The contemporary small arms market is currently navigating a significant transitional period, characterized by the convergence of competition-grade performance characteristics with duty-grade reliability requirements. For decades, the bifurcation between the 1911 platform—revered for its single-action trigger and ergonomic superiority—and the polymer striker-fired segment—dominated by Glock due to logistical ubiquity and reliability—was absolute. The emergence of the modular “2011” pistols and the double-stack 1911s, such as the ParaOrdnance and Rock Island A2 series, attempted to bridge this divide, yet it historically introduced a new logistical hurdle: expensive, proprietary, and often finicky magazine systems.

The Stealth Arms Platypus represents a radical engineering departure within this landscape. It is not merely another double-stack 1911; it is a successful attempt to reconcile the geometric and mechanical disparities between the 1911 fire control group and the Glock magazine ecosystem. This report provides an exhaustive industry analysis of the Platypus, evaluating its engineering architecture, market positioning, operational performance, and customer sentiment.

Our analysis, based on a comprehensive review of technical specifications, endurance testing data, and user feedback, classifies the Stealth Arms Platypus as a disruptive market entrant that successfully solves the “magazine tax” problem inherent to the 2011 platform. By utilizing a unibody 7075-T6 aluminum frame, Stealth Arms has engineered a solution that retains the preferred 17.5-degree grip angle of the 1911 while accepting magazines designed for the 22-degree rake of the Glock platform.1 This achievement significantly lowers the barrier to entry for the double-stack 1911 market, offering a Total Cost of Ownership (TCO) substantially lower than legacy competitors like Staccato or newer entrants like the Springfield Prodigy.

However, the platform is not without engineering compromises inherent to its design philosophy. The reliance on an aluminum frame for the slide rails creates a finite fatigue life, evidenced by isolated reports of structural failure at high round counts (20,000+), and necessitates a rigorous lubrication regimen to prevent galvanic corrosion and accelerated wear.3 Furthermore, while the platform’s reliability with OEM Glock magazines is exemplary, its tolerance for aftermarket magazines and specific projectile profiles requires end-user validation.5

Ultimately, this report concludes that the Stealth Arms Platypus is a “Strong Buy” for the enthusiast and competitive shooter demographic, particularly those already invested in the Glock ecosystem. For professional duty application, while the platform demonstrates promise, it currently lacks the extensive institutional track record of the Staccato P, and its aluminum frame limitations suggest it is better suited for the high-performance enthusiast rather than the infinite-duty lifecycle required by large-scale law enforcement deployment.

2. Market Context and Logistical Positioning

To fully appreciate the technical achievements and market relevance of the Platypus, it is necessary to contextualize the historical friction between the 1911 and modern logistics. The “2011” platform, originally popularized by STI International (now Staccato), revolutionized the competition circuit by mating a steel sub-frame to a polymer grip, allowing for double-stack capacity. However, this design legacy carried with it a significant financial burden: magazines.

2.1 The Magazine Economy

In the ecosystem of high-performance handguns, the magazine is often the single most expensive consumable after ammunition. Traditional 2011 magazines (Staccato, MBX, Atlas) command prices ranging from $70 to $120 per unit. For a competitor requiring ten magazines, this represents a capital investment of nearly $1,000—roughly the price of a mid-tier handgun itself.

Conversely, the Glock magazine pattern has become the “STANAG” of the pistol world—ubiquitous, inexpensive ($20-$25), and reliable. The industry has long sought a “Holy Grail” product: a pistol that combines the trigger press of a 1911 with the magazine economy of a Glock. Previous attempts were often hampered by extreme grip girth (due to the thickness of polymer-coated Glock mags) or poor ergonomics (due to the steep angle of Glock mags).

2.2 The Stealth Arms Value Proposition

Stealth Arms entered this space not by adapting an existing modular 2011 frame, but by machining a proprietary unibody frame from 7075-T6 aluminum.7 This decision was pivotal. By eliminating the need for a separate polymer grip module, engineers could thin the frame walls to the structural minimum, thereby accommodating the wider Glock magazine without expanding the grip circumference to unmanageable dimensions.8 This unibody design is what makes the Platypus a wide body 1911 vs. a modular 2011 to be clear.

