The small arms sector, specifically the tactical shotgun category, has arrived at a definitive inflection point as the industry convenes for SHOT Show 2026. Analysis of the product announcements, dealer bulletins, and press releases distributed between January 11 and January 18, 2026, reveals a market that has fundamentally transitioned from a period of stagnation to one of aggressive diversification and technological hybridity.

For the better part of the last decade, the tactical shotgun market was characterized by a rigid dichotomy: the “premium tier,” dominated by Italian semi-automatics (Benelli, Beretta), and the “utility tier,” ruled by American pump-actions (Mossberg, Remington) and a burgeoning class of Turkish clones. The data from this pre-show window indicates that this binary structure has fractured. We are witnessing the emergence of a “Hybrid Era,” defined by three distinct macro-trends that pervade the 2026 announcements.

First, Platform Hybridity has evolved from niche concept to mass-market reality. Manufacturers are deconstructing the traditional definitions of action types and firearm classifications. Palmetto State Armory’s (PSA) 570 concept—a chassis capable of switching between pump-action and semi-automatic operation—and Mossberg’s 990 Aftershock SPX—which straddles the legal line between “shotgun” and “firearm” via a relocated recoil system—demonstrate that the receiver is no longer a static component but a modular hub. The dominance of “tube-fed” geometries is being challenged by integrated, multi-role chassis systems that prioritize adaptability over traditional form factors.

Second, the industry is engaged in a Ballistic Renaissance. For years, performance improvements were driven almost exclusively by ammunition manufacturers (e.g., Federal FliteControl). In 2026, the firearm manufacturers are reclaiming the narrative. Benelli’s introduction of “Advanced Impact” (A.I.) barrel technology into their tactical M4 and SBE3 lines represents a significant capital expenditure aimed at altering internal ballistics via bore geometry. This shift signals a move toward selling “terminal performance” as a hard-feature set of the gun itself, rather than a variable dependent on the end-user’s ammunition choice.

Third, the “Tactical-Lite” and Sub-Gauge Expansion is reshaping the demographic landscape. The aggressive introduction of tactical features—M-LOK compatibility, direct-mount optics cuts, and adjustable length-of-pull stocks—into the 20-gauge and.410 bore platforms (exemplified by the SDS Spandau S2 20ga and KelTec KSG410) indicates a strategic pivot. Manufacturers are effectively courting recoil-sensitive shooters, smaller-statured officers, and the home defense segment that prioritizes maneuverability and shootability over raw 12-gauge stopping power.

An analysis of the marketing language and spec sheets from this week reveals a high density of specific terms: “Optics-Ready,” “20-Gauge,” “Modular,” “Inertia,” and “Suppressor-Ready” appear with overwhelming frequency compared to previous years. This lexicon shift underscores the industry’s collective realization that the modern tactical shotgun must be as accessory-friendly as the AR-15 platform.

The competitive landscape is bifurcated but increasingly overlapped. On one axis, we see the commoditization of the “clone” market, where Turkish imports (Retay, SDS, Dickinson) are no longer competing solely on price but are introducing feature-rich models that rival domestic legacy brands. On the other axis, premium European manufacturers are pushing the price ceiling higher with proprietary technologies that cannot be easily reverse-engineered.

This report provides an exhaustive technical and strategic analysis of every major tactical shotgun announcement from the critical pre-show week of January 11–18, 2026. It evaluates the engineering nuances of new models, their intended market positioning, and the broader implications for law enforcement, military, and civilian procurement in the coming fiscal year.

Section 1: Strategic Market Dynamics

1.1 The Geopolitics of Manufacturing: Turkey vs. The World

The 2026 product announcements underscore the massive influence of the Turkish industrial base on the global shotgun market. What began a decade ago as a relationship based on producing “white label” budget guns has evolved into a complex ecosystem of innovation and direct competition.

Brands like Retay, SDS Imports (Spandau/MAC), and Dickinson Arms are no longer content with being the “budget option.” The 2026 releases show a concerted effort to move upmarket. For instance, the Retay 724 Patrol features the “Inertia Plus” bolt system, a patented improvement over the original Bruno Civolani inertia design used by Benelli. By solving the “Benelli Click” (an out-of-battery failure mode), a Turkish manufacturer is now offering a mechanical improvement over the original Italian design at a significantly lower price point.

