A Market Analysis of the Top 20 Systems

Executive Summary

The 2026 Shooting, Hunting, and Outdoor Trade (SHOT) Show, held from January 20–23 at The Venetian Expo and Caesars Forum in Las Vegas 1, served as a definitive bellwether for the future of small arms fire control systems. For the past decade, the industry has been characterized by the pursuit of the “universal optic”—typified by the Low Power Variable Optic (LPVO) attempting to master both close-quarters battle (CQB) and mid-range precision. The exhibits of 2026 signal the end of this generalization era and the commencement of a new phase defined by functional bifurcation and photonic integration.

Industry analysis reveals a marked departure from the 1-6x and 1-8x LPVO dominance that characterized the early 2020s procurement cycles. Instead, the market is bifurcating into two distinct, highly specialized directions. First, the Medium Power Variable Optic (MPVO), specifically in the 2-10x and 2-12x ranges, has matured into the primary optical solution for the General Purpose Rifle (GPR), largely driven by the now-ubiquitous adoption of offset or piggybacked red dot sights which handle the 1x requirement more effectively than a variable optic ever could.2 Second, the thermal imaging sector has crossed a critical threshold of democratization and fusion. Companies such as Nocpix and Holosun are collapsing the price-to-performance ratio, integrating Laser Rangefinders (LRF) directly into objective lenses, and combining IR lasers into reflex sights, fundamentally altering the Size, Weight, and Power (SWaP) calculus for night vision operations.3

Furthermore, the open-emitter reflex sight appears effectively obsolete for professional duty use. The 2026 standard, as demonstrated by industry leaders SIG SAUER and Steiner, mandates fully enclosed emitters for both rifle and micro-compact pistol applications.5 This shift is not merely aesthetic but a response to rigorous durability requirements from law enforcement and military tenders demanding functionality in adverse environmental conditions.

This report provides an exhaustive technical review and market analysis of the top 20 optical systems showcased at SHOT Show 2026. These selections are based on their potential to disrupt distinct market sectors: Military/Law Enforcement (Mil/LE), Competitive Precision (PRS/NRL), and the high-end Civilian/Hunting market.

Section I: The Rise of the MPVO (Medium Power Variable Optic)

The most significant doctrinal shift observed at SHOT Show 2026 is the industry’s widespread embrace of the Medium Power Variable Optic (MPVO). For nearly fifteen years, the 1-6x and subsequently the 1-8x LPVOs were considered the “gold standard” for carbines, balancing speed with moderate precision. However, physics dictates that a variable optic’s 1x performance rarely matches the parallax-free speed of a dedicated red dot sight (RDS). As engagement distances for 5.56mm NATO and emerging 6mm ARC platforms have extended, users have demanded higher top-end magnification without incurring the weight penalty of a traditional high-power scope. The MPVO—typically featuring a 2-10x or 2-12x magnification range—answers this requirement by ceding the 1x capability to a secondary, specialized RDS.

1. Nightforce NX6 2-12x42mm F1

Category: Tactical/DMR | Market Impact: High

Nightforce Optics has strategically bridged the capability gap between their compact, combat-proven NX8 line and the optically superior but heavier ATACR series with the introduction of the NX6 family.7 While the new lineup includes various configurations, the NX6 2-12x42mm F1 (First Focal Plane) stands out as the archetype of the modern MPVO.

Technical Analysis and Lineage

The development of the NX6 2-12×42 appears to be a direct response to end-user feedback regarding the older NX8 2.5-20×50. A primary critique of the NX8 series was its tight eyebox—a result of an ambitious 8x magnification ratio packed into a compact tube. By restraining the magnification ratio to 6x (2x to 12x), Nightforce engineers have achieved an optical system that is significantly more forgiving to the shooter’s head position.8 This “eye relief latitude” is critical for dynamic engagements where the shooter may be firing from unconventional positions.

