The seven-day intelligence window leading up to SHOT Show 2026 (January 11–18) marks a definitive inflection point in the trajectory of the civilian and law enforcement small arms market. For the past decade, the industry was largely defined by the commoditization of the AR-15 platform and a volume-driven race to the bottom in terms of pricing. The announcements analyzed in this reporting period, however, signal the commencement of the “Refinement Era,” a strategic pivot where manufacturers are abandoning iterative cosmetic updates in favor of substantial mechanical re-engineering and system integration.

The most significant takeaway from this week’s disclosures is the widespread rejection of “Mil-Spec” as the ultimate benchmark of quality. In the tactical segment, major OEMs are no longer content with standardizing on 1960s-era technical data packages. This is most visibly manifested in Ruger’s clean-sheet redesign of the AR platform with the Harrier series 1, FN America’s complete overhaul of the SCAR operating system to address harmonic and recoil deficiencies 3, and Franklin Armory’s audacious attempt to hybridize push-feed and controlled-round-feed actions in the Prevail series.5

Furthermore, the suppressor-ready standard has evolved from a simple threaded barrel to a holistic design philosophy. The Next Generation FN SCAR incorporates 360-degree heat shields and tunable gas regulation specifically for forward-venting suppressors 3, while the lever-action sector—led by Smith & Wesson’s Model 1854 Stealth Hunter and Marlin’s Dark Series—is being fundamentally repurposed as a quiet, optic-ready host for modern accessories.6

This report provides a granular analysis of every major rifle announcement made between January 11 and January 18, 2026. It synthesizes technical specifications, manufacturing shifts, and market positioning to offer a comprehensive forward-looking assessment of the 2026 fiscal year. The data suggests that the winning strategy for 2026 is “out-of-the-box optimization,” effectively forcing manufacturers to incorporate features previously relegated to the aftermarket—such as receiver tensioning, hydraulic buffering, and carbon fiber components—directly into factory SKUs.

1. The Evolution of the Modern Battle Rifle

The battle rifle segment, traditionally dominated by 7.62x51mm platforms derived from Cold War designs, is undergoing its most significant technical refresh in twenty years. The focus has shifted entirely to “shootability”—specifically, the management of recoil impulse and the mitigation of harmonic stress on electronics.

1.1 FN America: The SCAR Platform Reborn

Strategic Context:

Since its commercial introduction in 2008, the FN SCAR (Special Operations Forces Combat Assault Rifle) has occupied a unique position as a premium, piston-driven alternative to the AR-10. However, it was plagued by two persistent user complaints: a reciprocating charging handle that could injure the shooter’s thumb or interfere with barricades, and a notoriously harsh recoil impulse (often termed the “forward whiplash”) that destroyed sensitive optics. On January 15, 2026, FN America announced the “Next Generation” SCAR family (16S, 17S, and 20S), a move that signifies a aggressive defense of its market share against emerging competitors like the SIG MCX SPEAR.3

Mechanical Analysis: The Hydraulic Imperative

The defining innovation of the 2026 SCAR is the integration of a lightweight, hydraulically buffered two-piece bolt carrier group. In the legacy design, the massive bolt carrier acted as a heavy piston; when it bottomed out against the rear of the receiver, it generated a sharp recoil spike. More critically, when the bolt slammed home into battery, it created a “forward recoil” impulse—a rapid deceleration that most optics, designed to handle rearward energy, were not engineered to withstand.

The new hydraulic buffer acts as a progressive damper. As the bolt carrier travels rearward, the hydraulic piston engages, metering fluid through orifices to slow the carrier’s velocity before it impacts the rear plate. This transforms the recoil impulse from a sharp “spike” into a smoother “curve”.3 The implications of this engineering change are threefold:

- Optic Survivability: The reduction in G-force spikes transferred to the receiver rail directly addresses the “SCAR Eater” phenomenon, allowing users to mount a wider variety of consumer-grade optics without fear of failure.

- Follow-Up Efficacy: By smoothing the cycle, muzzle rise is more predictable, allowing for faster split times between shots.

- User Endurance: The reduction in felt recoil significantly reduces shooter fatigue during high-volume training or operational use.

