Executive Summary

The 47th annual Shooting, Hunting, and Outdoor Trade (SHOT) Show, convened from January 20–23, 2026, at The Venetian Expo and Caesars Forum in Las Vegas, served as a definitive bellwether for a global small arms industry in transition. With over 54,000 industry professionals in attendance and more than 2,800 exhibitors occupying a record-breaking 830,000 net square feet of exhibit space 1, the event underscored a sector that has moved past the frantic, demand-driven surges of the early 2020s and entered a phase of calculated stabilization and technological maturation.

While the sheer scale of the event—spanning over 14 miles of aisles—demonstrates the industry’s enduring economic vitality 2, the prevailing narrative of 2026 is one of “hardening.” This hardening is visible across three distinct vectors: the physical hardening of supply chains against macroeconomic volatility and tariffs; the legislative hardening of product lines through “compliance-by-design” engineering; and the technological hardening of manufacturing processes through the industrialization of additive manufacturing.

This comprehensive report provides an exhaustive analysis of the top ten industry insights derived from SHOT Show 2026. It dissects the strategic maneuvers of major players like Sig Sauer, Glock, and Holosun, while evaluating the disruptive potential of emerging technologies in thermal optics and smart firearms. The analysis suggests that 2026 marks the end of the “gadget era” and the beginning of the “integrated systems era,” where connectivity, ergonomics, and advanced materials are no longer optional features but baseline requirements for market viability. Furthermore, the industry is grappling with significant external pressures, specifically the reimposition of aggressive tariffs on aluminum and steel, forcing a re-evaluation of domestic sourcing and cost structures.3

Insight 1: The “Tactical Renaissance” and Strategic Hybridization of the Lever-Action Rifle

The most visually dominant and strategically significant trend of SHOT Show 2026 was the aggressive modernization of the lever-action rifle. Once relegated to the domains of “Cowboy Action” shooting, heritage hunting, and historical collection, the lever-action platform has been radically reimagined as a primary defensive tool for the modern civilian. This is not merely an aesthetic shift; it represents a calculated hedging strategy by manufacturers against an increasingly volatile legislative landscape regarding semi-automatic firearms.

The Strategic Drivers of the Renaissance

To understand the explosion of “tactical” lever guns, one must look beyond the hardware to the regulatory environment. With various states enacting or strengthening bans on semi-automatic rifles with detachable magazines and pistol grips, the firearms industry has responded by optimizing the most effective manually operated action available: the lever gun. By modernizing this 19th-century mechanism with 21st-century materials and interfaces, manufacturers are providing consumers in restrictive jurisdictions with a compliant yet highly capable defensive platform.

The Bond Arms LVRB: A Category-Defining Hybrid

The standout innovation in this category, and arguably the most discussed firearm of the show, is the Bond Arms LVRB. While prototypes have been teased in previous years, the production-ready models displayed in 2026 demonstrate a level of engineering maturity that separates the LVRB from mere novelty.5

Technical Architecture and Innovation:

