The small arms industry, historically characterized by incremental innovation and conservative manufacturing philosophies, is at an inflection point. The confluence of persistent pressure from military modernization programs and the proven, transformative results of Artificial Intelligence (AI) in adjacent high-stakes industries like automotive and aerospace has created an environment where AI is no longer a theoretical advantage but a strategic imperative. This report provides a comprehensive analysis of how leading small arms manufacturers are beginning to leverage AI to accelerate and improve the design and production of their products. While public disclosures remain scarce due to the highly competitive and secretive nature of the defense sector, a clear trajectory can be established by analyzing the actions of industry pioneers, the powerful top-down drivers from military procurement, and the direct applicability of proven AI technologies from other advanced manufacturing sectors.

The analysis reveals that AI’s impact spans the entire product lifecycle. In the design phase, AI-driven generative design and advanced simulation are enabling the creation of components that are lighter, stronger, and more complex than what is achievable through traditional human-led processes. In the production phase, a suite of interconnected AI technologies—including digital twins, predictive maintenance, and computer vision for quality control—are converging to create the “Smart Factory,” an ecosystem optimized for maximum efficiency, near-zero defects, and unprecedented operational resilience.

While some manufacturers, notably Beretta, have been more public about their digital transformation, the strategic silence from other industry giants like SIG Sauer, Heckler & Koch, and FN Herstal should not be mistaken for inaction. The immense competitive advantages and the clear mandates from government clients, such as the U.S. Army’s initiative to modernize munitions manufacturing, suggest a “quiet arms race” in manufacturing technology is well underway. Companies that fail to make strategic investments in these capabilities risk being outmaneuvered, facing not only a loss of competitive advantage in the commercial market but also a diminished ability to meet the increasingly sophisticated demands of military contracts. This report details the specific AI applications, their proven impact, and the strategic calculus that will define the winners and losers in the next era of small arms manufacturing.

Table 1: AI Applications in Advanced Manufacturing and Their Potential Impact on the Small Arms Industry

| AI Technology | Core Function | Lead Industry & Case Study (Quantified Result) | Direct Small Arms Application/Example | Key Performance Impact |

| Generative Design | AI autonomously generates thousands of optimized design options based on engineering constraints (e.g., weight, material, stress loads).1 | Automotive (General Motors): Redesigned a seat bracket that was 40% lighter and 20% stronger by consolidating eight parts into one.3 | Lightweighting a rifle chassis or receiver; optimizing accessory mounts for maximum rigidity with minimum material. | Reduced material cost, improved weapon handling, enhanced performance, simplified supply chain. |

| Digital Twin | A high-fidelity, real-time virtual replica of a physical process or entire factory, used for simulation, monitoring, and optimization.5 | Automotive (Volkswagen): Used digital twins for real-time production monitoring, achieving a 20% decrease in downtime.7 | Simulating production line retooling for different weapon models; optimizing workflow between automated and manual assembly stations. | Maximized uptime, reduced changeover time, improved process efficiency, enhanced training. |

| Predictive Maintenance | AI analyzes sensor data (vibration, temperature) from machinery to forecast equipment failures before they occur.8 | Automotive (Ford): AI model predicts 22% of specific component failures 10 days in advance, saving an estimated 122,000 hours of downtime.10 | Beretta’s “SmartCow” project reduced maintenance intervention time from over 4 days to 30 minutes.11 | Minimized unplanned downtime, extended equipment lifespan, optimized maintenance schedules, increased production output. |

| Computer Vision QC | AI-powered cameras automate quality control inspections, detecting microscopic defects at superhuman speed and accuracy.12 | Automotive (OEM): AI system detects tiny defects in aluminum panels, saving up to $8 million annually in reduced waste and improved quality.14 | U.S. Army’s use of AI vision systems for automated, real-time defect detection in ammunition manufacturing.15 | Near-zero defect rates, improved product reliability and safety, reduced waste, enhanced brand reputation. |

Section 1: The Digital Blueprint: AI in Next-Generation Small Arms Design

Artificial Intelligence is fundamentally reshaping the process of invention and refinement in firearms engineering. The traditional, iterative cycle of human-led design, physical prototyping, and empirical testing is giving way to a new, collaborative model. In this emerging paradigm, the engineer’s role shifts from being the sole creator of a solution to being the architect of a problem definition, which AI then uses to explore a vast solution space, often generating designs that lie beyond the scope of human intuition. This digital-first approach is not merely accelerating the design process; it is unlocking new levels of performance, efficiency, and material innovation.

1.1. Generative Design: Beyond Human Intuition

The core concept of generative design represents a paradigm shift in engineering. It is an iterative design exploration process where engineers input a set of goals and constraints—such as load points, material properties, manufacturing methods, and weight targets—into an AI-driven software program.1 The software then autonomously generates, analyzes, and evolves hundreds or even thousands of design permutations, presenting the engineer with a range of optimized solutions that satisfy the predefined criteria.16 This moves the process away from a human incrementally modifying a known design to a human defining the performance envelope for the AI to populate with novel solutions.16

The most compelling proof-of-concept for this technology comes from the automotive industry, another sector where strength-to-weight ratios are a critical performance metric. In a landmark collaboration with Autodesk, General Motors applied generative design to a common but crucial component: a seat bracket, which secures seat belts and fastens the seat to the vehicle floor.3 The conventional part was a boxy assembly of eight distinct pieces welded together. By inputting the functional constraints into the generative design software, GM’s engineers were presented with over 150 alternative designs. The final chosen solution was an organic, almost alien-looking structure made from a single piece of stainless steel. The results were dramatic: the new, AI-generated bracket was 40% lighter and 20% stronger than the original multi-part assembly.3 This case study provides undeniable evidence of AI’s capacity to create non-intuitive geometries that outperform traditional, human-conceived designs, particularly when paired with modern manufacturing techniques.

