Executive Summary

The seventh edition of the Unmanned Systems Exhibition (UMEX) and Simulation and Training Exhibition (SimTEX), convened at the Abu Dhabi National Exhibition Centre (ADNEC) from January 20 to 22, 2026, represents a watershed moment in the trajectory of the global and regional small arms industry. While the event’s nomenclature emphasizes “unmanned systems,” the 2026 iteration revealed a profound and irreversible convergence between traditional infantry weaponry and autonomous architectures. For the small arms industry analyst, the distinction between a “rifle” and a “remote weapon station” (RWS) has effectively dissolved. The exhibition served as the primary theater for the “platforming” of lethality, where kinetic efficacy is no longer defined solely by ballistics, but by integration, digitization, and indigenous control.

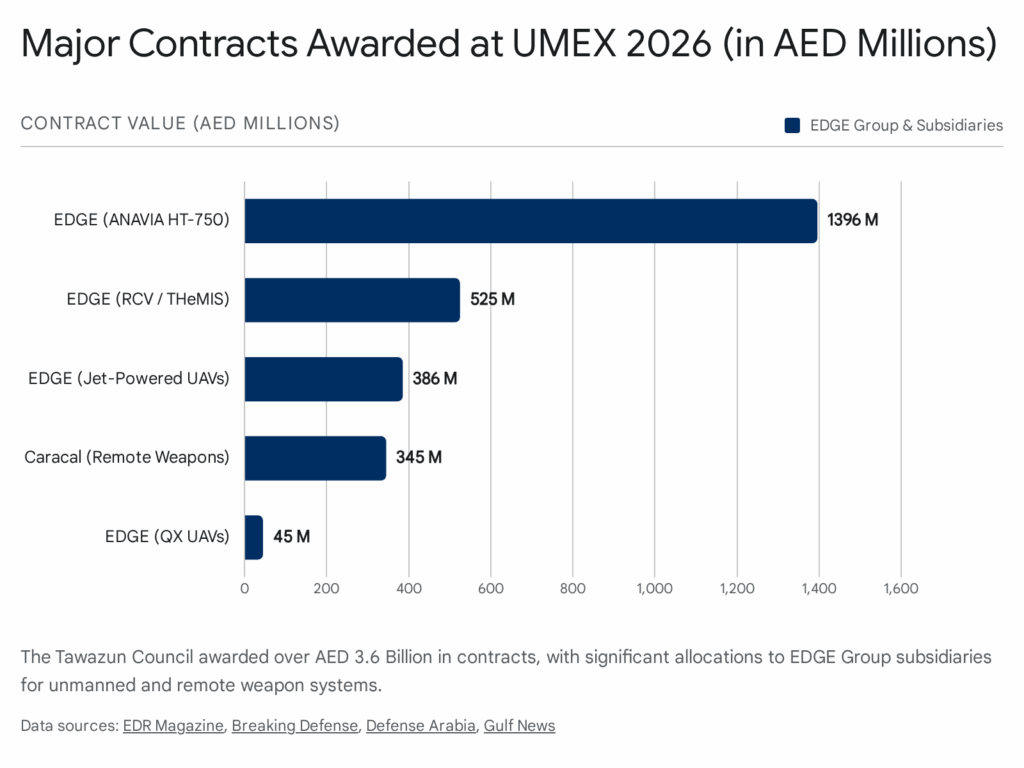

Drawing upon an exhaustive review of exhibitor displays, official contract announcements, and multi-lingual digital discourse, this report posits that the Middle Eastern small arms market has pivoted from a passive consumption model to an active industrial dominance model. This shift was underscored by record-breaking participation figures—37,878 visitors and 390 exhibitors—and a substantial AED 3.6 billion ($980 million) in total contracts awarded by the Tawazun Council.