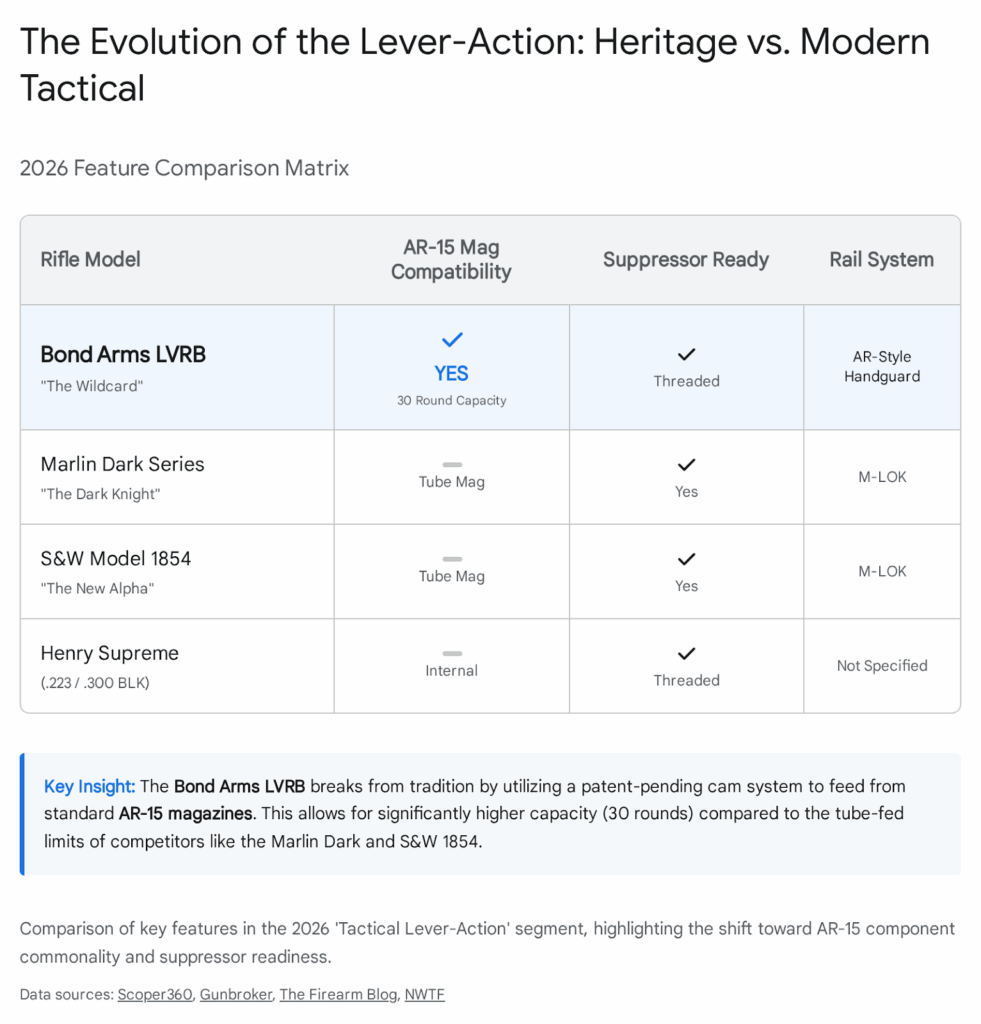

The LVRB is not simply a lever-action rifle; it is a hybrid platform that effectively bridges the gap between the AR-15 and the traditional lever gun. Its core innovation lies in its proprietary cam-driven cycling mechanism. Traditional lever actions require a long, sweeping motion of the lever to cycle the bolt, which can be slow and disruptive to the shooter’s sight picture. The LVRB utilizes a cam system to drastically reduce this throw, allowing for rapid cycling with minimal hand movement.

Crucially, the LVRB is engineered to interface with the omnipresent ecosystem of the AR-15. It accepts standard STANAG (AR-15) magazines, a feature that fundamentally changes the logistics of the lever gun. Traditional tube-fed lever actions are slow to reload and sensitive to bullet geometry (requiring flat-nosed projectiles to prevent chain-fire in the tube). The LVRB’s magazine compatibility allows users to utilize pointed, high-ballistic-coefficient projectiles and reload instantly.5 Furthermore, the platform features an ambidextrous magazine release, an out-of-battery safety, and a grip safety, bringing modern safety standards to a legacy manual of arms.

Market Positioning:

By utilizing standard AR-15 uppers, the LVRB allows consumers to leverage their existing investment in optics, handguards, and accessories. This “backward compatibility” is a brilliant strategic move, lowering the barrier to entry for the platform. It positions the LVRB not just as a “ban-state” alternative, but as a legitimate tactical evolution—a “50-state legal” patrol rifle that sacrifices little in terms of capacity or modularity.

The Standardization of the “Tactical Lever”

While Bond Arms represents the radical edge of innovation, the broader market has coalesced around a new standard for what constitutes a modern lever rifle. Legacy manufacturers are rapidly updating their catalogs to meet this demand.

Smith & Wesson Model 1854: Smith & Wesson’s re-entry into the lever market with the Model 1854 series has expanded for 2026. The new walnut-furniture variants combine traditional aesthetics with modern utility. The 1854 is built on the robust.45-70 Government cartridge, a round capable of taking any game in North America. S&W has integrated M-LOK slots directly into the forend and provided a Picatinny rail on the receiver, acknowledging that the modern consumer expects to mount lights and optics as a baseline requirement.7

Marlin (Ruger) Dark Series: Since its acquisition by Ruger, Marlin has seen a revitalization of quality and availability. The “Dark Series” represents the factory-standard for tactical lever guns. These rifles come factory-threaded for suppressors—a critical feature in 2026 as suppressor ownership hits record highs. The inclusion of polymer furniture with M-LOK capability and a darker, Parkerized or Cerakote finish signals clearly that these are working guns, not safe queens.7

Henry Repeating Arms: Henry has diversified its approach with the “Supreme” and “X Model” lines. The Supreme Lever Action is particularly notable for its internal hammer design and adjustable match-grade trigger, features typically associated with bolt-action precision rifles. This blurring of lines—making a lever gun feel and shoot like a precision rifle—demonstrates the industry’s intent to push the platform’s effective range and accuracy potential.5

Market Implications

The resurgence of the lever action is a “blue ocean” shift. It creates a new category of accessories—M-LOK handguards for lever guns, specialized optics mounts, and “lever-action specific” suppressors. It also opens a demographic door: the lever action is less intimidating and politically charged than the AR-15, making it an excellent “bridge” platform for new gun owners who may be wary of “black rifles” but still desire effective self-defense capability.

