Live Free Armory (LFA), legally incorporated as Central Florida Firearms, LLC, represents a compelling case study in the maturation and volatility of the modern American firearms manufacturing sector. Established in 2014 on Florida’s “Space Coast”—a region densely populated with aerospace and defense infrastructure—the company evolved from a garage-based prototyping operation into a significant Original Equipment Manufacturer (OEM) and independent consumer brand. This transformation was driven by a distinct operational philosophy: the application of aerospace-grade engineering tolerances and quality management systems (AS9100) to the commoditized market of small arms.

LFA’s market identity is defined by its aggressive disruption of price-to-performance ratios. Initially focusing on the AR-15 and AR-10 rifle platforms, the company pivoted in the early 2020s to address the “metal-framed” handgun segment. This strategic shift culminated in the release of the “AMP” (Aluminum Match Grade) pistol series and, most notably, the “Apollo 11” double-stack 1911 platform. The Apollo 11 challenged the established pricing hierarchy of the “2011” market, offering features traditionally reserved for boutique custom firearms—such as hand-fitted actions and match-grade bull barrels—at a sub-$1,000 price point. This move democratized a platform previously accessible only to affluent competitors, forcing legacy manufacturers to re-evaluate their value propositions.

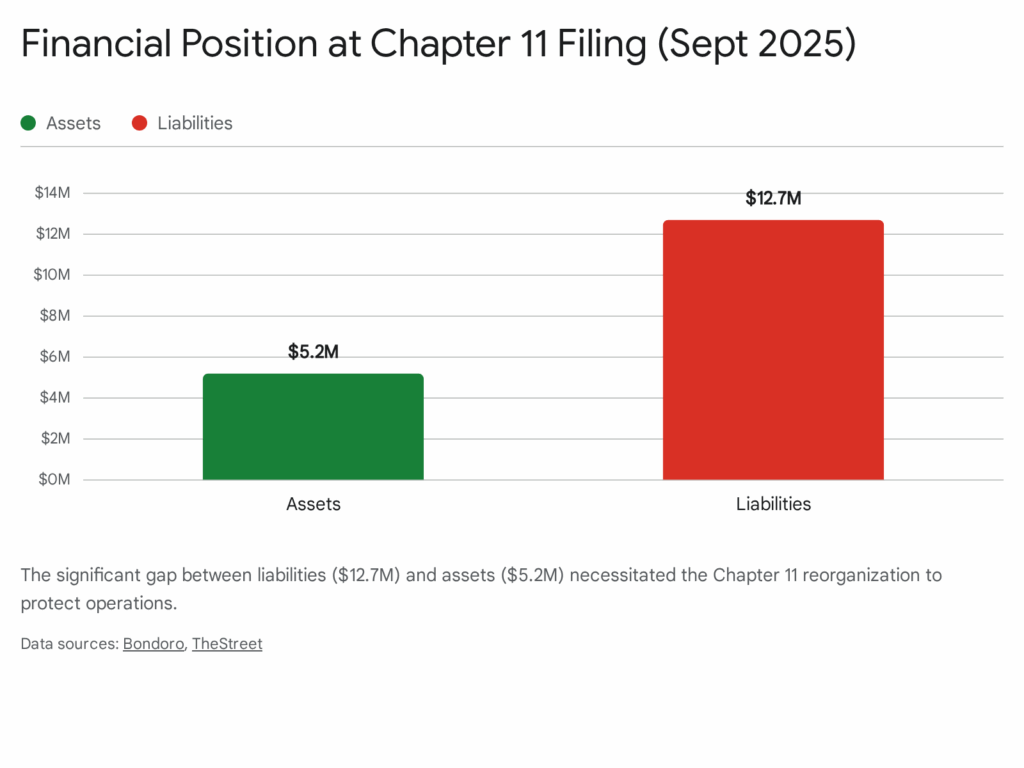

However, the capital intensity required to sustain this high-precision, low-margin manufacturing model at scale precipitated significant financial headwinds. Despite achieving robust brand recognition and securing supply chain partnerships with over 100 industry labels, Live Free Armory faced a liquidity crisis in 2025. On September 26, 2025, the company filed for Chapter 11 bankruptcy protection, revealing a stark disparity between its asset base ($5.2 million) and its liabilities ($12.7 million).

This exhaustive report analyzes the complete corporate lifecycle of Live Free Armory. It dissects the company’s foundational years, its strategic pivot from rifles to handguns, the industrial advantages of its Floridian location, and the root causes of its recent financial restructuring. Furthermore, it provides a forward-looking assessment of LFA’s potential to emerge from reorganization, examining how its intellectual property and manufacturing capabilities position it for the future in a contracting and highly competitive marketplace.

1. The Industrial Context of the Mid-2010s

To fully appreciate the trajectory of Live Free Armory, one must first understand the industrial and cultural landscape of the American firearms market circa 2014. The industry was in a state of chaotic flux, driven by the “Panic Buying” era following the Sandy Hook Elementary School shooting in 2012 and the subsequent political climate.