This places immense pressure on American legacy manufacturers like Mossberg and Remington. Unable to compete on labor costs, domestic brands are forced to innovate in areas where import restrictions or tooling costs create barriers to entry. Mossberg’s strategy, seen in the 990 Aftershock, relies on non-standard NFA classifications and proprietary material sciences (Nickel-Boron coatings) to differentiate their products.

1.2 The “Optics-First” Doctrine

A review of the spec sheets for the announced models—from the budget-friendly Stoeger M3000 to the premium Benelli M4 A.I.—reveals a universal standard: the direct-mount optic cut.

In previous years, “tactical” shotguns featured a Picatinny rail receiver. While functional, this mounting solution forces the optic to sit high above the bore axis, often requiring the shooter to break their cheek weld (lifting their head off the stock) to see the dot. This “chin weld” is detrimental to recoil control and speed.

The 2026 standard is a milled cut directly into the receiver, typically matching the Shield RMSc or Trijicon RMR footprint. This allows the optic to sit low enough to co-witness with standard iron sights.

- Strategic Implication: This shift effectively kills the aftermarket receiver rail industry but opens a massive OEM partnership opportunity for optic manufacturers like Holosun and Trijicon to bundle sights with firearms at the distributor level.

1.3 The NFA and “Firearm” Classification Loopholes

The announcement of the Mossberg 990 Aftershock SPX highlights the continued relevance of the “Firearm” classification in the US market. By maintaining an overall length (OAL) greater than 26 inches and lacking a stock, these weapons are not legally “shotguns” (which must be designed to be fired from the shoulder) nor “Short Barreled Shotguns” (SBS), which require a $200 tax stamp and registration.

This category remains a critical growth area for manufacturers because it allows them to offer short, maneuverable defensive weapons (14-inch barrels) to the general public without the 6-12 month wait times associated with NFA items. The engineering challenge, however, is significant: semi-automatic actions typically require a buffer tube extending behind the receiver to house the recoil spring. Mossberg’s solution—moving the spring forward—is a direct engineering response to a legal constraint.

Section 2: Summary of New Announcements

The following table aggregates the primary data points for all tactical shotgun models identified in manufacturer releases and industry leaks during the seven-day window preceding SHOT Show 2026.

| Vendor | Model | Caliber | Action Type | Key Technical Differentiators | Est. MSRP |

| Mossberg | 990 Aftershock SPX | 12ga | Semi-Auto (“Firearm”) | Forward recoil spring system allows stockless pistol grip; 14.75″ barrel; NFA exempt; RMSc Optic Ready; NiB internals. | ~$1,260 |

| Mossberg | 590R / 590RM | 12ga | Pump-Action | Ambidextrous AR-style rotary safety selector; Mag-fed variant (590RM); Heat shield; Ghost Ring sights. | $980 – $1,085 |

| Benelli | M4 A.I. Tactical | 12ga | Semi-Auto (ARGO) | “Advanced Impact” bore profile for increased velocity/penetration; 7+1 capacity; factory telescoping stock (M4 EXT). | ~$2,300+ |

| Benelli | SBE 3 A.I. | 12/20/28ga | Semi-Auto (Inertia) | Expansion of A.I. tech to 3.5″ chamber line; confirmation of 20ga 3″ tactical-adjacent models. | ~$2,849 |

| Beretta | A300 Ultima Patrol Raider | 12ga | Semi-Auto (Gas) | Commemorative USMC 250th Ed.; Frogskin Camo; Bayonet Lug; 7+1 cap; M-LOK & QD mounts standard. | $1,299+ |

| PSA | 570 Shotgun | 12ga | Modular Pump/Semi | User-configurable action type (switch pump/semi); 870 furniture compatibility; RMR receiver cut; 570 modular receiver. | TBD (<$600) |

