Period Covering: January 18, 2026 – January 24, 2026

1. Executive Summary

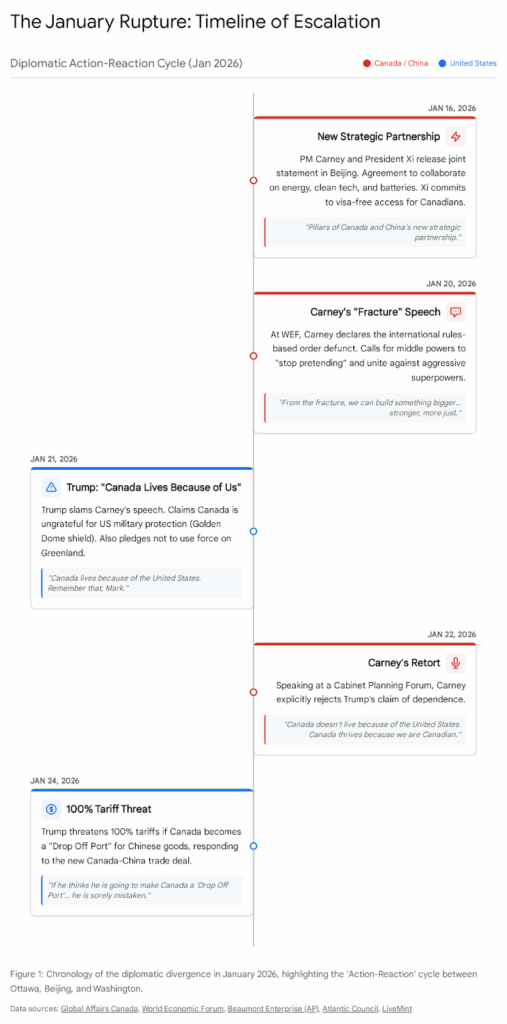

The reporting period ending January 24, 2026, represents a decisive and volatile inflection point in Canadian grand strategy. The administration of Prime Minister Mark Carney has executed a high-stakes geopolitical pivot, formalizing a “New Strategic Partnership” with the People’s Republic of China (PRC) aimed at economic diversification.1 This maneuver, characterized by a landmark agreement to lower tariffs on Chinese electric vehicles (EVs) and canola 2, explicitly breaks with the “Fortress North America” alignment that has defined continental security for decades. The move is underpinned by the “Carney Doctrine,” articulated at the World Economic Forum in Davos, which posits that the US-led global order has suffered a terminal “rupture” necessitating independent middle-power action.3

The reaction from the United States has been immediate, personalized, and strategically coercive. President Donald Trump has framed Canada’s diversification as an existential betrayal, threatening 100% tariffs on Canadian goods and actively moving to marginalize Ottawa in Arctic defense through a bilateral “framework deal” with Greenland/Denmark for the “Golden Dome” missile defense system.4 The bilateral relationship is currently operating in a zone of high friction, with the U.S. President explicitly questioning the viability of the Canadian state without American protection.6

