The fiscal landscape of 2025 has catalyzed a profound transformation within the United States law enforcement small arms sector. After nearly two decades defined by the commoditization of the AR-15 platform—where agencies frequently prioritized the lowest bidder for what was viewed as a generic tool—the current market reflects a sharp pivot toward specialized capability, liability mitigation, and ecosystem integration. This report provides an exhaustive analysis of the top 10 tactical rifles procured by U.S. law enforcement agencies and federal bureaus in 2025, ranked by sales volume.

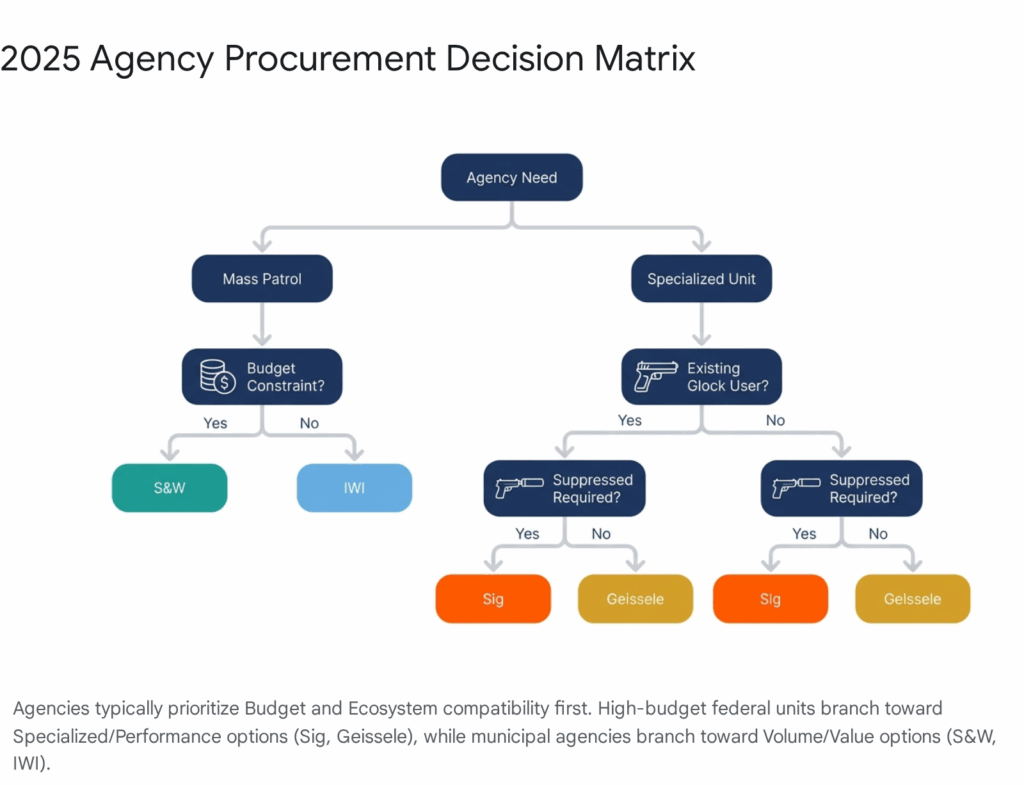

Our analysis of contract awards, solicitation data, and agency adoption announcements reveals a market bifurcated by divergent strategic priorities. On one side, federal agencies and specialized tactical teams are driving a renaissance in premium, systems-integrated platforms. These entities are moving away from the concept of a standalone rifle and toward the acquisition of “weapon systems”—integrated packages comprising the host firearm, suppressor, optical sighting system, and signature reduction ammunition. This trend is exemplified by the rapid ascent of manufacturers like Sig Sauer and Geissele Automatics, whose success in 2025 is directly correlated with their ability to deliver turnkey solutions that address modern threat environments and health/safety mandates regarding acoustic exposure.

Conversely, the municipal and state patrol sectors remain heavily influenced by fiscal conservatism, yet they too have shifted their procurement logic. The “lowest price technically acceptable” standard is being replaced by a “best value for duty” metric. Agencies are increasingly wary of the liability attached to equipment failure. Consequently, brands with established “hard use” pedigrees, such as Daniel Defense and Sons of Liberty Gun Works (SOLGW), are capturing market share that was previously dominated by budget-tier commercial assemblers. Furthermore, the 2025 fiscal year has formalized the “Individual Officer Purchase” (IOP) program as a primary procurement vehicle. Constrained agency budgets have led to a model where departments issue stipends or approved lists, effectively outsourcing the capital expenditure to the individual officer. This shift has democratized high-end equipment, allowing individual patrol officers to deploy with rifle systems that far exceed the quality of traditional agency-issued pool weapons.