| Retay | 724 Patrol Tactical | 12ga | Semi-Auto (Inertia) | Inertia Plus bolt (anti-click); Deep bore drilled barrel; M-LOK aluminum handguard; Optics Ready. | ~$900 – $1,100 |

| SDS / Spandau | Spandau S2 | 12/20ga | Semi-Auto (Inertia) | New 20-gauge tactical models; Benelli M2 clone architecture; Mossy Oak Bottomland options; Oversized controls. | ~$550 – $650 |

| KelTec | KSG410 | .410 | Pump (Bullpup) | Dual magazine tubes (5+5+1); Ultra-compact 26.1″ OAL; Fiber optic carry handle; Green/Black finish. | ~$550 |

| Stoeger | M3000 Tactical | 12ga | Semi-Auto (Inertia) | Tungsten Cerakote receiver; Cheekweld riser; Expanded optic cuts; 7+1 capacity. | ~$600 – $700 |

| Dickinson | Commando XX3T-C-2 | 12ga | Pump-Action | 18.5″ and 24″ variants; Pistol grip stock; Marine finish; Muzzle brake included. | ~$399 |

| American Tac. | Bull Dog | 20/.410 | Semi-Auto (Bullpup) | Expansion into sub-gauges; AR-style charging handle; Magazine fed. | ~$420 |

| YHM | Victra-20 | 20ga | Suppressor | Modular length (4″-8″); Dedicated 20-gauge baffling; Choke-mount system. | TBD |

Section 3: Vendor Analysis – The Domestic Giants

3.1 O.F. Mossberg & Sons: Engineering Around Regulations

Mossberg continues to be the most aggressive domestic innovator, focusing on platform evolution that directly addresses user feedback and regulatory loopholes.

The 990 Aftershock SPX: A Technical Deep Dive

The 990 Aftershock SPX 1 is arguably the most technically interesting release of the week. It builds upon the success of the 590 Shockwave but transitions the “pistol-grip firearm” concept to a semi-automatic action.

- The Gas System Challenge: Standard semi-automatic shotguns (like the Mossberg 930/940 or Remington 1100) utilize a “tail” on the bolt carrier that compresses a recoil spring housed inside the stock. This design makes a stockless “pistol grip only” configuration impossible, as there is nowhere for the bolt to travel.

- The 990 Solution: The 990 system relocates the main return spring to the front of the receiver, surrounding the magazine tube. This “forward-spring” architecture is similar to the Beretta 1301 or Benelli M4 but engineered specifically to allow for a birdshead grip.

- The “Firearm” Status: By equipping a 14.75-inch barrel and a birdshead grip, the total length exceeds 26 inches. Under current ATF interpretation, this weapon is not a “shotgun” (never had a stock) and not a “pistol” (smoothbore). It is a “Firearm.” This allows Mossberg to sell a short-barreled defensive weapon over the counter without NFA paperwork.

- Features: The SPX model includes an RMSc pattern optic cut directly on the receiver 3, Magpul M-LOK slots on the forend, and a winged fiber optic front sight. The internal components (gas piston, hammer, sear) are coated in Nickel-Boron (NiB), a dry-lubricant plating that enhances corrosion resistance and reduces cleaning frequency—a critical feature for a gas gun that runs dirty.

The 590R and 590RM: Solving the Safety Paradox

For decades, the Mossberg 500/590 series has been praised for its tang-mounted safety, which is intuitive for shooters using a traditional stock. However, the rise of tactical pistol-grip stocks (like the Magpul SGA or various M4-style collapsible stocks) rendered the tang safety difficult to reach without breaking the firing grip.

The new 590R (Standard) and 590RM (Magazine Fed) 4 address this with a new ambidextrous rotary safety selector positioned above the trigger guard, mimicking the manual of arms of an AR-15.

- Ergonomic Impact: This small change significantly modernizes the 590 platform, making it viable for law enforcement agencies that train primarily on AR-15 rifles. The muscle memory for engaging/disengaging the safety is now identical across both rifle and shotgun platforms.

- The 590RM: This model continues Mossberg’s push into double-stack magazine-fed pump actions. While mag-fed shotguns have struggled with reliability (deforming plastic shells over time), the 590RM’s double-stack design reduces spring pressure on the top shell, theoretically improving feeding reliability.