System Integration Features:

Beyond the internal mechanics, the Next Gen SCAR addresses ergonomic dogmas. The Non-Reciprocating Charging Handle (NRCH) is now standard across the line, eliminating the risk of induced malfunctions from grip interference.3 Furthermore, the receiver has been lengthened and updated with M-LOK slots at the 3, 6, and 9 o’clock positions, removing the need for heavy aftermarket rail extensions. The inclusion of a 360-degree heat shield around the gas block acknowledges the thermal realities of suppressed fire, protecting the user’s support hand from the radiant heat generated by modern high-flow suppressors.3

Market Positioning:

Perhaps most surprisingly, FN has maintained the pricing structure of the previous generation ($3,500–$4,000).3 In an inflationary economy, adding significant manufacturing complexity (hydraulic systems, new receiver extrusions) without raising the MSRP represents a “value-add” strategy intended to undercut the custom-built AR-10 market and stall the momentum of the SIG SPEAR.

1.2 SIG SAUER: The Resurrection of the Piston AR

Strategic Context:

While much of the industry’s attention has been focused on the MCX platform, a critical and largely overlooked announcement from the pre-show window is the return of the SIG516 G3.8 The SIG516, a short-stroke gas piston AR-15, was discontinued for commercial sale several years ago, despite retaining a cult following for its reliability and similarity to the HK416. Its reintroduction as the “G3” (Generation 3) suggests that SIG SAUER has identified a resurgence in demand for traditional AR-pattern piston rifles that the MCX (which uses a distinct recoil spring assembly) does not satisfy.

Mechanical Analysis:

The SIG516 G3 likely retains the core short-stroke push-rod system that made the original famous for running cleaner and cooler than direct impingement counterparts. The timing of this launch, coinciding with the “suppressor-standard” trend, is logical; piston systems are inherently easier to tune for suppressed use via an adjustable gas block, venting excess gas at the block rather than into the receiver. This release targets the demographic that desires the reliability of a piston system but prefers the manual of arms and parts compatibility of a standard AR-15, a segment that has been underserved since the discontinuation of the original 516 and the scarcity of HK MR556s.

1.3 Springfield Armory: The Velocity Maximization of the Hellion

Strategic Context:

Springfield Armory has expanded its Hellion (VHS-2) bullpup line to include 18-inch and 20-inch barrel variants.9 This update directly addresses the primary ballistic criticism of 5.56mm bullpups.

Mechanical Analysis:

The 5.56x45mm cartridge is heavily velocity-dependent for terminal efficacy; its fragmentation threshold is typically around 2,500–2,700 fps. Short barrels sacrifice this velocity. The bullpup configuration allows for a 20-inch barrel in an overall length comparable to a 14.5-inch AR-15. By offering these longer barrels, Springfield is positioning the Hellion not just as a CQB (Close Quarters Battle) tool, but as a ballistically superior general-purpose rifle. The 20-inch model features a ribbed barrel profile for enhanced cooling and an integral bayonet lug, mirroring the configuration of the Croatian military’s designated marksman rifle (VHS-D2).9 This appeals to both military clone enthusiasts and practical shooters seeking maximum ballistic coefficient and range from the 5.56mm cartridge.