The principles demonstrated by GM are directly applicable to the challenges of modern small arms design, where reducing weight and managing stress are paramount.

- Rifle Chassis and Receivers: A traditional rifle receiver, such as that on an HK417 battle rifle 18, is designed with the constraints of CNC machining in mind, resulting in relatively blocky structures milled from a solid billet of aluminum or steel. Applying generative design to this component could yield a skeletal, lattice-like structure that drastically reduces mass. The AI would intelligently distribute material only where it is needed to contain chamber pressure, manage recoil forces, and provide structural rigidity for mounting optics and accessories. The result would be a significant reduction in the overall weight of the weapon, directly impacting soldier load and improving handling characteristics without sacrificing strength.

- Accessory Mounts and Handguards: Components like scope mounts and forends are critical for accuracy, requiring maximum rigidity to prevent any shift in the point of impact. Generative design can optimize these parts to eliminate flex with the absolute minimum amount of material.17 Furthermore, the AI can integrate secondary features into a single, complex part. For example, a handguard could be designed with an integrated lattice that not only provides structural support but also acts as a highly efficient heat sink, drawing heat away from the barrel during sustained fire.

This approach is already being validated in other high-stress sectors. NASA’s Goddard Space Flight Center, using its “Evolved Structures” process, has leveraged generative design to achieve a greater than 3x improvement in structural performance (mass, stiffness, and strength) while simultaneously reducing development time and cost by a factor of more than ten.20 These are precisely the kinds of gains sought by military modernization efforts like the U.S. Army’s Next Generation Squad Weapons (NGSW) program, where SIG Sauer’s winning XM7 rifle and XM250 machine gun were selected in part for their advanced, lightweight designs.21

1.2. Accelerated R&D through AI-Powered Simulation

Beyond creating novel geometries, AI is also being used to dramatically accelerate the testing and validation phase of research and development. AI models, trained on vast datasets derived from thousands of past physical tests and computer simulations, can augment traditional Computer-Aided Engineering (CAE) and Finite Element Analysis (FEA) tools. These AI-enhanced systems can predict the performance of new designs, materials, and ammunition types with greater speed and fidelity than ever before, reducing the reliance on costly and time-consuming physical prototyping.22

The clearest industry leader in this domain is Beretta. The company, with a history spanning nearly 500 years, is actively embracing this digital future. Beretta publicly states that its R&D department relies on “advanced computerized design and simulation systems” and uses “mathematical calculation software…to build virtual prototypes and simulate the operating conditions of the firearm”.11 This capability is transformative; it allows their engineers to accurately predict the fatigue life and failure points of components under the stress of repeated firing without ever needing to manufacture a physical prototype or fire a single live round. This dramatically reduces the economic, logistical, and environmental burden associated with extensive live-fire testing.11

This AI-powered simulation capability has profound implications for the most complex aspects of firearms and ammunition development:

- Ballistics and Material Science: Machine learning algorithms are being applied to propellant research to formulate more efficient and powerful chemical compositions.22 In the realm of terminal ballistics, AI models can now learn from large experimental and simulated datasets to predict outcomes like projectile penetration, deformation, and fragmentation, reducing the need for repeated live-fire trials into ballistic gelatin or armor plate.24 This is invaluable for ammunition manufacturers seeking to develop next-generation rounds for military contracts. For firearms manufacturers like Heckler & Koch, which pioneered the use of advanced polymers in firearms like the VP70 and P9S 25, AI can simulate how new composite materials will behave under the extreme heat, pressure, and impact forces of the firing cycle, allowing them to innovate materials more rapidly.

- Digital Twins for Ammunition Design: The concept of the “digital twin,” which will be explored further in the context of manufacturing, is also being applied at the design stage. Ammunition developers can create a complete digital replica of a new cartridge design, allowing for extensive virtual testing of its aerodynamic properties, internal ballistics, and interaction with various firearm platforms before any physical components are ever produced.22

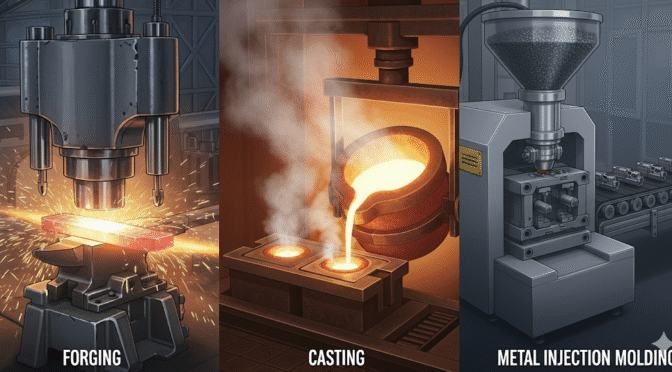

The fusion of generative design with additive manufacturing (3D printing) represents a critical symbiotic relationship. The organic, complex geometries that generative design algorithms produce to optimize strength-to-weight ratios are often difficult or impossible to create using traditional subtractive manufacturing methods like CNC milling, which excel at carving shapes out of solid blocks.16 Additive manufacturing, which builds parts layer-by-layer, is perfectly suited to realize these intricate internal lattices and optimized forms.16 Consequently, a small arms manufacturer cannot fully exploit the potential of generative design without a corresponding investment in advanced additive manufacturing capabilities. This reality has significant implications for capital expenditure strategies and the configuration of future supply chains.

