reconstruction. This sets up a titanic legal battle:

- China & Russia: Hold bilateral loans backed by oil. They risk being subordinated or wiped out as “odious debt.”

- Bondholders: Hold ~$60 billion in defaulted bonds. They will likely push for a debt-for-equity swap, potentially gaining ownership stakes in Venezuelan oil fields.19

- Corporate Claimants: Companies like ConocoPhillips and Crystallex have arbitration awards for past expropriations. They will likely be at the front of the line in U.S. courts.12

The resolution of this debt crisis will set legal precedents for sovereign restructuring for decades to come, particularly regarding the treatment of debt accrued by authoritarian regimes.

5. Conclusion

The U.S. takeover of Venezuela’s oil sector is a singularity in modern geopolitical history. It reverses the trend of waning U.S. influence in Latin America and reasserts the primacy of the Monroe Doctrine with overwhelming force.

- For Cuba, it is a potential death knell for the regime.

- For China and Russia, it is a stark demonstration of the risks of investing in U.S. adversaries in the Western Hemisphere.

- For the Global Energy Market, it promises a future of abundant heavy oil, effectively capping long-term prices and securing the U.S. refining advantage for a generation.

The speed at which the U.S. can transition from military occupier to industrial manager will determine whether this intervention stabilizes the region or plunges it into a protracted insurgency.

Appendix A: Methodology

To determine the ranking of the top 10 impacted countries, a weighted multi-variable scoring model was developed. The model assesses impact magnitude across four distinct dimensions.

1. Scoring Variables:

- Energy Security Dependence (ESD) – Weight: 30%

- Definition: Measures the reliance of a country on Venezuelan energy imports for critical national infrastructure (electricity, transport).

- Scale: 0 (No reliance) to 10 (Critical reliance/Single point of failure).

- Example: Cuba scores 10 due to 83% grid dependence.

- Financial & Asset Exposure (FAE) – Weight: 25%

- Definition: The total value of sovereign debt, direct foreign investment, or physical assets located in Venezuela that are at risk of seizure, write-down, or destruction.

- Scale: 0 (No exposure) to 10 (>$50 Billion or strategic irrecoverability).

- Example: China scores 10 ($60bn+ debt). Russia scores 8.

- Geopolitical Strategic Impact (GSI) – Weight: 25%

- Definition: The degree to which the regime change alters a country’s national security architecture, regional influence, or territorial integrity.

- Scale: 0 (Neutral) to 10 (Fundamental security shift).

- Example: Guyana scores 9 (Removal of invasion threat). USA scores 9 (Strategic dominance).

- Market & Commodity Sensitivity (MCS) – Weight: 20%

- Definition: The economic impact resulting from changes in global oil prices, refining margins, or trade competition caused by Venezuelan supply shifts.

- Scale: 0 (Insulated) to 10 (High correlation to national GDP).

- Example: Canada scores 8 (Direct competitor for heavy crude markets).

2. Calculation Formula:

Impact Score = (ESD x 3) + (FAE x 2.5) + (GSI x 2.5) + (MCS x 2)

(Result is normalized to a 0-100 scale)

3. Data Sources:

Data inputs were derived from International Energy Agency (IEA) reports, OPEC Annual Statistical Bulletins, IMF Sovereign Debt databases, and shipping/tanker tracking data (Kpler/Vortexa) as cited in the research material.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- U.S. designs for Venezuelan oil industry put pressure on Canadian oil stocks, accessed January 6, 2026, https://pipelineonline.ca/u-s-designs-for-venezuelan-oil-industry-put-pressure-on-canadian-oil-stocks/

- Experts react: The US just captured Maduro. What’s next for Venezuela and the region?, accessed January 6, 2026, https://www.atlanticcouncil.org/dispatches/us-just-captured-maduro-whats-next-for-venezuela-and-the-region/

- What role could the US play in Venezuela’s ‘bust’ oil industry?, accessed January 6, 2026, https://www.theguardian.com/business/2026/jan/04/venezuela-oil-industry-bust-what-role-could-the-us-play