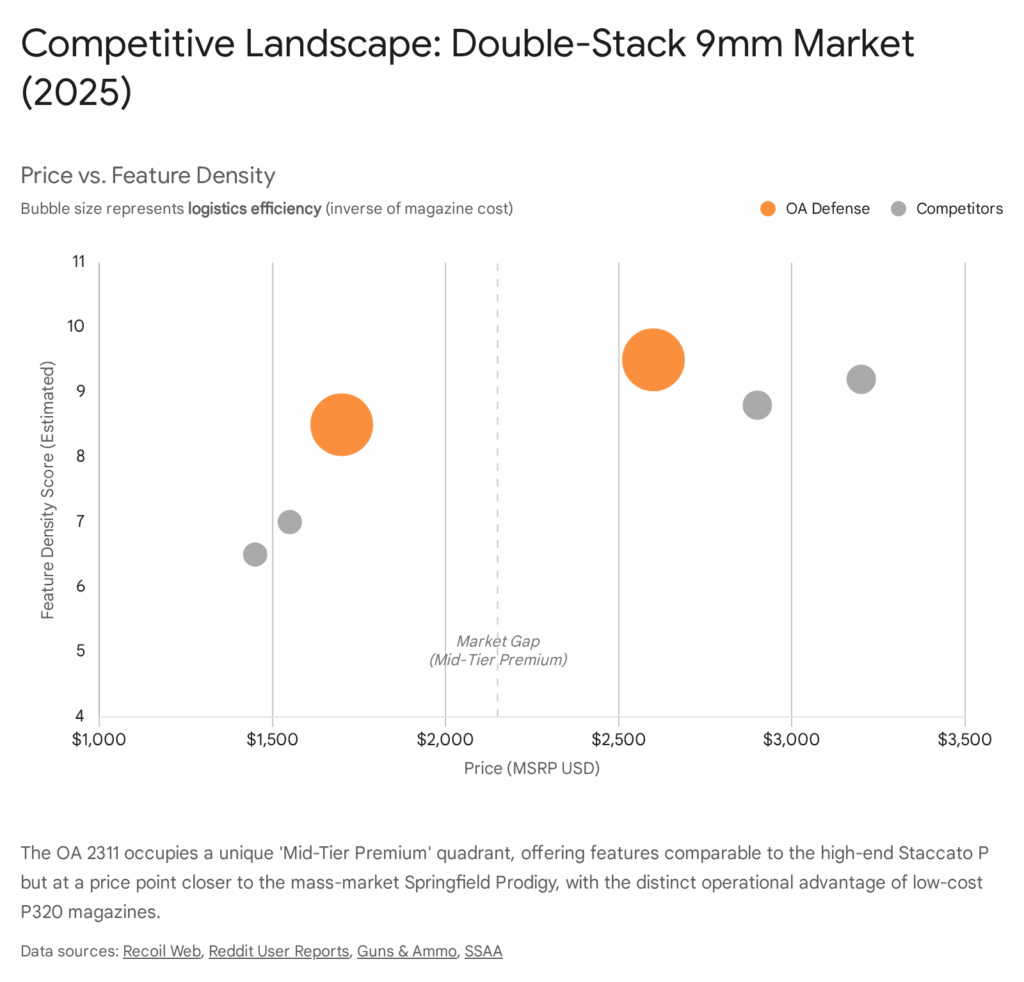

This places the Platypus in a unique market quadrant:

- Price Point: With a base MSRP of approximately $1,400, it undercuts the Staccato P ($2,500) and aligns with the Springfield Prodigy ($1,500).1

- Logistics: It shares magazine interoperability not just with Glocks, but with the vast ecosystem of pistol caliber carbines (PCCs) that utilize Glock magazines, creating a unified logistics chain for the user.10

- Customization: Unlike the “off-the-rack” nature of the Prodigy or Staccato, the Platypus utilizes a made-to-order model, allowing granular customization that appeals to the modern consumer’s desire for personalization.11

2.3 Expansion to the P320 Ecosystem

A significant recent development is the introduction of a variant compatible with SIG P320 magazines.12 This strategic move acknowledges the shifting landscape of military and law enforcement logistics, where the SIG P320 (M17/M18) has replaced the Beretta M9. By offering a chassis compatible with P320 magazines, Stealth Arms effectively future-proofs the platform, allowing it to serve the two most dominant magazine ecosystems in the United States.

3. Comprehensive Engineering Analysis

This section dissects the mechanical architecture of the Platypus, evaluating how Stealth Arms reconciled the conflicting geometries of the 1911 and the Glock magazine.

3.1 Frame Architecture and Metallurgy

The structural foundation of the Platypus is a monolithic frame machined from 7075-T6 aircraft-grade aluminum. This material choice is a critical differentiator from the steel-framed or modular-framed competition.

- Unibody Construction: Unlike the modular 2011 (steel frame + polymer grip), the Platypus grip and dust cover are a single continuous piece of metal. This increases structural rigidity and eliminates “grip flex,” a phenomenon in polymer guns that can dissipate recoil energy unpredictably.

- Metallurgical Trade-offs: The use of 7075-T6 aluminum provides an excellent strength-to-weight ratio, resulting in a pistol that weighs approximately 28-30 ounces.14 This is significantly lighter than a steel-framed Staccato P (approx. 33-35 oz) or Springfield Prodigy. While this reduces carry fatigue, it reduces the mass available to dampen recoil.15

- Wear Dynamics: The interaction between the carbon steel slide and the aluminum frame rails is a critical tribological concern. Steel is harder than aluminum. Over time, without proper lubrication, the steel slide can abrade the aluminum rails. Stealth Arms mitigates this with Cerakote finishes, but users have noted that this finish wears off the rail contact points relatively quickly.3

- Fatigue Limits: Aluminum possesses a finite fatigue limit, unlike steel which has an infinite fatigue limit if stress remains below a certain threshold. High-volume endurance data (20,000+ rounds) has produced isolated reports of frame rail cracking.3 While 20,000 rounds represents a lifetime of shooting for 99% of users, for USPSA Grand Masters, this fatigue limit classifies the frame as a consumable component rather than a permanent heirloom.