Furthermore, the increasing accessibility of these advanced AI simulation and design tools is poised to alter the competitive dynamics of the industry. Historically, firearms R&D has been the domain of large, established firms like FN Herstal, Beretta, and Heckler & Koch, which possess the significant capital required for extensive physical prototyping, dedicated testing facilities, and materials science laboratories.26 However, as generative design and AI simulation platforms become more widely available as commercial off-the-shelf (COTS) software, often through cloud-based subscription models, the barrier to entry for complex design work is lowered.2 A small, agile startup can now run thousands of virtual ballistic simulations or generate hundreds of optimized chassis designs without the overhead of a multi-million-dollar manufacturing plant. This “democratization” of advanced design could foster a new wave of innovation from smaller entities, forcing legacy manufacturers to adapt, acquire these innovators, or risk being technologically outpaced. The primary competitive advantage may begin to shift from manufacturing scale to design agility.

Section 2: The Intelligent Factory: AI on the Small Arms Production Floor

Transitioning from the digital blueprint to the physical product, AI is catalyzing a second revolution on the factory floor. The traditional, often siloed, production line is evolving into an integrated, intelligent ecosystem. This “Smart Factory” leverages a network of sensors, real-time data, and machine learning algorithms to achieve unprecedented levels of efficiency, resilience, and precision. The core technologies driving this transformation—digital twins, predictive maintenance, and computer vision—are not standalone solutions but deeply interconnected systems that create a self-optimizing manufacturing environment.

2.1. The Digital Twin: Simulating the Entire Production Line

A digital twin is a high-fidelity, dynamic virtual replica of a physical asset, a specific manufacturing process, or an entire factory.5 This is not a static 3D model; it is a living simulation continuously updated with real-time data from a network of Internet of Things (IoT) sensors on the factory floor.7 This virtual environment allows manufacturers to monitor operations, simulate changes, predict outcomes, and optimize processes without disrupting physical production.31

The automotive industry has pioneered the large-scale implementation of this technology with demonstrable success. Volkswagen, by utilizing digital twins for real-time monitoring of its production lines, was able to achieve a 20% decrease in unplanned downtime.7 Similarly, General Motors leveraged the predictive analytics capabilities of its digital twins to improve quality control processes by 15%.7 These cases provide hard evidence that digital twins deliver substantial, measurable improvements in both operational efficiency and product quality.

The application of this technology to the complexities of small arms manufacturing offers significant advantages:

- Virtual Retooling and Line Optimization: Consider a manufacturer like FN Herstal, which produces a diverse portfolio of military weapons, including the SCAR, M249, and M240 machine gun, often in multiple calibers and configurations.27 Switching a production line from one model to another is a complex and time-consuming process. By using a digital twin of the factory, FN could simulate the entire retooling process in a virtual environment. They could optimize the new workflow, identify potential bottlenecks, pre-program robotic arms, and even train operators on the new procedures using augmented reality, all before a single physical machine is taken offline. This would drastically reduce changeover times and associated costs.34

- Process Flow Analysis: For a company like Beretta, which prides itself on a blend of modern automation and traditional, skilled craftsmanship 28, a digital twin can provide invaluable insights. It can model the complete journey of a firearm through the factory, tracking the flow of a CNC-machined slide, a polymer frame from an injection mold, and a hand-fitted barrel assembly. By analyzing this holistic view, the system can identify subtle inefficiencies in material handling, workstation layout, or the handoff between automated cells and human artisans, allowing for continuous process improvement.38

2.2. Predictive Maintenance: From Reactive Repairs to Proactive Readiness

Predictive Maintenance (PdM) represents a strategic evolution in asset management. It utilizes data from sensors monitoring key equipment parameters—such as vibration, temperature, pressure, and acoustic signatures—and applies AI algorithms to forecast potential failures before they occur.8 This marks a fundamental shift away from reactive maintenance (fixing equipment after it breaks) and scheduled preventative maintenance (performing service at fixed intervals, regardless of actual condition).8 Instead, PdM enables condition-based, truly predictive interventions, ensuring maintenance is performed precisely when needed.40

This is one area where the small arms industry has a clear, public-facing pioneer. Beretta’s “SmartCow” project is a tangible example of an in-house predictive maintenance system. The system employs a portable monitoring unit to analyze the actual condition of lubricating oils in their machinery. This allows maintenance to be scheduled based on real-world degradation rather than on statistical averages. The impact was immediate and significant, leading to a “remarkable reduction in intervention time (down from over 4 days to 30 minutes)” for certain tasks, improving efficiency and reducing consumable costs.11

The potential of PdM is even more starkly illustrated by a leading-edge program in the automotive sector. Ford, in collaboration with the AI firm Kortical, developed a system that analyzes real-time sensor data from its commercial vehicles. The resulting AI model can now predict 22% of specific fuel injection equipment failures an average of 10 days in advance, with an impressively low 2.5% false positive rate. This capability is estimated to save customers over 122,000 hours of vehicle downtime annually.10