1.1 The Post-Panic “Slump” and the AR-15 Commoditization

By 2014, the “Panic” demand bubble had largely burst, leaving the market awash in inventory. The AR-15 rifle, once a high-margin item produced by a select group of manufacturers (Colt, Bushmaster, Smith & Wesson), had become thoroughly commoditized. A cottage industry of small machine shops had sprung up, capable of milling aluminum receivers and sourcing barrels to assemble “Mil-Spec” rifles. This led to a “race to the bottom” in pricing, where the differentiation between brands began to blur.

For a new entrant like Live Free Armory, entering this saturated market required a differentiator beyond price. The “Barbie Doll for Men” phenomenon—where AR-15 owners treated their rifles as modular platforms for endless customization—was reaching its zenith. Consumers were becoming more sophisticated; they no longer just wanted a rifle that functioned; they wanted specific aesthetics, lighter weights, and tighter fitment between the upper and lower receivers. The “sloppy” fit of mass-produced forged receivers was becoming a point of contention for enthusiasts.

1.2 The “Gunshine State” Industrial Complex

Geographically, Florida was cementing its reputation as the “Gunshine State,” not just for its permissive laws but for its manufacturing density. The state aggressively courted firearms manufacturers with tax incentives and a friendly regulatory environment, leading companies like Kel-Tec, Knight’s Armament, and later reforms of others to establish deep roots there.

Live Free Armory’s founders chose to plant their flag in the heart of this ecosystem: The Space Coast. This region, centered around Melbourne, Palm Bay, and Titusville, is unique in the American industrial landscape. It is home to NASA’s Kennedy Space Center and major defense contractors like Lockheed Martin, L3Harris, and Northrop Grumman.1 This location provided two critical assets that would define LFA’s future: a supply chain accustomed to rigorous specifications (anodizing, heat treating, metallurgy) and a labor pool of machinists who spoke the language of microns rather than fractions of an inch.

2. Genesis: The Garage Phase (2014–2016)

2.1 The Convergence of Craftsmanship and Engineering

Live Free Armory was incorporated on April 28, 2014, in Florida.4 The company was the brainchild of Christopher Riedeman, an entrepreneur with a vision for a firearms brand deeply rooted in American patriotism and Second Amendment advocacy. However, passion alone does not machine steel. The catalyst for the company’s technical competence was the partnership with Colby Santaw, a young aerospace engineer.5

The partnership between Riedeman and Santaw represented a synthesis of two often-opposing cultures in the firearms world: the “Gunsmith” and the “Engineer.”

- The Gunsmith Culture traditionally relies on hand-fitting, artisan skill, and “feel.” It is effective for custom work but difficult to scale.

- The Engineer Culture, represented by Santaw, relies on Geometric Dimensioning and Tolerancing (GD&T), CNC programming, and repeatable processes. Santaw came from a lineage of manufacturing owners and had experience in aerospace contracting.6 He understood that to build a better firearm at scale, one didn’t need a file; one needed a better code for the HAAS machine.

2.2 The “Bootstrap” Operations

Like many disruptive entities in the American industrial narrative—from Apple to Hewlett-Packard—Live Free Armory began in a residential garage.6 In 2014 and 2015, the operation was defined by its constraints. Capital was limited, meaning every piece of aluminum bar stock had to be accounted for.

The initial product focus was on the AR platform—specifically, receiver sets (the structural framework of the rifle). In a market flooded with forged receivers (which are pounded into shape and then lightly machined), LFA focused on “Billet” receivers. Billet receivers are carved from a solid block of aluminum. They are more expensive and time-consuming to produce but allow for unique aesthetic designs and tighter tolerances that forging dies cannot achieve.

During this garage phase, Santaw’s role was critical. He had to optimize tool paths to reduce machine time, allowing a small setup to produce enough inventory to generate cash flow. This period established the company’s “lean” ethos. There was no middle management or marketing department; there were just the founders, the machines, and the raw material. This intimacy with the production process created a feedback loop where design changes could be implemented instantly—a marked advantage over larger competitors with bureaucratic engineering change orders.

