In the global landscape of precision optics, Leupold & Stevens, Inc. represents a distinct anomaly: a fifth-generation, family-owned American manufacturer that has successfully navigated the transition from analog hydrographic instrumentation to becoming the preeminent supplier of sporting and tactical optics to the United States military and civilian markets. This report provides an exhaustive, analyst-grade examination of the company’s 117-year trajectory, dissecting the strategic pivots, engineering philosophies, and market forces that have solidified the “Golden Ring” trademark as a global standard for rugged reliability.

The analysis reveals that Leupold’s longevity is not merely a function of heritage but the result of a deliberate, often counter-intuitive corporate strategy: the refusal to outsource core competencies during the globalization waves of the late 20th century. While competitors migrated production to Asia to capitalize on lower labor costs, Leupold entrenched its manufacturing base in Beaverton, Oregon. This decision, initially a margin-compressing liability, matured into its greatest strategic asset. It allowed the company to secure lucrative U.S. Department of Defense contracts mandated by the Berry Amendment, maintain absolute quality control over its “Elite Optical System,” and react with agility to the evolving demands of the American shooter.

Currently, the company occupies a bifurcated and dominant market position. In the civilian sector, Leupold remains the volume and value leader in hunting riflescopes, leveraging a tiered product architecture (VX-Freedom through VX-6HD) that democratizes premium features like the Custom Dial System (CDS). In the defense sector, Leupold serves as the optical backbone for the U.S. Army’s sniper capabilities, with the Mark 5HD platform recently selected for the Precision Sniper Rifle (PSR) program, affirming the company’s status as a Tier 1 defense contractor.

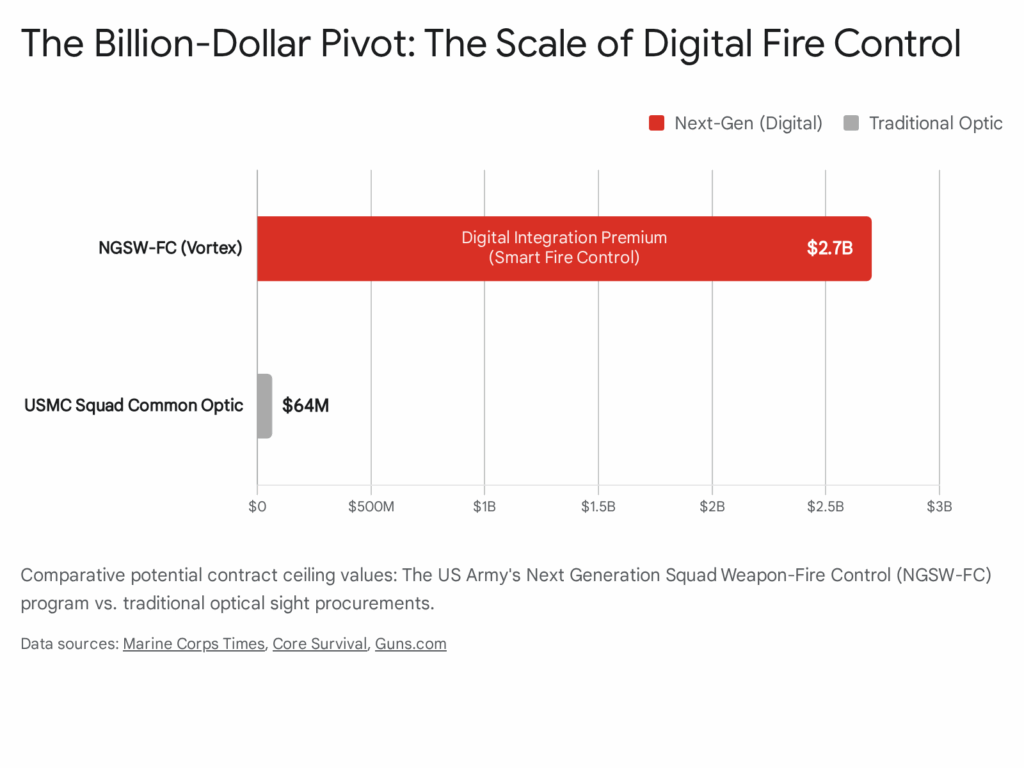

However, the future horizon presents significant technological and competitive challenges. The 2022 loss of the Next Generation Squad Weapon-Fire Control (NGSW-FC) contract to Vortex Optics signals a paradigmatic shift in military procurement—away from pure glass and toward integrated, active-matrix digital fire control systems. Leupold’s response to this digital disruption—balancing its mastery of mechanical precision with the necessity of electronic integration—will define its relevance in the coming decades. This report details the company’s journey from 1907 to the present, offering deep insights into its operational resilience, product evolution, and the strategic outlook for 2025 and beyond.

1. Introduction: The American Optical Anomaly

In the high-stakes world of firearms and optics manufacturing, longevity is often the exception rather than the rule. The industry is characterized by rapid technological obsolescence, cyclical demand curves driven by political climates, and a relentless pressure to reduce manufacturing costs through offshoring. Within this volatile environment, Leupold & Stevens, Inc. stands as a testament to the viability of a different business model—one rooted in family ownership, domestic manufacturing, and a relentless focus on solving the specific, practical problems of the end-user.

To understand Leupold’s current market dominance, one must look beyond the gleaming rows of riflescopes in a modern sporting goods store and examine the company’s unique DNA. Unlike many of its competitors, who began as lens grinders or camera manufacturers, Leupold began in the mud and rain of the Pacific Northwest, building instruments that measured the flow of rivers. This hydrographic heritage instilled a “durability first” engineering philosophy that predates their entry into optics by nearly half a century. When a water level recorder fails in a remote mountain stream, the data is lost forever; when a riflescope fails on a once-in-a-lifetime hunt, the opportunity is gone. Leupold understood early on that in the field, reliability is the only metric that matters.

This report will traverse the company’s history not as a linear list of dates, but as a study in strategic adaptation. We will explore how a missed deer in the 1940s led to the invention of nitrogen purging, how a request from the U.S. Army in the 1980s birthed the modern tactical scope, and how the company is positioning itself today to survive the digital revolution. For the industry analyst, Leupold provides a case study in brand resilience, illustrating how a commitment to core values—when coupled with genuine innovation—can create a formidable competitive moat.

2. Origins and Early History: The Engineering of Measurement (1907–1940s)

The genesis of Leupold & Stevens is not found in the firearms industry, but in the precise and demanding world of civil engineering and hydrology. The company’s foundational years established a culture of mechanical precision that would later translate seamlessly into optical engineering. This era is often overlooked in casual histories, yet it provides the essential context for understanding why Leupold scopes are built the way they are.