The small arms industry is heavily reliant on high-precision, often high-maintenance, equipment like multi-axis CNC machines for milling critical components like slides, receivers, and barrels.41 Unplanned downtime on one of these machines can create a bottleneck that halts an entire production line. By embedding PdM systems into this critical equipment, manufacturers can continuously monitor factors like spindle vibration, ball screw wear, and coolant temperature. The AI can detect subtle anomalies that are precursors to failure, allowing maintenance to be scheduled during planned shutdowns, thereby maximizing asset uptime and ensuring a smooth, predictable production flow.42 This internal push is reinforced by external pressures; the U.S. Department of Defense is strongly advocating for the widespread implementation of PdM on its own weapon systems, creating a powerful incentive for its contractors to adopt the same forward-thinking maintenance philosophies within their own factories.8

2.3. Computer Vision: Superhuman Quality Control

Quality control in precision manufacturing has traditionally been a labor-intensive process prone to human error and fatigue. AI-powered computer vision systems are revolutionizing this domain. These systems use high-resolution cameras and sophisticated deep learning algorithms to automate visual inspections, detecting defects with a speed, consistency, and accuracy that far surpasses human capabilities.12 Modern systems can achieve inspection accuracy rates of over 97% and, contrary to early AI models, can often be trained effectively with a relatively small number of sample images.13

The automotive sector again provides a powerful case study. An OEM that stamps aluminum body panels every four seconds employs an AI vision system from Cogniac. The system uses a bank of 28 cameras to instantly detect tiny splits and tears that would be impossible for a human inspector to catch reliably at that speed. By flagging defective parts for removal early in the process, this single application saves the company up to $8 million annually in reduced material waste and downstream quality issues.14 In another example, BMW reported a 30% reduction in overall defect rates within the first year of implementing comprehensive AI vision systems in one of its plants.47

The application of this “superhuman eye” to small arms manufacturing is direct and impactful:

- Component Inspection: A computer vision system can be placed at the exit of an injection molding machine, inspecting every polymer pistol frame for minute dimensional inaccuracies, voids, or “short shots” where the mold did not fill completely. It can scan every machined bolt carrier group, checking for out-of-spec tool marks, burrs, or discoloration that might indicate improper heat treatment.

- Precision Barrel Inspection: The integrity of a barrel’s internal rifling is paramount for accuracy. An automated probe, equipped with a high-resolution camera and guided by AI, could inspect the interior of every barrel, detecting microscopic imperfections in the lands and grooves. This automates a task that is currently slow, highly skilled, and subject to operator fatigue.

- Ammunition Quality Control: The U.S. Army is already at the forefront of this application. The Joint Program Executive Office Armaments and Ammunition (JPEO A&A) is actively deploying AI-driven vision systems to perform automated, real-time quality control in its munitions plants. These systems can detect defects in casings, primers, and projectiles, ensuring that every single round meets the highest standards of precision and reliability—a critical factor for both soldier safety and mission success.15

These technologies—Digital Twin, Predictive Maintenance, and Computer Vision—are not merely independent tools but are deeply interconnected components of a single, holistic Smart Factory ecosystem. The computer vision systems and the network of PdM sensors act as the factory’s “nervous system,” constantly gathering immense volumes of real-time data on product quality and machine health.15 This torrent of data is the lifeblood that feeds the digital twin, transforming it from a static model into a dynamic, accurate, and constantly evolving virtual representation of reality.6 The digital twin, in turn, functions as the “brain,” providing a centralized platform to visualize this complex data, run predictive simulations, and test optimization strategies based on the live inputs from the factory floor.31 A manufacturer attempting to build a digital twin without first investing in this underlying IoT sensor infrastructure would be creating a “digital shadow”—an outdated model with limited predictive power—rather than a true, living twin.49

This integrated model creates a powerful, self-reinforcing data feedback loop that can accelerate innovation across the entire product lifecycle. Imagine a scenario where a computer vision system identifies a recurring microscopic flaw on a specific area of a pistol slide. Simultaneously, predictive maintenance data reveals that the CNC machine producing that slide is experiencing abnormal tool wear during a particular cutting operation. This combined data is fed into the digital twin, which runs a simulation and confirms a causal link between that specific tool path and the resulting defect. This actionable insight is then relayed back to the R&D department. Using their AI-powered simulation tools, designers can make a minute adjustment to the slide’s geometry—one that eliminates the problematic tool path without compromising the part’s structural integrity. The new design is validated virtually, the change is pushed to the CNC machine, and the computer vision system confirms that the flaw has been eradicated. This “closed-loop” process breaks down the traditional walls between design and manufacturing.6 The factory floor is no longer just a site of production; it becomes a vast, intelligent data-gathering apparatus that continuously informs and refines the next generation of product design, creating a formidable and ever-accelerating competitive advantage.

Section 3: State of the Industry: Adoption, Drivers, and Key Players

Assessing the current landscape of AI adoption within the small arms industry requires a nuanced approach. While some pioneers are beginning to publicly signal their strategic direction, the majority of major players remain silent, treating their manufacturing capabilities as closely guarded trade secrets. However, by analyzing the actions of the visible leaders, inferring the strategies of the silent majority, and understanding the powerful external forces compelling change, a clear picture of the industry’s trajectory emerges.