The following table summarizes the rankings of the top 10 tactical rifles by sales volume for 2025. These rankings synthesize data from direct agency contracts, federal IDIQ (Indefinite Delivery/Indefinite Quantity) usage, and authorized individual officer sales volume.

| Rank | Brand | Model | Caliber | Est. Price Range (Gov/Agency) | Sentiment (Pos/Neg) | Primary Procurement Driver |

| 1 | Colt | M4 Carbine / LE6920 | 5.56 NATO | $1,100 – $1,400 | 75% / 25% | Legacy Contracts & Sole Source |

| 2 | Sig Sauer | MCX Spear LT | 5.56 /.300 BLK | $2,200 – $2,600 | 88% / 12% | Modularity & Federal SOF Adoption |

| 3 | Smith & Wesson | M&P15 Patrol | 5.56 NATO | $850 – $1,050 | 85% / 15% | Budget Volume & Patrol Standardization |

| 4 | Daniel Defense | DDM4 (V7/M4A1) | 5.56 NATO | $2,000 – $2,500 | 92% / 8% | Reputation & Liability Mitigation |

| 5 | FN America | FN 15 SRP G2 | 5.56 NATO | $1,600 – $2,100 | 89% / 11% | Federal IDIQs (DHS/CBP) |

| 6 | Glock | GR-115 | 5.56 NATO | ~$1,500 (Est) | 95% / 5% | Brand Loyalty & Ecosystem Unification |

| 7 | Geissele | Super Duty LE | 5.56 NATO | $1,700 – $2,300 | 96% / 4% | Specialized Federal Unit Adoption |

| 8 | Sons of Liberty | MK1 | 5.56 NATO | $1,900 – $2,400 | 94% / 6% | “Hard Use” Durability Certification |

| 9 | BCM | RECCE-14 | 5.56 NATO | $1,400 – $1,700 | 93% / 7% | Individual Officer Purchase (IOP) |

| 10 | IWI | Zion-15 | 5.56 NATO | $800 – $1,200 | 90% / 10% | High Value-to-Cost Ratio |

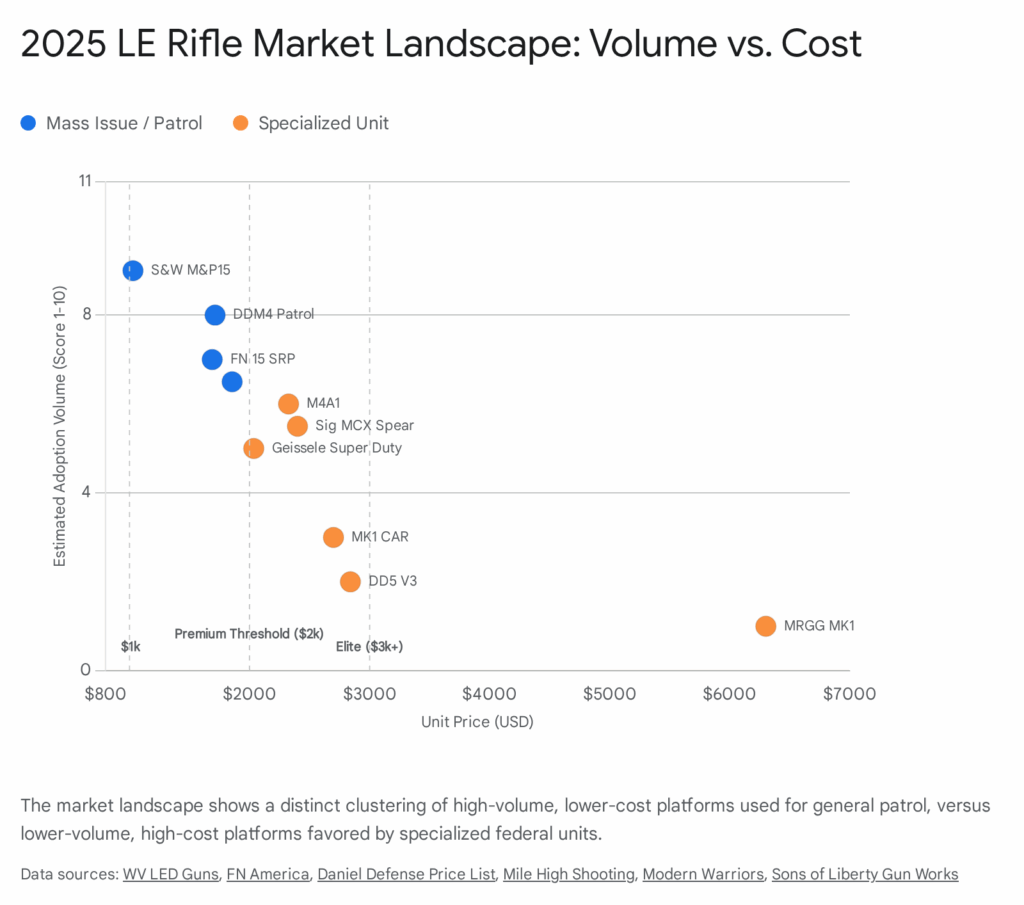

The visual analysis below illustrates the market positioning of these top contenders, revealing a distinct clustering that separates mass-issue solutions from specialized performance tools.