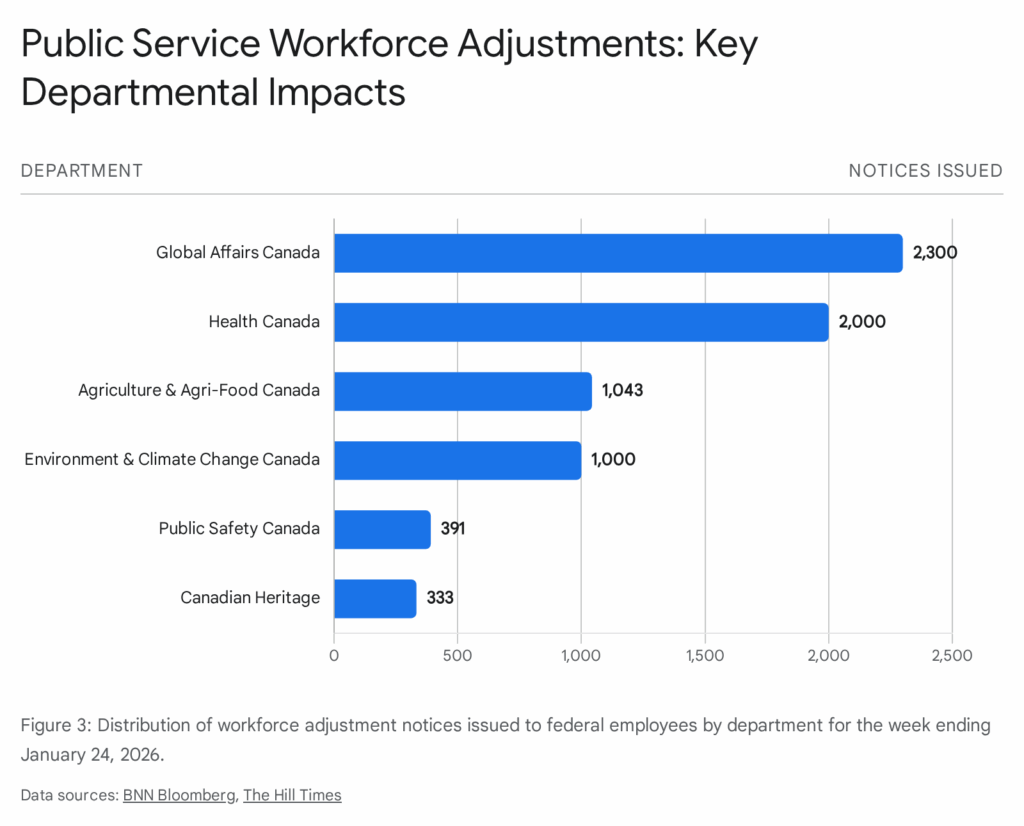

Domestically, the federal government is attempting to execute a “hard reset” of the state apparatus through the Canada Strong Budget 2025 implementation.7 This has triggered severe labor instability, with over 10,000 workforce adjustment notices issued this week alone targeting critical departments including Statistics Canada, Global Affairs Canada, and Shared Services Canada.7 The juxtaposition of external trade warfare and internal administrative chaotic downsizing presents a composite risk to national stability.

Security agencies are operating under a dual burden: managing the escalated counter-intelligence threat from both Chinese integration and American coercion, while reeling from a reputational crisis following a watchdog report confirming the Communications Security Establishment (CSE) breached federal law by directing surveillance against a Canadian national.8

Key Judgments:

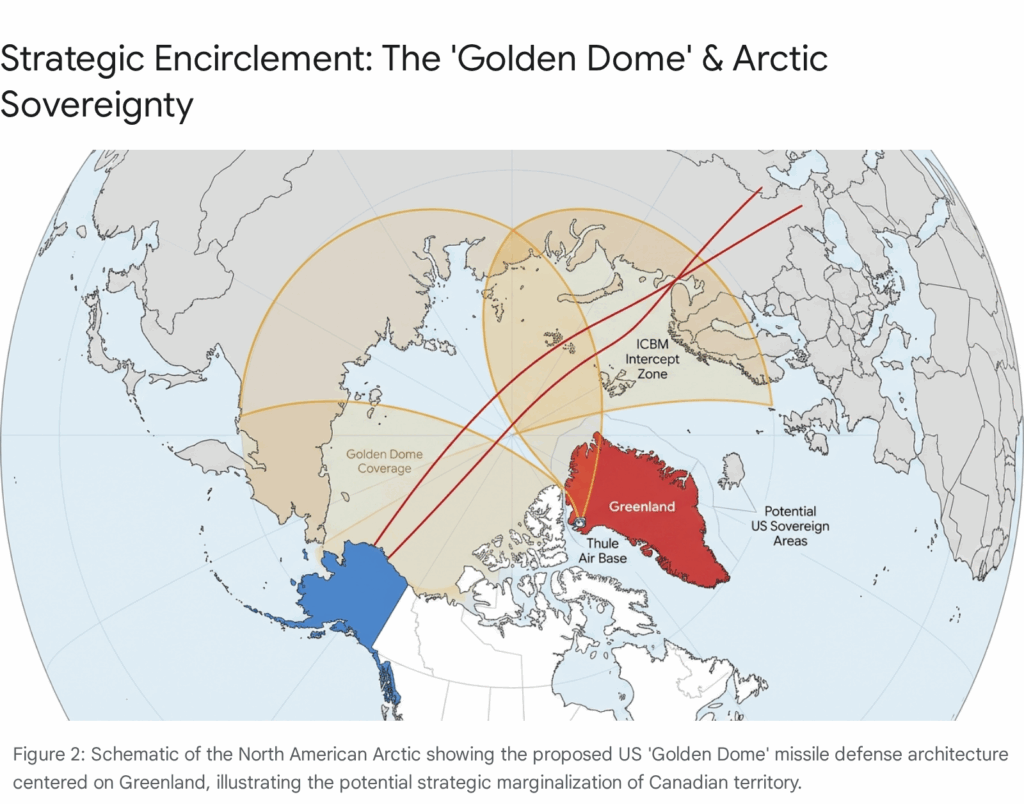

- Strategic Risk – CRITICAL: The “Carney Pivot” has shattered the North American security consensus. Washington now views Canada not merely as a wayward ally but as a potential vector for Chinese economic and intelligence penetration. This perception shift is driving the U.S. to bypass Canada in Arctic security architecture (Greenland), effectively threatening Canada’s northern sovereignty.4