3.1. Pioneer Case Study: Beretta’s “Factory of the Future”

Among the world’s oldest and most respected firearms manufacturers, Beretta has distinguished itself through its relatively open discussion of its digital transformation strategy.37 The company’s marketing language, which includes concepts like the “Beretta Intelligent Factory” and “Human Technology,” is more than just branding; it signals a clear strategic intent to fuse its centuries-old heritage of craftsmanship with the most advanced manufacturing technologies available.37

This strategy is substantiated by concrete, publicly discussed initiatives:

- Predictive Maintenance: The “SmartCow” project is a tangible, in-house developed predictive maintenance system that has yielded quantifiable improvements in machine uptime, demonstrating a practical commitment to AI-driven efficiency.11

- Advanced Simulation: Beretta’s explicit use of advanced simulation and virtual prototyping in its R&D process places it at the forefront of digital design within the industry, allowing for faster iteration and reduced development costs.11

- Open Innovation: The establishment of B.R.a.In. (Beretta Research and INnovation), a dedicated R&D spin-off, and active collaborations with universities to develop AI algorithms for shooting performance analysis, showcases a forward-thinking approach that embraces external expertise to drive innovation.11

Beretta’s decision to be transparent about these initiatives is likely a calculated strategic move. In a competitive market for top engineering talent and lucrative government contracts, positioning itself as an industry innovator can be a powerful differentiator.50

3.2. The Competitive Landscape: Strategic Silence and Inferred Activity

In stark contrast to Beretta, a review of public materials, corporate websites, and industry publications from other major manufacturers—including SIG Sauer, Heckler & Koch, and FN Herstal—reveals a near-complete absence of any explicit mention of AI, digital twins, or predictive maintenance in their manufacturing processes.25 Research into Glock’s use of AI is a dead end, consistently and incorrectly returning results for Elon Musk’s “Grok” AI chatbot, indicating no public evidence of AI adoption by the Austrian manufacturer.52

This pervasive silence, however, should not be misinterpreted as inaction. Given the immense and proven competitive advantages offered by AI-driven manufacturing, it is highly probable that these capabilities are being developed and implemented as proprietary, high-value trade secrets. Strategy must therefore be inferred from actions and market context:

- SIG Sauer’s recent acquisition of General Robotics, a developer of advanced lightweight remote weapon stations, demonstrates a strategic embrace of AI-adjacent technologies and complex systems integration.21 While not a direct manufacturing application, a commitment to producing such technologically advanced systems often necessitates a parallel modernization of the underlying production processes required to build them.

- Heckler & Koch manages highly complex product families, such as the HK417 platform, which has evolved into multiple variants for different military customers, including the G28 and the U.S. Army’s M110A1.18 The logistical challenge of managing the production of numerous interchangeable and variant-specific parts across this product line presents a perfect business case for the implementation of a digital twin to optimize scheduling, inventory, and assembly workflows.

- FN Herstal, as one of the largest exporters of military small arms in Europe, operates at a scale where even marginal efficiency gains can translate into significant cost savings and increased production capacity.27 The need to reliably supply major NATO and EU partners with a wide range of weapon systems creates a powerful incentive to adopt technologies that enhance production resilience and scalability.

3.3. The Catalyst: The U.S. Military’s Modernization Mandate

The single most powerful force driving the adoption of AI in the defense manufacturing sector is not commercial competition, but direct government demand. The U.S. Army’s Joint Program Executive Office Armaments and Ammunition (JPEO A&A) is spearheading a major initiative to fundamentally modernize munitions manufacturing through the integration of AI and automation, backed by an initial investment of $48 million through the Small Business Innovation Research (SBIR) program.15

The program’s goals are explicit: to overcome the limitations of traditional manufacturing, which the Army identifies as “slow, resource-intensive, and vulnerable to inefficiencies”.15 The initiative is focused on deploying AI for specific, high-impact applications, including:

- Predictive Maintenance to reduce machinery downtime.

- AI-driven Vision Systems for automated, real-time quality control.

- Smart Supply Chain Management using predictive analytics to anticipate shortages and optimize logistics.

The ultimate objective is to create a more agile, scalable, and resilient ammunition supply chain capable of meeting the surge demands of modern warfare.15 This government-led push creates an undeniable top-down imperative. To win and retain major defense contracts, particularly for ammunition and next-generation weapon systems, manufacturers will increasingly be required to demonstrate these advanced manufacturing capabilities. A company that can leverage a digital twin to rapidly scale up production of a new cartridge, or use predictive maintenance to guarantee the uptime of its production lines, will possess a decisive advantage in future procurement competitions.

The primary impetus for investing in a multi-million-dollar Smart Factory infrastructure is therefore rooted in the military-industrial complex. While the commercial firearms market is driven by consumer trends, brand loyalty, and specific product features, large-scale military contracts are defined by different imperatives: massive volume, stringent quality control, and the strategic need for “surge capacity” in times of crisis.15 The U.S. Army’s direct investment in AI to solve its production bottlenecks is a clear signal to the industry. For major defense suppliers like FN, SIG, and H&K, the business case for a digital twin or factory-wide predictive maintenance is most compellingly justified by the pursuit of a multi-billion dollar, multi-decade military contract.21 The resulting efficiency gains that benefit their commercial product lines are a significant, but secondary, advantage.

This deep integration of AI into the defense manufacturing base also introduces new and significant national security considerations. An AI-driven Smart Factory is an entity built on data. Its digital twin, its predictive models, and its quality control algorithms are invaluable intellectual property and strategic national assets.12 The interconnected nature of these systems, while highly efficient, creates new potential vectors for cyber-attacks. A sophisticated adversary could attempt to steal proprietary weapon designs, sabotage production by feeding a digital twin manipulated data, or subtly compromise quality control algorithms to introduce latent defects into critical components. As AI becomes indispensable to the production of munitions and weapons, government procurement agencies will inevitably impose stringent new cybersecurity and data governance standards on their contractors.56 Consequently, small arms manufacturers investing in AI must make parallel, and equally significant, investments in securing their digital infrastructure. This adds another layer of cost and complexity to adoption, but it will be a non-negotiable requirement for any company operating in the defense supply chain.