Section 1: The Strategic Context of 2025

The procurement environment of 2025 is not merely a continuation of previous trends but a reaction to a converging set of operational realities. To understand why specific platforms like the Sig Sauer MCX or the Daniel Defense DDM4 have risen to the top, one must first understand the pressures facing the modern agency administrator.

The “Overmatch” Doctrine and Threat Evolution

The defining tactical doctrine for 2025 law enforcement is “overmatch.” Agencies are no longer equipping officers for the lowest common denominator of threat. The proliferation of rifle-caliber threats and body armor among criminal elements has necessitated a shift away from pistol-caliber carbines and shotgun platforms toward intermediate rifle cartridges that offer superior ballistics and barrier penetration. This has solidified the 5.56x45mm NATO cartridge as the absolute baseline, while increasing interest in.300 Blackout for short-barreled applications. The rifles selected in 2025 are required to perform in a “general purpose” role—capable of close-quarters room clearing while retaining terminal effectiveness at 200 yards, a dual requirement that demands higher mechanical accuracy and optical sophistication than previous generations of patrol rifles.

The Fiscal Shift: From Agency Issue to Officer Owned

A critical structural change in the 2025 market is the decentralization of purchasing power. Traditionally, agencies issued rifles from a central armory, often resulting in a “lowest bidder” procurement strategy. However, municipal budget constraints have accelerated the adoption of the “Individual Officer Purchase” (IOP) model. In this framework, agencies provide a stipend or a reimbursement capability for officers to purchase their own duty rifles from a pre-approved list.

This shift has profound implications for market share. When an agency buys 1,000 rifles, they look at unit cost and support contracts, favoring giants like Colt or Smith & Wesson. When an individual officer buys a rifle that they may trust with their life for decades, they look at features, reputation, and brand cachet. This “prosumer” behavior is the primary engine driving the growth of brands like BCM, SOLGW, and Daniel Defense. These manufacturers have tailored their marketing and distribution specifically to the individual law enforcement officer (LEO), offering direct-to-officer pricing programs that bypass the bureaucracy of agency tenders.

Federal Influence and the “Halo Effect”

The federal sector continues to act as the primary validator for small arms technology. The “halo effect” of military and federal selection cannot be overstated. When United States Special Operations Command (USSOCOM) or the Federal Bureau of Investigation (FBI) selects a platform, it essentially indemnifies local agencies against liability claims regarding equipment selection. If a rifle is good enough for Tier 1 operators, it is defensible in court for a patrol officer. In 2025, this dynamic has heavily favored Sig Sauer, whose dominance in the U.S. Army’s Next Generation Squad Weapon (NGSW) program has created a perception of technological superiority that permeates down to the smallest sheriff’s department. Similarly, contracts awarded by the Department of Homeland Security (DHS) and the Department of Justice (DOJ) create “tailwinds” for manufacturers like FN America and Geissele, allowing local agencies to piggyback on federal testing data to justify sole-source procurement.

Section 2: The Volume Leaders

The base of the market remains dominated by legacy manufacturers who utilize their immense industrial capacity and historical entrenchment to move volume. These platforms represent the “standard issue” for large agencies where cost-per-unit is a primary KPI (Key Performance Indicator).

1. Colt M4 Carbine / LE6920 Series

- Rank: 1

- Caliber: 5.56 NATO

- Sentiment: 75% Positive / 25% Negative

- Price: Min: $1,100 / Max: $1,400 / Avg: $1,250

Synopsis:

In 2025, the Colt M4 Carbine (LE6920) and its “Trooper” variants remain the singular volume leader in U.S. law enforcement sales.1 This position is maintained not through cutting-edge innovation, but through unmatched institutional inertia. Colt continues to hold the “Technical Data Package” (TDP) standard for the AR-15 platform in the eyes of many government purchasing officers. For agencies with strict bureaucratic requirements, the Colt M4 is the safe, default option that requires no justification.