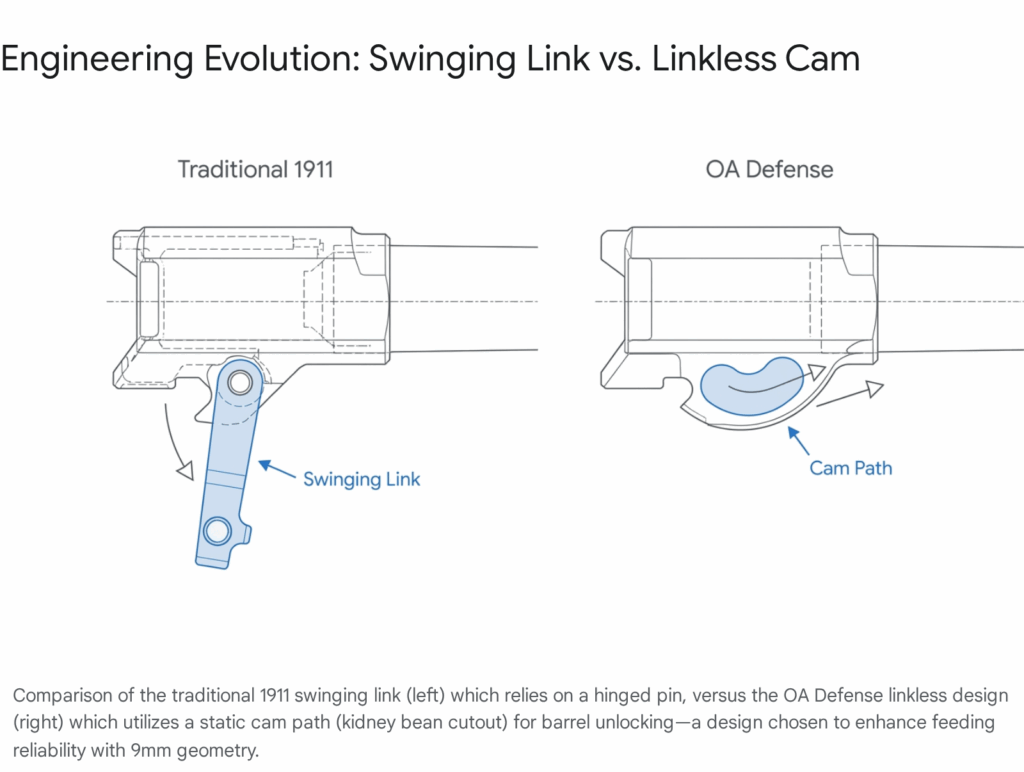

3.2 The Grip Angle Paradox

The most significant engineering challenge in the Platypus design is the reconciliation of grip angles.

- The Conflict: The 1911 platform is famous for its natural pointing characteristics derived from a ~17.5-degree grip angle. The Glock platform utilizes a steeper ~22-degree grip angle to accommodate its magazine feed lips.

- The Solution: Stealth Arms maintains the external 1911 grip angle (17.5 degrees) for the shooter’s hand. Internally, however, the magazine well is broached to accept the steeper Glock magazine. This is achieved by manipulating the internal geometry and thinning the backstrap of the aluminum frame to allow the magazine to sit in its natural orientation without forcing the shooter’s wrist into a “Glock” downward tilt.2

- User Impact: This engineering sleight-of-hand means the shooter experiences the point-of-aim of a 1911 while the gun feeds from a Glock magazine. It effectively decouples the magazine geometry from the ergonomic interface.

3.3 Magazine Interface Mechanics

The interface between the magazine and the frame involves unique engineering considerations due to the material mismatch.

- Friction Coefficients: Glock magazines are polymer-bodied. In a Glock, they slide against a polymer frame (plastic-on-plastic). In the Platypus, they slide against aluminum (plastic-on-metal). This change in friction coefficient can lead to magazines failing to drop free if the frame tolerances are too tight or if the user grips the frame tightly, compressing the aluminum slightly.