Insight 2: The Industrialization of Additive Manufacturing (3D Printing) in Suppressors

In 2026, 3D printing (additive manufacturing) has graduated from a prototyping method to a primary production modality for high-performance suppressors. This shift is driven not by novelty, but by the unyielding laws of fluid dynamics. The industry has reached the limits of what can be achieved with traditional subtractive manufacturing (CNC machining) regarding gas flow management.

The Physics of Flow-Through

The primary driver of this manufacturing shift is the widespread adoption of “flow-through” or “low back-pressure” technology. Traditional suppressors use a stack of baffles to trap and cool expanding gases. While effective at noise reduction, this design creates significant back-pressure, forcing toxic gas back down the barrel, into the receiver, and ultimately into the shooter’s face. This back-pressure also increases bolt velocity, leading to accelerated wear on the host firearm’s internal components.

To mitigate this, engineers have designed suppressors that vent gases forward through complex, tortuous paths rather than trapping them. These internal geometries often resemble organic lattices or complex helixes—shapes that are physically impossible to cut with a drill bit or lathe. They can only be grown, layer by layer, through Direct Metal Laser Sintering (DMLS) or similar additive processes.

Leading the Charge: HuxWrx, Dead Air, and Silent Steel

The 2026 showcase highlighted a definitive industry pivot toward these designs.

HuxWrx Flow 556K: HuxWrx (formerly OSS) has long championed flow-through technology, but their latest Flow 556K represents the maturation of the concept. Utilizing a 3D-printed core, this suppressor directs toxic gas forward, virtually eliminating back-pressure on direct-impingement rifles. This is particularly critical for law enforcement agencies, where officer health (exposure to lead and toxic heavy metals in fumes) is a growing liability concern.10

Dead Air RXD910Ti: Dead Air Silencers unveiled the RXD910Ti, a suppressor optimized for 9mm and 10mm cartridges. This unit is constructed from a single continuous piece of 3D-printed titanium. The “Triskelion” baffle system, a proprietary design that reduces back-pressure and recoil, relies on internal geometries that would be impossible to manufacture without additive technology. By printing the suppressor as a single monolith, Dead Air eliminates the need for welds or threaded joints, which are traditional failure points.11

Silent Steel Flow-IQ: Similarly, Silent Steel displayed their Flow-IQ technology, which replaces traditional baffles entirely with a “gas rotation system.” This system spins the gas to cool it while venting it forward, significantly reducing the thermal signature and heat transfer to the suppressor body—a critical factor for military applications where heat mirage can obscure optics.12

The Democratization of Manufacturing

Perhaps the most significant long-term trend is the commoditization of the manufacturing process itself. CF Manufacturing, a Daytona Beach-based OEM partner, had a major presence at the Supplier Showcase. They demonstrated turnkey capabilities for 3D-printed titanium suppressors, essentially offering “suppressor manufacturing as a service”.13

This development is disruptive. It lowers the barrier to entry for new brands. A company no longer needs millions of dollars in 5-axis CNC machines or DMLS printers to enter the market; they simply need a design file and a contract with an OEM like CF. This suggests a coming saturation of the suppressor market, which will likely drive prices down over the next 12-24 months and force legacy manufacturers to compete on brand equity and warranty service rather than just manufacturing capability.

Insight 3: The Commoditization and Democratization of Thermal Optics

Thermal imaging technology, once the exclusive domain of military units and wealthy specialized hunters, has reached a tipping point of commoditization in 2026. The SHOT Show floor revealed a massive influx of affordable, high-resolution thermal and digital night vision devices, aggressively driving down the price-to-performance ratio.

Holosun’s Market Disruption

Holosun, known for dominating the mid-tier red dot market through aggressive pricing and reliable electronics, has aggressively entered the night vision and thermal space. Their strategy is clear: apply high-volume consumer electronics manufacturing principles to a sector historically defined by low-volume, high-margin boutique production.