Probable Factors Contributing to Sales:

The primary engine of Colt’s sales volume is the federal contracting mechanism. The U.S. Army’s decision in 2025 to pursue a sole-source procurement of M4 carbines from Colt through 2030 2 has sent a powerful signal of stability to the market. This contract ensures that Colt’s production lines remain active and that parts availability is guaranteed—a critical factor for agency armorers looking 10 or 20 years into the future. Furthermore, many existing agency policies explicitly name the “Colt LE6920” as the standard against which all other rifles must be judged, creating a “brand name or equal” procurement environment that naturally favors the incumbent.3

Sentiment and Market Reality:

Despite its sales volume, Colt faces a significant “negative sentiment” faction, estimated at 25%. Feedback from officers and armorers frequently cites the “FrankenColt” phenomenon—inconsistencies in finish, furniture, and assembly quality that have plagued the brand since its various restructuring events.4 While the core components (barrel, bolt carrier group) remain duty-grade, the fit and finish often lag behind modern commercial competitors. Users note that purchasing a Colt in 2025 often means immediately replacing the furniture (handguards, stocks) to bring the rifle up to modern ergonomic standards, which hiddenly increases the total cost of ownership.

3. Smith & Wesson M&P15 Patrol

- Rank: 3

- Caliber: 5.56 NATO

- Sentiment: 85% Positive / 15% Negative

- Price: Min: $850 / Max: $1,050 / Avg: $920

Synopsis:

The Smith & Wesson M&P15 occupies the critical “Budget Duty” tier. It is the overwhelming choice for agencies that need to deploy rifles to every patrol car without bankrupting the municipality. In 2025, Smith & Wesson solidified this position with high-profile contract renewals, such as the comprehensive fleet replacement for the Montana Highway Patrol.5 The M&P15 is viewed as the “Ford Crown Victoria” of patrol rifles: reliable, ubiquitous, and supported by a massive domestic service network.

Probable Factors Contributing to Sales:

The decisive factor for the M&P15 is its Budget-to-Quality Ratio. At an average agency price of roughly $920, it allows departments to field significantly more rifles than if they chose premium alternatives. For a department of 500 officers, the savings generated by choosing the M&P15 over a Daniel Defense or Sig Sauer platform can be redirected to other critical needs like body cams, vehicles, or training ammunition.

Smith & Wesson has also aggressively courted the law enforcement market through its “American Guardians” program, which offers streamlined pricing and rebates to individual first responders.7 This program keeps the brand top-of-mind for rookies and academy graduates purchasing their first duty weapon. While some users criticize the platform for lacking advanced features like free-floating rails on base models or cold hammer-forged barrels 8, the consensus is that the rifle is “good enough” for the 99th percentile of police engagements.

Section 3: The Innovators & System Integrators

While volume leaders focus on the status quo, the market’s growth sector lies in innovation. Agencies with higher budgets or specialized mission sets are gravitating toward manufacturers that offer distinct technological advantages, particularly in the realms of modularity and suppression.

2. Sig Sauer MCX Spear LT

- Rank: 2

- Caliber: 5.56 NATO /.300 BLK

- Sentiment: 88% Positive / 12% Negative

- Price: Min: $2,200 / Max: $2,600 / Avg: $2,400

Synopsis:

The Sig Sauer MCX Spear LT has effectively conquered the high-end agency market in 2025. Evolving from the MCX Virtus, the Spear LT addresses the weight and ergonomic criticisms of its predecessors while retaining the core advantages of the short-stroke gas piston system.9 It is the preferred weapon for federal tactical teams, dignitary protection units, and well-funded metropolitan SWAT teams.

Probable Factors Contributing to Sales:

The MCX Spear LT’s success is built on the “Total Systems Provider” strategy. Sig Sauer does not just sell a rifle; they sell a unified ecosystem including the firearm, the electro-optics (Romeo/Tango series), the suppressor, and the ammunition. This “one throat to choke” model simplifies liability and logistics for agency heads.10 If the system fails, there is only one vendor to call.

Technically, the piston-driven operating system is a major differentiator. Unlike the Direct Impingement (DI) system of the AR-15, the MCX’s piston system keeps the action cleaner and cooler, which is a critical requirement for suppressed fire. With the increasing normalization of suppressors in LE to mitigate hearing loss liability, the MCX offers a “suppressor-optimized” platform out of the box. Furthermore, the lack of a buffer tube allows for a fully folding stock 12, a capability highly prized by officers operating from cramped patrol vehicles or conducting low-profile security details.

6. Glock GR-115

- Rank: 6

- Caliber: 5.56 NATO

- Sentiment: 95% Positive (Anticipation) / 5% Negative (Skepticism)

- Price: ~$1,500 (Estimated / LE Pricing)

Synopsis:

The Glock GR-115 represents the most disruptive market entry of 2025. After years of rumors and leaks surrounding “Project Hunter” and patents filed in Europe, the GR-115 was finally acknowledged as a viable product for U.S. law enforcement.13 While technically an AR-15 derivative featuring an internal piston system (distinct from the external piston of the HK416 or MCX), its primary value proposition is not mechanical novelty, but administrative unification.