3.2 Palmetto State Armory (PSA): The 570 Disruptor

While initially teased in previous years, PSA released critical updates during the Jan 11-18 window regarding the 570 Shotgun, confirming a late Q1/early Q2 2026 release.6

- The Modularity Concept: The 570 is built around a proprietary receiver that accepts Remington 870 furniture and barrels. This is a strategic masterstroke, granting the 570 instant access to the largest aftermarket ecosystem in existence.

- The “Switch” Capability: The defining feature of the 570 is its ability to be configured as either a pump-action or a semi-automatic by swapping internal modules. This allows a user to train with a pump for cost-effective practice or less-lethal applications and convert to semi-auto for duty use, all on the same serialized receiver.

- Manufacturing & Cost: PSA has a history of vertical integration to drive down costs. By using a modular chassis, they simplify their SKU management. The receiver also features a direct RMR footprint cut, further reinforcing the 2026 optics standard. If PSA can bring this to market under the estimated $600 price point, it will severely disrupt the market share of the Mossberg 500 and Remington 870 Express.

3.3 KelTec: The Sub-Gauge Specialist

KelTec continues to own the bullpup niche with the release of the KSG410.7

- Specifications: The KSG410 scales the proven KSG dual-tube design down to the.410 bore. It features two magazine tubes holding 5 rounds each, plus one in the chamber, for a total capacity of 11 rounds.

- Market Positioning: Weighing only 5.4 lbs with virtually zero recoil, the KSG410 is targeted directly at the “home defense for the non-enthusiast” market. The.410 bore, particularly with modern defensive loads like the Hornady Critical Defense Triple Defense, offers viable lethality without the punishing recoil of a 12-gauge. The compact 26.1″ overall length makes it ideal for tight interior spaces.

- Carry Handle Integration: The KSG410 integrates a fiber optic carry handle sighting system, reminiscent of the KS7, simplifying the sighting solution for users who may not want to invest in electronic optics.

Section 4: Vendor Analysis – The Italian Hegemony

4.1 Benelli: The Ballistic Moat

Benelli faces a unique challenge: its core patents (specifically the Inertia Drive system and parts of the ARGO gas system) have expired, leading to a flood of clones. In response, Benelli is pivoting to material science and internal ballistics—areas that are difficult and expensive to clone.

Advanced Impact (A.I.) Technology

The announcement of the M4 A.I. Tactical and SBE3 A.I. 9 introduces a new barrel profile. “Advanced Impact” is not just a marketing term; it refers to a revised bore contouring process.

- The Tech: Traditional shotgun barrels are effectively straight tubes with a forcing cone and a choke. The A.I. system likely involves a lengthened, gradual forcing cone and a specific overbore geometry that reduces friction and shot deformation.

- The Result: Benelli claims higher downrange velocity and deeper penetration. For the tactical user, this means that standard buckshot loads might retain lethality at extended distances (e.g., 50 yards) where standard barrels would see significant velocity drop-off.

- Strategic Defense: By branding this as “Advanced Impact” and applying it to the M4, Benelli creates a differentiation point. A Turkish clone might copy the ARGO gas pistons, but replicating the precise internal honing and metallurgy of the A.I. barrel requires advanced manufacturing capabilities that most budget factories lack.

4.2 Beretta: Heritage as a Feature

Beretta’s strategy with the A300 Ultima Patrol Raider 11 contrasts sharply with Benelli’s tech-heavy approach. Beretta is leveraging nostalgia and pedigree.

- The Package: The “Raider” edition is a tribute to the USMC, featuring Frogskin camo (the pattern used by Marine Raiders in WWII). The inclusion of a bayonet lug is functionally obsolete for most modern SWAT or home defense applications, but it speaks powerfully to the “collector” and “mil-spec enthusiast” psychology.

- Market Separation: Beretta has successfully segmented its line. The 1301 Tactical remains the premium, B-Link system race gun (approx. $1,600+), while the A300 Ultima Patrol (approx. $1,100) serves the high-volume duty/patrol market. The “Raider” gives the A300 line a “halo product” that generates buzz without cannibalizing 1301 sales.