- The IRIS Series: Holosun showcased the IRIS laser series and new digital reflex sights. These products bring feature sets—such as integrated IR illuminators and lasers—that previously cost thousands of dollars into a sub-$1,000 price bracket.14

- Market Impact: Holosun’s entry is expected to do for night vision what they did for red dots: force legacy incumbents (like L3Harris or Steiner in the commercial sector) to innovate or drastically lower prices. The “Holosun effect” creates a new baseline expectation for the consumer: night vision capability is no longer a luxury, but a standard feature set.

The Race to Resolution

The “race to the bottom” on price is being replaced by a “race to resolution” at mid-tier pricing. Brands like RIX Optics and AGM are pushing 1280-resolution thermal sensors—previously a premium tier reserved for $10,000+ units—into accessible price brackets.16

- X-Vision Optics: The introduction of the TR2 thermal optic exemplifies this trend. With a 1,700-yard detection range, 1-4x magnification, and a large 2.56-inch display, it offers professional-grade capability for an MSRP of roughly $3,500.18 Just five years ago, equivalent performance would have commanded a price tag north of $8,000.

The “Sensor-to-Shooter” Loop

This democratization changes the tactical landscape for civilians and law enforcement. The proliferation of affordable thermal optics means that concealment is becoming obsolete. As more hunters and recreational shooters adopt this technology, the “sensor-to-shooter” loop—detecting a target, identifying it, and engaging it—is becoming digitized. This also raises ethical and regulatory questions regarding fair chase in hunting, which state game agencies are only beginning to address.

Insight 4: Supply Chain Hardening Amidst Macro-Economic Pressures

While product innovation garners headlines, the underlying story of SHOT Show 2026 is the anxiety surrounding raw materials and logistics. The reimposition and increase of tariffs on aluminum and steel are forcing a restructuring of the small arms supply chain.

The Tariff Shock

Effective June 4, 2025, the United States increased tariffs on aluminum and steel imports from 25% to 50%.3 This policy shift has a direct and cascading effect on the firearm industry, which is heavily reliant on these specific materials.

- Aluminum: Used for AR-15 receivers (upper and lower), handguards, optic bodies, and buffer tubes.

- Steel: Used for barrels, bolt carrier groups, springs, and small internal parts.

The doubling of tariffs significantly increases the Cost of Goods Sold (COGS) for manufacturers who rely on imported raw materials or pre-machined forgings. Analyst commentary suggests that manufacturers are likely to pass these costs to consumers in Q3/Q4 2026. The “budget” tier of firearms (sub-$500 AR-15s and polymer pistols) will be disproportionately affected, as margins in that sector are already razor-thin and cannot absorb the input cost hike.19

The Supplier Showcase as a Bellwether

The expansion of the Supplier Showcase to over 600 exhibitors serves as a tangible indicator of this strategic shift.1 Manufacturers are aggressively seeking to diversify their supply chains to mitigate tariff risks and logistics disruptions. The intense activity in this “show-within-a-show” suggests that Original Equipment Manufacturers (OEMs) are actively hunting for domestic alternatives or partners in tariff-exempt regions to stabilize their supply lines. This “reshoring” or “friend-shoring” of the supply chain is a defensive mechanism to ensure resilience against future geopolitical trade wars.2

Insight 5: Evolution of the Duty Pistol (Glock Gen 6 & Staccato)

The handgun market in 2026 is characterized by ergonomic refinement rather than revolutionary mechanical changes. The focus has shifted from “reliability” (which is now largely assumed) to “shootability”—the interface between the shooter and the machine.

Glock Gen 6: The King Refines His Crown

The debut of the Glock Gen 6 was the most discussed handgun event of the show. After decades of incremental changes, the Gen 6 represents a significant ergonomic pivot for the Austrian giant.

- Ergonomics and Control: The most notable change is the new “RTF6” aggressive grip texture and the integration of a factory thumb ledge (often called a “gas pedal”) directly into the frame. This thumb ledge allows the shooter to apply downward pressure with their support thumb to mitigate recoil, a feature previously only available through aftermarket frame modification (stippling).22

- Design Reversals: Interestingly, the Gen 6 G17 sees a return to the single recoil spring assembly, reversing the dual-spring design introduced in the Gen 4 and Gen 5. This simplification reduces parts count and complexity, signaling a return to the core philosophy of extreme simplicity.23

- Compatibility Friction: While magazines largely remain compatible, the change in recoil spring assembly and the new frame geometry (specifically the thumb ledge) create significant holster compatibility issues. Law enforcement agencies looking to upgrade will face the additional cost of replacing duty holsters, which may slow adoption rates.10

Staccato C4X: The 2011 Goes Mainstream

Staccato continues to bridge the gap between competition-bred 2011 pistols and reliable duty weapons. The Staccato C4X represents a direct challenge to the dominance of polymer striker-fired pistols in the duty market.