Probable Factors Contributing to Sales:

The central driver for the GR-115 is Ecosystem Unification. It is estimated that Glock pistols hold a market share exceeding 65% within U.S. law enforcement agencies. This massive installed base creates a frictionless pathway for rifle adoption. Agencies can now leverage a single vendor relationship for their entire armory. This consolidation simplifies the supply chain for spare parts and, crucially, unifies the armorer certification process. An agency currently sending armorers to separate courses for Glock pistols and Colt/S&W rifles can now consolidate training, resulting in significant operational savings. The sentiment surrounding the GR-115 is overwhelmingly positive, driven by the brand’s legendary reputation for reliability. The “Glock perfection” marketing ethos translates effectively to the rifle market, where administrators are eager for a “boringly reliable” solution that mirrors the user experience of their duty sidearms.

Section 4: The Premium & Specialized Tier

This tier of the market is defined by “Duty Grade Plus” capability. These manufacturers offer platforms that exceed the minimum military specification (Mil-Spec), incorporating enhancements in metallurgy, quality control, and ergonomics that are demanded by high-liability agencies and discerning individual officers.

4. Daniel Defense DDM4 (V7 / M4A1)

- Rank: 4

- Caliber: 5.56 NATO

- Sentiment: 92% Positive / 8% Negative

- Price: Min: $2,000 / Max: $2,500 / Avg: $2,193

Synopsis:

Daniel Defense acts as the bridge between standard patrol rifles and exotic special operations platforms. The DDM4 series, specifically the V7 and M4A1, are the gold standard for “Premium Patrol.” In 2025, Daniel Defense maintained its position as a top-tier provider by focusing on liability mitigation through extreme durability. Their cold hammer-forged barrels and bomb-proof rail systems (such as the RIS III) are legendary for maintaining zero and accuracy under abusive conditions.15

Probable Factors Contributing to Sales:

The primary driver for Daniel Defense is Reputation and Liability Mitigation. In the wake of high-profile failures and the intense scrutiny of police response tactics (such as the Uvalde aftermath), chiefs and procurement officers are risk-averse. They choose Daniel Defense to immunize their department against claims of equipment inadequacy. The narrative is clear: if an officer is equipped with a DDM4, they have the best tool possible.

The brand has also successfully navigated the political landscape. Despite the optics of their rifles being used in tragedies, the law enforcement community has doubled down on the brand 16, viewing their hardware as essential for “active shooter response” capability. The DDM4 allows regular patrol officers to have capabilities—such as free-floated accuracy and rail space for mission-essential accessories—that were previously reserved for SWAT.

7. Geissele Automatics Super Duty LE

- Rank: 7

- Caliber: 5.56 NATO

- Sentiment: 96% Positive / 4% Negative

- Price: Min: $1,700 / Max: $2,300 / Avg: $1,995

Synopsis:

Geissele Automatics has completed its evolution from a niche components manufacturer to a prime firearm contractor. The Super Duty LE rifle is widely considered one of the finest “out of the box” fighting rifles available in 2025. Significant contract awards from federal entities like the U.S. Marshals Service and various components of the Department of Homeland Security 17 have validated the platform at the highest levels of government.

Probable Factors Contributing to Sales:

Federal Validation and Specialized Performance. Geissele’s sales are driven by the specific demands of federal agents and specialized units who require a rifle that outperforms the standard M4. Key differentiators include the “Nanoweapon” coating (a proprietary solid lubricant coating offering extreme corrosion resistance) and the SSA-E X trigger, which offers a level of shootability that standard mil-spec triggers cannot match.19

Furthermore, Geissele has aggressively targeted the rank-and-file officer with the “Super Duty LE” program, offering significant discounts to individual LEOs.20 This grassroots strategy builds a base of evangelists within departments who then lobby for agency-wide adoption, citing the rifle’s superior performance in dynamic shooting situations compared to pool-issue weapons.

5. FN America FN 15 SRP G2

- Rank: 5

- Caliber: 5.56 NATO

- Sentiment: 89% Positive / 11% Negative

- Price: Min: $1,600 / Max: $2,100 / Avg: $1,850

Synopsis:

FN America continues to leverage its massive industrial footprint as a primary defense contractor to secure large-scale federal law enforcement contracts. The FN 15 SRP G2 (Sight Ready Patrol, Generation 2) is the workhorse of federal law enforcement, seeing widespread service with Customs and Border Protection (CBP) and other DHS agencies.21

Probable Factors Contributing to Sales:

Supply Chain Resilience and IDIQ Dominance. The primary factor driving FN’s sales is the security of its supply chain. In a world where smaller manufacturers can be waylaid by raw material shortages, FN’s vertical integration (manufacturing its own barrels, bolts, and receivers in South Carolina) allows it to fulfill massive orders—thousands of rifles at a time—without delay. This reliability is paramount for federal agencies managing fleet replacements.23

The “G2” update has kept the platform relevant by modernizing the furniture with M-LOK handguards and improved ergonomics 24, addressing previous complaints about the platform feeling “dated” compared to commercial offerings. The rifle’s heavy, chrome-lined barrel is specifically prized for its ability to withstand high volumes of fire during training and qualification cycles without degrading accuracy, reducing long-term lifecycle costs for the agency.