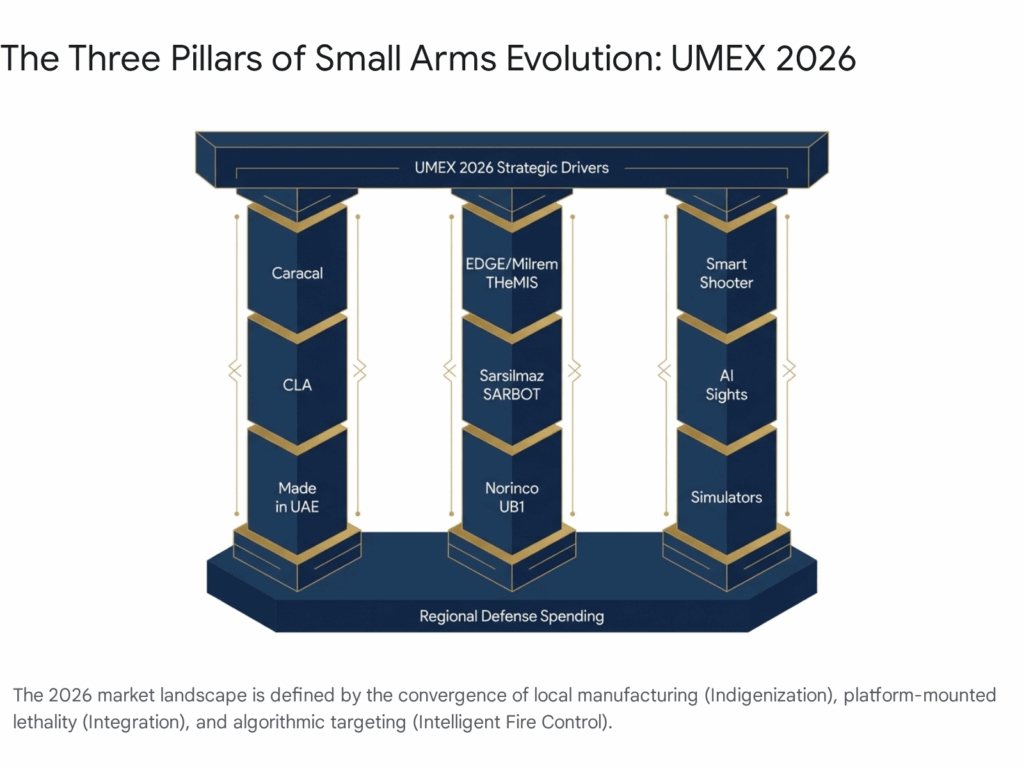

Three primary strategic drivers emerged from the exhibition floor, redefining the competitive landscape for 2026 and beyond:

- Indigenization as Doctrine: The hegemony of UAE-based conglomerates, particularly EDGE Group and its subsidiary Caracal International, was absolute. The awarding of a landmark AED 345.3 million ($94 million) contract to Caracal for “remote-controlled weapons” signals a transition from purchasing foreign arms to investing in domestic systems integration. This is further evidenced by Caracal’s expanding export footprint, notably the contract to supply CSR 338 sniper rifles to India, positioning the UAE as a net exporter of precision small arms to the Global South.

- The Integration of Kinetic Systems: The era of the standalone infantry weapon is ending. UMEX 2026 demonstrated that small arms are increasingly viewed as subsystems within a larger mobility matrix. From the EDGE/Milrem Robotics THeMIS UGV armed with 30mm cannons to the Sarsilmaz SARBOT quadruped, the industry is prioritizing the mounting of small arms on unmanned chassis. This trend extends to the maritime domain, with Norinco’s UB1 USV featuring remotely operated heavy machine guns, expanding the small arms market into littoral defense.

- Algorithmic Fire Control: The technological high ground is no longer determined by the caliber of the round, but by the intelligence of the sight. The proliferation of “smart sights” and fire control systems (FCS), exemplified by Smart Shooter and regional competitors, indicates a doctrinal shift toward “guaranteed hit” technology. This is driven by the urgent need for kinetic Counter-UAS (C-UAS) capabilities at the squad level, blurring the lines between infantry combat and air defense.

Financially, the allocation of capital at UMEX 2026 reveals a procurement strategy heavily weighted toward force multiplication. The extensive investment in simulation and training (SimTEX) and remote systems suggests a future force structure that relies on technological leverage to maximize the lethality of a smaller, highly trained, and partially automated fighting force.

This report provides a granular analysis of these trends, examining the specific hardware displayed—from the polymer frames of the Caracal EF pistol to the thermobaric warheads of Russian loitering munitions—and synthesizing the broader economic and geopolitical implications for the small arms industry.

1. Introduction: The Strategic Pivot of 2026

The context of UMEX 2026 cannot be divorced from the broader geopolitical currents reshaping the Middle East and North Africa (MENA) region. For decades, defense exhibitions in Abu Dhabi were primarily marketplaces where Western and Eastern prime contractors competed for the patronage of regional governments. The dynamic in January 2026 was markedly different. The overarching theme was “Strategic Autonomy.”

For the small arms analyst, this shift is critical. The United Arab Emirates, through the Tawazun Council, has successfully enforced a policy of industrial localization. It is no longer sufficient for a foreign manufacturer to simply sell rifles or ammunition; they must now offer Transfer of Technology (ToT), establish local joint ventures, or integrate their systems with UAE-owned intellectual property.