2.1 The Surveying Era: Leupold & Voelpel (1907–1914)

In 1907, the seeds of the company were sown by Markus Friedrich (Fred) Leupold, a German immigrant who brought with him the Old World tradition of precision mechanics. Fred established a modest one-man repair shop for surveying equipment at 5th and Oak streets in Portland, Oregon. The choice of location was serendipitous. The Pacific Northwest at the turn of the century was a region of explosive growth and rugged infrastructure development. The timber industry was booming, railroads were carving paths through the Cascades, and cities were expanding into the wilderness. All of this activity required precise surveying.

Recognizing the need for capital and trusted partnership to meet this growing demand, Fred was joined by his brother-in-law, Adam Voelpel, later that same year.1 The firm, initially christened “Leupold & Voelpel,” focused exclusively on the repair and manufacture of surveying transits and levels. The competitive advantage of the young firm was rooted in quality. Surveyors in the region quickly learned that instruments repaired by Leupold & Voelpel often returned to the field with tighter tolerances and smoother mechanics than when they were brand new from the factory. This commitment to a “square deal”—a foundational value attributed to Fred Leupold—laid the groundwork for the brand’s future legendary customer loyalty.3 The ethos was simple: the customer is entitled to a product that works, and if it doesn’t, the manufacturer must make it right.

2.2 The Stevens Partnership and the Hydrographic Shift (1914–1940)

A pivotal moment in the company’s history—one that arguably saved it from remaining a niche repair shop—occurred in 1911. J.C. Stevens, a prominent hydrologist and engineer, approached the firm with a specific engineering challenge. Stevens had invented a revolutionary water level recorder, a device essential for monitoring stream flows for the burgeoning hydroelectric power generation and irrigation projects of the West.1 However, the existing mechanisms available on the market were unreliable, fragile, and prone to failure in the pervasive dampness and harsh conditions of the Oregon wilderness.

Stevens needed a partner who could manufacture his invention to standards that could withstand the elements. Recognizing the commercial potential of Stevens’ design and the synergy with their own manufacturing capabilities, Leupold & Voelpel began manufacturing the device. The partnership was so successful that it was formalized in 1914, and J.C. Stevens was made a partner. The company was subsequently renamed “Leupold, Voelpel, and Co.”.4

The interwar years saw the company solidify its reputation in the field of hydrography. By 1938, the company introduced the “Telemark,” a sophisticated device invented by Stevens that could transmit water level data over telephone lines.1 This was a technological leap, allowing for remote monitoring of critical water resources without the need for constant human presence.

Strategic Insight: This era is critical to understanding the modern Leupold optic. The engineering constraints of water monitoring equipment are severe. These instruments are required to function autonomously in remote, wet, freezing, and humid environments for months at a time without maintenance. This necessity instilled a “durability first” engineering philosophy within the company culture. When Leupold eventually pivoted to riflescopes, their engineers did not approach them as delicate glass instruments to be pampered, but as rugged field tools akin to their water recorders—devices that must perform or be ignored. This “hydrographic DNA” is the hidden variable in Leupold’s success equation.

2.3 The Catalyst: The Legend of the Missed Buck (1940s)

The transition from surveying tools and water recorders to sporting optics is enshrined in company lore, centering on Marcus Leupold, the son of founder Fred Leupold. By the 1940s, the founding generation had passed—Adam Voelpel died in 1940 and Fred Leupold in 1944—leaving the company in the hands of the second generation, including Marcus and Norbert Leupold.1

As the story is recorded in company archives, Marcus was an avid sportsman who spent his leisure time hunting the black-tailed deer of the Oregon coastal ranges. During a hunt in the 1940s, Marcus spotted a trophy buck. He raised his rifle, only to find that his telescopic sight had fogged up internally due to condensation, rendering the shot impossible.5 The buck escaped, but the failure of the equipment sparked a revelation.

At the time, the riflescope market was dominated by European imports (offering excellent glass but poor weather sealing) or American commercial scopes that were essentially unsealed tubes. In the high-humidity, high-precipitation environment of the Pacific Northwest, internal fogging was a common, almost accepted failure mode. Frustrated by the equipment failure, Marcus reportedly exclaimed to his hunting party, “Hell! I could build a better scope than this!”.3

This moment of frustration catalyzed a radical shift in corporate strategy. Marcus realized that the company’s expertise in sealing water recorders against moisture could be directly applied to optical tubes. This was not merely a business opportunity; it was a personal mission to solve a problem that plagued hunters. By 1942, the company had changed its name to “Leupold & Stevens, Inc.,” reflecting the enduring partnership and the new direction under the new management.2 The stage was set for a revolution in sporting optics.

3. The Golden Age of Innovation: The Nitrogen Era (1947–1990s)

The post-World War II era marked the true beginning of Leupold as an optics manufacturer. The American economy was booming, and millions of GIs were returning home with a newfound appreciation for optical equipment and a desire to spend time in the outdoors. This period was characterized by a series of technological firsts that not only established Leupold’s market share but fundamentally altered the design standards of the entire global optics industry.