- Economic Outlook – NEGATIVE/VOLATILE: While the China deal offers relief to the Western agricultural sector (canola) and invites battery investment, the looming threat of 100% U.S. “Section 232” style tariffs creates existential uncertainty for the broader economy.9 Inflation has risen to 2.4%, complicating monetary policy as the Bank of Canada holds rates at 2.25%.10

- Domestic Stability – MODERATE TO HIGH RISK: The “culling” of the public service is mobilizing unions for large-scale disruption. The targeting of IT and diplomatic staff (SSC, GAC) degrades the government’s capacity to manage the very international crises it has ignited.12

2. Geopolitical Dynamics: The “Rupture” and the Triangle

2.1 The Carney-Xi Strategic Partnership (The “Pivot”)

The defining geopolitical event of early 2026 is the operationalization of Prime Minister Carney’s “New Strategic Partnership” with President Xi Jinping. Following his delegation to Beijing—the first by a Canadian leader in nearly a decade—the administration has formalized a deal that prioritizes economic diversification over continental alignment.2

The Deal Structure and Mechanics:

The agreement is asymmetric, trading market access for agricultural relief:

- Automotive Sector: Canada has agreed to admit up to 49,000 Chinese electric vehicles (EVs) annually at a reduced Most-Favored-Nation (MFN) tariff rate of 6.1%. This is a stark reversal from the 100% surtax policy aligned with U.S. measures in 2024.13 The quota is structured to scale, rising to approximately 70,000 vehicles by year five.

- Price Segmentation: Crucially, half of this quota is reserved for vehicles priced under CAD $35,000, directly targeting the affordability crisis for Canadian consumers but potentially undercutting North American manufacturing.14

- Agricultural Access: In exchange, Beijing will lower tariffs on Canadian canola from a prohibitive 85% to 15%, effective March 1, 2026. This reopens the massive Chinese market to Western Canadian producers, a move calculated to shore up domestic political support in the Prairie provinces.2

- Energy & Tech: The partnership includes a “Joint Action Plan” on green energy storage and battery technology, signaling Canada’s intent to integrate Chinese supply chains into its domestic green transition rather than decoupling from them.1

Strategic Rationale & “The Carney Doctrine”: The intellectual architecture for this pivot was unveiled in Davos during the Prime Minister’s special address to the World Economic Forum. Carney explicitly rejected the binary choice between Washington and Beijing, arguing that the US-led global order is undergoing a “rupture” defined by “great power competition and a fading rules-based order”.3

- The “Post-Pretense” Era: Carney urged middle powers to “stop pretending” that the traditional liberal order remains intact and to “name reality”—an implicit critique of U.S. unpredictability under President Trump. He positioned Canada as a convening power for those nations wishing to avoid satellite status to either hegemon.15

- Diversification as Survival: The administration argues that reliance on the U.S. is no longer a safety net but a liability due to “on-again-off-again tariffs”.2 By securing a “predictable” relationship with China, Canada attempts to hedge against American volatility.

Assessment of Implications:

This strategy is a high-beta gamble. By creating a regulatory carve-out for Chinese EVs, Canada is effectively creating a “backdoor” in the North American tariff wall. While the quota (49,000 units) is relatively small against total sales (1.8 million), the principle of independent tariff policy violates the spirit of the USMCA (CUSMA) review clause. The administration is calculating that the U.S. is already protectionist regardless of Canada’s actions; however, this underestimates the potential for the U.S. to weaponize security cooperation to force economic compliance.

2.2 The United States: The “Golden Dome” and Arctic Coercion

The response from Washington has shifted from diplomatic pressure to direct threats against Canadian territorial integrity and economic viability. President Trump’s rhetoric has targeted the fundamental legitimacy of the Canadian state, asserting that “Canada lives because of the United States” and demanding gratitude for American protection.6

The “Golden Dome” & Greenland Gambit: President Trump has resurrected and militarized his interest in purchasing Greenland, explicitly linking it to the “Golden Dome”—a proposed multi-layered missile defense system projected to cost upwards of $175 billion.16

- The Framework Deal: On January 21, 2026, Trump announced a “framework of a future deal” with NATO Secretary-General Mark Rutte. In exchange for withdrawing punitive tariffs on European allies, the U.S. would secure expanded rights in Greenland.4

- Strategic Encirclement: The “Golden Dome” architecture relies on mid-course interception capabilities that are geographically optimal in the Arctic. By securing a bilateral deal with Denmark/Greenland, the U.S. is effectively flanking Canada. If the U.S. establishes sovereign base areas in Greenland (similar to the UK’s Akrotiri in Cyprus) 5, it diminishes the strategic value of Canadian geography and the NORAD partnership.