This environment has fostered the rapid maturation of national champions. EDGE Group, and specifically its small arms entity Caracal International, appeared at UMEX 2026 not as a burgeoning startup but as an established prime. The scale of their booth, the breadth of their portfolio, and the volume of their contracts underscored a new reality: the UAE is transitioning from a consumer of security to a producer of security.

Furthermore, the co-location of UMEX (Unmanned Systems) and SimTEX (Simulation) created a unique ecosystem for small arms analysis. It highlighted that the future of infantry weapons is not just about the mechanics of the gun, but about how that gun is simulated in virtual training environments and how it is integrated into the broader unmanned network. The convergence of these fields—Ballistics, Robotics, and Simulation—was the defining characteristic of the show.

2. The Small Arms Ecosystem: Market Drivers & Trends

The exhibition floor at ADNEC offered a microcosm of the global defense industry’s current trajectory. Several key market drivers were observable in the layout and product focus of the exhibitors.

2.1 The Hybridization of Infantry Systems

Perhaps the most notable trend was the hybridization of the infantryman’s toolkit. Historically, “Small Arms” and “Unmanned Systems” were treated as distinct procurement categories. UMEX 2026 effectively collapsed this distinction. Military planners and industry leaders no longer view the rifle as a standalone tool. Instead, the discussion has shifted to “lethality effectors”—components that can be handheld by a soldier, mounted on a robotic dog, or integrated into a static border defense tower.

This was physically manifest on the show floor. Booths were not segregated by traditional categories. Rifles were displayed mounted on UGVs, and ammunition crates were stacked alongside loitering munition launchers. This visual integration signals a doctrinal shift: the rifle is becoming a sub-component of a larger autonomous system.

2.2 The Rise of Algorithmic Warfare at the Edge

A second major driver is the push for “Algorithmic Warfare” at the tactical edge. The processing power that was once reserved for headquarters or major platforms (jets, ships) has migrated to the rifle scope. Fire Control Systems (FCS) that utilize computer vision to identify targets, calculate ballistic solutions, and even inhibit firing until a hit is guaranteed were ubiquitous. This trend is driven by the democratization of threats; as adversaries employ small, fast-moving drones, the human eye and reflex are no longer sufficient. The rifle must become “smart” to remain relevant.

2.3 Economic Nationalism and Export Ambitions

The economic driver of “Indigenization” was palpable. The Tawazun Council’s announcements focused heavily on awarding contracts to domestic entities. However, a secondary trend of “Export Ambition” was also evident. The narrative around Caracal’s contract with the Indian Central Reserve Police Force (CRPF) suggests that the UAE is actively seeking to compete in the global small arms market, leveraging its agile manufacturing base and political neutrality to win contracts in the Global South.

3. Handguns and Personal Defense Weapons (PDW)

While the headline-grabbing technology focused on robotics, the fundamental tools of personal defense—handguns and PDWs—remained a core component of the exhibition, particularly for the domestic security sector.

3.1 Caracal International: The Domestic Benchmark

Caracal International utilized UMEX 2026 to showcase the maturity and diversity of its handgun portfolio. The company’s display was a statement of comprehensive capability, covering military, law enforcement, and competitive shooting requirements.

- Caracal Enhanced F (EF) & F Gen II: These polymer-framed, striker-fired pistols remain the workhorse of the UAE’s domestic security forces. The 2026 display emphasized their low bore axis and ergonomic adaptability. The “Enhanced F” series continues to be marketed on its extreme reliability in desert environments—a critical selling point for regional adoption. The presence of these pistols at a “systems” show underscores their role as the baseline for personal defense.

- The 2011 Series: A significant highlight was the Caracal 2011 pistol. Moving into the high-end tactical and competitive shooting market, the 2011 platform (a double-stack 1911 derivative) showcases Caracal’s precision engineering capabilities. The “Liwa” edition, featuring gold inlays and Arabic poetry, targeted the luxury collector market. This niche but lucrative segment in the GCC represents a unique intersection of heritage and tactical technology.

- CMP9 Submachine Gun: Positioned as a modern solution for close-protection and special operations, the CMP9 was displayed in various configurations, including suppressed models. Its presence at UMEX, often alongside VIP protection drone systems, highlights its role in the comprehensive security package. The 9x19mm platform is designed to offer volume of fire in compact spaces, making it ideal for vehicle-borne operations or urban VIP protection details.

3.2 Regional Competition: Sarsilmaz and Girsan

The Turkish defense industry provided the primary competition in the handgun segment, reflecting the broader geopolitical rivalry for influence in the defense sector.