The 42mm objective lens represents a calculated compromise. It offers superior light transmission and exit pupil diameter compared to the 24mm objectives found on LPVOs, yet maintains a low mounting profile suitable for gas guns, unlike the 50mm or 56mm objectives found on dedicated long-range scopes.7

A significant mechanical upgrade is the introduction of FieldSet™ Turrets. Previous generations of compact Nightforce scopes were occasionally criticized for “mushy” or indistinct click adjustments. The FieldSet system provides distinct, tactile, and audible clicks, allowing for precise blind adjustments in the field.7

The Efficiency Frontier: Weight vs. Performance

In the fiercely competitive MPVO market, the balance between magnification capability and physical weight is the primary decision factor for procurement. Analysis of the leading optics in this class reveals distinct engineering philosophies. The Nightforce NX6 2-12×42, estimated at approximately 28 ounces, positions itself as a robust, duty-grade option that prioritizes durability and optical forgiveness.7

Comparatively, its primary competitors adopt different strategies. The Leupold Mark 5HD 2-10×30, weighing in at a mere 24 ounces, prioritizes lightweight mobility above all else, sacrificing objective lens size to achieve this.9 Conversely, the Primary Arms PLxC 1.5-12×36, weighing approximately 26 ounces, pushes the boundaries of magnification ratio (8x) to offer maximum versatility.2 The Nightforce NX6, therefore, occupies the “Golden Mean”—offering more magnification than the Leupold and a more forgiving optical system than the high-ratio Primary Arms, utilizing a 30mm tube architecture that is compatible with the vast majority of existing mounting solutions.2

Operational Context

The NX6 2-12×42 is positioned to dominate the “Recce” and Designated Marksman Rifle (DMR) market sectors. The industry consensus is shifting toward a dual-optic setup: a primary MPVO for identification and engagement from 50 to 800 meters, paired with a piggybacked or offset red dot for 0 to 50 meters. The NX6’s FC-MRx reticle facilitates this role, offering a hybrid solution with rapid acquisition features at low magnification and precise holdovers at 12x without the visual clutter often associated with “Christmas tree” reticles.2

2. Leupold Mark 5HD 2-10x30mm

Category: Tactical/Lightweight | Market Impact: High

Leupold continues to aggressively target the weight-conscious professional and mountain hunter. The Mark 5HD 2-10x30mm is a direct evolution of the TS-30A2 and other legacy optics used on the Mk12 Special Purpose Rifle (SPR), modernized for the 2026 battlefield.9

Technical Analysis

The defining feature of the Mark 5HD series is the 35mm main tube. While non-standard compared to the 30mm or 34mm industry norms, this chassis allows for a massive range of elevation adjustment—specifically 34.9 MILs (approximately 120 MOA).9 This capability is crucial for maximizing the ballistic potential of modern efficient cartridges like the 6mm ARC or 6.5 Creedmoor, which stay supersonic well beyond 1,000 meters.

Despite the robust tube, Leupold remains the leader in lightweight engineering. The 2-10x30mm configuration is significantly lighter than its 34mm competitors. The 30mm objective lens is notably smaller than the Nightforce’s 42mm, which does reduce the exit pupil and low-light performance at dusk. However, this trade-off allows for a lower mounting height, reducing the shooter’s vertical profile and snag hazards—a critical consideration for patrol operations.

The optic is available with TMR (Tactical Milling Reticle) and CMR (Combat Milling Reticle) options.10 Some precision shooters have noted the lack of a complex grid reticle as a limitation for extreme long-range holds 2, but for the intended 0-800 meter envelope of a DMR, the TMR remains a combat-proven, uncluttered standard.

3. Primary Arms PLxC RDB 1.5-12x36mm

Category: Innovation/Value | Market Impact: Medium-High

Primary Arms Optics has successfully disrupted the premium tier with their PLxC (Compact) line, utilizing top-tier Japanese glass and manufacturing. The new 1.5-12x36mm offers the widest magnification range in this class, boasting an impressive 8x zoom ratio.2

Strategic Positioning

The “Compact” nomenclature is accurate; this scope is designed to minimize the footprint on the receiver rail. At 1.5x on the low end, it offers reasonable situational awareness and “both eyes open” shooting capability if the primary red dot fails—a redundancy that 2-10x or 3-18x optics cannot match. The top end of 12x matches the Nightforce, providing positive target identification capabilities.

