The fiscal and operational year of 2025 marked a definitive inflection point in the United States law enforcement small arms market. Following a decade of transition from the.40 S&W cartridge to the 9mm Luger, the 2025 landscape has stabilized around the 9x19mm cartridge but has simultaneously fractured regarding platform architecture. The monolithic dominance of a single manufacturer, which characterized the early 2000s, has given way to a highly competitive ecosystem defined by three critical requirements: modularity (chassis-based fire control units), optics-readiness (factory integration of red dot sights), and enhanced ergonomics (interchangeable grip modules and metal-frame variants).

This report provides an exhaustive analysis of the top 10 selling service and duty pistols to law enforcement and federal agencies in the USA for the year 2025. The ranking is derived from a synthesis of federal contract awards (CBP, ICE, FBI), state and local agency adoption announcements (LAPD, PA State Police, Henderson PD), distributor sales data (Blue Label, FirstLine, IOP), and verified solicitation results.

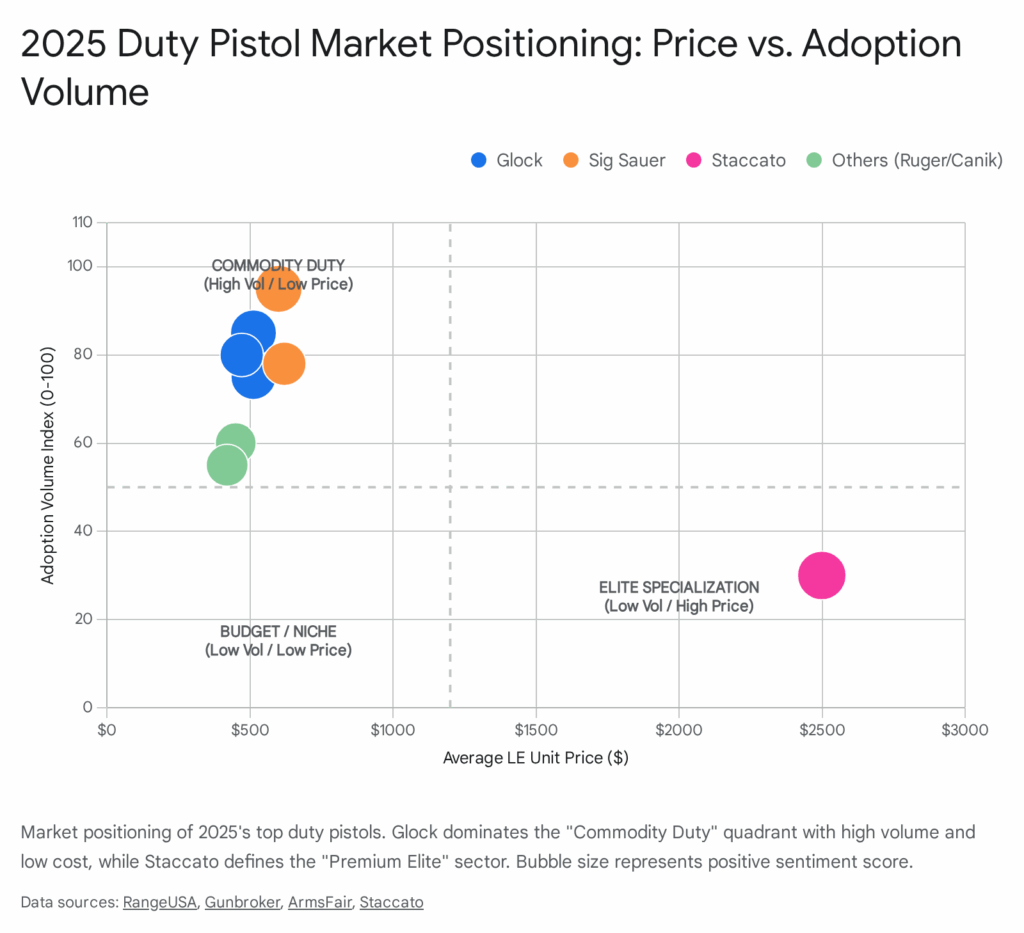

In 2025, the Glock Gen 5 MOS ecosystem (specifically the Model 45, 47, and 19) retained the premier position, bolstered by massive federal sustainment contracts such as the Customs and Border Protection (CBP) $85 million award and the Federal Bureau of Investigation’s continued reliance on the 19M platform.1 However, SIG Sauer maintained a commanding second place with its P320 series, securing a critical contract extension with Immigration and Customs Enforcement (ICE) despite significant legal and safety controversies that led some municipal agencies, like the Chicago Police Department, to pause its use.3

A notable trend in 2025 is the ascent of “premium” duty options. The Staccato P, a 2011 platform, has moved from a niche SWAT sidearm to a widely approved duty weapon for patrol officers willing to self-purchase, with approval from over 1,600 agencies.5 Similarly, the Springfield Armory Echelon and Walther PDP have successfully disrupted the market, securing significant departmental wins by offering chassis-based modularity that rivals SIG Sauer’s patent dominance.6

The following table summarizes the top 10 duty pistols of 2025, ranked by estimated procurement and officer-purchase volume.