- Reviving Venezuela’s oil industry no easy feat: Update | Latest Market News, accessed January 6, 2026, https://www.argusmedia.com/news-and-insights/latest-market-news/2772065-reviving-venezuela-s-oil-industry-no-easy-feat-update

- US energy stocks rise as Trump vows to unlock Venezuela’s oil, accessed January 6, 2026, https://www.theguardian.com/business/2026/jan/05/oil-price-dips-venezuela

- Top 10 countries with largest oil reserves in 2025: Venezuela leads the world, here’s where Middle East, US and India rank, accessed January 6, 2026, https://indianexpress.com/article/trending/top-10-listing/top-10-largest-oil-reserves-2025-venezuela-middle-east-us-india-rank-10457647/

- U.S. oil companies gain after Trump signals access to Venezuela’s reserves – BNN Bloomberg, accessed January 6, 2026, https://www.bnnbloomberg.ca/business/2026/01/05/us-oil-companies-gain-after-trump-signals-access-to-venezuelas-reserves/

- The 4 Things Standing Between the U.S. and Venezuela’s Oil, accessed January 6, 2026, https://heatmap.news/energy/venezuela-blockade-sanctions

- Cuba – Countries & Regions – IEA, accessed January 6, 2026, https://www.iea.org/countries/cuba/energy-mix

- Cuba braces for fallout as US action in Venezuela upends decades …, accessed January 6, 2026, https://www.nationalheraldindia.com/international/cuba-braces-for-fallout-as-us-action-in-venezuela-upends-decades-old-alliance

- Cuba – International – U.S. Energy Information Administration (EIA), accessed January 6, 2026, https://www.eia.gov/international/analysis/country/CUB

- US to blockade Venezuela oil flows: Trump, accessed January 6, 2026, https://www.argusmedia.com/en/news-and-insights/latest-market-news/2766679-us-to-blockade-venezuela-oil-flows-trump

- US Tanker Seizure Sparks Energy Crisis In Cuba – Evrim Ağacı, accessed January 6, 2026, https://evrimagaci.org/gpt/us-tanker-seizure-sparks-energy-crisis-in-cuba-519862

- Toppling of Venezuela’s Maduro stirs fear in Cubans, accessed January 6, 2026, https://sg.news.yahoo.com/toppling-venezuelas-maduro-stirs-fear-224445718.html

- Cuba’s Electricity Crisis: What’s Happening and What Comes Next – The University of Alabama at Birmingham, accessed January 6, 2026, https://sites.uab.edu/humanrights/2025/10/10/cubas-electricity-crisis-whats-happening-and-what-comes-next/

- Trump’s attack leaves China worried about its interests in Venezuela …, accessed January 6, 2026, https://www.theguardian.com/world/2026/jan/05/venezuela-trump-attack-china-interests-analysis

- US military action in Venezuela: oil market & geopolitical impact, accessed January 6, 2026, https://www.ig.com/en/news-and-trade-ideas/Intervention-Venezuela-implications-260106

- Maduro capture: What’s at stake for China’s economic interests in Venezuela, accessed January 6, 2026, https://www.businesstimes.com.sg/international/maduro-capture-whats-stake-chinas-economic-interests-venezuela

- Analysis-Venezuela debt rally belies complex creditor web, political quagmire By Reuters, accessed January 6, 2026, https://www.investing.com/news/stock-market-news/analysisvenezuela-debt-rally-belies-complex-creditor-web-political-quagmire-4432094

- Venezuela’s Oil Export Rebound: 2025 and Beyond – Import Globals, accessed January 6, 2026, https://www.importglobals.com/blog/venezuelas-oil-export-rebound-2025-and-beyond

- China’s oil investments in Venezuela – The Economic Times, accessed January 6, 2026, https://m.economictimes.com/news/international/world-news/chinas-oil-investments-in-venezuela/articleshow/126354640.cms