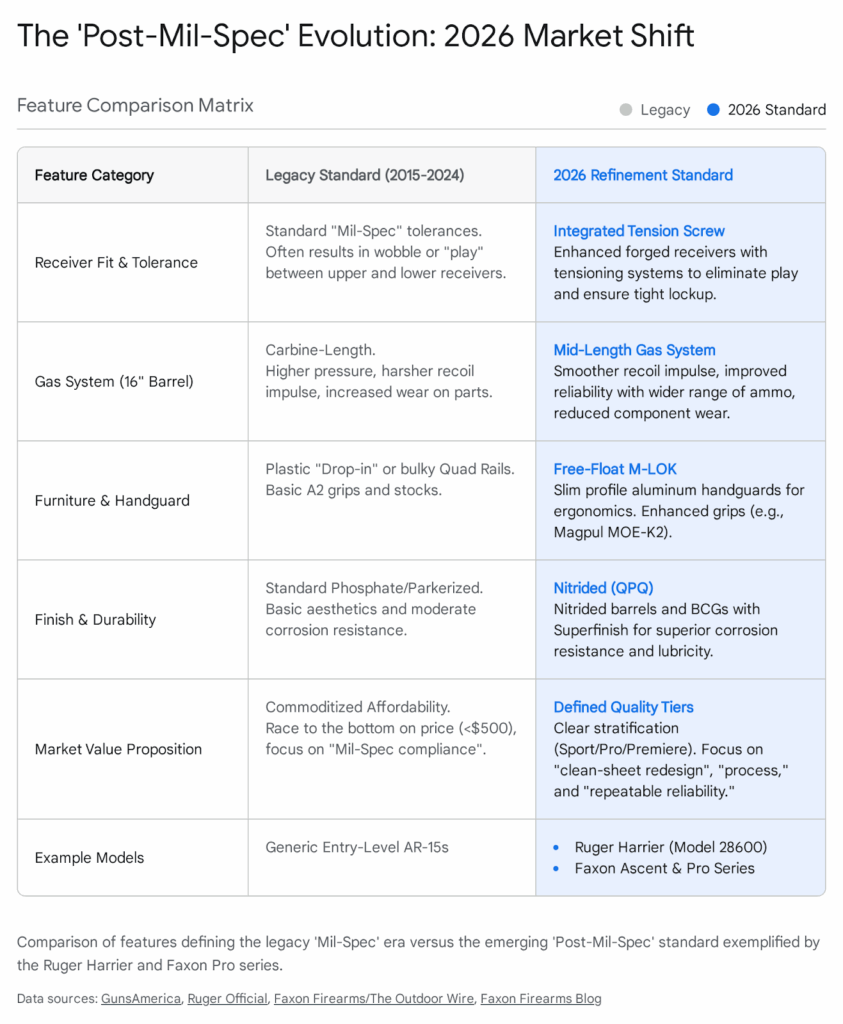

2. The Post-Mil-Spec AR-15 Market

For nearly two decades, “Mil-Spec” (Military Specification) was the marketing gold standard for the AR-15. It implied interoperability and a baseline of quality. However, the announcements of January 2026 confirm that the market has graduated beyond Mil-Spec. The modern consumer now demands tight tolerances, tuned gas systems, and ergonomic refinement that military specifications do not dictate.

2.1 Ruger Harrier: The Clean-Sheet Offensive

Strategic Context:

Ruger’s introduction of the Harrier 1 is a tacit admission that the AR-556, while a commercial success, could not compete with the refinement of mid-tier brands like BCM or Daniel Defense. The Harrier is not an iteration; it is a replacement of the design philosophy, manufactured at Ruger’s new facility in Hebron, Kentucky.

Mechanical Analysis: The Tension Solution

The most notable feature of the Harrier is the integration of a nylon-tipped tension screw in the lower receiver.2 In standard forged AR-15s, tolerance stacking often results in “play” or wobble between the upper and lower receivers. While this rarely affects mechanical accuracy (since the optic and barrel are paired on the upper), it significantly degrades the perception of quality and stability. By allowing the user to tighten the lower against the rear takedown lug of the upper, Ruger creates a “monolithic” feel typically reserved for expensive billet receiver sets.

Furthermore, Ruger has standardized on a mid-length gas system for the 16-inch Model 28600. A 16-inch barrel with a carbine-length gas system (the industry standard for cheap ARs) is inherently over-gassed, leading to harsher recoil and accelerated parts wear. The move to mid-length as a factory standard signals that Ruger is targeting the educated enthusiast who understands dwell time dynamics.

2.2 Faxon Firearms: The Trim-Level Strategy

Strategic Context:

Faxon Firearms has restructured its entire AR-15 offering into three distinct tiers: Sport, Pro, and Premiere.11 This mirrors the automotive industry’s approach to product segmentation (e.g., LE, XLE, Limited) and addresses a major pain point in the AR market: decision paralysis.

Market Analysis:

- Sport: Targets the entry-level buyer who needs a functional rifle but is price-sensitive.

- Pro: Likely the volume seller, targeting duty use and serious training. This tier presumably features Faxon’s renowned lightweight barrel profiles and upgraded nitride bolt carrier groups.