8. Sons of Liberty Gun Works (SOLGW) MK1

- Rank: 8

- Caliber: 5.56 NATO

- Sentiment: 94% Positive / 6% Negative

- Price: Min: $1,900 / Max: $2,400 / Avg: $2,164

Synopsis:

Sons of Liberty Gun Works (SOLGW) has successfully translated a cult-like commercial following into professional legitimacy. The selection of the MK1 rifle by U.S. SOCOM for the Combat Assault Rifle (CAR) program in late 2025 25 served as a watershed moment for the brand. While the SOCOM contract volume is focused on elite units, the certification acts as an undeniable “seal of approval” for domestic law enforcement agencies.

Probable Factors Contributing to Sales:

The “Hard Use” Guarantee. SOLGW’s market position is built on an unconditional lifetime warranty that resonates deeply with officers. Their policy is simple: if a duty rifle is used in a defensive shooting, they replace it. If a barrel is shot out during training, they replace it. For agencies and individual officers concerned with long-term sustainment, this guarantee effectively sets the lifecycle cost of the weapon to zero after the initial purchase.

Their rifles are tuned for reliability rather than comfort. They prioritize gas port sizing that ensures the rifle will cycle even when dirty, dry, or using underpowered ammunition—a philosophy that appeals to agency armorers and instructors who value functional reliability above all else.25

Section 5: The Value Disruptors & Individual Officer Preferences

This segment of the market is driven almost entirely by the “Individual Officer Purchase” (IOP) trend. These manufacturers offer high-value propositions that appeal to officers spending their own salary or stipend, prioritizing feature sets that offer the most capability per dollar.

9. BCM (Bravo Company Mfg) RECCE-14

- Rank: 9

- Caliber: 5.56 NATO

- Sentiment: 93% Positive / 7% Negative

- Price: Min: $1,400 / Max: $1,700 / Avg: $1,550

Synopsis:

BCM remains the premier choice for the “working man’s” professional rifle. While they pursue fewer massive agency-wide solicitations than FN or Colt, their dominance in the individual officer market is undeniable. The RECCE-14 and RECCE-16 series are the standard recommendation in police academies and online professional forums for any officer asking, “What rifle should I buy with my own money?”.26

Probable Factors Contributing to Sales:

Strategic Distribution Partnerships. In 2025, BCM’s partnership with Brownells for the “LE Patrol Rifle Program” streamlined the procurement process.28 This program creates a verified channel for individual officers to purchase duty-ready BCM rifles at discounted rates with immediate availability, bypassing the long lead times often associated with factory direct orders.

The brand’s “Mil-Spec+” philosophy—which involves rigorous Quality Assurance steps like High Pressure Testing (HPT) and Magnetic Particle Inspection (MPI) of every single bolt—builds a level of trust that officers are willing to pay for. The BCM gunfighter accessories (charging handles, grips) are often the very items officers add to other rifles; buying a BCM RECCE means the rifle comes pre-configured with these preferred ergonomic upgrades, saving the officer money and setup time.

10. IWI Zion-15

- Rank: 10

- Caliber: 5.56 NATO

- Sentiment: 90% Positive / 10% Negative

- Price: Min: $800 / Max: $1,200 / Avg: $970

Synopsis:

The IWI Zion-15 is the “disruptor” of the budget/mid-tier category. Manufactured in the U.S. (Pennsylvania) to comply with Berry Amendment requirements for funding, the Zion-15 offers a feature set usually reserved for rifles costing $1,500 or more, including B5 Systems furniture and a mid-length gas system, all at a sub-$1,000 price point.30

Probable Factors Contributing to Sales:

High Value-to-Cost Ratio. As agencies look to replace aging fleets of Bushmasters or older Colts but cannot justify the premium for Daniel Defense, the Zion-15 has emerged as the logical successor. It is widely viewed as “punching above its weight class.”

IWI has specifically targeted the LE market by offering factory SBR (Short Barreled Rifle) configurations, such as the 12.5″ model, which is an ideal length for patrol work.32 By offering these configurations direct from the factory, IWI saves agencies the administrative hassle and cost of buying 16″ rifles and paying gunsmiths to cut them down, or registering them separately. This “turnkey SBR” capability at a budget price point is a significant driver of their 2025 volume.