3. The AR Market Saturation and LFA’s Entry (2016–2019)

3.1 Scaling Up: The Move to St. Cloud

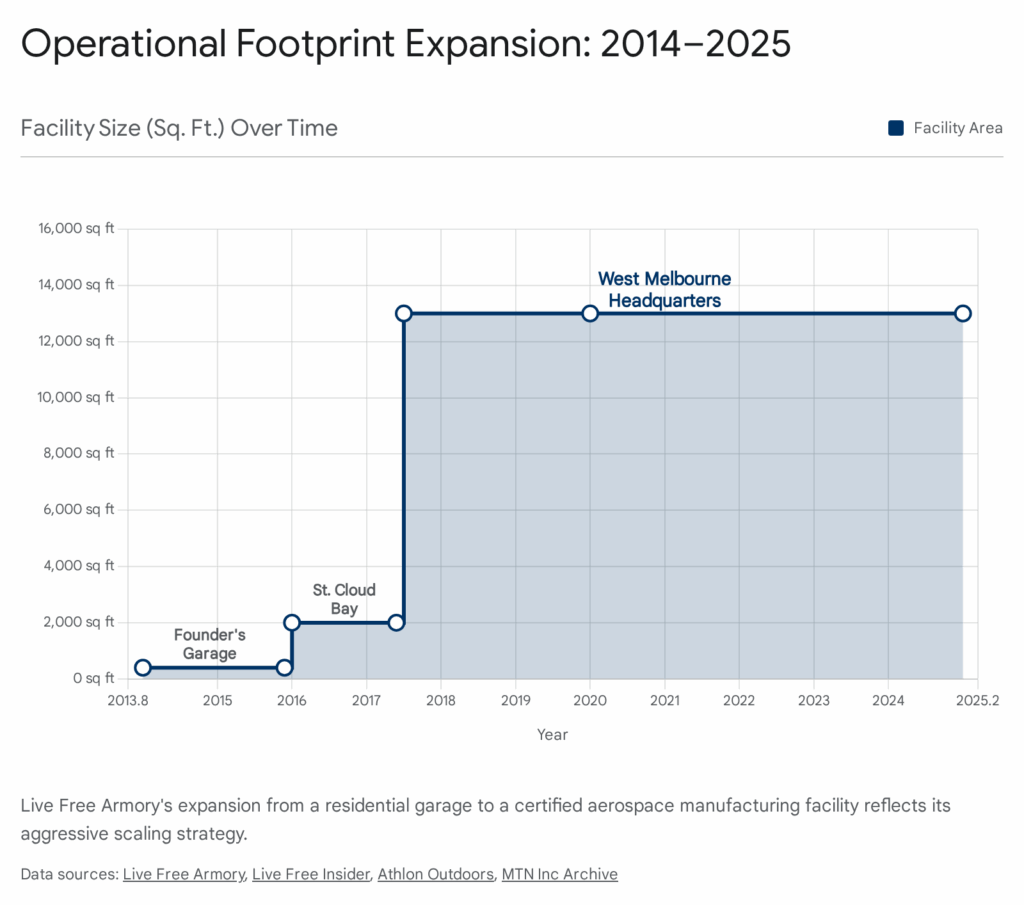

By 2016, the demand for LFA’s billet receiver sets had outgrown the residential zoning limits. The company executed its first major expansion, moving into a 2,000-square-foot industrial bay in St. Cloud, Florida.6 This move was not just about space; it was about power requirements for larger CNC machines and the ability to hire staff. The workforce grew to approximately six employees.6

This era marked the transition from “Parts Maker” to “Rifle Manufacturer.” LFA began assembling and selling complete rifles under its own brand, most notably the LF15 (5.56mm) and LF10 (7.62mm/.308 Win).8

3.2 The Challenge of the Large Frame AR (AR-10)

Entering the AR-10 market was a bold risk. Unlike the AR-15, which has a standardized “Mil-Spec” (Military Specification) technical data package that ensures parts from different manufacturers are compatible, the AR-10 world is fragmented. There is no single standard—there is the Armalite pattern, the DPMS pattern, and various proprietary hybrids.

Early reviews and user feedback from 2016–2017 highlight the teething issues LFA faced in this complex segment. Users on forums like Sniper’s Hide and Lone Star Boars reported reliability issues with the LF10, specifically regarding extraction failures and cycling issues with certain ammunition types.9 These are classic symptoms of an “over-gassed” or “under-buffered” system, a common pitfall for manufacturers trying to make a.308 rifle reliable across a wide spectrum of ammo pressures.

3.3 The Iterative Engineering Response

LFA’s response to these early stumbles revealed their corporate character. Instead of abandoning the platform or blaming the customer (a common tactic in the industry), they leveraged their engineering background to iterate. They began tuning gas port sizes, experimenting with buffer weights, and refining extractor geometries.

Crucially, they instituted a Lifetime Warranty.11 In the firearms industry, a warranty is a financial liability. For a small company to offer a lifetime guarantee on a mechanical device subject to explosions (gunfire) is a significant statement of confidence. It signaled to the market that LFA was willing to absorb the cost of its own learning curve. This built trust. Customers who had issues were taken care of, and the “Version 2.0” rifles benefited from the field data collected from the “Version 1.0” failures.

4. The Space Coast Advantage & Operational Maturation (2019–2022)

4.1 The West Melbourne Expansion

By 2020, the St. Cloud facility was bursting at the seams. LFA initiated a strategic relocation to a massive new facility in West Melbourne (Palm Bay area), Florida.1 This facility, eventually spanning over 13,000 square feet 7, was designed from the ground up for high-volume precision manufacturing.