- Premiere: The high-end option, likely featuring matched receiver sets, tuned gas ports, and premium furniture, competing with “boutique” builds.

This clarity allows retailers to stock a single brand that covers three price points, simplifying inventory management and sales training.

2.3 Daniel Defense: The “For The People” Initiative

Daniel Defense has leveraged the pre-SHOT window to announce a new entry in their “Limited Series” titled “For The People”.12 Based on the DDM4 V7 Pro, this model features a distinctive Tiger Stripe Cerakote finish, a Timney Impact AR Trigger, and high-end accessories like the Holosun DRS-NV (Night Vision/Red Dot fusion). This release highlights the trend of manufacturers acting as “system integrators,” selling fully kitted rifles with optics, slings, and lights pre-installed, offering a “turn-key” solution for affluent buyers who want immediate capability without researching individual components.

3. The Reinvention of the Bolt Action Rifle

The bolt action sector is currently witnessing a divergence. One path leads to ultra-lightweight, carbon-fiber-intensive mountain rifles. The other path leads to mechanical revolution, challenging the century-old dominance of the Mauser/Remington paradigm.

3.1 Franklin Armory: Solving the Feeder Dilemma

Strategic Context:

Perhaps the most technically ambitious announcement of the entire pre-show period is Franklin Armory’s Prevail series, featuring the Total Round Control (TRC) action.5 This system attempts to resolve the fundamental debate between Push Feed and Controlled Round Feed (CRF) actions.

Mechanical Analysis:

- The Problem: Push Feed actions (like the Remington 700) are accurate and cheap to make but can “double feed” if short-stroked because the cartridge is loose until the bolt closes. CRF actions (like the Mauser 98) hold the cartridge firmly from the magazine to the chamber but are expensive and complex.

- The TRC Solution: The Prevail’s action uses a novel extractor geometry that actively manages the cartridge throughout the entire cycle—feeding, chambering, firing, extraction, and ejection. This prevents the “loose round” jams that can occur in high-stress situations or when shooting from unconventional angles (e.g., prone on a steep incline).

- Implementation: The Prevail pairs this action with a carbon-fiber stock featuring V-block bedding and interchangeable bolt heads, allowing for caliber conversions between.308 Win, 6.5 Creedmoor, and magnum cartridges like.300 WSM and 6.5 PRC. This positions the Prevail as a direct competitor to high-end custom actions like Defiance or Impact Precision, appealing to the PRS (Precision Rifle Series) competitor and the serious western hunter.

3.2 Savage Arms: Precision for the Masses

Strategic Context:

Savage Arms continues to aggressively democratize precision features. The new 110 Trail Blazer 13 is priced at an MSRP of $719, yet it includes features that were once the domain of $2,000 custom rifles: a Cerakote finish, a straight-fluted barrel (for weight reduction and cooling), and a threaded muzzle.

Cartridge Innovation: The 22 Creedmoor

Critically, Savage has factory-chambered the 110 Trail Blazer in 22 Creedmoor. Previously a wildcat cartridge requiring hand-loading and custom barrels, the 22 Creedmoor pushes.22 caliber bullets at extreme velocities (often exceeding 3,400 fps), making it a devastatingly flat-shooting round for predators and varmints. By adopting it as a standard factory offering, Savage (in partnership with Hornady, who is producing the ammo) is legitimizing the cartridge for the mainstream market, potentially displacing the.22-250 Remington as the king of speed.

3.3 The High-End Hunting Segment

- Weatherby Model 307 Alpine ST: Weatherby’s move to the Model 307 action (a Remington 700 footprint clone) was a significant pivot from their proprietary Mark V action. The new Alpine ST variant adds a spiral fluted barrel and bolt, and significantly, a Peak 44 Bastion carbon fiber stock.6 At $1,999, this rifle brings aerospace-grade composites to a sub-$2k price point, targeting the “ounce-counting” sheep hunter.