- Sarsilmaz SAR9: The SAR9 pistol series, already well-established in the Turkish military and U.S. civilian market, was marketed aggressively. Sarsilmaz’s strategy at UMEX focused on volume and cost-effectiveness, contrasting with Caracal’s focus on premium indigenization. The SAR9 is positioned as a NATO-standard, battle-proven alternative for export clients looking for reliability at a competitive price point.

- Girsan’s Strategic Expansion: While Girsan’s physical presence was focused on distribution, news of their expansion into the US market (establishing GIRSAN USA in Florida) provided critical context. This move indicates that Turkish manufacturers are rapidly graduating from regional players to global exporters, putting pressure on other emerging manufacturers to secure their own market niches.

4. Assault Rifles & Carbines: The Standard Issue

The assault rifle market at UMEX 2026 was dominated by the AR-15/AR-18 architecture, reaffirming the global standardization on 5.56x45mm NATO platforms. The debate between gas-piston and direct-impingement systems was alive and well on the exhibition floor.

4.1 Caracal’s Modular Platforms

Caracal displayed its rifle portfolio as a modular family of systems, emphasizing interchangeability and adaptability.

- Caracal CAR 816: This gas-operated, short-stroke piston rifle remains the flagship of the UAE small arms industry. At UMEX 2026, it was displayed not just as a soldier’s weapon but as a platform for various optics and accessories. The “A2” variants were prominent, featuring upgraded furniture and M-LOK handguards, reflecting current trends in weight reduction and modularity. The piston system is favored in the region for its reliability in fine sand conditions, keeping the action cleaner than direct impingement alternatives.

- Caracal CAR 814: The direct-impingement sibling to the 816, the CAR 814 was positioned for law enforcement and export markets where cost-to-performance ratios favor direct impingement systems. The display of the CAR 814 A2 Patrol highlighted its suitability for police cruisers and general duty use.

- VERSUS Competition Rifle: Caracal also showcased the VERSUS, a competition-tuned rifle chambered in.223 Wylde. This demonstrates the company’s engagement with the sport shooting community, which often serves as a testbed for ergonomic and accuracy enhancements that eventually filter down to military products.

4.2 The Turkish Challenge: MPT-76 SH

Sarsilmaz displayed the MPT-76 SH, a 7.62x51mm battle rifle. While heavier than the 5.56mm platforms, the MPT-76 represents the Turkish indigenous equivalent to the CAR 816. Its presence underscores the different doctrinal choices—Turkey maintaining a focus on the heavier 7.62mm cartridge for its varied terrain, while the UAE focuses largely on 5.56mm carbines for mechanized and urban operations.

5. Precision Fires: Sniper & Anti-Materiel Systems

Precision fire was a major theme at UMEX 2026, driven by the operational need for counter-sniper capabilities, the neutralization of unexploded ordnance (UXO), and the engagement of light vehicles at standoff distances.

5.1 Caracal’s Precision Portfolio

- CSR 308 & CSR 338: The CSR (Caracal Sniper Rifle) series was the centerpiece of the precision display. The CSR 308 (7.62x51mm) and CSR 338 (.338 Lapua Magnum) feature fully adjustable chassis systems, essential for the modern sniper. The.338 Lapua Magnum variant is particularly significant as it bridges the gap between anti-personnel and anti-materiel capabilities, offering effective range out to 1,500 meters.

- Export Success: The context of the contract to supply CSR 338 rifles to India was a major talking point. This validation by a major foreign military power enhances the prestige of the platform.

- CSA 338 Semi-Automatic: Caracal also displayed the CSA 338, a semi-automatic precision rifle. This platform addresses the need for rapid follow-up shots, a capability increasingly requested for engaging multiple targets or drone swarms where a bolt-action rifle is too slow.

5.2 Accuracy International (AI): The Western Standard

British firm Accuracy International (AI), a legend in the sniper community, maintained a strong presence.

- AX MkIII: The latest evolution of the AX series, designed to meet current NATO requirements.

- AX50 ELR: The AX50 ELR (Extreme Long Range) is a multi-caliber anti-materiel rifle system. Configured primarily in.50 BMG, it can be converted to.408 CheyTac. Its presence aligns with the regional need for hard-target interdiction—stopping VBIEDs (Vehicle-Borne Improvised Explosive Devices) or disabling parked aircraft at extreme ranges.

5.3 Russian Heavy Hitters

Rosoboronexport showcased Russia’s continued focus on robust, heavy-caliber solutions.