The physical shortness of the PLxC is a strategic advantage for night vision integration. By occupying less rail space, it leaves ample room for clip-on thermal or night vision devices (such as the Knight’s Armament PVS-30 or emerging thermal clip-ons), a critical requirement for modern military and LE procurement.2

4. Vortex AMG 1-10x24mm FFP

Category: Technical Marvel | Market Impact: Niche/High-End

While the market anticipated a “Razor Gen IV,” Vortex Optics pivoted to their Advanced Manufacturing Group (AMG) to produce a US-made engineering marvel. The AMG 1-10×24 is an ultra-lightweight, First Focal Plane (FFP) optic that blurs the line between LPVO and MPVO.11

Technical Analysis

The AMG 1-10x represents a masterclass in materials science. By utilizing exotic materials—likely titanium internals and specialized aluminum alloys—Vortex has achieved a total weight of only 18.8 oz.11 This is astoundingly light for a 1-10x FFP optic with a 34mm tube, weighing nearly half as much as the legacy Razor Gen III 1-10x.

The optical design features a Dual Zero – Capped turret system and the dedicated EBR-9 MRAD reticle.11 The capped turrets suggest a design philosophy focused on “set and forget” zeroing with holdovers used for elevation, rather than constant dialing. This optic targets the elite operator or backcountry hunter who refuses to compromise on magnification but is strictly governed by weight limits. It effectively challenges the supremacy of heavier LPVOs by proving that high magnification does not require a heavy chassis.

Section II: The Thermal and Night Vision Revolution

The most dynamic and rapidly evolving sector at SHOT Show 2026 was thermal optics. The technology has matured from bulky, low-resolution novelties into high-definition, integrated weapon systems. The key trend is Convergence: optics are no longer just “scopes”; they are ballistic computers, rangefinders, and cameras wrapped in germanium and aluminum casings.

5. Nocpix ACE H50R Thermal Riflescope

Category: Thermal Imaging | Market Impact: Very High

Nocpix (formerly operating under iRay USA) has released the flagship ACE H50R, a device that fundamentally redefines the ergonomic and performance expectations for thermal weapon sights.3

Technical Analysis: The Vision+ System

The heart of the ACE H50R is a Gen-2 HD thermal sensor with 640×512 resolution. Crucially, it boasts an NETD (Noise Equivalent Temperature Difference) of ≤15mK.12 In the world of thermal imaging, NETD is the metric of sensitivity; a lower number is better. Most consumer-grade thermals hover around 35-40mK. A sub-15mK sensitivity allows the user to distinguish minute temperature differences—such as the tines of an antler against tree branches, or the heat signature of a prone suspect against sun-warmed concrete—even in “thermal washout” conditions like rain, fog, or high humidity.

The sensor’s output is projected onto a massive 2560×2560 AMOLED display.13 Most competitors utilize 1024×768 screens. The ACE’s ultra-high display density eliminates the “pixelation” or “screen door” effect common in digital optics, providing an image that rivals the clarity of high-end analog image intensification tubes.