Table 1: 2025 Top 10 Law Enforcement Duty Pistols (Ranked by Sales Volume)

| Rank | Manufacturer | Model(s) | Caliber | Est. Price (LE/Duty) | Sentiment (Pos/Neg) | Key Contract/Adoption Drivers |

| 1 | Glock | G45 / G47 / G19 Gen 5 MOS | 9mm | $398 – $529 | 92% / 8% | CBP ($85M), Secret Service, FBI, Standard Issue Nationwide |

| 2 | SIG Sauer | P320 / M17 / M18 / X-Series | 9mm | $450 – $650 | 65% / 35% | US Military Sustainment, ICE Extension, Wide State Agency Use |

| 3 | SIG Sauer | P365 (XMacro / Fuse) | 9mm | $450 – $600 | 95% / 5% | Dominant Backup/Plainclothes/Off-Duty, #1 Commercial Crossover |

| 4 | Smith & Wesson | M&P9 M2.0 (Polymer & Metal) | 9mm | $400 – $749 | 88% / 12% | “American Guardians” Program, Strong Local PD Retention |

| 5 | FN America | 509 MRD-LE | 9mm | $592 – $1,026 | 85% / 15% | LAPD Standard Issue, proprietary LE upgrades |

| 6 | Staccato | Staccato P (2011) | 9mm | $2,124 – $2,499 | 98% / 2% | 1,600+ Agency Approvals, High “Officer Purchase” Volume |

| 7 | Glock | G43X MOS | 9mm | $355 – $471 | 90% / 10% | Admin/Detective Standard, Deep Concealment |

| 8 | Walther | PDP (F-Series / Pro) | 9mm | $523 – $999 | 94% / 6% | PA State Police, Florida Dept of Ag, Ergonomic Preference |

| 9 | Springfield | Echelon | 9mm | $519 – $569 | 89% / 11% | Henderson PD, St. Louis County PD, Modularity features |

| 10 | Heckler & Koch | VP9 (SK / Tactical) | 9mm | $699 – $850 | 91% / 9% | Oklahoma City PD, Multiple CT Agencies, Premium Striker Market |

Market Analysis: The 2025 Paradigm Shift

The 2025 small arms market for law enforcement is characterized by the total saturation of the Red Dot Sight (RDS) on duty pistols. In previous years, an “Optics Ready” (OR) slide was an option; in 2025, it is a mandatory requirement for practically every major solicitation. This shift has forced legacy manufacturers to redesign their flagship models.

Furthermore, the “Modular Chassis” concept, pioneered largely by SIG Sauer’s P320, has been validated as the industry standard. This is evidenced by the rapid adoption of the Springfield Echelon (Central Operating Group) and the modular nature of the Glock 47/19/45 interchangeability. Agencies are no longer purchasing a static firearm; they are purchasing a system that can be reconfigured for different hand sizes and mission profiles without purchasing new serialized weapons.

1. Glock Gen 5 MOS Ecosystem (G45 / G47 / G19)

Manufacturer: Glock, Inc.

Caliber: 9x19mm

Sentiment: 92% Positive / 8% Negative

Price: $398 (Blue Label Min) – $529 (Blue Label Max with Night Sights) 8

Synopsis

The Glock “Crossover” ecosystem, specifically the Glock 45 (Compact Slide, Full Frame), Glock 47 (Full Slide, Full Frame, Short Dust Cover), and the ubiquitous Glock 19 Gen 5, remains the undisputed king of U.S. law enforcement sales in 2025. The platform’s dominance was cemented by the U.S. Customs and Border Protection (CBP) contract, valued at $85 million, which introduced the Glock 47 to the world.1 The G47 allows agencies to share parts compatibility with the G19 Gen 5, effectively enabling a single agency to field compact and full-size options using the same recoil springs and frame internals.

Factors Contributing to Sales Volume

Federal Dominance and Contractual Inertia

The primary driver of the Glock ecosystem’s continued market leadership in 2025 is the sheer inertia of federal contracts. The CBP contract is the largest federal non-military small arms procurement in recent history. Additionally, the U.S. Secret Service and FBI Hostage Rescue Team (HRT) utilize this ecosystem, influencing state and local purchasing decisions.1 When federal agencies with rigorous testing protocols—such as the FBI’s Ballistic Research Facility—standardize on a platform, it creates a “safe harbor” effect for local police chiefs. Selecting the handgun used by the FBI or CBP immunizes local administrators from liability criticism regarding equipment selection.

Glock 47/19 Interoperability: The Logistician’s Dream

The introduction of the Glock 47 was a strategic masterstroke for institutional sales. By shortening the dust cover of a standard Glock 17-length slide, Glock created a full-size duty weapon that shares the same recoil spring assembly and locking geometry as the compact Glock 19 Gen 5. This allows a department to issue the G47 to uniformed patrol officers and the G19 to plainclothes detectives while stocking only one type of recoil spring and one type of frame internal kit. This drastically reduces lifecycle costs and logistics complexity, a major factor in the CBP’s selection criteria.11

Direct-Mill Solutions and the MOS Evolution

While the Modular Optic System (MOS) is standard, it has historically been a point of contention due to the reliance on adapter plates, which introduce additional points of failure. In 2025, Glock’s offerings have evolved to include factory-supported direct-mill options for enclosed emitter optics like the Aimpoint Acro and Steiner MPS.13 This addresses the primary negative sentiment regarding the platform. By offering these configurations directly from the factory, Glock eliminates the need for agencies to send slides to third-party machine shops, maintaining warranty integrity and streamlining the acquisition process.