- Magazine Disruption: The most disruptive feature of the C4X and the new “HD” series is the reported compatibility with Glock-pattern magazines.25 Historically, the Achilles heel of the 2011 platform has been the magazine—expensive (often $100+ each) and prone to tuning issues. By designing a chassis that accepts the ubiquitous, cheap, and reliable Glock magazine, Staccato removes the single biggest barrier to entry for law enforcement and civilian adoption.

- Implication: If Staccato successfully integrates Glock magazine compatibility into a reliable 2011 platform, they fundamentally alter the value proposition of the platform. It allows agencies to transition to the superior trigger and shootability of the 2011 without discarding their massive inventory of magazines.

Insight 6: Civilian Access to NGSW Technology

The U.S. Army’s Next Generation Squad Weapon (NGSW) program is finally trickling down to the commercial market in tangible volumes, marking the first time in decades that a new military standard cartridge has been available to civilians almost concurrently with its service adoption.

Sig Sauer MCX-SPEAR (Civilian M7)

Sig Sauer is now shipping the MCX-SPEAR in 6.8x51mm (.277 Fury) in volume to the civilian market. This rifle is the commercial variant of the XM7 rifle selected by the Army.

- Platform Specifics: The rifle is available in 13″ and 16″ barrel configurations and features the unique dual charging handle design (both a non-reciprocating side charger and a standard rear AR-style charger) of the military M7.26

- The Ammunition Bottleneck: The primary constraint remains the availability of the hybrid case ammunition. The 6.8x51mm cartridge utilizes a steel case head fused to a brass body to withstand chamber pressures of 80,000 psi—far higher than standard brass can handle. While “training” rounds (ball ammo with standard brass cases at lower pressures) are becoming available, the high-performance hybrid rounds remain expensive and scarce for civilians.28

- Cultural Impact: This platform represents the new “halo” product for the industry. Just as the AR-15 became “America’s Rifle” following the Vietnam War and the Global War on Terror, the MCX-SPEAR is positioned to become the aspirational standard for the next generation of enthusiasts, despite its high price point ($3,000+).

Insight 7: Advanced Ballistics and New Calibers

The industry is moving away from standard legacy calibers (like.308 Win and.223 Rem) toward specialized, high-efficiency cartridges designed for specific ballistic windows.

The Rise of the “ARC” Family

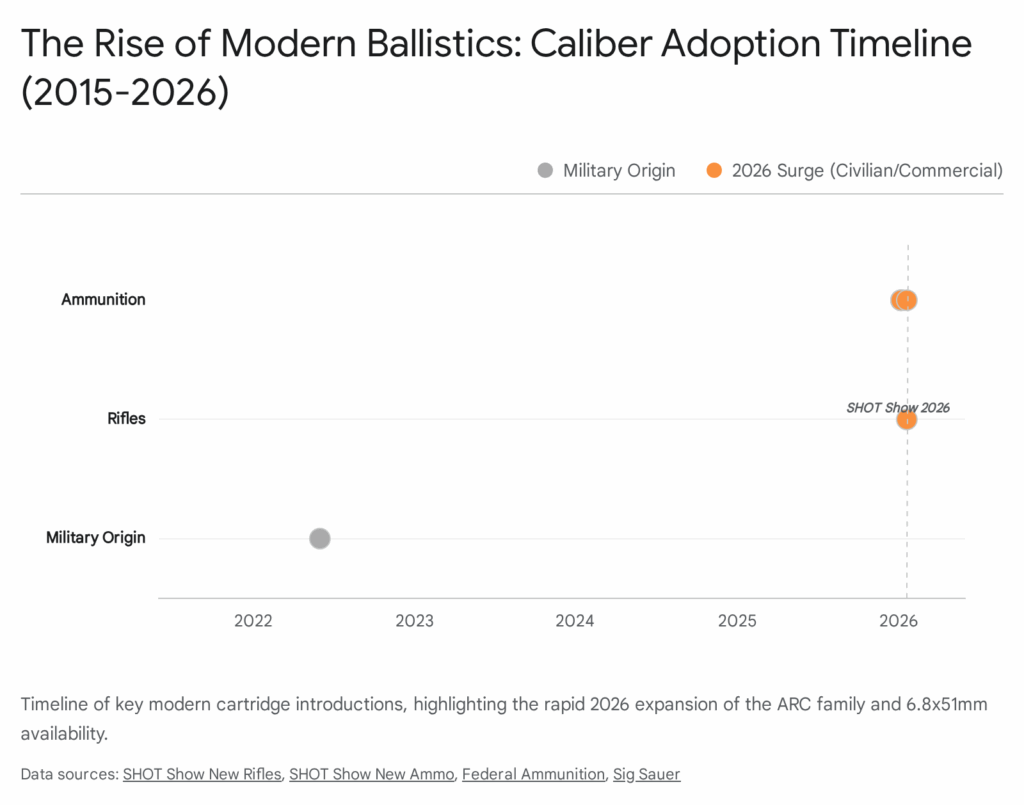

Hornady’s Advanced Rifle Cartridge (ARC) family is seeing massive adoption across the industry.