- Kord-M (ASVK-M): This 12.7x108mm anti-materiel rifle is known for its bullpup design, which significantly reduces the overall length of the weapon, making it more maneuverable in urban environments or transport vehicles compared to traditional lengths.

- Chukavin (SVCh): Discussions around the Chukavin sniper rifle highlighted its role as the modern successor to the Dragunov SVD. Reports of its testing in the Ukraine theater added a layer of “combat-proven” marketing to the Russian display.

| Model | Manufacturer | Caliber | Action | Role | Origin |

| CSR 338 | Caracal | .338 Lapua | Bolt Action | Long Range Precision | UAE 🇦🇪 |

| CSA 338 | Caracal | .338 Lapua | Semi-Auto | Rapid Engagement / DMR | UAE 🇦🇪 |

| AX50 ELR | Accuracy Int. | .50 BMG /.408 | Bolt Action | Anti-Materiel / Hard Target | UK 🇬🇧 |

| Kord-M | Rostec | 12.7x108mm | Bolt (Bullpup) | Urban Anti-Materiel | Russia 🇷🇺 |

| MPT-76 SH | Sarsilmaz | 7.62x51mm | Gas Piston | Battle Rifle / DMR | Turkey 🇹🇷 |

6. The Integration Frontier: Remote Weapon Stations (RWS) & Armed UGVs

The most significant trend at UMEX 2026 was the “Integration” of small arms onto unmanned platforms. This segment of the market is expanding rapidly as militaries seek to reduce risk to human personnel and increase the firepower available to light infantry units.

6.1 The EDGE & Milrem Robotics Nexus

The centerpiece of this trend was the collaboration between EDGE Group and Milrem Robotics. The THeMIS UGV (Unmanned Ground Vehicle) was displayed in a “Combat” configuration.

- Armament Upgrade: Unlike previous iterations often seen with 7.62mm machine guns, the 2026 variants were up-gunned with 30mm M230LF cannons and MK44 cannons.

- Strategic Implication: This elevates the UGV from a logistics or light support role to a mechanized infantry combatant capable of engaging light armor. For the small arms analyst, this signals a market shift where “small arms” manufacturers must ensure their receivers can withstand the recoil and environmental stresses of vehicle mounting.

- Operational Validation: The UAE Ministry of Defence signed a contract for 60 units (20 Tracked RCVs and 40 THeMIS UGVs). This is a massive validation of the concept, moving it from prototype to operational reality.

6.2 Sarsilmaz SARBOT and BEST Defence

Sarsilmaz showcased the SARBOT, an armed quadrupedal robot (robodog). While many such systems are prototypes, the integration of Sarsilmaz’s small arms onto a highly mobile legged platform suggests a future focus on urban clearing operations where wheeled or tracked vehicles cannot go.

- BEST Defence: A Sarsilmaz subsidiary, BEST Defence, displayed a 12.7mm Remote Controlled Weapon Station (RCWS). This system utilizes AI for stabilization and targeting, allowing heavy machine gun fire from light tactical vehicles or naval platforms.

6.3 Maritime Lethality: Norinco UB1

China’s Norinco introduced the UB1 Sharp Shark-10, an unmanned surface vessel (USV).

- Payload: It features a visible remote-controlled weapon station fitted with a 12.7mm or 14.5mm machine gun.

- Market Implication: This extends the domain of small arms into naval force protection and anti-piracy, traditionally the role of manned patrol boats. The integration of heavy machine guns on autonomous boats creates a new demand signal for “marinized” small arms capable of withstanding saltwater corrosion without constant human maintenance.

6.4 The “Mobilicom” Connector

An interesting detail from the supply chain perspective was Mobilicom’s announcement of a secured order from a “prominent UAE-based small-arms manufacturer” for its SkyHopper PRO datalinks and controllers. This connects the dots between the weapon and the drone. It implies that UAE manufacturers (almost certainly Caracal or an EDGE affiliate) are building the internal electronic architecture to make their weapons “remote-ready” out of the box, integrating sophisticated datalinks to ensure secure control.

7. Optics, Fire Control, and The Algorithmic Aim

If the gun is the hardware, the fire control system is the software that defines its efficacy. UMEX 2026 highlighted a transition from passive optics (scopes) to active fire control systems (FCS).

7.1 Smart Shooter: The “Lock and Fire” Revolution

Israeli company Smart Shooter continued to dominate the narrative around intelligent sighting systems. Their SMASH family of fire control systems (FCS) was prominent.

- Technology: The system uses image processing and AI to “lock” onto a target. The soldier pulls the trigger, but the system only releases the hammer when the weapon is perfectly aligned with the target.