- The Threat to Canada: Trump explicitly stated on Truth Social: “Canada is against The Golden Dome being built over Greenland… Instead, they voted in favor of doing business with China, who will ‘eat them up’.”.3 This frames Canada not as a partner, but as an obstacle to American security.

Trade War 2.0: The Trump administration has threatened a 100% tariff on all Canadian goods if the China trade deal proceeds.9 Unlike specific sectoral disputes (softwood lumber, dairy), this threat targets the aggregate trade flow. The administration views the entry of Chinese EVs as a national security threat, arguing that “connected vehicles” could serve as surveillance platforms. By permitting them, Canada is labeled a vector for Chinese espionage, potentially justifying “Section 232” national security tariffs.

2.3 International Reaction & Ukraine

While managing the North American crisis, Canada continues to project a hawkish stance in the European theater, creating a disjointed foreign policy where Ottawa opposes authoritarianism in Europe while partnering with it in Asia.

- Ukraine Support: Prime Minister Carney announced a $2.5 billion economic aid package and facilitated an additional $8.4 billion in IMF financing support for Ukraine.17

- Peace Coalition: Canada co-signed a pact with the “Coalition of the Willing” in Paris, pledging security guarantees to Ukraine post-conflict.19 This continued commitment aims to maintain standing with European NATO allies (France, Germany) who are also navigating Trump’s tariff threats.

3. National Security & Defense Architecture

3.1 The Communications Security Establishment (CSE) Breach

A significant failure in intelligence oversight was publicized this week, eroding public trust in the national security apparatus at a critical moment.

The Incident: The National Security and Intelligence Review Agency (NSIRA) reported that the CSE violated the Privacy Act and its enabling legislation by directing cyber operations against a Canadian national.8

- Mechanism: The breach involved the intersection of mandates between the Canadian Security Intelligence Service (CSIS) and CSE. CSIS, responsible for domestic threats, shared information on a Canadian target’s device with CSE. CSE then used its superior technical foreign intelligence capabilities to analyze the device.20

- Legal Violation: While CSE is permitted “incidental collection” of Canadian data, the NSIRA found that CSE’s analysis was intentional and directed, effectively using its foreign intelligence mandate to conduct domestic surveillance by proxy. The watchdog explicitly rejected the “incidental” defense.20

Implications:

This finding confirms long-held fears regarding the “blurring” of lines between domestic (CSIS) and foreign (CSE) intelligence.

- Legislative Gridlock: This will complicate the passage of the Critical Cyber Systems Protection Act (Bill C-26 successor), as opposition parties will likely demand stricter oversight mechanisms before granting new powers to CSE.21

- Operational Hesitancy: Risk aversion may increase within CSE, potentially slowing intelligence collection on genuine foreign interference threats (e.g., PRC activities) just as those threats are escalating due to the new partnership.

3.2 Arctic Sovereignty & Defense Procurement

The “Golden Dome” crisis has accelerated the timeline for Canada’s defense recapitalization, forcing the government to bypass standard procedures.

Procurement Pivot: The government has launched the Defence Investment Agency, a special operating agency within Public Services and Procurement Canada designed to fast-track acquisitions.22

- Buy Canadian Policy: Effective December 2025/January 2026, new rules mandate “Prioritizing Canadian Materials” (steel, aluminum) in defense projects valued over $25 million.23 While politically popular, industry analysts warn this could increase costs by up to 25% and delay delivery of critical platforms (e.g., submarines, icebreakers) needed to assert Arctic sovereignty.23

- Spending Targets: The government has reiterated its commitment to reach 2% of GDP by 2026 and an ambitious 5% by 2035.22 However, the Canada Strong Budget 2025 simultaneously demands a 2% budget cut from DND operations (part of the broader public service reduction), creating a contradiction between capital investment aspirations and operational reality.7

4. Domestic Stability: The Internal “Hunger Games”

While navigating an external crisis, the federal government is inducing a significant internal shock to its own workforce. The “Canada Strong Budget 2025” is now in the execution phase, leading to a period of high volatility in the public sector.

4.1 The “Culling” of the Public Service

For the week ending January 24, the Treasury Board Secretariat and individual departments escalated the issuance of “Workforce Adjustment” (WFA) notices.