Paradigm Shift: Integrated LRF

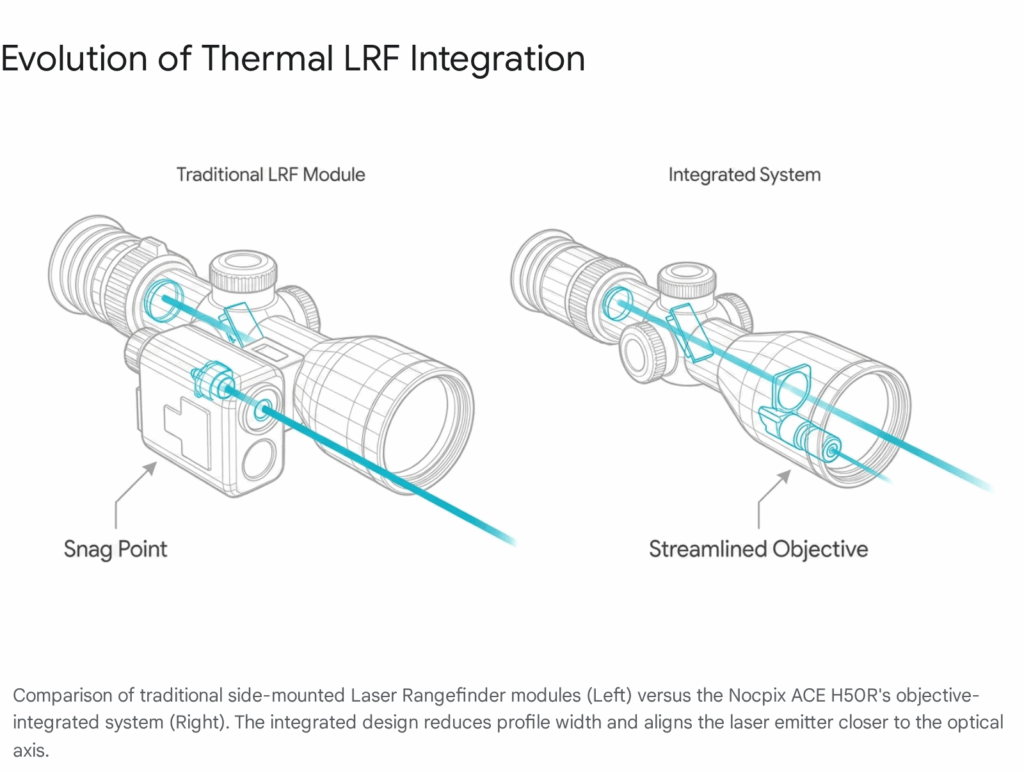

Unlike competitors that bolt a laser rangefinder module onto the side of the unit—creating snag hazards and offset issues—Nocpix has integrated the LRF directly into the objective lens assembly.3 This “Vision+” system streamlines the profile and aligns the laser axis significantly closer to the bore. Combined with an onboard ballistic calculator, this system turns a complex night engagement into a “point and shoot” solution, automatically adjusting the digital reticle based on the ranged distance.13

6. Pulsar Trail 3 LRF (XQ50 / XR50)

Category: Thermal Imaging | Market Impact: High

Pulsar, a legacy giant in the thermal space, responded to the intensifying competition with the introduction of the Trail 3 LRF family.14

Robustness and User Experience

A significant advancement in the Trail 3 is its reinforced architecture. It is explicitly rated for recoil energy up to 6,000 Joules, making it safe for use on heavy calibers such as.375 H&H Magnum.14 This addresses a historical durability gap where earlier generations of consumer thermal optics would suffer sensor degradation or power failure under heavy recoil impulse.

Pulsar has also refined the user interface with a round Picture-in-Picture (PiP) mode. This feature displays a magnified image of the target in a circular window (mimicking a traditional rifle scope view) while retaining the wide field of view in the peripheral display.14 This allows the hunter or operator to maintain situational awareness of the surroundings while taking a precise shot.

The XR50 model features a 640×480 sensor with a 12-micron pixel pitch, focusing on maximizing detection range—claimed up to 1,969 yards for deer-sized targets.15 The inclusion of a quick-change LPS7i battery pack ensures continuous operation in the field, a critical logistical consideration for professional users.

7. Holosun IRIS-ARC

Category: Night Vision Accessory (Laser) | Market Impact: Medium

While strictly categorized as an accessory rather than a primary optic, the IRIS-ARC is a critical optical component that signifies Holosun’s deeper entry into the night vision market. It is a compact Laser Aiming Module (LAM) featuring a VCSEL (Vertical-Cavity Surface-Emitting Laser) IR illuminator.4

The VCSEL Advantage

Traditional laser illuminators use edge-emitting diodes, which often produce “speckle” or grainy artifacts when viewed through night vision goggles (NVGs). The IRIS-ARC utilizes VCSEL technology, which emits light vertically from the chip surface, resulting in a much “cleaner,” more uniform flood of IR light. This provides a crisp, high-definition image for the end-user.

Ergonomically, the unit features a “slider” control for beam divergence. This allows the operator to instantly transition the illuminator from a tight spotlight (for long-range identification) to a wide flood (for room clearing) without breaking their firing grip. Historically, such features were reserved for expensive, restricted-sale units like the B.E. Meyers MAWL-C1+. Holosun’s introduction of this technology at a consumer price point represents a significant disruption to the existing market hierarchy.4

8. Nocpix Quest Rangefinding Thermal Binoculars

Category: Observation | Market Impact: Medium

The Quest series introduces “Reality+” image processing to binocular thermal systems. Thermal observation often causes significant eye fatigue due to the unnatural monochromatic image and the lag of digital screens. The Quest addresses this by using a high-resolution 640×512 sensor but displaying the output on dual 1920×1200 displays.16 This creates a stereoscopic effect that mimics natural vision, reducing eye strain during long duration surveillance sessions.

Furthermore, the integration of a laser rangefinder in a binocular format allows a spotter to range targets and communicate corrections to a shooter without needing to switch to a separate device, streamlining the “hunter-killer” team workflow.