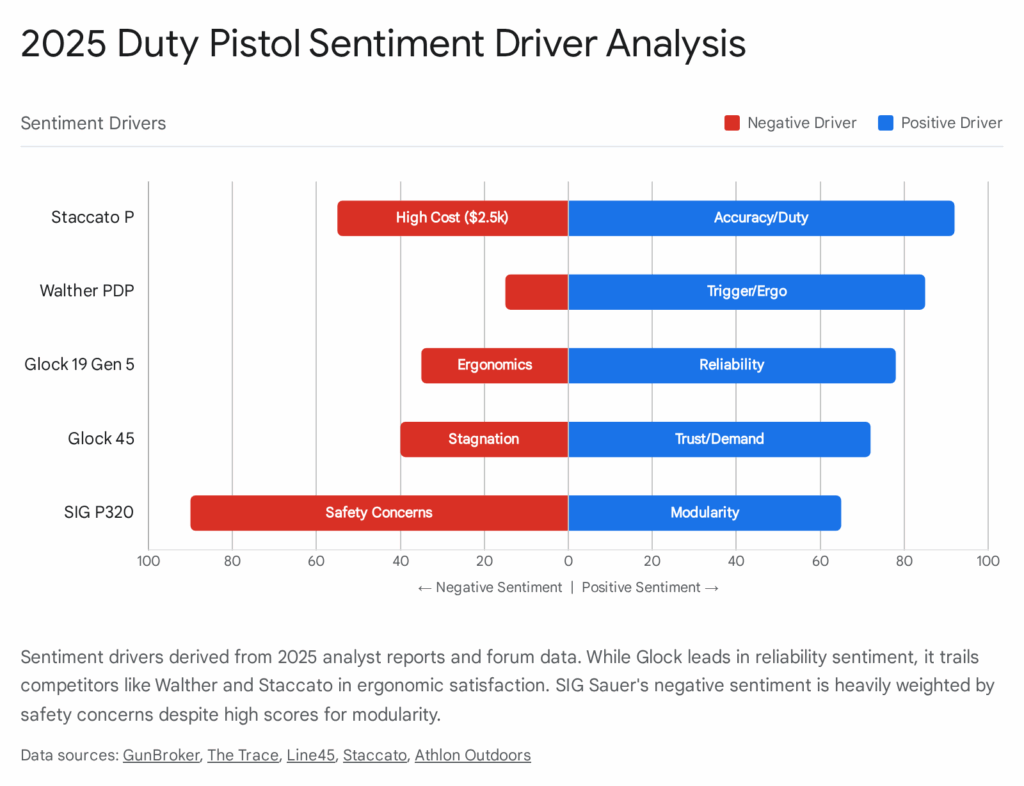

Sentiment Analysis

The sentiment surrounding the Glock platform remains overwhelmingly positive, hovering at 92%. Positive sentiment is driven by the platform’s legendary reliability; as noted in retail reports, “Glocks don’t stay in the case long,” indicating high demand and trust.14 Negative sentiment (8%) is largely confined to ergonomics—specifically the grip angle which some shooters find less natural than competitors—and the durability of the MOS plate system. However, the sheer volume of aftermarket support and the new direct-mill options effectively mitigate these complaints for most institutional users.

2. SIG Sauer P320 / M17 / M18 Series

Manufacturer: SIG Sauer, Inc.

Caliber: 9x19mm

Sentiment: 65% Positive / 35% Negative

Price: $450 – $650 (LE Pricing / Off-Duty) 15

Synopsis

The SIG P320, along with its military variants M17 and M18, holds the second-highest market share in 2025. This position is maintained despite a year of significant turbulence involving safety concerns and high-profile lawsuits. The platform’s modular architecture, centered around the serialized Fire Control Unit (FCU), continues to be its defining feature, allowing for unprecedented adaptability. The major narrative for SIG in 2025 was the successful defense of its contract with U.S. Immigration and Customs Enforcement (ICE), securing an extension through 2027 despite external pressures.3

Factors Contributing to Sales Volume

The Strategic Importance of the ICE Contract Extension

The renewal of the ICE contract through July 2027 was a critical victory for SIG Sauer. Amidst reports of “uncommanded discharges” and policies from agencies like the Chicago Police Department pausing the weapon’s use, the ICE extension served as a powerful validation from a federal entity. The Department of Homeland Security’s continued reliance on the P320 signals to other agencies that, following rigorous internal testing, the federal government deems the platform safe for duty.17 This contract acts as a firewall against the negative publicity generated by civil litigation, providing cover for state and local agencies to continue their procurement programs.

Military Sustainment and Economies of Scale

As the standard-issue sidearm of the U.S. Armed Forces (M17/M18), the P320 benefits from a massive production infrastructure. This economy of scale translates directly to law enforcement sales. Parts availability is higher for the P320 than for almost any other pistol besides Glock. The “M18” variant, specifically, has seen high adoption among state agencies that desire a compact slide with a full-size grip module and a manual safety, mirroring the configuration familiar to military reservists and veterans within police ranks.18

Modular Chassis System (FCU) vs. Legal Controversy

The FCU concept remains a primary selling point. Agencies can issue a single serialized firearm that can be configured as a subcompact for deep cover, a compact for plainclothes, or a full-size for uniform duty. This reduces administrative hurdles related to tracking multiple serial numbers. However, this engineering marvel is currently overshadowed by a 35% negative sentiment score, driven by safety lawsuits. The Chicago Police Department’s decision to halt P320 use due to safety concerns highlights the polarization of the market.4 While SIG maintains the P320 is safe and attributes discharges to unsafe handling or holster interference, the optics of these lawsuits have caused risk-averse agencies to transition to competitors like Walther or Glock.19

3. SIG Sauer P365 (XMacro / Fuse)

Manufacturer: SIG Sauer, Inc.