Scope of Reductions:

- Target: Elimination of 28,000 positions over four years (16,000 FTE cuts + 12,000 via attrition) to achieve $60 billion in savings.7

- Current Wave: Over 10,000 notices were issued this week, following 5,400 the previous week.7

- Impacted Departments: The cuts are hitting strategic nodes of the government:

- Statistics Canada: ~3,200 notices. This severe reduction threatens the government’s ability to maintain data sovereignty and accurate economic reporting.7

- Global Affairs Canada (GAC): ~2,300 notices. At the precise moment Canada requires maximum diplomatic agility to manage the US/China rift, the foreign service is facing a 30% reduction in staff.7

- Health Canada: ~2,000 notices, raising concerns about drug approval timelines and safety oversight.7

- Shared Services Canada (SSC): ~1,200 notices. This risks degrading the government’s IT infrastructure and cybersecurity posture.7

Operational & Social Risks: Union leaders have described the environment as “Hunger Games-style anxiety,” where employees are forced to compete for their own positions.12 The Public Service Alliance of Canada (PSAC) and the Professional Institute of the Public Service of Canada (PIPSC) are mobilizing for large-scale protests, including a rally on Parliament Hill scheduled for January 28.24

- Service Disruption: With widespread morale collapse and “work-to-rule” tactics likely, critical services (Employment Insurance, passports, border processing) face imminent slowdowns.

- Insider Threat: The deep cuts at Shared Services Canada (SSC) are particularly alarming. Disgruntled IT staff facing layoffs represent a potential “insider threat” risk, or their departure could simply leave gaping holes in network maintenance during a period of heightened state-sponsored cyber activity.

4.2 Political Landscape

The crisis has sharpened political lines, with opposition parties attacking the Prime Minister’s strategy from both flanks.

- Conservative Party: Leader Pierre Poilievre has characterized the China deal as a betrayal of national security, accusing Carney of allowing 50,000 “spy vehicles” onto Canadian streets while failing to secure a deal with the U.S. He framed the Davos speech as “eloquent” but ultimately hollow, criticizing the lack of tangible results in reducing US dependence.26

- NDP: Leader Jagmeet Singh has focused his attacks on the public service cuts, labeling Carney “no friend of working people” and comparing his management style to “Elon Musk” for the severity of the public sector slash.28 The NDP, while historically anti-tariff, is positioning itself as the defender of Canadian manufacturing jobs against the influx of Chinese EVs.

5. Economic Intelligence & Indicators

The macroeconomic environment remains fragile, limiting the government’s fiscal maneuvering room to address the geopolitical shock.

Inflation and Monetary Policy:

- CPI: The Consumer Price Index (CPI) rose to 2.4% in December 2025 (data released Jan 2026), up from 2.2% in November.10 The increase was driven largely by the expiration of a federal tax holiday, though core measures (CPI-trim, CPI-median) showed some moderation.

- Interest Rates: The Bank of Canada is widely expected to hold the overnight rate at 2.25% at its upcoming January 28 meeting.11 The “Carney Pivot” to China may be partly driven by a desperate need to stimulate growth through trade without further cutting rates, which would weaken the CAD and import more inflation.

- Bank Forecasts: Major Canadian banks are divided on the 2026 outlook, with forecasts for the overnight rate ranging wildly. The C.D. Howe Institute’s Monetary Policy Council recommended holding the rate at 2.25% throughout 2026, signaling a prolonged period of restrictive capital costs.11

Productivity and Investment: The IMF’s Article IV consultation (released Jan 2026) highlights that elevated trade uncertainty is reinforcing Canada’s long-standing productivity weakness.29 The government’s “Buy Canadian” policy, while politically expedient, risk shielding inefficient domestic industries from competition, further dragging on productivity.

Real Estate: The housing market remains a critical vulnerability. With rates holding at 2.25%, the hoped-for resurgence in sales has not materialized. Forecasts for 2026 are chaotic, with some analysts predicting a “rate hike” scenario if inflation persists, which would be catastrophic for variable-rate mortgage holders.30

6. Strategic Outlook & Foresight

Short-Term Forecast (0-30 Days):

- The Tariff Trigger: Expect President Trump to formally initiate a Section 232 investigation into Canadian EVs/Autos within the next 14 days. This legal mechanism, used previously for steel and aluminum, allows the President to impose tariffs on national security grounds without Congressional approval. This will likely serve as the prelude to the threatened 100% tariffs.

- Labor Escalation: The PSAC/PIPSC rally on January 28 will likely act as a catalyst for rotating strikes. If the government refuses to pause the workforce adjustments, expect targeted disruptions to tax season (CRA) and border services (CBSA) in February.

- Intelligence Blowback: The NSIRA report on the CSE breach will trigger parliamentary hearings. The government may be forced to sacrifice a senior security official to quell the controversy and protect the pending cybersecurity legislation.

Medium-Term Forecast (30-90 Days):

- The “Arctic Squeeze”: The U.S. will likely bypass Ottawa to negotiate directly with Nuuk (Greenland) and Copenhagen regarding the Golden Dome. Canada may be presented with a fait accompli: either participate and pay billions in “protection money” for the shield, or be excluded entirely, leaving the Canadian North strategically vulnerable and politically isolated.