3.1 The Plainsman and the Nitrogen Revolution (1947)

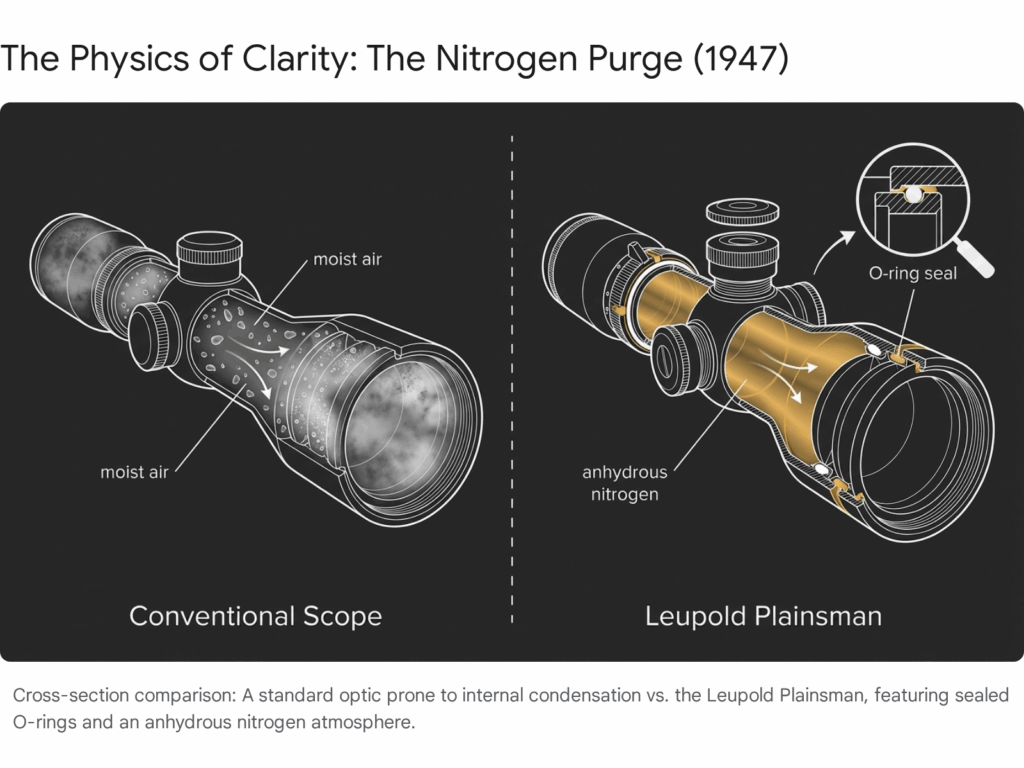

In 1947, Leupold introduced the “Plainsman,” the first riflescope designed and built entirely by the company. It was a revolutionary product, not necessarily for its magnification or optical clarity alone, but for its internal atmosphere. Marcus Leupold applied a technique borrowed from the Merchant Marines, who used dry gas to keep optics clear on ships: purging the humid air from the scope’s interior and replacing it with anhydrous (dry) nitrogen.5

The engineering process involved evacuating the air from the scope tube and refilling it with nitrogen, which contains no moisture. This created a positive pressure environment inside the tube that was impervious to temperature fluctuations. When a hunter moved from a warm cabin to freezing outdoors, or hiked through the damp Oregon rainforest, there was no moisture inside the tube to condense on the lenses. The Plainsman was marketed as the first truly fog-proof scope built by Americans.5

Market Impact Analysis: The introduction of nitrogen purging was a disruptive innovation in the truest sense. It rendered the competition’s products functionally obsolete in practical field conditions. While European optics (often referred to as “German glass”) were renowned for their superior light transmission and resolution, they were often fragile and susceptible to moisture intrusion. Leupold carved a massive niche by offering “rugged reliability”—a value proposition that resonated deeply with the American hunter who often hunted alone, far from support, and required equipment that could survive a fall or a rainstorm. The Plainsman shifted the consumer’s hierarchy of needs from “clarity at all costs” to “reliability above all.”

3.2 The Duplex Reticle: Standardization of Aim (1962)

Perhaps no single innovation in the history of sporting optics is as ubiquitous—and as frequently copied—as the Duplex reticle, invented by Leupold in 1962.5 Prior to this invention, riflescopes typically employed one of two reticle types: fine crosshairs or heavy posts.

- Fine Crosshairs: These offered excellent precision for target shooting but were notoriously difficult to see in low-light conditions or against a dark background, such as a bear in thick brush.

- Heavy Posts: These were easy to see in poor light but obscured a significant portion of the target, making precise shot placement at longer ranges difficult.

The Duplex design was a stroke of user interface genius. It combined both elements: heavy outer posts that boldly guided the eye to the center of the field of view, transitioning to fine inner crosshairs for precision aiming at the exact point of impact. This design allowed for rapid target acquisition in thick cover while maintaining the ability to place a precise shot at distance.

Industry Consequence: The Duplex reticle became the de facto industry standard. Today, nearly every scope manufacturer on the planet produces a variation of this design. It was a perfect synthesis of form and function, addressing the two most common complaints of hunters: losing the reticle in low light and covering the target with the reticle at long range. Leupold’s ability to identify this user friction and solve it with a simple, elegant visual design demonstrated their deepening understanding of the shooter’s experience.

3.3 The “Golden Ring” and Brand Identity (1964)

In 1964, Leupold began placing a distinct gold ring around the objective bell of its scopes.6 Initially a design flourish to distinguish their products on crowded gun racks, this ring became a powerful trademark symbolizing the company’s “Full Lifetime Guarantee.”

Leupold’s warranty policy was as revolutionary as its nitrogen purging. The guarantee was simple, absolute, and transferrable: if a Leupold product breaks, the company will repair or replace it for free, forever, regardless of whether you are the original owner.9 This policy was not a marketing gimmick but a statement of manufacturing confidence. In an industry where optics were fragile and expensive, this guarantee effectively de-risked the purchase for consumers. It allowed Leupold to command a premium price point because the product was viewed as a lifetime investment rather than a disposable accessory. The “Gold Ring” became a status symbol in deer camps across America, signaling that the hunter took their equipment—and by extension, their sport—seriously.

3.4 Expansion of the Vari-X Line and Market Segmentation

Throughout the 1960s and 70s, Leupold refined the variable power riflescope, moving the market away from fixed-power optics. The introduction of the Vari-X II in 1963 (and its production until 1992) set the benchmark for reliability.10 The Vari-X II became the “Ford F-150” of riflescopes—ubiquitous, reliable, effective, and accessible to the average deer hunter. It offered variable magnification (typically 3-9x), which gave hunters the versatility to shoot close in brush or reach out across a canyon.

The 1970s saw the introduction of the Vari-X III, which offered improved lens coatings and adjustments, catering to the growing market of long-range hunters and varmint shooters who demanded higher performance.12 By 1978, Leupold introduced the industry’s first line of compact riflescopes, acknowledging the trend toward lighter, shorter mountain rifles.5 This ability to segment the market—offering a scope for every type of rifle and every type of hunt—was a key driver of their growth during the golden age of American hunting.

As the company grew, so did its physical footprint. In 1968, under the leadership of Norbert Leupold (who took over after Marcus resigned), the company moved its operations to a new, purpose-built manufacturing plant and headquarters in Beaverton, Oregon.2 This facility remains the company’s home today. The leadership transitions continued with Werner Wildauer becoming President and Chairman in 1983. Wildauer’s story is notable; he emigrated from Germany in 1958 after receiving a job offer from Marcus Leupold and worked his way up from a manufacturing technician to the top office.5 His ascent underscored a company culture that valued technical competence and internal promotion.

4. The Tactical Pivot: Military Dominance (1980s–2015)

While Leupold dominated the hunting market by the 1980s, the military sector was underserved. U.S. forces were still largely using modified commercial hunting scopes or outdated equipment that lacked the ruggedness required for modern warfare. Leupold’s entry into the tactical market was not a simple extension of their hunting line, but a ground-up reengineering effort that birthed the legendary Mark 4 and changed the face of military sniping.

4.1 The Ultra M3A and the Mark 4 Project

In the mid-1980s, the U.S. Army sought a new sniper weapon system to replace the aging M21. The requirements for the optic were grueling and unprecedented: it had to withstand the “violent” recoil of repeated firing, survive being dropped from aircraft (jump-proof), and remain waterproof at depths of 66 feet.13 The military needed an optic that was as tough as the rifle itself.