9. Teledyne FLIR Black Hornet 3

Category: Surveillance/Drone Optic | Market Impact: Specialized (Mil/LE)

Although technically an Unmanned Aerial System (UAS), the Black Hornet 3 is categorized under optical surveillance assets at SHOT Show due to its role as a “flying sensor.” Its presence highlights the integration of remote optics into the squad level. It offers pocket-sized reconnaissance with both thermal and day video feeds, effectively allowing an operator to “throw” their optic around a corner, over a wall, or dozens of meters into the air to gain perspective.17 For law enforcement SWAT teams and military infantry, this capability provides optical intelligence that no rifle-mounted system can match.

Section III: The Evolution of Reflex Sights (Enclosed & Hybrid)

The “Open Emitter” red dot sight (typified by the Trijicon RMR Type 2) is increasingly viewed as a legacy design in the professional sector. The 2026 market demands enclosed emitters—sealed optical boxes that prevent mud, rain, snow, or lint from blocking the laser emitter path.

10. SIG SAUER ROMEO-X Enclosed (Compact & Pro)

Category: Pistol Reflex | Market Impact: High

SIG SAUER has leveraged the military pedigree of the ROMEO-M17 (adopted by the US Army) to create the commercial ROMEO-X Enclosed line.6

Mechanical Innovation

The ROMEO-X Enclosed utilizes a Beryllium Copper flexure arm for its adjustment mechanism. Traditional red dots use coil springs to hold the emitter in place, which can fatigue or shift under the violent, reciprocating G-forces of a pistol slide. The flexure arm provides immense resistance to this mechanical stress, ensuring zero retention over tens of thousands of rounds.

Crucially, the optic features an exceptionally low deck height. This allows the shooter to co-witness the red dot with standard-height iron sights. This eliminates the need for tall “suppressor height” iron sights, which can snag on clothing and limit holster compatibility. The series includes the Compact variant for the Shield RMSc footprint (e.g., SIG P365) and the Pro variant for the DeltaPoint Pro footprint (e.g., SIG P320), effectively covering 90% of the duty and concealed carry market.18

11. Holosun AEMS-EVO-DUAL

Category: Hybrid Rifle Sight | Market Impact: High

The AEMS-EVO-DUAL is arguably the most innovative hybrid sight of the show. It combines the popular AEMS (Advanced Enclosed Micro Sight) chassis with a coaxially aligned visible and IR laser.19

The “One Zero” Solution

Integrating a laser aiming module (LAM) onto a rifle usually introduces the “parallel zero” problem, where the laser is offset from the bore and the optic. The AEMS-EVO-DUAL solves this by integrating the red dot and the lasers into the same housing and aligning them coaxially. Therefore, zeroing the red dot automatically zeroes the visible and IR lasers.21

This capability essentially combines a red dot sight and a PEQ-15 style laser into a single, lightweight unit powered by a standard CR123A battery. For civilian night vision shooters and law enforcement officers, this consolidates two expensive, heavy items into one streamlined package, significantly reducing the weight and complexity of the weapon system.

12. Steiner MPS-C (Micro Pistol Sight – Compact)

Category: Pistol Reflex | Market Impact: Medium

Steiner has successfully shrunk their duty-grade MPS (Micro Pistol Sight) into the MPS-C. It is noticeably shorter (1.89 inches) and lighter than the original, yet paradoxically features a larger objective lens (21x19mm).5 This defies the usual physics of optics, where a smaller housing typically necessitates a smaller window. Steiner has likely achieved this through efficient internal prism design and component miniaturization. The MPS-C positions itself as a top contender for concealed carry users who demand “duty grade” enclosed durability without the bulk of a full-sized emitter.

13. Holosun 507-PROMAX

Category: Competition Pistol Sight | Market Impact: Medium

While the tactical trend is toward smaller, lower-profile carry optics, the competition market (USPSA/IPSC) desires larger windows. The 507-PROMAX offers a massive window for faster dot tracking during recoil.4 It utilizes the same durable housing technology as the 508T series but prioritizes Field of View (FOV) above all else. This optic caters directly to the “Carry Optics” divisions, where the ability to track the dot through the recoil arc translates directly to split-time reduction.