This expansion coincided with major investments in infrastructure in the surrounding area by defense giants like L3Harris, which was expanding its satellite integration facilities nearby.2 The proximity to these high-tech neighbors allowed LFA to recruit top-tier talent—CNC operators and quality engineers who were looking for work outside the fluctuating cycles of defense contracts.

4.2 The “Aerospace Grade” Standard: AS9100

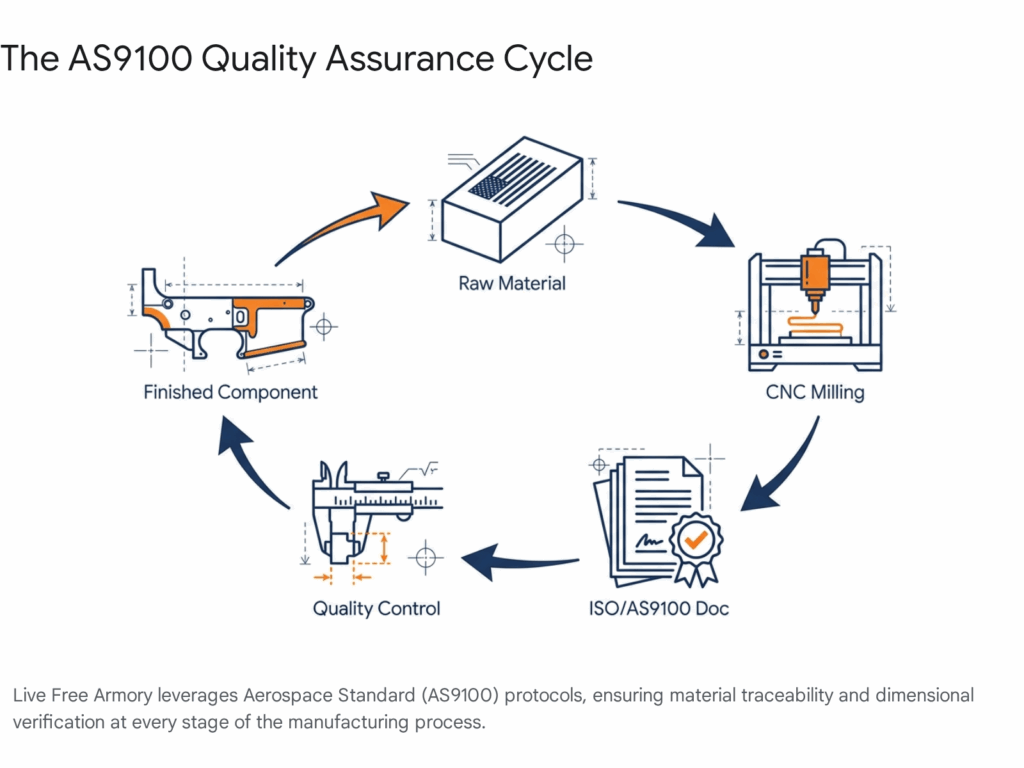

The most significant milestone of this period was LFA achieving ISO 9001:2015 and AS9100 compliance.14

- ISO 9001:2015 is a general quality management standard.

- AS9100 is the aerospace industry specific standard. It is rigorously difficult to attain. It requires a company to demonstrate complete material traceability (knowing exactly which mill in the USA produced the steel for a specific batch of firing pins), strict revision control, and validated processes for every manufacturing step.

Most firearms manufacturers do not bother with AS9100; it is considered “overkill” for consumer goods. However, LFA pursued it for two reasons:

- Marketing Differentiation: It allowed them to scientifically claim “Aerospace Precision” rather than using it as a buzzword.

- The OEM Pivot: LFA was no longer just making LFA guns. They were manufacturing slides, barrels, and small parts for over 100 other companies.6 Many of these clients were high-end boutique brands that required flawless machining. AS9100 certification gave these B2B clients the assurance that LFA could deliver consistent quality at scale.

4.3 OEM: The Silent Revenue Engine

While the Live Free Armory brand was visible to consumers, the “Central Florida Firearms” entity was quietly becoming a powerhouse in the Original Equipment Manufacturer (OEM) space.16

In the firearms industry, “white labeling” is common. A brand known for its barrels might not own a single lathe; they contract the production to a shop like LFA. LFA produced thousands of slides for the Glock 19, Glock 43, and Sig P320 platforms.17 They offered these in various stages of completion—from “raw blanks” for other machine shops to finish, to fully coated and assembled slides ready for retail.

This diversification was a crucial hedge. If the demand for LFA-branded rifles dipped, the demand for Glock aftermarket parts (which is nearly constant) kept the machines running. It provided the cash flow necessary to fund R&D for their next big gamble: The Pistol Market.