Leupold responded with the “Ultra” project. This resulted in the Ultra M3A 10x42mm fixed-power scope. Unlike hunting scopes which used wire reticles and 1-inch tubes, the Ultra used a glass-etched reticle (Mil-Dot) and a thick-walled 30mm maintube tailored for extreme durability and increased elevation adjustment travel.13 The 30mm tube was a significant departure from American standards, aligning more with European tactical designs, and it allowed for greater structural integrity.

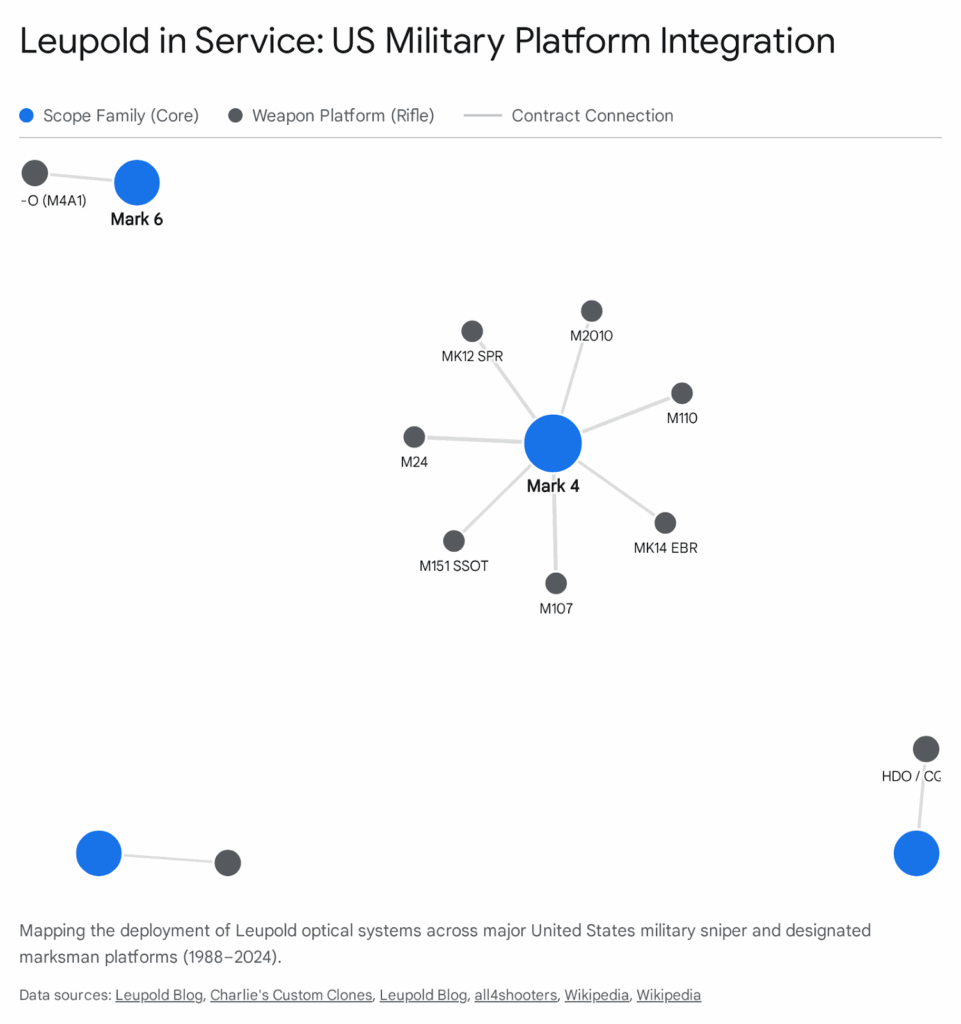

Milestone: In 1988, the U.S. Army officially adopted the Remington Model 700-based M24 Sniper Weapon System (SWS), topped with the Leupold Ultra M3A.13 This contract was a watershed moment. It validated Leupold not just as a consumer brand, but as a serious defense contractor capable of meeting and exceeding Mil-Spec standards.

4.2 Dominating the Global War on Terror (2001–2015)

The conflicts in Iraq and Afghanistan created an unprecedented demand for precision optics. Leupold’s presence on the battlefield expanded rapidly as the nature of engagement shifted toward long-range precision fire to minimize collateral damage and engage insurgents at standoff distances.

- M107 Long Range Sniper Rifle (.50 Cal): In 1989, Leupold began supplying the Mark 4 LR/T 4.5-14x50mm for the Barrett M82/M107 systems. The scope had to withstand the massive recoil impulse of the.50 BMG cartridge, a testament to the “Ultra” design lineage.13

- Mk 12 Special Purpose Rifle (SPR): In 2002, the Mark 4 MR/T (Mid-Range Tactical) 2.5-8x36mm (specifically the TS-30 A2) was adopted for the Mk 12 SPR. This rifle was designed for Navy SEALs and Special Forces to bridge the gap between a standard infantry carbine and a dedicated sniper rifle. The optic had to be versatile, compact, and extremely rugged.15

- M110 Semi-Automatic Sniper System (SASS): In 2008, the Army replaced the M24 with the semi-automatic M110, selecting the Leupold Mark 4 LR/T 3.5-10x40mm. This contract solidified Leupold’s ubiquity across Army sniper teams.13

Brand Synergy Analysis: During this period, the “Mark 4” brand became synonymous with military sniping. Leupold effectively leveraged this combat pedigree to sell premium optics to the civilian market. The “tactical” consumer segment exploded in the mid-2000s, driven by shooters who wanted the same gear used by the military. Leupold capitalized on this by offering civilian versions of the Mark 4, creating a high-margin revenue stream that complemented their hunting business.

4.3 The ECOS-O and Marine Corps Contracts

Leupold continued to innovate with the Mark 6 and Mark 8 lines, pushing the boundaries of zoom ratios. The Mark 6 3-18x44mm was selected for the Enhanced Combat Optical Sight-Optimized (ECOS-O) program, utilized by US Navy, Air Force, and Marine Corps units.17 This optic represented a leap in “power density”—providing a massive 6x zoom ratio in a remarkably compact package (less than 12 inches long), essential for carbines where rail space is at a premium.

However, the military market is fiercely competitive and zero-sum. In 2020, the US Marine Corps selected Trijicon for the massive Squad Common Optic (SCO) contract, replacing the Trijicon ACOG with a 1-8x Variable Combat Optical Gunsight (VCOG).19 This was a notable loss for Leupold, signaling the intense competition in the Low Power Variable Optic (LPVO) space, where other players like Sig Sauer and Vortex were also making significant inroads.