- Bergara Platinum Stalker: Bergara has introduced the Platinum Stalker 1, featuring a stainless Cerakote finish and a TriggerTech trigger standard. Its key differentiator is the stock: a “pepper-colored” laminate Monte Carlo design. While heavier than carbon fiber, laminate offers superior rigidity and vibration dampening compared to cheap polymer, appealing to traditionalists who demand weather resistance without the “plastic” feel.

- Proof Research Tundra TI-X: On the extreme high end, Proof Research’s Tundra TI-X combines a titanium action with their signature carbon-fiber-wrapped barrel.6 This is a “spare no expense” platform designed to offer the absolute lightest weight possible for a precision rifle, targeting the demographic that might otherwise commission a full custom build.

4. The Lever Action Renaissance: Tactical and Traditional

The lever action has officially graduated from a nostalgic curiosity to a modern tactical platform. The industry has recognized that in jurisdictions with “Assault Weapon Bans,” the lever action remains legal, fast-cycling, and capable of high capacity.

4.1 Marlin: The 10mm Auto Powerhouse

Strategic Context:

The Marlin Trapper Series Model 1894 chambered in 10mm Auto 17 is a ballistic revelation. The 10mm Auto is a powerful pistol cartridge, but when fired from a 16-inch carbine barrel, it gains significant velocity—up to 250 feet per second over pistol velocities.

Market Analysis:

This rifle bridges the gap between a pistol-caliber carbine (PCC) and a dedicated hunting rifle. It allows a hunter to carry a Glock 20 or FN 510 sidearm and a Marlin carbine that share the same ammunition. With a threaded barrel and Skinner sights, it is perfectly configured as a “brush gun” for hog hunting or defense against predators, offering potent stopping power in a compact, quick-handling package.

4.2 Smith & Wesson: The Stealth Hunter

Strategic Context:

Smith & Wesson continues to expand its lever-action footprint with the Model 1854 Stealth Hunter.6 Unlike traditional blued-and-wood rifles, the Stealth Hunter features a matte black aesthetic, a synthetic stock, and an integrated top rail for optics. It is designed from the ground up to host a suppressor. This confirms that the “Modern Lever Gun” (often tagged as #TacticalCowboy on social media) is a sustained market trend, not a fleeting fad.

4.3 Savage Arms: The Revel Classic

Savage has re-entered the lever-action market with the Revel Classic rimfire.18 This taps into the “fun gun” segment, offering a nostalgic plinker that is affordable and accessible, serving as a gateway for new shooters into the manual-action world.

5. Rimfire and Niche Innovation

5.1 Ruger 10/22: Defending the Throne

The Ruger 10/22 is the most ubiquitous rimfire rifle in America, but its dominance has been threatened by high-quality clones from companies like Bergara and Grey Birch. In response, Ruger has announced a sweeping update for 2026.19 Features that were previously aftermarket upgrades are now standard:

- BX-Trigger: A factory trigger with a crisp 2.5–3 lb pull.

- Match Bolt Release: Eliminating the frustrating two-handed fumble required to release the bolt on legacy models.

- Rear Cleaning Port: A hole in the rear of the receiver allowing the barrel to be cleaned from the breech, protecting the crown from damage.

This is a classic “moat-widening” strategy. By raising the baseline quality of the OEM rifle, Ruger makes the value proposition of expensive clones much harder to justify.

5.2 Savage 21 Sharp: A New Rimfire Cartridge

Savage Arms has introduced a proprietary new rimfire cartridge: the 21 Sharp.20 Designed to fix the inherent flaws of the.22 LR (specifically its “heeled” bullet design, which is aerodynamically inefficient and dirty), the 21 Sharp uses a modern, non-heeled bullet profile. This allows for cleaner burning, better aerodynamic stability, and compatibility with standard.22 LR magazines (with a barrel change). While new cartridges face an uphill battle for adoption, the promise of affordable, high-performance plinking ammo is compelling.

5.3 Pistol Caliber Carbines (PCCs)

- Bishop Firearms AR45TC (“Tabatha”): A unique PCC blending AR-15 ergonomics with Thompson SMG aesthetics (wood furniture).20 Available in.45 ACP and 10mm, it targets the home defense market with a heavy dose of retro style.