- Impact: This technology effectively democratizes marksmanship, allowing minimally trained conscripts to achieve sniper-like accuracy against moving targets and, crucially, small drones.

- Variants: The SMASH 3000 (lightweight) and SMASH AD (Anti-Drone specialized) were key discussion points. The system’s ability to calculate lead for a moving drone makes it one of the most cost-effective Kinetic C-UAS solutions on the market.

8. Ammunition: The Consumable Lethality

The ammunition sector at UMEX 2026 reflected the broader trends of indigenization and specialization, particularly in the context of C-UAS requirements.

8.1 Caracal Light Ammunition (CLA) / Lahab

Caracal Light Ammunition (CLA), also known under the Lahab brand, had a massive presence. As the UAE’s sole ammunition producer, their display focused on supply chain sovereignty.

- Portfolio: They showcased a full range of small caliber ammunition (5.56mm, 7.62mm, 9mm, 12.7mm).

- Strategic Importance: The massive contract for armed UGVs (Milrem) creates a sustained demand for 30mm ammunition. Lahab is positioned to be the primary supplier for these systems, ensuring that the UAE’s autonomous fleet is not dependent on foreign ammunition stocks.

8.2 Russian Innovations: Multi-Bullet Ammunition

Russian manufacturer High-Precision Systems (part of Rostec) announced the development of “multi-bullet ammunition” specifically designed to engage small UAVs.

- Concept: This likely refers to a “duplex” or “triplex” round, or a small-caliber shotshell concept, designed to create a spread pattern to increase the hit probability against small, fast-moving drones. This represents a direct adaptation of small arms ammunition to the modern threat environment.

8.3 Turkish BPS

BPS, a Sarsilmaz group company, displayed its ammunition manufacturing capacity. Their presence highlights the competition in the consumables market, with Turkish suppliers positioning themselves as alternative sources for NATO-standard ammunition in the region.

9. Simulation and Training (SimTEX): The Virtual Battlefield

The SimTEX component of the exhibition highlighted how virtual reality is reshaping small arms training.

- InVeris Training Solutions: Displayed the FATS 100MIL virtual training system.

- Capability: The system supports simulation for a vast array of small arms, machine guns, and mortars.

- Trend: The move is toward “ballistically accurate” simulation where the recoil, jam clearing, and reloading procedures are physically replicated, but the “bullet” is a digital pixel. This reduces the logistical cost of training and allows for complex “shoot/no-shoot” scenario training that live fire cannot safely replicate.

- Adoption: The selection of InVeris systems by the USAF Security Forces Center was a key marketing point, validating the system’s fidelity for high-level military training.

10. Counter-UAS (C-UAS) and Non-Kinetic “Small Arms”

The proliferation of drones has necessitated the invention of anti-drone “small arms.” UMEX 2026 blurred the line between a weapon that fires a bullet and a weapon that fires a signal.