Section 4: Strategic Outlook: The Path Forward

The integration of AI into small arms manufacturing is not a question of “if,” but “when” and “how.” While the trajectory is clear, the path forward is laden with practical challenges that require strategic planning. The long-term outlook suggests a convergence of smart manufacturing processes and intelligent weapon systems, raising new technological and ethical considerations. For manufacturers today, the key is to move from a reactive posture to a proactive strategy, recognizing that the initial steps taken now will determine their competitive standing for the next decade.

4.1. Implementation Hurdles and Mitigation

The transition to an AI-driven manufacturing model is a significant undertaking with substantial obstacles that must be addressed realistically. Drawing from the experiences of the broader manufacturing sector, several key challenges stand out 12:

- Data Privacy and Security: As established, an AI-powered factory generates vast quantities of sensitive data, from proprietary design files and process parameters to machine performance metrics. Securing this data against industrial espionage and cyber-attack is a paramount and costly challenge that must be addressed from the outset of any AI initiative.12

- The AI Skills Gap: The talent pool for data scientists, machine learning engineers, and AI specialists is limited and highly competitive. Small arms manufacturers must compete not only with each other but also with the technology and finance industries for these skilled individuals. A successful strategy will likely involve a combination of attracting new talent, aggressively upskilling the existing engineering workforce, and forming strategic partnerships with academic institutions, an approach that Beretta is already pursuing.11

- High Initial Investment: The capital expenditure required for a full-scale Smart Factory implementation—including industrial IoT sensors, high-performance computing infrastructure, and enterprise software licenses—is substantial. This can be a significant barrier, particularly for smaller companies. A prudent and effective mitigation strategy is to adopt a phased approach. By starting with targeted, high-impact pilot projects, such as implementing predictive maintenance on a single critical CNC cell or deploying a computer vision system on a high-volume component line, a manufacturer can prove the return on investment (ROI), build internal expertise, and generate momentum for broader adoption.50

- Cultural Resistance: Perhaps the most significant hurdle is cultural. The firearms industry often has a deeply ingrained culture built on generations of hands-on experience and traditional craftsmanship. Shifting this mindset toward a data-driven, AI-assisted workflow requires strong leadership, clear communication of benefits, and a commitment to training and change management to overcome institutional inertia.12

4.2. The Future Trajectory: From Smart Factories to Smart Weapons

The long-term trajectory of these technological trends points toward a powerful convergence. The “closed-loop” feedback system, where production data informs design, will become faster, more autonomous, and more intelligent. The logical endpoint is an AI-optimized factory that is primarily engaged in producing AI-enabled weapons.

The research already points clearly in this direction. AI is no longer just a tool for manufacturing; it is becoming a core component of the final product. Development is actively underway on:

- Smart Ammunition: AI is being used to design guided small caliber rounds, projectiles capable of autonomous target locking, and munitions that can adapt their behavior in complex environments.22

- Intelligent Fire Control: AI is being integrated directly into weapon systems to assist with aiming, provide real-time feedback for accuracy correction, manage recoil, and dynamically compensate for environmental factors.57

This convergence of an intelligent manufacturing base with intelligent products creates a powerful innovation cycle. However, it also brings to the forefront the significant ethical and geopolitical risks associated with the development of AI-powered autonomous weapon systems.56 While the primary focus of this report is on the manufacturing process, it is crucial to acknowledge that the tools being perfected to

build weapons more efficiently are simultaneously enabling the creation of weapons with greater levels of autonomy. This raises complex and urgent questions about maintaining meaningful human control (“human-in-the-loop”), the delegation of lethal decision-making, and the potential for rapid, unintended escalation in future conflicts.56

4.3. Concluding Analysis and Strategic Imperatives

The evidence synthesized in this report leads to an unequivocal conclusion: Artificial Intelligence is a proven, transformative force in advanced manufacturing. Its adoption within the small arms industry, while still in its early stages, is being driven by a combination of undeniable performance benefits and the compelling, non-negotiable demands of military modernization. The quiet arms race in manufacturing technology is real, and the pioneers are already establishing a significant lead.

For small arms manufacturers, formulating and executing an AI strategy is no longer an optional R&D endeavor; it is a fundamental requirement for long-term survival and competitiveness. The efficiency gains, quality improvements, and innovation potential offered by AI are too significant to ignore. A “wait-and-see” approach is a strategy for obsolescence.

The most effective path forward is one of strategic, incremental implementation. Rather than attempting a cost-prohibitive, factory-wide overhaul at once, manufacturers should adopt a pilot-based approach.

- Identify High-Value Targets: Begin by identifying the areas of the production process with the most to gain from AI. This could be a critical CNC machining cell that represents a frequent bottleneck, a high-volume component line where manual quality inspection is slow and costly, or a family of products with complex assembly requirements.

- Deploy Targeted Solutions: Implement a focused AI solution for that specific problem. Install predictive maintenance sensors on the bottleneck CNC machine. Deploy a computer vision system to automate inspection on the high-volume line. Build a limited-scope digital twin of the complex assembly process.

- Measure, Learn, and Scale: These pilot programs will serve to build crucial internal expertise, demonstrate tangible ROI to stakeholders, and begin laying the essential data infrastructure (the network of sensors and data streams) that will be required for a future, fully integrated Smart Factory.