- The Magazine Catch: Stealth Arms utilizes a proprietary steel magazine catch designed to engage the front-facing cutout of the Glock magazine.18 Since the catch is harder (steel) than the magazine body (polymer), long-term use will inevitably wear the polymer cutout on the magazine. However, given the low cost of Glock magazines ($20), this is considered an acceptable sacrificial wear part compared to the catch itself.20

- Basepad Compatibility: The Platypus features a flared magazine well (magwell) for faster reloads. However, the geometric variance of aftermarket Glock basepads (e.g., Strike Industries, Taran Tactical) can cause interference with this magwell, preventing the magazine from seating fully. The report indicates that OEM Glock magazines and specific extensions (like Springer Precision) are the most reliable, while others may require modification.5

3.4 Barrel and Lockup Geometry

The Platypus is offered with two primary barrel lockup systems, each influencing performance:

- Bushing Barrel: This is the traditional 1911 configuration where a removable bushing supports the muzzle. It is lighter and allows for a classic takedown but introduces a moving part that can affect accuracy consistency as it heats up.7

- Bull Barrel: A tapered, bushing-less design that locks directly into the slide. This adds non-reciprocating mass to the front of the pistol, which aids in mitigating muzzle flip—a crucial benefit given the lightweight aluminum frame. The bull barrel is generally preferred for competition applications due to its thermal mass and simplified lockup consistency.21

3.5 Fire Control System (Trigger)

The trigger mechanism is a standard Series 70 design, omitting the firing pin block found in Series 80 1911s. This results in the crisp, clean break enthusiasts expect.

- Proprietary Nature: Due to the widened magazine track required for the double-stack Glock mag, the trigger bow (the metal stirrup that connects the shoe to the sear) is wider than a standard 1911. This means standard aftermarket 1911 triggers are not drop-in compatible; users are reliant on Stealth Arms’ proprietary trigger components.17

- Performance: Factory settings typically deliver a pull weight between 3.0 and 4.0 lbs. The trigger shoe itself is polymer in some configurations, which has drawn mixed feedback regarding aesthetics versus the tactile grip it offers.23

4. Operational Performance Profile

This section evaluates the Platypus based on empirical performance data, distinguishing between mechanical reliability (function) and durability (longevity).

4.1 Reliability Analysis

Data aggregated from various endurance tests, including a 10,000-round operational review, indicates a reliability profile that is high but maintenance-dependent.

Summary Table: Operational Reliability Metrics

| Metric | Rating | Observation / Data Point |

| Feed Reliability (OEM Mags) | Excellent | Flawless feeding reported with ball, hollow point, and flat-nose ammo.24 |

| Feed Reliability (Aftermarket) | Variable | Sensitivity to mag geometry; ETS/ProMag less reliable; Magpul PMAGs tight.5 |

| Ejection Consistency | Good | Occasional stovepipes noted during break-in or when heavily fouled.3 |

| Lubrication Sensitivity | High | Aluminum rails require “wet” operation; dry rails lead to sluggish cycling.26 |

| Break-in Period | Required | ~200-500 rounds required to mate Cerakote surfaces and smooth slide travel.24 |

Detailed Findings:

- Lubrication: The aluminum-on-steel slide interface is intolerant of friction. Users employing viscous greases (like Frog Lube) in cold weather or allowing the gun to run dry reported failures to eject (FTE) and failures to return to battery (FRTB). Light oils (CLP, Wilson Ultima) are recommended to maintain hydrodynamic lubrication.26

- Magazine Dynamics: The feed ramp geometry successfully negotiates the “jump” from the Glock magazine. However, the lack of a polymer liner in the grip means that debris (sand, grit) can cause increased friction on the magazine body, potentially hindering drop-free operation in field conditions.5

4.2 Accuracy and Precision

Ransom Rest testing and expert shooter evaluations verify that the Platypus delivers match-grade accuracy, commensurate with its 1911 lineage.

- Mechanical Accuracy: Sub-2-inch groups at 25 yards are consistently achievable with quality ammunition (e.g., Federal HST, Gold Dot).27

- Optic Stability: The decision to mill the optic footprint directly into the slide (Direct Mill) rather than using an adapter plate system is a significant performance advantage. It lowers the bore-over-sight axis, improving the shooter’s index, and removes the failure point of adapter plate screws shearing under recoil.17

4.3 Recoil Impulse and Shootability

The physics of the Platypus create a distinct recoil signature.

- Mass Ratio: Being significantly lighter (~28 oz) than a steel-framed counterpart (~36-40 oz), the Platypus transmits more recoil energy to the shooter. This manifests as “snappiness” or sharper muzzle rise.29

- Mitigation: Users can mitigate this by selecting the Bull Barrel option (adding muzzle weight) and utilizing a properly tuned recoil spring. The “Prickle” grip texture also plays a vital role here, locking the lightweight frame into the hand to prevent it from shifting under recoil.30

- Comparison: While it shoots flatter than a polymer Glock due to the lower bore axis and single-action trigger, it is generally considered “snappier” than a heavy steel Staccato P or Prodigy.31

5. Customer Sentiment and Market Reception

The market reception of the Platypus has been overwhelmingly positive, driven by the unique “Builder” experience and the relief of magazine costs.

5.1 The “Builder” Experience Psychology

Stealth Arms utilizes a direct-to-consumer “Builder” tool that allows granular customization of every component, from the frame color to the screw finish.