5. Modern Product Portfolio and Technology Stack (2010–Present)

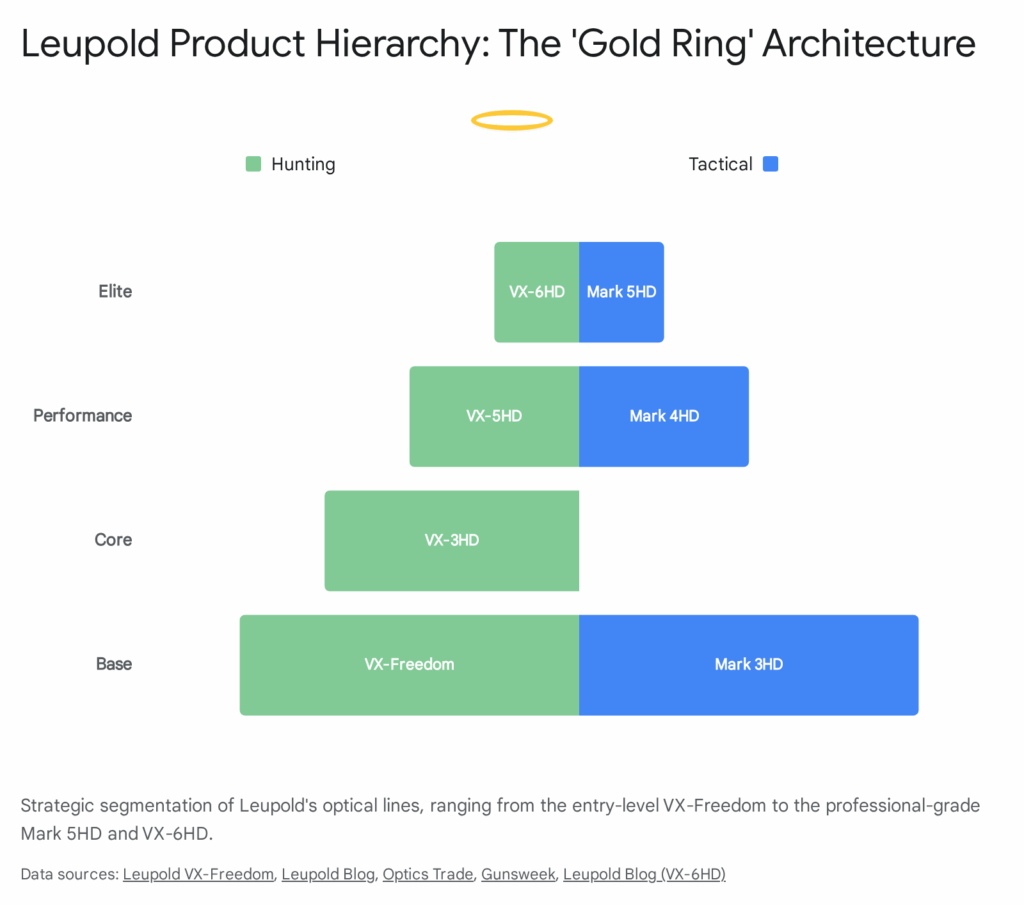

Leupold’s current portfolio is structured to capture every segment of the optics market, from the budget-conscious hunter to the elite Tier 1 operator. This segmentation is managed through distinct product families, primarily the VX (Variable-X) series for hunting and the Mark series for tactical use. The strategy is clear: provide an entry point for every shooter, and then upsell them on features and glass quality.

5.1 The VX Series: Hunting Dominance

The VX line is the direct descendant of the Vari-X scopes of the 20th century. Leupold has tiered this line to offer clear “good, better, best” options, creating a ladder of upgrades for the consumer:

- VX-Freedom: Replacing the legacy VX-1 and VX-2 lines, this is the entry-level offering. It maintains the “Gold Ring” guarantee and American assembly but utilizes simpler lens systems and fewer distinct features to keep costs down.21 It is designed to capture the first-time buyer.

- VX-3HD: The spiritual successor to the legendary VX-III. It occupies the “sweet spot” for serious hunters, featuring high-definition (HD) glass, the Custom Dial System (CDS), and illuminated reticles. It is arguably the core volume driver for the company, balancing performance with affordability.12

- VX-5HD & VX-6HD: These are premium lines featuring 5x and 6x zoom ratios, respectively. The VX-6HD includes advanced features like an in-scope electronic reticle level (to prevent canting), motion sensor technology (MST) for illumination battery conservation, and alumina flip-back covers. These scopes compete directly with high-end European optics from Swarovski, Zeiss, and Leica, offering similar optical performance at a more competitive price point and with better warranty support.23

Technological Differentiator: The Custom Dial System (CDS)

A key innovation in the hunting line is the CDS. Leupold allows customers to order a custom laser-marked elevation dial matched to their specific ballistics (caliber, bullet weight, velocity, altitude, temperature). This simplifies long-range shooting for hunters, removing the need for complex holdover calculations or DOPE charts. It turns a complex physics problem into a simple “range and dial” solution.25 This feature creates a sticky ecosystem; once a hunter is accustomed to dialing for distance with a CDS turret, they are less likely to switch to a competitor that requires learning a new system.

5.2 The Mark Series: Tactical Precision

- Mark 3HD: The entry point for tactical shooters, offering Mil-based adjustments and reticles at a consumer-friendly price.

- Mark 4HD: A newly revitalized line bridging the gap between the 3HD and 5HD, bringing back the legendary “Mark 4” name with modern internals.

- Mark 5HD: The flagship tactical optic and a current industry darling. Its 35mm maintube (a unique size in the industry) allows for massive elevation travel, essential for Extreme Long Range (ELR) shooting. It is lighter than competing scopes in its class (like the Vortex Razor Gen II), addressing the “ounces equal pounds” philosophy of military end-users who are already overburdened with gear.26 The “ZeroLock” dial prevents accidental adjustments while allowing for rapid dialing.