- Venezuela: the upending of values and another warning to Europe, accessed January 6, 2026, https://www.bruegel.org/first-glance/venezuela-upending-values-and-another-warning-europe

- What the US capture of Maduro means for China’s interests in Venezuela and beyond, accessed January 6, 2026, https://www.channelnewsasia.com/east-asia/us-venezuela-capture-maduro-china-latin-america-taiwan-implications-5817086

- Dense, sticky and heavy: why Venezuelan crude oil appeals to US refineries, accessed January 6, 2026, https://www.theguardian.com/business/2026/jan/05/venezuelan-crude-oil-appeals-to-us-refineries

- U.S. Seizure of Maduro and Venezuela Oil Assets Might Change The Case For Investing In Chevron (CVX) – Simply Wall St, accessed January 6, 2026, https://simplywall.st/stocks/us/energy/nyse-cvx/chevron/news/us-seizure-of-maduro-and-venezuela-oil-assets-might-change-t/amp

- U.S. pushes oil majors to invest big in Venezuela if they want to recover debts, accessed January 6, 2026, https://www.spokesman.com/stories/2026/jan/04/us-pushes-oil-majors-to-invest-big-in-venezuela-if/

- Colombia prepares for refugee influx after US strikes on Venezuela, accessed January 6, 2026, https://www.aljazeera.com/features/2026/1/6/colombia-prepares-for-refugee-influx-after-us-strikes-on-venezuela

- Neighbor nations can’t bear costs of Venezuelan refugee crisis alone – Brookings Institution, accessed January 6, 2026, https://www.brookings.edu/articles/neighbor-nations-cant-bear-costs-of-venezuelan-refugee-crisis-alone/

- Tracking Trump and Latin America: Security—Trump Blockades Sanctioned Venezuelan Oil, accessed January 6, 2026, https://www.as-coa.org/articles/tracking-trump-and-latin-america-security-trump-blockades-sanctioned-venezuelan-oil

- Venezuela’s Migrants Bring Economic Opportunity to Latin America, accessed January 6, 2026, https://www.imf.org/en/news/articles/2022/12/06/cf-venezuelas-migrants-bring-economic-opportunity-to-latin-america

- Explainer: Status of Foreign Oil Companies in Venezuela After …, accessed January 6, 2026, https://www.oedigital.com/news/534029-explainer-status-of-foreign-oil-companies-in-venezuela-after-maduro-s-arrest

- FACTBOX | Where global oil firms stand in Venezuela following Maduro’s capture, accessed January 6, 2026, https://www.bairdmaritime.com/offshore/drilling-production/factbox-where-global-oil-firms-stand-in-venezuela-following-maduros-capture

- US Intervention in Venezuelan Oil Drives Global Energy Disruption, accessed January 6, 2026, https://discoveryalert.com.au/strategic-petroleum-2026-us-venezuela-oil-disruption/

- Rosneft’s Withdrawal amid U.S. Sanctions Contributes to Venezuela’s Isolation – CSIS, accessed January 6, 2026, https://www.csis.org/analysis/rosnefts-withdrawal-amid-us-sanctions-contributes-venezuelas-isolation

- Russia Warns Citizens Against Travel to Venezuela After U.S. Ousts Maduro, accessed January 6, 2026, https://www.themoscowtimes.com/2026/01/05/russia-warns-citizens-against-travel-to-venezuela-after-us-ousts-maduro-a91609

- US control of Venezuelan oil may unlock $1 bn stuck dues for India, lift output, accessed January 6, 2026, https://m.economictimes.com/industry/energy/oil-gas/us-control-of-venezuelan-oil-may-unlock-1-bn-stuck-dues-for-india-lift-output/articleshow/126332919.cms

- Explained: Why US control of Venezuelan oil could free $1 bn owed to India, accessed January 6, 2026, https://www.businesstoday.in/india/story/explained-why-us-control-of-venezuelan-oil-could-free-1-bn-owed-to-india-509325-2026-01-04