- Psychological Impact: This creates a sense of ownership and “sunk cost” (emotional) before the product even arrives. Customers are willing to tolerate long lead times (12-14 weeks) because they are waiting for their specific creation, not a generic SKU.1

- Aesthetics: The wide array of Cerakote options has led to a sub-culture of “theme builds” (e.g., Perry the Platypus colors), fostering a strong community engagement on social media platforms.11

5.2 Grip Texture Feedback

The dichotomy between the “Chainlink” and “Prickle” grip textures is a frequent topic of consumer debate.

- Prickle Grip: Widely acclaimed by competitive shooters for its aggressive traction. It effectively locks the gun to the hand, essential for managing the recoil of the lightweight frame. However, for concealed carry (IWB), it requires an undershirt to prevent skin abrasion.30

- Chainlink Grip: Viewed as a less aggressive alternative suitable for carry, but some users report it becomes slick under sweaty conditions, leading to a preference for the Prickle grip despite the abrasion risk.7

5.3 Durability and Finish Concerns

While performance is praised, long-term cosmetic durability is a recurring minor complaint.

- Cerakote Wear: Unlike the DLC (Diamond-Like Carbon) or Nitride finishes found on duty-grade Staccatos, the Cerakote finish on the Platypus is softer. Users report holster wear appearing on the slide and frame rails relatively quickly. This is accepted as “patina” by some but seen as a quality tier differentiator by others.4

- Rail Wear: The visible wear of the Cerakote on the internal frame rails during the break-in period is a common observation. While functional (the gun “self-clearances”), it signals the importance of lubrication.33

Sentiment Summary Table

| Category | Sentiment Rating | Key Consumer Insights |

| Customization | 5/5 (Outstanding) | The online builder is a primary sales driver; highly valued. |

| Value / Cost | 5/5 (Outstanding) | Magazine savings are viewed as a massive long-term benefit. |

| Performance | 4.5/5 (Excellent) | Reliability is high; accuracy is excellent; recoil is manageable. |

| Lead Time | 3/5 (Moderate) | 12-14 week wait is a pain point, though deemed “worth it.” |

| Finish Durability | 3.5/5 (Average) | Cerakote wears faster than DLC; cosmetic wear is common. |

6. Competitive Landscape: Head-to-Head Analysis

The Platypus exists in a fiercely competitive “Double Stack 1911” sector. This section benchmarks it against its primary rivals.

6.1 Stealth Arms Platypus vs. Staccato P (Aluminum)

The Staccato P is the industry benchmark for duty-grade 2011s.

- Cost: The Platypus (~$1,400) is approximately $1,100 cheaper than the Staccato P (~$2,500).

- Magazines: A basic combat loadout (6 mags) costs $120 for the Platypus (Glock OEM) vs. $420-$600 for the Staccato.

- Duty Suitability: The Staccato P has a proven track record with hundreds of law enforcement agencies (US Marshals, LAPD SWAT). The Platypus lacks this institutional vetting. The Staccato’s DLC finish and tool-less guide rod are features oriented toward professional duty use that the Platypus lacks in its base configuration.9

- Conclusion: Staccato wins for Duty/Professional use. Platypus wins for value and enthusiast use.

6.2 Stealth Arms Platypus vs. Springfield Prodigy

The Prodigy aims to be the “budget Staccato.”

- Reliability: The Prodigy launch was plagued by reliability issues tied to MIM parts and spring weights. The Platypus, using tool steel internals and a Series 70 design, has demonstrated superior out-of-the-box reliability in the market.24

- Architecture: The Prodigy uses a steel frame (heavier, softer recoil) vs. the Platypus aluminum frame.

- Conclusion: The Platypus is a safer “out of the box” purchase. The Prodigy requires aftermarket investment (ignition kits, tuning) to reach parity, negating its price advantage.