- 22 ARC & 6mm ARC: Federal Ammunition and Black Hills have launched extensive lines for these calibers.29 Rifle manufacturers like Franchi (Momentum Elite) and Ruger (American Gen II) are now factory-chambering these rounds.31

- Significance: These cartridges offer a “ballistic free lunch”—providing trajectory and wind bucking capabilities that rival larger short-action cartridges (like.308) while fitting into the lighter, smaller AR-15 platform. This allows hunters and tactical shooters to carry lighter platforms without sacrificing effective range.

Benelli Advanced Impact (AI)

Benelli has introduced a fundamental change to their barrel geometry called “Advanced Impact.” Unlike simple porting or choking, this involves a re-engineering of the internal bore profile.

- Technology: This system utilizes a larger bore diameter (overbore) and a lengthened forcing cone to drastically reduce pellet deformation and friction. Benelli claims this results in a 50% increase in penetration depth at distance.32

- Strategy: In a shotgun market that rarely sees barrel innovation beyond porting, this is a significant proprietary differentiator. It attempts to lock consumers into the Benelli ecosystem for ballistic performance, countering the commoditization of the inertia-driven shotgun patent (which many Turkish manufacturers have now cloned).

Insight 8: Connected Optics Ecosystems (The “Smart” Glass)

The era of the standalone optical scope is ending. SHOT Show 2026 solidified the trend of “connected ecosystems” where rangefinders, wind meters, and scopes communicate wirelessly to automate the firing solution.

Sig Sauer BDX 2.0 vs. Swarovski dS

- Sig Sauer BDX 2.0: Sig has updated its Ballistic Data Xchange (BDX) system. The 2.0 iteration focuses on operational simplicity. Recognizing that relying on a smartphone app in a hunting scenario is a point of failure, the new system offers pre-loaded ballistic groups on the optic itself. This allows users to utilize the ballistic drop compensation (BDC) reticles without needing an active phone connection, addressing the primary criticism of “smart” scopes: fragility and complexity.34

- Swarovski dS Gen II: Swarovski continues to push the high-end envelope with the dS series, which projects the holdover point directly onto the glass. However, Sig’s BDX system is winning on accessibility and ecosystem width—allowing users to pair diverse laser rangefinders (KILO series) to diverse scopes.

- Implication: We are moving toward a future where a “dumb” scope (one with just crosshairs) will be a budget-only option. Mid-tier and high-tier optics will be expected to have Bluetooth capability and ballistic calculation engines on board as standard equipment.

Insight 9: The “Show Me” Era for Smart Guns

After years of hype and media attention, 2026 is emerging as a critical “put up or shut up” year for biometric firearms technology, specifically for the startup Biofire.

Biofire’s Critical Juncture

- Status: Biofire, the most prominent smart gun startup, faces significant industry scrutiny. While they have successfully secured placement on state rosters (like Maryland) and claimed to have shipped initial units, widespread independent reviews remain conspicuously absent.35

- Skepticism: Industry chatter at the show centered on reports of delivery delays (pushing into 2026 for pre-orders) and a lack of media range time for independent verification. The sentiment is shifting from curiosity to skepticism. If Biofire cannot deliver reliable units to independent reviewers in Q1/Q2 2026, the “smart gun” category may suffer a reputation setback that lasts a decade.36

- The Trust Gap: This contrasts sharply with the booming market for biometric storage (safes), which consumers largely trust. The reluctance to integrate electronics into the firing mechanism itself—the “blue screen of death” fear in a life-or-death scenario—remains a massive cultural and technical hurdle that Biofire must overcome with flawless reliability.

Insight 10: Counter-Drone (C-UAS) as a Small Arms Category

A burgeoning trend, driven by the conflicts in Ukraine and the Middle East, is the integration of Counter-Unmanned Aerial Systems (C-UAS) capability into the small arms sector.