5. The “AMP” Project & The Metal Frame Renaissance (2021–2022)

5.1 Market Trend: Polymer Fatigue

By 2021, the handgun market had been dominated by polymer-framed striker-fired pistols (Glocks, Sig P320s, S&W M&Ps) for decades. While polymer is light and cheap to manufacture, it lacks the rigidity and recoil-absorbing mass of metal. A segment of the market—competition shooters and tactical enthusiasts—began to yearn for the “feel” of metal, but they did not want to give up the reliability and simplicity of the striker-fired mechanism.

5.2 The AMP (Aluminum Match Grade) Design Philosophy

LFA identified this gap and launched the AMP (Aluminum Match Grade) pistol.6

The concept was disruptive in its simplicity: Take the internal geometry of the world’s most popular pistol (the Glock), which has an infinite supply of aftermarket parts, and house it in a precision-machined aluminum frame.

- Architecture: The AMP featured a milled aluminum frame that accepted Glock magazines and mostly standard Glock internal parts.19

- Ergonomics: Unlike the “blocky” feel of a Glock, the AMP’s metal frame allowed LFA to machine aggressive grip textures and a 1911-style grip angle, which many American shooters prefer.20

- Price Point: Most metal-framed striker pistols (like the ZEV OZ9) cost upwards of $1,500. LFA launched the AMP at a sub-$700 price point.19

5.3 Reception and Reality

The AMP was a polarized release. Conceptually, it was a home run. Reviewers praised the “American Made” origins and the ambitious pricing.6 However, the transition from polymer to metal is not just a material swap; it changes the physics of the gun. Metal frames transfer energy differently than flexing polymer frames.

Early iterations of the AMP faced reliability criticism. Issues included light primer strikes (due to tolerance stacking in the striker channel) and extraction failures.9 The “Budget” price point also meant that some finishing details were scrutinized. LFA, true to form, used the AS9100 feedback loops to iterate. They tightened tolerances on the slide rails and refined the trigger bar geometry. The AMP proved that LFA could design a handgun, but it was merely the prelude to their true magnum opus.

6. The Apollo 11 and the Democratization of the 2011 (2023–2024)

6.1 The History of the 2011 Platform

To understand the impact of the Apollo 11, one must understand the “2011” platform. In the 1990s, the company STI (now Staccato) patented a modular frame for the 1911 that allowed it to use double-stack magazines, increasing capacity from 8 rounds to 20+. For decades, this “2011” platform was the exclusive domain of elite competition shooters. The guns were hand-built, finicky, and cost between $3,000 and $6,000.

When the STI patents expired, the market opened up. Staccato (STI re-branded) successfully pivoted to the “Duty” market, selling reliable 2011s to police, but their prices remained high ($2,500+).

6.2 The Apollo 11 Launch: July 2023

In July 2023, Live Free Armory dropped a bombshell on the market: The Apollo 11.22