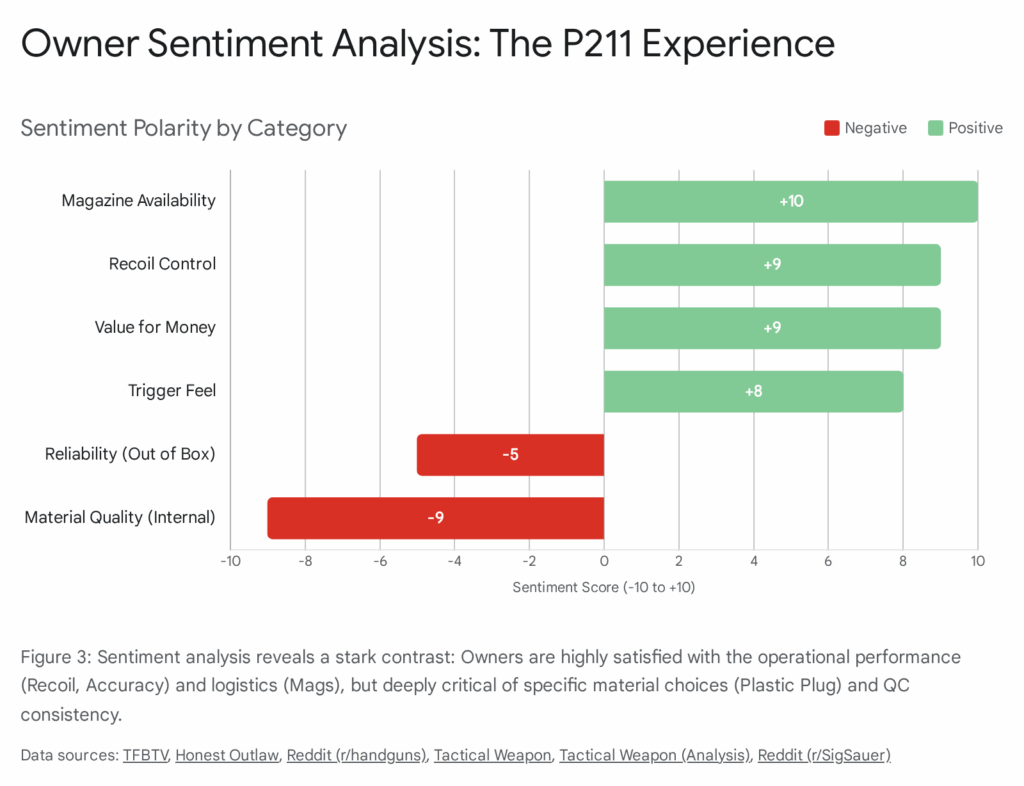

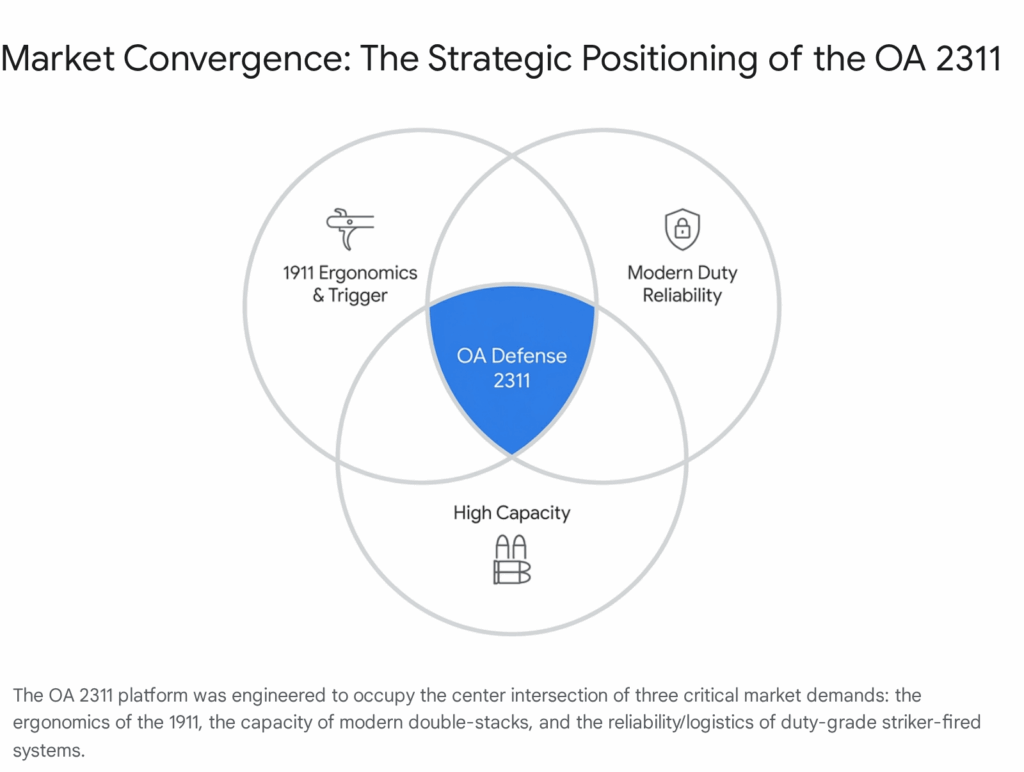

6.3 Stealth Arms Platypus vs. Oracle Arms 2311

The OA 2311 is a direct competitor utilizing SIG P320 magazines.

- Ergonomics: The Platypus is praised for maintaining the slim, classic 1911 profile. The OA 2311 is often described as bulkier or having a more “blocky” grip feel due to its modular architecture.36

- Design: The Platypus is a pure 1911 derivative. The OA 2311 integrates more “modern” features like ambidextrous slide releases but deviates further from the 1911 manual of arms.

- Conclusion: The Platypus offers a more traditional and refined shooting experience for 1911 purists.

7. Strategic Outlook and Future Implications

The Stealth Arms Platypus is more than a single product; it is a proof-of-concept for the “democratization” of the 2011 platform.

7.1 The SIG P320 Variant

The introduction of the P320 magazine-compatible frame is a strategic masterstroke. With the US Military adoption of the M17/M18 (P320 platform), millions of these magazines are entering circulation. By offering frames for both Glock (Civilian/LE dominance) and SIG (Military/LE dominance), Stealth Arms creates a total addressable market that covers nearly 80% of the modern striker-fired magazine supply.12

7.2 The Steel Frame Question

Consumer demand for a steel-framed Platypus is high.36 A steel frame would solve the two primary criticisms of the platform:

- Recoil Mitigation: Adding mass to dampen the 9mm snap.