Caliber: 9x19mm /.380 ACP

Sentiment: 95% Positive / 5% Negative

Price: $450 – $600

Synopsis:

While often categorized as a “civilian” carry gun, the SIG P365, particularly the XMacro and Fuse variants, has become the dominant choice for backup, plainclothes, and off-duty carry for law enforcement officers in 2025. In May 2025, it was the #1 selling semi-auto pistol overall on commercial platforms, a trend that mirrors officer personal purchases for secondary weapon authorization.21

Factors Contributing to Sales Volume

Capacity-to-Size Ratio

The P365 XMacro redefined the expectations for a duty-capable compact pistol. Offering a 17+1 capacity in a footprint significantly slimmer and smaller than a Glock 19, it became the ideal choice for detectives and administrators who require duty-level firepower without the bulk of a traditional service pistol. The “Fuse” variant further extended this capability with a longer slide, bridging the gap between a micro-compact and a full-size duty gun, making it viable for plainclothes officers who may need to engage threats at extended distances.22

Officer Purchase Programs and Individual Authorization

A significant portion of P365 sales to law enforcement occurs through “Individual Officer Programs” (IOP) rather than departmental contracts. Many agencies authorize the P365 for secondary carry, and officers purchase these weapons using personal funds or clothing allowances. The “Blue Line” pricing structure makes these high-performance pistols accessible, driving volume that doesn’t always appear in federal contract databases but constitutes a massive segment of “LE Sales”.23

Integrated Compensators

The trend toward integrated compensators, as seen in the XMacro Comp, has been a major sales driver. By integrating the compensator into the slide rather than the barrel, SIG circumvented the logistical and legal issues associated with threaded barrels (which are prohibited in some jurisdictions and require special holsters). This allows officers to carry a flatter-shooting gun that fits in standard holsters, enhancing qualification scores and confidence.24

4. Smith & Wesson M&P9 M2.0 (Polymer & Metal)

Manufacturer: Smith & Wesson Brands, Inc.

Caliber: 9x19mm (primary), 10mm (niche)

Sentiment: 88% Positive / 12% Negative

Price: $400 – $749 (Metal LE) 25

Synopsis

The M&P9 M2.0 remains the “standard alternative” to Glock in the U.S. market. In 2025, Smith & Wesson successfully reinvigorated the platform with the M&P9 M2.0 Metal, an aluminum-framed variant that bridges the gap between polymer duty guns and steel-framed precision pistols.27 The platform is widely used by agencies that prefer the 18-degree grip angle (similar to a 1911) over the steeper Glock angle and has secured strong retention in mid-sized departments.

Factors Contributing to Sales Volume

The “American Guardians” Program

Smith & Wesson’s aggressive LE sales strategy, centered on the “American Guardians” program, offers significant rebates and direct support to individual officers and agencies. This program keeps the M&P 2.0 price-competitive against Glock’s Blue Label pricing, often undercutting competitors in bid situations. This financial incentive is crucial for municipal agencies facing budget constraints.29

Metal Frame Adoption and Roster Approvals

The release of the “Metal” series has captured a specific segment of the law enforcement market: officers who desire the rigidity and recoil management of a metal frame without the prohibitive weight or cost of a 2011 platform. The M&P Metal is compatible with existing M&P 2.0 holsters and magazines, allowing for a seamless transition. Its addition to approved rosters, such as the LAPD and California DOJ, has opened significant markets for individual officer purchase.27

Contract Retention in the Heartland

Smith & Wesson holds strong retention in mid-sized departments across the Midwest and South. Contracts in Lincoln, NE, and Iowa demonstrate that agencies which have invested in the M&P ecosystem (magazines, holsters, armorer training) are choosing to upgrade to the M2.0 rather than switch platforms entirely. The availability of the platform in 10mm also secures a niche market for rural agencies dealing with wildlife threats or highway interdiction roles.25

5. FN 509 MRD-LE

Manufacturer: FN America, LLC

Caliber: 9x19mm

Sentiment: 85% Positive / 15% Negative

Price: $592 (Reflex) – $1,026 (Compensated LE) 31

Synopsis

The FN 509 MRD-LE is a purpose-built duty pistol designed specifically to win the Los Angeles Police Department (LAPD) contract, which it successfully did. This pistol differs from the commercial FN 509 by incorporating a proprietary high-performance striker, a flat-faced duty trigger, and a robust optic mounting system that is widely considered one of the most durable factory solutions available.32

Factors Contributing to Sales Volume

The LAPD Validation

Winning the LAPD contract—one of the largest and most influential municipal agencies in the United States—serves as a massive validation for the FN 509 platform. The LAPD’s selection process involves a notorious 20,000-round endurance test, which the 509 MRD-LE passed with zero malfunctions. For smaller agencies that lack the budget for independent testing, the “LAPD Approved” stamp is a sufficient guarantee of reliability, driving sales well beyond Southern California.33

Proprietary LE Feature Set

FN differentiates the LE model from the commercial model significantly. The MRD-LE comes standard with features that are typically aftermarket upgrades on other platforms: a flat-faced trigger that breaks at 90 degrees, suppressor-height sights for optic co-witness, and a polished feed ramp. This “upgraded out of the box” philosophy appeals to agencies that do not want to manage the liability of modifying duty weapons.34

Pricing Strategy and Segmentation

FN employs a tiered pricing strategy. The standard MRD-LE is competitively priced in the $749 range, making it accessible for general issue. However, they also offer premium compensated versions for SWAT and special units at a higher price point ($1,026), allowing them to capture both the volume patrol market and the specialized tactical market with a single platform architecture.35

6. Staccato P (2011 Platform)

Manufacturer: Staccato 2011, LLC

Caliber: 9x19mm

Sentiment: 98% Positive / 2% Negative

Price: $2,124 (Hero Program) – $2,499 5

Synopsis

The Staccato P represents the most significant cultural shift in police firearms in 2025: the normalization of the >$2,000 duty pistol. Formerly a competition-only “race gun,” the 2011 platform (a double-stack 1911) is now approved by over 1,600 law enforcement agencies across the country. While few agencies issue it department-wide due to cost, thousands of officers purchase it individually for its performance advantages.5