- Cheaper Venezuelan crude may benefit limited Indian private refiners, accessed January 6, 2026, https://www.newindianexpress.com/business/2026/Jan/05/cheaper-venezuelan-crude-may-benefit-limited-indian-private-refiners

- Venezuela crisis seen having minimal impact on Indian oil flow, upstream developments eyed, accessed January 6, 2026, https://www.hellenicshippingnews.com/venezuela-crisis-seen-having-minimal-impact-on-indian-oil-flow-upstream-developments-eyed/

- More oil production in Venezuela could hurt Canada’s oilpatch, accessed January 6, 2026, https://www.cbc.ca/news/canada/calgary/venezuela-oil-canada-9.7034122

- Venezuela’s oil reboot could chip away at Canada’s heavy crude edge, accessed January 6, 2026, https://www.benefitsandpensionsmonitor.com/investments/emerging-markets/venezuelas-oil-reboot-could-chip-away-at-canadas-heavy-crude-edge/392926

- U.S. designs for Venezuelan oil industry put pressure on Canadian oil stocks, accessed January 6, 2026, https://www.ctvnews.ca/business/article/canadian-oil-stocks-down-after-us-forces-capture-maduro/

- Western Canada Select widens; Venezuela a longer-term risk, analysts say, accessed January 6, 2026, https://boereport.com/2026/01/05/western-canada-select-widens-venezuela-a-longer-term-risk-analysts-say/

- Venezuela: The Rise and Fall of a Petrostate | Council on Foreign Relations, accessed January 6, 2026, https://www.cfr.org/backgrounder/venezuela-crisis

- The U.S.-Venezuela-Guyana Oil Triangle – Drilled Media, accessed January 6, 2026, https://drilled.media/news/guyana-venezuela

- Guyana–Venezuela territorial dispute – Wikipedia, accessed January 6, 2026, https://en.wikipedia.org/wiki/Guyana%E2%80%93Venezuela_territorial_dispute

- Its Allies’ Falls Continue the Destruction of Iran’s Financial Capital – Middle East Forum, accessed January 6, 2026, https://www.meforum.org/mef-observer/its-allies-falls-continue-the-destruction-of-irans-financial-capital

- Venezuela Boosting Oil Exports With Iranian Light Crude Supplies | Iran International, accessed January 6, 2026, https://www.iranintl.com/en/202205233767

- Why now is the right time for ‘maximum pressure’ on Iran’s oil exports – Atlantic Council, accessed January 6, 2026, https://www.atlanticcouncil.org/blogs/menasource/why-now-is-the-right-time-for-maximum-pressure-on-irans-oil-exports/

- The Consequences of Nicaragua’s Radicalization and Options for US Foreign Policy, accessed January 6, 2026, https://thedialogue.org/blogs/2025/10/the-consequences-of-nicaraguas-radicalization-and-options-for-us-foreign-policy

- Venezuelan oil fueled the rise and fall of Nicaragua’s Ortega regime – The World from PRX, accessed January 6, 2026, https://theworld.org/stories/2018/08/21/venezuelan-oil-fueled-rise-and-fall-nicaraguas-ortega-regime

- ‘Secondary’ Tariffs Target Countries Importing Venezuelan Oil – International Trade, accessed January 6, 2026, https://internationaltrade.btlaw.com/post/102k6tg/secondary-tariffs-target-countries-importing-venezuelan-oil

- Venezuela has the world’s most oil: Why doesn’t it earn more from exports? – Al Jazeera, accessed January 6, 2026, https://www.aljazeera.com/news/2025/9/4/venezuela-has-the-worlds-most-oil-why-doesnt-it-earn-more-from-exports

- Venezuela’s billions in distressed debt: Who is in line to collect? – Fox Business, accessed January 6, 2026, https://www.foxbusiness.com/economy/venezuelas-billions-distressed-debt-who-line-collect