- Durability: Eliminating the aluminum rail fatigue limit and wear concerns.

- Analysis: If Stealth Arms introduces a steel-framed variant, even at a higher price point (~$1,800), it would directly threaten the market share of the Staccato P and Springfield Prodigy in the competition sector, removing the only major hardware advantage those platforms currently hold.

8. Overall Conclusion and Recommendation

The Stealth Arms Platypus is a triumph of market-aware engineering. It identifies the single greatest pain point of the 2011 ownership experience—proprietary magazines—and solves it without destroying the ergonomic soul of the firearm.

Verdict: Worth Buying? YES.

Buy Case (The Ideal User):

- The Glock Convert: You own multiple Glocks and a bin full of magazines. You want the precision of a 1911 trigger but refuse to pay $100 per magazine.

- The Competitor: You shoot USPSA Limited Optics or IDPA and want a tunable, reliable gun where magazines are disposable consumables, not precious assets.

- The Individualist: You value the ability to customize the aesthetics of your firearm from the factory.

Cautionary Case (The Duty User):

- Law Enforcement/Defense: While the Platypus is reliable, its aluminum frame has a finite fatigue life compared to steel, and it lacks the widespread duty retention holster ecosystem of the Staccato P (Saf-ariland 6360/6390 series compatibility is spotty without modification).17 For life-safety applications where budget is secondary to infinite durability, the Staccato P remains the prudent choice.

In conclusion, the Stealth Arms Platypus is not a novelty; it is a serious performance tool that delivers 90% of the performance of a $3,000 custom gun for 50% of the price, with a logistical advantage that no other 1911 can match.

Appendix A: Methodology

1. Data Collection Strategy

This report utilized a multi-vector data collection approach to ensure a holistic evaluation of the Stealth Arms Platypus.

- Technical Specifications Review: Primary source data from Stealth Arms documentation was analyzed to establish baseline engineering facts (metallurgy, dimensions, compatibility).1

- Longitudinal Sentiment Analysis: User feedback was aggregated from high-traffic enthusiast hubs (Reddit r/2011, r/stealtharms, firearms forums) spanning a timeline from the product’s launch to present day. This allowed for the identification of trends, such as the initial skepticism regarding the grip angle followed by validation from owners.2

- Failure Mode Analysis: Specific attention was paid to “edge case” reports, such as the 20,000-round frame failure and magazine compatibility issues, to identify the mechanical limits of the platform.3

2. Analytical Framework

- Comparative Analysis: The Platypus was not evaluated in a vacuum but benchmarked against its direct market competitors (Staccato, Prodigy, OA 2311) using consistent vectors: Cost, Reliability, Logistics, and Durability.

- Engineering First Principles: Mechanical claims (e.g., “Glock mags in a 1911”) were evaluated against engineering principles (grip geometry, friction coefficients, material fatigue limits) to determine the validity of the design solutions.

3. Limitations

- Sample Size: While anecdotal reports are numerous, controlled laboratory endurance testing (e.g., 50,000-round torture tests by independent labs) is not publicly available.

- Variability: Due to the custom “Builder” nature of the product, individual unit performance may vary slightly based on the specific combination of parts selected by the user.

4. Terms of Reference

- TCO: Total Cost of Ownership (Gun + Holster + 10 Magazines).

- 2011: Used colloquially to refer to any double-stack 1911-style pistol, though mechanically the Platypus is a unibody double-stack 1911.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Works cited

- 1911 Platypus – Stealth Arms, accessed December 3, 2025, https://www.stealtharms.net/p/platypus

- Is it me or is the grip angle on the platypus more Glock than 1911? : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1bjeo94/is_it_me_or_is_the_grip_angle_on_the_platypus/

- Rail-Frame broke : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1p9atz1/railframe_broke/

- Cerakote Durability/Application on the Platypus? : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1ivqp5k/cerakote_durabilityapplication_on_the_platypus/

- Mags : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/16u0ggw/mags/

- Platypus Compatibility Guide | Magazines, Extensions & Holsters – Stealth Arms, accessed December 3, 2025, https://www.stealtharms.net/information/accessories

- Stealth Arms Platypus 1911 Government RMR Double Stack 9mm Pistol – BLK, accessed December 3, 2025, https://www.rainierarms.com/stealth-arms-platypus-1911-government-rmr-double-stack-9mm-pistol-blk/

- Stealth arms Platypus, a 1911..that takes glock mags! : r/guns – Reddit, accessed December 3, 2025, https://www.reddit.com/r/guns/comments/10ubzpb/stealth_arms_platypus_a_1911that_takes_glock_mags/

- Best 2011 Model – Staccato 2011, accessed December 3, 2025, https://staccato2011.com/blog/which-2011-is-right-for-me-