5.3 Electronic Optics and Thermal Diversification

Recognizing the limits of traditional glass, Leupold has expanded into electronics, although with a specific strategic focus:

- DeltaPoint Pro: Leupold is a dominant player in the pistol red dot market. The DeltaPoint Pro’s ruggedness led to its adoption by the US Army for the M17 Modular Handgun System (as a potential accessory) and widespread use in law enforcement. However, competition from Holosun (on price) and Trijicon (on RMR durability) is fierce.28

- LTO Tracker: Leupold entered the thermal market not with a weapon sight (initially), but with a handheld tracker. This strategic choice avoided ITAR (International Traffic in Arms Regulations) complications and export restrictions associated with thermal weapon sights, allowing mass market retail sales to hunters for game recovery. It allowed Leupold to dip a toe into thermal technology without the massive regulatory burden of weapon-mounted systems.29

5.4 Performance Eyewear

In 2020, Leupold launched a line of performance eyewear (sunglasses). While seemingly a diversion, this utilizes their core competency—lens coatings and clarity—to capture “lifestyle” spend. The glasses are ballistic rated (ANSI Z87.1), appealing to the shooter demographic who wants eye protection that looks like casual wear. This diversification helps smooth out revenue cycles, as eyewear is a lower-cost, higher-frequency purchase than a $2,000 riflescope.31

6. Manufacturing Operations and Corporate Strategy

In an era of globalized supply chains where “Made in China” or “Made in Philippines” is the norm for optics, Leupold’s adherence to domestic manufacturing is its most defining operational characteristic. This commitment is not merely patriotic sentimentality; it is a calculated strategic defense mechanism.

6.1 The Beaverton Fortress and the Berry Amendment

Leupold’s headquarters and manufacturing facility are located in Beaverton, Oregon. The company employs approximately 700 people.15 Unlike competitors who design in the US and manufacture in Asia, Leupold machines its maintubes and assembles its Gold Ring scopes onsite.

This vertical integration provides two critical advantages:

- Operational Agility: Leupold can pivot production lines rapidly to address defects or shifting demand without waiting for shipping containers to cross the Pacific. If a quality issue is detected, it can be solved on the factory floor in hours, not months.

- Berry Amendment Compliance: U.S. law requires the Department of Defense to give preference to domestically produced products for certain procurement categories. By manufacturing in Oregon, Leupold is often the default choice for military contracts that require 100% US content or substantial domestic transformation.33 This regulatory “moat” protects them from cheaper foreign competitors in the defense sector.

6.2 Supply Chain Challenges and Expansion

The COVID-19 pandemic and the subsequent surge in outdoor recreation demand (2020-2022) stressed Leupold’s capacity to the breaking point. The “Custom Shop,” a beloved service allowing customers to retrofit reticles and turrets, was closed indefinitely to focus all resources on standard production.34 This indicates a company operating at maximum capacity, forced to prioritize volume over bespoke services to meet market demand.

To address this bottleneck, Leupold broke ground on a new distribution center on its Beaverton campus in 2021.35 This expansion aims to streamline logistics and, crucially, free up floor space in the main factory for increased manufacturing capacity. The hiring of Rob Nees as VP of Manufacturing and Global Supply Chain underscores a focus on modernizing their operational efficiency and implementing Lean manufacturing principles to squeeze more output from their domestic footprint.36 Furthermore, the acquisition of Anodize Solutions—a long-time vendor—allowed Leupold to bring the critical anodizing process (the hard, protective coating on the aluminum tube) in-house, further securing their supply chain against external disruptions.37

6.3 Glass Sourcing Reality

It is a common misconception among consumers that Leupold “makes” its own glass. Like almost all high-end optics manufacturers, Leupold sources its raw glass and lens elements. The company is transparent that “there are no American manufacturers that can supply enough high quality lenses” to support their volume.38 Consequently, they source glass from Japan and other Asian partners who specialize in precision grinding and polishing. However, the design of the lens system, the engineering of the coatings, the machining of the housing, and the final assembly/purging occur in the USA. This distinction—”Assembled in USA” using some foreign components vs “Made in USA”—is crucial for legal labeling and managing consumer perception.

6.4 Executive Leadership and Regional Friction

The company remains family-owned, currently in its fifth generation.15 However, the appointment of Bruce Pettet as CEO (a non-family member with a background in consumer brands like Airwalk and Brooks Sports) marked a shift toward modern brand management.15 Pettet has pushed for a stronger digital presence, “lifestyle” branding (e.g., eyewear), and operational rigor. The tension between family stewardship (conservative, long-term legacy focus) and private equity-style growth (aggressive, quarterly results) will define the boardroom dynamic in the coming years.

Leupold also operates in the Portland metro area, a region that has become politically polarized. In 2019, the Portland Trail Blazers ended their partnership with Leupold due to political pressure regarding the company’s manufacturing of sniper scopes for the military and their potential use in crowd control contexts abroad.41 This cultural friction poses a talent acquisition and public relations challenge for a firearms-adjacent company operating in a progressive political stronghold.

7. The Future of Fire Control: 2025 and Beyond

As Leupold moves toward 2030, it faces a technological crossroads. The era of purely passive glass optics is waning in the military sector, replaced by “Smart Optics” that integrate ballistics, environmental sensors, and augmented reality.

7.1 The Digital Threat: The NGSW Loss

The most significant strategic signal for Leupold’s future is the loss of the Next Generation Squad Weapon-Fire Control (NGSW-FC) contract. Leupold partnered with defense giant L3Harris to offer a solution, but the contract—potentially worth $2.7 billion—was awarded to Vortex Optics (via its subsidiary Sheltered Wings).42

The Vortex XM157 is a “computer on a gun,” featuring a variable magnification optic, laser rangefinder, ballistic calculator, atmospheric sensors, and active display overlay. Leupold’s loss here suggests that while they are the masters of mechanical optics, they may lag in the rapid integration of advanced digital systems required for the next generation of infantry combat.

Strategic Implication: Leupold must decide whether to invest heavily to catch up in the digital fire control space or to double down on its core competency: creating the world’s best passive optical systems for snipers and hunters, where battery reliance is a liability rather than an asset. The Mark 5HD’s selection for the PSR proves there is still a massive market for high-end glass, but the “big money” future contracts are clearly digital.

7.2 The “Smart Scope” Pivot

Recent patents indicate Leupold is not ignoring the digital trend. Patents for “Firearm optic with locking feature” and various digital integrations suggest R&D is active.44 The LTO Tracker thermal line was a safe experiment, but the future will likely require a “smart” hunting scope that integrates the CDS logic electronically—perhaps an optic that projects the aim point based on a laser rangefinder reading (similar to the Burris Eliminator or Sig Sauer BDX) but with Leupold’s superior glass quality.

7.3 The PSR Win: A Foundation for the Future

Despite the SCO loss, Leupold achieved a massive victory in 2020 by winning the optic contract for the U.S. Army’s Precision Sniper Rifle (PSR) program. The Army selected the Leupold Mark 5HD 5-25x56mm to pair with the MK22 Mod 0 (Barrett MRAD).46

The selection of the Mark 5HD was significant for several reasons:

- Commercial Off-The-Shelf (COTS) Origins: The Mark 5HD was originally developed for the civilian precision rifle market (PRS/NRL competitions). Its adoption by the military demonstrates how civilian competitive shooting is now driving military innovation, rather than the reverse.