Section 6: Macro Trends & Future Outlook

The “General Purpose” (GP) Convergence

The 2025 data indicates a convergence in barrel lengths. The industry is moving away from the dichotomy of 10.3″ “entry” guns and 18″ “DMR” guns. The market is settling on the 11.5″ to 14.5″ range as the “General Purpose” standard. This length offers the optimal balance of dwell time (for reliability) and velocity (for terminal ballistics and barrier penetration). Manufacturers like SOLGW and BCM have heavily marketed their 13.7″ and 14.5″ rifles (often with pinned and welded muzzle devices to reach legal 16″ length for non-NFA ease of transfer) to fill this exact niche.26 This trend reflects a doctrinal shift where every patrol officer is expected to be capable of engaging threats from CQB distance out to 200+ yards.

Suppression as a Standard

The integration of suppressors is fast becoming a standard requirement rather than a specialized luxury. Driven by OSHA health and safety concerns regarding hearing loss, agencies are prioritizing “suppressor ready” platforms. This trend favors rifles with adjustable gas blocks or flow-through gas systems (like the Sig Spear) that can mitigate the “gas face” and increased cyclic rate associated with suppressed fire. The Montana Highway Patrol’s contract, which included Gemtech suppressors for every rifle 5, is a bellwether for this industry-wide shift.

Supply Chain Resilience

Post-pandemic supply chain disruptions have left a lasting impact on procurement strategies. Agencies are prioritizing manufacturers with vertical integration—those who control their own barrel and bolt production (FN, Sig Sauer, Daniel Defense)—over assemblers who rely on third-party forgings. The ability to guarantee delivery of spare parts and replacement units within a fixed window is now a weighted criterion in solicitation scoring, often ranking as high as raw performance or price.

Conclusion

The 2025 tactical rifle market for U.S. law enforcement is characterized by a sophisticated stratification of needs. It is no longer a monolithic market satisfied by a generic “M4.” Instead, it is a complex ecosystem where Colt and Smith & Wesson sustain the rank-and-file needs through pure volume and economic efficiency, while Sig Sauer and Daniel Defense define the new standards for performance and liability mitigation.

The emerging presence of Glock as a rifle manufacturer serves as a potent wildcard that is reshaping vendor relationships, incentivizing a “single-brand” armory concept that could threaten the market share of traditional rifle-only manufacturers in the coming years. Ultimately, the data reflects a law enforcement community that is increasingly actively involved in its own equipment selection, moving away from passive acceptance of issued gear toward a proactive pursuit of “duty grade” excellence—whether funded by the agency or the officer themselves. As recruitment and retention remain critical challenges, the provision of high-quality, modern firearms like the MCX Spear LT or Geissele Super Duty serves a dual purpose: it provides essential operational capability and acts as a tangible signal that the agency is invested in the survivability and professional standing of its personnel.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Colt Wins Nearly $13 Million Army M4 Contract – Guns.com, accessed January 5, 2026, https://www.guns.com/news/2025/12/16/colt-wins-nearly-13-million-army-m4-contract

- US Army Issues Intent to Sole Source Procurement of M4/M4A1 Carbines from Colt, accessed January 5, 2026, https://soldiersystems.net/2025/03/14/us-army-issues-intent-to-sole-source-procurement-of-m4-m4a1-carbines-from-colt/

- M4 Rifle and Parts (5.56x45mm NATO) – SAM.gov, accessed January 5, 2026, https://sam.gov/workspace/contract/opp/70bfcd93da9d4938afb9f1378e209e6f/view

- 16 Reviews – AimSurplus, LLC, accessed January 5, 2026, https://aimsurplus.com/products/leo-trade-in-colt-law-enforcement-16in-223556-ar15-carbine

- Smith & Wesson Secures Second Montana Highway Patrol Contract | An Official Journal Of The NRA, accessed January 5, 2026, https://www.shootingillustrated.com/content/smith-wesson-secures-second-montana-highway-patrol-contract/

- Smith & Wesson Secures 2nd Montana Highway Patrol Contract for SBRs, accessed January 5, 2026, https://www.thefirearmblog.com/blog/smith-wesson-secures-2nd-montana-highway-patrol-contract-for-sbrs-44822287

- Savings for those who serve | Smith & Wesson, accessed January 5, 2026, https://www.smith-wesson.com/american-guardians

- M&P®15 PATROL RIFLE LAW ENFORCEMENT ONLY | Smith & Wesson, accessed January 5, 2026, https://www.smith-wesson.com/product/m-p-15-patrol-rifle-law-enforcement-only

- How Sig Sauer Dominated Military & Law Enforcement Contracts – Guns.com, accessed January 5, 2026, https://www.guns.com/news/sig-sauer-dominated-military-and-law-enforcement-contracts

- Homeland Security Awards FLETC Ammunition Contract to SIG Sauer – Police Magazine, accessed January 5, 2026, https://www.policemag.com/news/homeland-security-awards-fletc-ammunition-contract-to-sig-sauer