- Stealth Arms — Platypus® Pistols – JP Rifles, accessed December 3, 2025, https://www.jprifles.com/1.2.8_platypus.php

- Stealth Arms Platypus: Not Your Typical 1911 – The Mag Life, accessed December 3, 2025, https://gunmagwarehouse.com/blog/stealth-arms-platypus-not-your-typical-1911/

- P320 Magazine Type Now Available Even For Builds!!!! : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1pavmqt/p320_magazine_type_now_available_even_for_builds/

- Retired my Sig p320. Stealth Arms Platypus Is the way. : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1jkqgf8/retired_my_sig_p320_stealth_arms_platypus_is_the/

- Comparative weights of my 2011’s (plus 1911 Range Officer Operator for comparison), accessed December 3, 2025, https://www.reddit.com/r/2011/comments/131gw3y/comparative_weights_of_my_2011s_plus_1911_range/

- Two Staccato P Duo Pistols Tested: Is Light Always Right? – Handguns, accessed December 3, 2025, https://www.handgunsmag.com/editorial/staccato-p-duo-pistols-tested/474291

- 3000 round initial review – (will update at 10,000) : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1ewmwj7/3000_round_initial_review_will_update_at_10000/

- Frequently Asked Questions | 1911 Platypus | 1911 80 Percent Frames – Stealth Arms, accessed December 3, 2025, https://www.stealtharms.net/information/faq

- Platypus Mag Catch – Stealth Arms, accessed December 3, 2025, https://www.stealtharms.net/p/platypus-mag-catch

- Platypus question: can you swap the mag release to the other side? : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/12ubgwc/platypus_question_can_you_swap_the_mag_release_to/

- Materials of parts : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1ei7lzg/materials_of_parts/

- Competition – Prodigy vs Platypus : r/2011 – Reddit, accessed December 3, 2025, https://www.reddit.com/r/2011/comments/1bfg9fl/competition_prodigy_vs_platypus/

- Stealth Arms – Platypus – Honest Opinion : r/2011 – Reddit, accessed December 3, 2025, https://www.reddit.com/r/2011/comments/1p6n6kk/stealth_arms_platypus_honest_opinion/

- Stealth Arms Platypus, Staccato P, Springfield Armory Prodigy DS1911 – YouTube, accessed December 3, 2025, https://www.youtube.com/watch?v=fGRBuFodaOI

- New Platypus – Range Report : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1omu0zh/new_platypus_range_report/

- 10,000 +- rounds out the tube, a Platypus review : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1ir8ffo/10000_rounds_out_the_tube_a_platypus_review/

- somethings that i learned. : r/stealtharms – Reddit, accessed December 3, 2025, https://www.reddit.com/r/stealtharms/comments/1hqsyip/somethings_that_i_learned/

- Worlds Largest 1911 Accuracy Test With A Ransom Rest | Day At The Range, accessed December 3, 2025, https://dayattherange.com/1911-accuracy-test-with-a-ransom-rest/

- (New to Me) Stealth Arms Platypus | The Armory Life Forum, accessed December 3, 2025, https://www.thearmorylife.com/forum/threads/new-to-me-stealth-arms-platypus.24301/

- Staccato or Platypus first 2011 : r/2011 – Reddit, accessed December 3, 2025, https://www.reddit.com/r/2011/comments/1f3p6ao/staccato_or_platypus_first_2011/

- Stealth Arms Platypus: Not Your Average Semi-Aquatic Mammal, accessed December 3, 2025, https://www.anrkydexholsters.com/stealth-arms-platypus-not-your-average-semi-aquatic-mammal/

- Stealth Arms Platypus – Nosler Reloading Forum, accessed December 3, 2025, https://forum.nosler.com/threads/stealth-arms-platypus.47891/

- Stealth Arms Platypus 1911 Commander Classic RMR Double Stack 9mm Pistol – Black, accessed December 3, 2025, https://www.rainierarms.com/stealth-arms-platypus-1911-commander-classic-rmr-double-stack-9mm-pistol-black/

- How do we feel about the Stealth Arms Platypus 1911? Haven’t heard a bunch myself about how it runs, but it sure looks nice. : r/guns – Reddit, accessed December 3, 2025, https://www.reddit.com/r/guns/comments/11zggkp/how_do_we_feel_about_the_stealth_arms_platypus/

- Stacatto vs Springfield Prodigy…really worth the $? : r/2011 – Reddit, accessed December 3, 2025, https://www.reddit.com/r/2011/comments/13lgk1d/stacatto_vs_springfield_prodigyreally_worth_the/

- Springfield Armory 1911 DS Prodigy 4.25-Inch PH9117AOSD 9mm Luger – Gun Tests, accessed December 3, 2025, https://www.gun-tests.com/handguns/springfield-armory-1911-ds-prodigy-4-25-inch-ph9117aosd-9mm-luger/

- SA Platypus or OA 2311 : r/2011 – Reddit, accessed December 3, 2025, https://www.reddit.com/r/2011/comments/1eyy6fi/sa_platypus_or_oa_2311/