14. Sig Sauer Tango-MSR Compact

Category: Budget/Entry-Level | Market Impact: High (Volume Sales)

Not every optic needs to cost $2,000 to be significant. The Tango-MSR Compact line (available in 1-6x, 1-8x, and 1-10x) is set to dominate the entry-level market.22

The “Compact” designation refers to a 20% reduction in weight and length compared to the previous MSR generation. This brings the handling characteristics of premium “short-body” LPVOs to the budget sector, which was previously dominated by heavy, long tubes. SIG’s strategy of including the Alpha-MSR cantilever mount in the box provides a “turnkey” solution for new rifle owners, aggressively undercutting competitors who require separate ring purchases.22

Section IV: Precision and Long Range Innovation

The precision rifle market, driven by the Precision Rifle Series (PRS) and National Rifle League (NRL), continues to chase two often-contradictory goals: wider Field of View (FOV) to spot trace and impacts, and higher magnification for extreme precision.

15. Kahles K328i DLR

Category: Competition Precision | Market Impact: High

Kahles has long been a favorite of the PRS community due to their ergonomic turret placement. The K328i DLR (Dynamic Long Range) represents a significant leap in optical engineering, changing the geometry of the internal erector system to achieve a 40% wider Field of View than its predecessor, the benchmark K525i.24

In competition, finding a target under time stress is often more challenging than hitting it. A 40% wider FOV at high magnification allows the shooter to locate targets, spot misses, and transition between plates significantly faster. The “DLR” variant features a windage turret that can be positioned on the left or right side (customizable) and includes large, easy-to-read parallax spinners, optimizing the scope for the high-speed manipulation required in timed stages.26

16. Kahles K864 (8-64x56mm)

Category: F-Class/Benchrest | Market Impact: Niche

For static long-range disciplines such as F-Class and Benchrest, Kahles introduced the K864.27 With a magnification range of 8-64x, this optic competes directly with the March Genesis and Nightforce Competition lines. It features 1/8 MOA clicks, allowing for microscopic point-of-impact adjustments at 1,000 yards—a necessity when the X-ring is smaller than the bullet diameter. The inclusion of a 56mm objective and high-transmission glass ensures that the image remains bright even at the extreme 64x magnification setting, where exit pupils typically become pinholes.

17. Burris Veracity PH Gen 2

Category: Hunting/Smart Optic | Market Impact: Medium

Burris has refined its “Programmable Elevation Knob” (PĒK) system in the Veracity PH Gen 2. This optic features a heads-up display (HUD) projected inside the scope view that shows the current turret setting and ballistic data.28

The innovation here is the “Clickless” Digital Turret. The elevation knob has no mechanical clicks; instead, a digital sensor tracks the rotation and updates the internal display. This allows for precision down to 1/10 MOA without the mechanical limitations of physical gears. It pairs via Bluetooth with the BurrisConnect app, allowing hunters to upload custom drag profiles for their specific load. This hybridizes the reliability of a glass optic with the precision of a ballistic computer.

Section V: Observation & Specialized Systems

18. Swarovski AT/ST Balance

Category: Spotting Scope | Market Impact: Medium

Swarovski Optik has brought electronic image stabilization to the high-end spotting scope market with the AT/ST Balance series.30

- The Problem: High magnification (30x-60x) makes spotting scopes extremely susceptible to wind vibration and tripod shake. Even the slightest breeze can render the image unusable.

- The Solution: The “Balance” system uses internal gyroscopic sensors to shift lens elements and stabilize the image in real-time, similar to the technology found in Canon’s IS camera lenses or stabilized binoculars. This effectively increases the “usable resolution” of the optic, allowing hunters to count tines or judge trophy quality in windy conditions where a standard spotter would be blurred. The “AT” (Angled) and “ST” (Straight) models cater to user preference.

19. Arken Target Lock TL3000

Category: Accessory/Tech | Market Impact: High (Budget)

Arken Optics has significantly disrupted the Laser Rangefinder market with the TL3000. At an MSRP of approximately $600, it offers a gun-mounted laser rangefinder with onboard ballistics.32 Previously, this capability was restricted to units costing over $3,000 (such as the Wilcox RAPTAR or SilencerCo Radius). Arken is commoditizing ballistic intelligence, making “smart” shooting solutions accessible to the average enthusiast or budget-minded competitor.