This methodical approach mitigates risk, controls costs, and builds the organizational capacity and cultural acceptance needed for a successful digital transformation. The competitive landscape of the 21st-century small arms industry will be defined not just by the performance of the weapons themselves, but by the intelligence, speed, and resilience of the factories that build them. The time to act is now.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- Generative design – Wikipedia, accessed September 26, 2025, https://en.wikipedia.org/wiki/Generative_design

- Generative design – Siemens Digital Industries Software, accessed September 26, 2025, https://www.sw.siemens.com/en-US/technology/generative-design/

- General Motors | Generative Design in Car Manufacturing | Autodesk, accessed September 26, 2025, https://www.autodesk.com/customer-stories/general-motors-generative-design

- Generative Design: Reframing the Role of the Designer in Early-Stage Design Process, accessed September 26, 2025, https://asmedigitalcollection.asme.org/mechanicaldesign/article/145/4/041411/1156493/Generative-Design-Reframing-the-Role-of-the

- 5 Game-changing digital twin examples in manufacturing | TXI, accessed September 26, 2025, https://txidigital.com/insights/digital-twin-examples-in-manufacturing

- Aerospace Digital Twin | Siemens Software, accessed September 26, 2025, https://resources.sw.siemens.com/en-US/e-book-aerospace-defense-digital-twin-in-manufacturing/

- Digital Twins in Automotive Manufacturing: Dynamic Virtual Models …, accessed September 26, 2025, https://www.ediweekly.com/digital-twins-in-automotive-manufacturing-dynamic-virtual-models-advantages/

- Predictive Maintenance: An Overview – J.S. Solutions, accessed September 26, 2025, https://www.js-solutions-llc.com/business/predictive-maintenance-an-overview/

- Predictive Maintenance in Automotive Manufacturing | LLumin, accessed September 26, 2025, https://llumin.com/predictive-maintenance-in-automotive-manufacturing/

- Ford – Case Study | Predicting failures using connected vehicle data …, accessed September 26, 2025, https://kortical.com/case-studies/ford-predicting-failures-ai-example/

- Factory – Beretta, accessed September 26, 2025, https://www.beretta.com/en/technology/factory

- AI in Manufacturing: The Smart Revolution in Industry – Sigma Technology, accessed September 26, 2025, https://sigmatechnology.com/articles/the-application-of-ai-in-manufacturing/

- How Computer Vision Is Used for Quality Control Inspection – Averroes AI, accessed September 26, 2025, https://averroes.ai/blog/how-computer-vision-is-used-for-quality-control-inspection

- AI Computer Vision System for Automotive Industry – Cogniac’s AI, accessed September 26, 2025, https://cogniac.ai/industries/automotive/

- AI-Driven Modernization: How the U.S. Army is Transforming Munitions Manufacturing, accessed September 26, 2025, https://idstch.com/technology/ict/ai-driven-modernization-how-the-u-s-army-is-transforming-munitions-manufacturing/

- Generative Design 101 – Formlabs, accessed September 26, 2025, https://formlabs.com/blog/generative-design/

- Generative design in manufacturing transforms the industry – Autodesk, accessed September 26, 2025, https://www.autodesk.com/design-make/articles/generative-design-in-manufacturing

- Heckler & Koch HK417 – Wikipedia, accessed September 26, 2025, https://en.wikipedia.org/wiki/Heckler_%26_Koch_HK417

- Generative Design & The Role of AI Engineering – Applied Use Cases | Neural Concept, accessed September 26, 2025, https://www.neuralconcept.com/post/generative-design-the-role-of-ai-engineering-applied-use-cases

- Generative Design and Digital Manufacturing: Using AI and robots to build lightweight instruments, accessed September 26, 2025, https://ntrs.nasa.gov/api/citations/20220012523/downloads/McClelland-Generative%20Design%20SPIE%202022.pdf

- Sig Sauer acquires General Robotics – Military Embedded Systems, accessed September 26, 2025, https://militaryembedded.com/unmanned/sensors/sig-sauer-acquires-general-robotics

- How AI Is Transforming Ammunition Market in North America – MarketsandMarkets, accessed September 26, 2025, https://www.marketsandmarkets.com/ResearchInsight/ai-impact-analysis-on-north-america-ammunition-market.asp

- AI’s Transformative Role in the Ammunition Market – MarketsandMarkets, accessed September 26, 2025, https://www.marketsandmarkets.com/ResearchInsight/ai-impact-analysis-on-ammunition-industry.asp

- (PDF) AI/ML IN TERMINALBALLISTICS: PREDICTING IMPACT EVENTS – ResearchGate, accessed September 26, 2025, https://www.researchgate.net/publication/395126470_AIML_IN_TERMINALBALLISTICS_PREDICTING_IMPACT_EVENTS

- VP9 – HK USA, accessed September 26, 2025, https://hk-usa.com/product/vp9/

- Heckler & Koch | Heckler & Koch, accessed September 26, 2025, https://www.heckler-koch.com/

- FN Herstal – Wikipedia, accessed September 26, 2025, https://en.wikipedia.org/wiki/FN_Herstal

- Beretta – Wikipedia, accessed September 26, 2025, https://en.wikipedia.org/wiki/Beretta

- Ai Gun Ballistics Analysis | AI/ML Development Solutions, accessed September 26, 2025, https://aimlprogramming.com/services/ai-gun-ballistics-analysis/

- doaj.org, accessed September 26, 2025, https://doaj.org/article/efb03b8ec6b54f1898798bf0a3bb79ec#:~:text=By%20creating%20virtual%20replicas%20of,precision%20and%20ultra%2Dprecision%20manufacturing.