- Political Fragility: If the economy dips due to U.S. retaliation or labor unrest, the Carney government’s poll numbers—already under pressure—could collapse. The NDP may see an advantage in distancing themselves from the “job-cutting” Liberals, raising the specter of a non-confidence vote in the spring session.

Recommendation for Decision Makers:

The government must urgently “wargame” the scenario of a full U.S. border closure or 100% tariff imposition. The current diversification strategy with China will take years to bear fruit; the U.S. retaliation will be immediate. A diplomatic off-ramp with Washington—likely requiring a cap on Chinese EV imports or a specific “national security” carve-out for connected vehicles—must be identified before the tariff threats calcify into permanent policy.

7. Detailed Situation Analysis

7.1 Foreign Affairs: The “Carney Doctrine” in Action

The China Pivot: Economic Necessity or Strategic Error?

The decision to allow 49,000 Chinese EVs into Canada is a calculated defiance of the emerging “North American Fortress” economic model.

- The Economic Logic: Canada’s automotive sector is struggling to transition to EVs at a competitive price point. By inviting Chinese investment and technology (NIO, BYD), Carney hopes to jumpstart a domestic battery ecosystem that is currently lagging. The reciprocal reduction in canola tariffs offers an immediate win for Western farmers, a key electoral demographic often alienated by Liberal policies.

- The Geopolitical Cost: This move essentially treats Canada as a separate economic bloc from the U.S. regarding China. In Washington, this is viewed not as “diversification” but as “defection.” It validates the “America First” hawk’s view that Canada is a leaky vessel for Chinese goods to enter the U.S. market via the backdoor.

Diplomatic Fallout:

- “Board of Peace” Snub: Trump withdrawing Canada’s invitation to his “Board of Peace” is symbolic but significant. It signals Canada’s demotion from “Core Ally” to “Transactional Partner”.31

- The Davos Exchange: The public spat between Carney and Trump at Davos was unprecedented. Carney’s speech on the “rupture” of the global order was intellectually robust but diplomatically risky. By implying the U.S. is a coercive hegemon (without naming Trump), he provoked a direct, humiliating response from the President. This personalized animosity will make de-escalation difficult.

7.2 National Security: The “Golden Dome” Threat

Operational Analysis of the Golden Dome:

The “Golden Dome” represents a paradigm shift in continental defense. Unlike NORAD’s current warning-centric posture, this system focuses on active interception.

- Greenland’s Role: Greenland is geographically essential for intercepting ICBMs from Russia or China in the “mid-course” phase of flight. Thule Air Base is already critical, but the “Golden Dome” likely requires new interceptor sites and radar arrays.32

- Canada’s Exclusion: If the U.S. proceeds with a bilateral deal with Greenland/Denmark, Canada loses its “gatekeeper” status in the Arctic. NORAD is a bi-national command; a unilateral U.S. missile shield over the Arctic undermines the bi-national principle. If Canada is not inside the “Dome,” it is theoretically vulnerable to debris or “leakers” (missiles that miss the intercept).

CSE and the Erosion of Social License:

The NSIRA report on the CSE breach is damaging because it validates the “surveillance state” narrative.

- The Breach Details: The transfer of a Canadian’s data from CSIS (domestic) to CSE (foreign) for analysis is a “grey zone” practice that civil liberties groups have long warned about. The watchdog’s finding that this was intentional rather than incidental removes the agency’s primary defense (“we didn’t mean to”).20

- Consequence: This will likely lead to stricter judicial oversight requirements for CSE assistance to CSIS, potentially slowing down counter-terrorism or counter-espionage investigations at a time when speed is critical.

7.3 Domestic Affairs: The Public Service Crisis

The “Canada Strong Budget 2025” Implementation:

The government’s austerity drive is aggressive.

- Rationale: The cuts are framed as necessary to fund the 2% defense target and reduce the deficit. However, the speed of execution—mass notices issued in a single week—suggests a desire to “rip the bandage off” before the next election cycle.

- Union Strategy: The unions (PSAC, PIPSC) are framing this as a safety issue (cutting food inspectors, drug approvals at Health Canada) and a sovereignty issue (cutting StatsCan data). Their “Hunger Games” narrative is gaining traction in the media.12

- Political Risk: The NDP, ostensibly partners in Parliament, are vehemently opposing the cuts. Jagmeet Singh has labeled Carney “no friend of working people.” While the NDP is polling poorly and unlikely to force an election immediately, this issue drives a wedge that weakens the government’s legislative stability.