- Faxon FX-19 and PCCs: Faxon’s new “Pro” tier includes 9mm PCCs with upgraded feed geometry to ensure reliability with hollow-point defensive ammunition.11

6. Budget and Entry-Level Market Analysis

6.1 Century Arms MB47

Century Arms has introduced the MB47 20, a US-made AK-47 pattern rifle featuring a milled billet 4140 receiver. With an MSRP of $1,699, this is not a budget AK; it is a premium, American-manufactured statement piece intended to compete with the likes of Arsenal and Meridian Defense. It features a chrome-lined barrel, RAK-1 trigger, and Magpul furniture, signaling that the US AK market is moving upmarket as surplus imports dry up.

6.2 Howa and the Glenfield Revival

Reports indicate a resurgence of the Glenfield brand name (historically a budget line for Marlin) applied to new bolt-action rifles, possibly manufactured by Howa or a similar OEM.22 These rifles target the sub-$500 market, providing a functional, no-frills hunting tool for the price-conscious consumer, filling the void left as the Ruger American moves upmarket in price.

7. Comprehensive Data Summary

The following table aggregates all confirmed rifle announcements from the reporting period, categorized by market segment.

| Vendor | Model | Caliber(s) | Key Innovations / Features | Market Segment |

| Bergara | Platinum Stalker | Multi (Standard/Mag) | Laminate stock, Stainless Cerakote, TriggerTech | Premium Hunting |

| Bishop | AR45TC “Tabatha” | .45 ACP, 10mm | AR/Thompson hybrid aesthetics, Glock mags | Retro / Defense |

| Century | MB47 | 7.62x39mm | Milled 4140 receiver, US-made, Chrome-lined bbl | Premium AK |

| Daniel Defense | Limited “For The People” | 5.56 NATO | Tiger Stripe, Holosun DRS-NV, Timney Trigger | Collector / Tactical |

| Faxon | AR-15 (Sport/Pro/Prem) | 5.56,.300 BLK, 6mm ARC | Tiered Product Strategy, Suppressor-ready uppers | Commercial AR |

| FN America | SCAR 16S (Next Gen) | 5.56 NATO | Hydraulic Buffer, NRCH, Heat Shield | Duty / SOF |

| FN America | SCAR 17S (Next Gen) | 7.62 NATO, 6.5 CM | Hydraulic Buffer, NRCH, Reduced Recoil | Duty / Heavy |

| FN America | SCAR 20S (Next Gen) | 7.62 NATO, 6.5 CM | 2-Stage Trigger, Precision Stock | DMR / Precision |

| Franklin Armory | Prevail Series | .308, 6.5 CM, 6.5 PRC | Total Round Control (TRC) hybrid feed action | Precision Hunting |

| Marlin | Model 1894 Trapper | 10mm Auto | High-velocity pistol caliber, Threaded, Skinner sights | Brush Hunting |

| Proof Research | Tundra TI-X | Multi | Titanium action, Carbon fiber barrel | Ultralight Mountain |

| Ruger | Harrier | 5.56 NATO | Clean-sheet design, Tension screw, Mid-length gas | Mid-Tier Duty |

| Ruger | American Gen II Prairie | .22 ARC, 7mm PRC | Splatter stock, Cerakote, Marksman trigger | Hunting |

| Ruger | 10/22 (2026 Update) | .22 LR | Standardized BX-Trigger, Rear cleaning port | Recreational |

| Savage Arms | 110 Trail Blazer | 22 CM, 7mm BC | 22 Creedmoor, Fluted barrel, Threaded | Value Precision |

| Savage Arms | Timber Tactical | Rimfire | Tactical wood stock | Trainer |

| Savage Arms | Revel Classic | Rimfire | Lever action, takedown | Recreational |

| Savage Arms | 21 Sharp Rifles | 21 Sharp | New cartridge ecosystem (Mark II / B-Series) | Small Game |

| Sig Sauer | SIG516 G3 | 5.56 NATO | Return of Piston AR, Short-stroke gas system | Duty / Reliability |

| Smith & Wesson | Model 1854 Stealth | .44 Mag,.45 Colt | Black synthetic, Top rail, Threaded | Tactical Lever |

| Springfield | Hellion (Long Barrel) | 5.56 NATO | 18″ and 20″ barrels, Ribbed profile, Bayonet lug | Bullpup / DMR |

| Weatherby | Model 307 Alpine ST | Weatherby Mags | Spiral fluted, Peak 44 Carbon Stock | Mountain Hunting |

8. Competitive Landscape Analysis

The 2026 market is defined by intense competition in two specific pricing corridors: the $700–$800 “Value Performance” segment and the $3,500+ “Super-Premium” segment.