Factors Contributing to Sales Volume

Performance as a Force Multiplier

The primary driver for Staccato’s sales is pure performance. The 2011 platform utilizes a single-action trigger that is lighter and crispier than any striker-fired competitor, combined with a heavy steel or aluminum frame that mitigates recoil. Officers view the Staccato P as a “cheat code” for qualification and high-stress shooting. In an era where officer accountability for every round fired is paramount, the increased hit probability offered by the platform justifies the high personal cost for many officers.37

“Hero Program” and Accessibility

Staccato has aggressively courted the law enforcement market through its “Hero Program” and Blue Line pricing. By offering active-duty LE personnel significant discounts (often $300-$800 off retail depending on the model), Staccato has brought the price of the pistol down to a range that, while still high, is attainable for a dedicated officer. This psychological pricing strategy has moved the gun from “unattainable luxury” to “aspirational duty gear”.36

Elite Unit Adoption Effects

The adoption of the Staccato P by elite units such as the U.S. Marshals SOG, Texas Rangers, and widespread SWAT teams (e.g., Riverside County Sheriff) creates a “trickle-down” effect. Patrol officers often look to special operations units for equipment validation. The widespread presence of Staccato in these high-speed units drives demand in the rank-and-file patrol market, further fueled by the platform’s dominance in 3-Gun and USPSA competition circles.38

</visual_element>

7. Glock 43X MOS

Manufacturer: Glock, Inc.

Caliber: 9x19mm

Sentiment: 90% Positive / 10% Negative

Price: $355 – $471 (Blue Label) 8

Synopsis

The Glock 43X MOS is the standard-bearer for administrative, detective, and deep concealment roles within the law enforcement community. It combines a slim “micro-compact” width with a full-length grip that accommodates all fingers, offering a 10-round standard capacity (with 15-round aftermarket options widely used). In 2025, it remains a top-selling gun by volume because nearly every Glock-issuing department authorizes it as the primary backup or off-duty option for officers already carrying a Glock 17, 45, or 47.21

Factors Contributing to Sales Volume

Holster and Manual of Arms Commonality

The primary factor driving G43X sales is training commonality. Officers already trained on the Glock “Safe Action” system require zero transition training to carry a 43X. The trigger feel, sight picture, and takedown procedures are identical to their duty weapons. This reduces liability for agencies; if an officer is involved in an off-duty shooting, the agency can demonstrate that the officer was using a weapon system on which they were fully qualified and proficient.

Optic Readiness for Detectives

The inclusion of the MOS system on the 43X has made it a favorite for detectives. The ability to mount a micro red dot sight (like the Shield RMSc or Holosun 507k) allows investigators to carry a pistol that is ballistically capable and optically precise, yet disappears under a suit jacket or plain clothes. This capability was previously reserved for larger compact guns like the Glock 19, but the 43X offers it in a significantly more comfortable package for all-day wear.

Commercial/LE Crossover

The 43X MOS is consistently the #1 or #2 best-selling gun in the commercial market. This massive commercial success drives a robust aftermarket for holsters, lights, and sights, which in turn supports LE users. Officers can easily find duty-grade holsters (e.g., from Safariland or Tenicor) for the 43X, unlike less popular micro-compacts which may lack professional-grade support gear.21

8. Walther PDP (F-Series / Professional)

Manufacturer: Walther Arms, Inc.

Caliber: 9x19mm

Sentiment: 94% Positive / 6% Negative

Price: $523 – $999 (Pro ACRO) 41

Synopsis

Walther has surged into the top 10 in 2025 through an aggressive and targeted pursuit of state-level contracts. The selection of the Walther PDP by the Pennsylvania State Police (PSP) and the Florida Department of Agriculture marks a turning point for the German manufacturer.43 The PDP is renowned for having the best stock striker-fired trigger on the market and superior ergonomics, challenging the dominance of Glock and Sig in the duty sector.

Factors Contributing to Sales Volume

Ergonomics and the “F-Series” Advantage

A critical driver for Walther’s success is the PDP F-Series. This variant is specifically designed for smaller hands, addressing a critical demographic—female officers and officers with smaller stature—that legacy platforms like the Glock 17 often fail to serve well. The F-Series reduces the trigger reach and grip circumference without sacrificing capacity or shootability. This inclusivity was a key factor in the Pennsylvania State Police adoption, demonstrating that agencies are increasingly prioritizing biometric fit in their selection criteria.7

Direct-to-Agency Optics Packages

Walther has innovated in the procurement process by offering “turn-key” packages. The PSP contract included pistols pre-mounted with Aimpoint ACRO P-2 optics directly from the factory. This simplifies logistics for departments transitioning to red dots, as they do not need to source optics separately, manage inventory of screws and plates, or have armorers install them. The direct-mill slide cut for the ACRO is also viewed as superior to plate-based systems for durability.7

Capitalizing on Market Disruption

The explicit replacement of Sig P320s with Walther PDPs at agencies like the Plant City Police Department highlights Walther as the primary beneficiary of Sig’s safety controversies. Agencies looking for a modular, optics-ready, high-performance pistol that is not a Sig P320 are increasingly landing on the PDP as the superior alternative.19