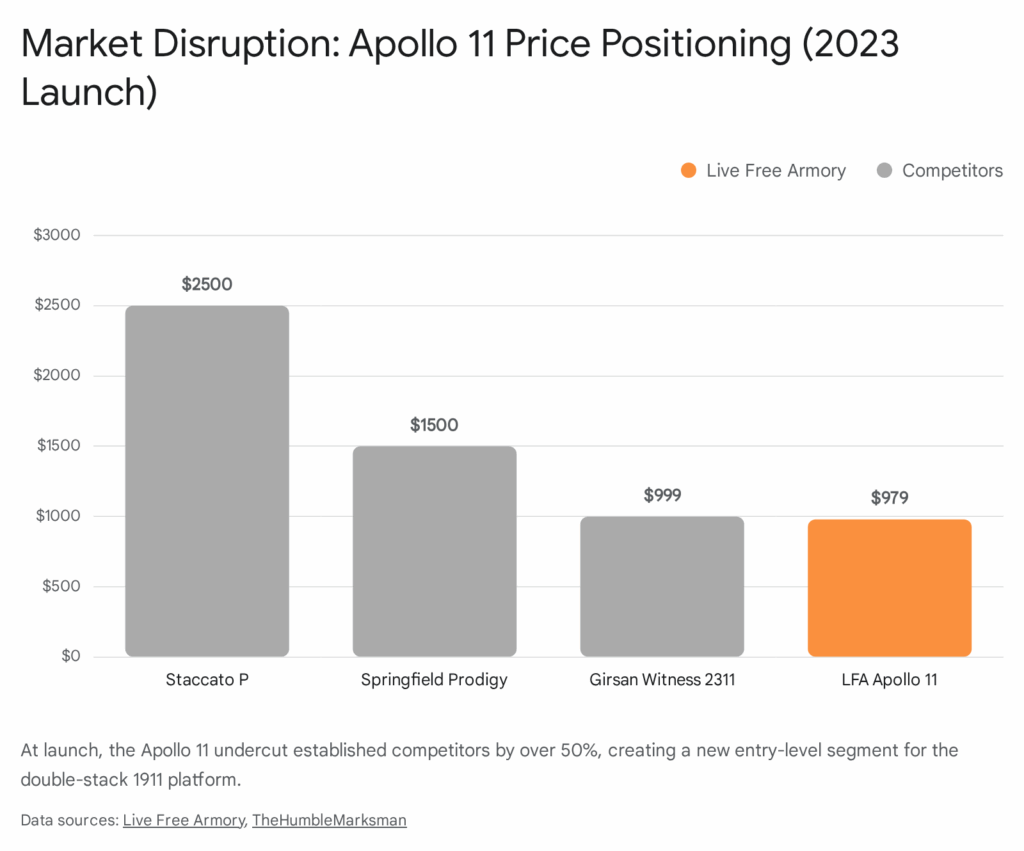

It was a double-stack 1911, made in America, with a starting price of $979.20

This was a psychological price barrier. It was the first time a US-made 2011 competed directly with the price of a high-end Glock or Sig.

Key Features:

- Construction: 416 Stainless Steel slide and 4140 Steel frame. No MIM (Metal Injection Molded) critical parts were advertised, a key selling point for purists.20

- Barrel: A 4.9-inch bushingless bull barrel, rifle-cut and honed to an 8-micron finish.20 This type of barrel usually requires expensive hand-fitting.

- Customization: It shipped optics-ready, acknowledging that the modern pistol is incomplete without a red dot sight.

6.3 The “Race to the Middle”

The Apollo 11 placed LFA in a brutal “sandwich” war.

- Above them: Staccato ($2,500) and the Springfield Armory Prodigy ($1,500).

- Below them: Turkish imports like the Girsan Witness 2311 ($900).

LFA’s value proposition was clear: “Don’t buy a Turkish import; buy American for $79 more. Don’t buy a Springfield Prodigy (which had a disastrous launch with reliability issues); buy our gun for $500 less.”

The market responded with fervor. Pre-orders surged, and the Apollo 11 became the topic of every major gun forum.23 However, this success brought a new danger: The “Osborne Effect” of demand outstripping the ability to manufacture complex mechanisms. A 2011 is not a Glock; it requires hand-tuning. Scaling hand-tuning is exponentially harder than scaling CNC machining.

7. Financial Strains and The Crisis of Growth (2024–2025)

7.1 The Capital Intensity Trap

The production of firearms, especially precision platforms like the Apollo 11, is incredibly capital intensive.

- Machinery: A 5-axis CNC mill costs hundreds of thousands of dollars.

- Materials: Sourcing American steel and aluminum 5 is significantly more expensive than importing from Asia.

- Inventory: To sell a gun today, you needed to buy the metal 6 months ago.

In 2024 and 2025, the macroeconomic environment turned hostile to this model. Interest rates remained elevated, making the cost of servicing debt on machinery expensive. Furthermore, the “race to the bottom” on pricing meant margins were razor-thin. To make money on a $979 Apollo 11, LFA had to sell thousands of them with zero defects. Any batch of scrapped parts due to a machine error was a direct hit to the bottom line.

7.2 The Chapter 11 Filing (September 2025)

On September 26, 2025, the strain became untenable. Central Florida Firearms, LLC (dba Live Free Armory) filed for Chapter 11 Bankruptcy in the Middle District of Florida (Case No. 6:25-bk-06150-GER).24

The filing revealed a precarious balance sheet:

- Assets: ~$5.2 Million.24

- Liabilities: ~$12.7 Million.24

This 2.5:1 debt-to-asset ratio indicates that LFA had leveraged itself heavily to fund its expansion and product development. The “Liabilities” likely consisted of machinery loans, raw material credit lines, and perhaps facility expansion costs associated with the West Melbourne site.2

7.3 Strategic Restructuring vs. Liquidation

It is vital to distinguish Chapter 11 (Reorganization) from Chapter 7 (Liquidation). LFA did not close its doors. It remained open, taking orders and manufacturing.26

The filing serves as a legal shield, pausing debt collection to allow the company to renegotiate terms. The presence of $5.2 million in assets—likely machinery, inventory, and intellectual property—suggests a viable core business. The filing explicitly noted that funds would be available for unsecured creditors, a positive signal that the business has cash flow.24

8. Product Diversification & Future Roadmap

Despite the financial drama in the courtroom, the engineering floor at LFA remained active. The company continued to unveil new products, signaling to the market that they were planning for a future post-bankruptcy.

8.1 The Falcon 9X and Component Resilience

The Falcon 9X slide series for Glock pistols remains a critical product line.17 These slides offer aesthetic and functional upgrades (optic cuts, aggressive serrations) for the millions of Glock owners in the US. This “aftermarket” business is less volatile than selling complete firearms (which require FFL transfers and taxes). It provides high-margin, direct-to-consumer revenue that is essential for liquidity during restructuring.