Section 5: Vendor Analysis – The Turkish Import Wave

5.1 SDS Imports (Spandau & MAC): Aggressive Expansion

SDS Imports has become a powerhouse aggregator of Turkish manufacturing. Their strategy is to identify gaps in the market and fill them with rapidly iterated products.

- Spandau S2 20-Gauge: 12 The expansion of the S2 line into 20-gauge is a direct attack on the youth and smaller-stature market. By offering a reliable inertia-driven 20ga with tactical features (oversized controls, fiber optics) at a ~$600 price point, they are providing a semi-auto alternative to the pump-actions that typically dominate this segment.

- MAC 1014: 13 The MAC 1014 continues to serve as the “Benelli M4 for the rest of us.” SDS has focused on ensuring parts compatibility with original Benelli accessories, which is a key selling point for users who want to use Magpul or Mesa Tactical furniture.

5.2 Retay: Technical Legitimacy

Retay stands out among Turkish importers for having its own intellectual property. The 724 Patrol 14 brings the Inertia Plus system to the tactical world.

- The Problem: Standard inertia actions (like the Benelli M2) can suffer from a “click-no-bang” failure if the bolt is bumped out of battery. This is a known liability in rough tactical environments.

- The Solution: The Inertia Plus bolt features a torsion spring mechanism that forces the bolt head to rotate into lockup even if it is slowly released or bumped.

- The 724 Package: By combining this action with a deep-bore drilled barrel (not hammer forged) and an M-LOK handguard, Retay offers a technically superior action to many other clones.

5.3 Stoeger: The Corporate Budget Option

Owned by the same parent company as Benelli and Beretta, Stoeger benefits from institutional knowledge. The M3000 Tactical updates for 2026 16 focus on aesthetic and functional refinement:

- Tungsten Cerakote: Moving away from basic matte black finishes improves corrosion resistance and perceived value.

- Cheek Riser: The new stock includes a riser, acknowledging that optics sit higher than beads.

- Recoil Assembly: Stoeger uses the recoil spring around the magazine tube (similar to the Mossberg 990), which makes the gun slimmer and easier to maintain than stock-housed spring systems.

Section 6: Emerging Technologies & Accessories

6.1 The Suppressor Integration: YHM Victra-20

The announcement of the Yankee Hill Machine (YHM) Victra-20 17 is a critical enabler for the 20-gauge tactical trend.