20. Trijicon Credo HX Line Extensions

Category: Hunting | Market Impact: Medium

Trijicon expanded the Credo HX line with larger objective lenses, specifically 2.5-15×42 and 2.5-15×56 models.33

- Optimization: These optics are strictly focused on the hunting market. The “HX” designation denotes Satin Black finishes (for lower glare in the field) and hunting-specific reticles (BDC Hunter Holds) that prioritize fast acquisition over the mathematical precision of a tactical grid. The shift to a 56mm objective indicates a growing demand for “European style” low-light performance in the American market, catering to hunters operating at dawn and dusk.

Honorable Mentions & Market Trends

Other notable releases include the EOTECH Vudu 4-12x36mm, a compact optic designed for short carbines 33, and the Hawke Vantage HD 34 FFP, which pushes the “value” segment by offering First Focal Plane mechanics at a budget price point.33 These releases reinforce the trend that high-performance features (FFP, high magnification ratios) are trickling down from flagship models to entry-level consumers.

Conclusion: The “So What?” of 2026

The “Top 20” optics of SHOT Show 2026 are not defined by incremental improvements in glass clarity. They are defined by computational photography (thermal/digital), mechanical integration (lasers inside scopes, dots inside housings), and doctrinal specialization (the dominance of the MPVO).

For the industry analyst, the signal is clear: the era of the “General Purpose” optic is ending. Users are no longer accepting a 1-8x LPVO that is mediocre at 1x and mediocre at 8x. They are moving toward specialized systems: a 2-12x MPVO (Nightforce/Primary Arms) for distance, paired with a specialized Red Dot (Holosun/Sig) for Close Quarters Battle.

Simultaneously, the pricing and form factors of the Nocpix ACE and Pulsar Trail 3 suggest the market has crossed the “Thermal Threshold.” High-resolution (640+) thermal imaging is no longer a Special Forces exclusive; it is a pro-consumer standard. The integration of LRFs into the objective lens is a second-order innovation that will likely force every other manufacturer to redesign their thermal housings by 2027 to remain competitive. Future growth lies in electronics and specialized form factors, while the traditional “tube and glass” market becomes a race to the bottom on price.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- accessed January 23, 2026, https://shotshow.org/wp-content/uploads/26SHOTShowFactsAndFigures.pdf

- Rifle Scopes – The New Landscape of the MPVO (2026 Poll) | Sniper’s Hide Forum, accessed January 23, 2026, https://www.snipershide.com/shooting/threads/the-new-landscape-of-the-mpvo-2026-poll.7280568/

- Nocpix Ace H50R 3-24x LRF Thermal Rifle Scope – Outdoor Legacy, accessed January 23, 2026, https://outdoorlegacygear.com/products/nocpix-ace-h50r-thermal-optic

- SHOT SHOW 2026: Holosun IRIS-ARC – Frag Out! Magazine, accessed January 23, 2026, https://fragoutmag.com/shot-show-2026-holosun-iris-arc/

- SHOT Show 2026 | thefirearmblog.com, accessed January 23, 2026, https://www.thefirearmblog.com/category/shot-show-shot-show-2026

- ROMEO-X ENCLOSED COMPACT – Sig Sauer, accessed January 23, 2026, https://www.sigsauer.com/romeo-x-compact-enclosed.html

- [SHOT 2026] First Look: Nightforce NX6 Scope Lineup …, accessed January 23, 2026, https://www.thefirearmblog.com/blog/shot-2026-first-look-nightforce-nx6-scope-lineup-44825470

- SHOT Show Exhibitor Profile: Nightforce Optics | NSSF SHOT Show 2026, accessed January 23, 2026, https://shotshow.org/shot-show-2026-exhibitor-profile-nightforce-optics/

- Mark 5HD 2-10×30 M5C3 FFP Illum. TMR Riflescope | Leupold, accessed January 23, 2026, https://www.leupold.com/mark-5hd-2-10×30-m5c3-ffp-illum-tmr-riflescope

- The Holy Grail of SPR Scopes – NEW Leupold Mark 5HD 2-10 – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=a84yTWGtqR4

- Vortex AMG 1-10×24 FFP Riflescope, accessed January 23, 2026, https://vortexoptics.com/amg-1-10×24-ffp-riflescope.html

- Nocpix ACE Series – S60R•H50R•H50•L35 – Thermal Imaging Rifle Scope, accessed January 23, 2026, https://www.nocpix.com/product-ace/

- Nocpix ACE H50R Thermal Scope 640 – High-Resolution Night Vision for Precision Hunting, accessed January 23, 2026, https://thethermalstore.com/products/nocpix-ace-h50r