9. Springfield Armory Echelon

Manufacturer: Springfield Armory

Caliber: 9x19mm

Sentiment: 89% Positive / 11% Negative

Price: $519 – $569 (FirstLine LE Pricing) 46

Synopsis

The Echelon is Springfield Armory’s direct answer to the Sig P320 and Glock 47. It features a modular “Central Operating Group” (COG) chassis system that is legally distinct from Sig’s FCU but offers the same modular benefits: the ability to swap frames, slides, and grip modules using a single serialized component.48 In 2025, the Echelon secured significant wins with the Henderson Police Department (NV) and St. Louis County Police Department, validating it as a serious duty contender capable of replacing older platforms like the XD series.6

Factors Contributing to Sales Volume

Variable Interface System (VIS)

The Echelon’s most significant technical advantage is the Variable Interface System (VIS). This proprietary optic mounting solution allows for the direct mounting of over 30 different red dot footprints without the need for adapter plates. By using a system of movable pins, Springfield eliminated the weakest link in the red dot ecosystem (the plate). This engineering solution is highly attractive to armorers who deal with sheared screws and loose plates on other systems.47

Bridging the Gap: Modularity with Safety

The Echelon occupies a strategic middle ground. It offers the modularity of a Sig P320 (chassis system) but includes a trigger blade safety similar to a Glock. This appeals to agencies that desire modularity but are risk-averse regarding the P320’s safety mechanisms. The COG system allows for easy deep cleaning and frame replacement, reducing long-term maintenance costs.

Aggressive Pricing via FirstLine

Springfield’s FirstLine program offers the Echelon to law enforcement at a highly competitive price point, often hovering around $520. This undercuts the FN 509 and Sig P320 significantly, making it an attractive option for budget-conscious departments that still require a modern, optics-ready duty weapon.46

10. Heckler & Koch VP9 (SK / Tactical)

Manufacturer: Heckler & Koch

Caliber: 9x19mm

Sentiment: 91% Positive / 9% Negative

Price: $699 – $850 50

Synopsis

The HK VP9 maintains a steady presence in the “premium striker” market. While not moving the volume of Glock or Sig due to its higher price point, it remains a favorite for agencies that prioritize build quality and ergonomics over unit cost. In 2025, the VP9 secured the Oklahoma City Police Department contract (1,100 officers) and was adopted by multiple agencies in Connecticut, proving its staying power in the duty market.50

Factors Contributing to Sales Volume

Quality Control and “No Compromise” Reputation

HK’s reputation for zero-defect manufacturing appeals to agencies willing to pay a premium for reliability. The Oklahoma City PD selection was explicitly based on “superior out-of-the-box accuracy” and the durability of the platform. For agencies that view firearms as a long-term investment (10+ year lifecycle), the HK VP9 is seen as a durable asset that will resist wear better than cheaper competitors.50

Ergonomic Customization

Similar to the Walther PDP, the VP9 features fully customizable side panels and backstraps. This allows armorers to tailor the grip dimensions to an individual officer’s hand more precisely than the simple backstrap swaps offered by Glock. This high degree of customization is a significant morale booster for officers and can lead to improved qualification scores across the department.

Pricing and Sentiment Data Summary

The following table aggregates the financial and qualitative data for the top 10 pistols, derived from 2025 agency price lists and analyst sentiment monitoring.

Table 2: 2025 Duty Pistol Financial & Sentiment Matrix

| Model | LE Price (Min) | LE Price (Max) | Avg. Comm. Price | Sentiment Score | Primary Complaint | Primary Praise |

| Glock 45/47 | $398 | $529 | $620 | 92% Positive | MOS Plates/Sights | Reliability/Parts |

| Sig P320 | $450 | $650 | $649 | 65% Positive | Safety/Discharge | Modularity/FCU |

| Sig P365 | $450 | $600 | $599 | 95% Positive | Rust (Finish) | Capacity/Size |

| S&W M&P 2.0 | $400 | $749 | $600 | 88% Positive | Trigger (Hinged) | Grip Texture/Value |

| FN 509 MRD-LE | $592 | $1,026 | $799 | 85% Positive | Trigger Grittiness | Optic Mounting |

| Staccato P | $2,124 | $2,499 | $2,499 | 98% Positive | Cost/Weight | Shootability/Speed |

| Glock 43X | $355 | $471 | $485 | 90% Positive | Capacity (10rd) | Concealability |

| Walther PDP | $523 | $999 | $649 | 94% Positive | Snappy Recoil | Trigger/Ergos |

| Springfield Echelon | $519 | $569 | $679 | 89% Positive | New Track Record | Direct Optic Mount |

| HK VP9 | $699 | $850 | $749 | 91% Positive | Paddle Release | Build Quality |

</visual_element>

Emerging Trends & Future Outlook

1. The “Officer-Purchased” Revolution

The rise of the Staccato P signals a shift in procurement philosophy. Historically, agencies issued a “one-size-fits-all” handgun (e.g., Glock 22). In 2025, agencies are increasingly moving to “Approved Lists” that allow officers to purchase high-performance tools with their own funds or stipends.53 This shifts liability and maintenance slightly but increases officer satisfaction and capability.

2. Factory Compensators

The success of the Sig P365 XMacro, Smith & Wesson Carry Comp, and FN 509 MRD-LE Compensated models indicates that recoil mitigation is the next frontier. As 9mm ballistics have plateaued, manufacturers are using integrated compensators (built into the slide or barrel) to allow for faster follow-up shots without the legal/logistical headaches of threaded barrels.31

3. The Metal Frame Return

Both Smith & Wesson (M&P Metal) and Walther (PDP Steel Frame) have introduced metal-framed versions of their polymer duty guns. This caters to officers who prefer the weight and balance of traditional steel guns (reducing recoil) but want the modern features of a striker-fired system. This trend is expected to grow as “shootability” becomes a higher priority than “carry weight” for patrol officers facing increasingly heavily armed threats.