- Mechanical Excellence: The Mark 5HD features the “ZeroLock” dial and huge elevation travel, necessary for the extreme ranges of the.300 and.338 Norma Magnum cartridges used by the PSR.

- Color: The contract specified a proprietary “Flat Dark Earth” (FDE) coating, moving away from the traditional anodized black, showing Leupold’s willingness to adapt aesthetic processes for specific contracts.48

8. Summary of Major Milestones

The following table chronicles the defining moments in Leupold & Stevens’ history, illustrating the march from hydrography to optical dominance.

| Year | Milestone | Significance |

| 1907 | Founding | Fred Leupold sets up a one-man survey repair shop in Portland, OR. |

| 1914 | Stevens Partnership | J.C. Stevens joins; company focuses on water level recorders. |

| 1942 | Name Change | Officially becomes Leupold & Stevens, Inc. |

| 1947 | The Plainsman | First Leupold riflescope. Introduces nitrogen purging, creating the first fog-proof scope. |

| 1949 | Incorporation | Leupold & Stevens incorporates, solidifying its business structure. |

| 1962 | Duplex Reticle | Invention of the Duplex reticle, which becomes the global standard for aiming points. |

| 1964 | Golden Ring | Introduction of the Gold Ring trademark to signify the Lifetime Guarantee. |

| 1968 | Beaverton Move | Relocation to the current manufacturing campus in Beaverton, Oregon. |

| 1978 | Compact Scopes | Launch of the industry’s first line of compact riflescopes. |

| 1988 | M24 Contract | US Army adopts the M24 SWS with the Leupold Ultra M3A scope. Entry into major defense contracts. |

| 1992 | Vari-X III | Launch of the Vari-X III, setting a new standard for hunting variables. |

| 2002 | Mk 12 SPR | Adoption of the Mark 4 MR/T for the Special Purpose Rifle. |

| 2008 | M110 SASS | US Army adopts Leupold Mark 4 for the M110 Semi-Automatic Sniper System. |

| 2014 | Bruce Pettet CEO | Appointment of non-family CEO to modernize the brand and operations. |

| 2016 | LTO Tracker | Entry into the thermal optics market with a handheld device. |

| 2017 | VX-HD Series | Launch of VX-5HD and VX-6HD, pushing high-definition glass and 6x zoom ratios. |

| 2018 | Mark 5HD | Launch of the Mark 5HD, a ground-up redesign for long-range precision. |

| 2020 | PSR Contract | US Army selects Mark 5HD for the Precision Sniper Rifle (MK22). |

| 2020 | Eyewear Launch | Diversification into ballistic-rated performance sunglasses. |

| 2021 | Expansion | Groundbreaking on a new distribution center in Beaverton. |

| 2022 | NGSW Loss | Competitor Vortex wins the Army NGSW-FC contract; Leupold/L3Harris bid fails. |

| 2025 | Gen 2 Launch | Introduction of VX-6HD Gen 2 and continued Mark 4HD rollout.49 |

Conclusion

Leupold & Stevens remains a singular force in the American firearms industry. Its journey from measuring river levels to guiding precision rifle fire is united by a common thread: the relentless pursuit of reliability in unforgiving environments. The company has successfully leveraged its heritage to build a brand that commands loyalty in the deer woods and respect on the battlefield.

However, the “Golden Ring” now faces a digital horizon. The loss of the NGSW contract is a warning shot, signaling that mechanical perfection alone may not suffice in the battlespace of tomorrow. To maintain its dominance through the 21st century, Leupold must execute a difficult balancing act: preserving the mechanical soul that built the company while daring to integrate the silicon brain that the future demands. For the firearms industry analyst, Leupold remains a “Strong Buy” for its dominant civil business and entrenched PSR position, but a “Watch” regarding its long-term digital strategy.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Leupold Optics History: Founding, Timeline, and Milestones – Zippia, accessed December 21, 2025, https://www.zippia.com/leupold-stevens-careers-29434/history/

- History of Leupold & Stevens, Inc. – FundingUniverse, accessed December 21, 2025, https://www.fundinguniverse.com/company-histories/leupold-stevens-inc-history/

- The Story of the Foggy Scope, the Missed Deer, and the Beginning of a Legendary Optics Brand – Wide Open Spaces, accessed December 21, 2025, https://www.wideopenspaces.com/the-story-of-the-foggy-scope-the-missed-deer-and-the-beginning-of-a-legendary-optics-brand/

- 10 Things You Didn’t Know About Leupold | An Official Journal Of The NRA, accessed December 21, 2025, https://www.americanhunter.org/content/10-things-you-didn-t-know-about-leupold/

- A Living History of Leupold & Stevens, Inc, accessed December 21, 2025, https://www.leupold.com/a-living-history

- The Story of Leupold: A Foundation in Focus – The Armory Life, accessed December 21, 2025, https://www.thearmorylife.com/the-story-of-leupold-a-foundation-in-focus/

- Selecting A Reticle | Leupold, accessed December 21, 2025, https://www.leupold.com/blog/post/selecting-a-reticle

- DUPLEX RETICLE – Leupold, accessed December 21, 2025, https://cdnp.leupold.com/content/documents/73686_duplex_reticle_spec_sheet-all.pdf

- Counterfeit Warning – Leupold, accessed December 21, 2025, https://www.leupold.com/counterfeit-warning

- Leupold VX-2 Riflescopes | An Official Journal Of The NRA, accessed December 21, 2025, https://www.americanrifleman.org/content/leupold-vx-2-riflescopes/

- accessed December 21, 2025, https://nchuntandfish.com/forums/index.php?threads/older-vari-x-ii.21631/#:~:text=The%20Vari%2DX%20II%20was,a%20very%20high%20quality%20scope.