8. Economic Dashboard: January 2026

The interplay between domestic economic weakness and external trade threats creates a precarious environment.

| Indicator | Current Value | Trend | Strategic Implication |

| CPI Inflation | 2.4% (Dec ’25) | ↗ Rising | Limits Bank of Canada’s ability to cut rates; erodes real wage gains. |

| Overnight Rate | 2.25% (Target) | ➡ Holding | Borrowing costs remain restrictive for housing and business investment. |

| GDP Growth | Sluggish | ↘ Slowing | Productivity crisis deepens; reliance on government spending is unsustainable. |

| Trade Balance | Deficit Risk | ↘ Worsening | 100% US tariffs would cause immediate recession; China deal too small to offset. |

| Unemployment | Stable/Rising | ↗ Risk | Public sector layoffs (28k) will begin to show in data soon. |

Analysis:

The rise in inflation to 2.4% is particularly ill-timed. It forces the Bank of Canada to remain hawkish/neutral just as the economy faces a massive external shock (Trump tariffs) and an internal shock (austerity). This “stagflationary” risk—stagnant growth with sticky inflation—limits the government’s ability to use fiscal stimulus to cushion the blow of the trade war.

9. Conclusion

The week of January 18-24, 2026, has fundamentally altered Canada’s strategic landscape. The Carney administration has made a decisive choice to diversify away from the United States, gambling that a partnership with China will provide economic leverage. The immediate result, however, has been to accelerate the disintegration of the North American security and trade perimeter.

Canada is now in a “two-front” diplomatic conflict: a trade and sovereignty war with the United States in the Arctic and automotive sectors, and a high-risk engagement with China that alienates traditional allies. Internally, the government is weakening its own implementation capacity through massive workforce reductions just as it requires a robust state apparatus to manage these crises.

Strategic Watchlist for Next Week:

- US Treasury/Commerce Actions: Watch for the official filing of Section 232 investigations against Canadian imports.

- Greenland Negotiations: Monitor for any joint US-Denmark statements that exclude Canada.

- Union Mandates: Watch for strike vote announcements from PSAC/PIPSC.

End of Report

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Prime Minister Carney forges new strategic partnership with the …, accessed January 24, 2026, https://www.pm.gc.ca/en/news/news-releases/2026/01/16/prime-minister-carney-forges-new-strategic-partnership-peoples

- Canada cosies up to China: Mark Carney strikes key deals with Xi Jinping; why Donald Trump will be furious, accessed January 24, 2026, https://timesofindia.indiatimes.com/world/rest-of-world/canada-cosies-up-to-china-mark-carney-strikes-key-deals-with-xi-jinping-why-donald-trump-will-be-furious/articleshow/126617252.cms

- ‘China will eat them up’: Trump slams Canada for rejecting ‘golden dome’ plan in Greenland, accessed January 24, 2026, https://indianexpress.com/article/world/trump-criticises-canadagreenland-china-will-eat-them-up-10492081/

- By taking a win on Greenland, Trump set US and allied security in …, accessed January 24, 2026, https://www.atlanticcouncil.org/dispatches/by-taking-a-win-on-greenland-trump-set-us-and-allied-security-in-the-arctic-on-a-better-path/

- Trump’s Greenland ‘framework’ deal: What we know about it, what …, accessed January 24, 2026, https://www.aljazeera.com/news/2026/1/22/trumps-greenland-framework-deal-what-we-know-about-it-what-we-dont

- Trump challenges Carney at Davos, asserts Canada should be ‘grateful’ for Golden Dome missile defense, accessed January 24, 2026, https://www.foxnews.com/politics/trump-challenges-carney-davos-asserts-canada-should-grateful-golden-dome-missile-defense

- Public Service job cuts: 10,000 notices issued – BNN Bloomberg, accessed January 24, 2026, https://www.bnnbloomberg.ca/business/politics/2026/01/23/global-affairs-canadian-heritage-issue-notices-to-public-servants/

- Canadian cyberspy agency breached law: watchdog report, accessed January 24, 2026, https://www.ctvnews.ca/canada/article/cse-breached-law-by-directing-actions-at-canadian-report/

- Trump threatens Canada with 100% tariffs over its new trade deal with China, accessed January 24, 2026, https://www.beaumontenterprise.com/business/article/trump-threatens-canada-with-100-tariffs-over-its-21312859.php

- Canadian Inflation Picks Up in December, Making 2026 Year-Long Rate Hold More Likely, accessed January 24, 2026, https://global.morningstar.com/en-ca/economy/canadian-inflation-picks-up-december-making-2026-year-long-rate-hold-more-likely

- Here’s what leading economists say is in store from the BoC in 2026, accessed January 24, 2026, https://www.mpamag.com/ca/mortgage-industry/industry-trends/heres-what-leading-economists-say-is-in-store-from-the-boc-in-2026/562862