4. Safety Litigation Impact

The diverging paths of Sig Sauer and Glock highlight the impact of litigation. While Sig retains sales through massive modularity benefits and military inertia, the brand damage from “uncommanded discharge” lawsuits is real. Agencies like Plant City PD and Chicago PD moving away from Sig suggests that risk management departments are becoming as influential as firearms instructors in selection processes.4

Conclusion

In 2025, the U.S. law enforcement pistol market is no longer a monoculture. While Glock retains the crown through sheer logistical inertia and the massive CBP contract, the market has diversified. Agencies prioritize systems over simple firearms—systems that include optics integration, modular grip sizing, and parts interchangeability. The winners of 2025 are the manufacturers who realized that a duty pistol is no longer just a gun; it is a platform for technology (optics/lights) and a customizable tool for the diverse biometrics of the modern police officer.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- CBP Awards Contract for Duty Handguns | U.S. Customs and Border Protection, accessed January 5, 2026, https://www.cbp.gov/newsroom/national-media-release/cbp-awards-contract-duty-handguns

- Becoming an Agent: Firearms Training – FBI, accessed January 5, 2026, https://www.fbi.gov/video-repository/becoming-an-agent-series-firearms-training.mp4/view

- United States Immigration and Customs Enforcement Extends SIG SAUER P320 Contract Another Two Years, accessed January 5, 2026, https://www.sigsauer.com/blog/united-states-immigration-and-customs-enforcement-extends-sig-sauer-p320-contract-another-two-years-

- Judge orders nation’s 2nd largest police department to stop carrying P320 handguns, accessed January 5, 2026, https://www.king5.com/article/news/investigations/investigators/judge-orders-nations-2nd-largest-police-stop-carrying-p320-handguns/281-75ca21c1-2546-47a6-bb2f-ca2b988155bd

- Staccato P, accessed January 5, 2026, https://staccato2011.com/products/staccato-p

- Springfield Armory® Announces Adoption of Echelon™ 4.5F and 4.0C By Henderson Police Department, accessed January 5, 2026, https://www.springfield-armory.com/intel/press-releases/springfield-armory-announces-adoption-of-echelon-4-5f-and-4-0c-by-henderson-police-department/

- Pennsylvania State Police Selects Walther PDP Compact, F-Series – Athlon Outdoors, accessed January 5, 2026, https://athlonoutdoors.com/article/pennsylvania-state-police-selects-walther/

- Glock Blue Label Price List | Arms-Fair, accessed January 5, 2026, https://www.armsfair.com/glock-blue-label-price-list

- Blue Label Glock – Officer Store, accessed January 5, 2026, https://officerstore.com/firearms/blue-label-Glock

- CONFIRMED: US Secret Service Adopts Glock 19, Glock 47 MOS Gen5 Pistols – Athlon Outdoors, accessed January 5, 2026, https://athlonoutdoors.com/article/us-secret-service-glock-19-pistols/

- Glock 47 Gen 5 MOS | Louisiana Firearms, accessed January 5, 2026, https://www.louisianafirearms.net/product-page/glock-47-gen-5-mos

- Best-Selling Guns in October 2025, accessed January 5, 2026, https://www.guns.com/news/2025/11/04/best-selling-guns-october-2025

- New Guns and Gear for 2025 – Police and Security News, accessed January 5, 2026, https://policeandsecuritynews.com/2025/03/17/new-guns-and-gear-for-2025/

- Americans Can’t Stop Buying THESE 7 Glocks in 2025! – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=FCrU77mMU3k

- Price List (Formatted), accessed January 5, 2026, https://dgs.maryland.gov/Documents/comm/hazmat/Sig%20Sauer%20Defense_2025%20Price%20List_%20001B4600364.xlsx

- OFF-DUTY Form – Sig Sauer, accessed January 5, 2026, https://www.sigsauer.com/media/sigsauer/resources/OFF_DUTY_Form_2025-2.pdf

- ICE Renews P320 Contract Through July 2027 | Soldier Systems Daily, accessed January 5, 2026, https://soldiersystems.net/2025/07/29/ice-renews-p320-contract-through-july-2027/

- SIG Sauer M17 – Wikipedia, accessed January 5, 2026, https://en.wikipedia.org/wiki/SIG_Sauer_M17

- CITY COMMISSION APPROVES NEW PISTOLS – Plant City Observer, accessed January 5, 2026, https://www.plantcityobserver.com/city-commission-approves-new-pistols/

- 521 Chicago Police Officers Still Using Gun Federal Judge Says Should be Banned, CPD Says – WTTW News, accessed January 5, 2026, https://news.wttw.com/2025/10/08/521-chicago-police-officers-still-using-gun-federal-judge-says-should-be-banned-cpd-says

- SIG SAUER & GLOCK Dominate May 2025’s Firearm Sales Rankings | GunBroker Report, accessed January 5, 2026, https://www.gunbroker.com/c/article/sig-sauer-glock-top-gunbroker-sales-may-2025/

- Top Selling Pistols of 2025: The Handguns Shooters Bought Most This Year at PSA, accessed January 5, 2026, https://palmettostatearmory.com/blog/top-selling-pistols-of-2025-.html

- Individual Officer Program – HK USA, accessed January 5, 2026, https://hk-usa.com/iop/

- New Product Highlight: Best New Guns of Sig Next 2025 – Pew Pew Tactical, accessed January 5, 2026, https://www.pewpewtactical.com/new-product-highlight-best-guns-sig-next/