8.2 Expanding the Apollo Line: 10mm and Subcompacts

At SHOT Show 2025, LFA demonstrated that it was not retreating. They unveiled two major expansions to the Apollo line:

- Apollo 10 (10mm Auto): The 10mm cartridge has seen a massive resurgence for “backcountry defense” (bear guns). By offering a high-capacity, double-stack 10mm at a reasonable price, LFA is targeting the hunting/outdoor demographic, moving beyond just “tactical” shooters.28

- Apollo 11 Subcompact: The trend in the 2011 world is “smaller.” Staccato released the CS; Wilson Combat has the SFX9. LFA’s subcompact Apollo aims to be the “Everyday Carry” (EDC) solution for the budget-conscious citizen.28 This puts them in direct competition with the high-end concealed carry market.

9. Strategic Outlook: 2026 and Beyond

9.1 The Restructuring Pathway

The immediate priority for 2026 is the successful confirmation of the Chapter 11 reorganization plan. LFA must convince its creditors—likely banks and material suppliers—that it is worth more alive than dead.

The arguments in their favor are strong:

- Brand Equity: The “Apollo 11” is a known and desired commodity.

- Manufacturing Capacity: The West Melbourne facility is a turnkey aerospace-grade factory.

- Order Book: Demand for affordable metal-framed pistols remains high.

9.2 Risks and Opportunities

- Risk: Quality Fade. The temptation during bankruptcy is to cut costs—cheaper tool heads, faster machine times, less QC. If the quality of the Apollo 11 slips, the brand will collapse. The 2011 platform is unforgiving of poor tolerances.

- Opportunity: Consolidation. LFA could be an acquisition target. A larger holding company (like PSA or a private equity firm) might see the AS9100 facility and the Apollo brand as a perfect addition to a portfolio, injecting the capital needed to clear the debt while keeping the operations running.

9.3 Analyst Verdict

Live Free Armory is at a crossroads. It has successfully traversed the “Valley of Death” from a garage startup to a recognized national brand. It now faces the “Scale-Up Trap,” where the complexity of financing growth overwhelms the cash flow.

However, the company’s fundamentals—its engineering pedigree, its location in the Space Coast industrial hub, and its wildly popular product lines—suggest resilience. If LFA can navigate the legal and financial restructuring of 2025 without sacrificing the “Aerospace Quality” that defines its brand, it is poised to emerge as a leaner, more disciplined, and highly competitive force in the American firearms market for the next decade.

Summary of Key Milestones

| Year | Milestone Event | Strategic Significance | Source |

| 2014 | Company Founded | Established by Chris Riedeman and Colby Santaw in a Florida garage. Mission: “American Made” precision. | 5 |

| 2016 | Expansion to St. Cloud | Moved to 2,000 sq ft industrial bay. Scaled LF15/LF10 rifle production. Transition from parts to full firearms. | 6 |

| 2017 | Product Refinement | Addressed early AR-10 reliability issues using iterative engineering. Established “Lifetime Warranty” to build trust. | 9 |

| 2020 | West Melbourne Relocation | Relocated to 13,000+ sq ft facility on the Space Coast. Major CAPEX investment in CNC infrastructure. | 7 |

| 2021 | AMP Pistol Launch | Introduction of the AMP (Aluminum Match Grade), marking the pivot from rifles to proprietary handguns. | 6 |

| 2022 | AS9100 Certification | Achieved aerospace-grade quality certification, enabling high-tier OEM contracts and validating marketing claims. | 14 |

| 2023 | Apollo 11 Launch (July) | Released the first American-made, double-stack 1911 under $1,000. Massive market disruption and viral demand. | 22 |

| 2025 | Apollo 10 & Subcompact Debut | Unveiled 10mm and compact variants at SHOT Show 2025, demonstrating continued R&D despite financial strain. | 28 |

| 2025 | Chapter 11 Filing (Sep 26) | Filed for bankruptcy protection to restructure $12.7M in liabilities. Operations continued uninterrupted. | 24 |

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- L3Harris Completes $100M Florida Facility Expansion – ExecutiveBiz, accessed December 29, 2025, https://www.executivebiz.com/articles/l3harris-100m-florida-facility-expansion

- L3Harris Expands Florida Facility to Support America’s Golden Dome, accessed December 29, 2025, https://www.l3harris.com/newsroom/press-release/2025/08/l3harris-expands-florida-facility-support-americas-golden-dome

- EDC Announces Strategic Expansion of Lockheed Martin on Florida’s Space Coast, accessed December 29, 2025, https://spacecoastedc.org/edc-announces-strategic-expansion-of-lockheed-martin-on-floridas-space-coast/

- Live Free Armory | BBB Business Profile | Better Business Bureau, accessed December 29, 2025, https://www.bbb.org/us/fl/melbourne/profile/firearm-manufacturer/live-free-armory-0733-90576101

- Live Free Armory at K-Var, accessed December 29, 2025, https://www.k-var.com/live-free-armory