- United States Immigration and Customs Enforcement Extends SIG SAUER P320 Contract Another Two Years, accessed January 5, 2026, https://www.sigsauer.com/blog/united-states-immigration-and-customs-enforcement-extends-sig-sauer-p320-contract-another-two-years-

- Sig Sauer Armed Professional Program – In Stock Guns, Suppressors, Ammo, & Accessories | Modern Warriors, accessed January 5, 2026, https://modernwarriors.com/product-search/sigsauer-law-enforcement

- It is official: GR-115 – GLOCK has an AR15 – SPARTANAT.com, accessed January 5, 2026, https://spartanat.com/en/es-ist-offiziell-gr-115-glock-hat-ein-ar15

- Glock made a rifle. Here’s what we know about it. – WeAreTheMighty.com, accessed January 5, 2026, https://www.wearethemighty.com/military-news/glock-made-a-rifle-heres-what-we-know-about-it/

- Law Enforcement – MILE – Daniel Defense, accessed January 5, 2026, https://danieldefense.com/mile/law-enforcement.html

- Turning Our Streets Into War Zones – The Smoking Gun, accessed January 5, 2026, https://smokinggun.org/report/turning-our-streets-into-war-zones/

- Justice Award | 15M10225PA4700440 | MISSION CRITICAL: APPREHENDING FUGITIVES FY25 D85 WEAPONS – Federal Compass, accessed January 5, 2026, https://www.federalcompass.com/award-contract-detail/15M10225PA4700440

- Contract 15DDTR25F00000161 Geissele Automatics – HigherGov, accessed January 5, 2026, https://www.highergov.com/contract/70B06C22D00000020-15DDTR25F00000161/

- Geissele Automatics 2025 MSRP – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=178276&v=26771&sv=0&i=76&ft=b

- Police firearms review: Geissele Super Duty LE rifle – Police1, accessed January 5, 2026, https://www.police1.com/police-products/firearms/articles/a-legendary-name-makes-a-rifle-for-cops-geissele-super-duty-le-review-F6jCkdE9jd47sc9i/

- FN WINS U.S. ARMY DEVELOPMENT CONTRACT FOR THE PRECISION GRENADIER SYSTEM | FN® Firearms – FN America, accessed January 5, 2026, https://fnamerica.com/press-releases/fn-wins-u-s-army-development-contract-for-the-precision-grenadier-system/

- Law Enforcement | FN® Firearms – FN America, accessed January 5, 2026, https://fnamerica.com/law-enforcement/

- M4 Rifle and Parts (5.56x45mm NATO) – HigherGov, accessed January 5, 2026, https://www.highergov.com/contract-opportunity/m4-rifle-and-parts-5-56x45mm-nato-20154948-r-09e6f/

- FN 15® SRP G2 | FN® Firearms, accessed January 5, 2026, https://fnamerica.com/products/fn-15-series/fn-15-srp-g2/

- Sons of Liberty Gun Works Awarded U.S. SOCOM Contract for MK1 Rifle, accessed January 5, 2026, https://sonsoflibertygw.com/sons-of-liberty-gun-works-awarded-u-s-socom-contract-for-mk1-rifle/

- BCM RECCE-14 MK2 MCMR 5.56/.223 14.5″ PIN & WELDED CARBINE MLOK RAIL – LC Action Police Supply, accessed January 5, 2026, https://lcaction.com/bcm-recce-14-mk2-mcmr-5-56-223-14-5-pin-welded-carbine-mlok-rail/

- Is The BCM Recce 14 Still One Of The Best Duty Rifles? – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=ONnkA_8AcSo

- Brownells Law Enforcement Patrol Rifle Program | Military, Police, & First Responder Deals and Discounts, accessed January 5, 2026, https://www.brownells.com/patrol-rifle-program/

- Brownells Launches Law Enforcement Patrol Rifle Program | An Official Journal Of The NRA, accessed January 5, 2026, https://www.shootingillustrated.com/content/brownells-launches-law-enforcement-patrol-rifle-program/

- Law Enforcement AR-15 – Zion-15 | IWI US, accessed January 5, 2026, https://iwi.us/firearms/select-fire-rifles/zion-15-le/

- 16″ Zion-15 Rifle – 5.56 NATO | IWI US, accessed January 5, 2026, https://iwi.us/firearms/zion-15/rifle-5-56-nato/

- Law Enforcement & Public Service Purchase Form | IWI US, accessed January 5, 2026, https://iwi.us/test-form/

- MK1 CAR – 11.5″ 5.56 – Anodized Finish – Sons Of Liberty Gun Works, accessed January 5, 2026, https://sonsoflibertygw.com/product/mk1-car-11-5-5-56mm-anodize/