- Trail 3 LRF XR50 Thermal Riflescope – Pulsar, accessed January 23, 2026, https://pulsarnv.com/products/trail-3-lrf-xr50-thermal-riflescope

- Pulsar Unveils Trail 3 Family: Next-Generation Thermal Riflescopes with Integrated Laser Rangefinder – Hunting Life, accessed January 23, 2026, https://huntinglife.com/pulsar-unveils-trail-3-family-next-generation-thermal-riflescopes-with-integrated-laser-rangefinder/

- Nocpix QUEST Rangefinding Thermal Binoculars | Hook & Barrel Magazine, accessed January 23, 2026, https://www.hookandbarrel.com/gear/nocpix-quest-rangefinding-thermal-binoculars

- SHOT Show 2026: Police firearms and tactical products reviews – Police1, accessed January 23, 2026, https://www.police1.com/shot-show

- SIG SAUER ROMEO-X Enclosed: Dependability Without Compromise, accessed January 23, 2026, https://www.sigsauer.com/blog/sig-sauer-romeo-x-enclosed-dependability-without-compromise

- Holosun 2026 Optics Sneak Peek – Frag Out! Magazine, accessed January 23, 2026, https://fragoutmag.com/holosun-2026-sneak-peak/

- Holosun Introduces the AEMS-EVO and AEMS-EVO DUAL Rifle Optics – The Outdoor Wire, accessed January 23, 2026, https://www.theoutdoorwire.com/releases/2026/01/holosun-introduces-the-aems-evo-and-aems-evo-dual-rifle-optics

- Holosun AEMS Evo Dual Red W/ Green Laser Enclosed Rifle Sight – Palmetto State Armory, accessed January 23, 2026, https://palmettostatearmory.com/holosun-aems-evo-dual-red-w-green-laser-enclosed-rifle-sight-aems-evo-dual.html

- Sig Sauer Tango-MSR Compact Scope 1-10X24 SFP Illum MSR BDC-10 w/Mount Black, accessed January 23, 2026, https://freedomarmory.com/sig-sauer-tango-msr-compact-scope-1-10×24-sfp-illum-msr-bdc-10-w-mount-black/

- First Look: SIG Sauer Tango-MSR Compact Scopes | An Official Journal Of The NRA, accessed January 23, 2026, https://www.shootingillustrated.com/content/first-look-sig-sauer-tango-msr-compact-scopes/

- K328i DLR – Riflescopes – KAHLES, accessed January 23, 2026, https://www.kahles.at/us/sport/riflescopes/k328i-3_5-28x50i-dlr

- KAHLES K328i – THE GAME-CHANGER – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=HM0yoYyMqKg

- WORLD FIRST K328i – KAHLES, accessed January 23, 2026, https://www.kahles.at/en/news/details/sport/worldfirst-k328i

- Rifle Scopes – New Kahles for 2026 is here | Sniper’s Hide Forum, accessed January 23, 2026, https://www.snipershide.com/shooting/threads/new-kahles-for-2026-is-here.7277896/

- [SHOT 2026] Updated Burris Veracity Scopes and Rapid Engagement Design, accessed January 23, 2026, https://www.thefirearmblog.com/blog/shot-2026-updated-burris-veracity-scopes-and-rapid-engagement-design-44825617

- Veracity PH – Burris Optics, accessed January 23, 2026, https://www.burrisoptics.com/riflescopes/veracity-ph

- SWAROVSKI OPTIK AT/ST Balance, accessed January 23, 2026, https://www.swarovskioptik.com/us/en/outdoor/press-releases/swarovski-optik-at-st-balance-11-25-2025

- Swarovski Optik AT/ST Balance New Premium Spotting Scope with Image Stabilization, accessed January 23, 2026, https://www.petersenshunting.com/editorial/swarovski-spotting-scope-image-stabilization/541043

- [SHOT 2026] Arken’s 3000 Yard $600 On-Gun Laser Rangefinder, accessed January 23, 2026, https://www.thefirearmblog.com/blog/shot-2026-arken-s-3000-yard-600-on-gun-laser-rangefinder-44825731

- Hot from SHOT: Best Optics of 2026 | An Official Journal Of The NRA – American Hunter, accessed January 23, 2026, https://www.americanhunter.org/content/hot-from-shot-best-optics-of-2026/