10.1 Carboteh BANS: The Handheld Electronic Weapon

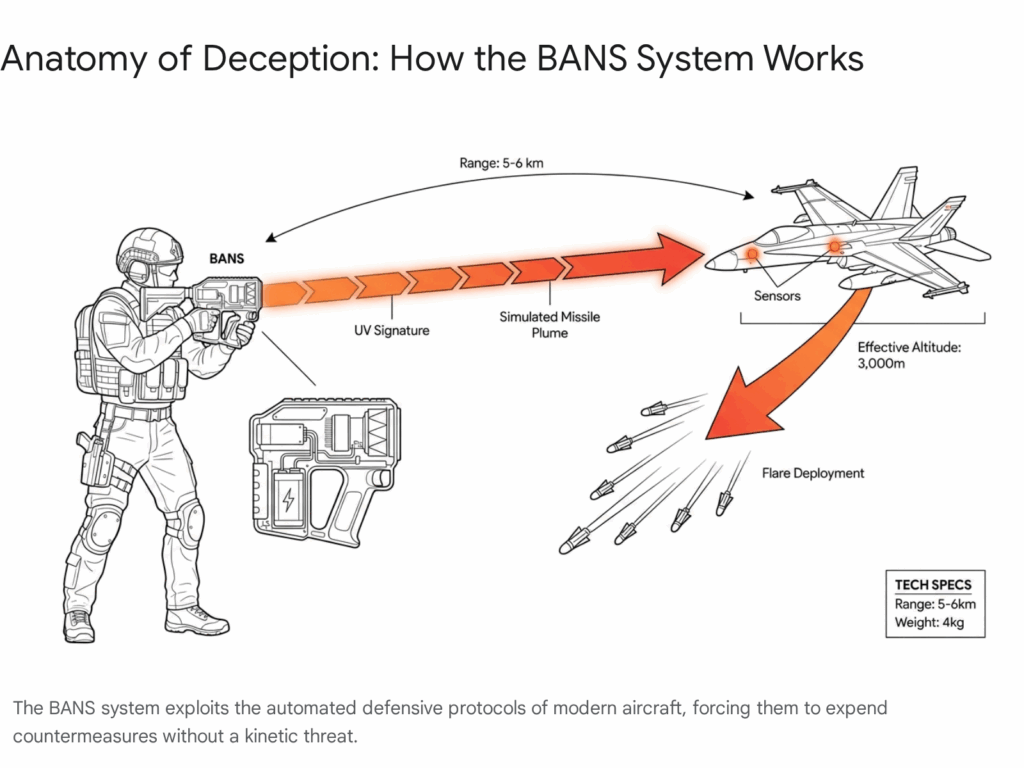

One of the most innovative “small arms” at the show fired no projectiles at all. The Battlefield Anti-Aircraft Non-Kinetic (BANS) system, developed by Carboteh, is a handheld device resembling a bullpup rifle.

- Function: It simulates the UV signature of a surface-to-air missile launch.

- Effect: When pointed at an enemy aircraft, the aircraft’s Missile Warning System (MWS) detects the “launch” and automatically deploys flares and countermeasures.

- Tactical Value: It forces enemy pilots to expend their limited defensive countermeasures or abort runs without the operator firing a single expensive missile. It is a psychological and logistical weapon in a rifle form factor.

10.2 Calidus “Spider Net”

UAE-based Calidus showcased the Spider Net system.

- Function: A kinetic C-UAS solution designed to physically capture or disable small drones.

- Significance: As drones become smaller and operate in swarms, jamming becomes less effective (due to autonomous navigation). Kinetic solutions like nets or fragmentation rounds are seeing a resurgence as the “hard kill” final layer of defense. This system, integrated with vehicles like the MCAV, provides a mobile “dome” of protection against loitering munitions.

11. Social Media and Digital Sentiment Analysis

A review of social media discussions (Twitter/X, LinkedIn, Reddit) surrounding UMEX 2026 reveals a distinct divergence between industry professionals and general enthusiasts.

- Industry Sentiment (LinkedIn): The discourse focused heavily on “partnerships” and “sovereignty.” Posts from EDGE and Tawazun executives garnered high engagement, reinforcing the narrative of UAE industrial success. The “Caracal India” deal was frequently cited as a proof point of the UAE’s rising status as a defense exporter. Mobilicom’s announcement of their win with a UAE small arms manufacturer also generated specific B2B buzz regarding supply chain integration.

- Enthusiast Sentiment (Twitter/Reddit):

- The “Robodog” Factor: The Sarsilmaz SARBOT and Milrem THeMIS generated the most viral content. The imagery of “guns on robots” continues to capture public imagination and anxiety, with threads discussing the ethical implications of autonomous fire.

- Technical Skepticism: Discussions on defense forums (e.g., r/CredibleDefense) dissected the Russian displays. Users questioned the practical efficacy of the Kub-2-2E based on its specs vs. battlefield performance in Ukraine. There was also scrutiny of the “Smart Shooter” type systems, with debates on their effectiveness against swarms vs. single targets.

- Joby Aviation: While not small arms, the announcement by Joby Aviation regarding commercial flights in the UAE by 2026 created a halo effect of “futurism” around the entire show, which defense exhibitors leveraged to frame their products as equally cutting-edge.

12. Market Analysis: Contracts and Economic Implications

The financial backbone of UMEX 2026 was the Tawazun Council, the UAE’s defense procurement authority. The volume and nature of the contracts signed provide a clear roadmap of the UAE’s defense strategy.

12.1 The Caracal Contract: Defining “Remote” Lethality

The most critical data point for the small arms analyst was the AED 345.3 million ($94 million) contract awarded to Caracal International for “remote-controlled weapons.”

- Analysis: This is not a standard rifle procurement. The specific terminology “remote-controlled” implies that this funding is dedicated to equipping the expanding fleet of UGVs (like the Milrem deal) and static defense posts with weaponized turrets. It validates the R&D investment Caracal has made in integrating its firearms with servos and sensors. It shifts revenue potential from low-margin hardware (rifles) to high-margin systems integration.

12.2 The EDGE/Milrem Deal

The AED 525 million ($143 million) deal for THeMIS and RCV units is a direct multiplier for the small arms ammunition market.