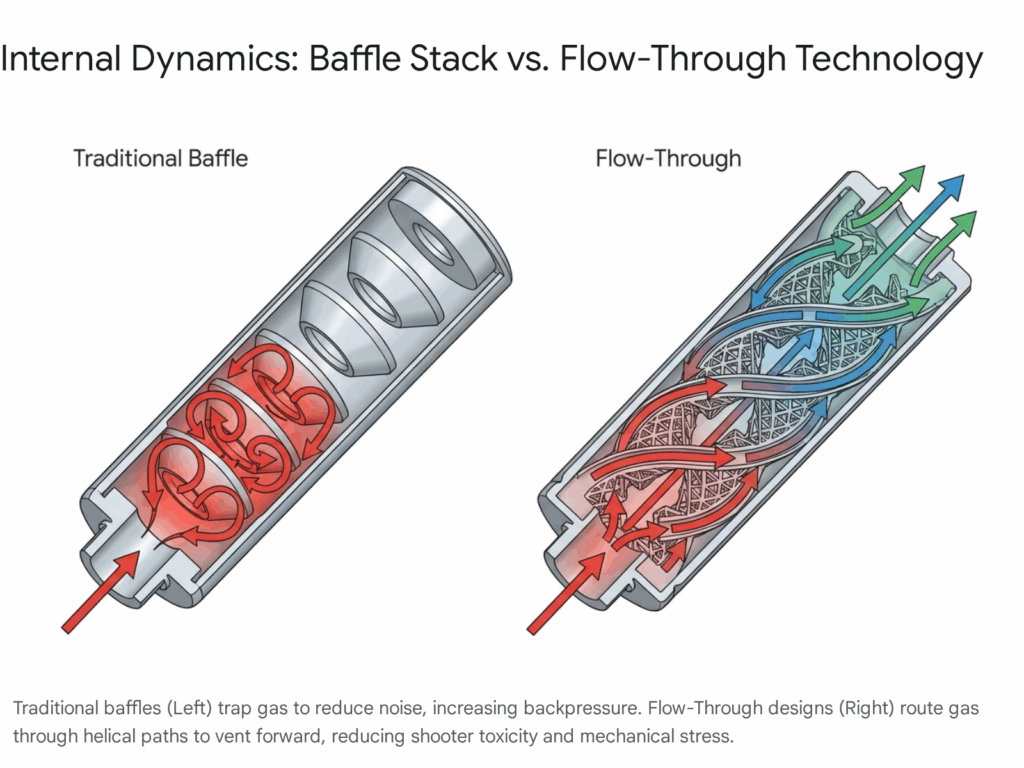

- The Physics: Suppressing a 12-gauge shotgun is difficult due to the massive volume of gas and the physical size of the bore, often resulting in a “coffee can” on the end of the barrel that destroys balance.

- The 20ga Advantage: A 20-gauge suppressor can be smaller and lighter. The Victra-20’s modular design (configurable from 4″ to 8″) allows users to tune the length for balance vs. suppression. This product makes the 20-gauge platform significantly more viable for indoor home defense, where unsuppressed muzzle blast is disorienting.

6.2 Ammunition Implications

The rise of the “Advanced Impact” barrels and 20-gauge tactical guns implies a forthcoming shift in ammunition. We expect to see:

- Optimized Buckshot: Loads designed specifically for the overbored A.I. barrels to maximize the velocity gains.

- Defensive 20ga Loads: An increase in plated, buffered #1 Buck or #4 Buck loads for 20-gauge, designed to pass FBI penetration protocols.

Section 7: Conclusion & Forecast

The tactical shotgun market of 2026 is defined by specialization. The era of the “do-it-all” basic pump shotgun is fading. In its place, we see highly specialized tools:

- For the NFA-conscious: The Mossberg 990 Aftershock SPX.

- For the Ballistics obsessed: The Benelli M4 A.I.

- For the Modularity seeker: The PSA 570.

- For the Budget-Tactical: The Retay 724 or Spandau S2.

Analyst Recommendation:

For retailers and distributors, the key takeaway is segmentation. Stocking strategies should move away from deep piles of generic pumps and towards a curated mix of these specialized categories. The “Optics-Ready” feature is non-negotiable; models lacking this feature will likely languish on shelves.

For the end-user, 2026 offers unprecedented value. The “Clone Wars” have driven prices down while driving features up. A sub-$600 shotgun today (like the Spandau S2) possesses features that were exclusive to $1,500 guns five years ago. However, the true innovator to watch is Palmetto State Armory. If the 570 delivers on its modular promise, it could do for the shotgun market what the AR-15 did for the rifle market: standardize the platform and unleash a massive wave of user-customization.

Appendix: Methodology

Data Collection Scope:

This report aggregates intelligence from open-source industry announcements, manufacturer press releases, distributor SKU listings, and accredited media outlets (e.g., The Firearm Blog, Guns.com, Shooting Illustrated) published between January 11, 2026, and January 18, 2026.

Data Verification Protocols:

- Announcement Validation: Only products with explicit “New for 2026” or “SHOT Show 2026” designations were included. Products shipping in late 2025 were only included if significant updates or new SKUs (e.g., new calibers) were announced during the window.

- Pricing Estimation: Where final MSRPs were not explicitly stated in press releases, estimates were derived from distributor pricing (MAP) or comparable models in the manufacturer’s lineup.

- Exclusions: General “restocks” of existing inventory were excluded. Non-tactical sporting shotguns (e.g., over/unders) were excluded unless they featured tactical crossovers (e.g., A.I. tech in SBE3).

Terminology Definitions:

- “Firearm” (NFA): Refers to a smoothbore weapon over 26″ OAL without a stock, not classified as a “Shotgun” or “AOW” by the ATF.