8.1 The Battle for the Mid-Tier ($700–$800)

The Ruger Harrier and Savage 110 Trail Blazer represent a pincer movement on the mid-tier market.

- Ruger is attacking the dominance of the Springfield Saint and IWI Zion-15 by offering a rifle with “custom shop” features (receiver tensioning) at a mass-production price ($699).

- Savage is redefining the entry-level hunting rifle. By including fluting, threading, and Cerakote for $719, they are effectively obsoleting the “budget rifle” category. Consumers now expect these features as a baseline, which spells trouble for competitors like the base-model Mossberg Patriot or legacy Remington 700 ADL.

8.2 The Clash of the Titans ($3,500+)

The high-end tactical market is witnessing a showdown between FN America and SIG SAUER.

- FN’s Strategy: Defense. The Next Gen SCAR is a defensive product update designed to retain existing institutional users and loyalists by fixing the platform’s known flaws (recoil, optics damage) without raising the price.

- SIG’s Strategy: Encirclement. With the MCX SPEAR attacking the top end and the reintroduced SIG516 G3 attacking the traditional piston AR market, SIG is offering a broader portfolio. The SCAR’s hydraulic buffer is a potent technological counter-argument, offering a theoretically smoother recoil impulse than the SIG offerings.

Methodology Appendix

This report was compiled using a multi-source intelligence gathering approach focused on the seven-day window immediately preceding SHOT Show 2026 (January 11–18, 2026).

Data Collection Sources:

- Primary Manufacturer Releases: Official press statements and product pages from FN America, Sturm Ruger & Co., Savage Arms, Franklin Armory, and Faxon Firearms were analyzed for technical specifications.

- Industry Trade Wire Services: The Outdoor Wire, Shooting Wire, and NSSF bulletins provided confirmation of release dates and booth locations.

- Specialized Firearm Media: Technical reviews and “first look” articles from outlets such as The Firearm Blog, Accurate Shooter, and Guns.com were utilized to cross-reference marketing claims with observed mechanical reality.

Analytical Framework:

- Innovation Grading: Announcements were categorized based on “Mechanical Innovation” (e.g., TRC action, hydraulic buffer) versus “Iterative Update” (e.g., new caliber, new stock color).

- Market Segmentation: Products were grouped into functional categories (Tactical, Hunting, Rimfire) rather than purely by vendor to highlight industry-wide trends.

- Pricing Normalization: All prices cited are Manufacturer’s Suggested Retail Price (MSRP) to ensuring a consistent baseline for value comparison, acknowledging that “street price” will vary.

Limitations:

This report covers announcements made prior to the opening of the SHOT Show floor on January 20, 2026. Surprise unveilings made during the show itself are outside the scope of this pre-show analysis.

If you find this post useful, please share the link on Facebook, with your friends, etc. Your support is much appreciated and if you have any feedback, please email me at in**@*********ps.com. Please note that for links to other websites, we are only paid if there is an affiliate program such as Avantlink, Impact, Amazon and eBay and only if you purchase something. If you’d like to directly contribute towards our continued reporting, please visit our funding page.

Sources Used

- New Rifles for 2026 – Pre-SHOT Show Edition – Silencer Central, accessed January 18, 2026, https://www.silencercentral.com/blog/new-rifles-pre-shot-show/

- Ruger Introduces Harrier Rifles, a Ground-Up Reboot of Its AR Line – GunsAmerica, accessed January 18, 2026, https://gunsamerica.com/digest/ruger-introduces-harrier-rifles/

- Updated FN SCAR Rifle Lineup Unveiled in U.S. at Previous Model Prices, accessed January 18, 2026, https://militarnyi.com/en/news/updated-fn-scar-rifle-lineup-unveiled-in-u-s-at-previous-model-prices/