- Analysis: These 60 vehicles will require significant stockpiles of 30mm ammunition. Unlike infantry, who fire conservatively, autonomous or remote systems often have higher rates of fire and sustained suppression capabilities. This bodes well for Lahab (Caracal Light Ammunition), which will likely supply the consumables for these platforms.

12.3 Export Success: The India Connection

While not a UMEX-specific signature, the context of the CSR 338 contract with India was buzzing on the floor.

- Significance: The supply of 200 sniper rifles to India’s Central Reserve Police Force (CRPF) is a watershed moment. It proves that UAE small arms are competitive against established European and American brands in open tenders. It opens the door to the massive Indian defense market, where “Make in India” initiatives align perfectly with Caracal’s willingness to transfer technology and manufacture locally.

13. Conclusion and Future Outlook

UMEX 2026 was a manifesto for the future of small arms. The era of the “dumb” iron sight and the standalone rifle is ending. The industry is pivoting toward an ecosystem where the weapon is merely the kinetic actuator in a networked loop of sensors, AI processors, and autonomous platforms.

For the UAE, the event was a triumph of industrial strategy. Caracal International has successfully transitioned from a local assembler to a global competitor, capable of winning foreign contracts and supplying advanced remote systems to its own military.

Key Takeaways for the Analyst:

- Watch the Software: The value in small arms is migrating to Fire Control Systems (Smart Shooter, etc.). The company that owns the “lock” algorithm owns the lethality.

- The UGV as the New Infantryman: The heavy procurement of armed UGVs (Milrem) suggests that future small arms requirements will increasingly prioritize vehicle-mounted configurations (heavy barrels, solenoid triggers) over man-portable ergonomics.

- Sovereignty is King: The GCC market is closed to those who merely wish to sell. It is open to those who wish to build locally.

The rifle of the future, as seen at UMEX 2026, is not just held in hands—it is mounted on tracks, guided by code, and built in Abu Dhabi.

Appendix: Methodology

This report was compiled using a synthesis of open-source intelligence (OSINT) gathered from the UMEX and SimTEX 2026 exhibition. Sources include:

- Official Press Releases: From Tawazun Council, EDGE Group, and ADNEC.

- Defense News Reporting: Articles from Breaking Defense, Jane’s (implied via snippets), and regional defense outlets (Defaiya, Gulf News).

- Exhibitor Data: Analysis of exhibitor lists and product catalogs from Caracal, Sarsilmaz, Rosoboronexport, and others.

- Social Media Analysis: Review of relevant hashtags (#UMEX2026, #SimTEX2026) and discussions on platforms like LinkedIn and Reddit to gauge sentiment and identify viral technologies.

- Contract Data: Aggregation of publicly announced contract values and scope.

All financial figures are reported in AED and converted to USD at the prevailing peg rate (approx. 3.67 AED = 1 USD) where applicable. Product specifications are derived from manufacturer claims displayed at the event.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works Cited

- Breaking Defense. (2026, January 22). UMEX total deals reach $980 million, navies seek 3D-printed USVs. Retrieved from breakingdefense.com

- Breaking Defense. (2026, January 20). UMEX opens with $240 million in contracts to EDGE Group. Retrieved from breakingdefense.com

- Caracal International. (2025, November 28). Caracal Debut Advanced Line Commercial Pistols and Rifles. Retrieved from edgegroupuae.com

- Defense Update. (2026, January 20). Carboteh introduces a non-kinetic system designed to force hostile aircraft to expend countermeasures. Retrieved from defense-update.com

- EDR Magazine. (2026, January 22). Tawazun announces Ministry of Defence deals 11 contracts worth AED 3.6 billion over 3 days at UMEX SIMTEX. Retrieved from edrmagazine.eu

- Gulf News. (2026, January 22). 37,878 visitors attend UMEX and SimTEX 2026 in a record-breaking edition. Retrieved from gulfnews.com

- H I Sutton. (2026, January 23). New Chinese Maritime Drone: UB1 Shark-10. Retrieved from hisutton.com

- Mobilicom. (2026, January 26). Mobilicom Announces New Design Win and Initial Order from United Arab Emirates-Based Arms Manufacturer. Retrieved from money.tmx.com

- Rosoboronexport. (2026, January 20). JSC ROSOBORONEXPORT is organizing a single Russian exhibit at UMEX & SimTEX 2026. Retrieved from roe.ru

- Tawazun Council. (2026, January 22). Tawazun Council awards AED 3.6 billion in defense deals. Retrieved from english.defensearabia.com