- The role of digital twin in advanced manufacturing – Siemens US, accessed September 26, 2025, https://www.siemens.com/us/en/company/topic-areas/advanced-manufacturing/digital-twin-in-advanced-manufacturing.html

- Digital Twins in Manufacturing: 5 Benefits & Applications | Matterport, accessed September 26, 2025, https://matterport.com/learn/digital-twin/manufacturing

- FN HERSTAL – Army Technology, accessed September 26, 2025, https://www.army-technology.com/contractors/civil-defence-security-and-law-enforcement/fnherstal/

- Digital Twin Use Cases in Various Industries Explained – Toobler, accessed September 26, 2025, https://www.toobler.com/blog/digital-twin-use-cases

- DELMIA Virtual Twin for Manufacturing | Dassault Systèmes, accessed September 26, 2025, https://www.3ds.com/products/delmia/virtual-twin-manufacturing

- Digital Twin Tech in Manufacturing: Taking Action with Laser Precision – Instinctools, accessed September 26, 2025, https://www.instinctools.com/blog/digital-twin-tech-in-manufacturing/

- Human Technology – Beretta, accessed September 26, 2025, https://www.beretta.com/en/factory-of-the-future/human-technology

- Review of Digital Twin in the Automotive Industry on Products, Processes and Systems-Scilight, accessed September 26, 2025, https://www.sciltp.com/journals/ijamm/article/view/971

- How AI Transforms Predictive Maintenance in Defense Equipment – – Datategy, accessed September 26, 2025, https://www.datategy.net/2025/07/01/how-ai-transforms-predictive-maintenance-in-defense-equipment/

- Predictive Maintenance in CNC Machining – Data-Driven Efficiency – Shamrock Precision, accessed September 26, 2025, https://shamrockprecision.com/leveraging-data-analytics-for-predictive-maintenance-in-cnc-machining/

- Predictive Maintenance Solutions – Axiomtek, accessed September 26, 2025, https://www.axiomtek.com/Default.aspx?MenuId=Solutions&FunctionId=SolutionView&ItemId=1737&Title=Predictive+Maintenance+Solutions

- Predictive Maintenance Tools in CNC Precision Manufacturing, accessed September 26, 2025, https://proformmfg.com/predictive-maintenance-tools-american-manufactuing/

- Evaluation of predictive maintenance efficiency with the comparison of machine learning models in machining production process i – PeerJ, accessed September 26, 2025, https://peerj.com/articles/cs-2999.pdf

- GAO-23-105556, MILITARY READINESS: Actions Needed to Further Implement Predictive Maintenance on Weapon Systems – Government Accountability Office, accessed September 26, 2025, https://www.gao.gov/assets/gao-23-105556.pdf

- Computer Vision for Quality Control – Softengi, accessed September 26, 2025, https://softengi.com/blog/computer-vision-for-quality-control/

- Improve manufacturing quality control with Visual Inspection AI | Google Cloud Blog, accessed September 26, 2025, https://cloud.google.com/blog/products/ai-machine-learning/improve-manufacturing-quality-control-with-visual-inspection-ai

- AI-Powered Quality Control in Manufacturing: A Game Changer – RevGen Partners, accessed September 26, 2025, https://www.revgenpartners.com/insight-posts/ai-powered-quality-control-in-manufacturing-a-game-changer/

- Digital Twin Manufacturing: Applications, Benefits, and Industry Insights – Simio, accessed September 26, 2025, https://www.simio.com/digital-twin-manufacturing-applications-benefits-and-industry-insights/

- (PDF) Digital Twin in Aerospace Industry: A Gentle Introduction – ResearchGate, accessed September 26, 2025, https://www.researchgate.net/publication/357190456_Digital_Twin_in_Aerospace_Industry_A_Gentle_Introduction

- Beretta Holding: Ready. Aim. Digitize. – BOSS Magazine, accessed September 26, 2025, https://thebossmagazine.com/profile/beretta-holding/

- Welcome – FN HERSTAL, accessed September 26, 2025, https://fnherstal.com/

- Grok (chatbot) – Wikipedia, accessed September 26, 2025, https://en.wikipedia.org/wiki/Grok_(chatbot)

- xAI: Welcome, accessed September 26, 2025, https://x.ai/

- Company | xAI, accessed September 26, 2025, https://x.ai/company

- How xAI turned a factory shell into an AI ‘Colossus’ for Grok 3 – R&D World, accessed September 26, 2025, https://www.rdworldonline.com/how-xai-turned-a-factory-shell-into-an-ai-colossus-to-power-grok-3-and-beyond/

- Artificial Intelligence’s Dangers in Weapons Design Industry – IT Supply Chain, accessed September 26, 2025, https://itsupplychain.com/artificial-intelligences-dangers-in-weapons-design-industry/

- AI’s Role in Small Caliber Ammunition Market – MarketsandMarkets, accessed September 26, 2025, https://www.marketsandmarkets.com/ResearchInsight/ai-impact-analysis-on-small-caliber-ammunition-industry.asp

- The Transformative Impact of Artificial Intelligence on the Firearms Industry – Web and Mobile App Development Blog – Technology News & Updates | TAFF Inc – Techaffinity Consulting, accessed September 26, 2025, https://www.taffinc.com/blog/impact-of-artificial-intelligence-on-the-firearms-industry/