- 50 Years of 3 Series Leupold Gold Ring Scopes: A Legacy of Precision – Viking Arms, accessed December 21, 2025, https://www.vikingshoot.com/50-years-of-3-series-leupold-gold-ring-scopes-a-legacy-of-precision/

- Honoring the Mark 4’s Legendary Military Service – Leupold, accessed December 21, 2025, https://www.leupold.com/blog/post/30-years-of-service

- M24 Sniper Weapon System – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/M24_Sniper_Weapon_System

- Leupold & Stevens – Wikipedia, accessed December 21, 2025, https://en.wikipedia.org/wiki/Leupold_%26_Stevens

- Leupold Mark 4 LR/T 3.5-10×40 M2 Illum TMR FDE/ Dark Earth M110 scope GOV model, accessed December 21, 2025, https://charliescustomclones.com/leupold-mark-4-lr-t-3-5-10×40-m2-illum-tmr-fde-dark-earth-m110-scope-gov-model/

- Embracing the American Spirit – Leupold, accessed December 21, 2025, https://www.leupold.com/blog/post/american-manufacturing-heritage

- Leupold Mark 6 3-18x44mm Wins Again With FBI Contract | Soldier Systems Daily, accessed December 21, 2025, https://soldiersystems.net/2014/08/26/leupold-mark-6-3-18x44mm-wins-fbi-contract/

- MCSC awards contract to produce the Squad Common Optic, accessed December 21, 2025, https://www.marcorsyscom.marines.mil/News/News-Article-Display/Article/2091999/mcsc-awards-contract-to-produce-the-squad-common-optic/

- Marines select a brand new rifle optic with $64M contract, accessed December 21, 2025, https://www.marinecorpstimes.com/news/your-marine-corps/2020/02/28/marines-select-a-brand-new-rifle-optic-with-64m-contract/

- VX-Freedom Rifle Scopes | Leupold, accessed December 21, 2025, https://www.leupold.com/shop/riflescopes/series/vx-freedom-rifle-scopes

- Leupold Announces Launch of VX-3HD Line of Riflescopes, accessed December 21, 2025, https://www.leupold.com/blog/post/leupold-announces-launch-of-vx-3hd-line-of-riflescopes

- VX-5HD and VX-6HD: Leupold’s mid-year introductions | GUNSweek.com, accessed December 21, 2025, https://gunsweek.com/en/optics/news/vx-5hd-and-vx-6hd-leupolds-mid-year-introductions

- VX-6HD: Elite Leupold Performance, accessed December 21, 2025, https://www.leupold.com/blog/post/vx-6hd-elite-leupold-performance

- PRODUCT CATALOG 2024 ENGLISH – Leupold, accessed December 21, 2025, https://www.leupold.com/media/EN_2024_Leupold_International_Catalog-Web.pdf

- Leupold Mark 5HD 5-25×56 MIL Riflescope Review – Optics Trade, accessed December 21, 2025, https://www.optics-trade.eu/blog/leupold-mark-5hd-5-25×56-mil-riflescope-review-optics-trade-reviews/

- Leupold Mark 5HD, By Caylen Wojcik – Journal of Mountain Hunting, accessed December 21, 2025, https://journalofmountainhunting.com/leupold-mark-5hd-by-caylen-wojcik/

- DeltaPoint Pro – Leupold, accessed December 21, 2025, https://www.leupold.com/deltapoint-pro-red-dot

- Tracker Thermal Optic – Leupold, accessed December 21, 2025, https://www.leupold.com/shop/thermals/series/tracker

- Leupold® LTO Tracker Thermal Sight a Vital Tool for Any Hunter, accessed December 21, 2025, https://www.leupold.com/blog/post/leupold-lto-tracker-thermal-sight-a-vital-tool-for-any-hunter

- Introducing Performance Eyewear – Leupold, accessed December 21, 2025, https://www.leupold.com/blog/post/introducing-performance-eyewear

- RMEF Media A New Era of Relentless Performance Arrives: Leupold Performance Eyewear Now Available for Purchase, accessed December 21, 2025, https://www.rmef.org/elk-network/a-new-era-of-relentless-performance-arrives-leupold-performance-eyewear-now-available-for-purchase/

- The Military’s Leupold Riflescopes | An Official Journal Of The NRA – American Rifleman, accessed December 21, 2025, https://www.americanrifleman.org/content/the-military-s-leupold-riflescopes/

- Custom Shop | Leupold, accessed December 21, 2025, https://www.leupold.com/custom-shop

- Leupold Breaks Ground on New Product Distribution Center, accessed December 21, 2025, https://www.leupold.com/blog/post/leupold-to-break-ground-on-new-product-distribution-center

- Leupold Chooses Rob Nees To Lead Manufacturing | SGB Media Online, accessed December 21, 2025, https://sgbonline.com/leupold-chooses-rob-nees-to-lead-manufacturing/

- Leupold Acquires Anodize Solutions | An Official Journal Of The NRA – American Rifleman, accessed December 21, 2025, https://www.americanrifleman.org/content/leupold-acquires-anodize-solutions/

- FAQS – Leupold, accessed December 21, 2025, https://www.leupold.com/faq

- Leupold & Stevens, Inc: Five Generations of Governance | Family Business Resource Center | Davis Wright Tremaine, accessed December 21, 2025, https://www.dwt.com/blogs/family-business-resource-center/2017/01/leupold–stevens-inc-five-generations-of-governanc

- Family Business CEOs to Watch 2020, accessed December 21, 2025, https://familybusinessmagazine.com/ownership/advisers-consultants/family-business-ceos-watch-2020/

- Portland Trail Blazers Announce the End of Its Partnership with Military Contractor Leupold & Stevens – Willamette Week, accessed December 21, 2025, https://www.wweek.com/sports/2019/09/30/portland-trail-blazers-announce-the-team-has-ended-its-partnership-with-military-contractor-leupold-stevens/

- U.S. Army Selected Vortex To Provide Its Next Generation Squad Weapon – Fire Control Optic (XM157) – CORE Survival, accessed December 21, 2025, https://www.coresurvival.com/core-news/us-army-selected-vortex-to-provide-its-next-generation-squad-weapon-fire-control-optic-xm157

- Vortex Win US Army Next Generation Squad Weapons – Fire Control Contract, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2022/01/07/vortex-win-us-army-next-generation-squad-weapons-fire-control-contract/

- Lens Cover, Scope Hood, Or Shade Patents and Patent Applications (Class 42/129), accessed December 21, 2025, https://patents.justia.com/patents-by-us-classification/42/129

- US10337830B2 – Portable optical device with interactive wireless remote capability – Google Patents, accessed December 21, 2025, https://patents.google.com/patent/US10337830B2

- Leupold Mark 5HD Selected by Army Precision Sniper Rifle Program – The Firearm Blog, accessed December 21, 2025, https://www.thefirearmblog.com/blog/2020/03/11/leupold-mark-5hd-army-psr/

- Leupold Mark 5HD – New Precision Sniper Rifle (PSR) scope of the US Army | all4shooters, accessed December 21, 2025, https://www.all4shooters.com/en/shooting/pro-zone/leupold-mark-5hd-new-precision-sniper-rifle-psr-scope-of-the-us-army-army/

- Army Precision Sniper Rifle Program Chooses Leupold Mark 5HD as Day Optic | RECOIL, accessed December 21, 2025, https://www.recoilweb.com/army-precision-sniper-rifle-program-chooses-leupold-mark-5hd-as-day-optic-158699.html

- CONSUMER GUIDE 2025 – Leupold, accessed December 21, 2025, https://www.leupold.com/media/2025_Consumer_Guide_Low_Res.pdf