Ammunition and Hardware Solutions

- Rostec Mnogotochie: While a Russian development, the global announcement of “Mnogotochie” (Multi-point) ammunition—which separates into three projectiles to increase hit probability against drones—signals a global R&D trend.38 U.S. and Western manufacturers are responding with similar concepts, likely to manifest as advanced buckshot or fragmenting rounds designed for standard rifles to increase hit probability against small, fast-moving aerial targets.

- Integration: We are seeing “Dronebuster” style jammers and even kinetic solutions (shotguns with smart computing optics for lead calculation) moving from strictly military booths to law enforcement and commercial security sectors.39 The traditional “Goose Gun” is being rebranded and repurposed as the “Drone Gun” for infrastructure protection.

Conclusion

The 2026 SHOT Show demonstrates an industry that is hardening. It is hardening its supply chains against economic volatility through diversification and reshoring. It is hardening its product lines against legislative bans through the strategic hybridization of platforms like the Bond Arms LVRB. And it is hardening its technology through the adoption of aerospace-grade manufacturing techniques like 3D printing.

For the investor and analyst, the key areas to watch in the coming quarters are:

- Consumer acceptance of the $3,000+ “Duty” pistol (Staccato/high-end Glock builds) and whether the “shootability” argument wins over budget constraints.

- The pass-through rate of tariff costs to the consumer and its impact on Q3 sales volumes, particularly in the entry-level segment.

- The reliability reports on additive-manufactured suppressors as they hit high round counts in civilian hands—will the 3D-printed cores hold up to abuse?

The small arms industry of 2026 is less about “new models” for the sake of novelty, and more about “new methods” of manufacturing, compliance, and connectivity that will define the next decade of development.

Works cited

- 2026 SHOT SHOW® FACTS AND FIGURES, accessed January 23, 2026, https://shotshow.org/wp-content/uploads/26SHOTShowFactsAndFigures.pdf

- SHOT Show Celebrates Industry Strength and Momentum – NSSF, accessed January 23, 2026, https://www.nssf.org/articles/shot-show-celebrates-industry-strength-and-momentum/

- US increases import tariffs of aluminum and steel – EY Global Tax News, accessed January 23, 2026, https://globaltaxnews.ey.com/news/2025-1192-us-increases-import-tariffs-of-aluminum-and-steel

- How Tariffs and Trade Policy Continue to Shape U.S. Metal Markets in 2026, accessed January 23, 2026, https://coastalmetals.com/how-tariffs-and-trade-policy-continue-to-shape-u-s-metal-markets-in-2026/

- 2024 Lever-Action Rifles Can Fire All Week Long – GunBroker.com, accessed January 23, 2026, https://www.gunbroker.com/c/article/2024-lever-action-rifles-can-fire-all-week-long/

- New: Bond Arms Reveals LVRB Lever-Action ‘AR’ Rifle, Mighty Derringer Trio – Guns.com, accessed January 23, 2026, https://www.guns.com/news/2024/01/25/bond-arms-lvrb-honey-b-cyclops-stinger-fireball-shot-show-2024

- Top 5 Tactical Lever Actions of 2026 (SHOT Show Leaks) – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=xmIOquZjgd4

- 2026 SHOT Show Firearms: Turkey Guns and More, accessed January 23, 2026, https://www.nwtf.org/content-hub/2026-shot-show-firearms-turkey-guns-and-more

- [SHOT 2026] Name Game And New Features: Henry Rifle Lineup Evolves, accessed January 23, 2026, https://www.thefirearmblog.com/blog/shot-2026-name-game-and-new-features-henry-rifle-lineup-evolves-44825374

- What actually stood out at SHOT Show Industry Range Day 2026 – Police1, accessed January 23, 2026, https://www.police1.com/shot-show/what-actually-stood-out-at-shot-show-industry-range-day-2026

- New Dead Air RXD910Ti Suppressor: Made for 9mm and 10mm | Hook & Barrel Magazine, accessed January 23, 2026, https://www.hookandbarrel.com/shooting/dead-air-rxd910ti-suppressor

- Silent Steel USA: The Future is Here | SHOT Show 2026 – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=-V3B8uRL8SM

- New AR Components & Suppressor Manufacturing | 2026 SHOT Show Product Spotlight – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=2DMhZeaU4lA

- Experience the Future of Optics: Holosun Takes Center Stage at SHOT Show 2026 – The Outdoor Wire, accessed January 23, 2026, https://www.theoutdoorwire.com/releases/2026/01/experience-the-future-of-optics-holosun-takes-center-stage-at-shot-show-2026

- Holosun 2026 Optics Sneak Peek – Frag Out! Magazine, accessed January 23, 2026, https://fragoutmag.com/holosun-2026-sneak-peak/