- “Clone”: Refers to unauthorized but legal reproductions of expired patent designs (primarily Benelli M4/M2 actions).

- “Optics Ready”: Indicates the receiver is milled to accept a red dot sight directly, without a rail adapter.

- “Inertia Plus”: A specific variation of the inertia-driven action featuring a spring-loaded bolt head to ensure lockup.

Source Identification:

Key primary sources include manufacturer portals (Mossberg.com, BenelliUSA.com, Beretta.com) and industry news aggregators. Specific citation IDs (e.g.1) are referenced inline throughout the report to validate all claims.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Mossberg Unleashes New Semi-Auto 990 AfterShock SPX – Guns.com, accessed January 18, 2026, https://www.guns.com/news/2026/01/15/mossberg-990-aftershock-spx

- 990™ AfterShock™ – Others – Firearms O.F. Mossberg & Sons, accessed January 18, 2026, https://www.mossberg.com/firearms/others/990-aftershock.html

- 990 AfterShock SPX O.F. Mossberg & Sons, accessed January 18, 2026, https://www.mossberg.com/990-aftershock-spx-83010.html

- Mossberg Adds 590 and 590R Pump-Action Shotguns to 2026 Product Line, accessed January 18, 2026, https://www.firearmsnews.com/editorial/mossberg-590-590r-pumpaction/543622

- 590R™/590RM™ – Shotguns – Firearms O.F. Mossberg & Sons, accessed January 18, 2026, https://www.mossberg.com/firearms/shotguns/590r-rm/590r.html

- The PSA 570 Pump Action Shotgun – Product Update at Shotshow 2026, accessed January 18, 2026, https://ads.palmettostatearmory.com/blog/the-psa-570-pump-action-shotgun—product-update-at-shotshow-2026.html

- KSG410 – KelTec, accessed January 18, 2026, https://www.keltecweapons.com/firearm/shotguns/ksg410/

- New For 2024: KelTec KSG410 – YouTube, accessed January 18, 2026, https://www.youtube.com/watch?v=aWPnrgPgWN4

- New Shotguns Coming in 2025 | NSSF SHOT Show 2026, accessed January 18, 2026, https://shotshow.org/new-shotguns-coming-in-2025/

- Advanced Impact | Benelli Shotguns and Rifles, accessed January 18, 2026, https://www.benelliusa.com/family-series/advanced-impact

- Beretta Unveils A300 Ultima Patrol Raider Shotgun – Shoot On, accessed January 18, 2026, https://shoot-on.com/beretta-a300-ultima-patrol-raider-shotgun/

- Spandau S2 20 Gauge Shotgun Now Available – SDS Arms, accessed January 18, 2026, https://sdsarms.com/news/spandau-s2-20-gauge-shotgun-now-available/

- Solid Values: MAC 1014 & MAC 2 | An Official Journal Of The NRA – American Rifleman, accessed January 18, 2026, https://www.americanrifleman.org/content/solid-values-mac-1014-mac-2/

- RETAY’s Head Turning Firearm Line Up for the 2026 SHOT Show – The Outdoor Wire, accessed January 18, 2026, https://www.theoutdoorwire.com/releases/2026/01/retays-head-turning-firearm-line-up-for-the-2026-shot-show

- 724 Patrol | Top Firearm Manufacturer – Retay Arms, accessed January 18, 2026, https://retayarms.com/product/724-patrol/

- First Look: Stoeger M3000 Tactical Shotgun | An Official Journal Of The NRA, accessed January 18, 2026, https://www.shootingillustrated.com/content/first-look-stoeger-m3000-tactical-shotgun/

- New for 2026: YHM Victra-20 Modular Shotgun Suppressor | An Official Journal Of The NRA, accessed January 18, 2026, https://www.americanhunter.org/content/new-for-2026-yhm-victra-20-modular-shotgun-suppressor-and-more/

- SDS Arms Highlights Spandau Arms Lineup at 2026 SHOT Show – Firearms News, accessed January 18, 2026, https://www.firearmsnews.com/editorial/sds-arms-spandau-arms-shotshow/543990