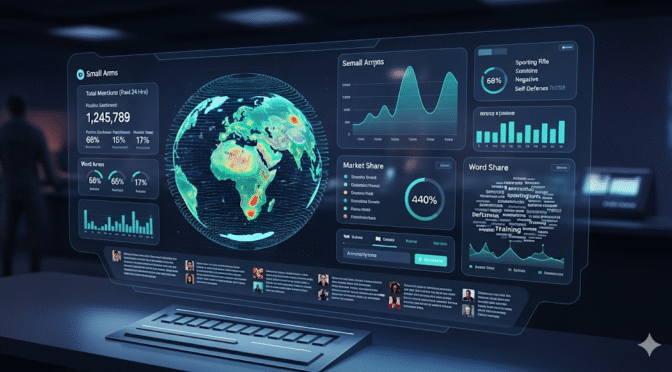

In the rapidly evolving world of small arms, relying on “gut feelings,” manually browsing a handful of websites, or simply asking a few friends for their opinions is no longer enough. This isn’t your grandfather’s gun market. Today, a sophisticated and demanding consumer base, coupled with relentless technological innovation, has transformed the landscape. If you’re looking to make truly informed purchasing decisions, understand market trajectory, or strategically position your brand, it’s time to move beyond anecdotal evidence and embrace data-driven decision making powered by comprehensive social media analytics.

The Limitations of “Traditional Wisdom”

Imagine trying to understand the nuances of a complex ecosystem by observing a single tree. That’s akin to how traditional market research often operates. Manually checking product pages or polling a small group of enthusiasts offers a narrow, often biased, view. It misses the subtle shifts in consumer priorities, the emergence of niche but influential segments, and the early warning signs of an authenticity crisis or a disruptive innovation. Legacy brands, for instance, have historically faced challenges reclaiming market share from agile, boutique manufacturers precisely because they were slow to recognize and cater to enthusiast demand for full-power loads in cartridges like the 10mm Auto, often sticking to underpowered “FBI Lite” offerings. This reluctance, likely stemming from traditional, less dynamic market insights, allowed competitors to capitalize effectively.

The Power of Data-Driven Insights

Our reports leverage a comprehensive sentiment analysis that synthesizes vast amounts of data—from major online retailers, specialized forums like Reddit’s r/10mm and r/longrange, independent review channels, and even professional law enforcement sources. This isn’t just counting mentions; our Total Mentions Index is a weighted metric, prioritizing substantive discussions, detailed performance reviews, and recurring expert recommendations. This rigorous approach allows us to:

- Uncover True Consumer Sentiment: We quantify the overall market perception, categorizing comments as Positive, Negative, or Neutral, and even factor in Price-Per-Round (PPR) as a value modifier to understand what truly constitutes “good value” to different buyers. We filter out low-information, high-bias content to focus on verifiable details about performance, round counts, and customer service experiences.

- Identify Disruptive Trends Before They Dominate – For Example:

- 10mm Auto’s Resurgence: We’ve seen how a passionate online following, driven by a demand for genuine Norma-level performance, revitalized the 10mm Auto. Consumers are “power users” who own chronographs and rigorously scrutinize advertised ballistics, rewarding transparent brands and penalizing underperformers. This “authenticity factor” is a primary purchasing driver uncovered through deep analysis.

- 12 Gauge Buckshot Innovation: The market is overwhelmingly positive for loads featuring flight-control wads, which are considered the “gold standard” for defensive applications due to their elite patterning. This technology was a disruptive innovation that fundamentally shifted the defensive shotgun paradigm.

- 5.56/.223 Defensive Shifts: Our analysis highlights the “LE Halo Effect,” where law enforcement contracts (like DHS’s choice of Federal’s 64-grain Tactical Bonded ammunition) significantly influence civilian trust. We also track the “SBR Arms Race,” as manufacturers develop specialized ammunition for short-barreled rifles, and the growing importance of flash suppression imperative for low-light conditions.

- 9mm Pistol Market Maturation: Beyond basic reliability, consumers now prioritize ergonomics, trigger quality, and advanced features. The rise of chassis systems (like SIG’s FCU and Springfield’s COG) and the “Glock Magazine Ecosystem” are defining new strategic directions for the industry, even influencing premium brands like Staccato to adopt Glock-pattern magazines.

- Defensive Shotgun Evolution: The market momentum is clearly shifting towards reliable semi-automatic shotguns, driven by reduced recoil and increased user-friendliness. Models like the Beretta A300 Ultima Patrol have redefined the value-premium segment by offering modern features and reliability at an accessible price.

- Firearm Suppressor Innovation: The market is moving beyond just “quietness” to prioritize low back-pressure systems for semi-automatic hosts. The adoption of the 1.375×24 “HUB” standard for mounting is empowering consumers, and additive manufacturing (3D printing) is revolutionizing suppressor design.

- PCC Advancements: The Pistol Caliber Carbine market is seeing the mainstreaming of delayed blowback systems to mitigate harsh recoil, the rise of factory SBRs due to regulatory changes, and the emergence of a PCC-specific optic ecosystem with tailored reticles and taller mounts.

- Understand Accelerated Adoption Cycles: Digital platforms have become the primary proving ground and marketing channel for new cartridges. This leads to an Accelerated Adoption Cycle, where cartridges with demonstrable performance advantages, such as the Hornady Precision Rifle Cartridges (PRC) line (7mm PRC, 6.5 PRC, .300 PRC), achieve widespread acceptance in a fraction of the time their predecessors did. Missing this “discussion velocity” means missing future market leaders.

Why YOU Need These Data-Driven Reports

For manufacturers, these insights are crucial for guiding product development, identifying market gaps (like the underserved value-premium segment in shotguns), integrating essential features (like optics mounting as standard), and leveraging aftermarket partnerships. For the Remington 870 Tactical (Express), for example, analysis showed a widespread negative reputation for quality control during a specific era, highlighting the need for transparent campaigns to rebuild trust.

For consumers and enthusiasts, these reports provide the strategic intelligence and data-backed ranking necessary to navigate a complex market with confidence. Whether you’re a “Proven Reliability First” user who prioritizes OEM Glock-level dependability, a “Best Value & Features” seeker looking for optimal performance without breaking the bank (like the Ruger RXM or Lone Wolf Dusk 19, which offer significant upgrades over a stock Glock), or a “Performance-Focused Enthusiast” aiming for the pinnacle of offerings like the Beretta 1301 Tactical Mod 2, our insights are tailored to your needs.

Don’t let outdated information or limited perspectives guide your decisions in the small arms market. The future is here, and it’s data-driven. Invest in understanding these nuanced trends to make superior choices, whether you’re buying, selling, or building the next great firearm.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.