- STATE OF IOWA MASTER AGREEMENT Contract Declaration and Execution MA 005 22122C, accessed January 5, 2026, https://bidopportunities.iowa.gov/Home/ShowContractDocument/1b081dff-3188-4eec-85f1-c65b5b6b419a

- M&P 2.0 FULL SIZE – Smith & Wesson, accessed January 5, 2026, https://www.smith-wesson.com/products/defense/mp2-full-size

- Recently Added Handgun Models | State of California – Department of Justice – CA.gov, accessed January 5, 2026, https://oag.ca.gov/firearms/certified-handguns/recently-added

- PERFORMANCE CENTER® M&P®9 M2.0 METAL CARRY COMP® – LAW ENFORCEMENT ONLY – Smith & Wesson, accessed January 5, 2026, https://www.smith-wesson.com/product/performance-center-m-p-9-m2-0-metal-carry-comp-law-enforcement-only

- Savings for those who serve | Smith & Wesson, accessed January 5, 2026, https://www.smith-wesson.com/american-guardians

- Weapons (25-185) – HigherGov, accessed January 5, 2026, https://www.highergov.com/sl/contract-opportunity/ne-weapons-56938720/

- Law Enforcement | FN® Firearms – FN America, accessed January 5, 2026, https://fnamerica.com/law-enforcement/

- Los Angeles Police Department “LAPD” Selects FN 509 MRD-LE as New Duty Pistol, accessed January 5, 2026, https://fnamerica.com/press-releases/los-angeles-police-department-lapd-selects-fn-509-mrd-le-as-new-duty-pistol/

- Inside look: Why the LAPD chose the FN 509 MRD-LE as its new duty weapon – Police1, accessed January 5, 2026, https://www.police1.com/police-products/firearms/articles/inside-look-why-the-lapd-chose-the-fn-509-mrd-le-as-its-new-duty-weapon-p0U1x0A7c0gNUs1V/

- FN 509® MRD-LE | FN® Firearms, accessed January 5, 2026, https://fnamerica.com/products/law-enforcement/fn-509-mrd-le/

- FN America 2025 LE Reseller Price List – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=179003&v=90409&sv=0&i=149&ft=b

- Blue Line Program – Staccato 2011, accessed January 5, 2026, https://staccato2011.com/heroes-program/blue-line-program

- The Most Significant Gun of 2025 – Staccato HD – YouTube, accessed January 5, 2026, https://www.youtube.com/watch?v=XgvrGyv1Tyk

- Staccato 2011 Pistols Duty-Approved by Over 250 Agencies – The Firearm Blog, accessed January 5, 2026, https://www.thefirearmblog.com/blog/2020/10/29/staccato-2011-duty-approved/

- Staccato & Law Enforcement – Purpose-Built 2011® Pistols & Exclusive Benefits, accessed January 5, 2026, https://staccato2011.com/stories/law-enforcement

- 2025 Best Sellers – A Year in Review – Range USA, accessed January 5, 2026, https://rangeusa.com/blog/2025-best-sellers

- Walther LE | Law Enforcement Handguns – Primary Arms, accessed January 5, 2026, https://www.primaryarms.com/le-restricted-firearms/walther-law-enforcement

- 2024 LE IOP PRICE LIST 12/31/2023 – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=179008&v=107648&sv=0&i=185&ft=b

- LE & Military – Walther Arms, accessed January 5, 2026, https://waltherarms.com/journal/le-military

- Florida Department of Agriculture and Consumer Services Adopts Walther PDP – The Firearm Blog, accessed January 5, 2026, https://www.thefirearmblog.com/blog/2023/07/25/fdacs-adopts-walther-pdp/

- Free C&H Duty Red Dot Optic – Walther Arms, accessed January 5, 2026, https://waltherarms.com/freeoptic

- Springfield Echelon FirstLine 4.5F 9mm 4.5″ 17+1/20+1 – Florida Gun Exchange, accessed January 5, 2026, https://www.floridagunexchange.com/springfield-echelon-9mm-first-line-4-5-17-1-20-1.html

- Springfield Armory Echelon 4.5″ 9mm Pistol | GT Distributors, accessed January 5, 2026, https://www.gtdist.com/springfield-echelon-9mm-4-25-u-notch-sights-blk.html

- Springfield Echelon vs Glock 17 – Inside Safariland, accessed January 5, 2026, https://inside.safariland.com/blog/the-springfield-echelon-versus-the-glock-17/

- Springfield Armory Announces St. Louis County Police Department’s Adoption of Echelon 4.5F – Tactical Wire, accessed January 5, 2026, https://www.thetacticalwire.com/releases/38caae67-8189-4115-b659-17d6d11db799

- Oklahoma City PD Selects Heckler & Koch USA VP9 | An Official Journal Of The NRA – Shooting Illustrated, accessed January 5, 2026, https://www.shootingillustrated.com/content/oklahoma-city-pd-selects-heckler-koch-usa-vp9/

- HK Pistols LE Increase MAY 2025 – MyVendorlink.com, accessed January 5, 2026, https://www.myvendorlink.com/external/vfile?d=vrf&s=178276&v=26771&sv=0&i=77&ft=o

- Multiple PDs in Connecticut Turning to HK, accessed January 5, 2026, https://hk-usa.com/2025/03/10/multiple-pds-in-connecticut-turning-to-hk/

- Houston recruits to receive $1K stipends to help with purchase of duty weapons – Police1, accessed January 5, 2026, https://www.police1.com/police-recruitment/houston-recruits-to-receive-1k-stipends-to-help-with-purchase-of-duty-weapons