- The Live Free Armory Aluminum Match-Grade Pistol (AMP) – Athlon Outdoors, accessed December 29, 2025, https://athlonoutdoors.com/article/live-free-armory-amp/

- Glock Aftermarket Replacement Slides – Live Free Insider, accessed December 29, 2025, http://www.livefreeinsider.com/2020/09/23/choosing-a-glock-replacement-slide/

- USER / TECHNICAL MANUAL – Live Free Armory, accessed December 29, 2025, https://livefreearmory.com/assets/manuals/OwnersManual_LF15_LF10.pdf

- Live Free Armory. Yay or Nay? : r/ar15 – Reddit, accessed December 29, 2025, https://www.reddit.com/r/ar15/comments/5tgkdw/live_free_armory_yay_or_nay/

- First 308 AR | Lone Star Boars, accessed December 29, 2025, http://lonestarboars.com/threads/first-308-ar.7638/

- How Live Free Armory Came To Be, accessed December 29, 2025, https://livefreearmory.com/our-story.php

- Firearms manufacturer Live Free Armory sets up in West Melbourne, accessed December 29, 2025, https://ftp.mtninc.com/ArchiveDocs/2017/2017-08-01/BBN-082817.pdf

- L3Harris Expands Florida Facility to Support America’s Golden Dome | Design and Development Today, accessed December 29, 2025, https://www.designdevelopmenttoday.com/industries/aerospace/news/22948533/l3harris-expands-florida-facility-to-support-americas-golden-dome

- Shop – Live Free Armory, accessed December 29, 2025, https://livefreearmory.com/shop.php

- USACE Database – Army.mil, accessed December 29, 2025, https://www.usace.army.mil/Portals/2/docs/Small%20Business/Database/USACE%20Contractor%20Database%20as%20of%2028%20FEB%202024%20Public.xls?ver=UpxB69x8XCzCvNo7C151UQ%3D%3D

- Dealer Locator – Live Free Armory, accessed December 29, 2025, https://livefreearmory.com/dealer-locator.php

- Components For Glock – Live Free Armory, accessed December 29, 2025, https://livefreearmory.com/product_gl.php

- Live Free Armory AMP Compact LFA-LFAMP19C084002 9MM Luger – Gun Tests, accessed December 29, 2025, https://www.gun-tests.com/handguns/live-free-armory-amp-compact-lfa-lfamp19c084002-9mm-luger/

- Live Free Armory AMP – Metal frame, Modular, optic cut Glock for $699 – Thoughts??, accessed December 29, 2025, https://www.reddit.com/r/Glocks/comments/rzhavz/live_free_armory_amp_metal_frame_modular_optic/

- Buy Your Next Pistol From Us – Live Free Armory, accessed December 29, 2025, https://livefreearmory.com/product_pstl.php?model=117

- AMP by LVA “Absolute GARBAGE!” with Range Review – YouTube, accessed December 29, 2025, https://www.youtube.com/watch?v=KRQGo7OF0Js

- Live Free Armory Apollo 11 Pistol – North American Outdoorsman, accessed December 29, 2025, https://northamerican-outdoorsman.com/live-free-armory-apollo-11-pistol/

- The Apollo has landed! : r/2011 – Reddit, accessed December 29, 2025, https://www.reddit.com/r/2011/comments/17a59em/the_apollo_has_landed/

- Filing Alert: Live Free Armory Chapter 11 – Bondoro, accessed December 29, 2025, https://bondoro.com/live-free-armory-filing-alert/

- Case number: 6:25-bk-06150 – Central Florida Firearms, LLC – Florida Middle Bankruptcy Court, accessed December 29, 2025, https://www.inforuptcy.com/browse-filings/florida-middle-bankruptcy-court/6:25-bk-06150/bankruptcy-case-central-florida-firearms-llc

- Franchise Group, Inc. – Restructuring Administration Cases, accessed December 29, 2025, https://cases.ra.kroll.com/FRG/

- Live Free Armory Falcon 9X – The Best American Made Glock Clone? – YouTube, accessed December 29, 2025, https://www.youtube.com/watch?v=e3gQ531e6QY

- [SHOT 2025] Live Free Armory Apollo 11 Subcompact & Apollo 10 Pistols | thefirearmblog.com, accessed December 29, 2025, https://www.thefirearmblog.com/blog/shot-2025-live-free-armory-apollo-11-subcompact-apollo-10-pistols-44818654

- Live Free Armory Apollo 10: The Future of Double Stack 10mm 1911s? Exclusive from SHOT Show 2025 – Dirty Bird Guns & Ammo, accessed December 29, 2025, https://dirtybirdusa.com/live-free-armory-apollo-10-the-future-of-double-stack-10mm-1911s/

- Another American gun, firearm company files Chapter 11 bankruptcy – TheStreet, accessed December 29, 2025, https://www.thestreet.com/retail/high-end-gun-firearm-manufacturer-files-chapter-11-bankruptcy