- AGM BREAKING NEWS | Day 1 SHOT Show 2026!! – YouTube, accessed January 23, 2026, https://m.youtube.com/watch?v=A27JsTvSdxY&pp=ugUEEgJlbg%3D%3D

- RIX BREAKING NEWS | Day 1 SHOT Show 2026!! – YouTube, accessed January 23, 2026, https://www.youtube.com/watch?v=e4mwq8zB8Ys

- New Optics Coming in 2025 | NSSF SHOT Show 2026, accessed January 23, 2026, https://shotshow.org/new-optics-coming-in-2025/

- U.S. Tariff Impact on Small Arms Market: Size, Share, Trends & Industry Growth Analysis, accessed January 23, 2026, https://www.marketsandmarkets.com/ResearchInsight/us-tariff-impact-on-the-small-arms-market.asp

- Supplier Showcase | NSSF SHOT Show 2026, accessed January 23, 2026, https://shotshow.org/supplier-showcase/

- How to best enable the new era of supply chains – The World Economic Forum, accessed January 23, 2026, https://www.weforum.org/stories/2026/01/how-we-can-best-enable-the-new-era-of-supply-chains/

- SHOT Show 2026: first new products seen and test fired at the Industry Day at the Range, accessed January 23, 2026, https://www.all4shooters.com/en/shooting/culture/shot-show-2026-industry-day-at-the-range/

- GLOCK® Gen 6: The Evolution of Excellence – SilencerCo, accessed January 23, 2026, https://silencerco.com/blog/glock-gen-6-evolution-of-excellence

- Glock Gen 6 is Here: Complete Guide to New Features & Holster Fits – Inside Safariland, accessed January 23, 2026, https://inside.safariland.com/blog/glock-gen-6-is-here-complete-guide-to-new-features-holster-fits/

- New Handguns From SHOT Show 2026 – Outdoor Life, accessed January 23, 2026, https://www.outdoorlife.com/guns/new-handguns-of-shot-show-2026/

- MCX-SPEAR 6.8X51 – SIG Sauer, accessed January 23, 2026, https://www.sigsauer.com/mcx-spear-6-8-x-51.html

- The Next Generation Has Arrived: MCX-SPEAR – Sig Sauer, accessed January 23, 2026, https://www.sigsauer.com/blog/now-shipping-the-incredible-new-mcx-spear-rifle

- First Look: SIG Sauer MCX 6.8x51mm Spear | An Official Journal Of The NRA, accessed January 23, 2026, https://www.shootingillustrated.com/content/first-look-sig-sauer-mcx-6-8x51mm-spear/

- New Ammo Coming in 2026 – SHOT Show, accessed January 23, 2026, https://shotshow.org/new-ammo-coming-in-2026/

- Federal Will Release More Than 20 New Centerfire Rifle Ammo Options in 2026, accessed January 23, 2026, https://www.federalpremium.com/news.html?id=2149

- New Rifles Coming in 2026 – SHOT Show, accessed January 23, 2026, https://shotshow.org/new-rifles-coming-in-2026/

- Advanced Impact | Benelli Shotguns and Rifles, accessed January 23, 2026, https://www.benelliusa.com/family-series/advanced-impact

- Video: We Tested Benelli’s Advanced Impact Barrel Claims – Outdoor Life, accessed January 23, 2026, https://www.outdoorlife.com/guns/benelli-advanced-impact-barrel-test/

- SIG Sauer Updates Award-Winning Optic System With Release of BDX 2.0, accessed January 23, 2026, https://athlonoutdoors.com/article/sig-bdx-2-0/

- News – The Biofire Smart Gun, accessed January 23, 2026, https://smartgun.com/explore/news

- Smart Gun Technology: Biofire and the Future of Firearm Safety – Liberty Safe, accessed January 23, 2026, https://www.libertysafe.com/blogs/the-vault/latest-smart-gun-technology

- I’m new. Has anyone here bought and actually received a Biofire Smart Gun? What are your thoughts? : r/liberalgunowners – Reddit, accessed January 23, 2026, https://www.reddit.com/r/liberalgunowners/comments/1j4a792/im_new_has_anyone_here_bought_and_actually/

- Rostec Unveils Mnogotochie Rounds to Counter UAVs Threats, accessed January 23, 2026, https://voennoedelo.com/en/posts/id12411-rostec-unveils-mnogotochie-rounds-to-counter-uavs-threats

- SHOT Show’s 2026 Range Day – The National Wild Turkey Federation, accessed January 23, 2026, https://www.nwtf.org/content-hub/shot-shows-2026-range-day