- THE NEXT GENERATION OF THE FN SCAR: THE LEGEND. REBORN. | FN® Firearms, accessed January 18, 2026, https://fnamerica.com/press-releases/the-next-generation-of-the-fn-scar-the-legend-reborn/

- Franklin Armory Unveils Prevail Line: ‘World’s First’ Total Round Control Bolt Rifles, accessed January 18, 2026, https://www.guns.com/news/2026/01/13/franklin-armory-prevail-total-round-control-rifle

- Sunday GunDay: Notable New Rifles — SHOT Show 2026 Preview « Daily Bulletin, accessed January 18, 2026, https://bulletin.accurateshooter.com/2026/01/sunday-gunday-notable-new-rifles-shot-show-2026-preview/

- Dark Series Lever-Action Rifles – Marlin Firearms, accessed January 18, 2026, https://www.marlinfirearms.com/s/leverAction-DarkSeries/

- SIG SAUER LAUNCHES SIG516 G3 – Morningstar, accessed January 18, 2026, https://www.morningstar.com/news/pr-newswire/20251112ny22764/sig-sauer-launches-sig516-g3

- Hellion™ Rifles – Springfield Armory, accessed January 18, 2026, https://www.springfield-armory.com/hellion-series/hellion-rifles/

- Ruger® Harrier™ Autoloading Rifle Model 28601, accessed January 18, 2026, https://www.ruger.com/products/harrier/specSheets/28601.html

- Faxon Firearms to Exhibit at SHOT Show 2026 – The Outdoor Wire …, accessed January 18, 2026, https://www.theoutdoorwire.com/releases/2026/01/faxon-firearms-to-exhibit-at-shot-show-2026

- Limited Series: FOR THE PEOPLE – Daniel Defense, accessed January 18, 2026, https://danieldefense.com/limited-series-january-2025-forthepeople.html

- Review: Savage 110 Trail Blazer Rifle in 22 Creedmoor | An Official Journal Of The NRA, accessed January 18, 2026, https://www.americanrifleman.org/content/review-savage-110-trail-blazer-rifle-in-22-creedmoor/

- New For 2026: Savage Arms 110 Trail Blazer – YouTube, accessed January 18, 2026, https://www.youtube.com/watch?v=dLqx5QRCzHc

- Weatherby® Introduces Model 307™ Alpine ST – Mule Deer Foundation, accessed January 18, 2026, https://muledeer.org/news/weatherby-introduces-model-307-alpine-st/

- Bergara Platinum Stalker – BPI Outdoors, accessed January 18, 2026, https://bpioutdoors.com/platinum-stalker/

- Ruger Introduces the Marlin Trapper Series Model 1894 Chambered in 10mm Auto, accessed January 18, 2026, https://www.marlinfirearms.com/s/news-2025-10-16/

- Best Of SHOT Show 2025: We Picked Five Products You Need To Watch This Year | An NRA Shooting Sports Journal, accessed January 18, 2026, https://www.ssusa.org/content/best-of-shot-show-2025-we-picked-five-products-you-need-to-watch-this-year/

- Updating A Legend: Ruger Makes 10/22 Upgrades Standard | An Official Journal Of The NRA – American Rifleman, accessed January 18, 2026, https://www.americanrifleman.org/content/updating-a-legend-ruger-makes-10-22-upgrades-standard/

- New Rifles Coming in 2025 | NSSF SHOT Show 2026, accessed January 18, 2026, https://shotshow.org/new-rifles-coming-in-2025/

- AR15 Firearms – Pro, accessed January 18, 2026, https://faxonfirearms.com/firearms/ar-15-firearms/pro/

- The Best Budget Rifles of 2026, Tested and Reviewed – Field & Stream, accessed January 18, 2026, https://www.fieldandstream.com/outdoor-gear/guns/rifles/best-budget-rifles

- Ruger Introduces Ruger Harrier Rifles – Ruger News, accessed January 18, 2026, https://www.ruger.com/news/2025-12-31.html

- Ruger Announces the Return of an American Legend: The Ruger Red Label III, accessed January 18, 2026, https://ruger.com/news/2025-12-24.html