- ‘Hunger Games-style anxiety’: Unions raise concerns after 5400 layoff notices issued to federal workers – CTV News, accessed January 24, 2026, https://www.ctvnews.ca/ottawa/article/public-service-job-cuts-creating-hunger-games-style-anxiety-union-says/

- Canada Cuts China EV Tariffs in Policy Shift, accessed January 24, 2026, https://www.batterytechonline.com/industry-outlook/canada-cuts-china-ev-tariffs-in-policy-shift

- How Elon Musk’s Tesla may become a ‘winner’ in Canada PM Mark Carney’s ‘welcome note’ to Chinese auto industry, accessed January 24, 2026, https://timesofindia.indiatimes.com/technology/tech-news/how-elon-musks-tesla-may-become-a-winner-in-canada-pm-mark-carneys-welcome-note-to-chinese-auto-industry/articleshow/126690491.cms

- Davos 2026: Special address by Mark Carney, PM of Canada, accessed January 24, 2026, https://www.weforum.org/stories/2026/01/davos-2026-special-address-by-mark-carney-prime-minister-of-canada/

- ‘China will eat them up’: US slams Canada for rejecting ‘Golden Dome’, accessed January 24, 2026, https://www.theweek.in/news/world/2026/01/24/china-will-eat-them-up-us-slams-canada-for-rejecting-golden-dome.html

- Prime Minister Carney announces new support for a just and lasting peace in Ukraine, accessed January 24, 2026, https://www.pm.gc.ca/en/news/news-releases/2025/12/27/prime-minister-carney-announces-new-support-just-and-lasting-peace

- Canada to provide $1.8 billion in economic aid to Ukraine, accessed January 24, 2026, https://kyivindependent.com/canada-to-provide-1-8-billion-in-economic-aid-to-ukraine/

- Canada co-signs pact to help secure Ukraine after an eventual peace deal, accessed January 24, 2026, https://www.rmoutlook.com/national-news/canada-co-signs-pact-to-help-secure-ukraine-after-an-eventual-peace-deal-11701075

- Canada’s cyberspy agency breached law by targeting citizen, watchdog says – Report, accessed January 24, 2026, https://m.uk.investing.com/news/economy-news/canadas-cyberspy-agency-breached-law-by-targeting-citizen-watchdog-says–report-4463809?ampMode=1

- Year in review 2025: Canadian digital policy | Gowling WLG, accessed January 24, 2026, https://gowlingwlg.com/en/insights-resources/articles/2026/year-in-review-2025-canadian-digital-policy

- Prime Minister Carney launches new Defence Investment Agency to rebuild, rearm, and reinvest in the Canadian Armed Forces faster, accessed January 24, 2026, https://www.pm.gc.ca/en/news/news-releases/2025/10/02/prime-minister-carney-launches-new-defence-investment-agency-rebuild

- Federal Government Rolls Out Its Buy Canadian Policy | Blake …, accessed January 24, 2026, https://www.jdsupra.com/legalnews/federal-government-rolls-out-its-buy-3691817/

- PSAC NCR – PSAC NCR, accessed January 24, 2026, https://psac-ncr.com/

- Workforce Adjustment Rally – PSAC NCR, accessed January 24, 2026, https://psac-ncr.com/events/workforce-adjustment-rally/

- Statement From Conservative Leader Pierre Poilievre on the Prime Minister’s Trip to China, accessed January 24, 2026, https://www.conservative.ca/statement-from-conservative-leader-pierre-poilievre-on-the-prime-ministers-trip-to-china/

- Poilievre calls Carney’s Davos speech ‘well-crafted,’ but says action must follow – CBC, accessed January 24, 2026, https://www.cbc.ca/news/politics/poilievre-carney-davos-speech-9.7057086

- Poilievre says he wants to cut the federal public service, doesn’t mind remote work – CBC, accessed January 24, 2026, https://www.cbc.ca/news/politics/poilievre-public-service-1.7438154

- Canada: 2025 Article IV Consultation-Press Release; and Staff Report, accessed January 24, 2026, https://www.imf.org/en/publications/cr/issues/2026/01/21/canada-2025-article-iv-consultation-press-release-and-staff-report-573340

- Bank of Canada 2026 Forecasts are WILD 💣, accessed January 24, 2026, https://www.youtube.com/watch?v=wZ80eUW1adY

- Trump says Canada is against Golden Dome in Greenland, accessed January 24, 2026, https://www.cp24.com/news/canada/2026/01/23/live-updates-trump-bars-carney-from-board-of-peace/

What to know about Greenland’s role in nuclear defence and Trump’s ‘Golden Dome’, accessed January 24, 2026, https://www.ctvnews.ca/world/article/what-to-know-about-greenlands-role-in-nuclear-defence-and-trumps-golden-dome/